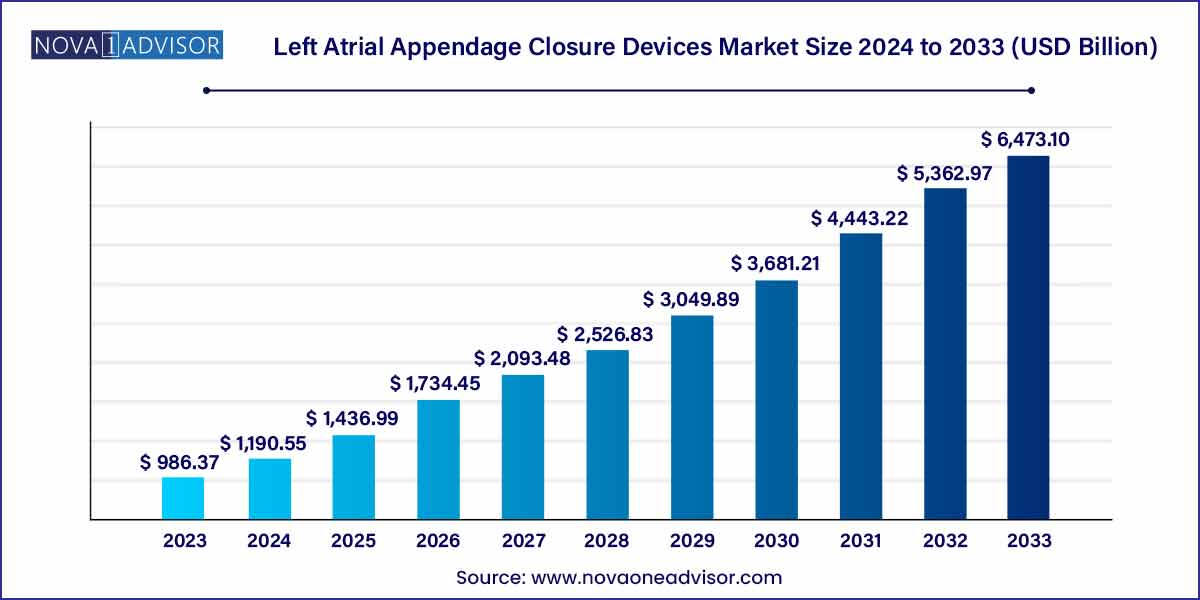

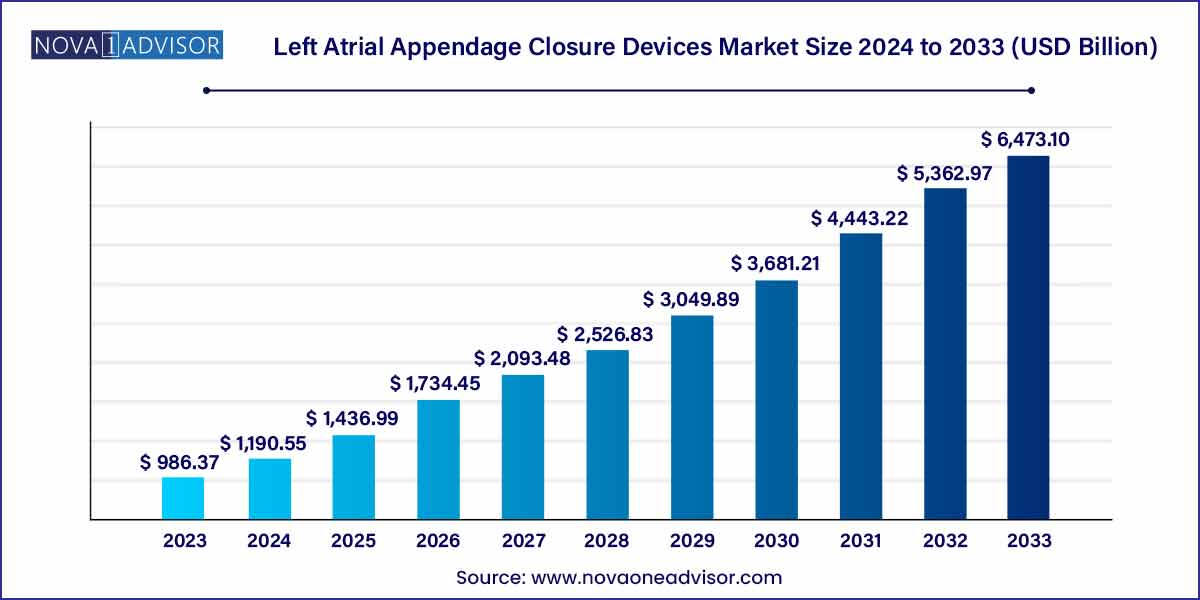

The global left atrial appendage closure devices market size was estimated at USD 986.37 million in 2023 and is expected to surpass around USD 6,473.10 million by 2033 and poised to grow at a compound annual growth rate (CAGR) of 20.7% during the forecast period of 2024 to 2033.

Key Takeaways:

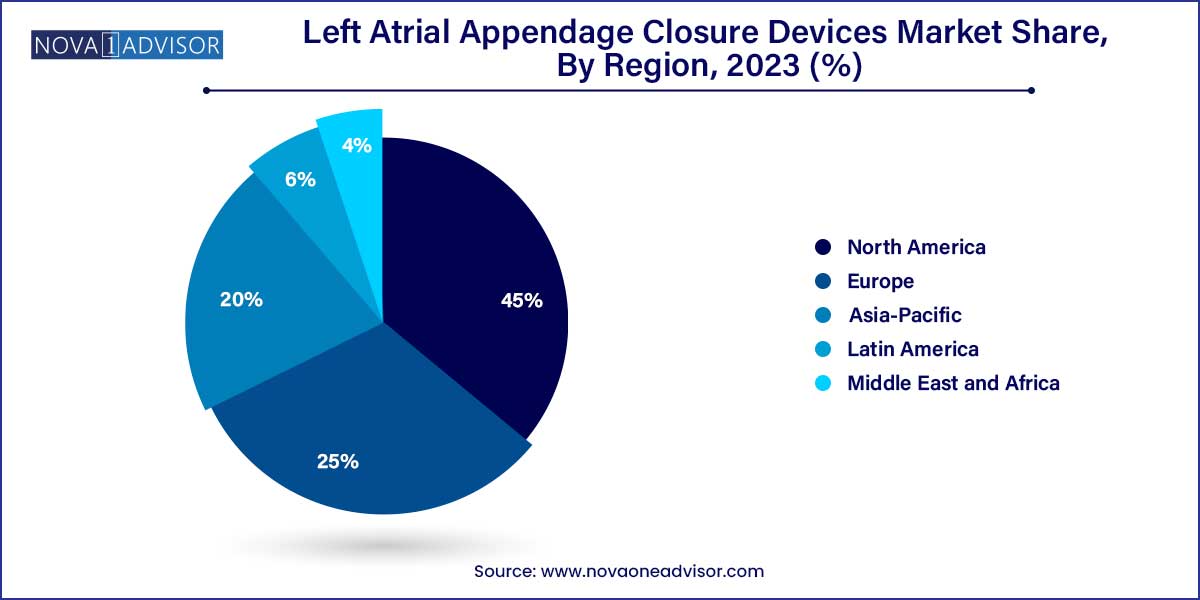

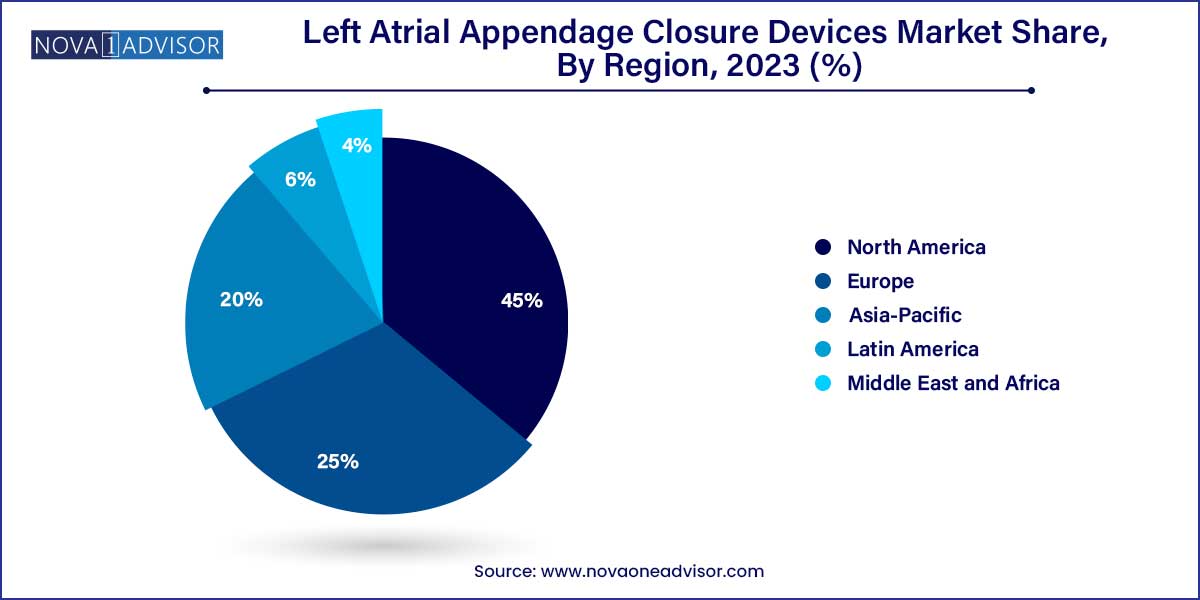

- In 2023, North America held the largest revenue share of more than 45.0%

- The endocardial segment garnered a large market share of more than 50% in 2023.

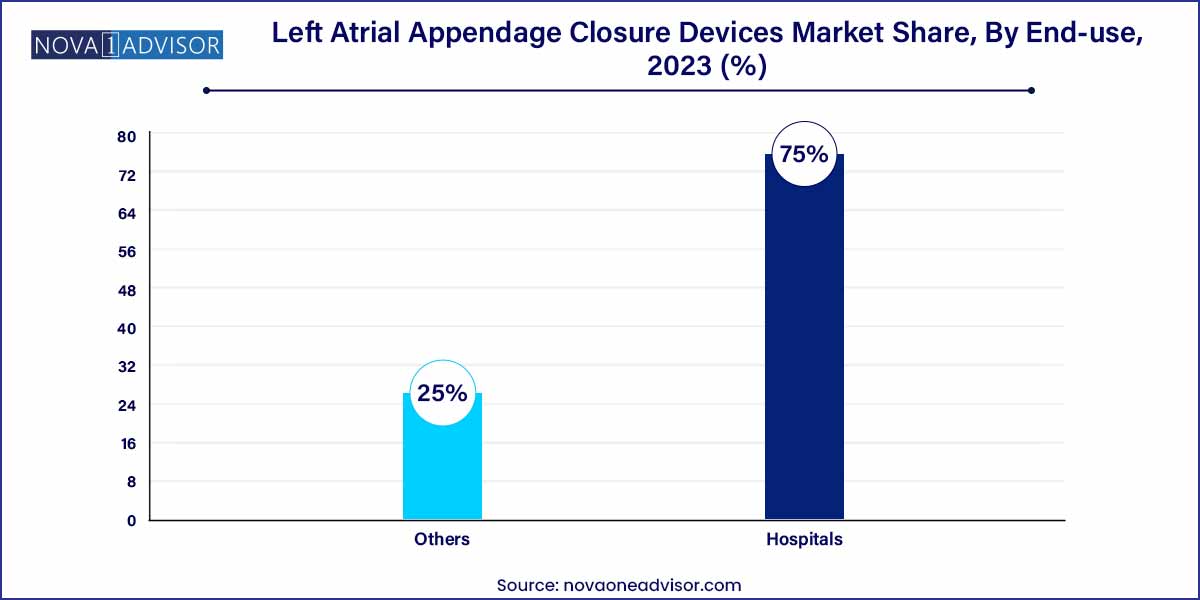

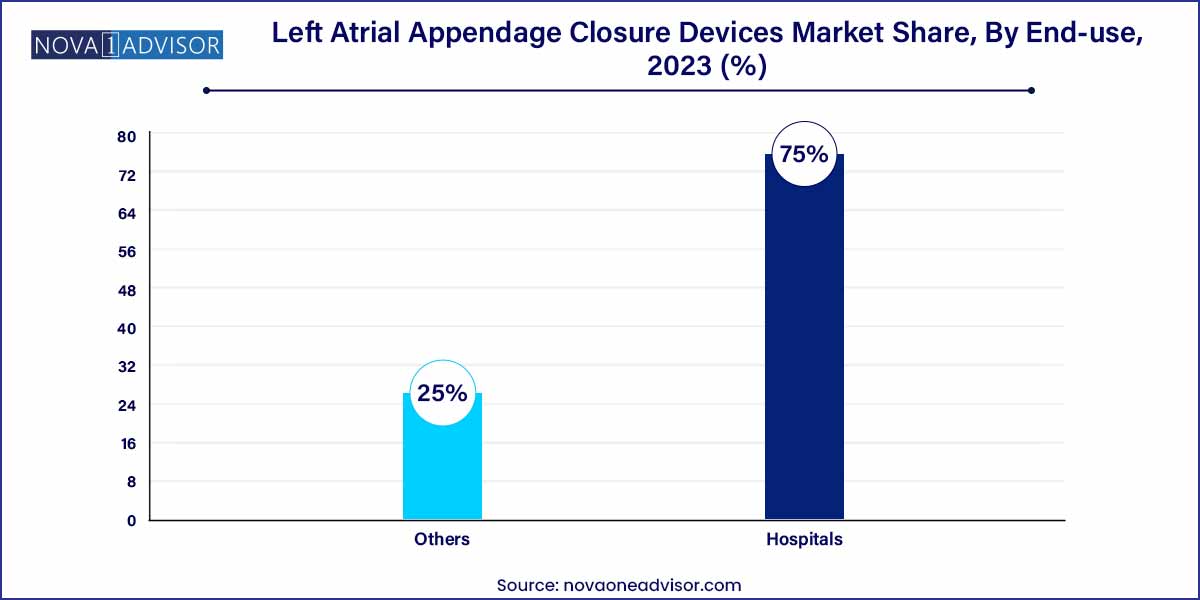

- The hospital segment held the largest share (75.0%) in 2023.

Market Overview

The Left Atrial Appendage (LAA) Closure Devices Market represents a highly specialized and evolving sector within cardiovascular intervention and stroke prevention therapy. LAA closure devices are used in patients with non-valvular atrial fibrillation (AF) who are at increased risk of stroke but cannot tolerate long-term oral anticoagulation therapy due to bleeding risks or contraindications. By sealing off the left atrial appendage—an area known to be a major source of thrombus formation in AF patients—these devices significantly reduce the risk of embolic stroke.

Globally, atrial fibrillation affects over 33 million people, and its prevalence is rising with aging populations, sedentary lifestyles, and increasing rates of hypertension and heart failure. Traditionally, oral anticoagulants like warfarin or direct oral anticoagulants (DOACs) have been used to manage stroke risk in AF patients. However, bleeding risks and patient compliance issues have fueled the development and adoption of LAA closure technologies as an alternative strategy, particularly for high-risk populations.

Innovations in minimally invasive delivery systems, coupled with growing clinical evidence supporting the efficacy of these devices, have driven their inclusion in updated clinical guidelines. Prominent device manufacturers are conducting pivotal trials to expand indications, improve implant performance, and secure favorable reimbursement pathways. As awareness among cardiologists and interventional specialists increases, the LAA closure device market is projected to expand rapidly over the next decade, offering both improved outcomes for patients and significant growth opportunities for medtech companies.

Major Trends in the Market

-

Growing preference for non-pharmacological stroke prevention: Especially in patients contraindicated for long-term anticoagulants, LAA closure offers a safer alternative.

-

Expansion of indication approvals: Regulatory bodies are approving LAA devices for broader patient groups, including those with moderate bleeding risks and those undergoing concurrent cardiac procedures.

-

Technological refinement of implant designs: Manufacturers are introducing new device generations with better conformability, repositionability, and reduced procedural complications.

-

Integration with imaging technologies: Use of transesophageal echocardiography (TEE), intracardiac echocardiography (ICE), and CT angiography during implantation enhances precision and safety.

-

Combined surgical approaches: Surgeons are combining LAA closure with atrial ablation and valve surgeries to optimize outcomes in complex AF patients.

-

Expansion into ambulatory and outpatient cardiac centers: With faster recovery times and less invasive techniques, certain LAA procedures are migrating from tertiary hospitals to specialty cardiovascular centers.

-

Reimbursement improvements: Increasing inclusion in health plans, especially in the U.S. and Western Europe, is making LAA closure more accessible.

-

Strong pipeline of clinical trials: Trials like CHAMPION-AF and ASAP-TOO are expected to redefine clinical adoption and patient eligibility in the coming years.

Left Atrial Appendage Closure Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 986.37 Million |

| Market Size by 2033 |

USD 6,473.10 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 20.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technique, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Boston Scientific Corporation; Abbott; AtriCureInc.; Life tech Scientific; Cardia; Inc. Lepu Medical Technology (Beijing) Co. Ltd.; Johnson & Johnson (Biosense Webster, Inc.). |

Key Market Driver: Increasing Prevalence of Atrial Fibrillation and Associated Stroke Risk

A major market driver is the global increase in atrial fibrillation cases, particularly among the elderly population. AF significantly raises the risk of ischemic stroke up to five-fold by promoting blood stasis and thrombus formation in the left atrial appendage. With stroke being one of the leading causes of disability and death, especially in aging populations, there is an urgent need for preventive strategies.

While anticoagulants remain first-line therapy, many patients face bleeding risks, medication intolerance, or compliance challenges. LAA closure devices address this unmet need by offering mechanical stroke prevention without long-term pharmacological burden. For example, the WATCHMAN device by Boston Scientific has demonstrated non-inferiority to warfarin in key studies like PROTECT-AF and PREVAIL. As global health systems prioritize personalized stroke prevention, especially in high-risk patients, demand for LAA closure will continue to grow.

Key Market Restraint: High Procedural Cost and Limited Accessibility in Developing Regions

Despite clinical promise, the high cost of LAA closure procedures remains a key constraint on market expansion. Total costs including device, imaging, and hospitalization can exceed USD 15,000 to USD 25,000, placing these therapies out of reach for many patients in low- and middle-income countries. Even in high-income countries, the cost-effectiveness of LAA closure is scrutinized, particularly in patients with lower stroke risk scores.

Moreover, the need for specialized infrastructure, such as cardiac catheterization labs, advanced imaging, and trained electrophysiologists or interventional cardiologists, limits widespread adoption. In many parts of Asia, Latin America, and Africa, LAA closure is only available in elite tertiary care centers. These economic and logistical barriers will need to be addressed through pricing strategies, reimbursement policy reforms, and training programs for broader accessibility.

Key Market Opportunity: Expanding Use of LAA Closure in Conjunction with Other Cardiac Procedures

A key opportunity lies in the increasing adoption of LAA closure as an adjunct to other structural or rhythm-control cardiac procedures, such as valve replacement, maze surgery, or catheter ablation. Surgeons and electrophysiologists are leveraging the procedural overlap to simultaneously address arrhythmia and stroke risk. In patients undergoing mitral valve repair or left-sided ablation, adding LAA closure can be clinically beneficial and cost-efficient.

This bundled approach is particularly compelling in healthcare systems aiming to reduce hospital readmissions and improve long-term outcomes. Device manufacturers and surgical instrument firms are exploring integrated kits and multi-purpose delivery systems that facilitate such combined interventions. As evidence supporting this strategy continues to accumulate, it opens a new segment of patients who wouldn’t have otherwise undergone standalone LAA closure presenting significant growth potential.

Segments Insights:

Technique Insights

Endocardial LAA closure dominated the market in 2024. Endocardial techniques involve percutaneous, catheter-based delivery of closure devices via the femoral vein and transseptal puncture into the left atrium. This minimally invasive approach is preferred for most high-risk AF patients due to its shorter recovery time and reduced surgical trauma. The WATCHMAN device is the most recognized endocardial LAA closure solution globally and has set the clinical benchmark for this technique. Physicians favor endocardial LAA closure due to its reproducibility, procedural safety, and compatibility with real-time imaging guidance.

Epicardial closure is the fastest-growing technique. It involves external access to the left atrial appendage, typically during open-heart or minimally invasive thoracoscopic surgeries. Devices like the AtriClip, placed on the external surface of the LAA, are commonly used during concurrent cardiac surgeries. Epicardial approaches are gaining traction among patients who are already undergoing valve or coronary artery procedures. Additionally, epicardial closure eliminates the need for transseptal puncture and has shown favorable occlusion rates in long-term studies. The development of minimally invasive thoracoscopic epicardial systems is expanding this segment's applicability beyond traditional surgical settings.

End-Use Insights

Hospitals accounted for the largest share of the LAA closure device market. Hospitals, especially those with specialized cardiac units, are equipped with the infrastructure and expertise required for complex interventional and surgical procedures. The majority of LAA closure devices are implanted in hospitals with hybrid cath labs, capable of managing procedural imaging and post-op care. Additionally, reimbursement pathways are more streamlined in hospital environments, encouraging clinicians to recommend LAA closure as part of stroke prevention protocols.

Other settings including ambulatory surgical centers (ASCs) and specialty cardiovascular clinics—are the fastest-growing end-use segment. As device technology becomes more refined and minimally invasive, procedures are shifting to outpatient or day-care models. Some centers in the U.S. and Europe are already conducting WATCHMAN procedures on a same-day discharge basis. This trend is likely to accelerate with cost-containment pressures, broader physician training, and patient preference for less institutional care. Manufacturers are responding by designing portable, simplified delivery systems optimized for smaller surgical centers.

Regional Insights

North America led the global LAA closure devices market in 2024. The United States represents the largest national market, driven by high AF prevalence, early adoption of minimally invasive technologies, and well-defined reimbursement policies. The U.S. Centers for Medicare & Medicaid Services (CMS) covers LAA closure under national coverage determinations, encouraging widespread use in eligible populations. Boston Scientific’s WATCHMAN device, FDA-approved since 2015, has become a cornerstone in AF-related stroke prevention. Additionally, the presence of world-renowned cardiovascular centers and ongoing clinical trials supports innovation and trust in LAA closure techniques.

Canada is also emerging as a strong player, with several centers adopting both endocardial and epicardial LAA closure. The combination of a publicly funded healthcare system and a proactive stance on interventional cardiology supports market growth in the region.

Asia-Pacific is the fastest-growing region in the LAA closure devices market. Rapid urbanization, lifestyle changes, and aging populations are driving an increase in atrial fibrillation diagnoses. Countries like China, Japan, India, and South Korea are investing heavily in cardiovascular infrastructure, expanding both surgical and interventional capacity. Government programs and private hospitals in China have begun introducing LAA closure as part of comprehensive stroke prevention programs, especially in high-volume cardiac centers.

Japan’s advanced medical technology landscape and its highly developed reimbursement framework make it a key driver within Asia-Pacific. Meanwhile, in India and Southeast Asia, international collaborations and public-private partnerships are enhancing access to LAA closure devices. As awareness grows and procedural costs decline, Asia-Pacific is expected to account for a larger share of new device implants and clinical trials in the years ahead.

Some of the prominent players in the left atrial appendage closure devices market include:

- Boston Scientific Corporation

- Abbott

- AtriCure Inc.

- Life tech Scientific

- Cardia, Inc.

- Lepu Medical Technology (Beijing) Co. Ltd.

- Johnson & Johnson (Biosense Webster, Inc.)

Recent Developments

-

Boston Scientific (January 2025): Reported promising results from the CHAMPION-AF trial, demonstrating that the WATCHMAN FLX device offers stroke prevention benefits comparable to DOACs in moderate-risk patients, potentially expanding its approved indications.

-

AtriCure, Inc. (March 2025): Received CE Mark approval for its latest AtriClip PRO-V device, which offers improved maneuverability and closure force for epicardial LAA procedures in minimally invasive cardiac surgeries.

-

Lifetech Scientific Corporation (February 2025): Launched the LAmbre™ Plus LAA closure system in select Asian and European markets, boasting enhanced conformability and repositioning capabilities.

-

Abbott Laboratories (December 2024): Entered the LAA closure market through a strategic investment in a start-up developing a next-gen endocardial occlusion device using biodegradable materials.

-

Biosense Webster (a Johnson & Johnson company) (April 2024): Announced a clinical partnership with U.S. hospitals to evaluate combined atrial fibrillation ablation and LAA closure in a single-procedure protocol under the MULTI-SHIELD study.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global left atrial appendage closure devices market.

Technique

End-Use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)