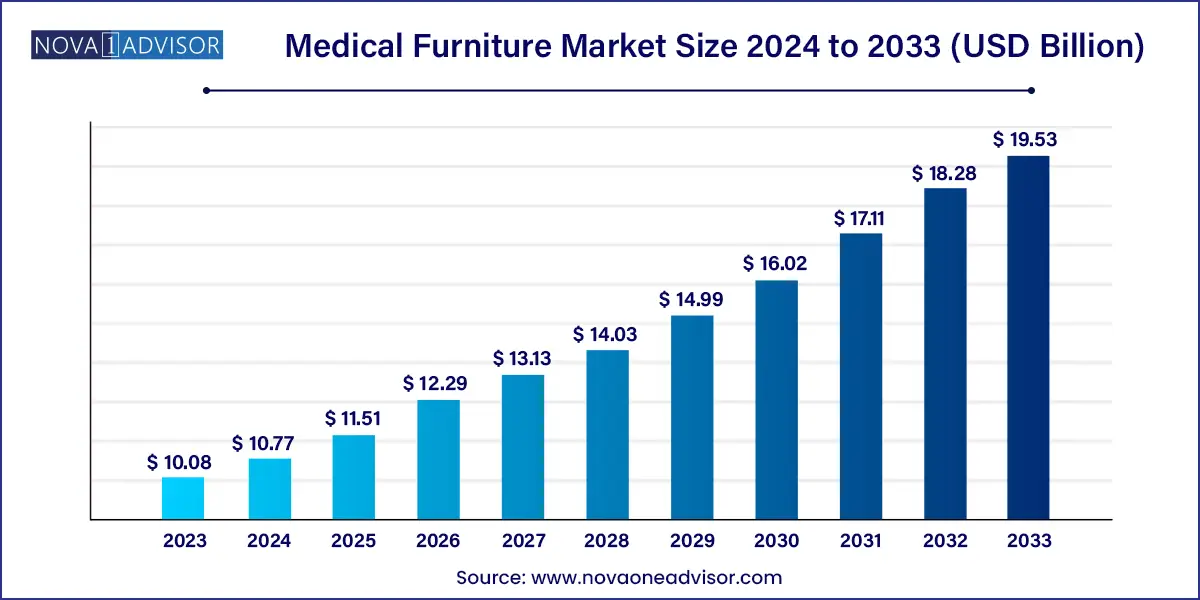

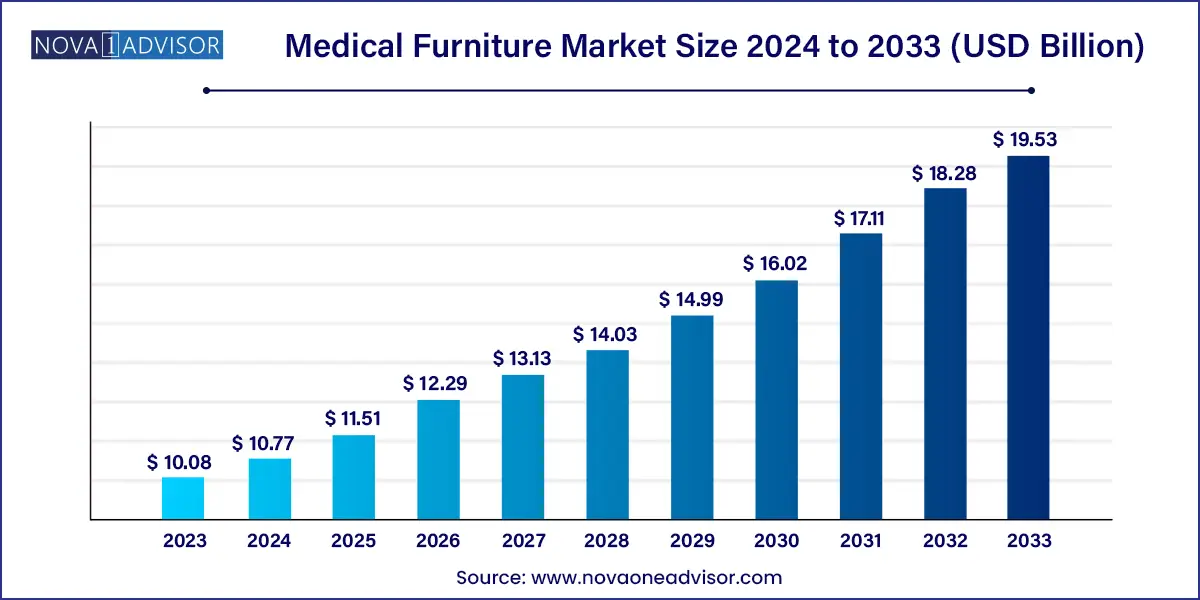

The global medical furniture market size was estimated at USD 10.08 billion in 2023 and is projected to surpass around USD 19.53 billion by 2033 with a CAGR of 6.84% from 2024 to 2033. The rising prevalence of chronic diseases Worl widely, needs to treat with long-term care and robust infrastructure facilitated with medical equipment is propelling the markets growth on a global scale.

Key Takeaways:

- North America has contributed the largest market share of 38% in 2023.

- Asia Pacific is expected to expand at a notable CAGR between 2024 and 2033.

- By material, the metal segment has accounted more than 42% of the market share in 2023.

- By product, the beds segment dominated the market with the largest share of 25% in 2023.

- By end use, the ambulatory surgical centers segment has recorded the major market share in 2023.

- By sector, the private sector dominated the medical furniture market in 2023.

Medical Furniture Market Overview

Medical furniture can be defined as a movable article that is primarily used by every healthcare centre, like hospitals, clinics, operation theatres, and nursing homes, to assist patients and visitors. Some examples of medical furniture include stretchers, medical trolleys, medical beds, tables, and chairs designed for bedbound patients. As per the data published by the World Health Organisation, in June 2021, more than 1.2 million people in the world died as a result of road accidents due to traffic crashes. Around 20 to 50 million people meet with an injury that is non-fatal but has the potential to make them permanently handicapped due to accidents. Such unfortunate incidences of road accidents are rising all over the world, causing severe damage to people's lives that needs to be acknowledged.

One of the significant initiatives for it would be hospitals built with emergency care units facilitated with necessary medical equipment and provisions to treat patients. Such a rising awareness is leading to the medical furniture market in the forward direction, propelling its growth on a global level.

Growth Factors

- The increasing prevalence of chronic diseases worldwide needs to be taken care of for a more extended period.

- Growing investment to build a robust healthcare infrastructure to provide better facilities for patients with all income levels.

- Increasing government support for the betterment of the healthcare sector leads to market growth.

- A rising number of patients visit clinics and hospitals promotes the market’s expansion.

- According to the World Health Organization, several accidents must be treated professionally.

- There is a growing preference for ambulatory surgery centres due to their incredible convenience.

Medical Furniture Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 10.08 Billion |

| Market Size by 2033 |

USD 19.53 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.84% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Material, By Product, By End-use, and By Sector |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Biomedical Solutions, Getinge, GPC Medical Limited, Herman Miller, Hill-Rom Holdings, Invacare Corporation, J&J Medical Specialties LLC, Kovonax, LINET, Met-Lak, Promotal, Skytron, STERIS Corporation, Stiegelmeyer, Stryker Corporation, and Others. |

Medical Furniture Market Dynamics

Driver: Rising hospitalization rate

Due to the increasing of patients with chronic diseases such as cancer, cardiovascular diseases, and diabetes, it is likely to augment the demand for medical furniture to serve the patients with proper care and treatment by medical professionals. For instance, according to the report published by national diabetes statistics, around 11.4% of the United States population has been diagnosed with diabetes. In the COVID pandemic, the market has benefitted due to the upsurge in hospitalization and medical emergencies. Also, growing efforts by medical faculties to expand the medical examination processes and diagnosis further drive the global medical furniture market.

The rising prevalence of accidental emergencies is another reason to treat patients and hospitalize them as early as possible. This needs medical equipment, including stretchers, chairs, and ambulatory surgical centers for first aid treatment. All these factors are gaining momentum due to urbanization, and people seek more medical help for various reasons, including an unregulated working lifestyle. Furthermore, hospitals are developing rapidly in many urban and rural areas to provide accessibility to everyone with facilitating infrastructure, and policies are likely to increase the demand for medical furniture and, thus, drive the market on a global scale.

Restraint: Rising preference for reconstructed products

Reconstructed or refurbished products are setting new trends in the market. Almost every business is adopting these products due to the convenience they provide with a low budget. Similarly, refurbished products are used in the healthcare market also owing to their higher demand and availability in the market. To meet the requirements of rising demand, many hospitals management tend to buy refurbished products, propelling manufacturers of refurbished products in the market. Such a practice of rental and reconstructed materials products can be a restraining factor to the growth of the medical furniture market.

Opportunity: Innovative designs of medical furniture

The medical furniture market is highly fragmented due to several domestic and international companies working in different areas of the market. Still, many marketers are creating opportunities for developing innovative medical products that ease the efforts of professionals and patients' treatment.

For instance, in August 2022, the intelligent connected bed was introduced by two foremost leaders of the medical furniture market in India, doze and MidMark .pvt. Ltd collaboratively launched a connected bed platform to integrate and collect patient monitoring systems in NON-ICU hospital beds. The bed can monitor crucial parameters such as heart rate, oxygen saturation, temperature, and blood pressure with respiratory functionalities in the human system.

Many companies launch such innovative products in the market to strengthen their hold by manufacturing the required furniture for hospitals and clinics. Such efforts by marketers will create vast opportunities to grow the market further with a higher expansion rate.

Segments Insights:

Material Insights

Metal remains the dominant material in the medical furniture market, due to its structural strength, corrosion resistance, and high load-bearing capacity. Most hospital beds, stretchers, trolleys, and diagnostic tables are made with powder-coated steel or aluminum alloys to ensure longevity and compliance with hygiene protocols. Metal components also support integration with electrical and hydraulic mechanisms for height, tilt, and recline adjustments, particularly in critical care settings like ICUs and operation theaters.

Hospitals and large clinics prefer metal furniture because of its durability and ability to withstand rigorous cleaning and disinfection cycles. Stainless steel, in particular, is used for surgical tables, overbed tables, and utility trolleys due to its chemical resistance and ease of sterilization.

Plastic is the fastest-growing material segment, gaining popularity for its lightweight nature, lower cost, and increasing eco-conscious innovations. Polycarbonate, polyethylene, and ABS plastics are used in chairs, trays, and modular cabinets, offering flexibility and portability. Advanced polymers with anti-microbial properties are being developed for use in high-traffic hospital areas.

As outpatient facilities, temporary clinics, and mobile health units expand—especially in emerging markets—plastic furniture is favored for being easier to transport, install, and maintain. Furthermore, the ability to mold plastics into ergonomic shapes has led to growth in patient chairs and pediatric furniture solutions.

Product Insights

Hospital beds dominate the medical furniture market, accounting for the largest revenue share across public and private healthcare facilities. Within this category, ICU beds, long-term care beds, and acute care beds represent significant segments, driven by increasing surgical procedures, aging populations, and chronic disease prevalence. Hospital beds have evolved from basic manual designs to motorized and smart beds equipped with sensors, pressure adjustment systems, and integrated alarms.

Smart beds, such as Stryker’s “ProCuity” or Hill-Rom’s “Centrella,” feature fall detection, bed exit monitoring, and remote control for head and leg positioning. Hospitals increasingly view high-tech beds as critical infrastructure for improving patient outcomes and nurse workflow efficiency, particularly in ICUs and post-op recovery rooms.

Trolleys are the fastest-growing product segment, as demand for mobility and modular storage rises across all hospital departments. Medical trolleys are essential in emergency rooms, surgical suites, labs, and wards to transport instruments, medications, and linens. The growth of emergency services, mobile vaccination units, and ambulatory surgery centers has fueled adoption of lightweight, customizable trolley systems with smart lock features.

Modern trolleys now come with color-coded drawers, RFID tracking, and ergonomic handles, streamlining clinical operations and reducing medical errors. As healthcare facilities aim to improve responsiveness and resource allocation, trolleys will continue to play a vital operational role.

End-use Insights

Hospitals are the largest end-use segment for medical furniture, serving as the primary site for acute, surgical, and critical care. In hospitals, specialized furniture is essential for patient accommodation, diagnostics, and recovery. High patient turnover, stringent hygiene requirements, and multidisciplinary care models make hospitals the biggest buyers of durable, adaptable, and tech-enabled furniture.

Most multi-specialty and government hospitals procure medical furniture in bulk through public tenders or long-term contracts, offering opportunities for both global and regional suppliers. Tertiary care and teaching hospitals are also testing next-gen designs for patient experience and infection control compliance.

Homecare settings are the fastest-growing end-use market, fueled by a global shift toward decentralized care, post-acute recovery at home, and the rise of eldercare services. Home-use products must be compact, user-friendly, and blend aesthetically with residential décor, unlike the institutional look of traditional medical furniture.

Furniture such as height-adjustable recliners, commode chairs, and bedside cabinets with medication drawers are gaining popularity among elderly patients and chronic disease sufferers. The COVID-19 pandemic has accelerated this trend, making home-based care a long-term component of healthcare delivery models across the globe.

Regional Analysis

North America leads the global medical furniture market, owing to its advanced healthcare infrastructure, high hospital density, and early adoption of smart technologies. The U.S. and Canada are home to some of the world’s leading hospital chains and medical device companies that prioritize safety, ergonomic design, and technological integration.

The region benefits from high healthcare expenditure, government-funded programs like Medicare and Medicaid, and active procurement of next-gen ICU furniture. Innovations in bariatric beds, caregiver-assist chairs, and mobile diagnostic stations have emerged from North American research and manufacturing centers. Demand from both public and private healthcare providers remains strong due to regulatory pressure for improved patient safety and comfort.

Asia-Pacific is the fastest-growing region, driven by large-scale healthcare development programs, population growth, and rapid urbanization. Countries such as China, India, Indonesia, and Vietnam are witnessing massive expansions in hospital capacity, often under government-backed schemes aimed at achieving universal health coverage.

Private healthcare groups in India and Southeast Asia are increasingly investing in premium hospital designs, featuring state-of-the-art furniture to attract medical tourism and high-end clientele. Meanwhile, local manufacturing capabilities are improving, leading to cost-effective product offerings for mid-tier facilities.

With increased focus on rural healthcare access, mobile units and modular clinics are emerging, pushing demand for foldable, easy-to-deploy medical furniture across urban and semi-urban zones.

Recent Developments

-

April 2025 – Hill-Rom Holdings (now part of Baxter International) launched its next-gen ICU bed with integrated remote monitoring and voice command features for high-acuity environments.

-

February 2025 – Stryker Corporation introduced lightweight modular stretchers targeted at emergency medical services in developing countries, combining affordability with performance.

-

November 2024 – Invacare Corporation expanded its homecare product line in Europe with a new range of motorized recliner chairs and home hospital beds, aimed at elderly care markets.

-

September 2024 – Medline Industries opened a new manufacturing facility in Malaysia to boost production of metal-based hospital cabinets and trolleys for Southeast Asia.

-

June 2024 – Paramount Bed Co., Ltd. unveiled a new line of anti-microbial pediatric beds with interactive entertainment modules to improve pediatric care experience.

Some of the prominent players in the medical furniture market include:

- Biomedical Solutions

- Getinge

- GPC Medical Limited

- Herman Miller

- Hill-Rom Holdings

- Invacare Corporation

- J&J Medical Specialties LLC

- Kovonax

- LINET

- Met-Lak

- Promotal

- Skytron

- STERIS Corporation

- Stiegelmeyer

- Stryker Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global medical furniture market.

By Material

- Metal

- Wood

- Plastic

- Others

By Product

-

- Acute Care Beds

- Long Term Care Beds

- ICU Beds

- Others

- Chairs

- Tables

- Stretchers

- Trolleys

- Cabinet and Lockers

- Others

By End-use

- Ambulatory Surgical Centres

- Hospitals

- Homecare Settings

- Others

By Sector

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)