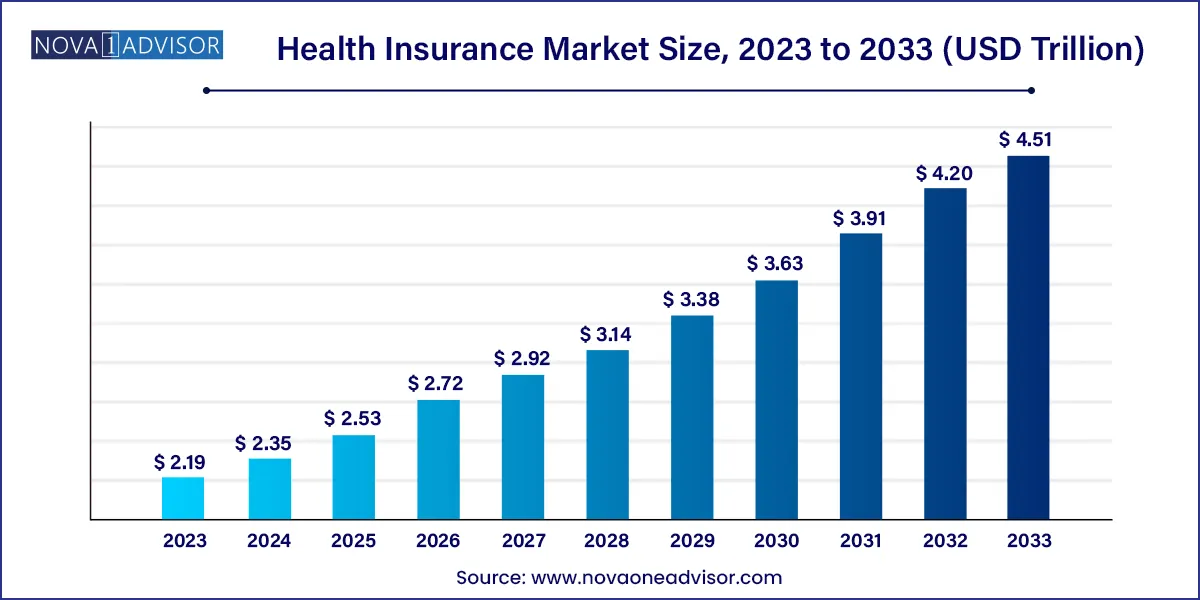

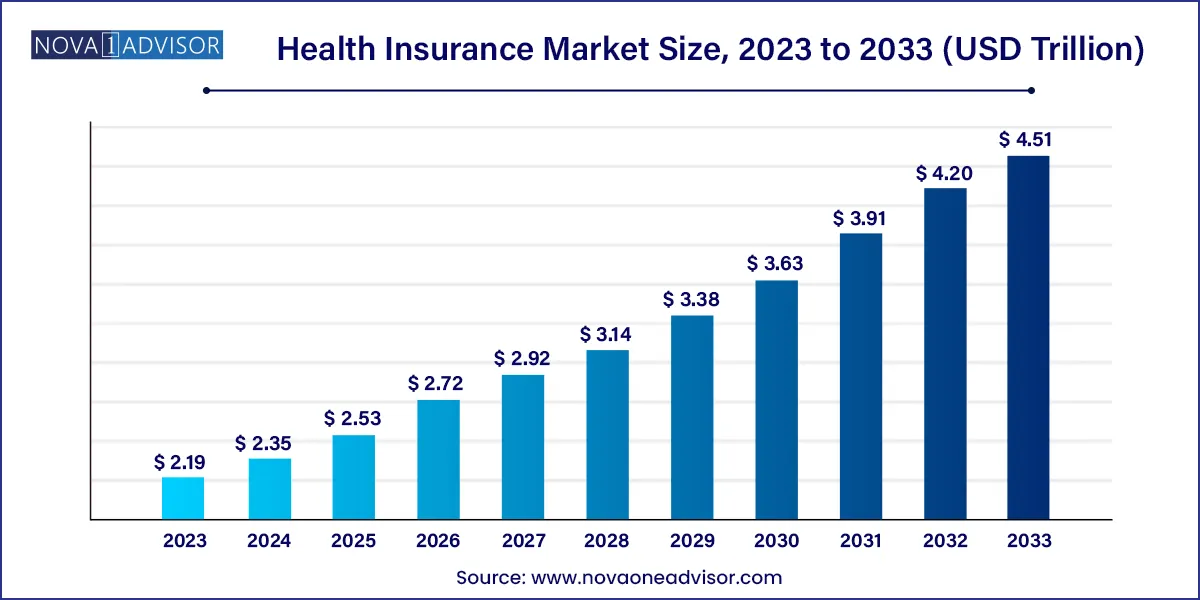

The global health insurance market size was exhibited at USD 2.19 trillion in 2023 and is projected to hit around USD 4.51 trillion by 2033, growing at a CAGR of 7.5% during the forecast period of 2024 to 2033.

Key Takeaways:

- North America accounted for 34% revenue share in 2023.

- By type, the critical illness insurance segment held a 39% revenue share in 2023.

- Lifetime coverage was the dominant segment in the global health insurance market, accounting for over 53% of the market share in 2023

Health Insurance Market by Overview

The global health insurance market is a critical pillar of modern healthcare systems, offering individuals and families financial protection against rising medical costs. Health insurance provides coverage for hospitalization, surgery, prescription drugs, diagnostic tests, and preventive care. As healthcare costs soar and life expectancy increases globally, health insurance has transitioned from being a luxury to a necessity, both in developed and emerging economies.

The market has witnessed significant evolution in recent decades, catalyzed by technological integration, regulatory mandates, demographic shifts, and consumer empowerment. Public and private health insurance schemes have become deeply embedded in national healthcare policies, while innovations such as telemedicine, wearable devices, and AI-driven claim management are redefining service delivery and customer engagement.

In developed economies, particularly the United States, Europe, and parts of Asia, a mature insurance culture exists with high penetration rates and sophisticated underwriting processes. Meanwhile, developing regions such as India, Brazil, and Southeast Asia are undergoing rapid insurance expansion due to government incentives, increased health awareness, and growing middle-class populations.

COVID-19 significantly impacted the market, highlighting the importance of coverage, prompting a surge in policyholders, and creating new demand for pandemic-specific and critical illness plans. The post-pandemic era continues to reflect this shift, as insurers recalibrate strategies to meet evolving consumer expectations and policy frameworks.

Major Trends in the Market

-

Rise of Digital Health Insurance Platforms: AI-powered portals, mobile apps, and blockchain-based claim systems are redefining customer experience and operational efficiency.

-

Integration of Preventive Healthcare: Insurers now incentivize wellness activities such as gym memberships, step counts, and regular screenings to reduce long-term claims.

-

Customized and Modular Plans: Consumers are demanding tailored insurance products, prompting providers to offer customizable coverage and riders.

-

Increase in Chronic Disease Plans: Specialized policies targeting diabetes, cancer, and cardiovascular conditions are on the rise due to growing NCD prevalence.

-

Public-Private Collaborations: Many governments are partnering with private insurers to expand coverage to underserved populations through hybrid schemes.

-

Inclusion of Mental Health Services: Mental wellness and therapy sessions are increasingly covered, aligning with global health awareness campaigns.

-

Microinsurance for Rural Populations: Low-cost, high-access plans are emerging for the unbanked and underinsured in rural and remote areas.

Health Insurance Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.19 Trillion |

| Market Size by 2033 |

USD 4.51 Trillion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Provider, Coverage Type, Network Provider, Plan Type, Age Group, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Cigna Corporation, CVS Health Corporation, Allianz, Centene Corporation, United Healthcare Services, Inc., WellCare Health Plans, Inc., National Insurance Company Limited, Bupa Global, Humana, Inc., AIA Group Limited. |

Health Insurance Market Dynamics

One of the most significant dynamics influencing the health insurance market is the continuous rise in healthcare costs. Factors such as medical inflation, advances in medical technology, and an aging population contribute to escalating healthcare expenses. As a result, insurers face the challenge of balancing the need to provide comprehensive coverage with the imperative to control costs for both themselves and their policyholders. This dynamic puts pressure on insurance premiums, deductibles, and out-of-pocket expenses, making healthcare affordability a growing concern for individuals, employers, and governments alike.

- Regulatory Changes and Policy Reforms:

Another key dynamic shaping the health insurance market is the evolving regulatory landscape and policy reforms. Healthcare regulations vary significantly across countries and regions, with government intervention playing a significant role in shaping the structure and functioning of the health insurance industry. Policy changes, such as the implementation of the Affordable Care Act (ACA) in the United States, can have far-reaching implications for insurers, providers, and consumers, influencing coverage requirements, reimbursement mechanisms, and market dynamics.

Health Insurance Market Restraint

One significant restraint in the health insurance market is the persistent disparities in access to coverage and healthcare services. Despite efforts to expand coverage through government-sponsored programs and employer-sponsored insurance, millions of individuals worldwide remain uninsured or underinsured, particularly among marginalized and underserved populations. Factors contributing to access disparities include socioeconomic status, geographic location, immigration status, and systemic barriers to healthcare access.

Another significant restraint in the health insurance market is regulatory uncertainty, driven by ongoing changes in healthcare regulations and policy reforms. Healthcare regulations are subject to frequent updates and revisions, influenced by political, economic, and social factors, as well as evolving healthcare priorities and demographic trends. Regulatory uncertainty creates challenges for insurers, providers, and consumers, leading to confusion, compliance burdens, and market volatility.

Health Insurance Market Opportunity

- Technological Advancements:

One significant opportunity in the health insurance market lies in leveraging technological advancements to enhance efficiency, improve customer experience, and drive innovation. The rapid evolution of technology, including artificial intelligence, data analytics, and telemedicine, presents new opportunities for insurers to transform their operations and offerings, positioning themselves for sustainable growth and competitive advantage.

- Aging Population and Chronic Disease Management:

Another significant opportunity in the health insurance market is the growing demand for coverage and services tailored to the needs of an aging population and individuals with chronic diseases. As life expectancy continues to increase and the prevalence of chronic conditions such as diabetes, heart disease, and cancer rises, there is a growing need for comprehensive health insurance solutions that address the unique healthcare needs and challenges of older adults and individuals with chronic illnesses.

Health Insurance Market Challenges

One of the most significant challenges facing the health insurance market is the persistent rise in healthcare costs. Factors such as medical inflation, advances in medical technology, and an aging population contribute to escalating healthcare expenses, placing strain on insurers, healthcare providers, employers, and consumers alike. The increasing cost of healthcare services and treatments drives up insurance premiums, deductibles, and out-of-pocket expenses, making health insurance coverage less affordable for individuals and families.

- Regulatory Uncertainty and Policy Changes:

Another key challenge in the health insurance market is regulatory uncertainty and frequent policy changes. Healthcare regulations are subject to constant evolution, driven by political, economic, and social factors, as well as changes in healthcare priorities and demographic trends. Regulatory uncertainty creates challenges for insurers in navigating compliance requirements, adapting their products and services, and anticipating the impacts on their business operations and financial performance.

Segments Insights:

Provider Insights

Public health insurance dominates the market, particularly in countries with established social healthcare systems such as the United Kingdom (NHS), Canada, Germany, and Scandinavian nations. These systems are often mandatory, government-funded, and designed to provide universal coverage. Public schemes are also prevalent in developing countries through initiatives like India’s Ayushman Bharat and Brazil’s SUS.

The primary advantage of public providers is affordability, as they are either free or subsidized. However, they often suffer from funding limitations, long waiting times, and restricted access to advanced care, prompting people to seek supplemental private plans.

In contrast, private health insurance is growing at the fastest rate, especially in urban areas and among the affluent and middle classes. Private plans offer more flexibility, faster claim processing, wider hospital networks, and better customer service. Insurance giants like UnitedHealth Group, Allianz, and AXA are expanding aggressively in regions with rising disposable incomes and underserved private insurance penetration.

Coverage Type Insights

Term insurance dominates in terms of volume, primarily due to its affordability and suitability for short- to medium-term health needs. These policies typically cover expenses for a fixed period, such as one year, and are often renewed annually. They are popular among working adults and young families seeking cost-effective options.

However, life-time coverage is witnessing strong momentum, driven by demographic aging and increased prevalence of chronic conditions. These plans, which offer continuous coverage without the need for reapplication, are particularly attractive to seniors and individuals with genetic predispositions to disease. As long-term care needs rise globally, insurers are bundling these offerings with chronic illness riders and long-term disability options.

Network Provider Insights

Preferred Provider Organizations (PPOs) dominate the network provider landscape, offering flexibility for consumers to choose healthcare providers within and outside of a prescribed network. PPOs are particularly popular in North America, where policyholders value the ability to visit specialists without referrals and prefer minimal restrictions on provider access.

Meanwhile, Health Maintenance Organizations (HMOs) are the fastest-growing segment, especially in regions aiming for cost-effective, coordinated care. HMOs typically focus on preventive services, gatekeeping by primary care physicians, and lower premium costs. In countries with integrated health systems and urban population clusters, HMOs provide an efficient model for delivering consistent, managed care.

Regional Insights

North America leads the global health insurance market, with the U.S. accounting for the majority share. Despite not having a universal health system, the U.S. has a complex and robust insurance landscape dominated by private players such as UnitedHealth Group, Anthem, and Humana. Employer-sponsored insurance, Medicare for seniors, and Medicaid for low-income groups form the backbone of the American system.

The Affordable Care Act (ACA) introduced significant reforms, increasing coverage rates and creating online insurance marketplaces. In Canada, the public healthcare model is dominant, but private supplemental insurance is common for dental, vision, and non-core services.

Asia-Pacific is the fastest-growing region, propelled by economic development, healthcare reforms, and demographic transitions. Countries like India, China, Indonesia, and Vietnam are witnessing a surge in insurance uptake. Government initiatives such as Ayushman Bharat (India) and the Basic Medical Insurance Scheme (China) are expanding public coverage.

At the same time, private insurers are capitalizing on rising middle-class demand for quality care. Digital health startups and insurance aggregators are thriving in these markets, offering user-friendly, localized services. As infrastructure improves and awareness grows, Asia-Pacific is poised to become a dominant player in the health insurance landscape.

Key Developments in the Marketplace:

-

March 2025 – Cigna Corporation announced the expansion of its global telehealth services under its health insurance portfolio, focusing on mental health and chronic disease management.

-

February 2025 – AIA Group (Asia-Pacific) launched a new product combining wearable-based rewards with personalized premium discounts for policyholders maintaining a healthy lifestyle.

-

December 2024 – UnitedHealth Group reported a partnership with the Mayo Clinic to integrate AI in claims adjudication and fraud detection.

-

October 2024 – Allianz SE announced the rollout of microinsurance plans in rural Africa, accessible through mobile networks in collaboration with local telecom companies.

-

August 2024 – Star Health and Allied Insurance launched India’s first comprehensive plan for senior citizens covering pre-existing diseases from day one.

Some of the prominent players in the health insurance market include:

- Cigna Corporation

- CVS Health Corporation

- Allianz

- Centene Corporation

- United Healthcare Services, Inc.

- WellCare Health Plans, Inc.

- National Insurance Company Limited

- Bupa Global

- Humana, Inc.

- AIA Group Limited

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global health insurance market.

By Provider

By Coverage Type

- Term Insurance

- Life-time Coverage

By Network Provider

- Point of Service

- Preferred Provider Organizations

- Exclusive Provider Organizations

- Health Maintenance Organizations

By Plan Type

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

By Age Group

- Minor

- Adults

- Senior Citizen

By Distribution Channel

- Direst Sales

- Brokers/Agents

- Banks

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)