Flight Simulator Market Size and Trends

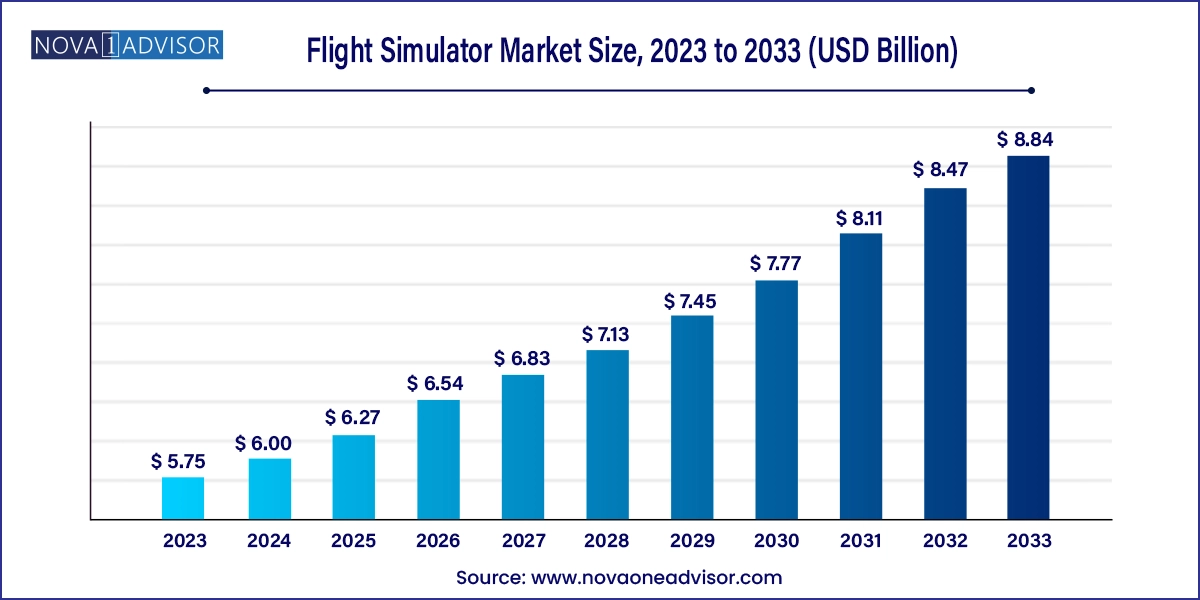

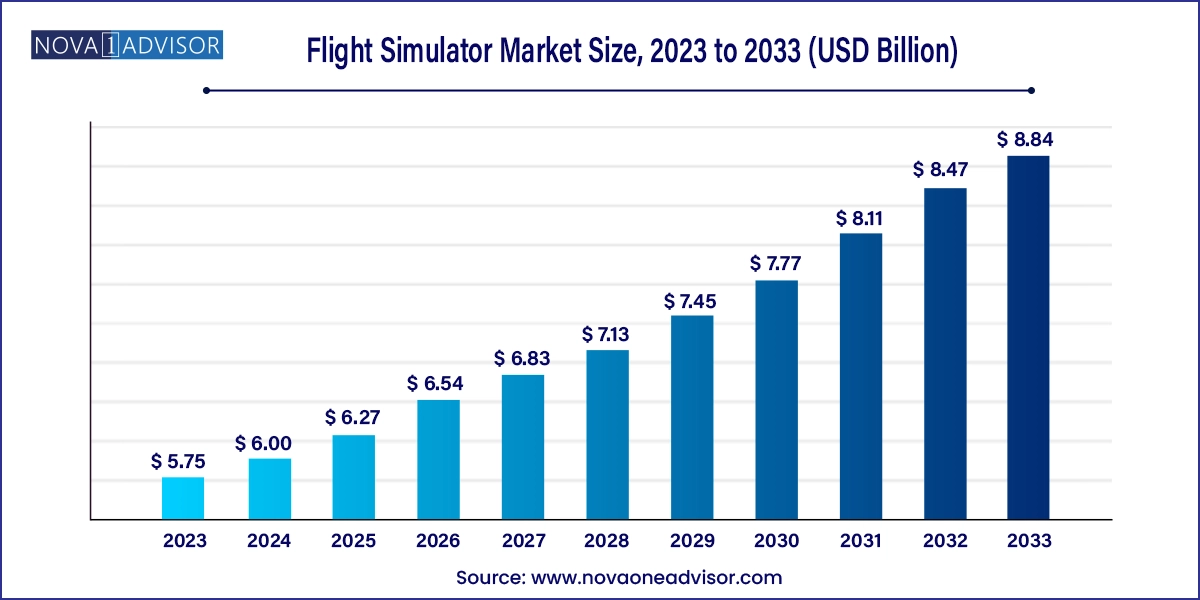

The global flight simulator market size was exhibited at USD 5.75 billion in 2023 and is projected to hit around USD 8.84 billion by 2033, growing at a CAGR of 4.4% during the forecast period 2024 to 2033.

