Human Resource Management Market Size and Research

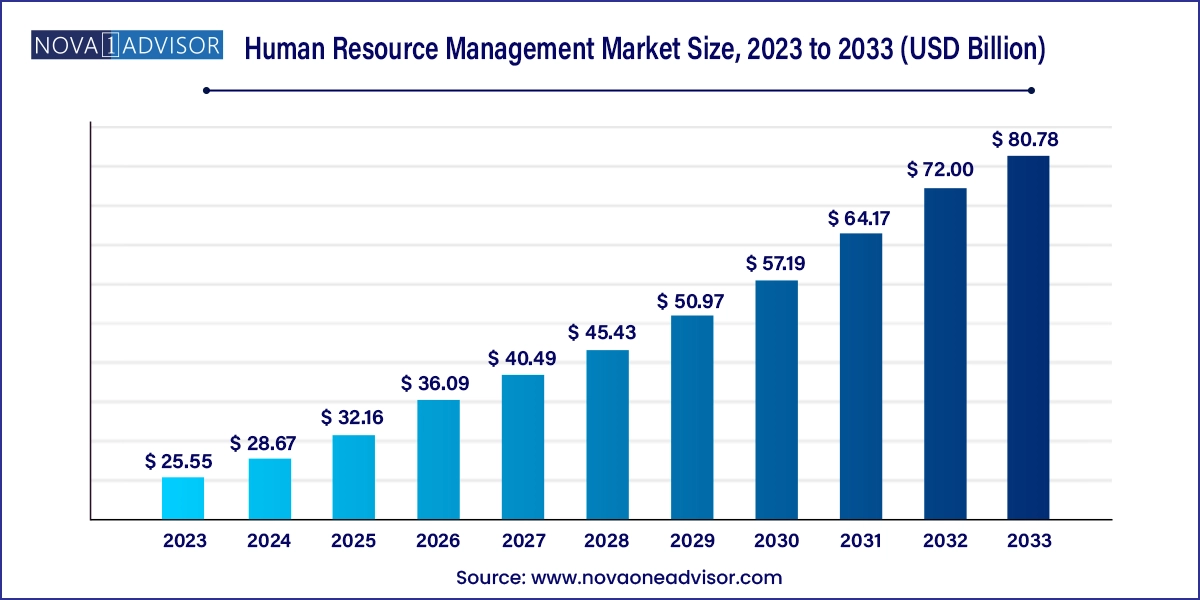

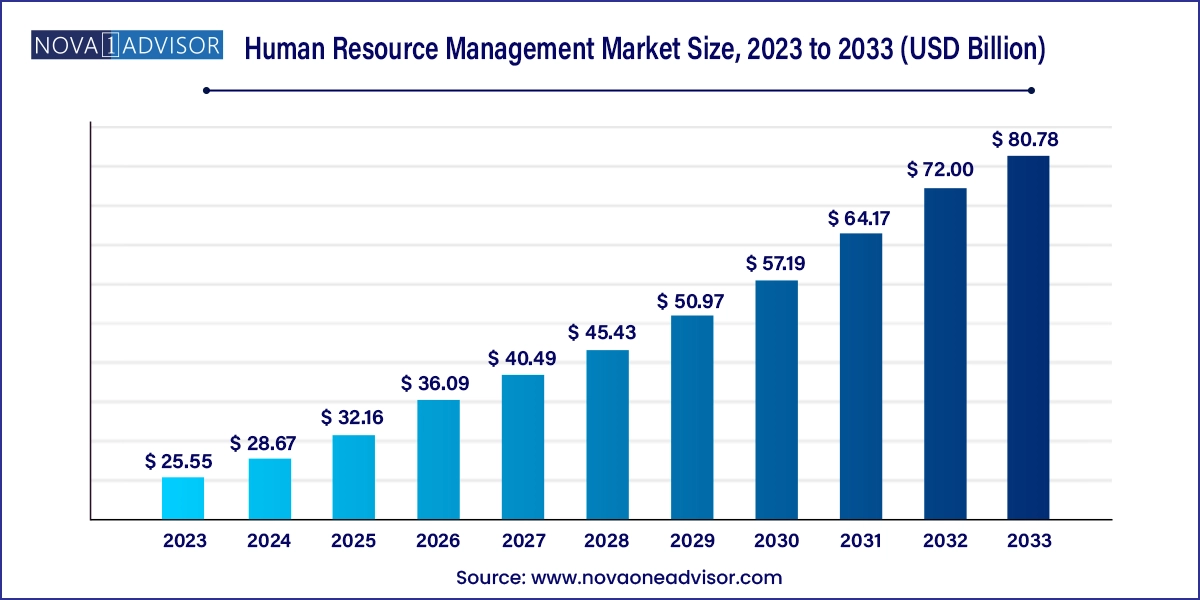

The global human resource management (HRM) market size was exhibited at USD 25.55 billion in 2023 and is projected to hit around USD 80.78 billion by 2033, growing at a CAGR of 12.2% during the forecast period 2024 to 2033.

Human Resource Management Market Key Takeaways:

- The software segment accounted for a major revenue share in 2023.

- The core HR segment is anticipated to account for largest market share in 2023 with a revenue.

- The talent management segment is estimated to witness the fastest CAGR from 2024 to 2033.

- Based on service, integration and deployment segment accounted for notable revenue share in 2023.

- The support and maintenance segment is estimated to record the fastest CAGR from 2024 to 2033.

- Based on deployment, on-premise segment dominated the market in 2023.

- Large enterprise segment dominated the global human resource management market in 2023.

- IT & telecom category, based on end-use segment, achieved the highest revenue share in 2023.

- North America dominated the market in 2023 with a revenue share of over 34.0%.

- Asia Pacific is anticipated to witness the fastest CAGR from 2024 to 2033.

Market Overview

The global Human Resource Management (HRM) market is experiencing robust growth, driven by an era of digital transformation, evolving workforce dynamics, and heightened demand for strategic workforce planning. HRM refers to a comprehensive suite of processes and tools used to manage an organization’s workforce, ranging from recruitment and onboarding to performance tracking, learning management, and employee engagement. As enterprises face growing complexity in managing global teams, the need for intelligent, centralized, and scalable HR solutions has never been more pronounced.

Cloud computing, artificial intelligence (AI), data analytics, and mobile applications have reshaped the traditional HR function into a proactive, data-driven enabler of business growth. Modern HRM systems not only automate routine administrative tasks but also offer predictive insights, engagement tools, and tailored employee development programs. Organizations, particularly in competitive industries such as IT & telecom, healthcare, and BFSI, are leveraging HRM tools to foster agility, compliance, and workforce satisfaction.

According to internal industry data and company expansions, digital HRM platforms are gaining traction across both large enterprises and SMEs, driven by flexible deployment models and cost-effectiveness. The COVID-19 pandemic further accelerated the transition to cloud-based HRM systems, with remote work, digital onboarding, and virtual learning becoming standard practices. With increasing emphasis on employee experience and strategic talent management, the HRM market is set to witness continuous innovation and substantial investments.

Major Trends in the Market

-

Shift to Cloud-Based HRM: Enterprises are increasingly adopting hosted HRM platforms for greater flexibility, scalability, and cost efficiency.

-

AI and Automation Integration: AI-driven chatbots, resume screening tools, and predictive analytics are transforming recruitment, engagement, and performance management.

-

Focus on Employee Experience (EX): HR departments are leveraging engagement platforms to enhance morale, retention, and well-being.

-

Data-Driven HR Practices: Analytics dashboards and workforce planning tools offer insights into turnover, skill gaps, and workforce productivity.

-

Learning & Upskilling Platforms: Continuous learning and career development systems are being implemented to boost retention and competitiveness.

-

Remote & Hybrid Workforce Support: Mobile-enabled HRM solutions support remote onboarding, collaboration, and compliance.

-

Diversity, Equity, and Inclusion (DEI): HRM systems are incorporating modules to track DEI metrics and drive inclusive hiring.

-

Integration with Third-Party Tools: Seamless integration with payroll, ERP, and communication tools is becoming a standard requirement.

Report Scope of Human Resource Management Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 28.67 Billion |

| Market Size by 2033 |

USD 80.78 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Component, Software, Service, Deployment, Enterprise Size, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Accenture; ADP, Inc.; Cezanne HR; Ceridian HCM Holding, Inc.; IBM; Mercer LLC; Oracle; PwC; SAP SE; Cegid; UKG Inc.; Workday, Inc. |

Market Driver: Rising Need for Strategic Workforce Management

One of the key drivers of the global HRM market is the increasing importance of strategic workforce management. Organizations today are navigating an environment marked by skill shortages, employee turnover, and shifting employee expectations. As a result, HR departments are no longer limited to administrative functions but are expected to align closely with business strategy.

Strategic workforce management involves forecasting talent needs, identifying skill gaps, optimizing labor costs, and supporting succession planning. Modern HRM tools enable real-time workforce analytics, personalized training paths, and performance tracking aligned with key business outcomes. For instance, an IT company can use talent analytics to identify future leaders, assess project readiness, and minimize bench time. This holistic view of workforce dynamics drives better business decisions and fuels market demand.

Market Restraint: Data Privacy and Compliance Challenges

Despite its growth, the HRM market faces a significant restraint in the form of data privacy and regulatory compliance. HRM systems store vast amounts of sensitive personal data, including salaries, performance reviews, and health-related information. With global operations, organizations must comply with a complex web of data protection regulations such as GDPR in Europe, HIPAA in the U.S., and local labor laws.

Data breaches, non-compliance penalties, and reputational risks make HR data security a top concern. Moreover, hosted HRM platforms often involve third-party vendors, increasing exposure to potential vulnerabilities. Ensuring role-based access, encrypted storage, and transparent data policies is essential but challenging, particularly for SMEs with limited IT resources. Thus, privacy concerns can delay HRM adoption or lead to restricted usage.

Market Opportunity: Rise of AI-Powered HR Tech for SMEs

A major opportunity in the HRM market lies in the emergence of AI-powered, cost-effective HR solutions tailored for SMEs. Traditionally, smaller enterprises lacked access to advanced HRM systems due to budget constraints and complexity. However, the SaaS model has democratized access to scalable, intelligent HR tools, enabling SMEs to compete on par with large enterprises in talent management.

AI-powered solutions offer SMEs functionalities like resume parsing, candidate ranking, automated onboarding, real-time engagement tracking, and workforce analytics. Vendors are now offering modular solutions where SMEs can pick and choose functionalities as per their needs. For example, a startup can begin with a recruitment and payroll module and scale up to performance management as the team grows. The growing gig economy and freelance workforce also make agile HR solutions imperative for small businesses

Human Resource Management Market By Component Insights

The software segment dominates the HRM market by contributing the largest share of the revenue. This includes platforms for core HR operations such as recruitment, onboarding, payroll, and employee engagement. These tools are often delivered via SaaS models, making them accessible to companies of all sizes. Advanced HR software allows for centralized dashboards, automated workflows, real-time tracking, and mobile access, significantly improving HR productivity. Platforms such as SAP SuccessFactors and Workday are used by large enterprises, while tools like Zoho People and BambooHR cater to SMEs.

Conversely, the services segment is the fastest-growing, owing to the growing complexity of HRM tool integration and usage. Organizations are increasingly seeking professional services such as integration, deployment, training, and support to fully leverage the software's capabilities. For instance, integrating HR tools with ERP systems or configuring DEI dashboards often requires specialist input. Additionally, as remote work expands, training services to onboard HR staff on digital tools have seen increased demand. The ongoing shift toward data-driven HR strategies is making consulting services more indispensable.

Human Resource Management Market By Software Insights

Core HR software holds the leading market share, encompassing essential functions like personnel tracking, payroll, attendance, and benefits administration. These are foundational tools for every organization, regardless of industry or size. Core HR platforms are often the entry point for companies digitizing their HR functions. The demand for standardized, automated core processes is universal and largely recession-proof. Vendors provide compliance features and integration capabilities that make these systems indispensable for daily operations.

Learning management software (LMS) is witnessing the fastest growth as companies invest in continuous upskilling and reskilling to remain competitive. LMS platforms allow HR departments to deliver, track, and assess training programs. With hybrid and remote work, virtual learning solutions have surged in adoption. For example, platforms like Docebo and Cornerstone OnDemand allow businesses to create personalized learning paths and gamified experiences. The rise of digital certifications, micro-learning, and compliance training further fuels this segment.

Human Resource Management Market By Service Insights

Integration & deployment services dominate the HRM service market. As enterprises adopt comprehensive HR platforms, seamless integration with payroll, ERP, and CRM systems becomes crucial. Vendors often bundle deployment services with platform subscriptions to ensure rapid, hassle-free implementation. Large-scale enterprises with legacy systems rely heavily on these services to ensure continuity and performance.

Meanwhile, training & consulting is the fastest-growing segment, as organizations need strategic guidance on using HR data, implementing DEI frameworks, and adopting change management. With HR roles expanding into business intelligence and analytics, consulting services help HR teams interpret data, plan recruitment strategies, and implement AI tools. Small firms also benefit from training sessions on new HR regulations and digital compliance practices.

Human Resource Management Market By Deployment Insights

The hosted (cloud-based) model dominates the HRM deployment landscape, fueled by the SaaS revolution. Organizations favor cloud-based systems for their scalability, automatic updates, lower upfront costs, and remote accessibility. Hosted platforms reduce IT overhead and support real-time collaboration. Platforms like Gusto and Zenefits have gained popularity by offering robust cloud-based HRM solutions that are user-friendly and cost-effective.

Simultaneously, the hosted model is also the fastest-growing, especially post-pandemic. Organizations prefer agile and secure HR systems that can support mobile workforces and geographically dispersed teams. Cloud solutions enable quick rollouts, real-time analytics, and integration with productivity apps. Vendors have increased investment in cybersecurity and compliance to support broader cloud adoption.

Human Resource Management Market By Enterprise Size Insights

Large enterprises dominate the HRM market, owing to their expansive workforce and complex HR needs. They often require highly customized HR solutions with modules for global compliance, multilingual support, and scalable performance tracking. These organizations invest heavily in advanced HRM tools integrated with business intelligence and predictive analytics for strategic HR planning.

Small and Medium Enterprises (SMEs) represent the fastest-growing segment, driven by the accessibility of cloud-based, modular HRM tools. The rise of HR tech startups offering affordable subscriptions has enabled SMEs to digitize their HR functions. With increasing labor regulations and employee expectations, SMEs are prioritizing tools for engagement, performance tracking, and virtual onboarding.

Human Resource Management Market By End-use Insights

IT & telecom sector leads the HRM market due to its dynamic workforce, high attrition rates, and intense competition for skilled talent. These companies rely on advanced HRM platforms for recruitment, remote collaboration, training, and performance management. The demand for agile and scalable HR solutions is pronounced in this sector, especially with a global and often remote workforce.

The healthcare sector is growing fastest, propelled by workforce shortages, regulatory compliance, and the need for ongoing training. Healthcare providers are adopting HRM systems to manage diverse roles, credentials, and scheduling. The pandemic underscored the importance of real-time HR tools for managing frontline staff and rolling out mandatory training.

Human Resource Management Market By Regional Insights

North America is the largest market for HRM solutions, owing to early adoption of digital technologies, strong cloud infrastructure, and the presence of leading vendors such as Oracle, Workday, and ADP. U.S.-based enterprises emphasize employee experience, diversity, and talent analytics, contributing to high HRM software penetration. The region is also characterized by a robust regulatory environment that mandates digital HR compliance, especially in sectors like BFSI and healthcare.

The high concentration of Fortune 500 companies, advanced IT ecosystems, and a trend toward hybrid work arrangements ensure sustained demand for innovative HR solutions. The region also leads in integrating AI, machine learning, and behavioral analytics into HR systems.

Asia Pacific is the fastest-growing HRM market, driven by rapid digitization, rising employment levels, and the expansion of multinational companies across India, China, and Southeast Asia. Government initiatives encouraging digital transformation and startup growth have created a fertile ground for HRM adoption. For example, India’s push toward labor law compliance and digital skilling programs has led to increased investment in HR platforms.

Local vendors and global players are offering cost-effective, localized solutions to cater to language, currency, and compliance variations. As Asian companies compete for global talent, there is increased interest in employee engagement, performance tracking, and learning platforms. The region's dynamic labor market makes workforce analytics a critical component of HR strategy.

Human Resource Management Market Recent Developments

-

April 2025: Workday announced the launch of "Workday Skills Cloud for SMEs," a scaled-down version of its AI-driven talent intelligence platform, targeting small businesses.

-

February 2025: SAP acquired the HR startup "PeopleMatter" to enhance its employee engagement and performance management modules.

-

January 2025: Oracle introduced new generative AI features into its HCM Cloud platform, including automated job description drafting and intelligent candidate matching.

-

November 2024: ADP expanded its GlobalView HCM to cover payroll and HR management in five additional Asia Pacific countries.

-

October 2024: BambooHR launched a new suite of remote onboarding tools, responding to increased demand for digital-first HR processes.

Some of the prominent players in the global human resource management (HRM) market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global human resource management (HRM) market

Component

Software

- Core HR

- Employee Collaboration & Engagement

- Recruitment and Applicant Tracking

- Talent Management

- Learning Management

- Workforce Planning & Analytics

- Others

Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

Deployment

Enterprise Size

- Large Enterprise

- Small & Medium Enterprise (SME)

End-use

- Education

- Banking, Financial Services, and Insurance (BFSI)

- Government

- Healthcare

- IT & telecom

- Manufacturing

- Retail

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)