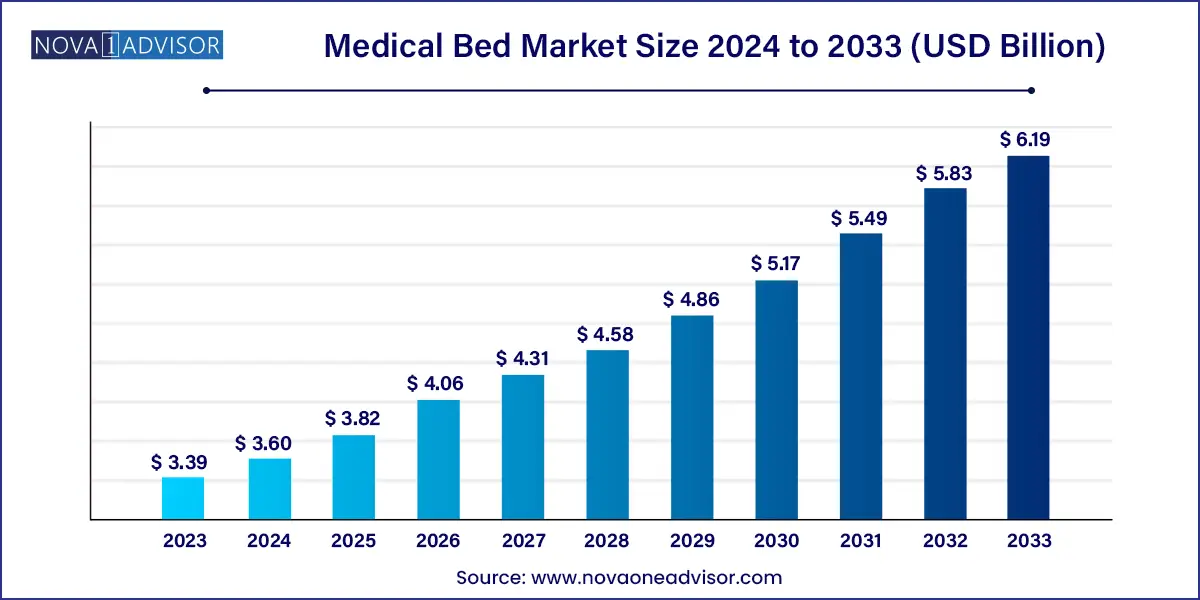

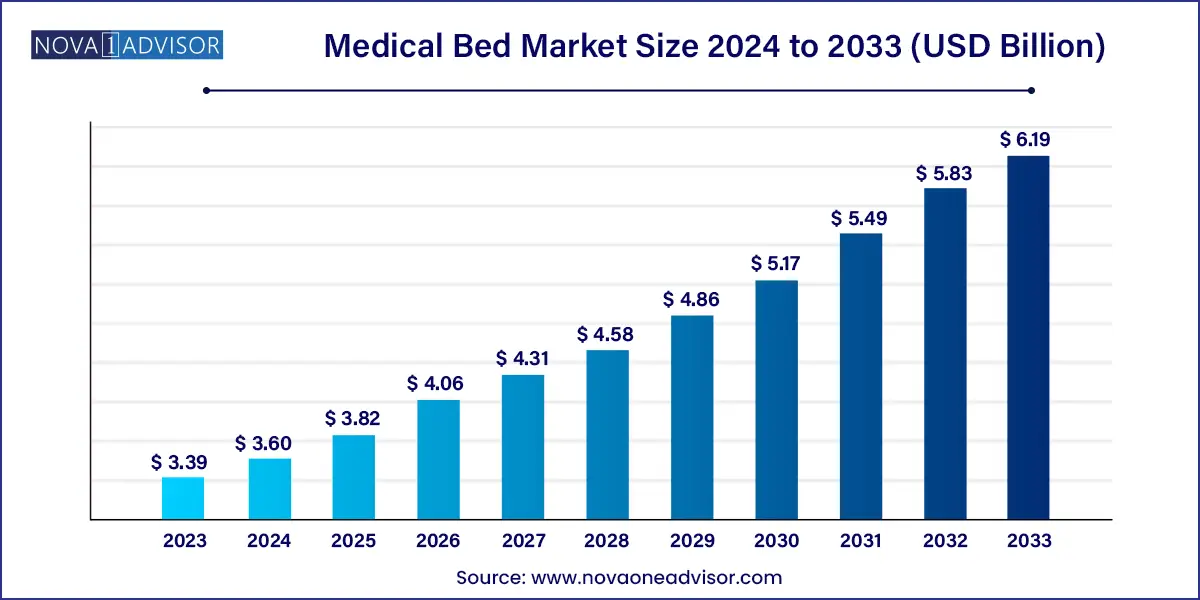

The global medical bed market size was exhibited at USD 3.39 billion in 2023 and is projected to hit around USD 6.19 billion by 2033, growing at a CAGR of 6.2% during the forecast period of 2024 to 2033.

Key Takeaways:

- According to estimates, the electric bed market would see the greatest CAGR between 2023 and 2033.

- These beds allowed medical workers to provide patients with greater comfort without having to elevate them.

- Over the course of the projection, North America is anticipated to hold a sizable portion of the market.

Market Overview

The medical bed market is a critical pillar of the global healthcare infrastructure. Medical beds are designed to provide support, comfort, and safety to patients while accommodating the ergonomic needs of healthcare providers. These specialized beds are indispensable in a variety of care settings—ranging from intensive care units and maternity wards to psychiatric centers and long-term nursing facilities. Their versatility is further enhanced by technology, enabling adjustments in height, head/foot elevation, patient monitoring, and mobility.

The global medical bed market has witnessed robust growth, driven by an aging population, an increasing number of hospitalizations, the rising prevalence of chronic illnesses, and the global expansion of healthcare infrastructure. The COVID-19 pandemic further spotlighted the critical role of hospital beds, especially in acute and emergency care, accelerating procurement and public investments across regions.

Technological advancement has led to the emergence of fully electric and semi-electric beds with advanced features such as weight sensors, automated repositioning, fall alarms, and connectivity with electronic health records. Furthermore, the growing trend of patient-centric care is emphasizing safety, comfort, and mobility—all of which medical beds are evolving to deliver.

From emergency preparedness to home healthcare and aging-in-place support, medical beds are evolving from passive support structures to intelligent, multifunctional care systems. As public and private healthcare providers continue to modernize care delivery, the demand for diverse, high-performance medical beds is expected to expand rapidly across the globe.

Major Trends in the Market

-

Technological Advancement in Electric Beds: Integration of remote controls, patient monitoring systems, and automated repositioning is transforming care delivery.

-

Demand Surge in Long-Term and Home Care Beds: A growing elderly population is driving adoption of beds suitable for residential and nursing home use.

-

Smart Bed Adoption in ICU and Critical Care: Smart ICU beds with sensors, digital dashboards, and bed-exit alarms are becoming standard.

-

Rising Preference for Lightweight and Modular Designs: Healthcare facilities are investing in easily transportable and adjustable bed systems.

-

Increased Focus on Infection Control: Beds with antimicrobial coatings, seamless surfaces, and detachable parts for disinfection are gaining popularity.

-

Customization and Specialty Segment Growth: Maternity, pediatric, psychiatric, and bariatric beds are receiving increased attention for specialized care.

-

Sustainability and Eco-Friendly Materials: Hospitals are seeking medical beds manufactured using recyclable components and low-impact processes.

Medical Bed Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.39 Billion |

| Market Size by 2033 |

USD 6.19 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Type, By Application, By Usage |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Invacare Corporation., Hill-Rom Services, Inc., Stryker Corporation, Medical Depot, Inc., Gendron Inc., Arjo., HARD Manufacturing Company, Inc., GF Health Products, Inc., Transfer Master Products, Inc., Umano Medical inc., ProBed Medical Technologies, American Medical Equipment, Getinge AB., Amico Group of Companies., Merivaara, ANTANO GROUP, LINET., Stiegelmeyer GmbH & Co. KG, Mobility Aids Sales and Services, PARAMOUNT BED CO., LTD. and Others. |

Key Market Driver: Increasing Global Hospitalization and Aging Population

A prominent driver of the global medical bed market is the rising volume of hospital admissions, particularly due to the increasing geriatric population and chronic disease burden. According to the United Nations, by 2050, the global population aged 60 years and older will double, reaching over 2 billion. Elderly patients often suffer from multiple comorbidities such as cardiovascular diseases, diabetes, arthritis, and respiratory issues—conditions that typically require frequent and extended hospital stays.

Hospitals, rehabilitation centers, and nursing homes are under pressure to accommodate more patients while maintaining comfort and safety. Medical beds with adjustable positioning and patient mobility support are central to this mission. These beds help prevent complications like pressure ulcers, facilitate better respiratory mechanics, and reduce caregiver injuries. Advanced beds used in ICUs also enhance monitoring and improve outcomes in critical care scenarios.

For instance, during the COVID-19 pandemic, the availability of ICU beds became a crucial determinant of healthcare readiness. Governments around the world ramped up procurement, often opting for fully electric beds equipped with oxygen holders and side rails. As demand for patient-centric and scalable hospital infrastructure rises globally, so too will the demand for advanced medical beds.

Key Market Restraint: High Capital and Maintenance Costs

Despite widespread demand, the high cost of acquisition and maintenance of advanced medical beds is a significant barrier, particularly in underfunded healthcare systems or rural hospitals. High-end electric beds can cost between $5,000 and $15,000 per unit depending on features like tilt functions, weight sensors, and patient monitoring integration. These costs are often unaffordable for smaller clinics or facilities in low- and middle-income countries (LMICs).

Moreover, the maintenance of complex beds involves recurring costs. Hydraulic systems, electronics, and mobility components require regular servicing and parts replacement to ensure patient safety. Additionally, training is needed for both healthcare workers and maintenance staff, which adds to the total cost of ownership.

This financial burden often leads public hospitals to overuse manual or semi-electric beds, which may lack the necessary safety and ergonomic features for critical or elderly patients. In markets with budget constraints, procurement decisions are typically driven by price rather than innovation, which can hinder market expansion for premium medical bed segments.

Key Market Opportunity: Rise of Home Healthcare and Telehealth

A compelling opportunity for market expansion lies in the growing adoption of home healthcare services. Aging populations, a preference for aging in place, and the rising cost of institutional care are prompting patients and caregivers to seek at-home treatment alternatives. The global pandemic also normalized telemedicine and virtual care, further reinforcing the need for high-quality medical infrastructure at home.

Manufacturers are responding by designing medical beds that are compact, easy to operate, and aesthetically suitable for residential use. These home-use beds often feature electric adjustment, safety rails, and mobility aids, while offering comfort and easy maintenance. Lightweight foldable frames, battery backup, and compatibility with mobile health devices are also in demand.

For instance, companies like Invacare and Drive Medical offer specialized beds tailored for post-acute home care, palliative care, and long-term assisted living. As governments and insurance providers begin reimbursing home healthcare expenses, the medical bed market is expected to benefit from a broader demographic and geographic reach.

Segments Insight

Type Insights

Electric beds dominate the global medical bed market due to their enhanced functionality, user comfort, and operational efficiency. Fully electric beds allow electronic adjustments of height, head, and foot sections through hand-held controls or remote devices. These beds significantly reduce the physical strain on caregivers, improve patient autonomy, and integrate advanced features like weight sensing, tilt functions, and side rail alerts. They are widely used in ICUs, long-term care, and rehabilitation centers.

Electric beds are particularly favored in high-acuity settings where rapid repositioning and integration with digital health monitoring systems are essential. Manufacturers such as Hill-Rom, Stryker, and Linet offer a range of electric beds catering to both acute and chronic care requirements. Their long-term benefits—such as reduced hospital-acquired injuries and better patient compliance—make them a top choice in most high-resource healthcare systems.

Semi-electric beds represent the fastest-growing segment, as they offer a balance between functionality and affordability. These beds typically feature electric adjustment for the head and leg sections, with manual height adjustment. This hybrid design is attractive for mid-tier hospitals and long-term care facilities operating on constrained budgets but seeking improved care standards over fully manual beds.

The popularity of semi-electric beds is also growing in emerging markets, where cost-effectiveness is a major consideration. They provide many of the patient comfort benefits of electric beds at a fraction of the cost, making them an attractive option for both institutions and home users.

Application Insights

Medical nursing homes are the leading application segment in the medical bed market. Long-term residents in these facilities require specialized beds that support mobility, comfort, pressure redistribution, and patient handling. With the global increase in elderly populations, demand for beds in nursing homes and assisted living centers is steadily growing.

These beds often come with features like low-height settings for fall prevention, battery backup for power outages, and pressure-relief mattresses. Manufacturers are designing models specifically for geriatric care, with adjustable side rails, caregiver controls, and ergonomic positioning. The increased attention on quality-of-life in elder care facilities is reinforcing the centrality of advanced beds.

Outpatient clinics are the fastest-growing segment, reflecting the global shift toward ambulatory and day-care procedures. Clinics performing minor surgeries, diagnostics, or short-term recovery require beds that are mobile, lightweight, and adaptable. These facilities are expanding rapidly due to the lower cost of outpatient care and higher patient turnover, making compact medical beds a necessity.

Modular and foldable beds that can be stored when not in use are being widely adopted in these settings. Additionally, mobile diagnostic units, rural outreach programs, and specialty clinics are creating new demand in this space.

Regional Insights

North America dominates the global medical bed market, led by the United States, which accounts for a large share of the total installed base. The region benefits from a mature healthcare infrastructure, high expenditure on hospital modernization, and robust demand for technologically advanced beds.

The U.S. Centers for Medicare & Medicaid Services (CMS) provides reimbursement for home-use and hospital beds, increasing adoption across care settings. Moreover, the region has a well-established base of leading manufacturers like Stryker and Hill-Rom, who continuously innovate and cater to a wide variety of medical needs. North America’s strong hospital network, stringent safety standards, and emphasis on patient outcomes keep it at the forefront of market leadership.

Asia-Pacific is the fastest-growing region in the global medical bed market. Rapid economic development, urbanization, and healthcare investments in China, India, Indonesia, and Vietnam are contributing to the surge. Government initiatives to expand public healthcare access, such as Ayushman Bharat in India and China's healthcare reforms, are driving the construction of new hospitals and care centers.

Moreover, private hospital chains in Southeast Asia are investing in advanced infrastructure to cater to the booming medical tourism industry. Demand is rising not only in metropolitan hospitals but also in rural areas where access to basic healthcare is being strengthened. As a result, both basic and advanced medical beds are in high demand across the region.

Recent Developments

-

March 2025 – Stryker Corporation unveiled a new smart ICU bed model with enhanced AI-enabled pressure monitoring and integrated nurse call features.

-

January 2025 – Linet Group SE announced the expansion of its production facility in Germany to meet growing demand for long-term care beds in Europe.

-

November 2024 – Invacare Corporation introduced a lightweight electric homecare bed series with an intuitive mobile app for remote control.

-

August 2024 – Drive DeVilbiss Healthcare launched a bariatric hospital bed line targeting North American long-term care centers.

-

June 2024 – Arjo AB partnered with a Malaysian healthcare provider to supply advanced maternity beds for newly built women’s hospitals.

Some of the prominent players in the medical bed market include:

- Invacare Corporation. (US)

- Hill-Rom Services, Inc. (US)

- Stryker Corporation (US)

- Medical Depot, Inc. (Canada)

- Gendron Inc. (US)

- Arjo. (Sweden)

- HARD Manufacturing Company, Inc. (US)

- GF Health Products, Inc. (US)

- Transfer Master Products, Inc. (US)

- Umano Medical inc. (Canada)

- ProBed Medical Technologies (Canada)

- American Medical Equipment. (US)

- Getinge AB. (Sweden)

- Amico Group of Companies. (US)

- Merivaara (Finland)

- ANTANO GROUP (Italy)

- LINET. (Czechia)

- Stiegelmeyer GmbH & Co. KG (Germany)

- Mobility Aids Sales and Services (India)

- PARAMOUNT BED CO., LTD. (Japan)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global medical bed market.

By Type

- Electric Bed

- Semi Electric Bed

- Manual Bed

By Application

- Outpatient Clinics

- Medical Nursing Homes

- Medical Laboratory and Research

By Usage

- Acute Care

- Long Term Care

- Psychiatric Care

- Maternity

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)