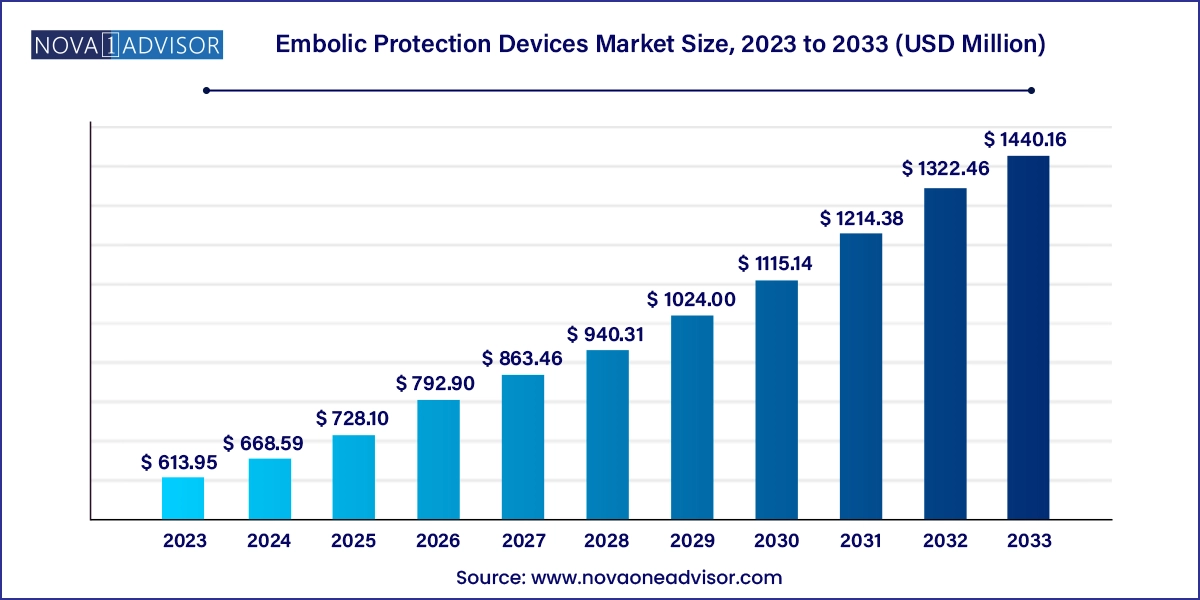

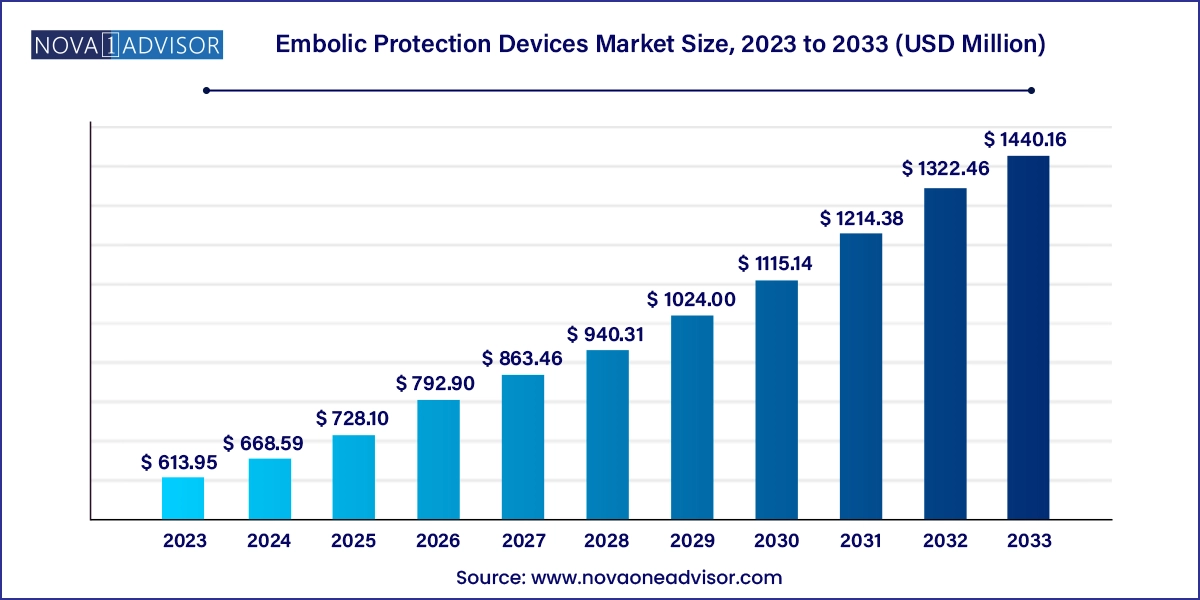

Embolic Protection Devices Market Size and Growth

The embolic protection devices market size was exhibited at USD 613.95 million in 2023 and is projected to hit around USD 1440.16 million by 2033, growing at a CAGR of 8.9% during the forecast period 2024 to 2033.

Embolic Protection Devices Market Key Takeaways

- Distal filters accounted for the largest share of 49.7% in 2023

- Distal occlusion devices are projected to witness a CAGR of 8.9% over the forecast period.

- Cardiovascular diseases dominated the market with a share of 48.8% in 2023.

- Neurovascular diseases are projected to grow at a CAGR of 7.9% over the forecast period.

- North America embolic protection devices market held 43.9% of the market share in 2023.

Market Overview

The global embolic protection devices (EPDs) market has become a crucial pillar in interventional cardiology, neurovascular interventions, and peripheral vascular procedures. Embolic protection devices are specialized tools used during endovascular procedures to capture or prevent emboli small blood clots or debris that may dislodge and travel to critical organs, potentially leading to life-threatening complications such as stroke or myocardial infarction.

The increasing prevalence of cardiovascular diseases (CVDs), peripheral artery disease (PAD), and neurovascular disorders has elevated the clinical demand for these devices. As procedures such as carotid artery stenting, percutaneous coronary intervention (PCI), transcatheter aortic valve replacement (TAVR), and endovascular aneurysm repair (EVAR) grow in volume, the need for reliable embolic protection has become paramount. For instance, in TAVR procedures, cerebral embolization can occur in up to 90% of patients, increasing the importance of embolic protection solutions that reduce stroke risk.

The use of embolic protection devices is also gaining momentum outside traditional cardiovascular applications. In neurovascular interventions, especially during thrombectomy and stenting procedures for acute ischemic stroke, the integration of EPDs enhances procedural safety and clinical outcomes. Similarly, in peripheral interventions, where plaque debris in lower limb arteries can lead to downstream embolization, EPDs are gradually being incorporated as standard-of-care tools.

Technological innovation is a core driver of this market’s evolution. Manufacturers are developing miniaturized, self-expanding, and highly maneuverable filter and occlusion systems that provide superior vessel coverage and minimal procedural disruption. The integration of imaging and catheter-based navigation systems is further enhancing the precision of EPD deployment, thereby expanding their adoption in complex anatomical settings. Despite these advancements, challenges related to device compatibility, cost, and operator skill remain prevalent.

Overall, the embolic protection devices market is set to witness robust growth due to the aging population, increase in interventional procedures, and improved physician awareness regarding embolic risks during vascular access and treatment.

Major Trends in the Market

-

Increasing Utilization of EPDs in Transcatheter Heart Valve Procedures: The growth of TAVR and TMVR (Transcatheter Mitral Valve Repair) is driving the adoption of cerebral protection devices.

-

Rising Integration in Neurovascular Applications: Embolic protection in stroke interventions, particularly mechanical thrombectomy, is gaining traction.

-

Development of Dual-Filter and Proximal-Plus-Distal Devices: Advanced designs are improving capture efficiency and procedural versatility.

-

Miniaturization and Enhanced Flexibility of EPDs: Manufacturers are prioritizing low-profile, more navigable devices for complex anatomy.

-

Regulatory Approvals and Expanded Indications: Devices are receiving expanded regulatory labels for use in broader procedures, including EVAR and PAD.

-

Growing Preference for Single-Use and Disposable Systems: Infection control and simplified logistics are increasing the demand for sterile, single-use EPD kits.

-

AI Integration in Procedural Planning: Artificial intelligence and imaging software are supporting preoperative planning for optimal device selection and deployment.

Report Scope of Embolic Protection Devices Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 668.59 Million |

| Market Size by 2033 |

USD 1440.16 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 8.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Mexico, Colombia, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

| Key Companies Profiled |

Boston Scientific Corporation ; Edwards Lifesciences Corporation.; Abbott.; Medtronic ; Cardinal Health.; Innovative Cardiovascular Solutions, LLC; Transverse Medical, Inc.; W. L. Gore & Associates, Inc. |

Key Market Driver: Rising Prevalence of Cardiovascular and Neurovascular Disorders

One of the foremost drivers propelling the embolic protection devices market is the increasing global incidence of cardiovascular and neurovascular diseases, particularly among aging populations. According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally, accounting for over 17.9 million deaths each year. Stroke remains a leading cause of long-term disability and mortality, with ischemic strokes making up the majority.

These statistics have led to a corresponding surge in vascular interventions such as carotid artery stenting, percutaneous coronary intervention, and TAVR, where the risk of embolization during catheter manipulation is well-documented. Embolic protection devices act as an insurance mechanism, mitigating adverse events that can complicate otherwise successful procedures. In the case of carotid artery stenting, studies have shown that using EPDs reduces the risk of periprocedural stroke by capturing atheromatous debris dislodged during balloon angioplasty and stent deployment.

As patient volumes increase and clinical guidelines become more stringent regarding embolic risk mitigation, the role of embolic protection devices is becoming more standardized, thereby boosting their market penetration.

Key Market Restraint: Device Compatibility and Procedural Complexity

Despite their clinical utility, a significant restraint limiting broader adoption of embolic protection devices is device compatibility with diverse anatomical profiles and procedural complexity. Each EPD is typically designed to function optimally within specific vessel diameters, flow conditions, or anatomical regions, which may not be suitable for all patients or procedures.

For instance, in highly tortuous vessels or severely calcified arteries, delivering a distal filter may be technically challenging or risk vessel dissection. Moreover, proximal occlusion devices may obstruct blood flow temporarily, which is not ideal for certain high-risk patients. Physicians often face a steep learning curve when incorporating EPDs into routine practice, particularly if the devices require separate guidewires or add procedural steps.

The issue of incompatibility with smaller access sites and the requirement of large introducer sheaths can also limit the feasibility of EPD use in patients with fragile vasculature. These technical challenges reduce adoption among less experienced operators and in resource-constrained settings where training or high-end imaging support may be limited.

Key Market Opportunity: Growing Use in Neurovascular Interventions

A promising opportunity for growth in the embolic protection devices market lies in the expanding use of EPDs in neurovascular interventions, particularly for stroke management and cerebral aneurysm procedures. Mechanical thrombectomy, now a frontline therapy for acute ischemic stroke caused by large vessel occlusion, is often performed without adequate embolic protection, despite the risk of dislodged thrombus fragments traveling to unaffected brain regions.

Recent clinical studies and trials are underscoring the benefits of using EPDs in neurovascular stenting and coiling procedures. These devices help prevent secondary embolic strokes, reduce clot fragmentation, and preserve perfusion to critical brain areas. The development of low-profile, flexible, and rapidly deployable cerebral protection systems is opening new avenues for usage in this delicate therapeutic area.

As awareness grows and reimbursement systems evolve to accommodate neuro-interventions, manufacturers who focus R&D on this segment can tap into a high-margin, underpenetrated niche with significant clinical demand.

Embolic Protection Devices Market By Product Insights & Trends

Distal filters dominated the embolic protection devices market, owing to their proven efficacy, ease of use, and favorable compatibility with a wide range of interventional procedures. These devices are deployed distal to the lesion site, where they act like sieves to capture embolic debris without halting blood flow. Their application is especially prevalent in carotid artery stenting, where they are often preferred due to their ability to maintain cerebral perfusion during the procedure. Several leading products, including the SpiderFX and Emboshield NAV6 systems, have demonstrated positive outcomes and widespread clinical adoption.

Proximal occlusion devices are the fastest-growing segment, particularly in high-risk, anatomically challenging cases where distal filter delivery is not feasible. These devices temporarily occlude the flow of blood during the procedure, preventing emboli from traveling upstream. This technique has gained popularity in TAVR and neurovascular applications, where manipulation of calcified or stenotic valves can result in significant embolic load. Recent advancements in balloon-based occlusion systems and integrated guiding catheters are enhancing usability and expanding the range of procedures in which proximal protection can be applied. These devices are also gaining favor due to their ability to capture both particulate and gaseous emboli, offering broader protection.

Embolic Protection Devices Market By Application Insights & Trends

Cardiovascular diseases dominate the application segment, largely due to the widespread use of embolic protection during carotid artery stenting, TAVR, and PCI procedures. Given the high incidence of coronary artery disease and the growing elderly population undergoing valve replacement surgeries, embolic protection devices have become indispensable tools in cardiac catheterization labs. Numerous trials have demonstrated the role of EPDs in reducing major adverse cardiovascular and cerebrovascular events (MACCE), supporting their routine use in high-risk patient subsets. Regulatory agencies and clinical guidelines continue to emphasize their value, especially in interventions involving atherosclerotic plaque disruption.

Neurovascular applications are emerging as the fastest-growing segment, driven by the increasing number of stroke interventions, aneurysm repairs, and complex cerebral stenting procedures. The urgency of stroke treatment and the delicate nature of cerebral vessels have highlighted the importance of embolic protection to prevent secondary infarctions. Companies are investing in cerebral embolic protection devices (CEPDs) that are compatible with small-diameter vessels and that offer real-time deployment feedback. With stroke incidence rising globally and thrombectomy gaining broader indications, neurovascular applications represent a high-growth frontier for EPD manufacturers.

Embolic Protection Devices Market By Regional Insights & Trends

North America dominates the global embolic protection devices market, attributed to a well-developed healthcare infrastructure, high procedural volumes, and the presence of leading EPD manufacturers. The U.S., in particular, accounts for a significant portion of the global market, with increasing adoption of TAVR, carotid stenting, and mechanical thrombectomy procedures. The region also benefits from favorable reimbursement policies, strong clinical research output, and early adoption of innovative technologies. Moreover, stringent FDA regulations have ensured the availability of only clinically validated products, reinforcing physician and patient confidence in device performance.

Asia Pacific is the fastest-growing regional market, driven by rapidly aging populations, rising cardiovascular disease prevalence, and improving access to interventional procedures. Countries like China, India, Japan, and South Korea are seeing increased investments in cath labs and neuro-intervention centers, supported by growing public health awareness. The shift toward value-based healthcare and the rising demand for minimally invasive solutions are propelling the demand for embolic protection devices in the region. Additionally, regional manufacturers are entering the market with competitively priced alternatives, improving affordability and expanding access.

Embolic Protection Devices Market Recent Developments

-

Boston Scientific (March 2025): Launched the next-generation FilterWire EZ system in select European markets, featuring enhanced deployment speed and embolic capture efficiency.

-

Claret Medical (a Boston Scientific Company, January 2025): Announced expanded clinical trial data for its Sentinel Cerebral Protection System in stroke prevention during TAVR procedures.

-

Abbott Laboratories (November 2024): Received CE Mark for its new integrated embolic protection catheter for peripheral vascular interventions, expected to launch across Europe by mid-2025.

-

Medtronic (October 2024): Partnered with a leading Chinese hospital group to conduct a real-world study on the use of EPDs in high-risk carotid stenting.

-

Silk Road Medical (September 2024): Reported positive results from its ROADSTER 3 trial, further supporting the use of its ENROUTE system in transcarotid artery revascularization (TCAR).

Some of the prominent players in the Embolic Protection Bevices Market Include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the embolic protection devices market

Product

- Distal Occlusion Devices

- Proximal Occlusion Devices

- Distal Filters

Application

- Cardiovascular Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- MEA