Medical Imaging Phantoms Market Size and Research

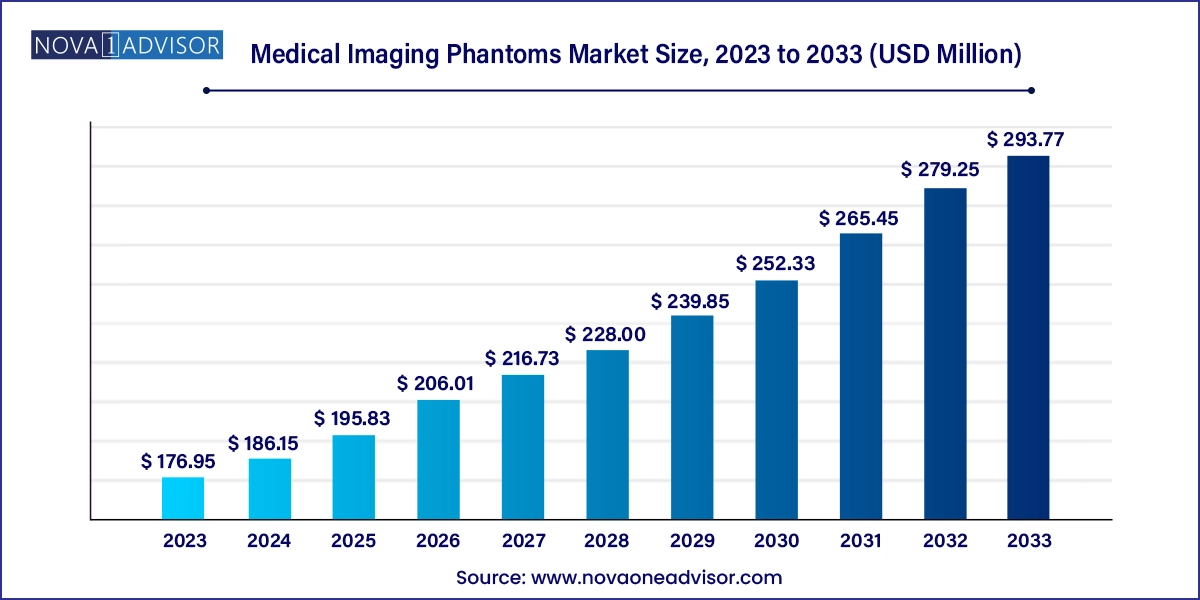

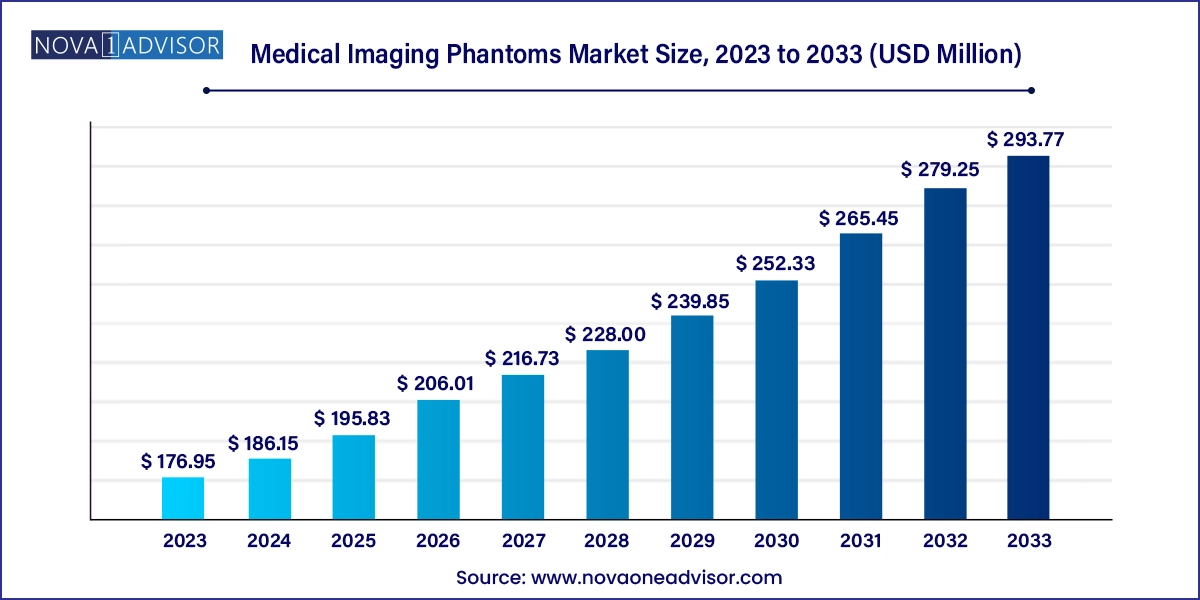

The global medical imaging phantoms market size was exhibited at USD 176.95 million in 2023 and is projected to hit around USD 293.77 million by 2033, growing at a CAGR of 5.2% during the forecast period 2024 to 2033.

Medical Imaging Phantoms Market Key Takeaways:

- Based on device type, the medical imaging phantom market has been segmented into ultrasound, X-ray, CT, nuclear imaging, MRI, and others.

- Based on material, the market has been segmented into simulating devices and false organs.

- The false organs segment is expected to witness a moderate growth rate over the forecast period.

- Hospitals held the largest market share in 2023, and the segment is estimated to grow at a significant rate during the forecast period

- North America held the largest share in the global market in 2023.

- Asia Pacific is expected to witness the fastest growth rate during the forecast period.

Market Overview

The global medical imaging phantoms market is a vital component of the broader medical imaging landscape, playing a critical role in equipment calibration, quality assurance, training, and system testing. Medical imaging phantoms are artificial objects that simulate human tissues and organs, allowing practitioners and researchers to test the accuracy, sensitivity, and reliability of diagnostic imaging devices such as MRI, CT, ultrasound, X-ray, and nuclear imaging systems.

The demand for phantoms is directly tied to the rise in diagnostic imaging procedures worldwide. According to industry estimates, billions of imaging tests are conducted annually to detect, diagnose, and monitor a wide array of health conditions ranging from cancer and cardiovascular disorders to neurological diseases. Each of these procedures depends on the precision of imaging equipment an aspect where phantoms play a foundational role.

Further, the market has witnessed a significant boost due to the technological evolution of imaging modalities. Advanced modalities like functional MRI, dual-energy CT, and hybrid PET/MRI scanners necessitate more sophisticated phantoms that can replicate complex physiological functions. As a result, manufacturers are innovating materials and designs to meet increasingly specific testing requirements. For instance, phantoms are now developed with tissue-mimicking properties that can replicate various densities, elasticities, and perfusion characteristics, enabling more realistic simulations.

Moreover, increased emphasis on radiation safety and standardized imaging practices in both clinical and academic environments is fostering the integration of phantoms across hospital radiology departments, diagnostic labs, and research institutions. The proliferation of imaging in minimally invasive and image-guided surgeries has also expanded phantom applications, creating a broader demand base across the medical value chain.

Major Trends in the Market

-

Growth of Hybrid Imaging Technologies: The increasing use of combined imaging systems like PET-CT and PET-MRI is fueling demand for versatile phantoms compatible with multiple modalities.

-

Customization of Phantoms: A growing preference for patient-specific and disease-specific phantom designs tailored to research or educational needs is shaping the market.

-

Incorporation of AI and 3D Printing: The integration of artificial intelligence and 3D printing in phantom manufacturing is enabling more anatomically accurate and functionally complex models.

-

Simulation-Based Medical Training: Medical schools and hospitals are leveraging phantoms for hands-on training and skill assessment in imaging techniques, improving patient safety.

-

Rising Demand from Emerging Markets: Emerging economies are expanding their diagnostic imaging infrastructure, driving phantom adoption to ensure equipment accuracy and regulatory compliance.

-

Sustainable and Reusable Phantom Materials: Innovation in eco-friendly, long-lasting phantom materials is gaining traction as healthcare facilities seek cost-effective solutions.

-

Focus on Regulatory Calibration Standards: Stricter imaging accreditation and QA regulations in regions like North America and Europe are boosting demand for high-precision calibration phantoms.

