Hemophilia Treatment Market Size and Trends

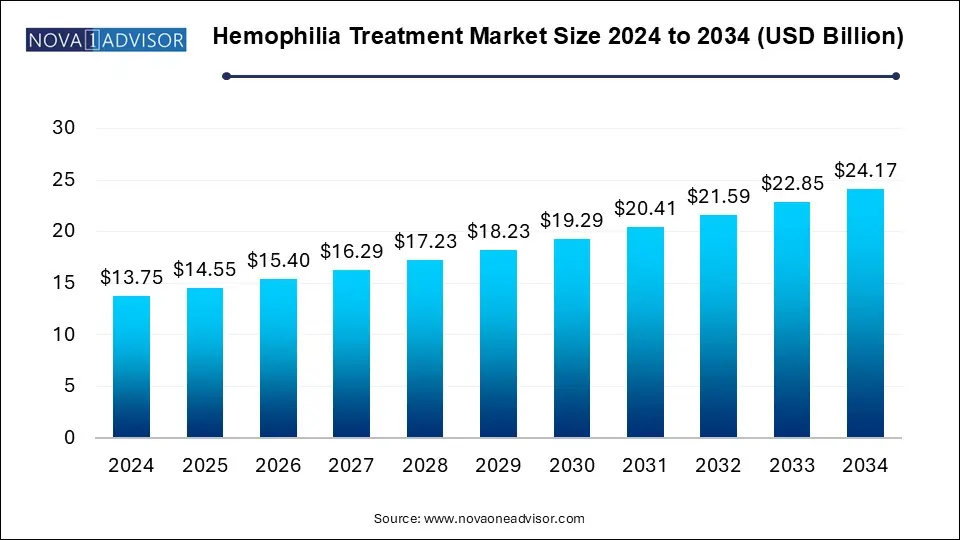

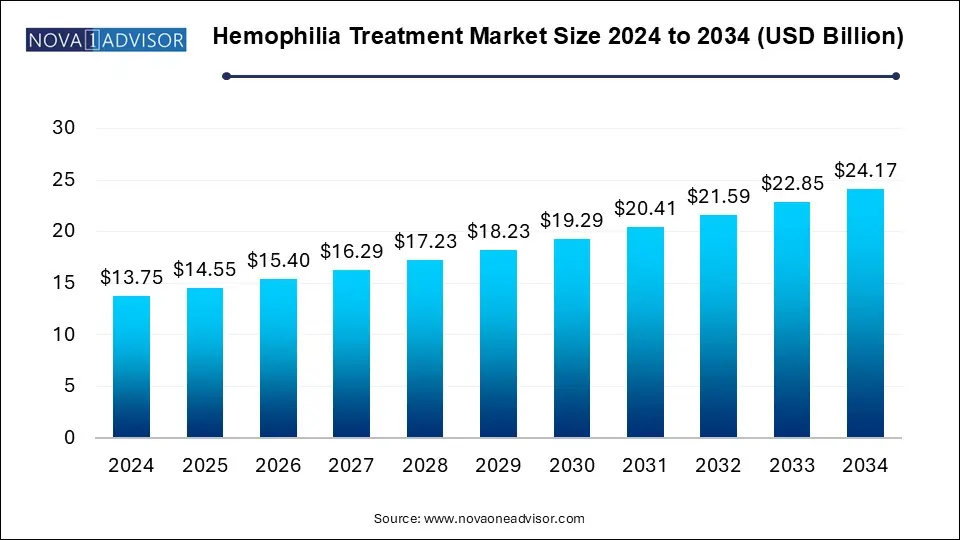

The hemophilia treatment market size was exhibited at USD 13.75 billion in 2024 and is projected to hit around USD 24.17 billion by 2034, growing at a CAGR of 5.8% during the forecast period 2025 to 2034.

Hemophilia Treatment Market Key Insights:

- In 2024, the Hemophilia A segment led the market, generating USD 10.12 billion.

- The recombinant coagulation factor concentrates segment held a dominant position in 2024, capturing a 59.0% market share.

- The adult segment is further categorized into 19-44 years and 45+ years, with an expected CAGR of 5.6% over the forecast period.

- The prophylaxis segment was the market leader in 2024 and is projected to reach USD 15.1 billion by 2032.

- Factor replacement therapy dominated in 2024 and is anticipated to expand at a CAGR of 5.6% throughout the analysis period.

- Coagulation factors accounted for a 94.8% market share in 2024.

- The injectable segment is forecasted to witness significant growth, reaching USD 18.4 billion by 2024.

- Hospitals held the largest market share in 2024 and are expected to grow at a CAGR of 5.9% between 2025 and 2034.

