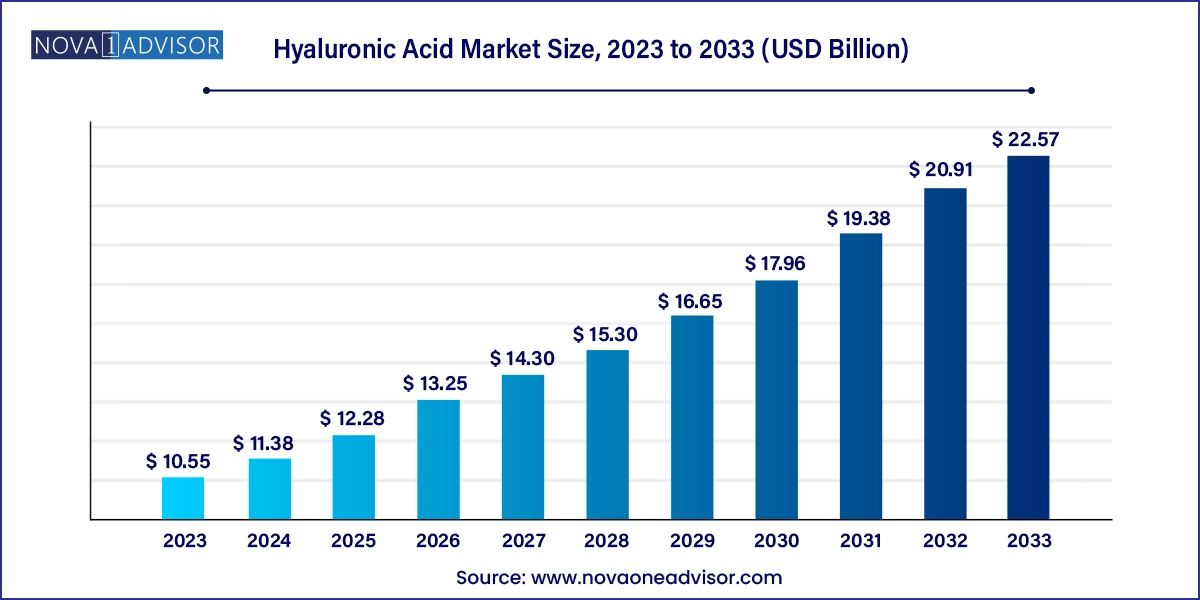

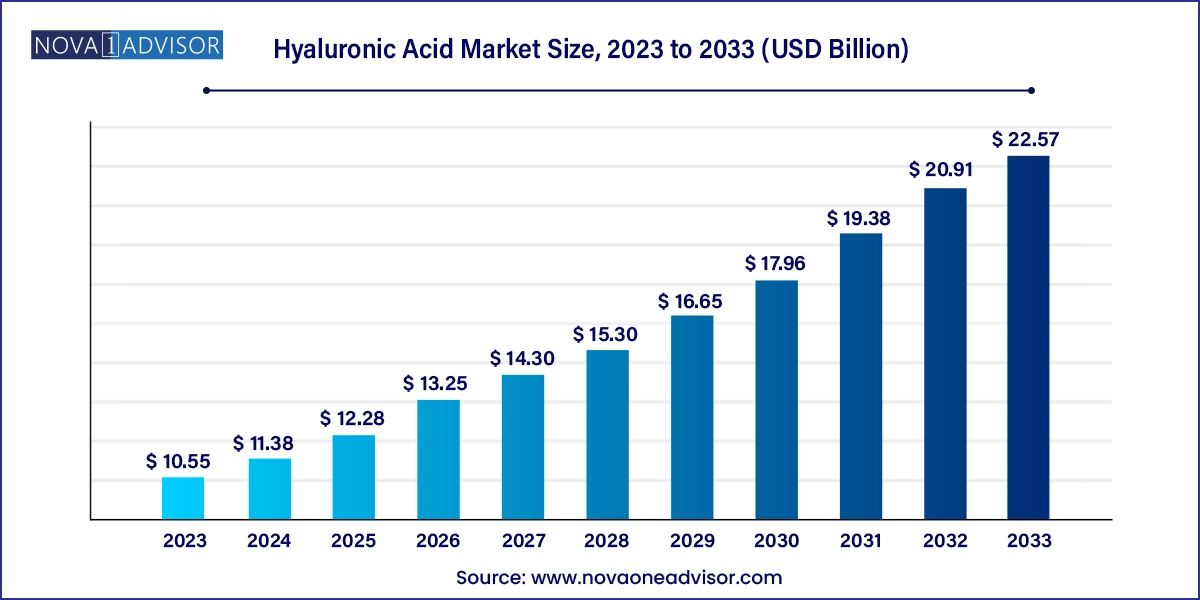

Hyaluronic Acid Market Size and Growth

The global hyaluronic acid market size was exhibited at USD 10.55 billion in 2023 and is projected to hit around USD 22.57 billion by 2033, growing at a CAGR of 7.9% during the forecast period 2024 to 2033.

Hyaluronic Acid Market Key Takeaways:

- Dermal fillers segment led the market and accounted for the largest revenue share of 39.9% in 2023

- Osteoarthritis is anticipated to witness the significant market growth over the forecast period.

- North America dominated the market and accounted for 43.4% share in 2023.

- The U.S. is accounted for the largest share in terms of revenue in North America in 2023.

Market Overview

The global hyaluronic acid (HA) market has evolved into a dynamic and multidisciplinary sector, encompassing applications across aesthetic medicine, orthopedics, ophthalmology, and urology. Hyaluronic acid is a naturally occurring glycosaminoglycan found in connective tissues, skin, and eyes, known for its moisture-retaining and viscoelastic properties. With its unique ability to bind water molecules, HA serves as a crucial component in maintaining skin hydration, cushioning joints, and facilitating ocular integrity.

Over the past decade, HA has gained substantial traction in both clinical and commercial settings. In the cosmetic dermatology space, HA-based dermal fillers have become synonymous with non-surgical facial rejuvenation, offering minimally invasive solutions for wrinkle reduction, volume enhancement, and lip augmentation. Meanwhile, in orthopedics, HA is administered via intra-articular injections for managing osteoarthritis, providing pain relief and improving joint mobility. Ophthalmic uses, particularly in cataract surgery and dry eye treatment, have further diversified the product’s application scope.

Market expansion is fueled by a combination of aging populations, technological advancements in HA formulations, and growing consumer preference for non-invasive therapies. Additionally, the rising prevalence of musculoskeletal disorders, driven by sedentary lifestyles and increasing obesity rates, has boosted demand in the orthopedic segment. The market also benefits from a thriving beauty and wellness industry, where HA is prominently featured in skincare products and injectable cosmetics.

As awareness spreads and regulatory pathways ease in emerging markets, the global hyaluronic acid industry is witnessing robust growth. The market is characterized by ongoing research in novel delivery mechanisms, such as cross-linked and nano-formulated HA, which are pushing the boundaries of efficacy and application. However, challenges related to high treatment costs, product standardization, and limited reimbursement frameworks in some regions continue to affect accessibility and adoption.

Major Trends in the Market

-

Shift Toward Minimally Invasive Aesthetic Procedures: Demand for HA-based dermal fillers continues to surge as consumers seek non-surgical facial rejuvenation options.

-

Rising Geriatric Population: Increasing life expectancy and age-related joint disorders are driving HA applications in osteoarthritis treatment.

-

Innovation in HA Cross-Linking Technologies: Enhanced formulations offering longer durability and better bioavailability are shaping product development.

-

Expansion of HA-Based Eye Drops and Surgical Aids: Ophthalmic uses of HA are growing due to rising cataract surgeries and dry eye cases globally.

-

Combination Therapies and Multi-Functional Injectables: Development of HA-based products with additional bioactive ingredients is broadening therapeutic scope.