Flight Simulator Market Key Takeaways:

- The FFS segment accounted for over 92.0% of the market share in 2023.

- The FTD segment is expected to expand significantly during the forecast period.

- The civil segment held the highest market share of 69.2% in 2023.

- The military & defense sector is expected to expand at the fastest CAGR of 4.4% during the forecast period.

- North America emerged as a key market for flight simulators, accounting for a significant global revenue share in 2023.

- Europe accounted for the highest revenue share of 31.8% in 2023.

- The Asia Pacific is estimated to exhibit high growth over the forecast period.

Market Overview

The flight simulator market has emerged as a crucial component of modern aviation, bridging the gap between theoretical training and actual flight experience. Flight simulators are advanced systems that replicate real-world flying conditions, aircraft behavior, and cockpit instrumentation to provide safe, cost-effective, and high-fidelity training for pilots. As aviation expands across commercial and military domains, the demand for simulators continues to rise due to their effectiveness in enhancing pilot proficiency, reducing operational risks, and minimizing training costs.

Over the last decade, the market has witnessed rapid evolution, driven by technological innovation, changing aviation regulations, and a growing focus on safety. Simulators today incorporate immersive technologies such as virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) to create highly realistic training environments. The COVID-19 pandemic further highlighted the significance of simulators, as flight schools and airlines leaned on digital training methods during periods of restricted flight activity. Additionally, as the aviation sector works to address the global pilot shortage, flight simulation has become more central to both initial and recurrent training.

Major Trends in the Market

-

Adoption of VR/AR-Based Training Platforms

Flight training organizations are increasingly using VR and AR to offer immersive, cost-effective alternatives to traditional full-motion simulators.

-

Growth of AI-Powered Flight Simulation

Artificial intelligence is being used to adapt simulation scenarios dynamically based on trainee performance, making sessions more personalized.

-

Integration of Cloud-Based Simulation Systems

Cloud infrastructure enables remote access to flight training software, offering flexibility and continuity for training organizations.

-

Rising Demand for UAM and eVTOL Simulators

Urban air mobility (UAM) initiatives and electric vertical takeoff and landing (eVTOL) aircraft require specialized simulator training, fostering niche market expansion.

-

Increase in Fixed Training Devices (FTD) Adoption

Fixed training devices are gaining popularity among civil aviation schools for basic and intermediate pilot training due to lower cost and maintenance.

-

Sustainability in Training Operations

Airlines and institutions are reducing their carbon footprint by substituting in-aircraft training hours with simulator time, supporting eco-conscious aviation training.

Report Scope of Flight Simulator Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.00 Billion |

| Market Size by 2033 |

USD 8.84 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Leonardo S.p.A.; Boeing; CAE Inc.; AIRBUS; The DiSTI Corporation; Fidelity Technologies Corporation; Havelsan Air Electronic Industry; Kratos Defense & Security Solutions, Inc.; L3Harris Technologies, Inc.; Lockheed Martin Corporation; Meggitt PLC; Collins Aerospace; Saab AB; Teledyne Brown Engineering; Thales; VirTra, Inc. |

Market Driver: Rising Global Pilot Demand

A significant driver of the flight simulator market is the rising global demand for qualified pilots. The aviation sector is projected to require hundreds of thousands of new pilots over the next two decades due to fleet expansion, retirements, and the emergence of new air travel markets in Asia and Africa. According to Boeing's Pilot and Technician Outlook, more than 600,000 commercial pilots will be needed globally by 2040. This immense demand has placed pressure on training organizations to scale up rapidly.

Flight simulators provide a scalable, safe, and cost-efficient solution for pilot training, enabling institutions to maintain quality while handling increased enrollment. For instance, simulator time replaces expensive and riskier in-flight hours, especially during early training stages. Airlines are also investing in in-house simulation centers to ensure a steady pipeline of certified pilots. Countries like India and Vietnam, where aviation is booming, are witnessing a surge in simulator procurement to meet this growing demand.

Market Restraint: High Cost of Full Flight Simulators

Despite their advantages, the adoption of advanced simulators is often hindered by the high initial cost and maintenance complexity associated with full flight simulators (FFS). An FFS, particularly those certified to Level D, can cost between $10 million to $20 million depending on the aircraft model and system complexity. These devices also require dedicated infrastructure, power supply, software updates, and periodic re-certification by aviation authorities.

Smaller flight schools, especially in developing countries, may find it financially challenging to invest in FFS. Even leasing or shared ownership models come with operational constraints and scheduling limitations. Although technological innovations are making simulators more affordable, the cost barrier remains significant, limiting accessibility to top-tier training devices.

Market Opportunity: Expansion of Civil Aviation in Emerging Economies

An exciting growth opportunity lies in the rapid expansion of civil aviation in emerging markets, particularly in Asia Pacific and Latin America. Rising middle-class populations, government-backed infrastructure projects, and increased regional connectivity have led to a spike in demand for air travel in countries like India, Indonesia, and Brazil. This trend is paralleled by investments in flight schools, training academies, and aviation universities.