Report Scope of Medical Imaging Phantoms Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 186.15 Million |

| Market Size by 2033 |

USD 293.77 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 5.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Device Type, End-use, Material, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled |

Biodex Medical Systems, Inc.; Gold Standard Phantoms; Pure Imaging Phantoms; Modus Medical Devices Inc.; True Phantom Solutions; Computerized Imaging Reference Systems, Inc.; Carville Limited; PTW Freiburg GmbH; Dielectric Corporation; Quart GmbH; Leeds Test Objects Ltd; Kyoto Kagaku Co. Ltd; PhantomX |

Key Market Driver: Surge in Diagnostic Imaging Volume Globally

One of the most prominent drivers of the medical imaging phantoms market is the exponential rise in diagnostic imaging procedures across the globe. From mammography to advanced neuroimaging, medical imaging is becoming a first-line approach for both acute and chronic conditions. The World Health Organization (WHO) has reported a substantial rise in imaging infrastructure investment, especially in middle-income countries, to cater to their growing healthcare needs.

As imaging volumes increase, so does the emphasis on maintaining the precision and functionality of diagnostic equipment. This growing reliance on imaging naturally requires rigorous, frequent equipment validation, where phantoms are indispensable. Hospitals, for example, need to periodically verify that their CT machines deliver the correct Hounsfield Unit values or that MRI scanners can maintain image homogeneity across a specified field of view. This makes phantoms an essential part of imaging QA protocols, not only ensuring patient safety but also extending the lifecycle of costly equipment.

Key Market Restraint: High Cost of Advanced Phantoms

While phantoms are essential in diagnostic accuracy and safety, their high cost remains a notable restraint, particularly for smaller healthcare and academic institutions. Phantoms that simulate multiple organs, incorporate moving parts (like heartbeats or respiratory motion), or are compatible with high-end hybrid modalities can be prohibitively expensive. This is especially true for phantoms that require custom design or are made with sophisticated tissue-equivalent materials.

Smaller diagnostic labs or rural hospitals may find it challenging to justify investment in high-end phantoms, especially if imaging volumes are low or if their budgets are constrained. Even when leasing or collaborative sharing options exist, the cost of maintaining, updating, or replacing worn-out phantom models can hinder widespread adoption, particularly in developing economies or publicly funded institutions.

Key Opportunity: 3D-Printed and AI-Optimized Phantoms

The advent of 3D printing and artificial intelligence in phantom design and manufacturing presents a powerful opportunity to revolutionize the market. 3D printing enables the creation of anatomically accurate and patient-specific phantoms at relatively lower costs compared to traditional manufacturing methods. Research institutions and medical device firms are already exploring 3D-printed organ models to replicate unique patient pathologies for preoperative planning and equipment testing.

AI is further contributing by enabling the optimization of phantom material selection, structure design, and predictive performance under different imaging conditions. For example, machine learning algorithms can simulate and predict how different materials will appear on MRI or CT scans, helping manufacturers tailor phantom properties accordingly. This synergy not only enhances imaging realism but also opens up new commercial applications in radiomics, dosimetry, and personalized medicine.

Medical Imaging Phantoms Market By Device Type Insights

CT phantoms dominated the device type segment owing to their essential role in routine clinical QA and dose verification. Computed tomography is one of the most widely used diagnostic tools globally, employed in oncology, cardiology, trauma, and general imaging. CT phantoms are extensively used to evaluate parameters such as contrast resolution, noise, beam alignment, and dose distribution. A common example is the ACR CT accreditation phantom, which includes modules to assess geometric accuracy and low-contrast detectability—key performance indicators for clinical utility.

On the other hand, MRI phantoms are expected to grow at the fastest rate due to the growing adoption of MRI technology, particularly in neurology and musculoskeletal imaging. As MRI systems evolve into high-field (3T and above) and even ultra-high-field platforms (7T), there’s a greater need for phantoms that can withstand magnetic fields and accurately replicate tissue relaxation times. MRI-specific phantoms also enable functional MRI testing, cardiac motion simulation, and even diffusion imaging calibration, expanding their relevance in both clinical and research domains.

Medical Imaging Phantoms Market By Material Insights

Simulating devices dominate the materials segment, given their utility in general imaging equipment testing. These phantoms mimic human tissue properties like density, attenuation, and acoustic impedance to allow for precise calibration and system benchmarking. For instance, in ultrasound applications, phantoms with varying elasticity levels are used to train sonographers in identifying tumors or cysts of different stiffness—critical in breast and liver imaging.

False organs are expected to be the fastest-growing material type, driven by the demand for anatomically accurate models in surgical planning and interventional radiology training. These phantoms go beyond simple simulation, incorporating features such as vascular channels, respiratory motion, and even lesion insertion points to mimic real physiological scenarios. A neurosurgical phantom replicating brain vasculature can assist in guiding catheters during simulated aneurysm clipping procedures, significantly enhancing surgical preparedness.

Medical Imaging Phantoms Market By End-use Insights

Hospitals represent the largest end-user segment, accounting for a substantial share of phantom utilization due to the high volume of imaging procedures conducted daily. In high-throughput radiology departments, phantoms are regularly used for machine calibration, accreditation compliance, and operator training. They play a pivotal role in quality control protocols and contribute to reducing patient radiation exposure by ensuring that machines perform optimally.

Academic and research institutes are emerging as the fastest-growing segment, propelled by increased funding in medical imaging R&D. Universities and medical colleges use phantoms for student training, device prototyping, and simulation-based learning. Furthermore, research institutes involved in imaging software development and AI-based diagnostics depend heavily on high-quality phantoms to test algorithm accuracy and variability. These phantoms allow researchers to simulate disease conditions without ethical concerns tied to live patient data, thereby accelerating experimental timelines.

Medical Imaging Phantoms Market By Regional Insights

North America continues to dominate the medical imaging phantoms market, primarily due to its well-established healthcare infrastructure, strong regulatory oversight, and the presence of leading medical imaging equipment manufacturers and phantom producers. The U.S. has rigorous imaging accreditation programs such as the ACR (American College of Radiology) and the Joint Commission, which mandate the periodic use of phantoms for equipment validation. Institutions like the Mayo Clinic and Johns Hopkins use phantoms not only for diagnostic accuracy but also in clinical research, including AI model development and image-guided therapy trials.

Asia Pacific is anticipated to be the fastest-growing regional market, owing to significant healthcare investments, medical tourism growth, and rising imaging equipment installation across countries like China, India, South Korea, and Japan. Government initiatives aimed at enhancing diagnostic accessibility and the increasing presence of local medical device manufacturers are boosting the demand for cost-effective phantom solutions. Moreover, Asia Pacific’s vibrant research environment, particularly in Japan and South Korea, is propelling innovation in phantom design and simulation technologies.

Medical Imaging Phantoms Market Recent Developments

-

CIRS Inc. (February 2025) unveiled a new line of MRI-compatible phantoms designed specifically for 7T imaging applications, enhancing research capabilities in neuroimaging.

-

Modus Medical Devices (January 2025) partnered with a Canadian university to develop 3D-printed anthropomorphic phantoms for radiotherapy quality assurance.

-

PhantomX (December 2024) announced a collaboration with a European imaging AI company to create algorithm validation phantoms tailored to specific disease pathologies.

-

Sun Nuclear Corporation (October 2024) introduced its next-gen CT QA phantom, compatible with AI-driven analytics platforms for automated performance monitoring.

-

Kyoto Kagaku (September 2024) expanded its line of ultrasound training phantoms with new breast and liver models incorporating embedded lesions for advanced detection training.

Some of the prominent players in the global medical imaging phantoms market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global medical imaging phantoms market

Device Type

- X-ray

- Ultrasound

- CT

- MRI

- Nuclear imaging

- Others

End-use

- Hospitals

- Academic and Research Institutes

- Diagnostic and Reference Laboratories

- Medical Device Companies

Material

-

- X-ray

- Ultrasound

- CT

- MRI

- Nuclear imaging

- Others

-

- X-ray

- Ultrasound

- CT

- MRI

- Nuclear imaging

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa