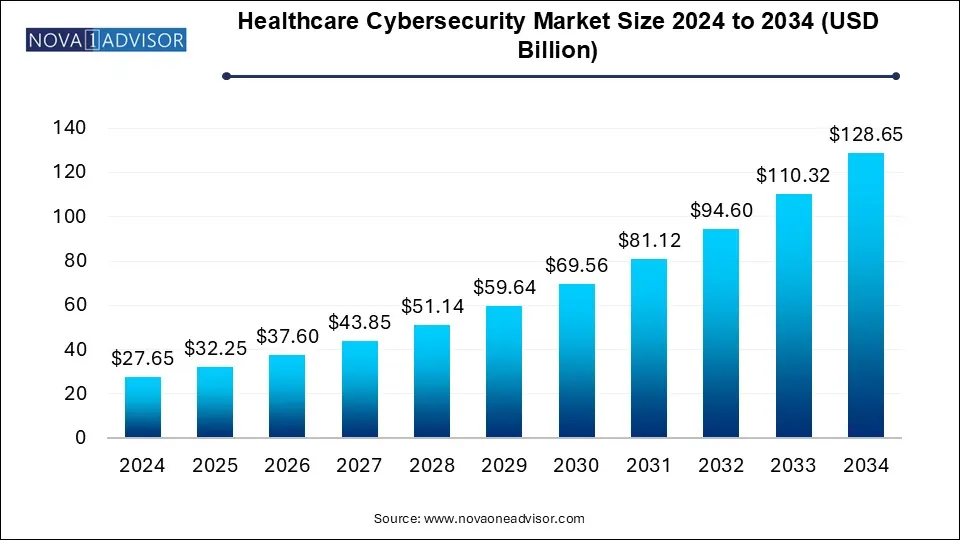

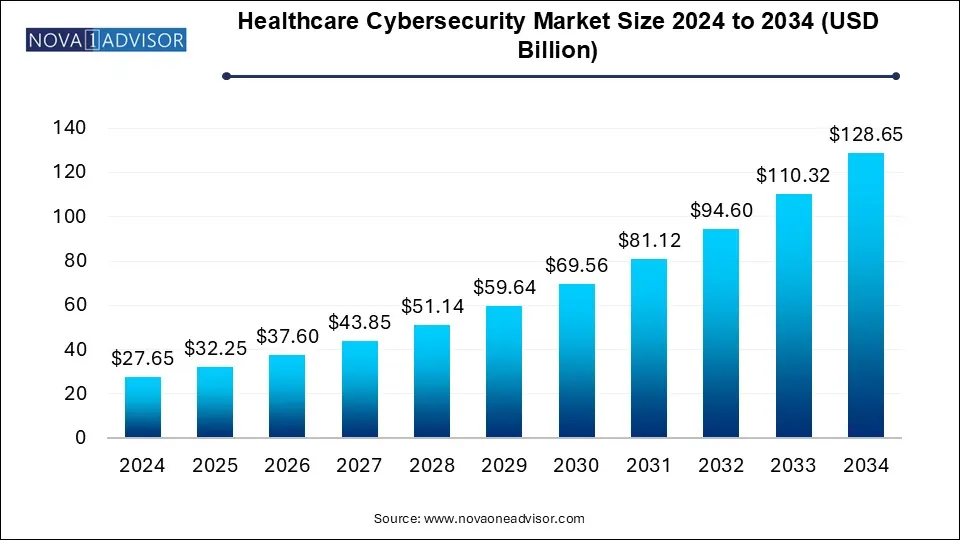

Healthcare Cybersecurity Market Size and Growth

The healthcare cybersecurity market size was exhibited at USD 27.65 billion in 2024 and is projected to hit around USD 128.65 billion by 2034, growing at a CAGR of 16.62% during the forecast period 2025 to 2034.

Healthcare Cybersecurity Market Key Takeaways:

North America led the global market with the highest market share of 43.0% in 2024.

By Offering, the solution segment has held the largest market share in 2024.

By End User, the healthcare provider segment captured the biggest revenue share in 2024.

By Security, the cloud security segment is estimated to hold the highest market share in 2024.