To support this growing ecosystem, governments and private players are increasingly procuring simulators to ensure the availability of certified pilots and maintenance crew. For example, India’s UDAN scheme (Ude Desh ka Aam Naagrik), which promotes regional air connectivity, has triggered demand for regional aircraft and corresponding pilot training. By establishing local simulation centers, these countries can reduce their dependence on overseas training programs, thereby fostering domestic aviation capacity building.

Flight Simulator Market By Product Insights

The Full Flight Simulator (FFS) segment dominates the product category, owing to its high fidelity and regulatory acceptance for both commercial and military training. Full flight simulators provide a highly realistic replication of actual cockpit environments, complete with motion systems, visuals, and control feedback. Their accuracy makes them essential for type rating certifications and advanced maneuver training. Aircraft manufacturers often collaborate with simulator vendors to develop FFS units aligned with newly launched aircraft models. For example, Boeing and Airbus frequently release simulators alongside new jetliner series to expedite pilot readiness.

Fixed Flight Training Devices (FTDs) are the fastest-growing segment, driven by their lower cost, ease of deployment, and suitability for basic training. Flight schools and universities increasingly prefer FTDs for initial training and ground school integration, especially when operating on limited budgets. These devices, though lacking full motion capabilities, offer sufficient fidelity for visual navigation, radio procedures, and cockpit familiarization. With regulatory authorities recognizing higher-level FTDs for logging flight hours, their usage is expanding rapidly. Additionally, upgrades in visual systems and user interfaces are narrowing the capability gap between FTDs and full-motion simulators.

Flight Simulator Market By Application Insights

The military and defense application segment leads the market, supported by extensive simulation use in combat, mission rehearsal, and operational readiness training. Military organizations globally rely on simulators to train pilots for complex tactical scenarios, including night operations, electronic warfare, and formation flying. The high cost and risk of using actual combat aircraft make simulation a preferred method for maintaining pilot proficiency. Countries such as the United States, Russia, and Israel have heavily invested in simulator infrastructure for fighter jets, helicopters, and unmanned aerial systems (UAS).

The civil aviation segment is experiencing the fastest growth, as commercial airlines, charter operators, and civil aviation training institutes expand their training capacities. The surge in low-cost carrier operations and growing demand for short-haul pilots are fueling simulator purchases for narrow-body and regional aircraft types. Moreover, international mandates on pilot licensing and recurrent training hours are compelling airlines to invest in full-spectrum simulator programs. Civil aviation authorities are also encouraging indigenous simulator development to meet local training demands.

Flight Simulator Market By Regional Insights

North America dominates the global flight simulator market, owing to its mature aviation ecosystem, presence of major manufacturers, and high defense spending. The United States alone accounts for a substantial share due to the combined strength of its commercial aviation industry and military aviation programs. Companies such as Boeing, CAE Inc., Lockheed Martin, and L3Harris Technologies lead innovation and supply a wide range of simulation systems worldwide.

The region's strict pilot licensing norms, high demand for MRO training, and proliferation of aviation academies support sustained simulator adoption. In the defense sector, ongoing procurement programs such as the F-35 fighter jet include dedicated simulation training packages. Moreover, the Federal Aviation Administration (FAA) has stringent simulation standards, prompting consistent investment in simulator upgrades.

Asia Pacific is the fastest-growing region in the flight simulator market, driven by explosive growth in air travel, government investments, and a surging aviation workforce. Countries such as India, China, Vietnam, and Indonesia are experiencing exponential increases in air passenger traffic and fleet expansion, which necessitate a proportional growth in pilot and crew training infrastructure.

Governments and airlines in the region are actively collaborating with international simulator vendors to set up regional training centers. For example, China has incorporated simulation training into its aviation curriculum across multiple provinces, while India’s civil aviation ministry has launched programs to incentivize simulator manufacturing. As Asia becomes the new aviation hub, the demand for both FFS and FTDs is expected to soar.

Flight Simulator Market Recent Developments

-

March 2025: CAE Inc. announced the opening of a new training center in Madrid, Spain, focusing on Airbus A320 and Boeing 737 simulators, to serve the growing European and North African markets.

-

February 2025: L3Harris Technologies secured a $300 million contract from the U.S. Air Force for next-generation flight simulators supporting F-22 and F-35 platforms.

-

January 2025: Thales Group launched a compact, mobile full flight simulator (FFS Lite) aimed at regional training centers and defense forces in Asia and Africa.

-

December 2024: Boeing Global Services signed an MoU with India’s HAL and Air India Engineering Services to co-develop training simulators tailored to Boeing 737 and 787 fleets.

-

November 2024: Indra Sistemas revealed a new VR-integrated simulation system for pilot cadets, reducing initial training costs by 40% while maintaining regulatory compliance.

Some of the prominent players in the global flight simulator market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global flight simulator market

Product

- Full Flight Simulator (FFS)

- Fixed Flight Training Devices (FTD)

Application

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa