Engineering Services Outsourcing Market Size and Research

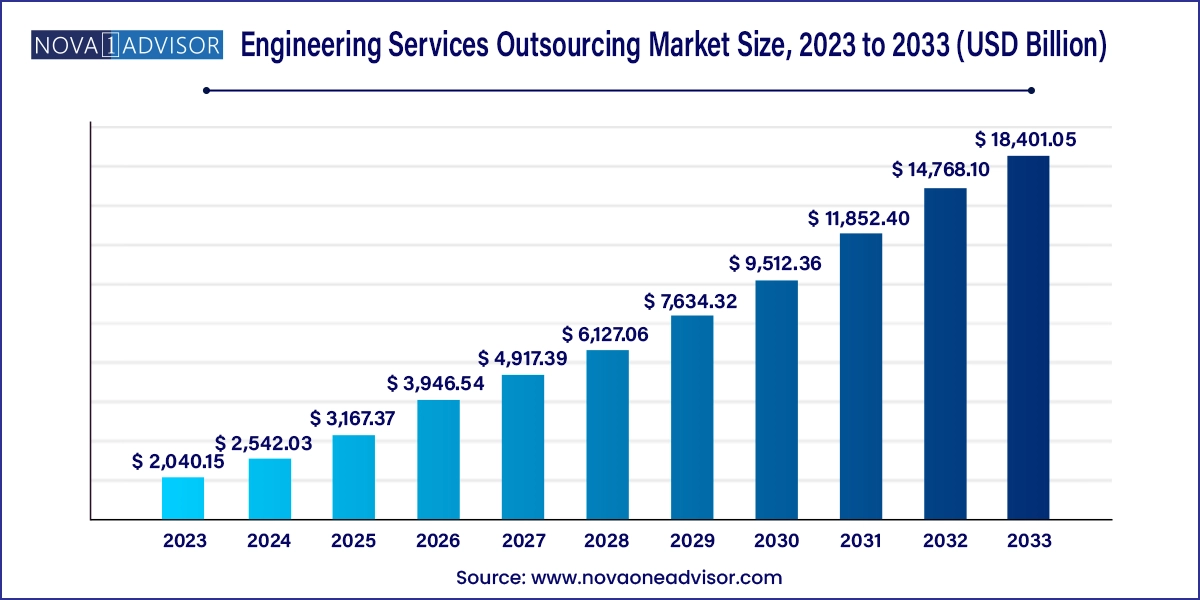

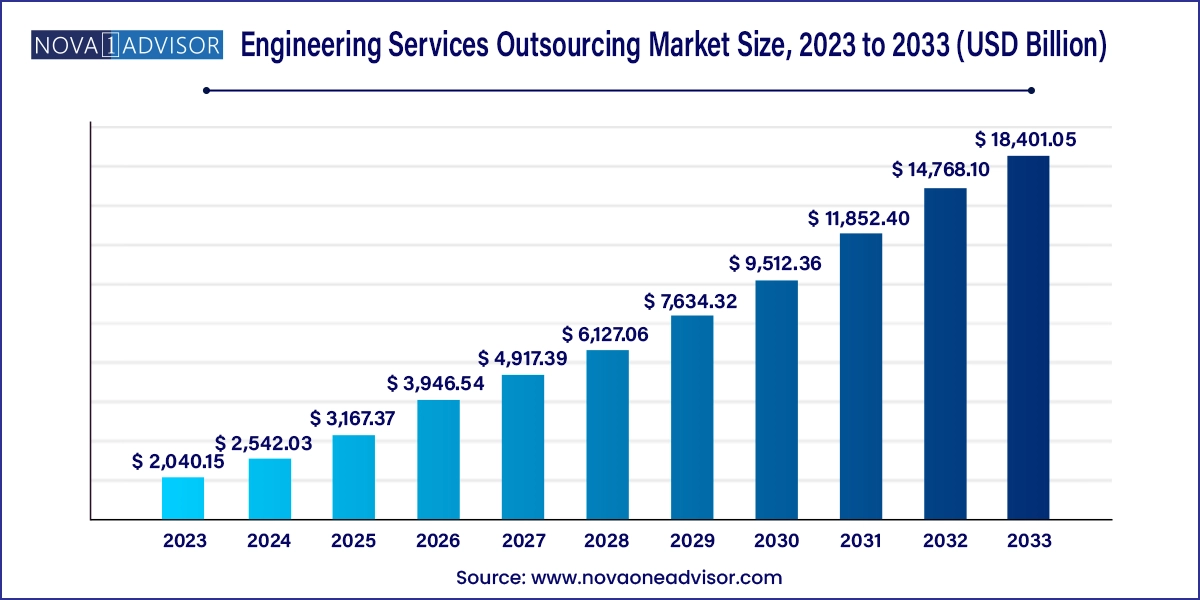

The global engineering services outsourcing market size was exhibited at USD 2,040.15 billion in 2023 and is projected to hit around USD 18,401.05 billion by 2033, growing at a CAGR of 24.6% during the forecast period 2024 to 2033.

Engineering Services Outsourcing Market Key Takeaways:

- The manufacturing segment accounted for the highest revenue share in 2023 and is expected to continue to dominate the market over the forecast period.

- Based on services, the ‘testing’ sub-segment is anticipated to record the largest revenue share in 2023.

- Based on services, is expected to witness growth at a notable CAGR over the forecast period.

- The on-shore part accounted for the highest revenue share of over 57% in 2023 and is anticipated to dominate the market from 2024 to 2033.

- Asia Pacific registered the highest revenue share in the global market share of over 41% in 2023.

- South America is expected to witness the fastest growth registering a CAGR of over 28.9% during the forecast period.

Market Overview

The Engineering Services Outsourcing (ESO) market refers to the practice of engaging external service providers to carry out engineering-related activities such as product design, development, prototyping, testing, and system integration. These services span across multiple industries including automotive, aerospace, telecom, semiconductors, energy & utilities, and consumer electronics. Organizations increasingly rely on ESO to tap into specialized talent, reduce costs, accelerate time to market, and focus on core competencies.

This market has witnessed significant evolution over the past decade, driven by digitization, increasing complexity of product development, and the necessity to innovate swiftly. Companies are outsourcing both product and process engineering tasks, enabling them to keep pace with disruptive technologies like AI, IoT, digital twins, and automation. As businesses pursue scalable and flexible engineering models, ESO emerges as a strategic lever offering a competitive edge.

In recent years, multinational corporations have strategically partnered with ESO providers in emerging economies, especially India and Eastern Europe, to benefit from lower labor costs, a robust engineering talent pool, and a favorable outsourcing ecosystem. Moreover, the COVID-19 pandemic acted as a catalyst for remote collaboration, expediting digital transformation and further bolstering the ESO demand curve.

According to current industry estimates, the ESO market is poised for sustained growth, driven by continuous innovation, integration of new technologies, and a sharp focus on cost efficiency and time optimization. As the digital engineering paradigm expands, the market is likely to diversify into high-value, domain-specific services.

Major Trends in the Market

-

Digital Engineering Integration: Rapid adoption of digital engineering tools like CAD, CAE, PLM, and digital twins is reshaping ESO strategies.

-

Shift Toward High-Value Services: Companies are outsourcing not just low-end design work, but complex, value-added services such as system integration and simulation.

-

Rise of Cloud-Based Engineering: ESO providers are leveraging cloud infrastructure to offer scalable, collaborative platforms for global clients.

-

Customized Outsourcing Models: Flexible engagement models such as BOT (Build-Operate-Transfer), staff augmentation, and dedicated centers are gaining popularity.

-

Focus on Sustainability and Green Engineering: Clients are increasingly demanding sustainable engineering practices, driving ESO firms to incorporate eco-friendly solutions.

-

Growing Demand in Emerging Economies: ESO adoption is expanding beyond traditional hubs as new regions invest in digital infrastructure and STEM education.

-

Increased AI and Automation Usage: ESO is embracing AI for predictive maintenance, design automation, and process optimization.

-

Cybersecurity Integration: As digital engineering expands, ESO firms are strengthening their security protocols to prevent data leaks and cyber threats.

Report Scope of Engineering Services Outsourcing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2,542.03 Billion |

| Market Size by 2033 |

USD 18,401.05 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 24.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Services, Location, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; South America; Middle East & Africa (MEA) |

| Key Companies Profiled |

AKKA; Alten Group; Capgemini Engineering; Entelect; HCL Technologies Limited; Infosys Limited; Tata Elxsi; Tata Consultancy Services Limited.; Tech Mahindra Limited; Wipro Limited |

Key Market Driver: Cost Optimization through Specialized Talent Access

One of the primary drivers fueling the growth of the Engineering Services Outsourcing market is cost optimization, enabled through access to a global talent pool with specialized engineering capabilities. Companies across sectors are facing mounting pressure to reduce operational expenditure while maintaining innovation velocity. Outsourcing engineering functions to countries with lower labor costs—such as India, the Philippines, and Poland—offers significant savings without compromising on quality.

Additionally, ESO providers typically employ domain-specific engineers proficient in cutting-edge tools and methodologies. This specialized workforce ensures faster project execution, higher precision, and better alignment with global engineering standards. For example, aerospace firms outsourcing component testing to certified labs in Eastern Europe are reducing development timelines by over 30%, thereby gaining first-mover advantage in a competitive market.

Key Market Restraint: Intellectual Property (IP) Concerns

Despite its growth potential, the ESO market is hindered by persistent intellectual property (IP) concerns, especially when outsourcing to jurisdictions with weak IP enforcement regulations. Engineering projects often involve proprietary designs, algorithms, and product blueprints, making IP protection crucial. Transferring sensitive data across borders poses risks of unauthorized access, replication, or leakage.

This issue is particularly concerning in sectors such as semiconductors and aerospace, where any breach of IP could lead to strategic or economic losses. Some companies hesitate to outsource high-value design or prototyping work to offshore partners due to fear of compromised confidentiality. Although ESO firms are adopting ISO certifications and implementing cybersecurity protocols, IP apprehensions remain a barrier, especially for first-time outsourcers.

Key Market Opportunity: Growing Demand for Smart Product Engineering

A compelling opportunity in the ESO market lies in the growing demand for smart and connected products. With the proliferation of IoT, 5G, and AI, industries are shifting toward embedded intelligence in their products from smart meters and connected vehicles to wearable medical devices. Designing such smart products requires interdisciplinary knowledge in embedded systems, software, electronics, and mechanical engineering.

Companies lacking in-house expertise are increasingly turning to ESO providers to co-develop these sophisticated solutions. For instance, automotive firms collaborating with ESO partners to develop EV powertrains with intelligent battery management systems are witnessing a surge in adoption. The rise of Industry 4.0 and digital twins further amplifies the need for skilled engineering talent that ESO firms are well-positioned to offer.

Engineering Services Outsourcing Market By Application Insights

The automotive sector dominated the application segment, accounting for a significant portion of ESO demand. Automakers and Tier 1 suppliers are extensively outsourcing design, simulation, powertrain testing, and software development to accelerate innovation. With the transition to electric vehicles (EVs), the demand for advanced engineering skills in battery systems, autonomous driving, and embedded software has surged. For example, major OEMs like Volkswagen and GM have partnered with engineering service providers to co-develop next-gen infotainment and driver assistance systems.

Healthcare is poised to be the fastest-growing application segment. The demand for connected medical devices, diagnostic equipment, and personalized health monitoring tools is driving the need for sophisticated engineering. ESO providers offer end-to-end capabilities—from regulatory-compliant design to embedded firmware development. The post-pandemic focus on telehealth, home diagnostics, and portable devices is spurring investment in outsourced healthcare engineering projects, especially in regions with aging populations.

Engineering Services Outsourcing Market By Service Insights

Designing emerged as the dominant service segment in the ESO market. As industries rapidly innovate product lines and integrate technologies like smart sensors and AI chips, the demand for mechanical, electrical, and software design services has skyrocketed. Designing forms the foundation of product development, encompassing CAD modeling, architecture layout, circuit design, and structural analysis. Especially in sectors like automotive and electronics, time-sensitive product launches hinge on robust design capabilities. ESO providers equipped with multi-domain design proficiency and advanced simulation tools are being increasingly engaged to reduce concept-to-prototype cycle times.

On the other hand, Prototyping is projected to be the fastest-growing segment. As businesses embrace rapid prototyping technologies like 3D printing and CNC machining, outsourcing this function provides agility and cost savings. The need for multiple iteration cycles before mass production especially in healthcare and consumer electronics makes outsourcing a practical choice. Startups, in particular, rely on ESO firms to bring early-stage product concepts to life without investing in expensive in-house prototyping facilities. Furthermore, the advent of digital prototyping with VR/AR is expected to add momentum to this segment.

Engineering Services Outsourcing Market By Location Insights

Off-shore outsourcing dominates the ESO market by location, as companies continue to leverage cost-effective talent in geographies like India, Vietnam, and Eastern Europe. These regions offer a favorable mix of skilled engineers, supportive government policies, and English proficiency. The maturity of outsourcing ecosystems in cities like Bengaluru and Kraków has attracted global corporations to set up long-term engineering partnerships. Large organizations often establish global capability centers (GCCs) offshore, offering 24/7 engineering support, especially in prototyping and testing.

Conversely, on-shore outsourcing is gaining traction and is expected to grow at a significant CAGR, particularly in highly regulated industries. Sectors like defense, telecom, and energy prefer on-shore models to ensure regulatory compliance and tighter IP control. U.S. and European firms are increasingly outsourcing engineering work to domestic or near-shore partners to reduce legal risks and improve collaboration through cultural proximity and time zone alignment.

Engineering Services Outsourcing Market By Regional Insights

Asia Pacific has emerged as the dominant regional market, with countries like India, China, and the Philippines serving as engineering outsourcing hubs. India, in particular, commands a lion’s share due to its extensive engineering talent pool, strong IT infrastructure, and a thriving startup ecosystem. Multinational corporations across aerospace, automotive, and telecom verticals have established strategic engineering delivery centers in Bengaluru, Hyderabad, and Pune. Moreover, the Indian government’s initiatives such as “Make in India” and increased STEM education investments further strengthen the region’s ESO appeal.

Major firms like Tata Technologies, HCLTech, and L&T Technology Services have scaled global engineering support for clients in the U.S. and Europe, driving Asia Pacific’s dominance. Additionally, cost arbitrage and favorable time zones facilitate seamless collaboration with Western clients, enhancing the region’s attractiveness.

North America is forecasted to grow at the fastest rate, driven by the region’s rapid digital transformation and innovation-led demand in sectors like aerospace, semiconductors, and life sciences. The U.S., in particular, has a high concentration of enterprises seeking high-quality, agile engineering solutions to support R&D initiatives. ESO firms are increasingly being engaged to co-create next-gen technologies such as autonomous vehicles, medical robotics, and 5G infrastructure.

The trend of near-shoring in Canada and Mexico is also contributing to the region’s growth. U.S. companies prefer outsourcing to nearby locations to ensure data security, compliance, and smoother communication. Furthermore, a surge in government-funded tech initiatives and startup-driven innovation are amplifying engineering services demand across North America.

Engineering Services Outsourcing Market Recent Developments

-

March 2025 – Tata Technologies announced a strategic partnership with Airbus to provide digital engineering services for aircraft design and simulation, enhancing its presence in the aerospace ESO segment.

-

February 2025 – Alten Group expanded its engineering delivery center in Romania, focusing on automotive prototyping and system integration services for European clients.

-

January 2025 – Wipro Engineering Edge launched a new AI-powered design automation platform aimed at reducing development cycles for consumer electronics and smart devices.

-

December 2024 – L&T Technology Services acquired a U.S.-based medical device engineering firm to strengthen its portfolio in healthcare ESO offerings.

-

November 2024 – Cyient Ltd. inaugurated a new global innovation hub in Singapore to offer prototyping and testing services across APAC.

Some of the prominent players in the global engineering services outsourcing market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global engineering services outsourcing market

Service

- Designing

- Prototyping

- System Integration

- Testing

- Others

Location

Application

- Aerospace

- Automotive

- Manufacturing

- Consumer Electronics

- Semiconductors

- Healthcare

- Telecom

- Energy & Utilities

- Construction & Infrastructure

- Others

Regional

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa (MEA)