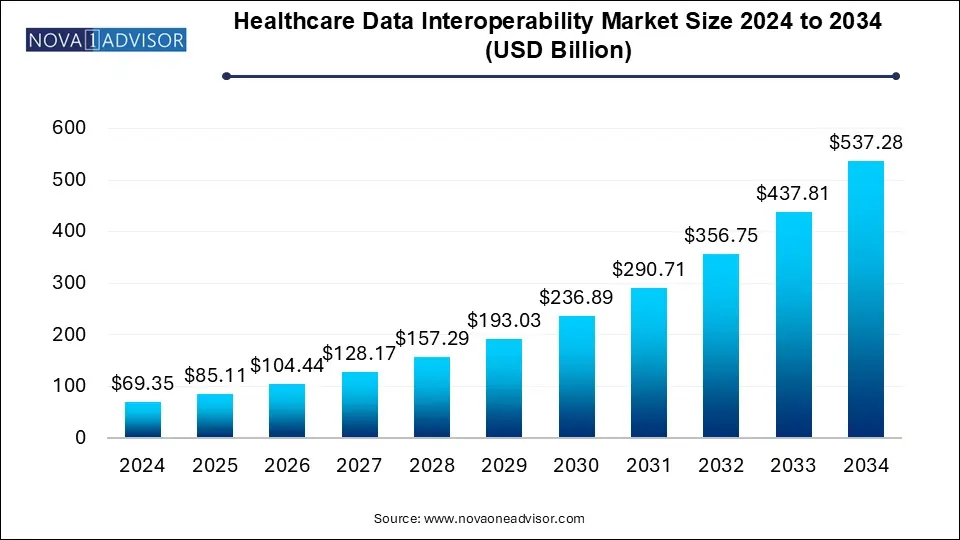

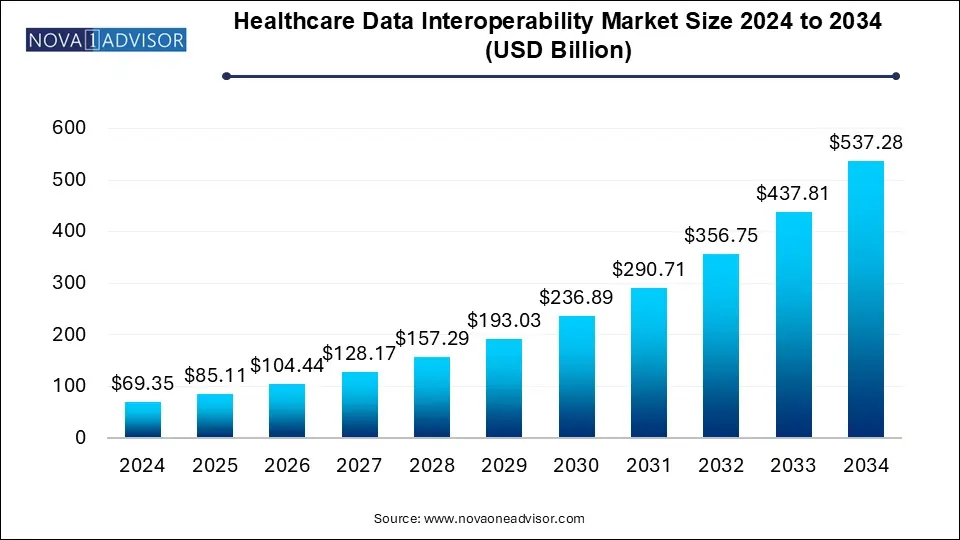

Healthcare Data Interoperability Market Size and Growth

The healthcare data interoperability market size was exhibited at USD 69.35 billion in 2024 and is projected to hit around USD 537.28 billion by 2034, growing at a CAGR of 22.72% during the forecast period 2025 to 2034.

Key Trends in the Healthcare Data Interoperability Market

The Healthcare Data Interoperability Market is witnessing significant growth due to advancements in healthcare technology and the increasing necessity for seamless data exchange among healthcare providers.

The widespread adoption of electronic health records (EHRs), the implementation of interoperability standards, and the expansion of cloud-based healthcare solutions are major factors propelling the market forward. Additionally, the emphasis on patient-centric care and the need to enhance healthcare outcomes are driving the demand for data interoperability solutions.

Key trends shaping the market include the rising utilization of application programming interfaces (APIs) for data sharing, the growing role of blockchain technology in secure data transactions, and the emergence of artificial intelligence (AI)-driven interoperability platforms.

These advancements are helping healthcare organizations eliminate data silos and integrate information from various sources, leading to improved patient care and cost efficiencies.

Opportunities within the Healthcare Data Interoperability Market lie in the development of specialized interoperability solutions targeting specific healthcare areas such as chronic disease management, population health, and precision medicine. Furthermore, integrating interoperability with cutting-edge technologies such as the Internet of Medical Things (IoMT) and telehealth presents significant potential for expansion. By capitalizing on these trends, healthcare providers and technology firms can foster innovation and enhance healthcare service delivery.

Report Scope of Healthcare Data Interoperability Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 85.11 Billion |

| Market Size by 2034 |

USD 537.28 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 22.72% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Technology, Interoperability Standard, Application, Data Source, Deployment Model, Regional |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

IBM, Epic Systems, Microsoft, Amazon Web Services, Oracle, Inter Systems, Philips Healthcare, GE Healthcare, Cerner, NextGen Healthcare, Google Cloud, Allscripts Healthcare Solutions, McKesson Corporation, SAP |

Drivers of the Healthcare Data Interoperability Market

Driver 1: Rising Demand for Patient-Centric Care

The healthcare industry is increasingly adopting a patient-focused approach, empowering individuals to take an active role in managing their health.

This shift is influenced by factors such as the growing consumerism in healthcare, the increasing availability of online health information, and a heightened awareness of patient engagement's importance. As patients demand greater access to their health records, the need for healthcare data interoperability solutions continues to grow.

Furthermore, the transition towards value-based care, which prioritizes patient outcomes and satisfaction, necessitates the ability to track and measure health outcomes effectively. This requires seamless data exchange across various providers and settings, positioning healthcare data interoperability as a key enabler in this transformation.

Beyond patient-centric and value-based care, additional factors fueling the market include rising healthcare costs, the need for enhanced healthcare quality, the widespread adoption of EHRs, the increasing use of mobile health (mHealth) applications, and the advancement of emerging technologies such as AI and machine learning (ML). These elements collectively drive the demand for healthcare data interoperability solutions.

Driver 2: Government Regulations

Government regulations play a crucial role in shaping the healthcare data interoperability market. Across various countries, governments are implementing policies that mandate healthcare providers to share patient data with other providers and patients. These regulations aim to enhance care quality, reduce costs, and improve patient safety.

For instance, in the United States, the Health Information Technology for Economic and Clinical Health (HITECH) Act, enacted in 2009, promotes the adoption of health information technology (HIT), including EHRs and health information exchanges (HIEs). It also includes provisions requiring healthcare providers to facilitate patient data sharing.

Similarly, the European Union (EU) has established directives promoting the adoption of EHRs and health information exchange, such as the Directive on the application of patients' rights in cross-border healthcare and the Directive on eHealth.

These regulatory frameworks are driving the demand for interoperability solutions, as healthcare providers must comply to avoid penalties and maintain compliance. The healthcare data interoperability market is well-positioned to support providers in meeting these requirements effectively.

Driver 3: Advancements in Technology

Technological progress is another key factor accelerating the healthcare data interoperability market. Innovations in AI and ML are facilitating the efficient collection, sharing, and analysis of healthcare data. AI and ML algorithms can identify patterns and trends within health records, ultimately improving care quality, reducing costs, and aiding in the development of new treatments.

The adoption of cloud computing is also transforming the healthcare data landscape by providing a secure, scalable, and cost-effective solution for storing and exchanging health information. Cloud-based platforms enable the development and deployment of interoperability applications, further advancing data-sharing capabilities.

These technological advancements are making interoperability solutions more accessible and affordable for healthcare providers, fueling the rapid adoption of these solutions and reinforcing their role in the future of healthcare delivery.

Healthcare Data Interoperability Market Segment Insights

Healthcare Data Interoperability Market By Technology Insights

The technology sector of the Healthcare Data Interoperability Market is largely influenced by the adoption of interoperability frameworks such as HL7 FHIR, DICOM, and XML. These standards facilitate the seamless transfer and integration of healthcare data across diverse systems and applications.

The market is poised for substantial expansion in the coming years, driven by the growing demand for interoperable healthcare solutions and the necessity for improved patient care coordination. HL7 FHIR (Fast Healthcare Interoperability Resources) is a widely recognized standard for exchanging healthcare data in a uniform format. It establishes a common language for healthcare professionals to share patient data efficiently, enhancing communication across various platforms. The increasing adoption of HL7 FHIR is anticipated to fuel the growth of the technology segment.

DICOM (Digital Imaging and Communications in Medicine) is another vital standard that enables the sharing of medical images and related information. It allows seamless transmission of medical imaging data between different imaging systems and healthcare applications, thereby improving accessibility and collaboration among healthcare providers.

Additionally, XML (Extensible Markup Language) serves as a flexible data format for exchanging structured healthcare information, including patient records, laboratory findings, and medical images. Its continued adoption is expected to further drive the expansion of the technology segment.

Overall, the technology sector of the Healthcare Data Interoperability Market is projected to experience significant growth, propelled by the increasing adoption of interoperability frameworks such as HL7 FHIR, DICOM, and XML. The rising demand for seamless healthcare solutions and enhanced patient care coordination will continue to boost market expansion. The technology segment's revenue is anticipated to reach USD 123.4 billion by 2034, with a compound annual growth rate (CAGR) of 22.7%.

Healthcare Data Interoperability Market By Interoperability Standard Insights

The Healthcare Data Interoperability Market is categorized based on Interoperability Standards, including EHR Standards, Clinical Document Architecture (CDA), Health Level Seven (HL7), and Fast Healthcare Interoperability Resources (FHIR).

In 2024, the EHR Standards segment accounted for the largest market share, comprising over 40% of total revenue. This growth is primarily attributed to the increasing adoption of EHR systems by healthcare providers. Meanwhile, the CDA segment is anticipated to expand significantly due to the rising demand for structured and interoperable clinical documentation.

The HL7 segment is projected to witness considerable growth as healthcare providers continue adopting HL7 standards for data exchange. Furthermore, the FHIR segment is expected to experience the fastest growth, given its capacity to support diverse healthcare data types and its increasing acceptance among healthcare providers and technology vendors.

Healthcare Data Interoperability Market By Application Insights

The Healthcare Data Interoperability Market is segmented by Application into Electronic Health Records (EHRs), Health Information Exchanges (HIEs), Telehealth, and Clinical Decision Support Systems (CDSSs).

Among these, the EHR segment dominated the market in 2024 and is expected to retain its leading position throughout the forecast period. The segment's growth is driven by the widespread adoption of EHRs by healthcare providers to enhance patient care coordination and optimize administrative workflows.

The HIE segment is set to grow substantially due to the increasing need for seamless data sharing across various healthcare settings. Similarly, the Telehealth segment is expected to expand rapidly, providing convenient and accessible healthcare services to patients. The CDSS segment is also projected to grow steadily, assisting healthcare professionals in making informed decisions by offering timely and relevant patient information.

Healthcare Data Interoperability Market By Data Source Insights

The Healthcare Data Interoperability Market is classified based on data sources into clinical data, administrative data, financial data, and patient-generated data. Clinical data held the largest market share in 2024, contributing over 50% of global revenue. This segment includes information from electronic health records (EHRs), such as patient medical history, diagnoses, treatments, and medications.

Administrative data was the second-largest segment, accounting for more than 25% of global revenue. This category includes data from claims processing systems, which contain details about insurance coverage, benefits, and payments.

Financial data ranked as the third-largest segment, comprising over 15% of global revenue. This segment consists of billing system data, including charges, payments, and financial adjustments.

Patient-generated data accounted for the smallest market share, contributing over 10% of global revenue in 2024. This segment includes data collected from patient portals, wearable devices, and self-reported sources.

Market growth is fueled by increasing EHR adoption, the rising demand for data-driven healthcare solutions, and the necessity for interoperability among different healthcare systems. The Healthcare Data Interoperability Market is projected to expand at a CAGR exceeding 22% from 2025 to 2034, reaching a valuation of over USD 288.9 billion by 2034.

Healthcare Data Interoperability Market By Deployment Model Insights

The deployment model segment of the Healthcare Data Interoperability Market is categorized into cloud-based, on-premises, and hybrid solutions. Among these, the cloud-based segment is expected to dominate the market throughout the forecast period.

The rising adoption of cloud computing in the healthcare sector, along with its advantages such as scalability, flexibility, and cost-efficiency, is driving this segment’s growth. The on-premises segment is also projected to maintain steady growth, as some healthcare organizations prefer to retain full control and security over their data.

Meanwhile, the hybrid deployment model, which integrates the benefits of both cloud-based and on-premises solutions, is gaining traction and is expected to witness increased adoption in the near future.

Healthcare Data Interoperability Market By Regional Insights

The Healthcare Data Interoperability Market is segmented by region into North America, Europe, Asia-Pacific (APAC), South America, and the Middle East & Africa (MEA).

North America emerged as the leading market in 2024, accounting for over 35% of global market share. The region's strong and established healthcare infrastructure, along with government-driven interoperability initiatives, is fueling market expansion.

Europe is another significant player in the market, with a strong emphasis on patient-centered care and the widespread adoption of electronic health records (EHRs).

The APAC region is expected to witness the highest growth rate during the forecast period, driven by increasing healthcare investments and a growing demand for improved healthcare services. Meanwhile, South America and MEA are projected to experience moderate growth due to developing healthcare infrastructures and the gradual adoption of interoperability solutions.

Some of The Prominent Players in The Healthcare Data Interoperability Market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Feminine Hygiene Products Market

By Technology

By Interoperability Standard

- EHR Standards

- Clinical Document Architecture (CDA)

- Health Level Seven (HL7)

- Fast Healthcare Interoperability Resources (FHIR)

By Application

- Electronic Health Records (EHRs)

- Health Information Exchanges (HIEs)

- Telehealth

- Clinical Decision Support Systems (CDSSs)

By Data Source

- Clinical Data

- Administrative Data

- Financial Data

- Patient-Generated Data

By Deployment Model

- Cloud-based

- On-premises

- Hybrid

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)