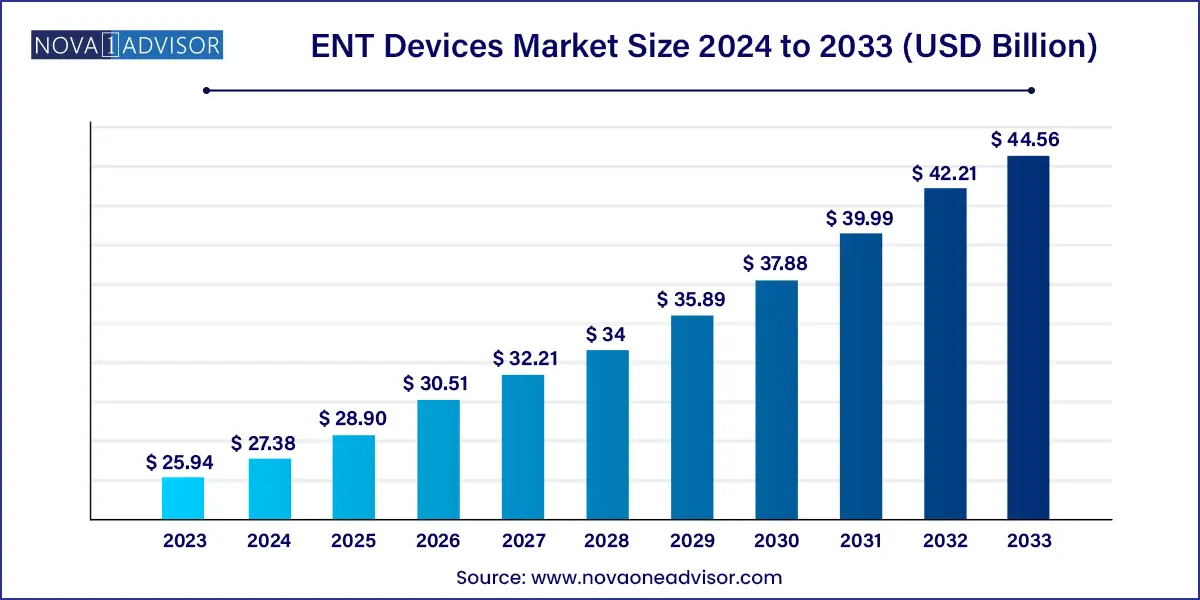

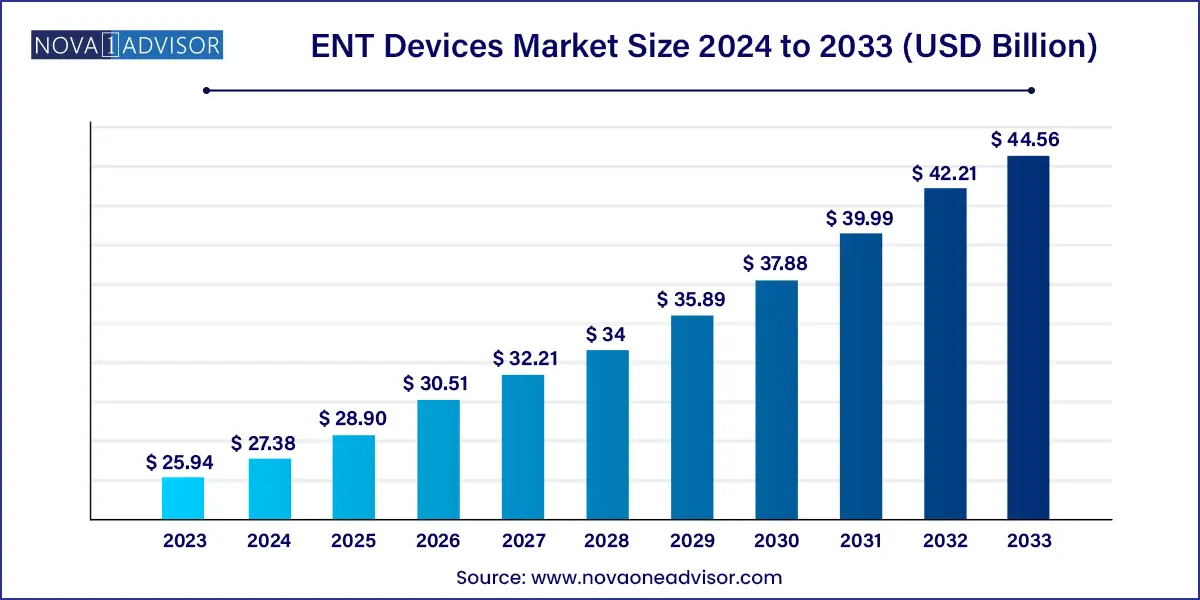

The global ENT devices market size was exhibited at USD 25.94 billion in 2023 and is projected to hit around USD 44.56 billion by 2033, growing at a CAGR of 5.56% during the forecast period of 2024 to 2033.

Key Takeaways:

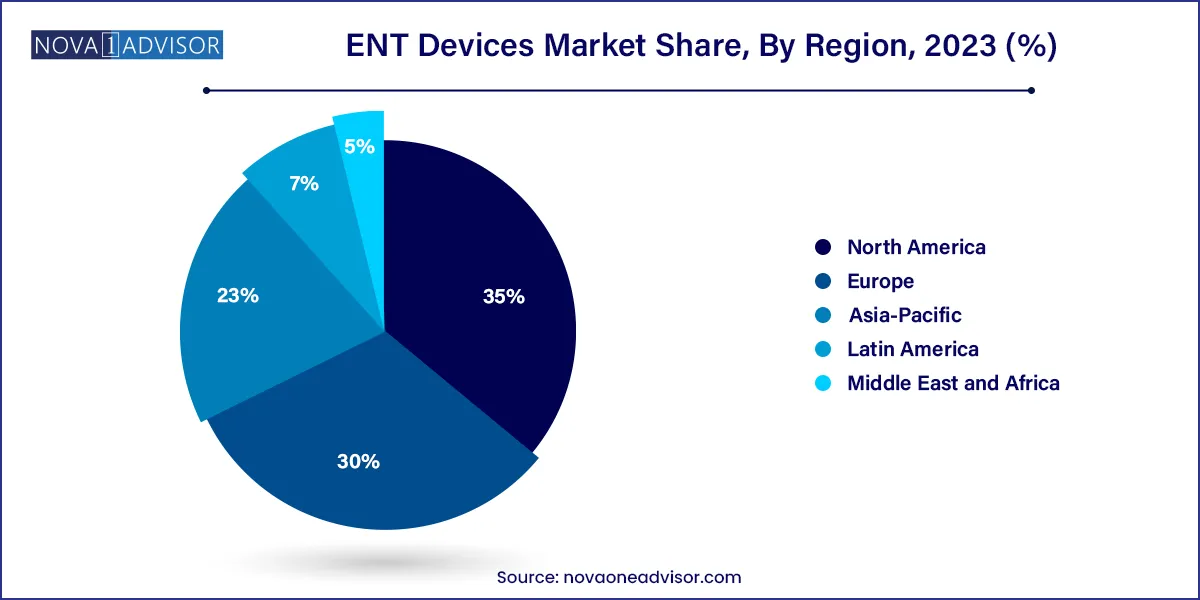

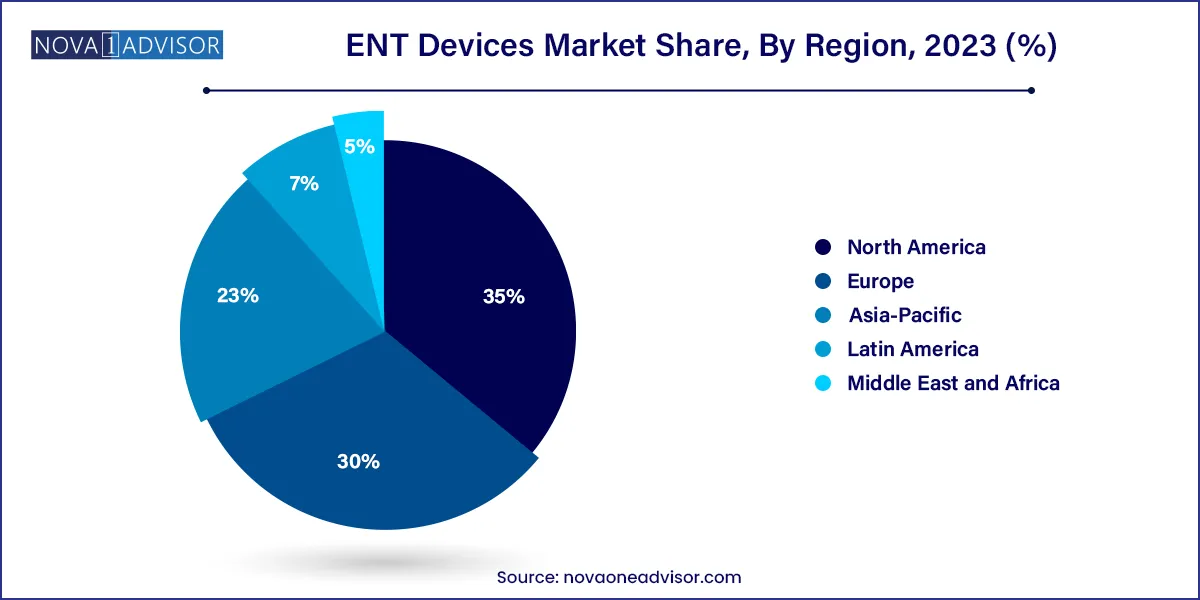

- North America dominated the market with 35% share in 2023.

- The hearing aids segment held the largest revenue share of over 30% in 2023.

Market Overview

The Ear-Nose-Throat (ENT) devices market plays a crucial role in the global medical device ecosystem, addressing a wide range of disorders affecting hearing, breathing, speech, balance, and facial aesthetics. This market encompasses diagnostic and surgical instruments, hearing aids, implants, and associated accessories used in otolaryngology—the branch of medicine that deals with diseases and conditions of the ear, nose, and throat.

The global burden of ENT disorders is substantial. According to the World Health Organization (WHO), over 430 million people globally require rehabilitation for disabling hearing loss. Simultaneously, sinusitis, rhinitis, chronic ear infections, and laryngeal disorders are among the most frequently diagnosed conditions in outpatient departments worldwide. The increasing incidence of these disorders—particularly among aging populations and children—has driven demand for advanced ENT solutions that are safe, minimally invasive, and technologically superior.

Rising awareness about hearing care, favorable reimbursement policies in developed economies, and improved access to ENT services in emerging markets are major contributors to market growth. Moreover, the market is experiencing a paradigm shift due to the integration of AI-powered diagnostics, robot-assisted surgery, and connected hearing devices that offer real-time health monitoring. Rapid technological innovation, increasing demand for outpatient ENT procedures, and expansion of ENT specialty clinics globally have further fueled market momentum.

As the population ages and chronic conditions like allergic rhinitis, obstructive sleep apnea, and hearing impairment become more prevalent, ENT care is evolving from a niche specialty into a cornerstone of global health systems. This has translated into consistent investments, clinical research, and robust competition among medical device manufacturers.

Major Trends in the Market

-

Rising adoption of minimally invasive ENT procedures, particularly in sinus surgeries and hearing implant placements.

-

Technological integration of AI and machine learning in diagnostic ENT devices like otoscopes and endoscopes for automated image analysis.

-

Growth in robot-assisted ENT surgeries, enabling precise, minimally invasive interventions for complex anatomical regions.

-

Increasing popularity of wireless and Bluetooth-enabled hearing aids, improving patient comfort and functionality.

-

Shift toward outpatient care settings and ENT specialty clinics due to cost-effectiveness and faster recovery times.

-

Improved reimbursement structures in countries like the U.S., Germany, and Japan for ENT surgical procedures and assistive devices.

-

Expansion of ENT services in emerging markets, driven by telemedicine, mobile diagnostic units, and government programs for hearing screening.

-

Rising awareness and screening programs for pediatric hearing loss, especially in neonatal care.

ENT Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 25.94 Billion |

| Market Size by 2033 |

USD 44.56 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.56% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Demant A/S; Sonova; GN Store Nord A/S; Ambu A/S; Pentax Medical (HOYA Corporation); Karl Storz; Olympus Corporation; Richard Wolf GmbH; Cochlear Ltd.; Starkey Laboratories, Inc.; Rion Co., Ltd.; Stryker; and Smith & Nephew plc; Nico Corporation, Nemera |

Key Market Driver: Increasing Prevalence of Hearing Loss and ENT Disorders

A major driving force behind the ENT devices market is the growing global prevalence of hearing loss and related disorders. Hearing impairment is no longer confined to aging populations; it affects children, working adults, and individuals with comorbidities such as diabetes, cardiovascular disease, and infections like meningitis.

According to the WHO, by 2050 nearly 2.5 billion people are projected to suffer from some degree of hearing loss, with over 700 million requiring hearing rehabilitation. This immense burden is not only a clinical concern but a public health issue affecting communication, education, productivity, and quality of life. Consequently, the demand for diagnostic screening, hearing aids, cochlear implants, and supportive surgical interventions has risen sharply.

Additionally, conditions such as sinusitis, allergic rhinitis, sleep apnea, and voice disorders have seen a sharp uptick due to increasing urban pollution, sedentary lifestyles, and stress. ENT devices from otoscopes and nasal endoscopes to radiofrequency handpieces and dilation tools are integral to managing and treating these conditions, contributing significantly to global device sales.

Key Market Restraint: High Cost of Advanced ENT Devices and Limited Reimbursement in Emerging Markets

Despite its promising growth trajectory, the ENT devices market is restrained by the high cost of technologically advanced equipment and limited reimbursement options, especially in low- and middle-income countries. Many modern ENT devices, including robot-assisted systems and high-definition flexible endoscopes, come with substantial upfront investments, training requirements, and maintenance costs.

In countries where healthcare systems are underfunded or heavily reliant on out-of-pocket spending, adoption of these advanced tools is slow. Even hearing aids one of the most commonly prescribed ENT devices remain underutilized due to affordability issues. WHO data shows that only 17% of people who need hearing aids in low-income countries actually use them.

Furthermore, insurance policies in many developing nations do not fully reimburse costs associated with elective ENT surgeries or assistive devices like hearing aids or nasal splints. This gap in financial support limits access, particularly among elderly and rural populations.

Key Market Opportunity: Expansion of ENT Care in Ambulatory and Outpatient Settings

A major opportunity in the ENT devices market lies in the ongoing transition from inpatient surgical settings to outpatient and ambulatory care environments. With the advancement of less invasive surgical techniques and the miniaturization of medical devices, ENT procedures such as endoscopic sinus surgery, tonsillectomy, and hearing aid fitting are increasingly being performed outside traditional hospitals.

This trend is fueled by growing demand for cost-effective, time-efficient care, and reduced risk of nosocomial infections. Ambulatory surgical centers (ASCs) and ENT clinics offer shorter recovery times, streamlined workflows, and greater patient satisfaction. For device manufacturers, this represents an opportunity to develop portable, compact, and digitally connected devices tailored for outpatient use.

Additionally, this shift supports the rising demand for ENT care in rural and semi-urban areas where hospital infrastructure is limited but clinic-based services are expanding rapidly. Companies that design scalable, user-friendly tools for decentralized care settings stand to benefit significantly.

Segments Insights:

Product Insights

Diagnostic ENT devices held the largest market share due to their foundational role in the detection and monitoring of ENT-related diseases. Tools like rigid and flexible endoscopes, otoscopes, and laryngoscopes are indispensable in evaluating sinus cavities, auditory canals, and laryngeal structures. Among rigid endoscopes, sinuscopes are especially popular in diagnosing chronic sinusitis and guiding surgical planning.

Flexible endoscopes, including bronchoscopes and nasopharyngoscopes, are gaining traction for their ability to reach deeper anatomical areas with minimal discomfort. The robot-assisted endoscope segment, though nascent, is showing promise for high-precision diagnostics in complex cases like base-of-skull tumors and laryngeal disorders.

In contrast, surgical ENT devices are emerging as the fastest-growing sub-segment. Innovations in radiofrequency handpieces, sinus dilation balloons, and nasal packing systems have enhanced surgical precision and reduced recovery times. ENT hand instruments—such as forceps, specula, and curettes continue to see widespread use, but the market is gradually shifting towards multifunctional and powered instruments that reduce surgeon fatigue and improve patient outcomes.

Regional Insights

North America led the global ENT devices market, primarily driven by high healthcare spending, sophisticated ENT infrastructure, and strong demand for hearing care. The United States accounts for the lion’s share, with a large aging population and proactive screening programs for hearing loss and sinus disorders. According to the National Institute on Deafness and Other Communication Disorders (NIDCD), approximately 15% of American adults report some trouble hearing, creating a strong market base.

Additionally, well-established ENT specialty practices, favorable reimbursement for procedures like cochlear implants, and the presence of leading market players such as Medtronic and Stryker reinforce regional dominance. Research grants, public awareness initiatives, and robust distribution networks further support the market.

Asia-Pacific is the fastest-growing region, buoyed by a combination of rising ENT disease burden, increasing disposable income, and government-led health initiatives. Countries like China and India are experiencing rising cases of allergic rhinitis, otitis media, and age-related hearing loss due to urban pollution, lifestyle changes, and aging populations.

To combat these issues, national screening programs and mobile ENT clinics are being deployed in rural areas. Japan and South Korea lead the way in innovation, especially in hearing technologies. Additionally, growing medical tourism in Southeast Asia for affordable ENT surgeries contributes to market momentum.

Multinational device makers are establishing regional manufacturing hubs and entering into partnerships with local ENT clinics and hospitals to tap into this burgeoning demand.

Recent Developments

-

April 2025 – Cochlear Ltd. unveiled its next-generation cochlear implant platform "Nucleus Synergy" with enhanced neural response telemetry and remote fitting capabilities.

-

February 2025 – Medtronic plc launched its AI-assisted flexible endoscope system for laryngeal diagnostics in the U.S. and Canada.

-

November 2024 – Sivantos (WS Audiology) introduced Signia Pure Charge&Go AX hearing aids with integrated motion sensors and directional microphones for noisy environments.

-

September 2024 – Smith & Nephew expanded its ENT surgical portfolio with the acquisition of a U.S.-based startup specializing in balloon sinus dilation devices.

-

July 2024 – Olympus Corporation received regulatory clearance for its next-gen bronchoscopes with 4K visualization and robotic articulation in Japan and Europe.

Some of the prominent players in the ENT devices market include:

- Ambu A/S

- Cochlear Ltd.

- Demant A/S

- GN Store Nord A/S

- Karl Storz SE & Co.

- Olympus Corporation

- Pentax of America, Inc.

- Richard Wolf GmbH

- Rion Co., Ltd.

- Smith & Nephew plc

- Sonova

- Starkey Laboratories, Inc.

- Stryker

- Nico Corporation

- Nemera

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global ENT devices market.

Product

-

-

- Sinuscopes

- Otoscopes

- Laryngoscopes

-

-

- Bronchoscopes

- Laryngoscopes

- Nasopharyngoscopes

-

- Robot Assisted Endoscope

- Hearing Screening Device

-

- Radiofrequency handpieces

- Otological Drill Burrs

- ENT Hand Instruments

- Sinus Dilation Devices

- Nasal Packing Devices

- Hearing Aids

- Hearing Implants

- Nasal Splints

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)