Industrial Air Filtration Market Size and Research

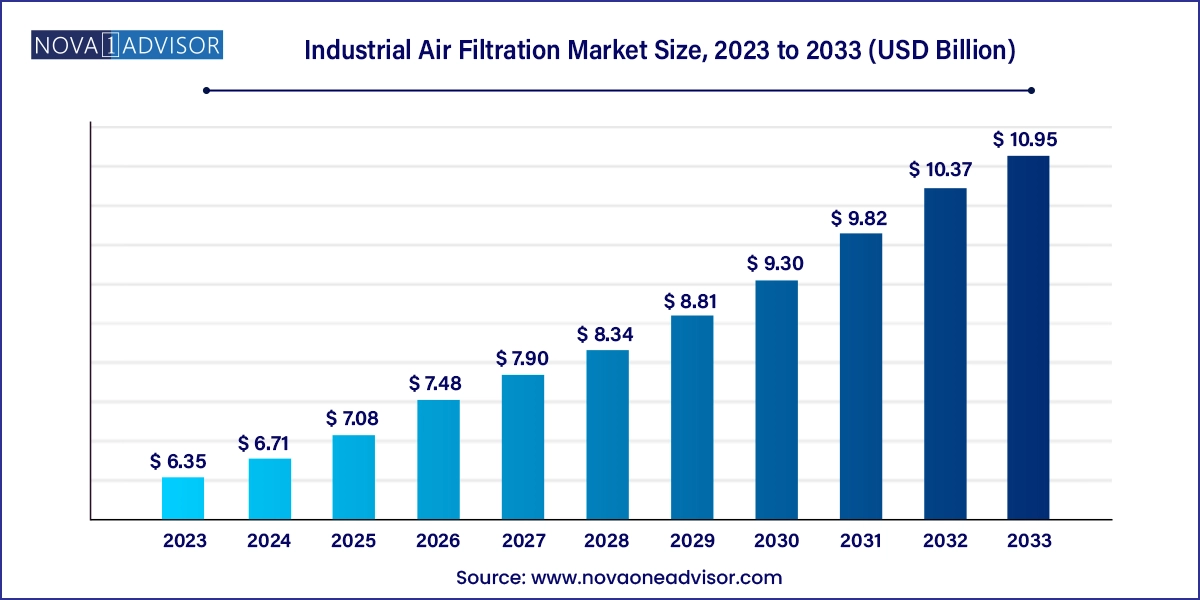

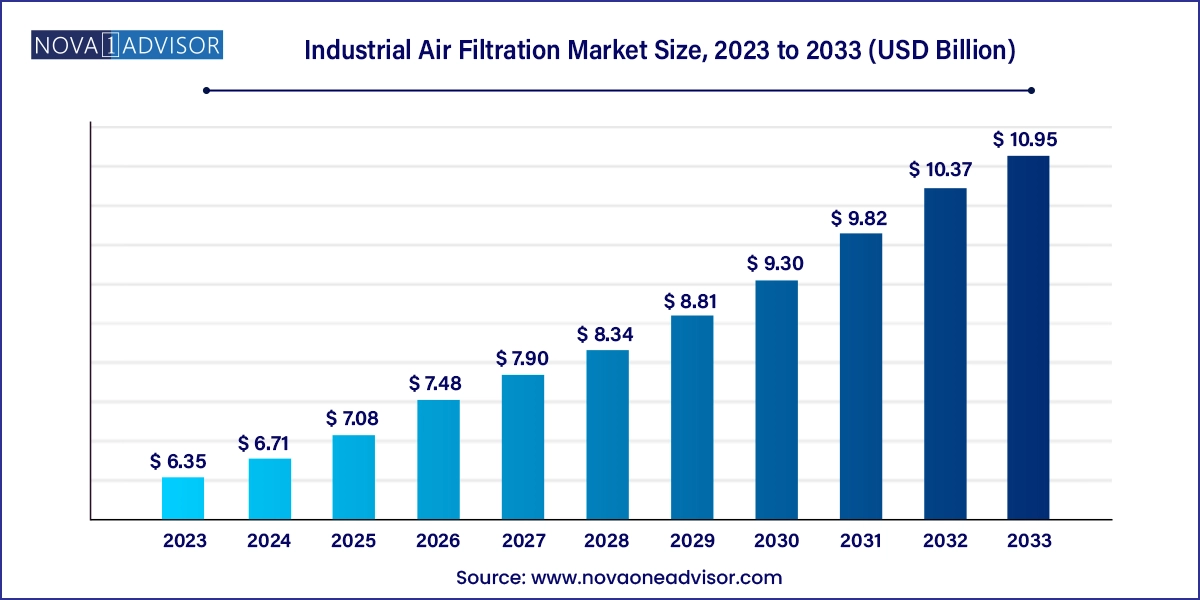

The global industrial air filtration market size was exhibited at USD 6.35 billion in 2023 and is projected to hit around USD 10.95 billion by 2033, growing at a CAGR of 5.6% during the forecast period 2024 to 2033.

Industrial Air Filtration Market Key Takeaways:

- Dust collection filters dominated the market and accounted for the largest revenue share of 42.0% in 2023.

- HEPA filters are expected to grow at a CAGR of 6.9% over the forecast period.

- The food & beverage segment led the market and accounted for the highest revenue share of 21.3% in 2023.

- The pharmaceutical segment is expected to grow at a CAGR of 7.0% over the forecast period

- The aftermarket segment accounted for the highest revenue share, 78.6%, of the overall market in 2023.

- Above 17 MERV rating led the market and accounted for the largest revenue share of 36.2% in 2023.

- 9 to 12 MERV rating is expected to grow at a CAGR of 6.6% over the forecast period.

- North America industrial air filtration market dominated the global market and accounted for the largest revenue share of 42.2% in 2023.

Market Overview

The industrial air filtration market has become a foundational pillar of modern manufacturing and processing industries, serving as both a health safeguard and an operational efficiency enabler. As industrialization expands and regulatory oversight strengthens globally, companies across sectors are prioritizing air quality management to ensure workplace safety, protect equipment, and comply with stringent emission norms.

Industrial air filtration systems are engineered to remove airborne contaminants such as dust, mist, fumes, and pathogens from production environments. These systems are deployed in a range of end-use sectors, including cement, metalworking, food and beverage, chemical processing, pharmaceuticals, agriculture, and wood products manufacturing. Whether it's preventing metal particulates from damaging sensitive machinery or ensuring clean air in pharmaceutical manufacturing, air filtration plays a critical role in risk mitigation.

Beyond health and compliance, clean air also enhances operational reliability, reduces maintenance costs, and extends the life of machinery. With rising awareness around occupational safety, increasing focus on ESG (Environmental, Social, and Governance) goals, and the growing adoption of smart factory solutions, the industrial air filtration market is poised for robust growth in the years ahead.

Leading players like Camfil, Donaldson, Parker Hannifin, and Nederman continue to innovate with advanced media technologies, energy-efficient systems, and modular filtration designs that cater to evolving industrial needs. As of 2025, the market is experiencing dynamic change through digitization, automation, and sustainability-oriented upgrades.

Major Trends in the Market

-

Growth of Energy-Efficient and Low-Pressure Drop Filters

Manufacturers are demanding filters that optimize airflow with minimal energy loss, reducing operational costs.

-

Integration of Smart Monitoring and IoT Sensors

Real-time filter monitoring for pressure drop, saturation levels, and airflow efficiency is transforming system maintenance and predictive servicing.

-

Increased Demand for HEPA and ULPA Filters in Critical Environments

Pharmaceutical and microelectronics sectors are driving demand for ultra-fine filtration to ensure sterility and purity.

-

Shift Toward Modular and Retrofittable Systems

Facilities are investing in scalable solutions that can be expanded or adapted without full system overhauls.

-

Emphasis on Circular Economy and Reusable Filter Media

Recyclable filters and sustainable designs are gaining popularity as part of corporate sustainability agendas.

-

Expansion of Air Filtration in Agriculture and Indoor Farming

Controlled air environments are increasingly vital in vertical farming and livestock production for disease control.

-

Tightening of Global Occupational Health Standards

New workplace safety laws in Asia and Latin America are driving demand for certified air filtration systems.

-

Emergence of Portable and Compact Dust Collectors

Mobile units are in demand for maintenance, temporary setups, or small-volume operations.

Report Scope of Industrial Air Filtration Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.71 Billion |

| Market Size by 2033 |

USD 10.95 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, End use, Distribution Channel, MERV rating, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

CMANN+HUMMEL; Donaldson Company Inc.; Honeywell International Inc.; Daikin Industries, Ltd.; Danaher; SPX FLOW, Inc.; Lydall, Inc.; American Air Filter Company, Inc.; Industrial Air Filtration, Inc.; PARKER HANNIFIN CORP; Camfil; K&N Engineering; Freudenberg SE; Testori Spa; Eaton |

Key Market Driver: Regulatory Push for Workplace Safety and Emissions Control

A leading force behind the rapid adoption of industrial air filtration systems is the tightening web of occupational safety and environmental regulations. Governments worldwide are imposing strict air quality mandates to protect workers and reduce industrial emissions into the atmosphere. In sectors like metalworking, pharmaceuticals, and chemical manufacturing, exposure to airborne pollutants such as silica dust, fumes, and volatile organic compounds (VOCs) can lead to serious health risks, prompting enforcement of exposure limits.

