Hydroponics Market Size and Trends

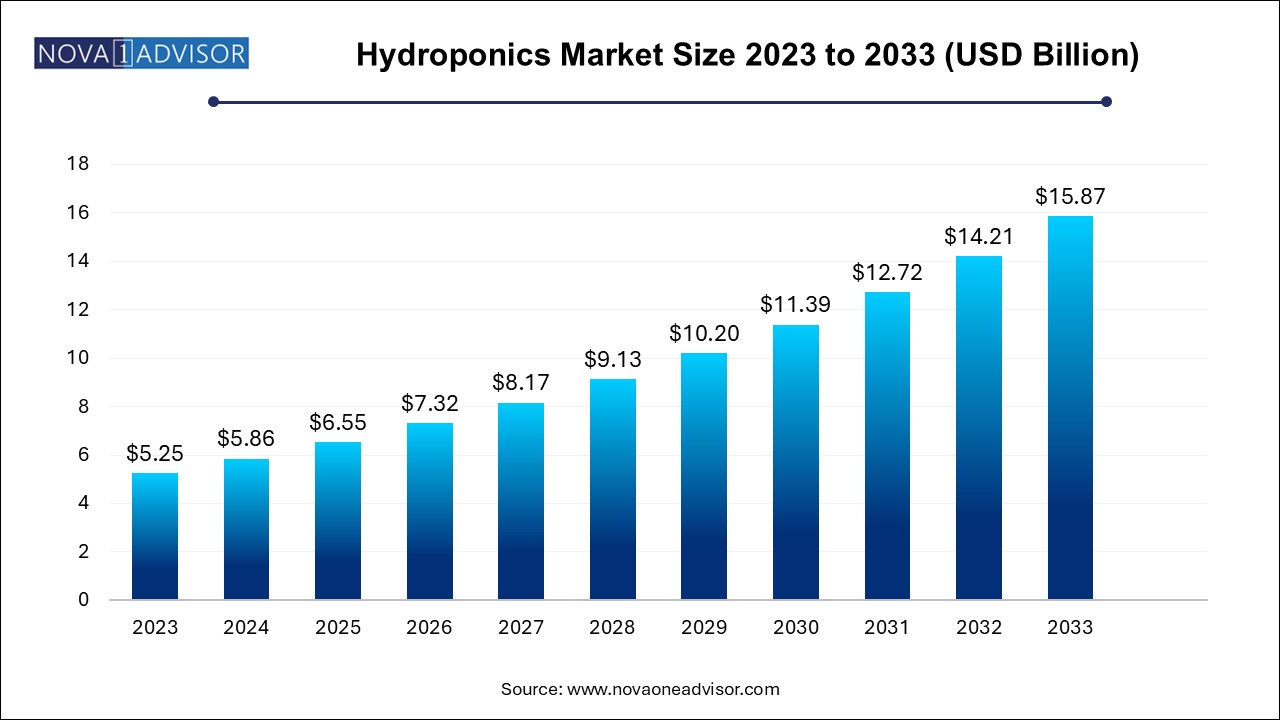

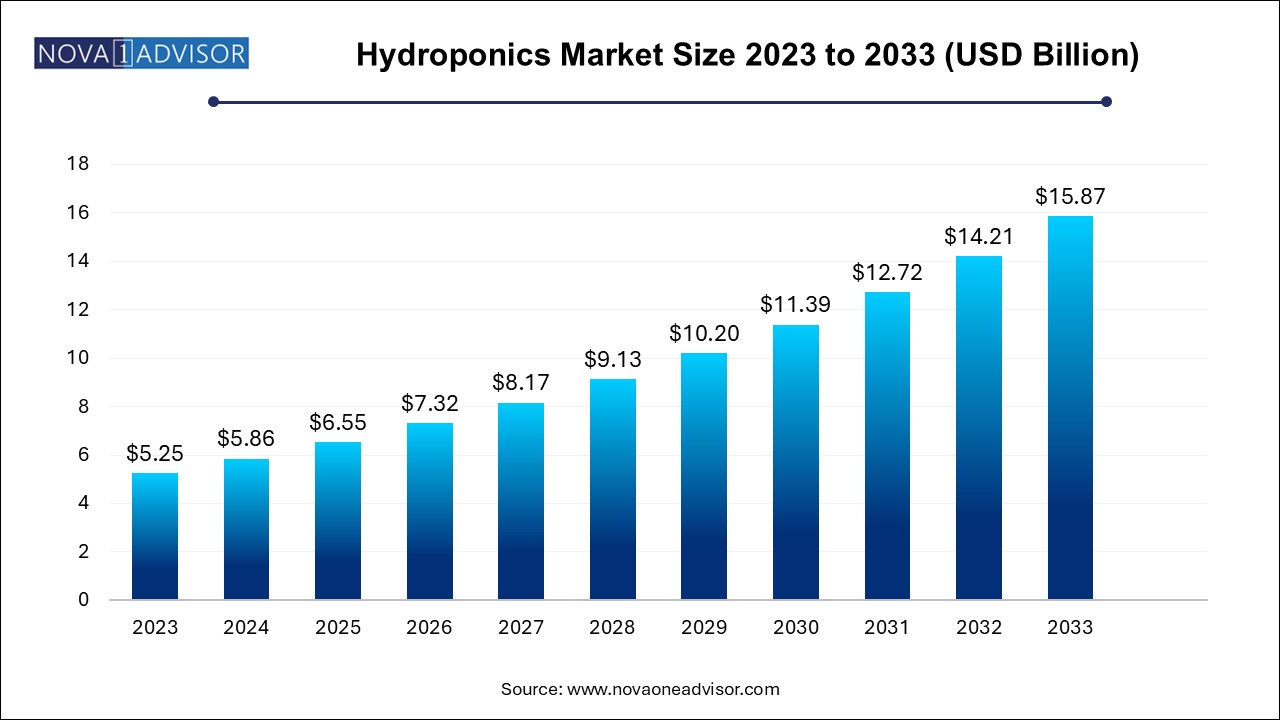

The global hydroponics market size was exhibited at USD 5.25 billion in 2023 and is projected to hit around USD 15.87 billion by 2033, growing at a CAGR of 11.7% during the forecast period 2024 to 2033.

Hydroponics Market Key Takeaways:

- The aggregate systems segment accounted for the largest revenue share of 52.5% in 2023.

- The liquid systems segment is anticipated to record the most rapid compound annual growth rate (CAGR) of 14.2% in the forecast period from 2024-2033.

- The tomatoes segment accounted for the largest revenue share of 44.2% in 2023.

- The lettuce segment is estimated to register the fastest CAGR of 15.4% over the forecast period from 2024-2033.

- Asia Pacific dominated the hydroponics market and accounted for the largest revenue share of 35.6% in 2023.

- Europe is expected to register the fastest CAGR of 13.6% over the forecast period from 2024-2033.

Report Scope of Hydroponics Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.86 Billion |

| Market Size by 2033 |

USD 15.87 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Crop Type, Crop Area, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, South America, MEA |

| Key Companies Profiled |

AeroFarms; AmHydro; Argus Control Systems Limited; Emirates Hydroponics Farms; Freight Farms, Inc.; BrightFarms.; Heliospectra; Signify Holding; Nutrifresh India; UrbanKisaan |

Hydroponics Market By Type Insights

Aggregate systems currently dominate the global hydroponics market due to their simplicity, lower setup cost, and ease of operation. These systems use inert media such as perlite, vermiculite, or coconut coir to anchor plants, with nutrients supplied via controlled irrigation. Among aggregate systems, drip systems are especially popular for their scalability and suitability for high-volume vegetable crops like tomatoes and peppers. Drip irrigation's ability to precisely control nutrient delivery and water flow makes it ideal for commercial greenhouse operations.

On the other hand, liquid systems such as deep water culture (DWC) and nutrient film technique (NFT) are the fastest-growing segment due to their efficiency and suitability for urban and vertical farming. DWC is increasingly used for leafy greens and herbs, particularly in controlled indoor environments. NFT, where a thin film of nutrient solution flows over plant roots, is gaining popularity for space-efficient setups. Liquid systems require less substrate and are often easier to automate, making them attractive for high-tech urban farms and home-based systems alike.

Hydroponics Market By Crop Type Insights

Lettuce dominates the hydroponic crop segment, primarily due to its short growing cycle, high market demand, and consistent yield under controlled conditions. As a staple in salads and ready-to-eat meals, lettuce enjoys year-round demand from retail chains, foodservice providers, and health-conscious consumers. Its compatibility with NFT and DWC systems makes it a preferred crop for both commercial and educational hydroponic projects. Large-scale hydroponic farms in the U.S., the Netherlands, and the UAE typically dedicate a majority of their space to multiple varieties of lettuce.

Herbs, including basil, mint, oregano, and chives, represent the fastest-growing crop segment in hydroponics. Their high value, compact growth, and demand in both culinary and nutraceutical industries make them ideal for vertical farming setups and urban gardens. Hydroponic herbs are often marketed as premium, pesticide-free products in upscale grocery chains and online platforms. Their shorter growth cycle also makes them profitable for small-scale operators and startup farms. As consumer preferences evolve toward fresh, organic, and locally grown seasoning options, herb cultivation is set to expand significantly.

Hydroponics Market By Crop Area Insights

The 1000–50000 sq.ft segment dominates the global hydroponics market, as it encompasses commercial greenhouses, institutional farms, and urban farm operations. Farms in this range benefit from economies of scale while maintaining operational manageability. These setups are commonly seen in peri-urban areas and are typically owned by agribusinesses or startup ventures targeting specific high-value crops for local distribution.

However, the above 50000 sq.ft category is growing fastest, driven by investments from agritech firms, multinational retailers, and food conglomerates. These large-scale hydroponic farms are often fully automated, integrated with vertical stacking systems, and serve regional or even national markets. For example, U.S.-based companies like AeroFarms and Plenty are operating multi-acre vertical hydroponic farms that supply major retail chains. Similar initiatives are emerging in the Middle East and Asia, supported by sovereign funds and climate resilience programs.

Hydroponics Market By Regional Insights

Europe dominates the global hydroponics market, driven by its strong commitment to sustainable agriculture, high urbanization, and government support for greenhouse farming. Countries like the Netherlands, Germany, and France have long-standing traditions of advanced horticulture, with the Netherlands being a global leader in hydroponics technology and greenhouse integration. The region is home to several pioneering companies offering state-of-the-art nutrient systems, climate control devices, and fully integrated hydroponic platforms.

The European Union's push toward reducing carbon footprints and chemical pesticide use, along with its Common Agricultural Policy (CAP), has incentivized farmers to adopt hydroponics. The growing popularity of locally produced organic vegetables, coupled with favorable consumer attitudes toward tech-driven food production, further boosts the market.

The Asia Pacific region is witnessing the fastest growth, fueled by rapid urbanization, food security concerns, and increasing acceptance of alternative farming techniques. Countries like India, China, Singapore, and Japan are investing heavily in hydroponic systems to ensure year-round fresh produce supply to their growing urban populations.

In Singapore, vertical hydroponic farms are being integrated into buildings and public spaces, while Japan has been a pioneer in plant factories and automation in controlled environment agriculture. In India, startups and educational institutions are promoting hydroponics as a tool for agricultural innovation and entrepreneurship. Government support programs, rising food safety concerns, and the availability of affordable technology are accelerating adoption across the region.

Hydroponics Market Recent Developments

-

March 2024 – Hydrofarm Holdings Group Inc. announced a strategic partnership with a European greenhouse solutions provider to expand commercial hydroponic offerings in North America. The collaboration aims to introduce integrated lighting and nutrient management systems for large-scale CEA operations. [Source: GlobeNewswire]

-

January 2024 – AeroFarms launched a new 150,000 sq. ft. indoor vertical farm in Virginia, USA, expected to be one of the world’s largest indoor hydroponic farms producing leafy greens.

-

November 2023 – AmHydro (American Hydroponics) released a new line of plug-and-play NFT systems aimed at small-scale commercial growers, with IoT-enabled nutrient management features.

Some of the prominent players in the global hydroponics market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global hydroponics market

Type

-

- EBB & Flow Systems

- Drip Systems

- Wick Systems

-

- Deep Water Culture

- Nutrient Film Technique (NFT)

- Aeroponics

Crop Type

- Tomatoes

- Lettuce

- Peppers

- Cucumbers

- Herbs

- Others

Crop Area

- Upto 1000 sq.ft.

- 1000-50000 sq.ft.

- Above 50000 sq.ft

Regional

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa (MEA)