-

Growth in Direct-to-Consumer Skincare Products: Over-the-counter HA-infused serums and creams are increasingly popular among beauty-conscious consumers.

-

Emerging Use in Urology: Vesicoureteral reflux (VUR) treatment using HA-based bulking agents is gaining clinical acceptance.

-

Increased Investments in R&D and Clinical Trials: Companies are exploring HA in wound healing, drug delivery systems, and regenerative medicine.

Report Scope of Hyaluronic Acid Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 11.38 Billion |

| Market Size by 2033 |

USD 22.57 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

| Key Companies Profiled |

Allergan, Sanofi, Genzyme Corporation, Anika Therapeutics, Inc., Salix Pharmaceuticals, Seikagaku Corporation, F. Hoffmann-La Roche Ag, Galderma Laboratories L.P., Zimmer Biomet, Smith & Nephew Plc, Ferring B.V., Lifecore Biomedical, Llc, HTL Biotechnology, Shiseido Company, Limited, Bloomage Biotechnology Corporation Limited, LG Life Sciences Ltd (LG Chem.), Maruha Nichiro, Inc. |

Key Market Driver: Increasing Demand for Aesthetic Enhancements

A significant market driver is the growing demand for non-invasive aesthetic enhancements, particularly in developed economies where cosmetic awareness and disposable income are high. HA-based dermal fillers have become one of the most popular cosmetic injectables worldwide due to their safety, biocompatibility, and natural-looking results. These fillers are used to treat age-related volume loss, facial wrinkles, and lip thinning, offering subtle yet effective rejuvenation without surgical downtime.

Millennials and Gen Z consumers are emerging as key demographic contributors to this trend. Influenced by social media, beauty influencers, and a rising culture of self-optimization, younger populations are opting for early intervention using HA fillers to maintain youthful appearances. Clinics and MedSpas are responding with customized treatment packages, and manufacturers are innovating with new formulations tailored to specific facial regions, skin types, and ethnic preferences. The aesthetic segment’s growth is further supported by improved injection techniques, widespread practitioner training, and regulatory support for new product launches.

Key Market Restraint: High Treatment Costs and Limited Insurance Coverage

Despite increasing demand, one of the major restraints in the hyaluronic acid market is the high cost of treatments, particularly in orthopedic and aesthetic applications, which often lack comprehensive reimbursement support. Intra-articular HA injections for osteoarthritis, for example, may require multiple sessions costing hundreds of dollars each, with uncertain insurance coverage depending on geographic region and medical policy.

Similarly, aesthetic treatments are largely categorized as elective and cosmetic, making them ineligible for public health insurance or subsidized programs. While affordability is less of an issue in premium markets like the U.S., Europe, and Japan, it significantly hampers uptake in cost-sensitive regions like Latin America and Africa. Additionally, price disparities across product types (e.g., monophasic vs. biphasic fillers, single vs. cross-linked HA) further complicate market dynamics. These cost barriers hinder broader access and are especially concerning in low- and middle-income countries.

Key Market Opportunity: Expansion in Emerging Economies

An important growth opportunity lies in the expansion of HA-based treatments in emerging economies, where improving healthcare infrastructure, rising income levels, and growing aesthetic consciousness are aligning to create new demand. Countries such as India, Brazil, Mexico, China, and Indonesia are witnessing increased investments in aesthetic clinics, orthopedic centers, and ophthalmology services.

Additionally, local governments and private players are actively working to democratize access to advanced treatments through subsidized public healthcare models, telemedicine consultations, and localized manufacturing. The increasing presence of international brands and local partnerships for distribution is enhancing product availability and affordability. Furthermore, the penetration of e-commerce and beauty influencers is shaping a new generation of skincare consumers in these regions, accelerating the growth of HA-based dermocosmetics and OTC formulations. As regulatory standards stabilize and awareness improves, emerging markets will contribute significantly to future HA market growth.

