Medical Device Testing Services Market Size and Research

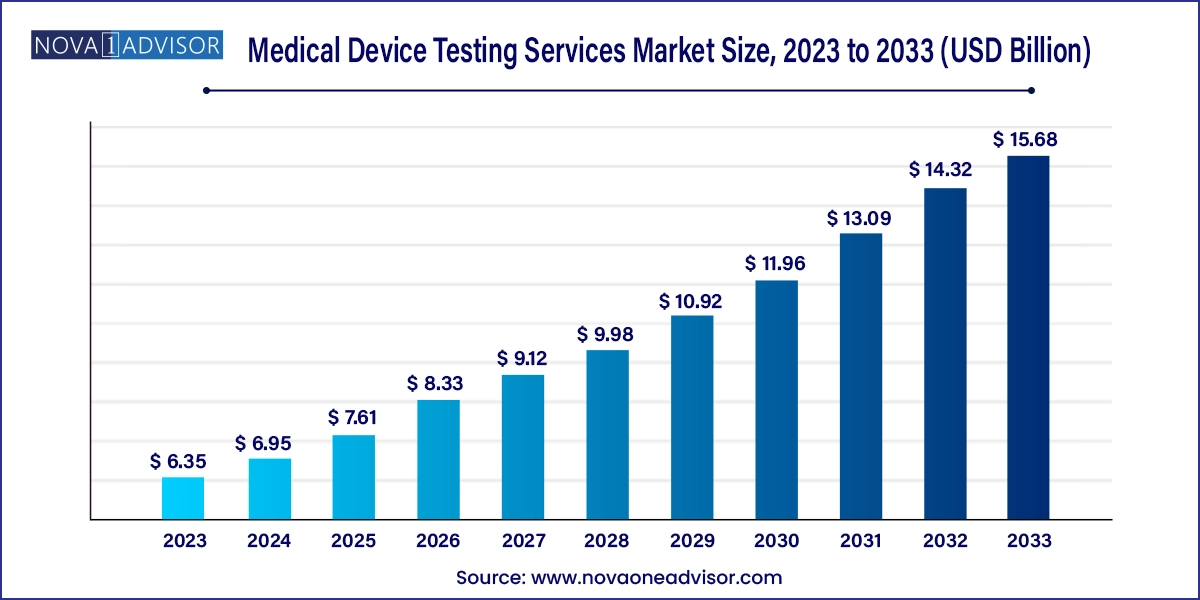

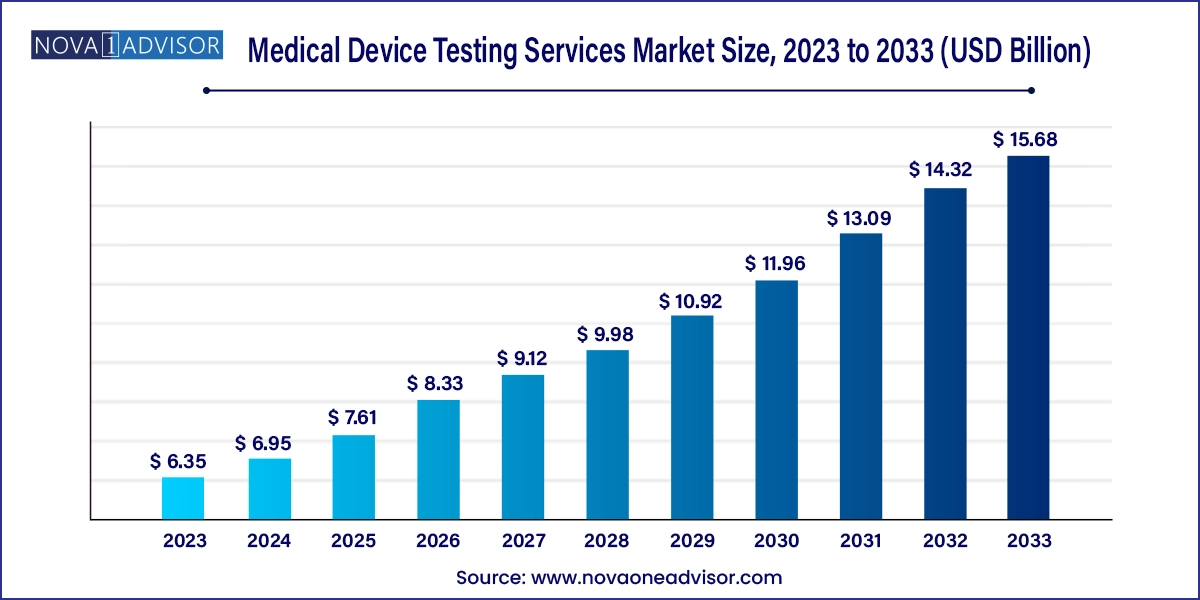

The global medical device testing services market size was exhibited at USD 6.35 billion in 2023 and is projected to hit around USD 15.68 billion by 2033, growing at a CAGR of 9.46% during the forecast period 2024 to 2033.

Medical Device Testing Services Market Key Takeaways:

- Besides, the chemistry test segment is expected to grow at a lucrative CAGR of 9.72%.

- The clinical segment held the largest market share in 2023.

- The preclinical market accounted for the 39.74% share in 2023.

- Asia Pacific dominated the global medical device testing services market in 2023, holding a revenue share of 41.1%.

- North America is estimated to show growth at a lucrative rate in the market over the forecast period.

Market Overview

The Medical Device Testing Services Market plays a critical role in ensuring the safety, efficacy, and compliance of medical technologies used across the healthcare landscape. As medical devices become more complex, diverse, and regulated, the demand for rigorous testing services has surged, both from regulatory bodies and market participants. These services include a broad range of tests that assess a product's biological safety, mechanical performance, chemical composition, microbiological characteristics, and packaging integrity.

With increasing investment in medical technology innovation, the market is witnessing a substantial rise in the number of new devices entering preclinical and clinical trials. This surge is reinforced by regulatory requirements in the U.S. (FDA), Europe (CE marking), and other global jurisdictions, necessitating third-party testing to ensure product conformity. Moreover, the expanding elderly population and the associated rise in chronic diseases such as cardiovascular disorders, orthopedic conditions, and diabetes are fueling the need for diverse diagnostic and therapeutic devices, thereby boosting the demand for medical device testing services.

In recent years, service providers have not only expanded their testing capabilities but also embraced automation, artificial intelligence (AI), and digitization to streamline test procedures and data management. Additionally, increasing outsourcing trends among original equipment manufacturers (OEMs) and startups have created a fertile environment for third-party testing laboratories and consultancies.

Major Trends in the Market

-

Rise in Preclinical Outsourcing: Startups and mid-size medtech firms are increasingly outsourcing preclinical tests to specialized laboratories to cut costs and expedite product launches.

-

Growing Adoption of Biocompatibility Testing: With the rise in implantable and wearable medical devices, biocompatibility assessments have gained prominence for ensuring patient safety.

-

Emphasis on Sterility and Microbiological Testing: The COVID-19 pandemic highlighted the critical need for robust sterilization validation, especially in disposable and surgical products.

-

Integration of AI and Automation: Companies are using AI-powered analytical tools to enhance test accuracy, reduce turnaround times, and meet compliance efficiently.

-

Shift Toward Personalized and Minimally Invasive Devices: Innovations in neurostimulation, cardiovascular implants, and ophthalmic products are increasing the demand for tailored testing protocols.

-

Expansion in Emerging Economies: Asia Pacific and Latin America are seeing rapid infrastructure development in laboratory services to cater to growing local manufacturing bases.

-

Heightened Regulatory Scrutiny: The EU MDR (Medical Device Regulation) and updated FDA guidelines are compelling device manufacturers to perform more extensive testing.

-

Collaborations and M&A: Testing service providers are merging and forming alliances with CROs and CMOs to offer end-to-end solutions.

Report Scope of Medical Device Testing Services Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.95 Billion |

| Market Size by 2033 |

USD 15.68 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.46% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service, Phase, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

SGS SA, Laboratory Corporation of America Holdings, Nelson Laboratories, LLC, TÜV SÜD, Charles River Laboratories, Element Minnetonka, North America Science Associates Inc. (NAMSA), Eurofins Scientific, Pace Analytical Services LLC, Intertek Group Plc, WuXi AppTec |

Key Market Driver: Stringent Regulatory Frameworks

One of the most pivotal drivers of the medical device testing services market is the stringent and evolving regulatory landscape across the globe. Regulatory bodies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and international standards like ISO 10993 and ISO 13485 necessitate rigorous testing for every medical device. These include biocompatibility, chemical, microbiological, and packaging validations to ensure patient safety and product performance.

For instance, the implementation of the European Union’s Medical Device Regulation (EU MDR) has significantly increased the complexity and depth of testing required for CE marking. Devices previously exempt from certain tests are now required to undergo comprehensive evaluation, including toxicological risk assessments and leachable-extractable studies. As a result, manufacturers increasingly rely on external labs equipped with the latest infrastructure and regulatory knowledge to navigate these requirements efficiently. This surge in compliance complexity directly contributes to the market’s expansion.

Key Market Restraint: High Cost and Time Constraints

Despite the market’s growth trajectory, one significant restraint is the high cost and long duration associated with comprehensive testing services. Rigorous and repeated testing particularly for implantable and high-risk devices can stretch over months and cost hundreds of thousands of dollars. These costs are even more daunting for startups and small medical device firms with limited financial resources.

Moreover, navigating regulatory protocols for multiple regions simultaneously (e.g., FDA, CE, CDSCO) can further escalate costs due to the need for multiple test iterations tailored to each jurisdiction. Time delays can severely impact go-to-market strategies, resulting in missed revenue opportunities and increased development costs. This limitation often forces companies to make trade-offs between speed and testing breadth, which may impact long-term product reliability.

Key Market Opportunity: Emergence of Advanced and Wearable Devices

An exciting opportunity lies in the proliferation of advanced and wearable medical devices. As healthcare moves towards personalized and remote care, the demand for non-invasive, wireless, and wearable devices such as continuous glucose monitors, smart patches, neurostimulators, and portable ECGs is skyrocketing. These devices require highly customized testing procedures, especially in terms of biocompatibility (due to long-term skin contact), sterilization, and electrical safety.

Companies offering niche testing services tailored for wearable and sensor-based products stand to gain significant market traction. For instance, the introduction of wearable drug-delivery devices by firms like Insulet and Ypsomed has created demand for integrated biocompatibility and analytical chemistry testing. Further, as more devices connect via the Internet of Medical Things (IoMT), cybersecurity and software validation testing will likely evolve into integral services within the market.

Medical Device Testing Services Market By Service Insights

Biocompatibility Tests dominated the service segment due to the rising use of implantable and body-contacting medical devices. These tests ensure that devices such as pacemakers, orthopedic implants, dental implants, and ophthalmic products do not trigger adverse biological responses when used within the human body. The growing number of implants and customized devices, especially in cardiovascular and orthopedic treatments, mandates extensive biocompatibility verification under ISO 10993 standards. The high volume of required sub-tests such as cytotoxicity, sensitization, and genotoxicity further propels demand for such services.

On the other hand, Microbiology and Sterility Testing is expected to grow at the fastest rate, driven by an increasing number of single-use and disposable medical products. This includes syringes, catheters, surgical instruments, and diagnostic swabs. Since sterility breaches can lead to serious infections, the demand for pyrogen testing, sterility validation, and bioburden analysis has surged. With heightened concerns post-COVID, especially regarding antimicrobial resistance and hospital-acquired infections, microbiological testing is forecasted to gain significant momentum globally.

Medical Device Testing Services Market By Phase Insights

Preclinical Phase dominated the testing phase segment as the majority of device evaluations occur prior to first-in-human trials. Preclinical testing includes a mix of small and large animal studies and various lab-based evaluations such as biocompatibility, chemistry, and microbiology assessments. The preclinical stage is vital in determining the safety profile, biological response, and chemical stability of the device, allowing manufacturers to make informed go/no-go decisions before investing heavily in human trials.

However, the Clinical Phase is emerging as the fastest-growing segment, owing to rising complexities in late-stage device development and the global push for real-world evidence. Clinical phase testing often involves usability studies, performance validation in real environments, and post-market surveillance testing especially under FDA 510(k) or PMA approvals. As regulatory bodies increasingly mandate real-time clinical data, demand for testing services that support post-market commitments is escalating rapidly.

Medical Device Testing Services Market By Regional Insights

North America currently dominates the global medical device testing services market, primarily due to the presence of a mature regulatory framework, advanced healthcare infrastructure, and a high concentration of medical device manufacturers. The U.S. is home to many of the world's leading medtech companies, such as Medtronic, Abbott, and Boston Scientific, who require continuous testing to innovate and comply with FDA requirements. Furthermore, the region has a rich ecosystem of CROs and certified labs offering full-spectrum testing services. According to industry estimates, over 40% of global device approvals originate from North America, making it the epicenter of medical device testing demand.

In contrast, Asia Pacific is expected to be the fastest-growing region during the forecast period. Countries like China, India, and South Korea are rapidly building local testing infrastructure and regulatory clarity to support indigenous manufacturing. The rise of the “Make in India” initiative, for example, encourages medtech companies to test and produce domestically. The low cost of testing services and the availability of skilled labor are also drawing international clients to outsource testing to APAC labs. As regulatory frameworks mature (e.g., China's NMPA reforms), the regional market will likely see exponential growth in outsourced testing contracts.

Medical Device Testing Services Market Recent Developments

-

Eurofins Scientific, a global testing services leader, announced in January 2025 the expansion of its medical device testing facility in Switzerland to meet EU MDR testing demand. The facility includes expanded capacity for microbiology and toxicology testing.

-

In March 2024, SGS SA launched a new high-throughput biocompatibility lab in Suzhou, China, targeting Asia Pacific’s rising domestic demand for implantable devices and testing efficiency.

-

WuXi AppTec completed its acquisition of Frontage Labs' Medical Device Testing Division in November 2024, strengthening its footprint in analytical and microbiological testing services across North America and Asia.

-

Intertek Group introduced a cloud-based platform in August 2024 that enables real-time test result monitoring for its clients, aimed at improving compliance documentation and decision-making timelines.

-

Pace Analytical, in October 2024, partnered with a major U.S.-based orthopedic device manufacturer to provide long-term biocompatibility and package validation services under a 5-year contract.

Some of the prominent players in the global medical device testing services market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global medical device testing services market

Service

-

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

-

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

-

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

Phase

-

-

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

-

-

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)