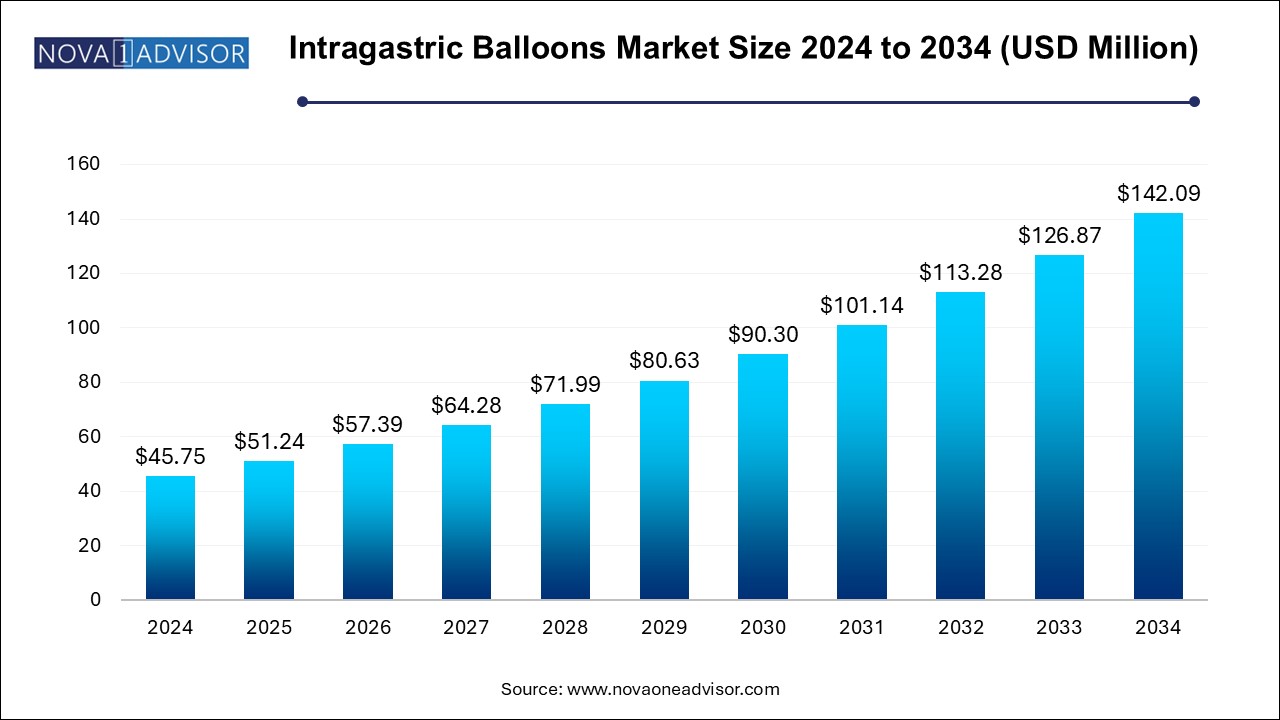

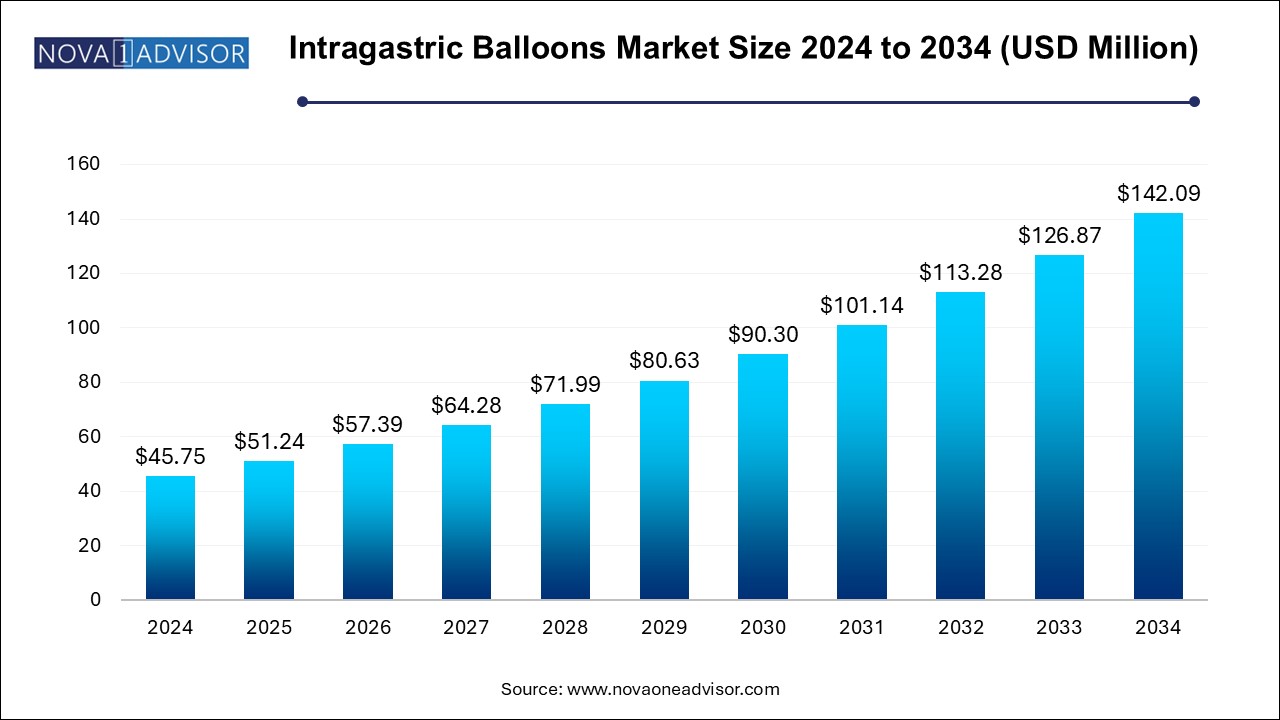

The global intragastric balloons market size was exhibited at USD 45.75 million in 2024 and is projected to hit around USD 142.09 million by 2034, growing at a CAGR of 12.0% during the forecast period of 2024 to 2034.

Intragastric Balloons Market Key Takeaways:

- North America dominated the market and accounted for the largest revenue share of 40.0% in 2024 in the intragastric balloons market.

- The endoscopy segment dominated the market for the intragastric balloon and held the largest revenue share of 69.8% in 2024.

- The saline-filled segment dominated the market for the intragastric balloon and held the largest revenue share of 71.1% in 2024

- The single segment dominated the market for the intragastric balloon and held the largest revenue share of 75.2% in 2024

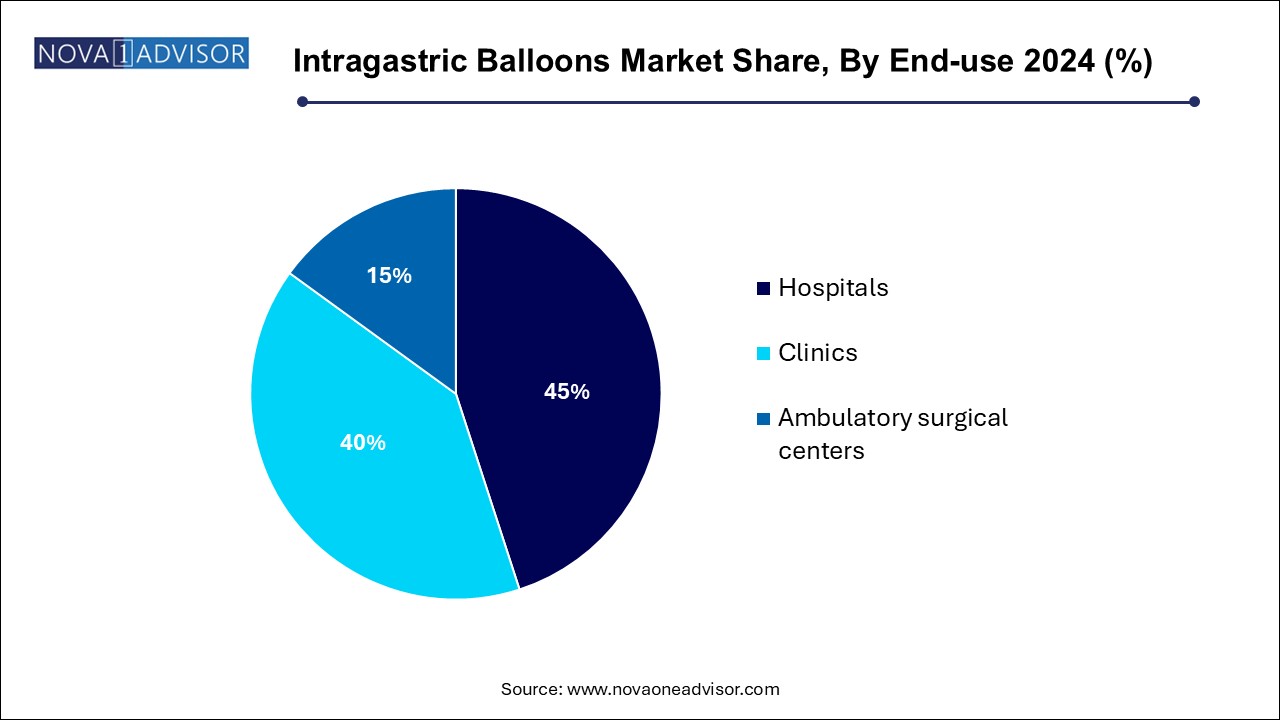

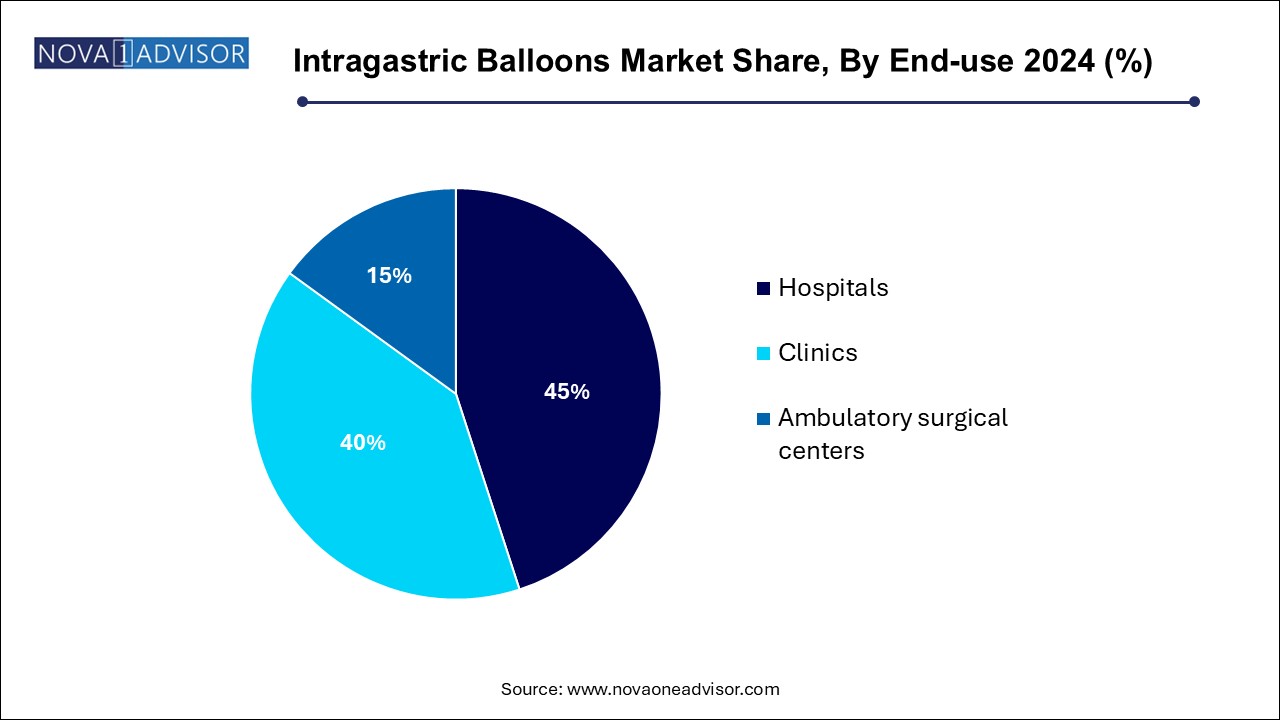

- The hospital segment dominated the market for the intragastric balloon and held the largest revenue share of 45.0% in 2024.