Hyaluronic Acid Market By Application Insights

Dermal fillers dominated the hyaluronic acid market owing to their widespread use in aesthetic medicine and personal care. These fillers have become the cornerstone of non-surgical cosmetic interventions for treating facial wrinkles, fine lines, and volume loss. Products such as Juvederm, Restylane, and Belotero are internationally recognized brands used in procedures performed by dermatologists, plastic surgeons, and aesthetic practitioners. Their growing acceptance is supported by increased consumer education, clinical safety data, and product availability across retail and MedSpa channels. Fillers tailored for specific areas like the cheeks, lips, and under-eyes further drive personalized treatment approaches and fuel demand.

Osteoarthritis treatment is the fastest-growing segment, particularly in aging populations across North America, Europe, and parts of Asia. HA injections provide a therapeutic alternative to NSAIDs and corticosteroids, offering longer-term relief with fewer side effects. Among the subtypes, three-injection therapies currently dominate due to a favorable balance of efficacy and cost, particularly in moderate cases. However, single-injection treatments are growing rapidly, favored for their convenience, quicker administration, and higher patient compliance. With continued R&D in cross-linked HA formulations and improvements in viscoelasticity, the osteoarthritis segment is poised for sustained growth in orthopedic care.

Hyaluronic Acid Market By Regional Insights

North America remains the dominant region in the global hyaluronic acid market, driven by high demand across dermal filler, osteoarthritis, and ophthalmic applications. The U.S. accounts for a substantial portion of global aesthetic procedure volumes, with thousands of certified professionals offering HA-based treatments. Regulatory bodies like the FDA have approved a wide range of HA products for both medical and cosmetic use, ensuring product safety and consumer trust. Additionally, strong reimbursement policies for osteoarthritis treatments, availability of advanced healthcare infrastructure, and the presence of leading manufacturers like AbbVie (Allergan), Zimmer Biomet, and Anika Therapeutics contribute to market leadership.

Asia Pacific is the fastest-growing region, led by countries such as China, South Korea, and Japan. In South Korea, HA dermal fillers are a standard part of aesthetic regimens, supported by a thriving cosmetic surgery culture. In China, HA-based skincare products and aesthetic injectables are experiencing explosive growth, fueled by rising disposable incomes, e-commerce penetration, and shifting beauty standards. Japan’s aging population is creating robust demand for osteoarthritis and ophthalmic applications. Government investments in healthcare modernization and increasing clinical adoption are further accelerating the region’s market expansion.

Hyaluronic Acid Market Recent Developments

-

Anika Therapeutics (March 2025) announced positive Phase III trial results for its single-injection HA therapy for knee osteoarthritis, positioning it as a leading contender in long-acting viscosupplementation.

-

Allergan Aesthetics (January 2025) expanded its Juvederm Volux range to more Asia-Pacific countries, targeting jawline and chin enhancement with higher viscosity HA fillers.

-

LG Chem (December 2024) launched a new cross-linked HA filler in South Korea, designed for deep wrinkle correction and facial contouring.

-

Seikagaku Corporation (November 2024) gained regulatory approval in Japan for a next-generation ophthalmic viscoelastic agent based on high molecular weight HA.

-

Bloomage Biotech (October 2024) opened a new manufacturing facility in China dedicated to producing pharmaceutical-grade HA for export to global markets.

Some of the prominent players in the global hyaluronic acid market include:

- Allergan

- Sanofi

- Genzyme Corporation

- Anika Therapeutics, Inc.

- Salix Pharmaceuticals

- Seikagaku Corporation

- F. Hoffmann-La Roche Ag

- Galderma Laboratories L.P.

- Zimmer Biomet

- Smith & Nephew Plc

- Ferring B.V.

- Lifecore Biomedical, Llc

- HTL Biotechnology

- Shiseido Company, Limited

- Bloomage Biotechnology Corporation Limited

- LG Life Sciences Ltd (LG Chem.)

- Maruha Nichiro, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global hyaluronic acid market

Application

- Dermal fillers

- Osteoarthritis

-

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa