Light Therapy Market Size and Trends

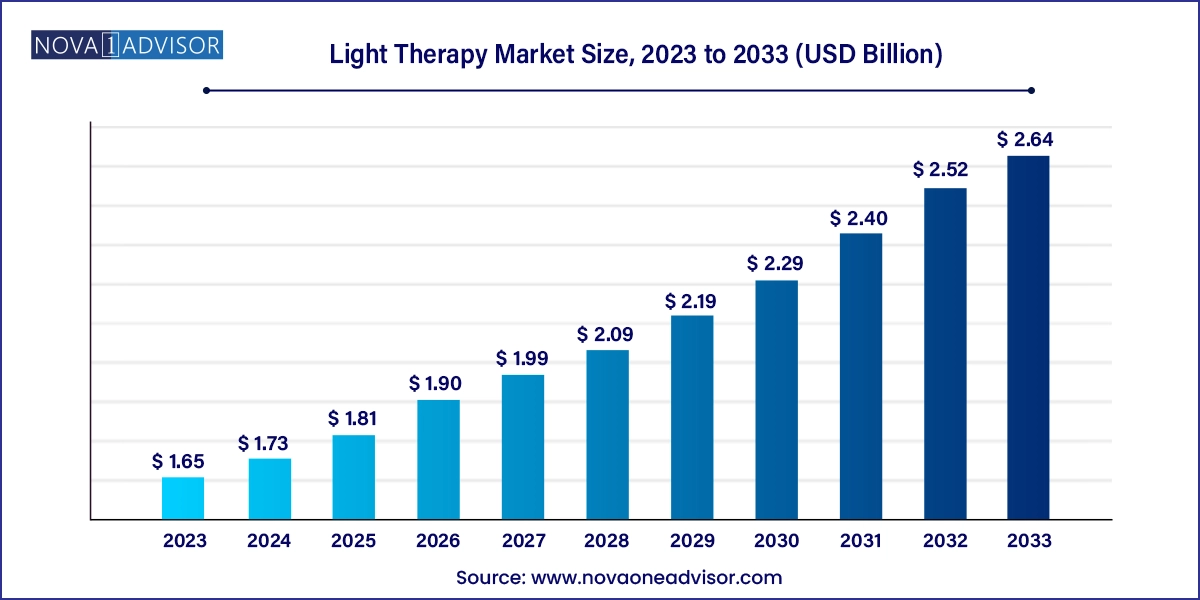

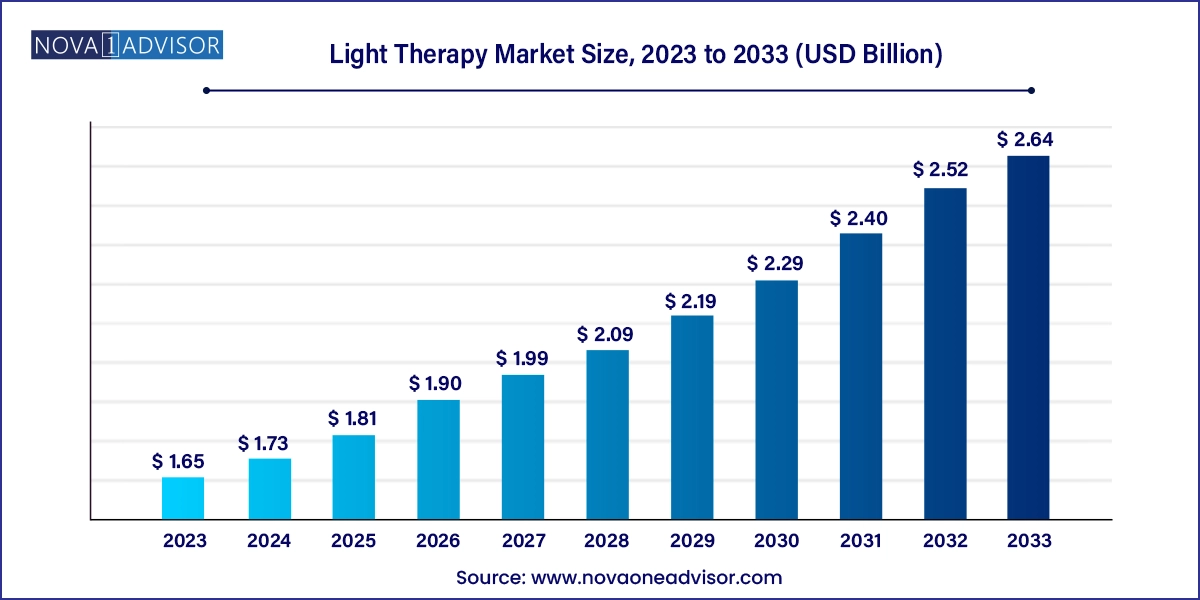

The global light therapy market size was exhibited at USD 1.65 billion in 2023 and is projected to hit around USD 2.64 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2024 to 2033.

Light Therapy Market Key Takeaways:

- In 2023, the hand-held devices segment dominated the market with a revenue share of 26.7% and is expected to expand at the highest CAGR of over 5.3% during the forecast period.

- The light visor segment is expected to progress at a CAGR of 4.9% over the forecast period.

- The sleeping disorder segment held the largest market share of 23.4% in 2023.

- The SAD/winter blues segment is expected to witness the fastest CAGR of 5.3% during the forecast period.

- The blue light segment dominated the market in terms of a revenue share of 42.8% in 2023 and is also expected to witness the fastest CAGR of 5.1% over the forecast period.

- The home healthcare segment dominated the market with the highest revenue share of 54.7% in 2023.

- North America dominated with the highest revenue share of 36.3% in 2023.

- The Asia Pacific region is expected to expand with the fastest CAGR of 5.6%.

- Europe is expected to have a CAGR of 4.6% over the forecast period.

Market Overview

The global light therapy market has emerged as a transformative segment in the healthcare and wellness industries, with applications that span dermatological, psychological, and circadian rhythm-related disorders. Light therapy, also known as phototherapy, involves the use of specific wavelengths of light to treat various medical and cosmetic conditions. It has gained prominence as a non-invasive, drug-free treatment option that is particularly effective in treating Seasonal Affective Disorder (SAD), psoriasis, acne, eczema, and sleep-related issues.

In recent years, growing awareness about mental health, an increasing preference for aesthetic treatments, and the rising burden of dermatological conditions have all contributed to the accelerating demand for light therapy solutions. Furthermore, the development of portable, user-friendly, and home-based light therapy devices has significantly widened consumer accessibility. With the convergence of healthcare innovation and lifestyle demand, the market is expected to continue its upward trajectory.

In addition to its therapeutic efficacy, light therapy appeals to a tech-savvy and wellness-focused population, with wearable devices and app-integrated products enabling personalized treatment regimens. According to industry estimations, the global market is projected to expand robustly over the next decade, driven by both clinical endorsement and consumer enthusiasm.

Major Trends in the Market

-

Rise of Home-Use Devices: Consumers are increasingly adopting compact, easy-to-use light therapy devices for home-based treatment, reducing the need for clinical visits.

-

Integration with Digital Health Technologies: Smart light therapy devices connected to mobile applications offer real-time monitoring and customized treatment plans.

-

Expansion into Wellness and Lifestyle Products: Beyond clinical use, light therapy is being incorporated into wellness gadgets for stress relief and sleep improvement.

-

Growth of Red Light Therapy in Anti-aging and Fitness: Red light therapy is gaining popularity among fitness enthusiasts and cosmetic users for its benefits in muscle recovery and skin rejuvenation.

-

Increased FDA Approvals and Clinical Trials: Regulatory support through faster approvals and rising clinical evidence is enhancing product credibility and adoption.

-

Portable and Wearable Devices Boom: Lightweight, battery-powered wearables are entering the market, enabling users to undergo therapy on the go.

-

Focus on Mental Health Treatment: Increasing use of light therapy for treating depression and sleep disorders reflects a broader mental health awareness trend.

Report Scope of Light Therapy Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.73 Billion |

| Market Size by 2033 |

USD 2.64 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, Light Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Koninklijke Philips N.V.; Beurer GmbH; BioPhotas; Northern Light Technologies; Lumie; Verilux, Inc.; Zepter International; The Daylight Company; Zerigo Health; Naturebright |

Key Market Driver: Growing Prevalence of Skin Disorders

One of the primary drivers of the global light therapy market is the rising prevalence of dermatological conditions, especially chronic ailments like psoriasis, acne vulgaris, vitiligo, and eczema. Skin disorders not only impact physical health but also psychological well-being and quality of life, creating a consistent demand for effective treatment options.

For example, according to the World Health Organization (WHO), around 125 million people globally suffer from psoriasis, a condition that can be significantly improved with narrowband UVB phototherapy. Light therapy offers a controlled and localized treatment option with fewer side effects compared to systemic therapies or steroids. Additionally, the increasing awareness of non-invasive and side-effect-free treatments has made light therapy a preferred choice among patients and dermatologists alike. This driver is further amplified by an aging population more susceptible to skin conditions, and a growing aesthetic consciousness among younger demographics.

Key Restraint: Limited Reimbursement Policies

A significant challenge for the light therapy market is the lack of widespread insurance reimbursement policies, particularly in developing nations. While light therapy is clinically effective and increasingly adopted, the high upfront cost of devices can be prohibitive for many patients.

Most insurance providers do not cover home-use light therapy devices or consider them elective treatments unless prescribed for specific medical conditions such as SAD or severe psoriasis. This financial barrier limits patient accessibility, especially in lower-income segments and countries where out-of-pocket healthcare spending is the norm. Furthermore, the ambiguity in regulatory classification of many light therapy devices—whether they are medical devices or wellness tools—often hinders reimbursement approval. Addressing these policy limitations is critical for broader market penetration.

Key Opportunity: Rising Demand for Non-Pharmacological Sleep Aids

An emerging opportunity in the market is the rising demand for non-pharmacological interventions for sleep disorders. As the global population faces increasing sleep disturbances due to digital screen exposure, shift work, and stress, there is growing interest in natural, drug-free solutions.

Light therapy has shown great promise in regulating circadian rhythms and melatonin secretion, particularly with the use of blue and white light during waking hours and red light at night. Products like dawn simulators and light boxes are being used to mimic natural sunlight patterns and treat delayed sleep phase disorders, insomnia, and jet lag. This opens a lucrative segment for manufacturers to target a broad consumer base, including students, frequent travelers, night-shift workers, and elderly populations, especially in urban settings with limited natural light exposure.

Light Therapy Market By Product Insights

Light boxes currently dominate the global light therapy market in terms of revenue and usage. These devices are commonly used for treating Seasonal Affective Disorder (SAD), with clinical recommendations supporting their effectiveness. Their larger surface area and intense illumination make them ideal for therapeutic applications that require longer exposure. They are especially popular in regions with long winters or low sunlight exposure, such as Northern Europe and Canada.

Conversely, handheld devices for skin treatment represent the fastest-growing product segment, fueled by the increasing trend of home-based skincare and personal wellness. These portable devices, often featuring blue and red LED light, are widely used to treat acne, improve skin tone, and support anti-aging routines. Their compact design, affordability, and convenience make them highly attractive to the younger demographic and wellness enthusiasts. The proliferation of beauty tech influencers and online reviews further accelerates consumer adoption.

Light Therapy Market By Application Insights

Seasonal Affective Disorder (SAD) and Winter Blues constitute the dominant application segment. With millions affected annually by seasonal mood disorders—especially in regions with reduced daylight hours—light therapy has been proven to be a front-line treatment. The efficiency, low side effects, and natural therapeutic mechanism make light therapy an increasingly adopted option among psychiatrists and general practitioners.

Meanwhile, acne vulgaris treatment is emerging as the fastest-growing application. With an increasing number of adolescents and adults suffering from acne due to stress, pollution, and lifestyle factors, non-invasive light therapy is gaining traction. Blue light, in particular, has been shown to target acne-causing bacteria without harming the skin. The cosmetic benefits of smoother skin and reduced scarring appeal strongly to appearance-conscious consumers, boosting product demand in both clinical and home-use formats.

Light Therapy Market By Light Type Insights

White light is the most widely used light type in therapeutic applications, particularly for treating SAD and sleep disorders. It mimics natural daylight and is frequently used in light boxes and dawn simulators. Its broad-spectrum illumination makes it versatile and suitable for regulating mood and circadian rhythms.

On the other hand, red light therapy is witnessing the fastest growth, particularly in the skincare and fitness recovery markets. Its ability to stimulate collagen production and cellular regeneration has made it popular in anti-aging treatments and post-exercise muscle recovery. Dermatology clinics and fitness centers are rapidly adopting red light therapy equipment, and consumer-grade products are also gaining popularity due to visible cosmetic benefits.

Light Therapy Market By End-use Insights

Dermatology clinics dominate the end-use segment as they offer a professional, supervised environment for light therapy procedures. Patients suffering from chronic skin conditions or seeking cosmetic improvements often prefer specialized care. Clinics offer higher-intensity equipment and personalized treatment plans, contributing to their leading market share.

In contrast, home healthcare is the fastest-growing end-use segment, as individuals seek convenience, privacy, and cost-effective alternatives. Portable light therapy lamps, visors, and handheld devices are increasingly adopted for personal use. The COVID-19 pandemic catalyzed this trend by shifting consumer preference toward at-home wellness solutions, a momentum that has continued with ongoing product innovation.

Light Therapy Market By Regional Insights

North America dominates the global light therapy market due to high awareness of light therapy’s benefits, strong healthcare infrastructure, and favorable reimbursement policies for certain conditions like SAD and psoriasis. The U.S. and Canada, in particular, experience high incidences of seasonal affective disorder owing to their long winters and reduced sunlight hours.

The region is also characterized by a robust presence of leading light therapy companies and high adoption of wellness technologies. For instance, in the U.S., companies such as Verilux and Beurer offer a wide range of FDA-cleared light therapy devices. Moreover, the presence of dermatological and psychological research institutions supports innovation and validation of new treatments.

Asia Pacific is the fastest-growing region, driven by increasing skin-related issues, a burgeoning middle class, and rising consumer interest in cosmetic and wellness therapies. Countries like China, Japan, South Korea, and India are witnessing rapid urbanization, pollution, and lifestyle changes that contribute to skin and sleep disorders.

Furthermore, South Korea and Japan, known for their strong beauty and cosmetic sectors, have rapidly embraced red and blue light therapy devices for skincare. The rise of e-commerce and cross-border beauty product sales also support regional growth. With government initiatives supporting mental health and digital healthcare platforms, Asia Pacific is poised for rapid expansion in the coming years.

Some of the prominent players in the global light therapy market include:

- Koninklijke Philips N.V.

- Beurer GmbH

- BioPhotas.

- Northern Light Technologies

- Lumie

- Verilux, Inc

- Zepter International

- The Daylight Company

- Zerigo Health

- Naturebright

Recent Developments

-

January 2025 – CurrentBody, a U.K.-based beauty tech company, launched its new LED Neck and Dec Perfector, expanding its red light therapy portfolio to include anti-aging solutions for the neck and décolletage area.

-

November 2024 – Philips Lighting announced its partnership with mental health app Calm, integrating light therapy with guided mindfulness practices for improved sleep and mood regulation.

-

August 2024 – Beurer GmbH introduced a new line of portable blue light therapy devices for acne, targeting teens and young adults across European and Asian markets.

-

May 2024 – Joovv Inc. unveiled its latest Joovv Go 2.0, a pocket-sized red light therapy device with enhanced power and Bluetooth-enabled tracking, making it more accessible for home users and athletes.

-

February 2024 – NatureBright collaborated with retail giant Target to stock its light therapy lamps in over 800 stores across the U.S., increasing retail footprint and consumer access.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global light therapy market

Product

- Light Box

- Floor and Desk Lamps

- Handheld Devices for Skin Treatment

- Light Visor

- Dawn Simulator

- Light Therapy Lamps

Application

- Psoriasis

- Vitiligo

- Eczema

- Acne Vulgaris

- SAD/Winter Blues

- Sleeping Disorders

Light Type

- Blue Light

- Red Light

- White Light

End-use

- Dermatology Clinics

- Home Healthcare

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa