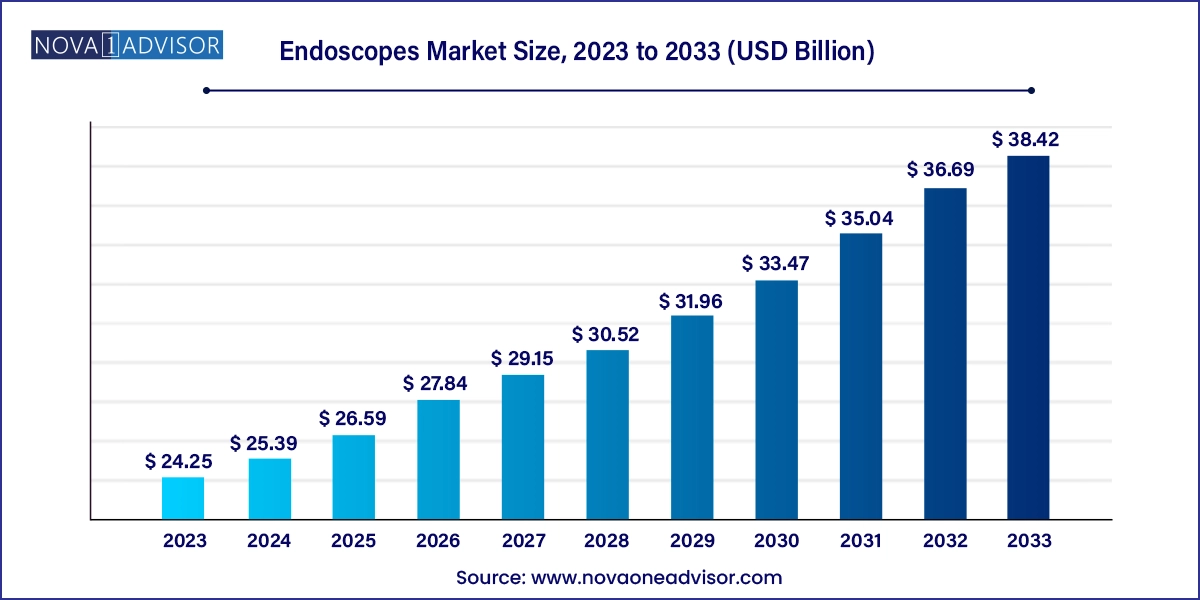

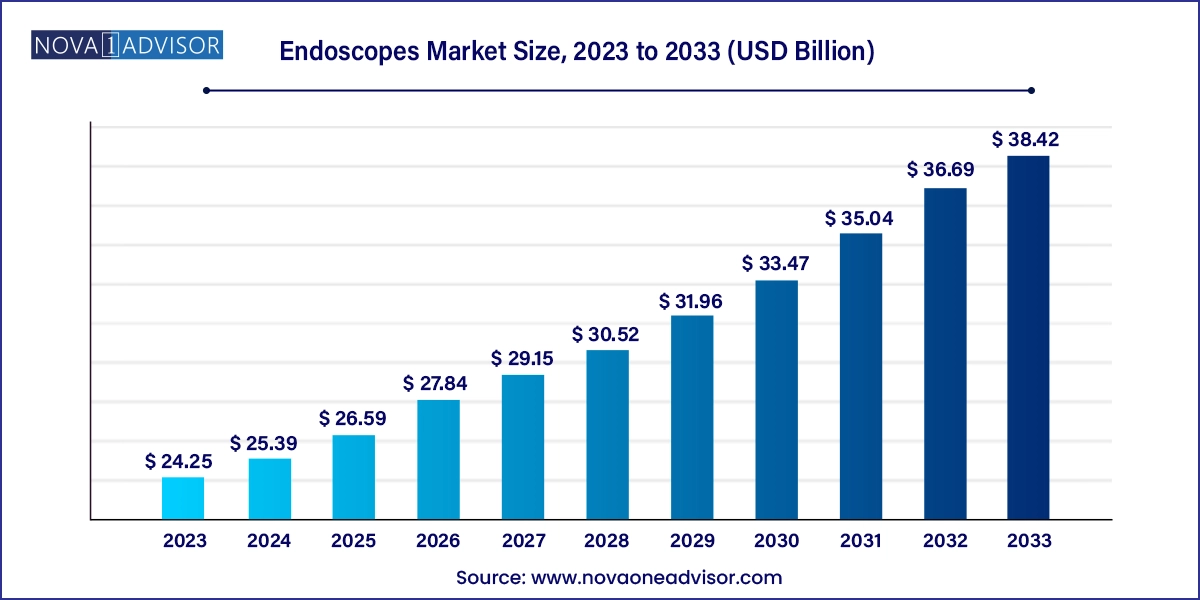

Endoscopes Market Size and Growth

The global endoscopes market size was exhibited at USD 24.25 billion in 2023 and is projected to hit around USD 38.42 billion by 2033, growing at a CAGR of 4.71% during the forecast period 2024 to 2033.

Endoscopes Market Key Takeaways:

- By product, the reusable endoscopes segment dominated the market with revenue share of 87.6%.

- Disposable endoscopes segment is expected to witness fastest CAGR growth during the forecast period.

- By end use, the outpatient facilities’ segment dominated the market in 2023 and accounted for the largest revenue share of 53.3%.

- Hospitals segment in endoscopes market is anticipated to register a significant growth over the forecast period.

- North America dominated the endoscopes market in 2023 and accounted for the largest revenue share of 41.0%.

Market Overview

The Global Endoscopes Market is a rapidly evolving segment within the broader medical devices landscape, driven by the increasing demand for minimally invasive diagnostic and therapeutic procedures. Endoscopes long, flexible or rigid instruments equipped with cameras and light sources are essential tools in modern medical practice, allowing physicians to visualize internal organs and cavities without the need for large incisions. These devices serve both diagnostic and interventional purposes across various specialties, including gastroenterology, urology, pulmonology, gynecology, neurology, and orthopedics.

Over the last decade, the use of endoscopes has grown significantly due to technological advancements in imaging (HD, 4K, and 3D), improved ergonomics, and the integration of robotics. The global healthcare industry’s shift toward cost-effective, outpatient-based treatment pathways has further cemented endoscopy’s relevance, particularly in early disease detection and ambulatory care. Aging populations, rising gastrointestinal disorders, a global uptick in colorectal and lung cancer screenings, and growing awareness about minimally invasive procedures are fueling the expansion of this market.

Furthermore, endoscope-assisted surgeries have demonstrated advantages such as shorter hospital stays, faster recovery, reduced scarring, and lower infection risks, making them the preferred choice in both developed and developing healthcare systems. The COVID-19 pandemic initially posed setbacks due to postponed elective procedures; however, post-pandemic recovery has reignited procedural volumes and prompted a reevaluation of sterilization and disposable endoscope use to mitigate infection risk.

Major Trends in the Market

-

Surge in Disposable and Single-Use Endoscopes: Increasing concerns over cross-contamination and hospital-acquired infections have driven adoption of sterile, single-use devices.

-

Adoption of Robotic-Assisted Endoscopy: Precision-driven, minimally invasive procedures powered by robotic arms are gaining traction, especially in urology and neurology.

-

Miniaturization and Capsule Endoscopy: Non-invasive gastrointestinal imaging using ingestible capsule endoscopes is expanding diagnostics, particularly for hard-to-reach areas like the small intestine.

-

Integration of AI in Endoscopy Imaging: AI-assisted image analysis is being developed to enhance lesion detection and reduce diagnostic error rates.

-

Shifting Preference to Outpatient Facilities: Cost-conscious healthcare systems and patient convenience are driving procedures away from hospitals to ambulatory care centers.

-

High Demand in Cancer Screening Programs: Governments and healthcare providers are expanding colonoscopy, sigmoidoscopy, and bronchoscopy programs for early cancer detection.

-

4K/8K and 3D Endoscopy Adoption: Enhanced imaging quality is transforming surgical precision and procedural confidence.

-

Expansion in Emerging Markets: Asia Pacific and Latin America are witnessing increased endoscope uptake due to growing healthcare infrastructure and surgical volumes.

Report Scope of Endoscopes Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 25.39 Billion |

| Market Size by 2033 |

USD 38.42 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.71% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Olympus Corporation; Boston Scientific Corporation; PENTAX Medical (Hoya Corporation); FUJIFILM Holdings Corporation; Karl Storz GmbH & Co., KG; Stryker; Medtronic; Ambu A/S; STERIS plc. |

Key Market Driver: Increasing Preference for Minimally Invasive Procedures

One of the most significant drivers in the endoscopes market is the growing preference for minimally invasive surgical and diagnostic interventions. This trend is underpinned by both clinical efficacy and patient-centric benefits. Minimally invasive endoscopic procedures reduce the need for large incisions, resulting in less post-operative pain, quicker recovery times, and fewer complications.

Hospitals and outpatient centers are increasingly opting for endoscope-assisted surgeries to reduce the overall cost burden, enhance patient throughput, and improve outcomes. For example, laparoscopic cholecystectomy has largely replaced open surgery for gallbladder removal. In urology, ureteroscopes and cystoscopes offer excellent visualization for procedures like stone removal and biopsies, which previously required more invasive access. These efficiencies not only benefit the patient experience but also lower hospital readmission rates and procedural costs—making endoscopy an attractive option for value-based care systems.

Key Market Restraint: High Cost of Advanced Endoscopic Equipment

A major challenge restraining the growth of the endoscope market is the high cost associated with acquiring, maintaining, and sterilizing reusable endoscopes and their associated imaging systems. Advanced endoscopes with features like 4K resolution, 3D imaging, and robotic articulation are expensive investments, often costing hospitals hundreds of thousands of dollars for a complete setup.

In addition to upfront equipment costs, the maintenance and reprocessing of reusable endoscopes involve stringent cleaning protocols, specialized equipment, trained staff, and regular audits—leading to ongoing operational expenses. These challenges are particularly significant for small healthcare facilities, outpatient centers in rural areas, and emerging economies with limited capital budgets. Moreover, occasional contamination due to inadequate reprocessing has led to device recalls and loss of confidence in reusable systems, compounding the economic burden on providers.

Key Market Opportunity: Expansion of Outpatient Endoscopy and Home Diagnostics

The growing decentralization of healthcare and focus on ambulatory and home-based diagnostic services presents a promising opportunity for the endoscopes market. Outpatient endoscopy centers are becoming prevalent due to their cost-effectiveness, streamlined operations, and favorable patient satisfaction scores. These settings provide a lucrative environment for flexible endoscopes, capsule endoscopes, and disposable devices that don’t require extensive reprocessing infrastructure.

Further, the advancement in capsule endoscopy technology is enabling at-home gastrointestinal diagnostics, particularly for chronic conditions like Crohn’s disease, obscure GI bleeding, and iron-deficiency anemia. These capsules are mailed to the patient, ingested at home, and returned for data processing—an innovation that aligns perfectly with telehealth trends and remote care models. As regulatory approvals and reimbursement mechanisms evolve, this sector is expected to see exponential growth in both developed and developing healthcare systems.

Endoscopes Market By Product Insights

Reusable endoscopes continue to dominate the global market, thanks to their established use across hospital and clinical settings. Among reusable endoscopes, flexible endoscopes have emerged as the most widely utilized category, particularly in gastroenterology, pulmonology, and urology. Flexible scopes offer better navigation in anatomically complex regions and reduce trauma during insertion. Devices like colonoscopes, bronchoscopes, and gastroscopes form the cornerstone of cancer screening and routine diagnostic protocols worldwide. Their reusability offers cost efficiency for high-volume healthcare facilities, despite requiring sophisticated sterilization workflows.

In contrast, disposable endoscopes are the fastest-growing segment, driven by infection control concerns and convenience. The COVID-19 pandemic catalyzed demand for single-use bronchoscopes and ureteroscopes to prevent cross-contamination and streamline turnaround times. Major manufacturers have introduced sterile, high-performance disposable models with competitive imaging quality, catering especially to outpatient centers and emergency settings. Additionally, robot-assisted and capsule endoscopes are seeing double-digit growth, particularly in specialized procedures. Capsule endoscopy is increasingly used for small bowel visualization, while robotic systems are entering neurosurgery and prostate interventions with precision control and minimal invasiveness.

Endoscopes Market By End-use Insights

Hospitals currently account for the largest share of the endoscopes market, due to their ability to invest in advanced technologies, house multidisciplinary specialties, and perform high-volume procedures. Hospitals typically use reusable systems integrated with centralized imaging suites and sterile processing units. These settings are critical for complex interventions requiring laparoscopes, neuroendoscopes, and bronchoscopes, as well as emergency diagnostic scopes. Teaching and research hospitals also serve as innovation hubs where robotic and AI-assisted endoscopic tools are adopted and evaluated.

On the other hand, outpatient facilities are the fastest-growing end-use segment. Driven by payer preference, reduced procedural costs, and quicker recovery times, these centers are gaining favor for routine colonoscopies, cystoscopies, and ENT procedures. Ambulatory surgery centers (ASCs) and specialty clinics increasingly prefer disposable or compact endoscopic systems that require minimal processing. The convenience, cost-effectiveness, and efficiency of outpatient models are leading manufacturers to design customized equipment lines for non-hospital usage—catering to the broader trends of decentralization and home-based diagnostics.

Endoscopes Market By Regional Insights

North America leads the global endoscopes market, supported by advanced healthcare infrastructure, favorable reimbursement systems, and early adoption of cutting-edge medical technologies. The U.S. alone conducts millions of colonoscopies annually as part of its preventative health programs. High prevalence of colorectal cancer, chronic lung disease, and gastrointestinal disorders further strengthens the demand for endoscopic devices. Additionally, prominent companies like Boston Scientific, Stryker, and Olympus America drive innovation and local availability. Regulatory clarity, clinical guidelines, and integration of robotic endoscopy platforms into hospital systems provide a strong foundation for market leadership.

Meanwhile, Asia Pacific is the fastest-growing region in the global endoscopes market. Rapid economic development, increasing healthcare investments, and expanding medical tourism in countries like China, India, and South Korea are driving procedural volumes. Government initiatives aimed at early cancer detection, particularly for gastric and esophageal cancers in East Asia, have increased the adoption of gastroscopes and colonoscopes. Local manufacturing, cost-effective pricing, and increased awareness among urban populations contribute to growth. Furthermore, partnerships between global firms and regional healthcare providers are improving access to advanced endoscopic equipment in Tier 2 and Tier 3 cities.

Endoscopes Market Recent Developments

-

In February 2025, Olympus Corporation launched its latest EVIS X1 endoscopy system in Europe and North America, featuring AI-powered image enhancement for lesion detection in gastrointestinal procedures.

-

Boston Scientific announced in October 2024 the expansion of its EXALT Model D disposable duodenoscope in APAC markets, targeting hospitals looking to reduce infection risks.

-

In August 2024, Ambu A/S, a leader in single-use endoscopes, received FDA clearance for its next-generation aScope™ Gastro, marking a significant advancement in GI-focused disposable scopes.

-

Fujifilm Medical Systems revealed in November 2024 its collaboration with a U.S. startup to co-develop capsule endoscopy AI tools for small intestine diagnostics.

-

In January 2025, Medtronic announced strategic investments into its robotic-assisted Hugo™ endoscopy platform, focusing on global expansion and broader specialty adoption.

Some of the prominent players in the global endoscopes market include:

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co., KG

- Stryker

- Medtronic

- Ambu A/S

- STERIS plc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global endoscopes market

Product

-

-

-

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Pharyngoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Gastrointestinal Endoscopes

-

-

-

-

- Gastroscope (Upper GI Endoscope)

- Enteroscope

- Sigmoidoscope

- Duodenoscope

-

-

-

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Pharyngoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Gastrointestinal Endoscopes

-

-

-

-

- Gastroscope (Upper GI Endoscope)

- Enteroscope

- Sigmoidoscope

- Duodenoscope

- Colonoscope

-

-

- Capsule Endoscopes

- Robot- Assisted Endoscopes

-

-

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Otoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Gastrointestinal Endoscopes

-

-

-

- Gastroscope (Upper GI Endoscope)

- Enteroscope

- Sigmoidoscope

- Duodenoscope

- Colonoscope

-

- Robot- Assisted Endoscopes

End use

- Hospitals

- Outpatient facilities

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- MEA