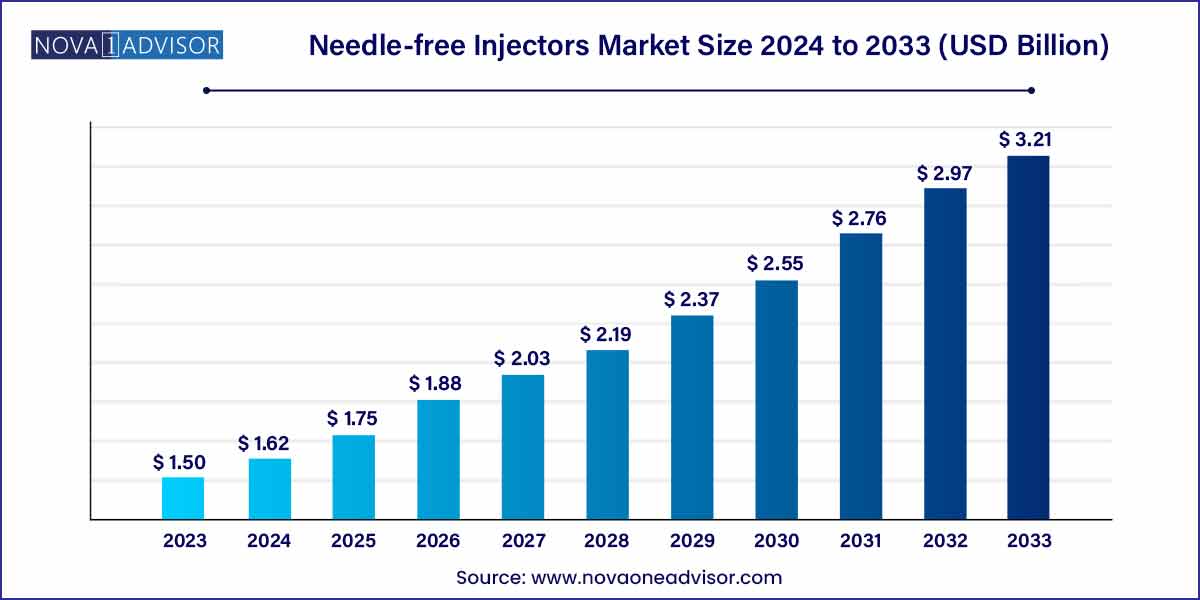

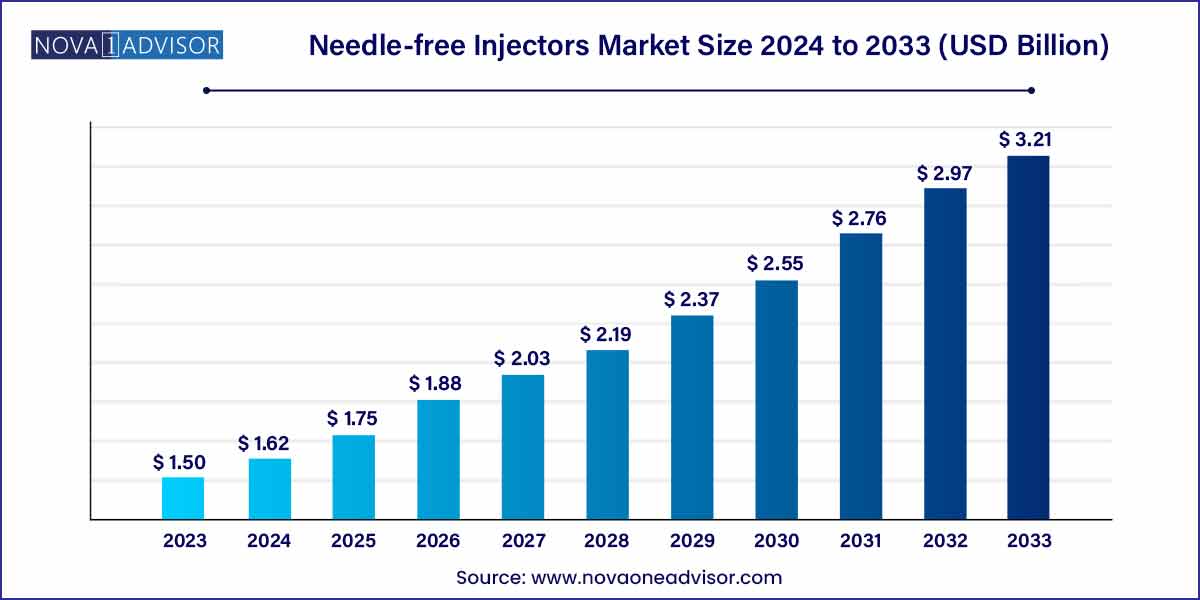

The global needle free-injectors market size was exhibited at USD 1.50 billion in 2023 and is projected to hit around USD 3.21 billion by 2033, growing at a CAGR of 7.9% during the forecast period of 2024–2033.

Key Takeaways:

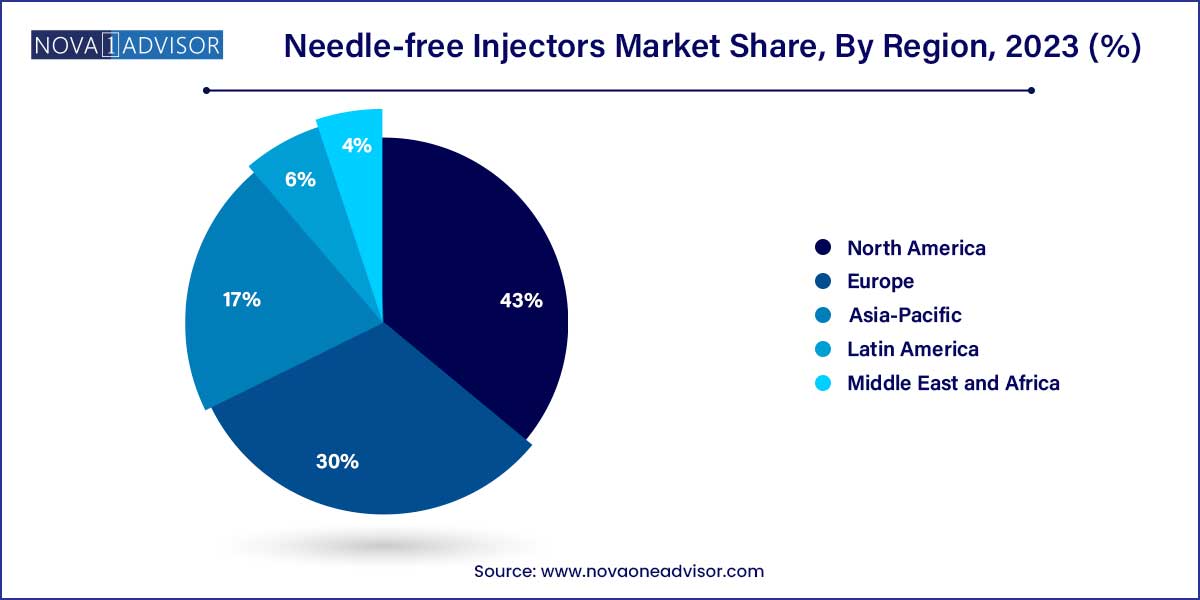

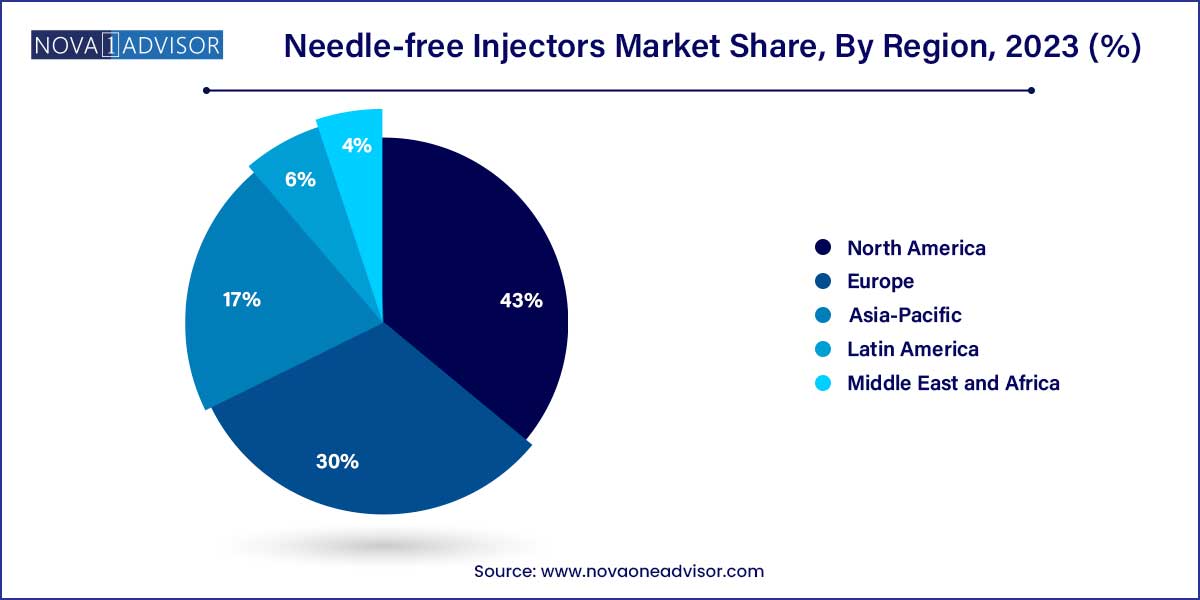

- North America is anticipated to dominate the market at 43.0% in 2023

- The reusable segment dominated the needle-free injectors market and accounted for a significant revenue share in 2021.

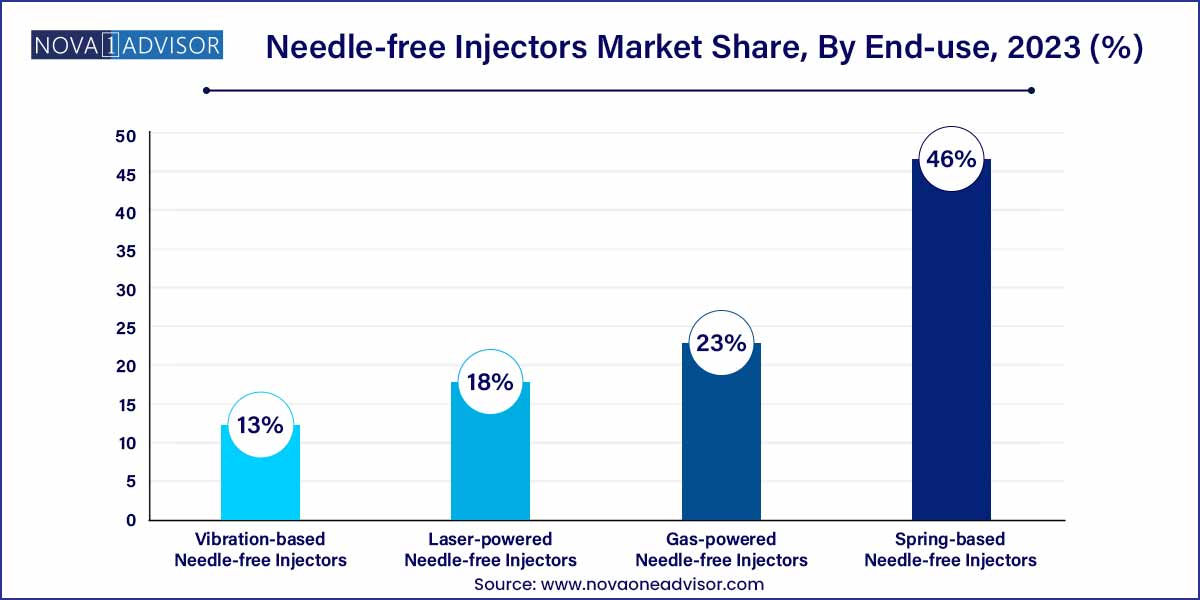

- The gas powered needle-free injectors segment held the largest revenue share in 2023.

- The subcutaneous segment held the largest market share in 2023.

- The hospitals segment captured the largest revenue share of in 2023.

Market Overview

The global needle-free injectors (NFI) market is transforming the landscape of drug delivery by offering a less invasive, safer, and more patient-friendly alternative to traditional hypodermic needles. Needle-free injectors deliver medications and vaccines through the skin using high-pressure technology, eliminating the need for needles. Originally developed to address needle-phobia and reduce risks associated with needle-stick injuries, these systems are now gaining traction across multiple healthcare applications, including vaccination, insulin delivery, hormone therapy, and pain management.

The rise in chronic disease prevalence—particularly diabetes—alongside mass immunization efforts against infectious diseases like COVID-19, has significantly bolstered the adoption of needle-free injectors. These devices are increasingly being deployed in both developed and emerging healthcare systems, owing to their ease of use, cost-effectiveness over time, and potential for self-administration. Additionally, needle-free systems minimize the risk of cross-contamination and enable safer waste disposal due to the absence of sharps.

Technological advancements in NFI design such as prefilled cartridges, precise dosing, and improved penetration mechanisms have widened their scope of application across various end-users, including hospitals, homecare settings, and research laboratories. With increasing global health awareness, improved regulatory approvals, and strong investments in biotechnology, the needle-free injectors market is poised for robust growth in the years ahead.

Major Trends in the Market

-

Increased Focus on Painless Drug Delivery: Patient preference is shifting towards pain-free and anxiety-reducing delivery systems, especially in pediatric and geriatric populations.

-

Growth of Home-based Care Models: NFIs are increasingly used in home settings for chronic disease management, empowering patients with self-administration tools.

-

Technological Integration in Injectors: Incorporation of laser and vibration-based technologies is enhancing precision, comfort, and efficacy of drug delivery.

-

Customization for Specific Drugs: Pharmaceutical companies are collaborating with device manufacturers to design drug-specific injectors for vaccines, biologics, and hormones.

-

Government-driven Mass Immunization Programs: Rising demand for safe, sharpless delivery systems is being supported by public health vaccination drives, especially in resource-limited regions.

-

Eco-friendly and Sustainable Solutions: Manufacturers are exploring biodegradable materials and reusable injectors to address environmental and economic concerns.

-

Rise of Wearable and Smart Injectors: Next-gen injectors integrated with sensors and connectivity features are enabling real-time dosage tracking and patient monitoring.

Needle-free Injectors Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.50 Billion |

| Market Size by 2033 |

USD 3.21 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Technology, Usability, Type, Application, Delivery Site, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

PharmaJet; Crossject; Portal Instruments; NuGen Medical Devices; Inovio Pharmaceuticals; Antares Pharma, Inc; Aijex Pharma International Inc.; Ferring B.V.; Penjet Corporation; Medical International Technology Inc. |

Market Driver: Rising Prevalence of Chronic Diseases Requiring Long-term Drug Administration

A major catalyst driving the needle-free injectors market is the increasing prevalence of chronic conditions such as diabetes, rheumatoid arthritis, and multiple sclerosis, all of which require long-term medication adherence. For instance, diabetes—affecting over 540 million adults globally—demands regular insulin administration, traditionally delivered via subcutaneous injection. However, needle phobia, which affects roughly 25% of adults, often results in skipped doses and poor treatment adherence.

Needle-free injectors address this challenge by delivering insulin and other medications painlessly and without the need for traditional needles. This is especially valuable in pediatric and elderly populations where comfort and compliance are critical. Companies like InsuJet and PharmaJet have developed NFI solutions specifically for insulin delivery, significantly improving patient autonomy and adherence rates. This driver is reinforced by the rise in self-administered care and the growing emphasis on preventive health management.

Market Restraint: High Initial Costs and Limited Access in Low-resource Settings

Despite their long-term advantages, the high upfront cost of needle-free injectors remains a significant restraint to widespread adoption, particularly in low-income regions. While disposable syringes are cheap and widely available, NFI devices involve complex mechanisms, higher manufacturing costs, and specialized components. Prefilled and reusable injectors often come at premium prices, limiting their reach in public healthcare systems with constrained budgets.

Additionally, the infrastructure required for maintenance, storage, and training in the use of these devices is not uniformly available, especially in rural clinics or underfunded hospitals. In markets like Sub-Saharan Africa or Southeast Asia, this cost barrier may hinder adoption, even where the need for safe, non-invasive drug delivery is high. Bridging this cost gap through government subsidies, insurance reimbursements, or philanthropic initiatives is critical to unlocking the market’s full potential.

Market Opportunity: Mass Vaccination and Pandemic Preparedness

A defining opportunity for the needle-free injectors market lies in global vaccination initiatives and pandemic preparedness. The COVID-19 pandemic exposed critical limitations in healthcare infrastructure, including the dependency on cold chains, trained personnel, and needle-based delivery methods. NFIs emerged as efficient alternatives capable of simplifying logistics, improving safety, and enabling rapid deployment in mass immunization campaigns.

The continued threat of infectious disease outbreaks ranging from influenza and monkeypox to future pandemics—necessitates scalable, safe, and efficient drug delivery systems. Needle-free injectors reduce the burden on healthcare systems by minimizing needlestick injuries, enhancing compliance, and streamlining distribution in high-density or resource-limited areas. Partnerships with organizations like WHO, UNICEF, and GAVI could pave the way for large-scale adoption of NFIs in future global health responses.

Segments Insights:

Product Insights

Prefilled needle-free injectors dominated the market due to their user-friendly design, consistent dosing, and reduced risk of contamination. These devices come preloaded with medication, eliminating the need for manual preparation and significantly simplifying administration in both clinical and homecare settings. Their adoption has been particularly strong in vaccination campaigns and chronic disease management, where ease-of-use and dose accuracy are paramount.

Pharmaceutical companies are increasingly developing drug-device combinations that package biologics, vaccines, and hormones into prefilled formats, ensuring compatibility and extending shelf life. Examples include the PharmaJet Stratis injector used for influenza vaccines, which has been widely deployed in immunization campaigns due to its efficiency and safety. The prefilled segment is expected to continue leading as more medications are tailored for these formats.

The fillable injector segment is witnessing rapid growth, especially in research, specialized clinics, and developing regions where bulk vials are preferred for cost-efficiency. These injectors offer flexibility, allowing clinicians to use a single device for multiple formulations or dosages. They are also ideal for scenarios requiring on-site drug preparation, such as in military deployments, field hospitals, or mobile clinics.

Recent designs in fillable injectors emphasize reusability, modularity, and ease of sterilization. Although they demand trained personnel, their affordability and adaptability make them suitable for diverse medical environments. As demand rises for versatile delivery systems in global health emergencies, fillable injectors are becoming an increasingly attractive option.

Usability Insights

Disposable needle-free injectors held the largest market share due to their role in mass vaccination programs and outpatient drug administration. Designed for single-use, these devices eliminate concerns about sterilization, cross-contamination, and device malfunction. Their convenience and safety have made them a preferred option in large-scale public health initiatives and emergency healthcare services.

In the context of COVID-19 and influenza vaccination drives, disposable injectors like those from PharmaJet and Inovio played a critical role in simplifying logistics and improving patient safety. Their straightforward operation makes them ideal for use by minimally trained personnel, further enhancing their appeal in rural or resource-limited areas.

Reusable injectors are gaining popularity in long-term care scenarios, particularly for chronic diseases like diabetes and hormone therapy. These devices offer economic and environmental benefits by allowing multiple uses with proper sterilization and maintenance. They are typically paired with refillable cartridges or ampoules, offering flexibility for varied drug regimens.

Manufacturers are innovating with modular designs that support different drug types and dosing regimens, while maintaining durability and ease of cleaning. The rising demand for home-based care, combined with sustainability concerns, is driving growth in this segment.

Technology Insights

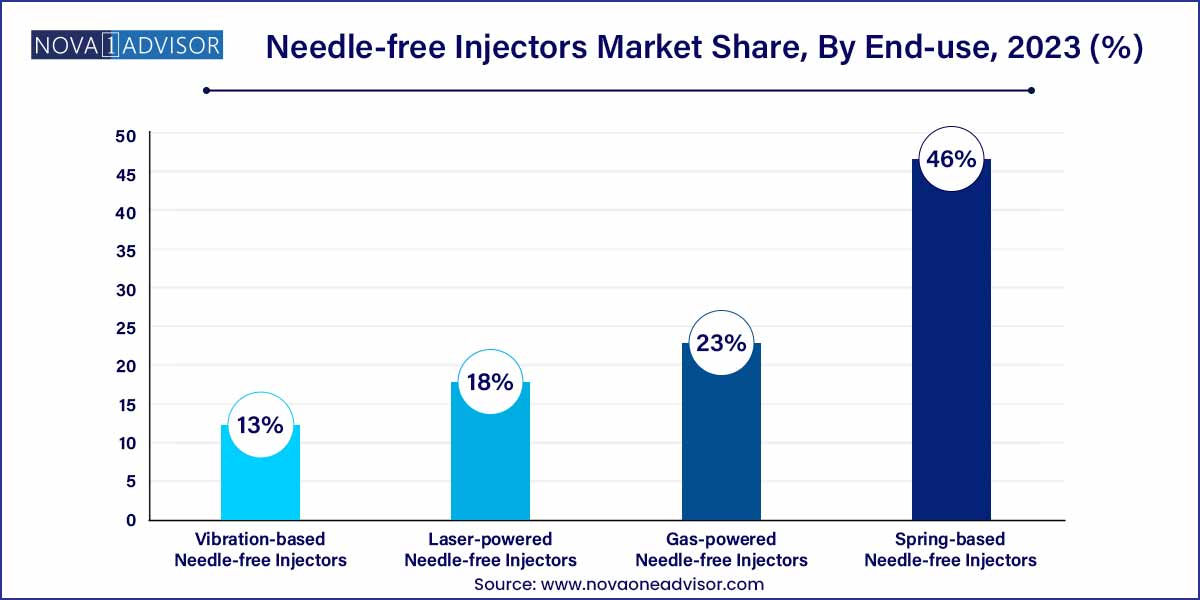

Spring-based needle-free injectors currently dominate the technology segment due to their simple mechanics, reliability, and cost-effectiveness. These devices use mechanical energy from a compressed spring to force medication through the skin at high velocity, enabling subcutaneous or intramuscular delivery without a needle. Their portability, reusability, and absence of batteries or gas cartridges make them ideal for resource-limited and emergency settings.

Companies like Zogenix and Crossject have developed spring-based systems compatible with a wide range of drugs. This technology also benefits from a favorable regulatory track record, making it easier for manufacturers to enter new markets. Spring-based devices are especially prevalent in mass immunization, military healthcare, and disaster response.

The laser-powered segment is the fastest-growing due to its emerging application in delivering precise doses of biologics and genetic therapies. These injectors use laser-generated micro-explosions or focused pulses to create controlled pressure bursts, propelling the drug through the skin. Their non-contact design reduces the risk of infection and allows highly targeted delivery into specific skin layers, such as intradermal zones.

This technology is being actively explored for next-generation vaccines, DNA-based drugs, and pediatric applications where skin sensitivity is a concern. While still in the early adoption phase, laser-powered injectors represent the future of high-precision, patient-centric drug delivery.

Type Insights

Liquid-based injectors dominate the type segment due to their compatibility with most modern drugs, including vaccines, insulin, and analgesics. These injectors deliver a concentrated stream of liquid through the dermis, mimicking traditional injections in efficacy while avoiding the discomfort of needles. The majority of commercially available needle-free systems, such as PharmaJet Tropis and InsuJet, utilize this delivery mechanism.

Their widespread use across immunization, diabetes care, and pain management highlights their reliability and adaptability. Additionally, liquid-based injectors align well with pharmaceutical industry standards, making them the preferred choice for drug-device integration.

Powder-based injectors are witnessing rapid growth, especially in vaccine R&D and the delivery of fragile biologic molecules that degrade in liquid form. These systems propel a dry drug powder into the skin or muscle using compressed air or electrostatic charge. The absence of liquid components enhances stability, shelf-life, and storage convenience—particularly valuable in global vaccination campaigns and military deployments.

Research collaborations involving DARPA, WHO, and leading biotech firms are exploring powder-based injectors for next-generation, room-temperature-stable vaccines against influenza and emerging zoonotic diseases. As biologics and genetic therapies grow in importance, powder injectors are set to become a critical segment.

Delivery Site Insights

Subcutaneous injection remains the dominant delivery site, particularly for insulin, vaccines, and hormone therapies. NFIs are well-suited for this route, offering consistent absorption and minimal discomfort. Most reusable systems are designed to accommodate this delivery site, making it suitable for daily or weekly self-administration.

Intradermal delivery is growing quickly due to its effectiveness in reducing vaccine doses while maintaining immunogenicity. Recent studies in COVID-19 and monkeypox vaccines demonstrated that intradermal administration can achieve comparable immune responses with smaller doses, enhancing vaccine equity in low-resource settings.

Application Insights

Vaccine delivery emerged as the dominant application area due to the global expansion of immunization campaigns targeting diseases like COVID-19, influenza, hepatitis, and HPV. Needle-free injectors have proven highly effective in large-scale vaccine programs, reducing the risk of needlestick injuries, increasing patient compliance, and simplifying training for healthcare workers.

For example, PharmaJet’s devices were used in WHO-backed polio immunization campaigns across Pakistan and Nigeria, demonstrating scalability and safety. With a global push toward pandemic preparedness, this segment will remain central to future healthcare initiatives.

Pain management is a fast-growing application, especially in vulnerable populations like the elderly and children. Needle-free systems are being adopted for delivering analgesics, anesthetics, and migraine medications without inducing additional pain or anxiety. Devices offering rapid absorption through intradermal or subcutaneous routes are gaining favor in emergency medicine and home care.

The demand is also growing in surgical recovery and chronic pain therapy, where consistent and non-invasive drug delivery can significantly enhance patient comfort and adherence.

End-use Insights

Hospitals and clinics lead in terms of end-use, leveraging NFIs for outpatient services, immunizations, and post-operative care. These settings ensure professional administration, especially for one-time or initial dosing.

Home care settings are experiencing the fastest growth as more patients manage chronic conditions like diabetes, growth disorders, and osteoporosis from home. NFIs enable painless, self-administered therapy, reducing hospital dependency and improving adherence.

Regional Insights

North America held the largest share due to early adoption of medical technologies, a strong pharmaceutical pipeline, and the high prevalence of chronic diseases. The U.S. market, in particular, is driven by insurance reimbursement, strong R&D activity, and the presence of major manufacturers. The FDA’s streamlined approval process for innovative injectors further supports market maturity.

Asia-Pacific is the fastest-growing region, propelled by mass vaccination efforts in countries like India, China, and Indonesia. The increasing burden of diabetes and government-led healthcare reforms are encouraging adoption of cost-effective, needle-free delivery methods. Strategic partnerships between global manufacturers and regional health agencies are accelerating growth in this region.

Some of the prominent players in the needle free-injectors market include:

- PharmaJet

- Crossject

- Portal Instruments

- NuGen Medical Devices

- Inovio Pharmaceuticals

- Antares Pharma, Inc

- Aijex Pharma International Inc.

- Ferring B.V.

- Penjet Corporation

- Medical International Technology Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global needle free-injectors market.

Product

Technology

- Spring-based Needle-free Injectors

- Gas-powered Needle-free Injectors

- Laser-powered Needle-free Injectors

- Vibration-based Needle-free Injectors

Usability

Type

- Powder-based Needle Free Injectors

- Liquid-based Needle Free Injectors

- Projectile/depot-based Needle Free Injectors

Application

- Vaccine Delivery

- Insulin Delivery

- Pain Management

- Others

Delivery Site

- Subcutaneous

- Intramuscular

- Intradermal

End-use

- Hospitals & Clinics

- Home Care Settings

- Research Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)