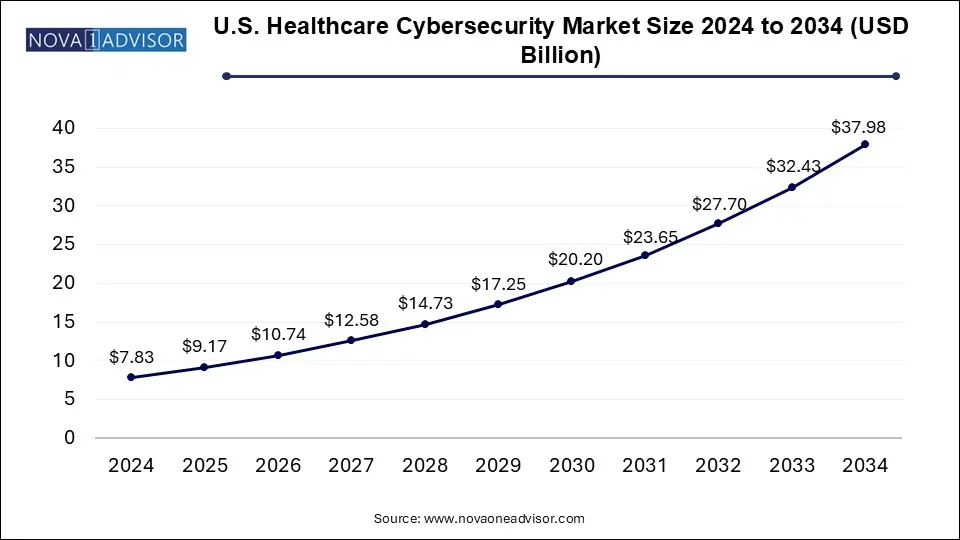

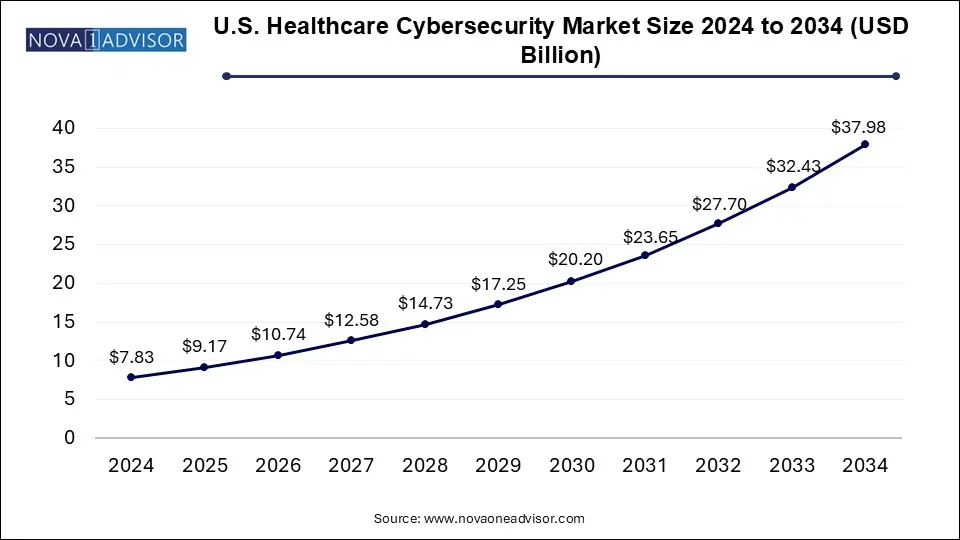

U.S. Healthcare Cybersecurity Market Size and Growth 2025 to 2034

The U.S. healthcare cybersecurity market size reached USD 7.83 billion in 2024 and is predicted to be worth around USD 37.98 billion by 2034, at a CAGR of 17.1% from 2025 to 2034.

Until 2024, North America held the largest share of the healthcare cybersecurity market, accounting for 42.0% of the total. The United States and Canada have the most advanced healthcare infrastructure in the region. As a technologically developed area, North America offers cutting-edge healthcare services. The presence of key industry players, numerous startups, well-established healthcare and medical infrastructure, increased investment in healthcare IT, widespread adoption of cloud-based solutions, and the rising frequency of cyberattacks are key factors driving market growth. Major companies are introducing innovative products to enhance data security in the healthcare sector, further fueling market expansion during the forecast period.

The Asia-Pacific region is also expected to witness significant growth, reaching 20% during the forecast period. This growth is driven by the rising number of cyberattacks, stricter regulatory requirements, and an increasing number of connected devices. Greater awareness and adoption of cybersecurity solutions among healthcare organizations, supported by advanced technologies, will contribute to market expansion. The use of the Internet of Things (IoT), 5G technology, growing concerns about privacy and security, and the adoption of cloud computing will further accelerate market growth in the region.

In Europe, increased economic spending on healthcare and cybersecurity services is boosting market growth. Rising investments in digital security measures are expected to strengthen the region’s position in the global healthcare cybersecurity market.

Healthcare Cybersecurity Market Overview

The increasing use of Internet of Medical Things (IoMT) devices in the healthcare sector has led to a rising demand for advanced healthcare cybersecurity solutions. Due to potential threats in this industry, cybersecurity firms provide essential security services and solutions to healthcare institutions, safeguarding hospitals and patient information. Cybersecurity, also known as information security, involves maintaining the confidentiality, integrity, and availability of data. Numerous companies in the market offer cutting-edge cybersecurity solutions tailored to healthcare needs. The healthcare sector is a prime target for cybercriminals, as medical data is often considered more valuable than banking details or credit card information. The digitization of healthcare has heightened the risk of cyberattacks, necessitating robust cybersecurity measures. Cybersecurity solutions help mitigate risks by preventing digital threats, data breaches, and unauthorized access to networks, healthcare data, devices, and various applications.

The healthcare cybersecurity market experienced significant growth during the pandemic. The increasing frequency of cyber threats in the healthcare industry during this period contributed to market expansion. As healthcare institutions transitioned to remote operations, reliance on personal devices and home internet connections without adequate security measures heightened vulnerability to cyberattacks. Consequently, the demand for cybersecurity solutions in healthcare continues to rise.

Healthcare Cybersecurity Market Growth Factors

Phishing attacks in the healthcare sector surged during the pandemic, contributing to the market’s growth. The increased use of the internet and digital platforms in healthcare has amplified the necessity for cybersecurity. The availability of advanced cybersecurity solutions is also expected to support market expansion. Various healthcare organizations and governments are making significant investments and launching initiatives to strengthen healthcare cybersecurity systems. The growing number of data breaches further fuels market growth.

Report Scope of Healthcare Cybersecurity Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 32.25 Billion |

| Market Size by 2034 |

USD 128.65 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 16.62% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Offering, By End User, By Security, By Threat Type, By Deployment, By End Use, and By Solution, and Regions |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

SYMANTEC CORPORATION, Cisco Systems, Inc., FireEye, Inc., NORTHROP GRUMMA CORPORATION, Palo Alto Networks, Inc., sensato investors, Lockheed Martin Corporation, MACAFEE, INC., ibm corporation, and Kaspersky Lab. |

Healthcare Cybersecurity Market By Offering Insights

In terms of offerings, the solutions segment is projected to hold the largest market share during the forecast period. This segment has demonstrated strong growth in previous years, driven by rising concerns over data security and privacy. The increasing demand for advanced security solutions that are cost-effective has further fueled its expansion. The solutions segment within the healthcare cybersecurity market is expected to grow due to heightened awareness of electronic health records, along with regulatory and compliance requirements aimed at data protection.

Healthcare Cybersecurity Market By End-User Insights

By end-user, the healthcare provider segment held the highest market share in revenue until 2024. The growing awareness of electronic health records, along with rising concerns over data security, has contributed to this segment's expansion. Government initiatives, regulations, and policies supporting e-health solutions are also expected to drive market growth. Governments worldwide are implementing measures to protect patient data from cyber threats.

The healthcare provider segment is anticipated to grow further during the forecast period due to the increasing adoption of connected IoT devices and cloud-based services. The rise of emerging digital technologies such as IoT and cloud computing, along with substantial government investments in healthcare infrastructure, will further propel this segment’s expansion. As hospitals and healthcare providers remain highly vulnerable to cyber threats, the demand for cybersecurity solutions in this sector is expected to continue rising.

Healthcare Cybersecurity Market By Security Insights

Among security types, the cloud security segment is expected to witness the fastest growth during the forecast period. The overall cybersecurity market is also projected to expand significantly. The growing volume of sensitive data within the healthcare industry, coupled with the increasing adoption of IoT in healthcare, has driven the demand for cloud security solutions. Many healthcare firms are now integrating cloud-based security technologies to enhance data protection. Additionally, the widespread adoption of IoT devices in the healthcare sector has further contributed to this trend. Cloud services offer efficient data storage solutions, and these factors are expected to support the growth of the cloud security segment.

Some of The Prominent Players in The Healthcare cybersecurity market Include:

Healthcare Cybersecurity Market Recent Developments

- Mediagate carried an expansion of clinical IoT and General IO T medical devices. In order to enable the accurate and comprehensive medical device management for the protection from cyber attacks we announcement was made in the year 2019.

- In order to manage security services, identity management. And cloud security in the healthcare sector, Atos launched its first comprehensive cybersecurity solution. This comprehensive cybersecurity solution was launched in the year 2019. The firm approached about 300 health care organisations to adopt this strategy for cyber attacks.

- In order to detect, analyze and respond to the cyber security threats in the government hospitals as well as in the private hospitals. GE Healthcare had announced a cybersecurity solution named Skeye. The cyber security solution was launched in the year 2020. The solution helps in defending the vulnerabilities and provides the visibility and resolution of threat.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the healthcare cybersecurity market

By Offering

By End User

- Healthcare Payers

- Healthcare Providers

By Security

- Cloud security

- Network security

- Application security

- Endpoint security

By Threat Type

- Ransomware

- Malware & Spyware

- Distributed Denial of Service (DDoS)

- Phishing & spear phishing

- Others

By Deployment

By Application

- Hospitals

- Pharmaceutical and biotechnology industries

- Healthcare payers

- Others

By Solution

- Identity and Access Management

- Risk and Compliance Management

- Antivirus and Antimalware

- DDoS Mitigation

- Security Information and Event Management

- Intrusion Detection System/ Intrusion Prevention System

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)