Mobile Marketing Market Size and Trends

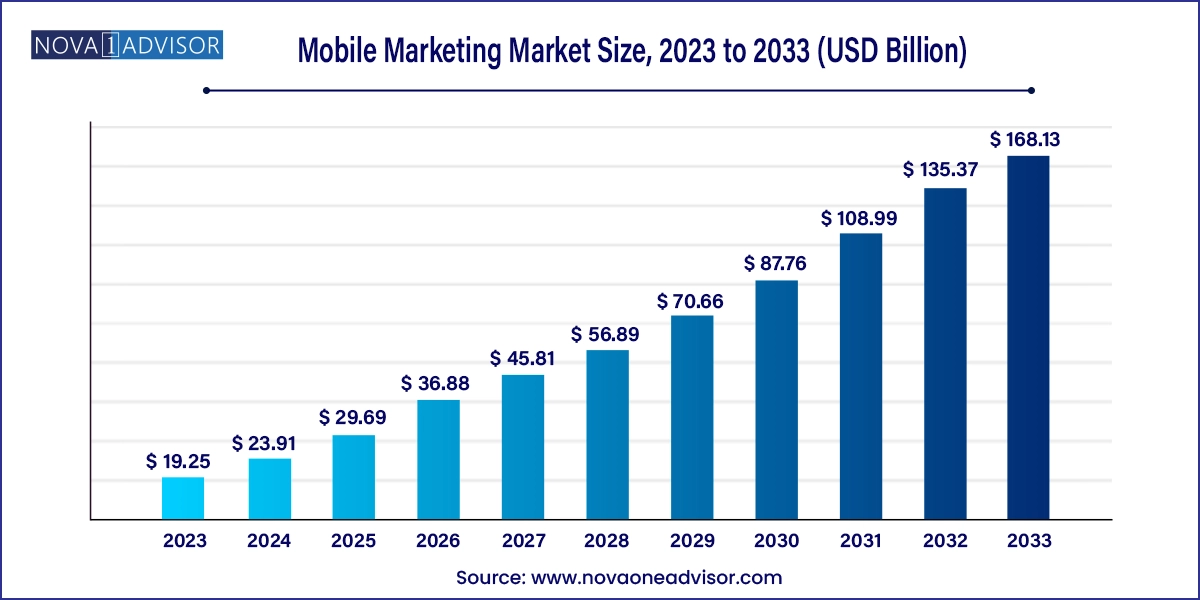

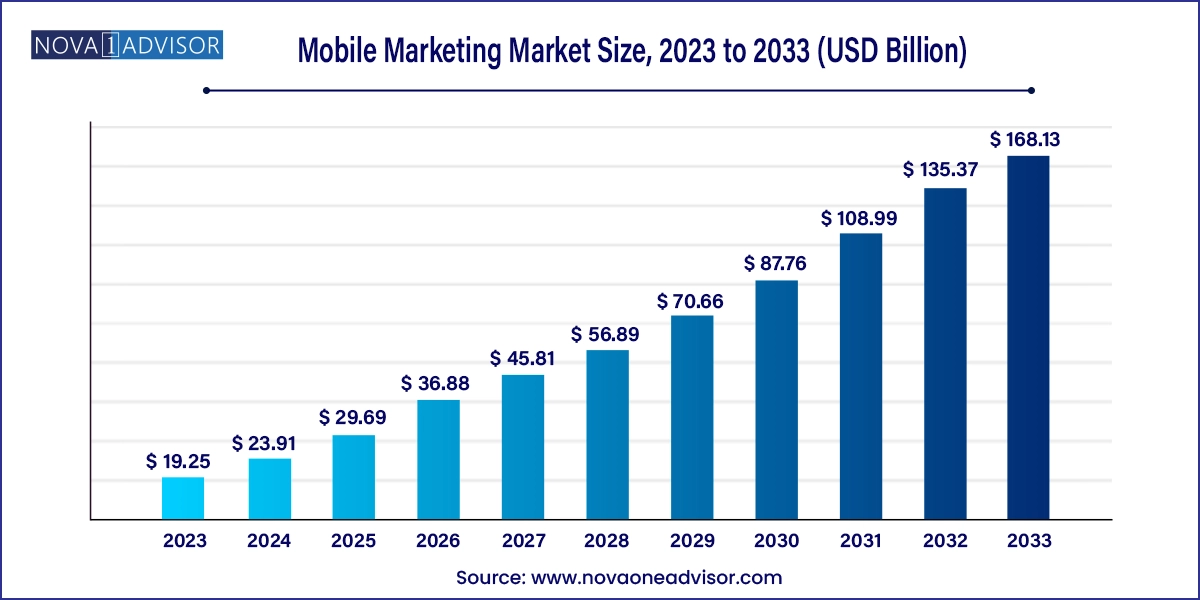

The global mobile marketing market size was exhibited at USD 19.25 billion in 2023 and is projected to hit around USD 168.13 billion by 2033, growing at a CAGR of 24.2% during the forecast period 2024 to 2033.

Mobile Marketing Market Key Takeaways:

- The platform segment dominated the market and accounted for largest market share of 67.9% in 2023.

- The services segment is expected to register the fastest CAGR during the forecast period.

- Mobile web channel dominated the market and accounted for largest revenue share in 2023.

- QR Codes channel is expected to register the fastest CAGR during the forecast period.

- Large enterprises accounted for the largest revenue share of in 2023.

- Small & medium enterprises are expected to register the fastest CAGR during the forecast period.

- The retail segment dominated the market in 2023.

- The media and entertainment sector is projected to grow at a significant CAGR of over the forecast period.

- North America mobile marketing market dominated the global market with a revenue share of 36.5% in 2023.

Market Overview

The global mobile marketing market has evolved into one of the most critical arms of the digital marketing landscape, driven by the surging penetration of smartphones, growing internet accessibility, and shifting consumer behaviors toward mobile-first interactions. With billions of active mobile devices worldwide, marketers have gained unprecedented access to potential customers, allowing for personalized, real-time, and location-based engagement strategies.

Mobile marketing involves using mobile devices such as smartphones and tablets to deliver promotional content, advertisements, and value-added services to users. Channels such as SMS, in-app messages, push notifications, QR codes, and mobile web platforms are integrated to deliver timely and relevant messages. Businesses are capitalizing on these mobile touchpoints to capture attention, nurture leads, and drive conversions. With mobile devices now central to consumer experiences—spanning communication, commerce, entertainment, and productivity—mobile marketing offers an unparalleled medium for marketers to connect directly with their audiences.

Moreover, technological advancements such as AI-driven analytics, geofencing, and real-time campaign optimization are enhancing the effectiveness and ROI of mobile marketing. As a result, companies of all sizes are allocating a significant portion of their advertising budgets to mobile channels, making it one of the fastest-growing segments in the digital advertising ecosystem.

Major Trends in the Market

-

Personalization through AI and Machine Learning

AI algorithms are enabling hyper-personalized mobile campaigns by analyzing real-time user behavior, purchase history, and preferences.

-

Rise of Location-Based Marketing (LBM)

Businesses, particularly retailers and restaurants, are leveraging geofencing and beacon technologies to send location-specific promotions and alerts.

-

Increased Adoption of Rich Media Formats

With higher smartphone processing power and bandwidth, marketers are using rich media formats like video, carousel ads, and interactive content.

-

Growth of In-App Advertising

Mobile apps have become prime real estate for marketers as users spend significant screen time within apps, encouraging more brands to advertise through SDK integrations.

-

Focus on Privacy and Consent-Based Marketing

With global data protection regulations (GDPR, CCPA), marketers are adapting to consent-driven strategies and privacy-centric mobile ad delivery mechanisms.

-

Integration of Mobile Wallet Marketing

Digital wallet platforms like Apple Pay, Google Pay, and Samsung Pay are now marketing platforms in themselves—enabling offers, loyalty programs, and push notifications.

-

Proliferation of 5G Connectivity

5G rollout is expected to boost real-time and immersive ad formats like AR/VR-powered mobile campaigns by minimizing latency and enhancing data speeds.

Report Scope of Mobile Marketing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 23.91 Billion |

| Market Size by 2033 |

USD 168.13 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 24.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Component, Channel, Enterprise Size, End Use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Amobee, Inc.; Chartboost, Inc.; Flurry.; Google Inc.; IBM Corporation; InMobi; Marketo; AppSamurai; Oracle; Salesforce, Inc.; SAS Institute Inc. |

Market Driver: Surging Smartphone Penetration and Mobile Internet Usage

One of the strongest drivers propelling the mobile marketing market is the exponential rise in global smartphone adoption, coupled with improved mobile internet infrastructure. As of 2025, over 7 billion smartphones are estimated to be in use globally, and the number continues to climb due to affordability, better network coverage, and increasing digital literacy. This extensive mobile base offers marketers a direct line to consumers across age groups, geographies, and economic strata.

Moreover, the mobile-first behavior, particularly in emerging economies like India, Brazil, and Indonesia, has fundamentally shifted marketing priorities. Users in these regions rely more on mobile devices than desktops for accessing e-commerce, streaming, social media, and financial services. For example, Indian startups heavily use mobile push notifications and app-based ads to gain traction among digitally native audiences. Mobile marketing offers unparalleled targeting capabilities—such as behavioral, contextual, and location-based targeting—making it more effective than traditional or desktop-based campaigns. These dynamics make mobile marketing a strategic necessity for both B2C and B2B brands.

Market Restraint: Data Privacy and Regulatory Compliance Challenges

While mobile marketing offers personalized experiences, it often hinges on collecting and processing vast amounts of user data—raising serious privacy concerns. Increasing regulatory scrutiny around data usage is a major restraint impacting the growth and freedom of mobile marketing practices. Laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States mandate clear consent mechanisms, data transparency, and the right to opt out.

These regulations have introduced complexities in how brands collect data, store it, and use it for targeted marketing. Non-compliance can lead to hefty fines and reputational damage. Moreover, technology changes such as Apple’s App Tracking Transparency (ATT) framework which requires apps to seek explicit user permission for data tracking have significantly impacted the effectiveness of in-app advertising. Brands now need to strike a careful balance between personalization and privacy, often resulting in added operational and compliance costs.

Market Opportunity: Integration of AR and VR in Mobile Campaigns

An exciting opportunity lies in the integration of Augmented Reality (AR) and Virtual Reality (VR) technologies into mobile marketing. AR-powered campaigns allow users to engage with brands in immersive ways whether it’s trying out furniture in their living room using IKEA’s mobile app, or previewing makeup looks with L'Oréal’s AR mirror. Such experiences drive higher user engagement, brand recall, and purchase intent.

As smartphones become increasingly AR/VR-compatible and 5G networks minimize latency, brands are exploring gamified advertisements and experiential content to stand out in a saturated digital landscape. For example, PepsiCo launched an AR treasure hunt campaign during a sports event, enabling users to scan QR codes on beverage bottles and win merchandise. With Gen Z and millennial consumers demanding engaging and interactive content, AR/VR mobile experiences offer a fresh, scalable frontier for marketers looking to differentiate their brands.

Mobile Marketing Market By Component Insights

The platform segment dominated the mobile marketing market, owing to the widespread need for centralized solutions that manage campaign design, automation, data analytics, and multichannel distribution. Marketing platforms such as HubSpot, Salesforce Marketing Cloud, and Adobe Experience Manager empower businesses to create targeted mobile campaigns while ensuring cross-platform consistency. Enterprises, particularly large ones, prefer robust platforms that offer AI capabilities, real-time analytics, and CRM integration—enabling them to track ROI and optimize campaigns dynamically.

The services segment, however, is witnessing the fastest growth, particularly due to the increasing adoption of managed services and consulting by SMEs and non-tech-intensive industries. Many businesses are outsourcing campaign strategy, execution, and analytics to third-party mobile marketing service providers. Agencies offering mobile-first campaign design, app store optimization, SMS campaign execution, and customer journey mapping are in high demand. This trend is especially prominent in regions like Southeast Asia and Latin America, where in-house marketing capabilities may be limited but smartphone penetration is high.

Mobile Marketing Market By Channel Insights

Mobile web dominated the channel segment, driven by the broad accessibility of mobile browsers without the need for app downloads. Brands utilize responsive websites, display ads, and SEO-optimized landing pages to engage users, especially for discovery-stage interactions. Mobile web campaigns are cost-effective, easy to track, and suitable for high-traffic platforms like news portals, e-commerce, and forums.

Push notifications are the fastest growing channel, fueled by the rise of mobile apps and the desire for direct engagement. These notifications deliver time-sensitive messages, offers, and reminders that significantly enhance app stickiness and user retention. Retailers use geofenced push messages to alert users of discounts when near physical stores, while fintech apps send instant transaction alerts. The opt-in nature of push notifications also ensures higher engagement rates compared to passive formats.

Mobile Marketing Market By Enterprise Size Insights

Large enterprises hold the largest market share, owing to their substantial digital budgets and widespread adoption of omnichannel marketing platforms. These companies, particularly in BFSI, telecom, and retail, leverage mobile marketing to enhance customer experiences, personalize communication, and boost loyalty. For example, major banks use SMS OTPs, mobile ads, and app-based notifications to streamline financial services.

Small and medium enterprises (SMEs) are the fastest-growing segment, as affordable SaaS platforms and simplified marketing automation tools democratize access to mobile marketing. Many SMEs rely on plug-and-play tools like Mailchimp, MoEngage, or CleverTap to run localized campaigns on limited budgets. This growth is particularly strong in emerging markets where mobile commerce is the default channel for small businesses.

Mobile Marketing Market By End Use Insights

Retail is the leading end-use segment, due to the industry’s strong focus on customer acquisition and retention through promotions, loyalty programs, and personalized recommendations. Mobile marketing is widely used for app-only offers, digital wallets, and push-based flash sales. Brands like Amazon, Walmart, and Alibaba use location-based and behavioral data to drive conversions through app notifications and in-app banners.

Healthcare is emerging as the fastest-growing end-use sector, propelled by telemedicine, health-tracking apps, and remote patient engagement. Hospitals and clinics are using mobile SMS and apps to send appointment reminders, medicine refills, and health tips. During the COVID-19 pandemic, governments and private health providers extensively used mobile marketing for awareness campaigns, test bookings, and vaccination schedules—laying the groundwork for long-term digital healthcare engagement.

Mobile Marketing Market Regional Insights

North America continues to dominate the global mobile marketing market, driven by high smartphone penetration, mature digital infrastructure, and early adoption of cutting-edge marketing technologies. The U.S. accounts for a major share due to its large consumer base and digital-savvy population. Tech giants such as Google, Apple, and Meta are headquartered in the region, contributing to continuous innovation in mobile ad tech and consumer data analytics. Businesses across verticals, from automotive to finance, deploy sophisticated mobile campaigns with AI-powered personalization, multichannel orchestration, and real-time feedback loops. Regulatory developments like CCPA have also led to more responsible data usage, enhancing consumer trust in mobile communication.

Asia Pacific is the fastest-growing region, driven by an exploding smartphone user base, increasing mobile internet affordability, and rapid digital transformation. India, China, Indonesia, and Vietnam are at the forefront, where mobile-first behavior is the norm across all economic classes. Regional e-commerce platforms like Shopee, Flipkart, and Tokopedia rely heavily on mobile push notifications, SMS offers, and in-app gamification to drive sales. The growing startup ecosystem, coupled with mobile-first financial services and entertainment platforms, is creating fertile ground for mobile marketing. Additionally, governments across the region are pushing for digital literacy and financial inclusion, opening new audiences to mobile engagement strategies.

Mobile Marketing Market Recent Developments

-

In March 2025, Salesforce launched its upgraded Mobile Studio platform, featuring enhanced AI capabilities for predictive push notifications and location-based personalization, targeting retail and banking clients.

-

In February 2025, CleverTap announced a partnership with Gojek, a Southeast Asian super app, to deliver real-time in-app messages and behavioral analytics, aiming to boost user engagement across ride-hailing and food delivery services.

-

In January 2025, Airship acquired mobile wallet marketing startup Walletly, expanding its ability to offer digital loyalty cards and coupon campaigns integrated with Apple Wallet and Google Pay.

-

In December 2024, MoEngage raised $45 million in a funding round to scale its AI-powered mobile marketing suite across Europe and North America, highlighting investor confidence in customer engagement platforms.

Some of the prominent players in the global mobile marketing market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global mobile marketing market

Component

Channel

- Mobile Web

- SMS

- Location-Based Marketing

- In-App Messages

- Push Notifications

- QR Codes

- MMS

- Others

Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

End Use

- Retail

- Media & Entertainment

- Travel

- Automotive

- Healthcare

- IT & Telecom

- BFSI

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)