Organizations like OSHA (U.S.), HSE (UK), and EU-OSHA have mandated airborne particulate thresholds, driving companies to invest in certified air filtration solutions. Beyond legal penalties, non-compliance carries reputational damage and employee retention challenges. This regulatory environment has not only expanded the scope of air filtration adoption but also prompted continual upgrades and system redesigns in existing facilities.

For example, a metal fabrication plant operating under OSHA standards must now ensure respirable crystalline silica exposure remains below 50 micrograms per cubic meter, leading to investments in advanced dust collection systems with HEPA filtration and continuous air monitoring.

Key Market Restraint: High Initial Investment and System Customization Complexity

Despite the clear benefits of industrial air filtration, high upfront costs and system complexity remain significant barriers to widespread adoption, particularly among small to medium enterprises (SMEs). Advanced systems such as central dust collectors with smart controls or fume extraction units with HEPA-grade filters require substantial capital investment, installation planning, and integration with existing HVAC or processing systems.

Moreover, every industrial facility has unique airflow, particulate type, temperature, and humidity profiles. Designing a one-size-fits-all filtration solution is not feasible, and customizing systems to match precise application needs requires engineering expertise and longer lead times. For example, installing a filtration unit in a cement plant demands different material resistance and airflow configurations compared to a food processing facility.

This complexity often results in longer sales cycles, higher engineering costs, and slower ROI realization for buyers. While technological advances are reducing these barriers, affordability and deployment agility remain challenges.

Key Market Opportunity: Digitalization and Predictive Maintenance Integration

The adoption of digital technologies and predictive analytics represents a transformative opportunity for the industrial air filtration market. As manufacturers embrace Industry 4.0, air filtration systems are being integrated into broader factory automation ecosystems. Sensors embedded within filters and ducts now collect real-time data on airflow rates, particulate concentration, pressure drop, and media saturation.

By transmitting this data to cloud-based dashboards, facilities can monitor performance, schedule filter replacements proactively, and avoid unplanned downtime. This smart integration reduces manual inspections, enhances regulatory reporting, and improves long-term equipment efficiency.

Leading filtration providers are offering IoT-enabled filters with alerts and self-diagnostics. For instance, a plant manager can receive a notification when a dust collector's filter is approaching clogging threshold allowing preemptive action rather than reacting to system failure. This predictive model is especially valuable in high-volume industries like cement, mining, or power, where any disruption translates to significant operational losses.

Industrial Air Filtration Market By Product Insights

Dust collection filters dominated the product category, especially in industries like metal, cement, wood, and agriculture where particulate generation is intense and continuous. These systems remove dust and debris from manufacturing and processing airflows, improving plant cleanliness, worker safety, and machinery longevity. Among subtypes, baghouse filters are widely used for heavy dust load environments, offering large surface areas and effective particulate retention. Cartridge collectors, with their compact design and high efficiency, are preferred in space-constrained setups or where quick filter changes are required.

As dust emissions increasingly fall under regulatory scrutiny, companies are upgrading legacy systems to include modular dust collectors with improved airflow, filtration capacity, and ease of maintenance. The proliferation of HEPA-compatible filters in dust collectors is also expanding applications into cleaner production zones.

HEPA filters are the fastest-growing product segment, driven by their crucial role in high-purity environments such as pharmaceuticals, biotechnology, microelectronics, and even food packaging. These filters capture 99.97% of particles as small as 0.3 microns, making them essential where contamination control is paramount. With rising concern over airborne pathogens and cross-contamination risks post-pandemic, industries are integrating HEPA filters into production cleanrooms and employee zones. Their adoption is also expanding into precision industries like battery manufacturing and 3D printing facilities.

Industrial Air Filtration Market By End Use Insights

The cement industry dominated the end-use segment due to its inherently dust-intensive processes, including crushing, grinding, and material handling. Cement plants rely heavily on dust collectors, particularly baghouses and electrostatic precipitators, to maintain air quality and meet emissions regulations. The large scale and continuous operation of cement kilns demand robust, high-capacity filtration systems with minimal downtime. In developing countries with growing infrastructure demand, cement producers are ramping up production, driving demand for rugged and scalable filtration solutions.

In contrast, the pharmaceutical industry is the fastest-growing, owing to its stringent cleanliness standards and zero-tolerance for contamination. Drug manufacturing, tablet pressing, and packaging environments require multi-stage air filtration—often with HEPA and ULPA filters—to ensure sterile and particle-free environments. Regulatory compliance with GMP (Good Manufacturing Practice) and FDA standards further accelerates filtration upgrades. The rise in vaccine production, generic drug manufacturing, and bio-pharma R&D globally is pushing pharma facilities to invest in modular cleanroom-grade filtration systems.

Industrial Air Filtration Market By Distribution Channel Insights

OEM (Original Equipment Manufacturer) channel dominated the distribution segment as many new facilities opt to procure air filtration systems as part of integrated industrial equipment setups. OEM installations offer seamless integration, brand assurance, and lifecycle service contracts. Large firms often prefer working with OEMs to ensure system compatibility and compliance documentation from the beginning.

The aftermarket segment is expanding rapidly, fueled by rising replacement rates, system upgrades, and filter reordering. With regulatory audits becoming more frequent and digital tracking more advanced, manufacturers are replacing filters more proactively. Additionally, companies now demand aftermarket filters that are compatible with legacy systems, energy-efficient, and IoT-ready. Many aftermarket providers are bundling filter replacements with periodic system checkups, calibration, and performance audits—enhancing their value proposition.

Industrial Air Filtration Market By MERV Rating Insights

Filters in the 9 to 12 MERV range dominated the market, offering a balanced blend of efficiency, cost-effectiveness, and airflow compatibility. These filters are widely used in general industrial settings, capable of capturing fine dust, mold spores, and auto emission particulates. MERV 9–12 filters are common in sectors like automotive, agriculture, and paper processing, where filtration standards are important but not ultra-critical.

Filters with MERV 13 to 16 ratings are growing rapidly, especially in clean manufacturing, pharma, and public health-sensitive sectors. These filters can trap particles as small as 0.3–1.0 microns, including bacteria and some viruses. As governments set higher air purity benchmarks and organizations embrace wellness-centered facility design, high-MERV filters are becoming standard even in non-critical industries.

Industrial Air Filtration Market By Regional Insights

Europe dominated the global industrial air filtration market, underpinned by strong environmental regulations, industrial modernization, and emphasis on workplace safety. The European Union’s stringent policies, including the Industrial Emissions Directive and REACH regulation, mandate rigorous filtration in chemical, metal, and cement industries. Countries like Germany, Sweden, and the Netherlands also lead in implementing clean manufacturing protocols. Furthermore, Europe’s push for circular economy practices has encouraged adoption of recyclable filters and energy-efficient filtration units.

Asia Pacific is the fastest-growing region, driven by rapid industrialization, urbanization, and pollution control policies. China and India, in particular, have introduced tougher air quality norms and industrial workplace standards. Cement, steel, electronics, and chemical manufacturing booms across Southeast Asia further contribute to demand. Many local manufacturers are upgrading systems not only to meet local laws but also to qualify as suppliers to global clients with strict environmental compliance expectations. The region is also seeing high adoption of mobile and compact filtration units for distributed facilities and SMEs.

Industrial Air Filtration Market Recent Developments

-

April 2025 – Camfil launched its next-generation Gold Series X-Flo industrial dust collector, optimized for high-efficiency particulate removal with low energy consumption. The system integrates digital monitoring and smart airflow modulation.

-

March 2025 – Donaldson Company, Inc. expanded its PowerCore filter line to serve compact equipment applications, including modular dust collection in smaller urban facilities.

-

February 2025 – Parker Hannifin announced a cloud-based remote monitoring system for its industrial filtration systems, offering real-time alerts on filter performance and lifecycle analytics.

-

January 2025 – Nederman Group introduced a portable fume collection unit for metal fabrication workshops, equipped with smart LED indicators and customizable suction hoods.

Some of the prominent players in the global industrial air filtration market include:

- MANN+HUMMEL

- Donaldson Company Inc.

- Honeywell International Inc.

- Daikin Industries, Ltd.

- Danaher

- SPX FLOW, Inc.

- Lydall, Inc.

- American Air Filter Company, Inc.

- Industrial Air Filtration, Inc.

- PARKER HANNIFIN CORP

- Camfil

- K&N Engineering

- Freudenberg SE

- Testori Spa

- Eaton

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global industrial air filtration market

Product

-

- Cartridge Collectors & Filters

- Baghouse Filters

- Other Filters

- Mist Collection Filters

- Fume Collection Filters

- HEPA Filters

- Others

End Use

- Cement

- Food & Beverage

- Metal

- Power

- Pharmaceutical

- Chemical & Petrochemical

- Paper & Wood Processing

- Agriculture

- Others

Distribution Channel

MERV Rating

- 1 to 4 MERV

- 5 to 8 MERV

- 9 to 12 MERV

- 13 to 16 MERV

- Above 17 MERV

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)