Market Overview

The intragastric balloons market has emerged as a promising frontier in the global obesity treatment landscape. As rates of obesity and overweight conditions continue to rise across all age groups, healthcare systems and patients are increasingly turning to non-invasive or minimally invasive alternatives to bariatric surgery. Intragastric balloons (IGBs), designed to occupy space within the stomach to promote early satiety and reduce food intake, are one such innovation offering both efficacy and safety without the extensive surgical risks associated with traditional weight-loss procedures.

These devices, typically saline- or gas-filled balloons, are placed in the stomach either endoscopically or via swallowable capsules (pill forms). They remain in place for several months, after which they are removed or expelled naturally, depending on the design. The weight loss outcomes are supported by supervised dietary and behavioral programs, making them an increasingly popular bridge therapy between lifestyle modification and more invasive interventions.

Technological advancements, such as the development of self-inflating and swallowable balloons, are further improving patient comfort and procedural convenience. As the global population becomes more health-conscious and demand for safe weight loss methods intensifies, intragastric balloons are positioned to play a central role in addressing the obesity epidemic. The market is expected to expand significantly, driven by innovations, regulatory approvals, and broader physician adoption.

Major Trends in the Market

-

Surge in Non-Invasive Weight Loss Alternatives: Patients are increasingly opting for intragastric balloons over bariatric surgery due to reduced downtime, cost, and risk.

-

Rising Use of Swallowable Balloons: Capsule-based administration is revolutionizing patient comfort and expanding access to outpatient settings.

-

Short-Term Weight Management Integration: IGBs are now part of short-term, medically supervised weight loss regimens, especially before surgery in obese patients.

-

Technological Improvements in Balloon Design: Enhanced materials, programmable deflation, and combined saline-gas systems are improving safety and results.

-

Growing Demand in Emerging Markets: Increasing obesity rates in Asia-Pacific and Latin America are boosting the demand for cost-effective weight management tools.

-

Expansion of Aesthetic and Wellness Clinics: These clinics are emerging as important channels for intragastric balloon procedures, especially in urban markets.

-

Increased Regulatory Approvals: Companies are securing FDA, CE, and other regional approvals, enabling greater product availability and market confidence.

Intragastric Balloons Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 51.24 Million |

| Market Size by 2033 |

USD 142.09 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 12.0% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Administration, Balloon Type, Filling Material, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Apollo Endosurgery, Inc.; Obalon Therapeutics, Inc.; Allurion Technologies, Inc.; Spatz3; Helioscopie; Endalis; MEDSIL; ReShape Medical, Inc.; Lexel Medical. |

Key Market Driver: Growing Global Prevalence of Obesity

A major force propelling the intragastric balloons market is the alarming rise in obesity rates worldwide. According to the World Health Organization, over 1.9 billion adults were overweight in 2022, with more than 650 million classified as obese. Obesity is associated with numerous comorbidities, including type 2 diabetes, hypertension, sleep apnea, and cardiovascular diseases. This rising health burden has created immense pressure on healthcare systems to provide scalable and cost-effective treatment solutions.

Intragastric balloons address this need by offering a less invasive option compared to bariatric surgeries like gastric bypass or sleeve gastrectomy. These balloons can be placed as outpatient procedures with minimal recovery time, making them ideal for patients seeking a jumpstart to long-term lifestyle changes. They also provide an attractive option for patients who may not qualify for or wish to delay major surgery. As obesity becomes a leading public health challenge, the demand for intragastric balloon therapy is expected to escalate globally.

Key Market Restraint: Limited Insurance Reimbursement and High Out-of-Pocket Costs

Despite the clinical effectiveness and growing popularity of intragastric balloons, lack of insurance coverage remains a significant barrier in many countries. Most health insurance providers classify these procedures under elective or cosmetic treatments, rather than essential healthcare services. As a result, patients are often required to bear the full cost, which can range from $5,000 to $10,000 depending on the region, product type, and healthcare facility.

This cost barrier is particularly restrictive in price-sensitive emerging markets, where out-of-pocket healthcare spending dominates. Additionally, the temporary nature of the therapy—requiring careful dietary follow-up and post-removal lifestyle modifications—can discourage patients from investing unless long-term benefits are guaranteed. Expanding insurance inclusion and aligning with obesity prevention initiatives will be essential to unlocking the market’s full potential.

Key Market Opportunity: Expansion into Non-Traditional Healthcare Settings

A major growth opportunity exists in the expansion of intragastric balloon placement into non-hospital healthcare settings, such as outpatient clinics, cosmetic surgery centers, and wellness facilities. With the advent of capsule-based balloon systems that do not require endoscopic placement or sedation, the procedure can now be performed quickly and safely in a broader range of clinical environments.

This shift can dramatically reduce procedural costs and open access to a wider patient population. It also aligns with the global trend of decentralizing healthcare delivery and focusing on patient-centered convenience. Several companies are already partnering with wellness and nutrition centers to integrate IGB therapy as part of holistic weight loss programs. The opportunity to combine these procedures with digital health tools and remote monitoring further enhances this avenue for market expansion.

Segments Insights:

Intragastric Balloons Market By Administration Insights

Endoscopic administration continues to dominate the intragastric balloon market. Traditionally, balloons have been placed using an upper gastrointestinal endoscope, a method that allows physicians to precisely control the placement and inflation of the balloon. This route is favored by specialists who value the direct visualization of the stomach during insertion and removal. Hospitals and specialty clinics widely support this method due to its reliability and procedural familiarity.

Endoscopy-based placement is particularly preferred for saline-filled and adjustable balloons that require careful positioning. Despite the need for anesthesia and recovery time, the method is considered highly effective for ensuring correct placement and maximizing patient safety. As a result, many physicians still regard endoscopic placement as the gold standard, especially in cases involving multiple or larger balloons.

Pill-form or capsule-based administration is the fastest-growing segment, gaining favor due to its ease of use, reduced invasiveness, and outpatient suitability. These balloons are swallowed in capsule form, then inflated once inside the stomach using a catheter or remote activation system. The Elipse Balloon, for instance, is a leading product that requires no endoscopy or anesthesia, and is expelled naturally after a few months.

This simplified approach is highly appealing to patients hesitant about sedation or clinical intervention. Clinics offering wellness and medical weight management packages are increasingly adopting capsule-based systems, helping drive adoption across non-hospital settings. This innovation is redefining procedural accessibility and is expected to claim significant market share in the coming years.

Intragastric Balloons Market By Filling Material Insights

Saline-filled balloons are the dominant segment in the intragastric balloons market. These systems use a sterile saline solution to fill the balloon once placed inside the stomach. Saline provides a dense and stable mass that induces satiety and is easily visible on imaging scans, aiding in placement and monitoring. Most FDA-approved and CE-marked products fall under this category, making it the most clinically accepted filling material.

Moreover, saline-filled balloons are associated with a lower risk of spontaneous deflation compared to gas-filled alternatives. In the event of leakage, the addition of methylene blue dye in the saline can alert the patient via discoloration of urine, providing a safety mechanism. This design advantage makes saline-filled systems a reliable choice for many practitioners.

Conversely, gas-filled balloons are growing rapidly due to their lightweight nature, reduced patient discomfort, and ease of administration. These balloons exert less pressure on the gastric walls, resulting in fewer early removal cases caused by nausea or vomiting. Products such as Obalon, which can be swallowed and then inflated using gas, represent a significant shift toward patient-friendly weight loss solutions.

Gas-filled systems are especially appealing to patients undergoing initial weight management programs or those sensitive to balloon volume. The ongoing innovation in gas formulations and multi-balloon configurations is expected to further accelerate growth in this segment.

Intragastric Balloons Market By Balloon Type Insights

Single-balloon systems currently dominate the market, accounting for the majority of global sales. These systems are easier to place, manage, and remove, and are often the first choice for both physicians and patients new to intragastric therapies. Their lower cost compared to multi-balloon alternatives further contributes to their widespread use, especially in developing regions. Products such as the Orbera balloon (from Apollo Endosurgery) exemplify this segment’s reliability and effectiveness in achieving significant weight loss.

Single-balloon designs have also benefited from multiple enhancements in materials and filling agents over the years, resulting in better safety and comfort. With a strong body of clinical evidence supporting their outcomes, they remain the cornerstone of the global market.

However, dual and triple balloon systems are emerging as the fastest-growing segment, especially for patients with higher BMI levels or those who have not responded to traditional therapies. These systems offer a more evenly distributed volume within the stomach, reducing the risk of balloon migration and improving satiety effects.

For instance, ReShape Dual Balloon (by ReShape Lifesciences) is designed with two independently filled balloons to enhance efficacy and safety. Triple balloon systems, while still in their infancy, are being explored for even greater volume customization and extended duration. As clinicians seek more adaptable and tailored solutions, the demand for multi-balloon systems is set to rise significantly.

Intragastric Balloons Market By End-use Insights

Hospitals remain the leading end-use segment for intragastric balloon procedures due to their infrastructure, availability of endoscopy suites, and access to emergency care if complications arise. Many hospitals also integrate IGBs into broader bariatric programs that include nutrition counseling, behavioral therapy, and follow-up monitoring. This comprehensive approach makes them ideal settings for patients requiring clinical oversight or with high BMI comorbidities.

Hospitals also play a key role in early-stage trials and first-time placements of new balloon types, contributing to training and product validation. As a result, most initial placements of novel or high-volume systems still occur in hospital settings.

Ambulatory surgical centers (ASCs) represent the fastest-growing end-use segment, driven by demand for outpatient care, shorter procedure times, and lower overhead costs. ASCs are particularly suited to capsule-based and gas-filled balloon placements, which require minimal recovery and can be completed in under an hour.

With the global shift toward day-care procedures and decentralized healthcare, ASCs are being increasingly equipped to perform balloon insertions, especially in urban and tier-2 cities. Their convenience and affordability make them an attractive option for both patients and insurers.

Intragastric Balloons Market By Regional Insights

North America dominates the global intragastric balloons market, led by the United States. High obesity prevalence—affecting over 40% of adults combined with strong healthcare infrastructure and early FDA approvals, has made the region a prime market for IGB adoption. The presence of key companies such as Apollo Endosurgery and ReShape Lifesciences further strengthens the innovation and distribution ecosystem.

Insurance coverage for certain high-risk cases and increasing public awareness campaigns around obesity have also supported growth. Furthermore, the popularity of outpatient and wellness-driven procedures among millennials and middle-aged adults is sustaining long-term demand.

Asia-Pacific is the fastest-growing region in the intragastric balloons market. Rising obesity rates in China, India, and Southeast Asia driven by urbanization, sedentary lifestyles, and dietary changes are creating vast opportunities. In countries like South Korea and Thailand, medical tourism and cosmetic health consciousness are also fueling interest in non-surgical weight loss treatments.

Government healthcare modernization efforts and private sector investments in outpatient facilities are accelerating access to IGBs. Moreover, regional manufacturers are introducing cost-effective alternatives tailored to local regulatory and economic contexts, enhancing adoption across mid- and low-income populations.

Some of the prominent players in the intragastric balloons market include:

- Apollo Endosurgery, Inc.

- Obalon Therapeutics, Inc.

- Allurion Technologies, Inc.

- Spatz3

- Helioscopie

- Endalis

- MEDSIL

- ReShape Medical, Inc.

- Lexel Medical

Recent Developments

-

March 2025 – Allurion Technologies announced a partnership with UAE-based hospitals to introduce the Elipse Swallowable Balloon across the Middle East.

-

January 2025 – ReShape Lifesciences received CE approval for its next-generation Dual Balloon System, optimized for longer retention and enhanced comfort.

-

November 2024 – Apollo Endosurgery expanded its manufacturing capacity in Mexico to meet rising demand for the Orbera balloon in Latin America.

-

September 2024 – Obalon Therapeutics resumed U.S. sales of its gas-filled swallowable balloon system after updating its digital inflation system and post-market trials.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global intragastric balloons market.

Administration

Balloon Type

Filling Material

End-use

- Hospitals

- Clinics

- Ambulatory surgical centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)