Report Scope of Hemophilia Treatment Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 14.55 Billion |

| Market Size by 2034 |

USD 24.17 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.8% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Disease Type, Product, Patient, Treatment, Therapy, Drug Class, Route of Administration, End-use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Bayer AG, Biogen Inc., Biotest AG (Grifols, S.A.), BioMarin Pharmaceutical Inc, CSL Behring LLC, Ferring B.V., Genentech, Inc. (Roche Holding AG), Kedrion S.p.A, Novo Nordisk A/S , Octapharma AG, Pfizer, Inc., Sanofi SA, Swedish Orphan Biovitrum AB, Takeda Pharmaceutical Company Limited |

Report Scope of Hemophilia Treatment Market

Various governmental and non-governmental organizations are actively promoting awareness about hemophilia, its symptoms, diagnosis, and treatment. For instance, the World Federation of Hemophilia (WFH) is committed to enhancing care for individuals with inherited bleeding disorders worldwide. Such initiatives contribute to increased adoption of treatment solutions, thereby boosting market expansion.

Moreover, the introduction of novel therapies, including extended half-life factor concentrates and non-factor replacement therapies, is expanding the treatment landscape. Collaborations between pharmaceutical companies and research institutions are accelerating the development of new treatments, while favorable reimbursement policies in developed countries enhance patient access to advanced therapies, stimulating market growth.

Market Trends in Hemophilia Treatment

- The rising global prevalence of hemophilia significantly drives market growth. With increasing diagnoses of this genetic disorder, the demand for effective treatment solutions has surged.

- According to the Centers for Disease Control and Prevention (CDC), hemophilia A affects approximately 1 in 5,000 male births annually in the U.S. This substantial prevalence underscores the need for enhanced healthcare services, increasing the market demand for hemophilia treatment.

- Advancements in diagnostic technologies and growing awareness have resulted in a higher detection rate, further amplifying the necessity for therapeutic interventions.

- Additionally, the growing global population and improved healthcare infrastructure in developing nations have enabled better access to medical services, leading to earlier diagnoses and more comprehensive disease management.

- The increasing prevalence of hemophilia highlights the urgent need for advanced treatment solutions, including clotting factor concentrates, gene therapy, and prophylactic treatments, thereby fueling market expansion.

Market Segmentation

Hemophilia Treatment Market By Disease Type

The market is categorized into Hemophilia A, Hemophilia B, and other types. In 2024, Hemophilia A led the market with revenue of USD 10.12 billion, primarily due to its higher prevalence.

According to the CDC, approximately 400 infants are born with Hemophilia A annually in the U.S. This high disease incidence is expected to drive demand for treatment solutions, positively influencing market revenue.

Innovations in recombinant Factor VIII products and advancements in gene therapies are further strengthening the treatment landscape for Hemophilia A, improving patient outcomes and market expansion.

Hemophilia Treatment Market By Product

The market is divided into recombinant coagulation factor concentrates, plasma-derived coagulation factor concentrates, extended half-life products, desmopressin, antifibrinolytic agents, and gene therapy products. Recombinant coagulation factor concentrates are further segmented into Factor VIII and Factor IX. The recombinant coagulation factor concentrates segment dominated the market in 2024 with a 59.0% market share.

Recombinant coagulation factor concentrates are highly preferred due to their advantages over plasma-derived alternatives. These products, developed using recombinant DNA technology, minimize the risk of bloodborne pathogen transmission, a crucial concern associated with plasma-derived factors.

Their strong market position is driven by consistent efficacy, improved safety profiles, and ongoing innovations in recombinant therapies, making them a preferred choice among healthcare providers and patients.

Hemophilia Treatment Market By Patient Type

The market is segmented into pediatric and adult patients, with the adult category further divided into 19-44 years and 45+ years. The adult segment is projected to grow at a CAGR of 5.6% during the forecast period.

Adult patients with hemophilia often require specialized treatments to manage complications and maintain their quality of life, driving demand for therapeutic products.

The aging population further contributes to market growth, as older adults are more prone to severe hemophilia-related complications, necessitating continued medical intervention.

Hemophilia Treatment Market By Treatment Type

The market is classified into prophylaxis and on-demand treatments. The prophylaxis segment led the market in 2024 and is projected to reach USD 15.1 billion by 2032.

The significant market share of the prophylaxis segment is attributed to the increasing focus on preventive healthcare and the widespread adoption of prophylactic treatment to manage hemophilia. Prophylaxis involves the regular infusion of clotting factors to prevent bleeding episodes, enhancing patient quality of life.

Advancements in recombinant therapies and extended half-life products have further strengthened the adoption of prophylactic regimens.

Additionally, rising awareness among patients and healthcare providers regarding the benefits of early intervention and regular prophylactic treatment is fueling demand.

Hemophilia Treatment Market By Therapy Type

The market is divided into factor replacement therapy and non-factor replacement therapy. Factor replacement therapy dominated in 2024 and is expected to grow at a CAGR of 5.5% during the analysis period.

This segment's growth is primarily driven by its proven efficacy and widespread adoption.

Advancements in recombinant DNA technology have further improved the safety and availability of these treatments, minimizing the risk of bloodborne infections.

Moreover, the development of extended half-life factor products, which require less frequent dosing, has enhanced patient compliance and quality of life, reinforcing the dominance of factor replacement therapy in the market.

Hemophilia Treatment Market By Drug Class

The market is divided into vasopressin and coagulation factors, with coagulation factors holding a 94.7% market share in 2024.

Given that hemophilia results from deficient clotting factors, regular replacement therapy remains essential for managing the condition effectively.

The continued demand for coagulation factors is driven by their ability to prevent and control bleeding episodes, thereby enhancing patients' quality of life.

Hemophilia Treatment Market By Route of Administration

The market is categorized into injectable, nasal spray, and oral administration methods. The injectable segment is expected to see significant growth, reaching USD 18.4 billion by 2024.

Injectables offer a fast and efficient method for drug administration, providing rapid therapeutic effects.

Intravenous injections play a crucial role in improving clinical outcomes, increasing life expectancy, and enhancing functional status and quality of life for hemophilia patients. The preference for injectables is expected to drive market growth due to their clinical effectiveness and positive results.

Hemophilia Treatment Market By End-Use

The market is segmented into hospitals, clinics, hemophilia treatment centers, and other end-users. Hospitals led the market in 2024 and are projected to grow at a CAGR of 5.9% between 2025 and 2034.

Hospitals serve as primary care centers for hemophilia patients, offering specialized treatment facilities and advanced diagnostic tools. Their collaboration with hemophilia treatment centers ensures continuous access to specialized care, genetic counseling, and patient education programs, further supporting market growth.

In 2023, the North American hemophilia treatment market was valued at USD 5.8 billion and is projected to reach USD 9.1 billion by 2032.

The region holds a substantial market share, driven by its advanced healthcare infrastructure, high patient awareness, and strong reimbursement policies.

North America benefits from a well-developed healthcare system that facilitates comprehensive diagnosis and treatment options for hemophilia patients.

Additionally, continuous advancements in therapeutic solutions, such as gene therapy and recombinant factor products, further strengthen North America's leading position in the market.

The U.S. hemophilia treatment market is projected to expand at a CAGR of 5.1% from 2025 to 2034.

This significant growth is driven by factors such as increased government investments in healthcare and R&D, along with the presence of well-established manufacturers.

Rising awareness of advanced treatment technologies and an expanding patient population are also fueling market revenue.

For instance, according to the World Federation of Hemophilia (WFH), approximately 17,757 individuals in the U.S. were diagnosed with hemophilia in 2018.

Germany is expected to experience strong growth in the global hemophilia treatment market.

The country’s emphasis on healthcare research and development has led to the introduction of innovative treatment options, accelerating market expansion.

Additionally, the presence of major pharmaceutical companies and leading healthcare institutions in Germany fosters collaboration and drives advancements in hemophilia treatment, positioning the country as a key market in this sector.

The Asia-Pacific region is poised for substantial growth throughout the forecast period.

Factors such as increasing awareness of hemophilia, improved diagnosis rates, and the expansion of healthcare infrastructure are contributing to market expansion.

Additionally, rising healthcare spending and government initiatives aimed at improving healthcare accessibility are supporting treatment adoption.

Furthermore, the region’s vast population, particularly in countries like China and India, provides a significant patient base for hemophilia treatment, reinforcing the market's strong growth trajectory in Asia-Pacific.

Some of The Prominent Players in The Hemophilia Treatment Market Include:

Hemophilia Treatment Market Recent Developments

- In June 2024, BioMarin Pharmaceutical Inc. announced that the U.S. FDA approved ROCTAVIAN (valoctocogene roxaparvovec-rvox) gene therapy for the treatment of adults with severe hemophilia A (congenital factor VIII (FVIII) deficiency with FVIII activity 1 IU/dL) without antibodies to adeno-associated virus serotype 5 (AAV5). This helped the company expand its product portfolio.

- In October 2024, CSL announced that Health Canada has authorized HEMGENIX (etranacogene dezaparvovec), gene therapy for the treatment of hemophilia B. HEMGENIX is indicated for the treatment of adults with hemophilia B who require routine prophylaxis to prevent or reduce the frequency of bleeding episodes. This approval helped the company commercialize its product in Canada.

- In February 2023, Novo Nordisk announced the U.S. FDA approval for its biologics license application for Esperoct. This medicine is used in pediatric and adult patients suffering from congenital factor VIII deficiency to lessen the frequency of bleeding episodes. This launch helped the company to introduce innovative products, further offering a competitive edge.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Hemophilia Treatment Market

By Disease Type

By Product

- Recombinant coagulation factor concentrates

- Plasma-derived coagulation factor concentrates

- Extended half-life products

- Desmopressin

- Antifibrinolytic agents

- Gene therapy products

By Patient

By Treatment

By Therapy

- Factor replacement therapy

- Non-factor replacement therapy

By Drug Class

- Vasopressin

- Coagulation factors

By Route of Administration

- Injectable

- Nasal spray

- Oral

By End-use

- Hospitals

Clinics

Hemophilia treatment centers

Other end-users

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)