Drone Sensor Market Size and Research

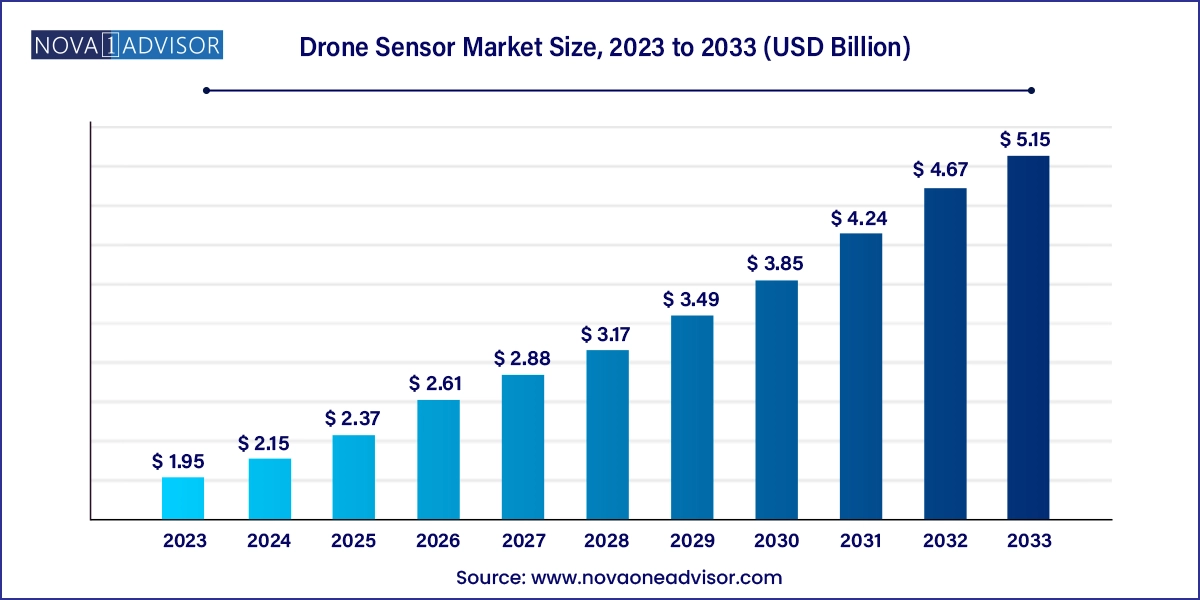

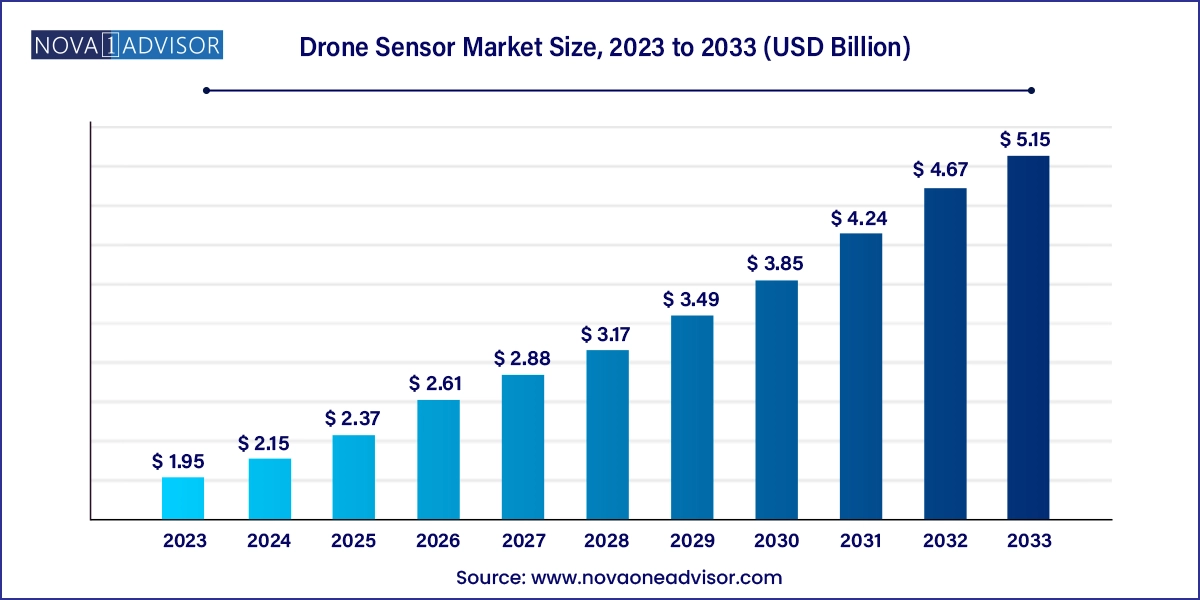

The drone sensor market size was exhibited at USD 1.95 billion in 2023 and is projected to hit around USD 5.15 billion by 2033, growing at a CAGR of 10.2% during the forecast period 2024 to 2033.

Drone Sensor Market Key Takeaways:

- The image sensor segment dominated the market in 2023 with a share of around 32%.

- The inertial sensor segment is estimated to have a significant CAGR from 2024 to 2033.

- The Vertical Take-Off and Landing (VTOL) segment held the largest revenue share in 2023.

- The hybrid segment is estimated to register the fastest CAGR from 2024 to 2033.

- The navigation segment held the largest revenue share in 2023.

- The data acquisition segment is estimated to register the fastest CAGR from 2024 to 2033.

- The remotely operated segment held the highest revenue share in 2023.

- The fully autonomous segment is estimated to register the fastest CAGR from 2024 to 2033.

- The military segment held the highest revenue share in 2023.

- The consumer segment is estimated to register the fastest CAGR from 2024 to 2033.

- The drone sensor market in North America accounted for a revenue share of nearly 40% in 2023.

Market Overview

The Drone Sensor Market is a rapidly evolving segment of the broader unmanned aerial vehicle (UAV) ecosystem. Sensors serve as the foundational components of modern drones, enabling them to perform tasks ranging from simple obstacle avoidance to complex operations such as aerial mapping, 3D imaging, environmental monitoring, surveillance, and military reconnaissance. As drone applications expand across industries—from agriculture and energy to logistics, defense, and filmmaking—the demand for sophisticated, accurate, and lightweight sensor systems has surged.

A drone’s capability is fundamentally defined by its sensor suite. Modern drones are equipped with a wide variety of sensors: inertial measurement units (IMUs), cameras (RGB, thermal, multispectral), GPS units, LiDAR systems, ultrasonic sensors, barometers, and more. These sensors not only guide the drone’s flight but also facilitate data collection, environmental interaction, and situational awareness. As commercial drones move toward higher autonomy and versatility, the requirement for multi-sensor fusion and real-time data processing is intensifying.

Governments and regulatory bodies worldwide are embracing UAVs for border security, infrastructure inspection, disaster management, and law enforcement. Meanwhile, enterprises are deploying sensor-laden drones for precision agriculture, solar farm monitoring, and aerial logistics. The development of AI-integrated drones, improvements in battery technology, and sensor miniaturization are expected to propel the drone sensor market into a new phase of innovation and commercialization.

Major Trends in the Market

-

Sensor fusion for enhanced situational awareness: Integrating data from multiple sensors (e.g., LiDAR + GPS + IMU) is becoming standard for higher accuracy and redundancy in navigation and detection.

-

Shift toward fully autonomous drones: Sensor technologies are critical in enabling autonomy in drones for applications like last-mile delivery, surveillance, and combat missions.

-

Growing use of multispectral and hyperspectral sensors: These sensors are increasingly used in agriculture, mining, and environmental monitoring for detailed data capture across light spectrums.

-

Integration of AI and edge computing: Real-time onboard processing allows sensors to feed actionable data instantly without reliance on cloud processing.

-

Miniaturization of components: Ongoing innovation in sensor design is making it possible to mount multiple, lightweight, high-performance sensors even on small UAV platforms.

-

Emergence of swarm drones: Sensor communication across drone swarms for coordinated missions is gaining traction in both commercial and military sectors.

-

Regulatory shifts encouraging BVLOS flights: Beyond Visual Line of Sight (BVLOS) operations demand more advanced sensing systems to ensure airspace safety and drone autonomy.

Report Scope of Drone Sensor Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.15 Billion |

| Market Size by 2033 |

USD 5.15 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Sensor Type, Platform Type, Application, Technology, End user, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

| Key Companies Profiled |

ams-OSRAM AG; Bosch Sensortec GmbH; InvenSense; KVH Industries, Inc.; LeddarTech Holdings Inc.; RTX; Sentera; Sony Semiconductor Solutions Group; Sparton; TE Connectivity; Teledyne FLIR LLC; Trimble Inc. |

Key Market Driver: Rising Adoption in Industrial Inspection and Infrastructure Monitoring

A major growth catalyst for the drone sensor market is the accelerated adoption of drones in industrial inspections and infrastructure monitoring. Drones offer an efficient, safe, and cost-effective way to inspect large or hard-to-reach structures such as power lines, wind turbines, oil rigs, pipelines, bridges, and transmission towers. These inspections require drones to be equipped with precise sensors like thermal imagers, LiDAR, position sensors, and high-resolution cameras.

For example, energy companies deploy drones with infrared sensors to detect hotspots in solar farms or to identify potential faults in power grids. The use of 3D mapping through LiDAR sensors helps in construction site monitoring and structural assessments. In the aftermath of natural disasters, drones assist in damage evaluation without exposing workers to hazardous environments. With industries prioritizing predictive maintenance and operational efficiency, sensor-enabled drones are becoming indispensable tools for data-driven infrastructure management.

Key Market Restraint: Challenges in Sensor Calibration and Interference

Despite the growth, one of the critical restraints in the drone sensor market is the challenge of sensor calibration, data synchronization, and signal interference. Many drone sensors require meticulous calibration to function accurately, especially in applications involving motion tracking, navigation, and image stitching. Miscalibrated sensors can lead to inaccurate mapping, poor flight control, or even system failure during missions.

Additionally, environmental factors such as electromagnetic interference (EMI), weather changes, or signal occlusion in urban canyons or dense forests can degrade sensor performance. For instance, GPS-based sensors may lose accuracy in areas with poor satellite reception, while optical sensors may underperform in low-light or foggy conditions. These technical limitations necessitate complex sensor fusion algorithms and redundancy systems, increasing the cost and complexity of deployment.

Key Opportunity: Expanding Use in Smart Agriculture and Environmental Monitoring

The growing use of drones in precision agriculture and environmental monitoring offers significant opportunities for sensor manufacturers. Modern farms are turning to drones equipped with multispectral and thermal sensors to monitor crop health, soil moisture, irrigation patterns, and pest activity. Such sensors allow farmers to make real-time decisions that optimize yields, reduce waste, and conserve water and fertilizers.

In environmental conservation, drones equipped with COâ‚‚ sensors, thermal imagers, and photogrammetry tools are being used to monitor forest health, track animal populations, and assess water quality in inaccessible areas. Governments and NGOs are leveraging sensor-equipped drones to track deforestation, illegal fishing, glacier retreat, and wildlife migration. As sustainability and climate change responses become more urgent, drones with advanced sensor payloads are expected to play a central role in environmental data acquisition.

Drone Sensor Market By Sensor Type Insights

Image sensors dominated the sensor type segment in 2024. These include RGB, infrared, thermal, and multispectral cameras. Their application spans across consumer photography, agricultural analysis, surveillance, media production, and construction. As visual data becomes critical for decision-making in both commercial and defense sectors, the need for high-resolution imaging continues to grow. Companies are integrating AI into imaging systems to enable automatic object recognition, change detection, and anomaly alerts.

Inertial sensors are expected to be the fastest-growing segment. These sensors, comprising accelerometers and gyroscopes, are fundamental to drone stability, motion detection, and navigation. As the complexity of drone maneuvers and autonomy increases, high-performance IMUs (Inertial Measurement Units) are being deployed across platforms. The development of micro-electromechanical systems (MEMS)-based inertial sensors has enabled their integration into compact drones without compromising performance.

VTOL (Vertical Take-Off and Landing) platforms led the market by platform type. VTOL drones combine the hovering capabilities of helicopters with the range of fixed-wing aircraft, making them ideal for mapping, surveying, and military surveillance. These drones require precise sensor systems for stability, altimetry, and obstacle avoidance during transitions between vertical and horizontal flight.

Hybrid drones are poised to be the fastest-growing platform type. Hybrids integrate the endurance of fixed-wing aircraft with the maneuverability of VTOLs. They are gaining popularity in delivery logistics, long-range inspections, and military cargo transport. The need for multisensory systems to ensure safe transitions, autonomous navigation, and obstacle detection is boosting demand for hybrid-compatible sensors.

Drone Sensor Market By Application Insights

Navigation applications dominated the segment in 2024. Position sensors, IMUs, and magnetometers are essential for guiding drones, maintaining stability, and avoiding obstacles. These sensors are critical for both autonomous drones and those piloted remotely. Navigation accuracy is vital in military missions, delivery logistics, and surveillance.

Data acquisition is the fastest-growing application. Sensor-laden drones are transforming how organizations collect spatial, environmental, and thermal data. From photogrammetry in construction to volumetric calculations in mining and forest monitoring, sensor-rich drones are increasingly the preferred data-gathering tool. This segment is benefiting from AI integration and real-time analytics for rapid data processing and decision-making.

Drone Sensor Market By Technology Insights

Remotely operated drones continue to dominate the technology segment. Most drones deployed today are piloted via ground stations or mobile apps. These systems depend on sensors for telemetry, collision avoidance, and orientation control. Manual drone operations still dominate industries like media, construction, and hobbyist photography.

Fully autonomous drones are expected to grow at the fastest rate. Autonomy demands complex sensor arrays, including LiDAR, radar, ultrasonic rangefinders, and visual odometry tools. Industries such as defense, delivery, and agriculture are investing heavily in autonomous fleets that can operate without human intervention, particularly for repetitive or high-risk tasks.

Drone Sensor Market By End User Insights

The commercial segment dominated the end-user category. Sectors such as energy, mining, agriculture, logistics, and infrastructure inspection are deploying drones with advanced sensors to reduce labor costs and increase operational safety. For example, mapping & surveying operations use drones with LiDAR and RTK-GNSS for high-precision terrain modeling. Inspection/maintenance drones use thermal cameras to identify equipment faults in real time.

The military segment is expected to grow the fastest. Defense agencies globally are investing in drone programs for surveillance, target acquisition, and even precision strikes. Sensor types include hyperspectral imagers, synthetic aperture radar (SAR), and long-range communication payloads. Countries such as the U.S., China, and Israel are leading investments in ISTAR drones that rely heavily on sensor capabilities for strategic superiority.

Drone Sensor Market By Regional Insights

North America accounted for the largest market share in 2024. The U.S. is a leader in drone sensor development, driven by its strong defense sector, tech infrastructure, and commercial drone usage. Major companies such as FLIR Systems, Teledyne, and Lockheed Martin are headquartered in the region, contributing significantly to R&D in imaging, navigation, and reconnaissance sensors. The Federal Aviation Administration (FAA) has facilitated drone deployment through evolving regulations, enabling widespread commercial use.

Additionally, government agencies like NASA and the Department of Defense have deployed drones for scientific exploration and battlefield intelligence. Agricultural drones in the Midwest, inspection drones in Texas’s oil fields, and police surveillance drones in urban areas reflect a mature and diversified market that continues to innovate and expand.

Asia Pacific is poised to witness the fastest growth. Rapid urbanization, growing defense budgets, and expanding agricultural economies in China, India, Japan, and Southeast Asia are key drivers. China, home to DJI—one of the world’s largest drone manufacturers—has already established leadership in consumer drones and is now scaling up in commercial and government applications. Indian startups are leveraging drones for precision farming, public safety, and infrastructure mapping under government-backed initiatives.

The growing push for indigenous defense technology, coupled with increased spending on border surveillance and disaster management, is also spurring demand for sensor-rich drones. Furthermore, regional governments are easing drone regulations to foster innovation, which is encouraging sensor manufacturers to expand their footprints in Asia.

Drone Sensor Market Recent Developments

-

DJI (February 2025): Released the Zenmuse L2 LiDAR sensor with integrated RGB camera for high-accuracy 3D mapping in forestry and construction.

-

FLIR Systems (January 2025): Announced a new series of dual thermal-visual payloads for UAVs used in industrial and military surveillance.

-

Teledyne (March 2025): Partnered with a mining company in Australia to deploy drones equipped with hyperspectral sensors for mineral exploration.

-

Parrot (April 2024): Launched an AI-enabled imaging sensor for precision agriculture drones, allowing real-time NDVI vegetation analysis.

-

Lockheed Martin (December 2024): Upgraded its Stalker UAV with enhanced onboard sensors for long-range surveillance and nighttime operations.

Some of the prominent players in the drone sensor market include:

- ams-OSRAM AG.

- Bosch Sensortec GmbH

- InvenSense.

- KVH Industries, Inc.

- LeddarTech Holdings Inc.

- RTX

- Sentera

- Sony Semiconductor Solutions Group

- Sparton

- TE Connectivity.

- Teledyne FLIR LLC

- Trimble Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the drone sensor market

Sensor Type

- Inertial Sensor

- Image Sensor

- Position Sensor

- Current Sensor

- Others ( Light Sensor, Pressure Sensor, Speed and Distance Sensor)

Platform Type

Application

- Navigation

- Data Acquisition

- Motion Detection

- Air Pressure Measurement

- Others

Technology

- Remotely Operated

- Semi-autonomous

- Fully Autonomous

End User

-

- Prosumer

- Toy/Hobbyist

- Photogrammetry

-

- "Inspection/Maintenance"

- Mapping & Surveying

- Photography/ Filming

- Surveillance & Monitoring

- "Localization/Detection"

- Spraying/ Seeding

- Others

-

- Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR)

- Communication

- Combat Operations

- Military Cargo Transport

- Precision Strikes

- Others

- Government & Law Enforcement

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)