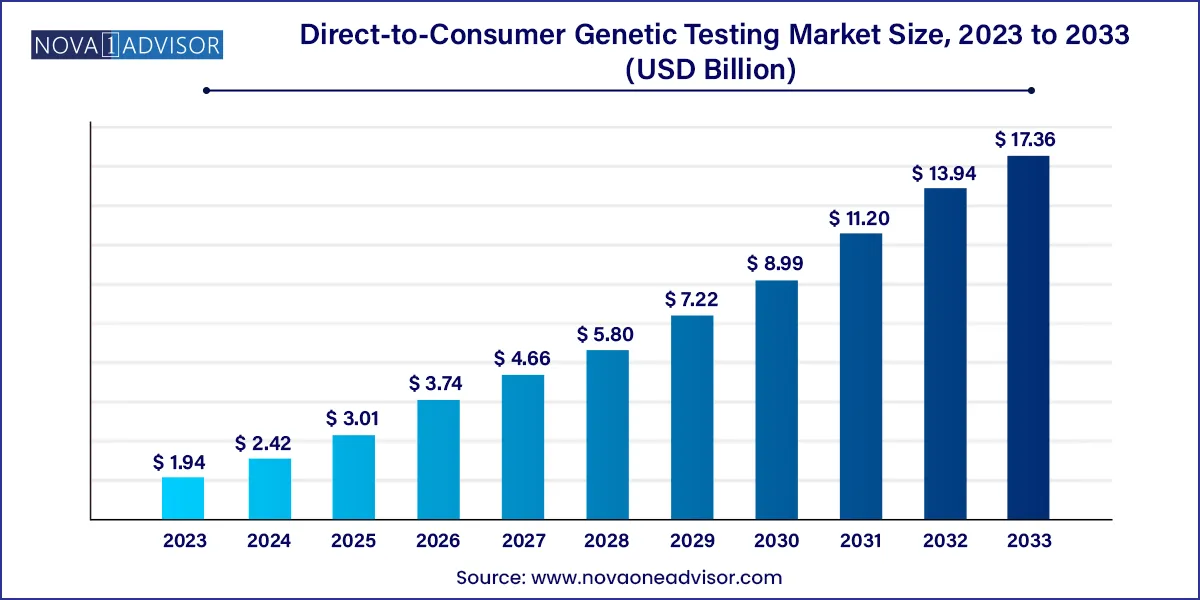

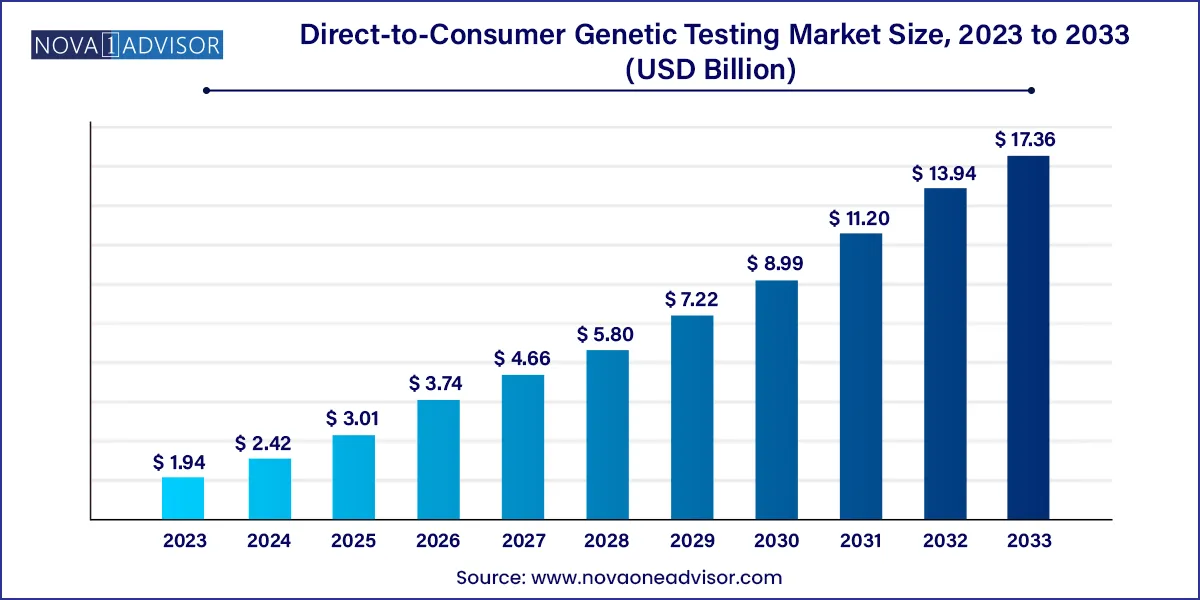

The global direct-to-consumer genetic testing market size was exhibited at USD 1.94 billion in 2023 and is projected to hit around USD 17.36 billion by 2033, growing at a CAGR of 24.5% during the forecast period of 2024 to 2033.

Key Takeaways:

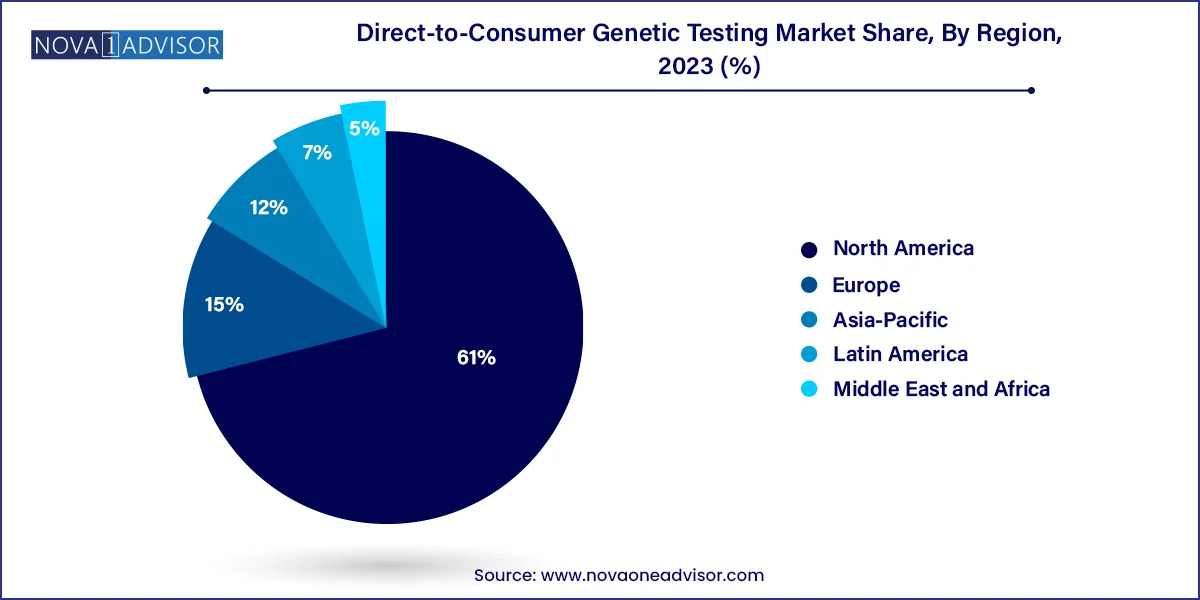

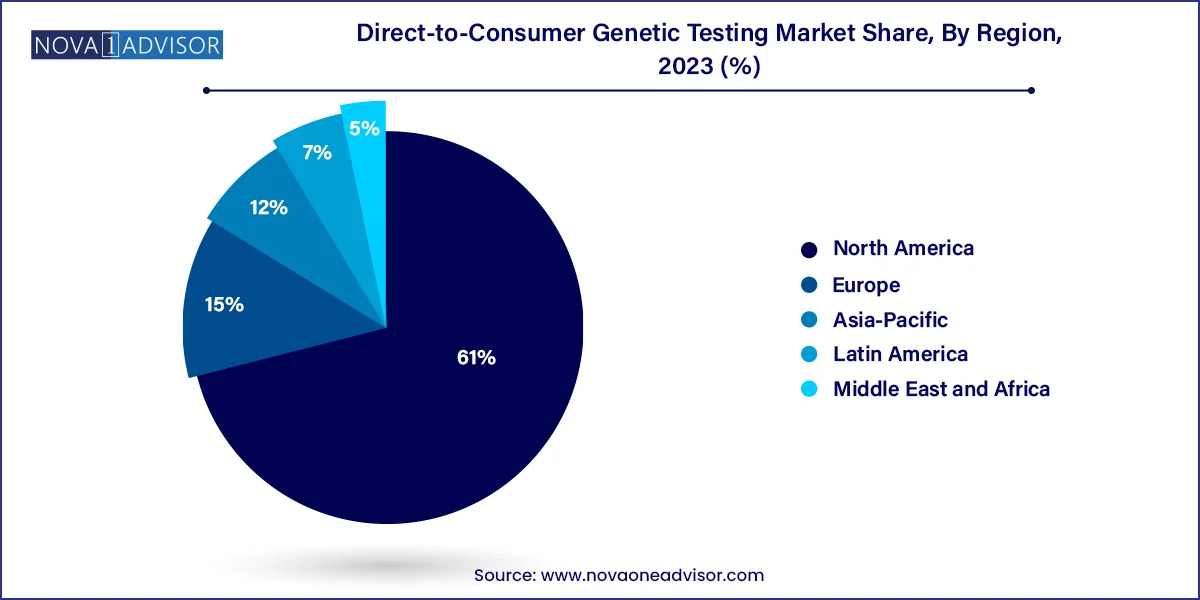

- North America dominated the direct-to-consumer genetic testing market and held the largest revenue share of 61.0% in 2023.

- Based on the distribution channel, the online platform segment dominated the market and held the largest revenue share of 65.0% in 2023.

- The predictive testing segment dominated the market with the largest revenue share of 38.1% in 2023 and is expected to grow at the fastest CAGR over the forecast period.

- The whole genome sequencing segment dominated the DTC genetic testing market and accounted for the maximum revenue share of 39.2% in 2023.

Market Overview

The Direct-to-Consumer (DTC) Genetic Testing Market represents a significant paradigm shift in the field of genomics and personalized medicine. Traditionally confined to clinical environments and dependent on physician referrals, genetic testing is now increasingly accessible directly to consumers through online platforms and retail distribution. DTC genetic testing allows individuals to uncover insights about their ancestry, health predispositions, carrier status for genetic conditions, and even lifestyle traits without needing a prescription or visiting a healthcare provider.

The market has gained remarkable traction, particularly among health-conscious and tech-savvy populations. As consumers become more involved in their personal health management, DTC genetic testing provides them with the tools to make informed decisions. Whether it's discovering a genetic tendency toward lactose intolerance or learning about one's predisposition to certain cancers, the utility of these tests is rapidly expanding.

Advancements in genomic technology, decreasing costs of sequencing, and increased awareness about the potential of personalized health have also catalyzed market growth. Companies like 23andMe, AncestryDNA, and MyHeritage have popularized the concept, offering comprehensive genetic insights at accessible prices. As data privacy regulations become more robust and consumer interest matures, the DTC genetic testing industry is poised to become a cornerstone of preventive healthcare.

Major Trends in the Market

-

Shift Toward Preventive Healthcare: Consumers are increasingly interested in genetic insights to prevent diseases rather than merely diagnose them.

-

Integration with Digital Health Platforms: DTC genetic results are being synced with wellness apps and digital health platforms for personalized fitness and diet plans.

-

Emergence of Nutrigenomics: Customized diet plans based on one’s genetic profile are gaining popularity, especially among millennials and fitness enthusiasts.

-

Affordable Whole Genome Sequencing: The decreasing cost of genome sequencing is enabling more comprehensive and budget-friendly DTC offerings.

-

Regulatory Advancements and Challenges: Countries are introducing new frameworks to regulate the accuracy and ethical use of DTC tests, particularly in health-related testing.

-

Collaborations with Pharmaceutical Firms: DTC companies are partnering with pharma firms for research purposes, using anonymized genetic data to accelerate drug development.

-

Consumer Education Campaigns: Companies are investing in educational tools to improve genetic literacy and increase trust in DTC testing services.

Direct-to-Consumer Genetic Testing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.94 Billion |

| Market Size by 2033 |

USD 17.36 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 24.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Test Type, Technology, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

23andMe; Family Tree DNA; Ancestry; Genesis HealthCare; EasyDNA; Veritas; Myriad Genetics Inc.; Full Genomes Corporation, Inc.; Living DNA Ltd.; Color Health, Inc., |

Key Market Driver: Rising Consumer Interest in Personalized Health and Wellness

One of the most significant drivers of the DTC genetic testing market is the growing consumer interest in personalized health and wellness. In an age where people are seeking tailored approaches to fitness, nutrition, skincare, and disease prevention, genetic insights offer a highly customized roadmap.

For example, a customer might use nutrigenomics testing to understand their body's ability to metabolize fats or caffeine, which can then guide their dietary choices. Another might use predictive testing to evaluate their genetic predisposition to Type 2 diabetes and take preventive action through lifestyle changes. This consumer-centric model aligns with broader trends in healthcare that emphasize empowerment, preventive action, and personalized services. Furthermore, marketing campaigns that humanize genetics—using real-life stories and testimonials—have played a major role in encouraging first-time users to try these tests.

Key Market Restraint: Data Privacy and Ethical Concerns

Despite growing adoption, the market faces a crucial restraint: data privacy and ethical concerns. Genetic information is highly sensitive and, if mishandled, can lead to severe consequences such as discrimination in employment or insurance, identity theft, or unauthorized use for research.

Notably, several incidents have drawn attention to potential risks. In 2018, it was reported that law enforcement agencies in the U.S. used a DTC genealogy database to track the Golden State Killer. While this marked a breakthrough in forensics, it also raised alarms over privacy rights and consent. Furthermore, concerns over how DTC companies share or monetize consumer data—often buried in lengthy consent forms—have led to calls for stricter data governance and transparency.

These concerns have prompted regulatory scrutiny in regions like Europe, where the GDPR mandates explicit user consent and limits how data can be stored or processed. In markets without strong data protection laws, these fears could hinder adoption and trust.

Key Market Opportunity: Expansion in Emerging Markets

The expansion into emerging markets represents a high-potential growth opportunity for the DTC genetic testing industry. As healthcare systems in Asia-Pacific, Latin America, and parts of Africa modernize, the demand for innovative, self-directed health tools is increasing.

Emerging economies have large populations with rising disposable incomes, increased internet penetration, and growing awareness of preventive health. For instance, in India, startups like Mapmygenome are offering personalized genetic insights related to health and nutrition, catering to an increasingly urban and health-focused middle class. Similarly, in China, government-led genome projects have cultivated public awareness and acceptance of genetic technologies.

Localization—such as providing language-specific platforms and culturally relevant interpretations of genetic data—can further enhance penetration in these regions. As awareness and affordability align, DTC testing could see exponential growth outside traditional Western markets.

Distribution Channel Insights

Online platforms dominate the DTC genetic testing market, with the vast majority of kits sold directly through company websites or third-party e-commerce platforms. The convenience of ordering tests online, receiving kits at home, and accessing results via secure web portals has become a major selling point. These platforms often include personalized dashboards, lifestyle tips, and options to share results with medical professionals. The digital model also supports subscription-based services for ongoing health monitoring, creating recurring revenue opportunities.

Meanwhile, the over-the-counter (OTC) channel is gaining ground, particularly through retail chains like Walgreens, CVS, and Boots (UK). DTC testing kits are now stocked in physical stores, increasing visibility among consumers who may not actively seek them online. For instance, in December 2024, Walgreens began selling LetsGetChecked and Everlywell genetic kits in select U.S. locations. This approach broadens the target audience, particularly those less tech-savvy or who prefer purchasing health products in person.

Test Type Insights

Predictive genetic testing is the dominant test type in the DTC market, owing to its perceived value in identifying an individual's susceptibility to diseases like cancer, Alzheimer’s, and cardiovascular conditions. With consumers becoming proactive in managing long-term health risks, predictive testing has become popular among middle-aged adults and even younger individuals with family histories of certain illnesses. These tests empower users to implement preventive lifestyle changes or undergo regular screenings. For instance, 23andMe offers BRCA1 and BRCA2 gene testing, which can indicate an increased risk of breast and ovarian cancer.

On the other hand, nutrigenomics testing is witnessing the fastest growth, especially among younger demographics focused on wellness optimization. These tests analyze genes related to metabolism, vitamin absorption, food intolerances, and more, enabling consumers to personalize their diets and fitness plans. With the rise of personalized wellness platforms like DNAfit and Habit, consumers can now access meal plans and fitness routines tailored to their genetic profiles. The growing popularity of biohacking and performance optimization is further driving this trend.

Technology Insights

SNP chip technology currently dominates the market due to its affordability and efficiency in analyzing known genetic variations associated with common traits and conditions. These chips are cost-effective, provide quick results, and are sufficient for most ancestry and carrier tests. Most mainstream providers, including AncestryDNA and MyHeritage, rely on SNP chips for their consumer offerings. The vast databases of known SNPs make this technology highly reliable for pattern recognition in ancestry and health trait analyses.

However, whole genome sequencing (WGS) is rapidly gaining traction, offering the most comprehensive view of an individual’s DNA. While previously cost-prohibitive, WGS is becoming more affordable and accessible, thanks to advancements in sequencing platforms. Unlike SNP chips, which scan only a fraction of the genome, WGS captures all genetic variations, including rare mutations. Companies like Nebula Genomics and Veritas Genetics are championing this technology, attracting users who want deeper, more nuanced insights into their genetic makeup.

Regional Insights

North America is the leading region in the global DTC genetic testing market, accounting for the largest market share due to high consumer awareness, robust digital infrastructure, and the presence of major players. The U.S., in particular, has pioneered the commercialization of consumer genetic testing through companies like 23andMe, Ancestry, and Helix.

Government support for genomic research, widespread adoption of preventive health practices, and a favorable regulatory framework have further fueled market development. Consumers in the U.S. are open to exploring personal data for health and lifestyle improvement, and insurance policies are beginning to include genetic counseling, albeit cautiously. Canada also contributes significantly, with companies like DNA Genotek and Lobo Genetics actively innovating.

Asia-Pacific is the fastest-growing regional market, driven by rapid technological advancement, urbanization, and a growing middle class. Countries like China, India, Japan, and South Korea are leading the way, with startups and established labs launching region-specific products.

China's consumer genetics sector is booming, supported by government-backed genome initiatives and a rising demand for personalized health solutions. In India, companies such as Mapmygenome and Xcode Life offer cost-effective and localized DTC testing services. Additionally, the popularity of K-beauty and personalized skincare in South Korea has driven interest in genetic-based dermatological tests. Increased mobile and internet penetration, along with digitally savvy consumers, are accelerating adoption.

Some of the prominent players in the direct-to-consumer genetic testing market include:

- 23andMe

- Family Tree DNA

- Ancestry

- Genesis HealthCare

- EasyDNA,

- Veritas

- Myriad Genetics Inc.

- Full Genomes Corporation, Inc

- Living DNA Ltd.

- Color Health, Inc.

Recent Developments

-

April 2025 – 23andMe launched a new subscription-based service, 23andMe+ Premium, offering deeper insights into chronic illness risks and pharmacogenetics.

-

February 2025 – AncestryDNA announced an expansion into personalized wellness testing, including reports on fitness potential, hydration needs, and nutrient absorption.

-

December 2024 – MyHeritage introduced Deep Nostalgia™ 2.0, enhancing AI-driven heritage visualization and expanding into epigenetic indicators.

-

October 2024 – Nebula Genomics reduced its full genome sequencing cost to under $200, making it one of the most affordable WGS offerings on the market.

-

August 2024 – Helix partnered with a major U.S. hospital network to offer genomic wellness screenings to employees as part of a corporate health initiative.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global direct-to-consumer genetic testing market.

Test Type

- Nutrigenomics Testing

- Predictive Testing

- Carrier Testing

- Others

Technology

- Whole Genome Sequencing

- Single Nucleotide Polymorphism Chips

- Targeted Analysis

- Others

Distributional Channel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)