Industrial Vending Machine Market Size and Research

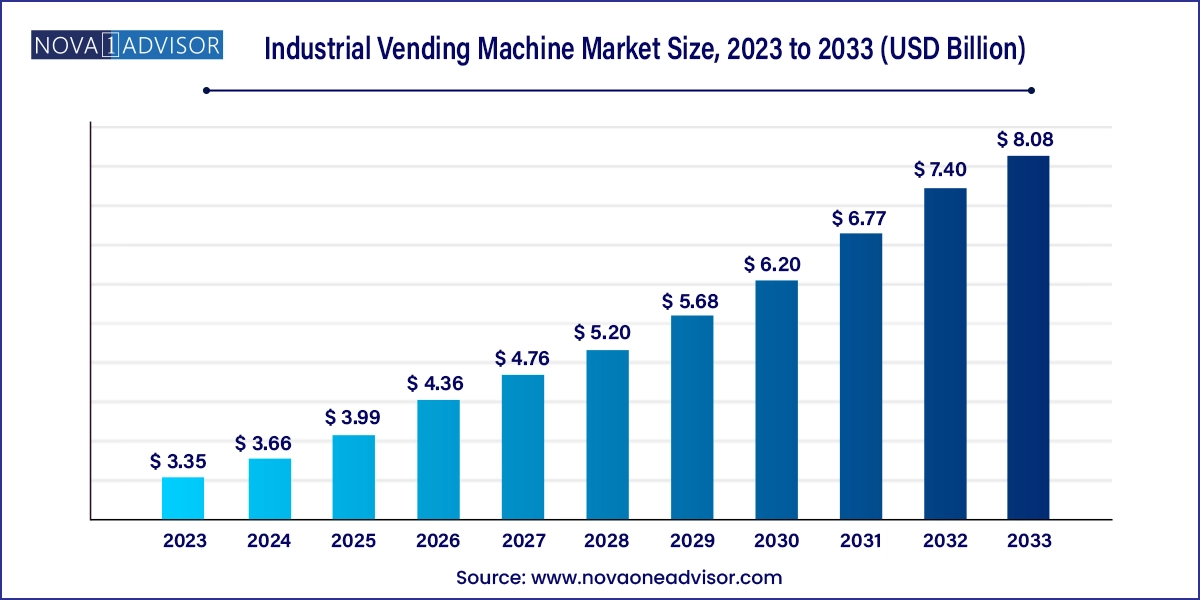

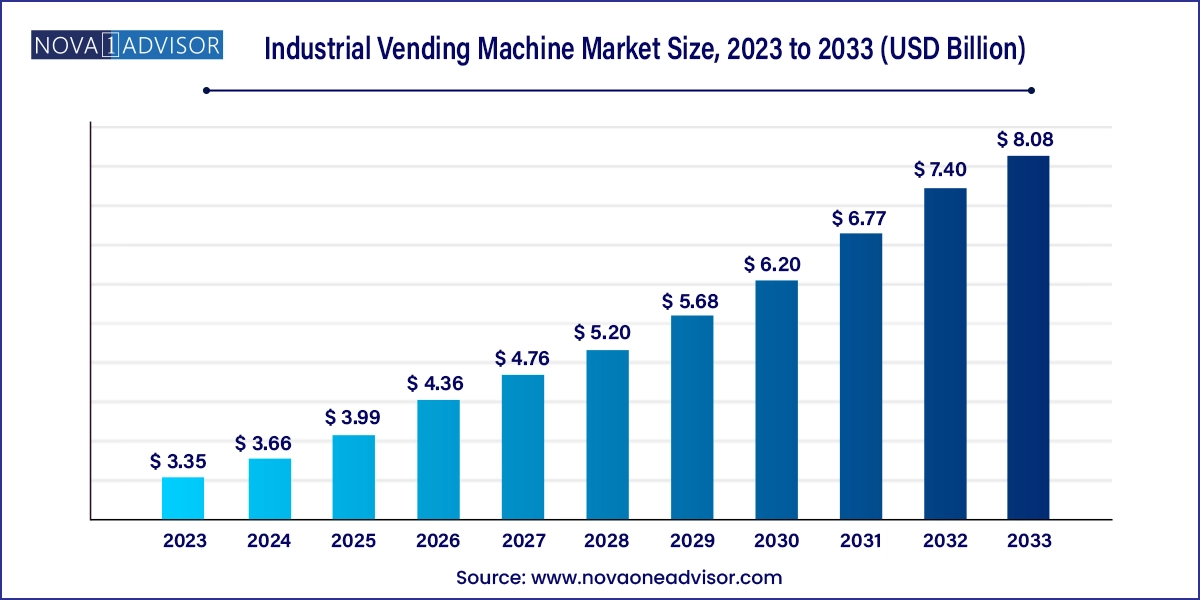

The global industrial vending machine market size was exhibited at USD 3.35 billion in 2023 and is projected to hit around USD 8.08 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2024 to 2033.

Industrial Vending Machine Market Key Takeaways:

- The coil vending machine held the largest market revenue share of 37.8% in 2023.

- The carousel vending machines segment is projected to grow at the fastest CAGR of 10.3% over the forecast period.

- The PPE segment held the largest market revenue share in 2023.

- The MRO tools segment is projected to grow at the fastest CAGR over the forecast period.

- The manufacturing segment held the largest market revenue share in 2023.

- The aerospace segment is projected to grow significantly over the forecast period.

- North America held the largest market revenue share of 34.9% in 2023.

Market Overview

The global industrial vending machine market has emerged as a transformative force within industrial supply chain management, offering a blend of automation, data intelligence, and cost control. These machines are used to dispense critical industrial supplies such as maintenance, repair, and operations (MRO) tools, personal protective equipment (PPE), and other consumables at the point of use. Unlike traditional vending machines intended for consumer goods, industrial vending machines are smart devices integrated with enterprise software systems, capable of inventory tracking, access control, and real-time reporting.

The market has witnessed significant traction over the past decade, driven by increasing demand from the manufacturing, oil & gas, construction, and aerospace sectors. Industrial facilities across the globe are investing in these machines to streamline inventory management, minimize stockouts, reduce waste, and enhance productivity. With operational efficiency being the top priority, especially in competitive industries, industrial vending solutions offer a highly efficient alternative to centralized tool cribs or manual inventory processes.

The COVID-19 pandemic further accelerated the shift toward automation in industrial operations. As companies faced labor shortages, health concerns, and pressure to maintain operational continuity, contactless dispensing of critical safety equipment and tools became not just a luxury, but a necessity. Today, the market is in a mature-to-growing phase in developed regions such as North America and Western Europe, while gaining rapid adoption in Asia Pacific and Latin America due to growing industrialization and digitization trends.

Advancements in connectivity such as Internet of Things (IoT), AI-based analytics, and RFID integration have elevated the capabilities of industrial vending machines. These devices are no longer just point-of-use distributors but are central to data-driven decision-making, predictive maintenance, and enterprise-wide cost optimization. With environmental, safety, and regulatory concerns growing, the ability to track the lifecycle of tools and PPE usage is further pushing adoption.

Major Trends in the Market

-

Integration of IoT and Cloud Technology: Vendors are increasingly incorporating IoT sensors and cloud-based dashboards to provide real-time visibility into usage patterns, restocking needs, and employee access.

-

Rising Demand for PPE Vending Machines: Post-pandemic emphasis on workplace safety is driving the demand for machines that dispense gloves, masks, eyewear, and other safety gear.

-

Adoption of AI and Predictive Analytics: Advanced vending solutions are leveraging AI to forecast consumption trends, optimize inventory levels, and flag anomalies in usage.

-

Shift Toward Multi-Use Machines: Modular vending machines capable of dispensing a variety of items—from consumables to high-value tools—are gaining popularity.

-

Customization and Industry-Specific Configurations: Vending solutions tailored for specific industries (e.g., aerospace or oil & gas) with unique user interfaces and stocking systems are on the rise.

-

Contactless and Touchless Access Mechanisms: Technologies such as RFID badges, facial recognition, and mobile apps are being used for secure, hygienic dispensing.

-

Sustainability and Waste Reduction: Companies are using vending machines to track consumables and reduce overuse or theft, contributing to environmental goals.

-

Increased Focus on Integration with ERP Systems: Seamless integration with SAP, Oracle, or Microsoft Dynamics is becoming a standard requirement for enterprise clients.

Report Scope of Industrial Vending Machine Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.66 Billion |

| Market Size by 2033 |

USD 8.08 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Product, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Apex Industrial Technologies, LLC; AutoCrib, Inc.; Brammer; IMC Group; SecuraStock; CribMaster; Fastenal Company; Airgas Inc.; IVM, Inc. |

Market Driver: Demand for Inventory Control and Cost Reduction

A primary driver of the industrial vending machine market is the growing need for efficient inventory control and cost optimization across industrial environments. Organizations, particularly in manufacturing and heavy industries, face substantial costs due to inventory shrinkage, misuse, or overconsumption of tools and consumables. Manual inventory systems are often inaccurate, time-consuming, and prone to human error. Industrial vending machines offer a scalable solution by automating the dispensing process, setting usage limits, and tracking item access on a per-user basis.

For example, a mid-sized automotive manufacturing plant in Germany implemented 30 cabinet vending machines across its facility, integrated with their internal ERP system. Within six months, the company reported a 40% reduction in tool loss and a 25% drop in overall consumable expenses. The visibility and accountability provided by these machines not only drive direct cost savings but also improve operational efficiency by minimizing time spent by workers locating tools.

Market Restraint: High Initial Investment and Integration Costs

Despite the long-term cost benefits, the high upfront investment required for purchasing and deploying industrial vending machines can act as a barrier, especially for small to mid-sized enterprises (SMEs). A single machine equipped with smart technologies, software integration, and modular compartments can cost several thousand dollars. When scaled across large facilities or multiple sites, the capital expenditure can become significant.

Moreover, integrating these systems with existing enterprise resource planning (ERP) or supply chain management (SCM) systems often requires IT support, customization, and employee training. For companies operating on tight budgets or lacking digital maturity, these challenges may delay adoption or limit deployment to pilot projects. Additionally, maintenance and periodic software upgrades may add to long-term costs, making the total cost of ownership a concern for budget-sensitive firms.

Market Opportunity: Expansion in Emerging Markets

Emerging markets present a lucrative opportunity for industrial vending machine providers. Countries in Asia Pacific, Latin America, and parts of Africa are undergoing rapid industrialization and infrastructure development. Governments are pushing for local manufacturing under initiatives such as India's "Make in India," Mexico's nearshoring boom, and Indonesia’s industrial corridors—all of which are driving demand for advanced manufacturing tools and better inventory control mechanisms.

With labor costs rising even in traditionally low-cost regions, automation in inventory management is becoming economically viable. For instance, several Indian automotive and electronics OEMs have begun deploying PPE and MRO vending solutions to manage factory-floor inventory more efficiently. Vendors offering low-cost, cloud-managed vending systems specifically designed for SMEs in these regions are well-positioned to capture first-mover advantages. Localization of manufacturing and expanding regional distribution networks will further enhance market penetration in these high-growth geographies.

Industrial Vending Machine Market By Type Insights

Coil vending machines dominate the global industrial vending machine market, primarily due to their versatility and cost-effectiveness. These machines use spiral coils to dispense a variety of items such as gloves, batteries, drill bits, and tapes. Their simple mechanical structure makes them relatively easier to maintain and ideal for low- to medium-value consumables. Coil machines are widely used in general manufacturing, electronics assembly, and warehouse environments. Their compatibility with most consumables makes them a go-to option for businesses looking to digitize inventory control with minimal capital expenditure.

Cabinet vending machines are the fastest-growing segment, fueled by rising demand in sectors that require secure storage and traceability of high-value tools. These machines feature multiple lockable compartments that can be customized to store everything from power tools to safety harnesses. Advanced cabinet models also support RFID-based access and item return tracking, which is critical in environments like aerospace and oil & gas, where equipment safety and regulatory compliance are paramount. As industries embrace more stringent traceability standards, cabinet vending machines are likely to see broader adoption.

Industrial Vending Machine Market By Product Insights

MRO tools are the most widely dispensed product through industrial vending machines, comprising the dominant segment. These tools, which include items like drill bits, fasteners, lubricants, and wrenches, are essential for ongoing operations and equipment maintenance. Given their frequent usage and relatively high replacement cost, companies often lose track of inventory or face shortages. Vending machines solve this issue by providing 24/7 access with real-time consumption tracking. Major manufacturing hubs in the U.S. and Germany report MRO vending as a key strategy in reducing operational delays.

PPE vending is the fastest-growing product segment, driven largely by heightened workplace safety awareness post-pandemic. Gloves, helmets, goggles, face masks, and coveralls are now frequently dispensed through vending units in construction, mining, and manufacturing facilities. Organizations value the ability to monitor who accessed what PPE and when—critical for compliance with occupational safety regulations. Industries like pharmaceuticals and chemicals, where hygiene and contamination control are vital, are also adopting PPE vending solutions at a faster rate.

Industrial Vending Machine Market By End-use Insights

The manufacturing sector dominates the industrial vending machine market, accounting for the highest share. The sector’s reliance on continuous operations, tool availability, and compliance with safety standards makes vending machines an essential tool for productivity and regulation. Manufacturers in automotive, electronics, and metal fabrication often operate around the clock, requiring reliable access to MRO tools and safety gear. Industrial vending helps reduce downtime caused by tool unavailability and improves workforce accountability, especially in multi-shift environments.

The aerospace sector is the fastest-growing end-use segment, propelled by the need for precision, traceability, and high-value inventory management. In aerospace manufacturing and maintenance, where tools must be certified and usage tracked for compliance, vending machines offer automated documentation and secure storage. Companies like Boeing and Airbus have incorporated vending solutions at their manufacturing sites to streamline tool control and reduce losses. The high stakes of aerospace operations make such traceable systems indispensable.

Industrial Vending Machine Market By Regional Insights

North America leads the global industrial vending machine market, owing to its mature industrial infrastructure, widespread digitization, and early adoption of automation technologies. The U.S. is home to several key manufacturers and solution providers such as Fastenal, AutoCrib, and SupplyPro. American manufacturing companies prioritize lean inventory practices and operational efficiency, making vending systems a natural fit. Furthermore, integration with existing ERP and warehouse systems is a common practice, further embedding these machines into everyday operations.

Asia Pacific is the fastest-growing region, driven by rapid industrial expansion in China, India, Indonesia, Vietnam, and Thailand. These countries are seeing a boom in construction, electronics, automotive, and energy sectors—all requiring improved inventory management and safety compliance. In China, the integration of AI and IoT in factory automation is facilitating faster adoption of smart vending systems. Indian firms, especially in tier-1 cities, are deploying vending solutions as part of their smart manufacturing strategy under Industry 4.0 initiatives. Regional players offering cost-effective, cloud-native machines tailored for emerging markets are gaining traction.

Industrial Vending Machine Market Recent Developments

-

April 2024 – Fastenal Company announced the launch of its next-gen industrial vending machine platform, “FAST360,” featuring AI-based inventory forecasting and advanced reporting capabilities. The system was showcased at the Hannover Messe trade fair in Germany.

-

February 2024 – AutoCrib Inc., a leading provider of inventory vending solutions, partnered with a major aerospace OEM in the U.S. to deploy RFID-based tool management systems across five production sites.

-

November 2023 – SupplyPro Inc. expanded its European presence by opening a new distribution hub in the Netherlands, aimed at serving growing demand in the EU industrial sector.

-

September 2023 – CribMaster (a Stanley Black & Decker brand) launched a touchscreen-enabled PPE vending unit designed specifically for pharmaceutical and cleanroom applications.

-

July 2023 – IVM Inc. (Innovative Vending Machines) secured a contract with a global construction giant in Australia to deploy 150 vending units at mining and infrastructure development sites.

Some of the prominent players in the global industrial vending machine market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global industrial vending machine market

Type

- Carousel Vending Machine

- Coil Vending Machine

- Cabinet Vending Machine

- Others

Product

End-use

- Manufacturing

- Oil & Gas

- Construction

- Aerospace

- Other

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)