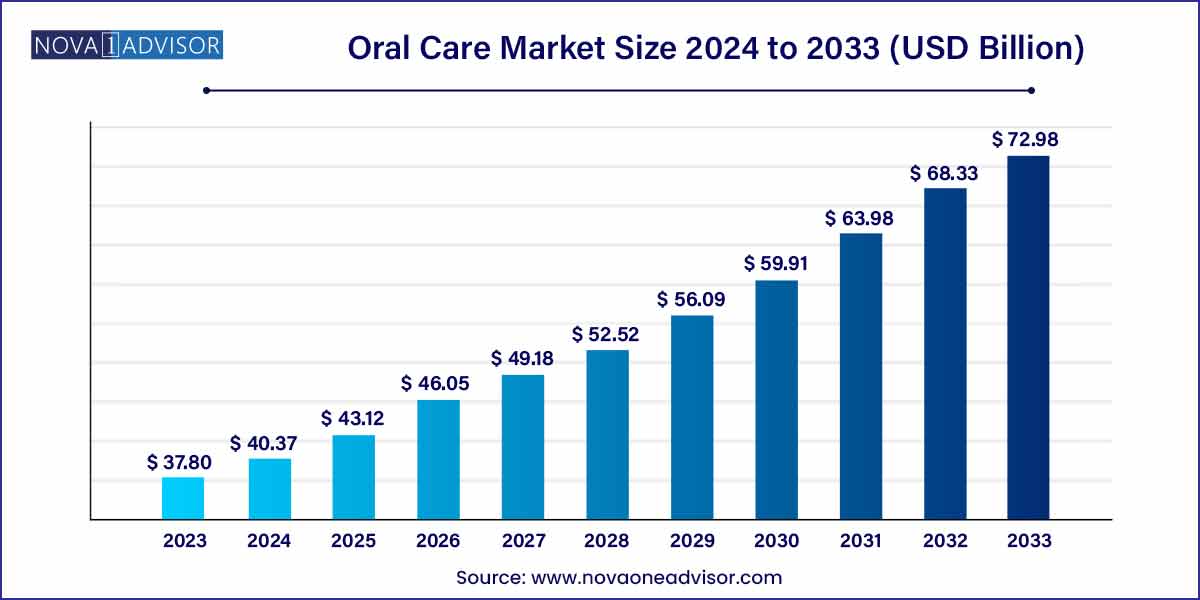

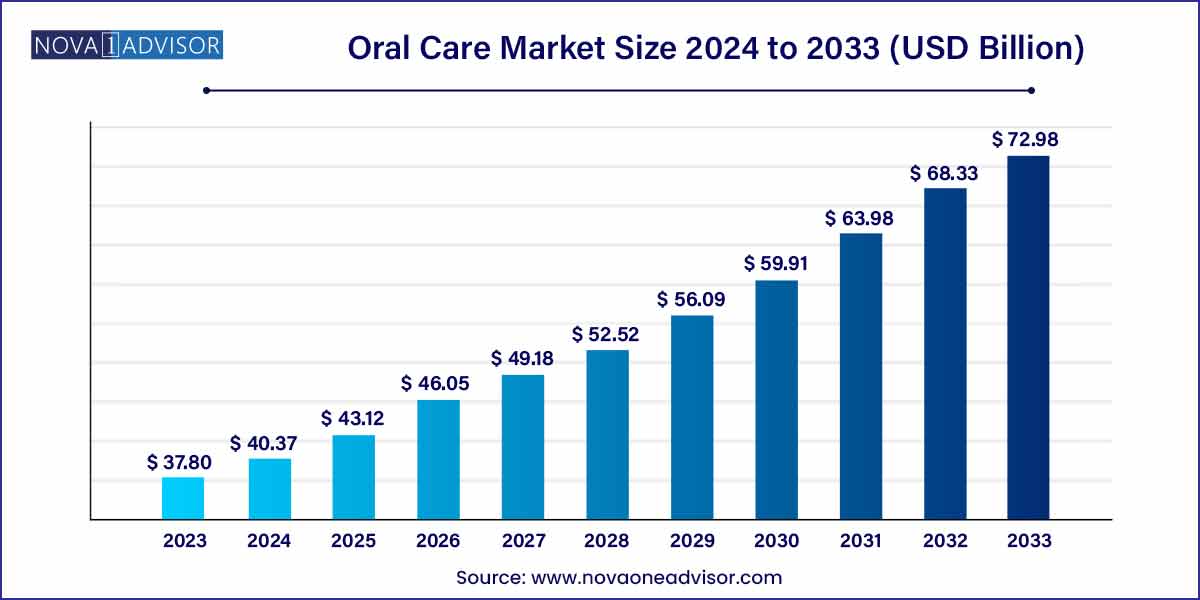

The global oral care market size was exhibited at USD 37.80 billion in 2023 and is projected to hit around USD 72.98 billion by 2033, growing at a CAGR of 6.8% during the forecast period of 2024 to 2033.

Key Takeaways:

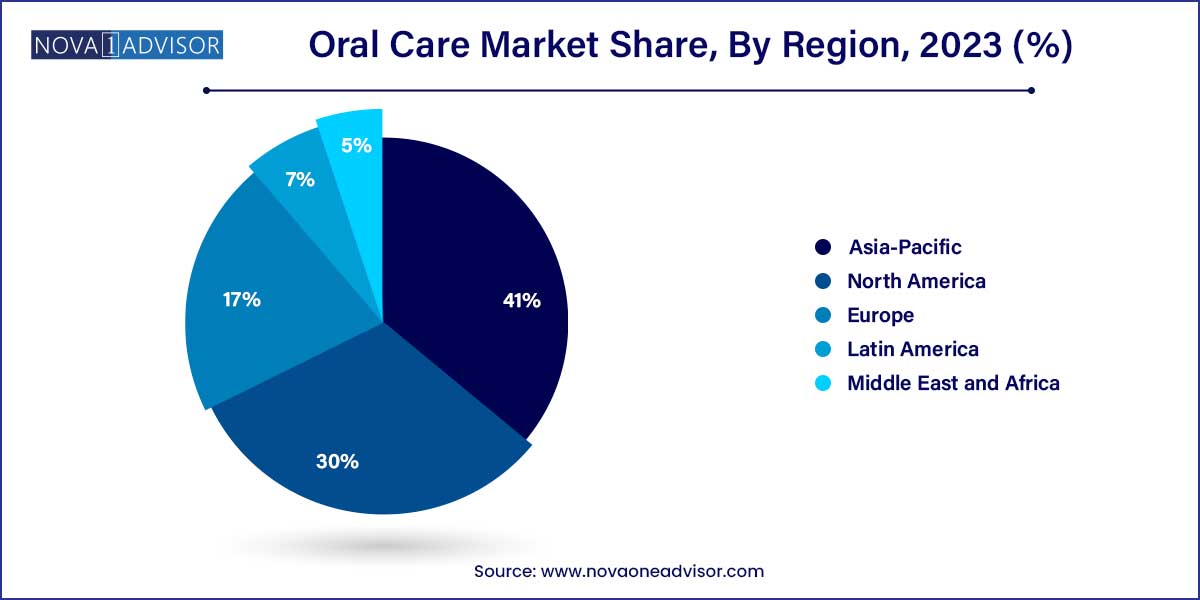

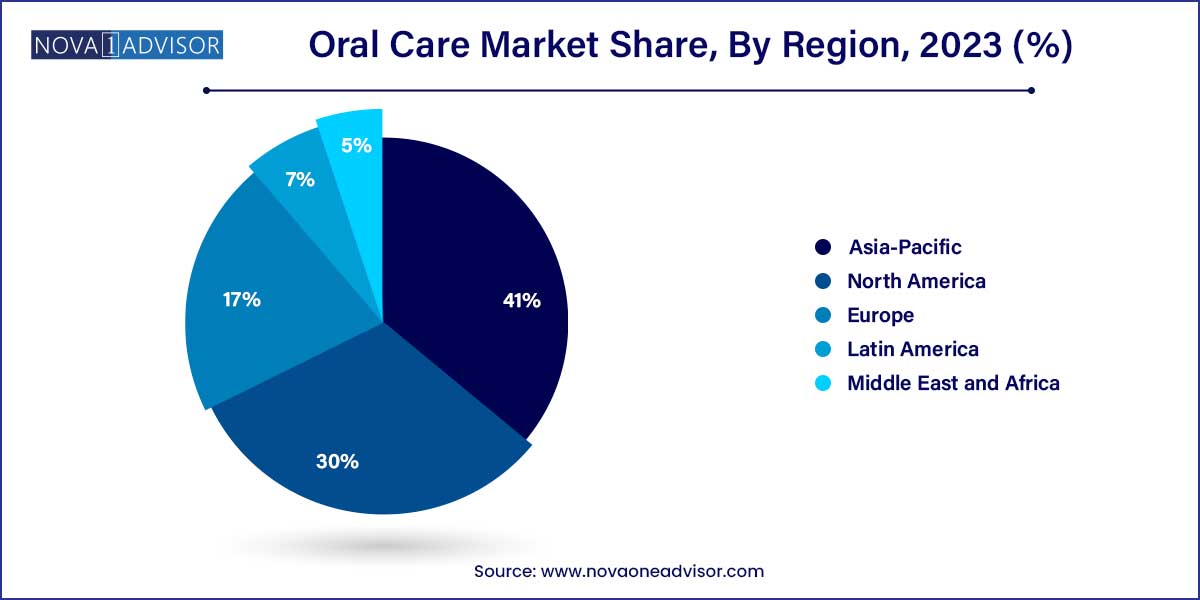

- The Asia Pacific dominated the market with the revenue share of a 41.0% in 2023

- Based on product, the toothbrush segment held the market with the largest revenue share of 26% in 2023.

- Based on distribution channel, the supermarkets/hypermarkets segment held the largest market share in 2023.

Oral Care Market: Overview

The oral care market is witnessing steady growth globally, driven by increasing awareness of oral health and hygiene, rising disposable incomes, and advancements in oral care products and technologies. This overview will delve into key factors influencing the oral care market, including market trends, growth drivers, challenges, and future prospects.

Oral Care Market Growth

The growth of the oral care market is propelled by several key factors. Firstly, heightened awareness of oral hygiene and health has led to an increased demand for oral care products globally. Rising disposable incomes, especially in emerging economies, have expanded the consumer base for these products. Furthermore, advancements in oral care technologies and formulations have resulted in the development of innovative products that cater to diverse consumer needs. Additionally, the growing prevalence of dental conditions such as cavities and gum disease has underscored the importance of preventive oral care measures, further driving market growth. Moreover, changing lifestyles, urbanization, and adoption of western habits have fueled the demand for oral care products, particularly in developing regions. These growth factors collectively contribute to the robust expansion of the oral care market, presenting lucrative opportunities for manufacturers and retailers alike.

Oral Care Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 37.80 Billion |

| Market Size by 2033 |

USD 72.98 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Products, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Colgate-Palmolive Company; GSK plc; Johnson & Johnson Services, Inc; Church & Dwight Co., Inc.; Procter & Gamble; Unilever PLC; GC Corporation; Lion Corporation; Henkel AG & Co; KGaA; and Sunstar Suisse S.A. |

Oral Care Market Dynamics

- Consumer Awareness and Education:

One of the primary dynamics shaping the oral care market is the increasing awareness and education regarding oral health among consumers. With the availability of information through various channels such as social media, healthcare campaigns, and dental professionals, consumers are becoming more conscious about the importance of maintaining good oral hygiene. This heightened awareness has led to a shift in consumer preferences towards preventive oral care products and treatments. Moreover, consumers are actively seeking products that address specific oral health concerns, such as tooth sensitivity, gum problems, and bad breath.

- Technological Advancements and Product Innovation:

Another significant dynamic driving the oral care market is technological advancements and product innovation. The industry is witnessing continuous innovation in oral care products, including toothpaste, toothbrushes, mouthwashes, and dental floss, among others. Advancements in materials science, manufacturing processes, and dental technologies have enabled the development of products that offer superior cleaning, whitening, and protection against oral health issues. For instance, the introduction of electric toothbrushes with features such as pressure sensors, timers, and connectivity to mobile apps has gained popularity among consumers seeking more effective and convenient oral hygiene solutions. Additionally, there is a growing demand for natural and organic oral care products, leading to the development of formulations free from harsh chemicals and artificial additives.

Oral Care Market Restraint

- Regulatory Compliance Challenges:

A major restraint in the oral care market is the complex regulatory landscape governing the manufacturing, labeling, and marketing of oral care products. Regulatory requirements vary across different regions and countries, posing challenges for manufacturers to ensure compliance with diverse standards and regulations. Additionally, stringent regulations regarding the safety and efficacy of oral care products necessitate extensive testing and documentation, leading to increased costs and time-to-market for new product launches. Non-compliance with regulatory requirements can result in product recalls, fines, and damage to brand reputation, further complicating market entry and expansion strategies for manufacturers.

- Pricing Pressures and Competitive Landscape:

Pricing pressures and intense competition pose significant challenges for players in the oral care market. With numerous brands competing for market share, price sensitivity among consumers is high, leading to price wars and downward pressure on profit margins. Moreover, the presence of both established multinational companies and smaller regional players intensifies competition, resulting in aggressive marketing tactics and promotional activities. Additionally, the proliferation of private label brands and counterfeit products further exacerbates pricing pressures and erodes brand loyalty.

Oral Care Market Opportunity

- Growing Emphasis on Cosmetic Dentistry:

One prominent opportunity within the oral care market lies in the growing emphasis on cosmetic dentistry procedures and products. With increasing awareness of aesthetic dental treatments and the desire for a brighter, more attractive smile, there is a rising demand for cosmetic dental procedures such as teeth whitening, dental veneers, and orthodontic treatments. This trend presents opportunities for oral care product manufacturers to develop innovative whitening toothpaste, enamel-strengthening treatments, and other cosmetic oral care products to cater to consumer preferences. Moreover, the advent of advanced dental technologies such as laser dentistry and 3D printing enables the creation of customized and minimally invasive cosmetic dental solutions, further expanding the market opportunities in this segment.

- Growing Aging Population and Oral Health Concerns:

Another significant opportunity within the oral care market is the growing aging population and associated oral health concerns. As the global population ages, the prevalence of age-related oral health issues such as tooth decay, gum disease, and tooth loss increases. This demographic shift presents opportunities for oral care product manufacturers to develop specialized products targeting the unique oral health needs of older adults, such as sensitive teeth toothpaste, denture care products, and oral moisturizers for dry mouth. Additionally, there is a growing demand for preventive oral care products and treatments to maintain oral health and quality of life in the elderly population.

Oral Care Market Challenges

- Consumer Skepticism and Product Efficacy:

A notable challenge in the oral care market is consumer skepticism regarding the efficacy of certain oral care products. Despite extensive marketing efforts and claims made by manufacturers, consumers may question the effectiveness of certain products in delivering the promised benefits, such as cavity prevention, plaque removal, or teeth whitening. This skepticism can stem from past experiences with ineffective products, conflicting information from dental professionals, or concerns about the safety of certain ingredients.

- Regulatory Compliance and Safety Standards:

Another significant challenge facing the oral care market is ensuring compliance with regulatory standards and safety requirements. Regulatory bodies worldwide impose strict regulations governing the formulation, manufacturing, labeling, and marketing of oral care products to safeguard consumer health and safety. Manufacturers must navigate a complex landscape of regulations and standards, including those related to ingredient safety, product labeling, and advertising claims. Failure to comply with regulatory requirements can result in product recalls, fines, and reputational damage, posing significant challenges for market entry and expansion.

Segments Insights:

Product Insights

Toothpaste continues to dominate the product segment, owing to its universal use, wide availability, and continuous innovation in formulation. It is a daily-use product with extremely high penetration across age groups and geographies. While traditional fluoride-based pastes remain staple, the segment has expanded significantly with herbal, anti-sensitivity, whitening, and multi-benefit variants. Leading brands such as Colgate, Sensodyne, and Crest have introduced variants that address niche needs like enamel protection, gum strengthening, or plaque control.

Moreover, toothpaste manufacturers are investing heavily in packaging innovations and flavor profiles to increase appeal, especially among children. Toothpaste remains a high-volume, high-frequency product that is essential even in the most underserved markets, cementing its position as the backbone of the oral care industry.

While toothpaste leads in usage, oral irrigators are the fastest-growing product segment, particularly in developed markets and among tech-savvy users. These devices, also known as water flossers, use pressurized streams of water to clean between teeth and along the gumline. They are especially recommended for individuals with braces, dental implants, or gum disease. Their popularity is increasing in urban centers where consumers are seeking dentist-level cleaning at home.

The segment has benefited from innovations such as cordless designs, portable travel options, and integration with smartphone apps. With consumers embracing comprehensive oral hygiene routines, oral irrigators are transitioning from luxury devices to mainstream essentials.

Distribution Channel Insights

Hypermarkets and supermarkets hold the largest share in distribution, driven by their broad consumer reach, product variety, and high footfall. These retail formats are critical for daily-use products like toothpaste, manual toothbrushes, and mouthwashes. In-store promotions, discounts, and bundling strategies further enhance sales in this channel.

However, the online retail segment is witnessing the fastest growth, driven by changing consumer behavior and digital commerce expansion. E-commerce platforms offer a wide array of oral care products, including niche and premium variants not available in brick-and-mortar stores. Subscription models, user reviews, and influencer-driven marketing are helping brands directly connect with consumers and establish long-term loyalty through digital channels.

Regional Insights

North America remains the largest market for oral care, attributed to high awareness, advanced dental infrastructure, and widespread product innovation. The U.S. leads the region with a strong preference for electric toothbrushes, medicated rinses, and cosmetic oral care. Additionally, the market benefits from robust dental insurance, government public health initiatives like the CDC’s oral health program, and strong promotional efforts by major brands.

Consumer behavior in North America reflects high disposable incomes and a desire for aesthetic improvements. From premium teeth whitening kits to smart toothbrushes with app integrations, the market is characterized by high-value products and a tech-savvy user base.

Asia-Pacific is the fastest-growing region in the oral care market due to rapid urbanization, rising disposable incomes, and growing health consciousness. Countries like China, India, and Indonesia are seeing an upsurge in oral care awareness through government initiatives and educational campaigns. The urban middle class is embracing advanced oral care tools, while rural markets are increasingly adopting basic oral hygiene routines.

International brands are expanding aggressively in Asia-Pacific through partnerships, localized product lines, and digital marketing. For example, Unilever and Colgate-Palmolive have introduced herbal toothpaste lines specifically for Indian consumers. E-commerce platforms like Tmall and Flipkart are facilitating deeper product penetration and consumer engagement.

Recent Developments

-

Colgate-Palmolive (March 2025): Launched a new AI-powered smart toothbrush, Colgate SmartPro, with real-time feedback and customized brushing analytics, targeting tech-conscious users in the U.S. and Europe.

-

Procter & Gamble (January 2025): Introduced a subscription-based oral care kit under the Oral-B brand, combining electric toothbrush heads, toothpaste, and floss tailored to consumer preferences.

-

Unilever (February 2025): Expanded its Ayush Ayurveda oral care line in India with natural ingredients like neem and clove, targeting traditional health-conscious consumers.

-

GlaxoSmithKline (April 2025): Announced a collaboration with dental clinics across Southeast Asia to distribute Sensodyne Rapid Relief kits as part of an awareness campaign on tooth sensitivity.

-

Hello Products (February 2025): Released its first sustainable toothpaste packaging line, made from 100% recycled material, aligning with the global eco-conscious trend.

Some of the prominent players in the oral care market include:

- Colgate-Palmolive Company

- GSK plc

- Johnson & Johnson Services, Inc

- Church & Dwight Co., Inc.

- Procter & Gamble

- Unilever PLC

- GC Corporation

- Lion Corporation

- Henkel AG & Co. KGaA

- Sunstar Suisse S.A.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global oral care market.

Product

-

- Manual

- Electric (Rechargeable)

- Battery-powered (Non-rechargeable)

- Others

-

- Cleaners

- Fixatives

- Floss

- Others

-

- Cosmetic Whitening Products

- Fresh Breath Dental Chewing Gum

- Tongue Scrapers

- Fresh Breath Strips

- Others

Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacies and drug stores

- Convenience Stores

- Online retail stores

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)