Personalized Retail Nutrition And Wellness Market Size and Trends

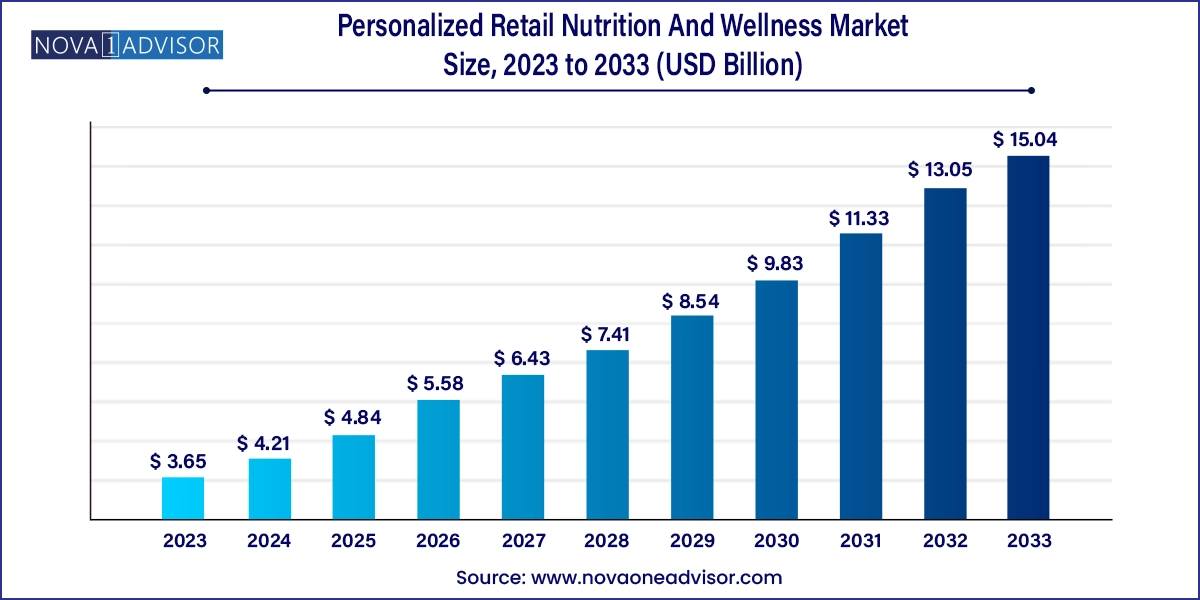

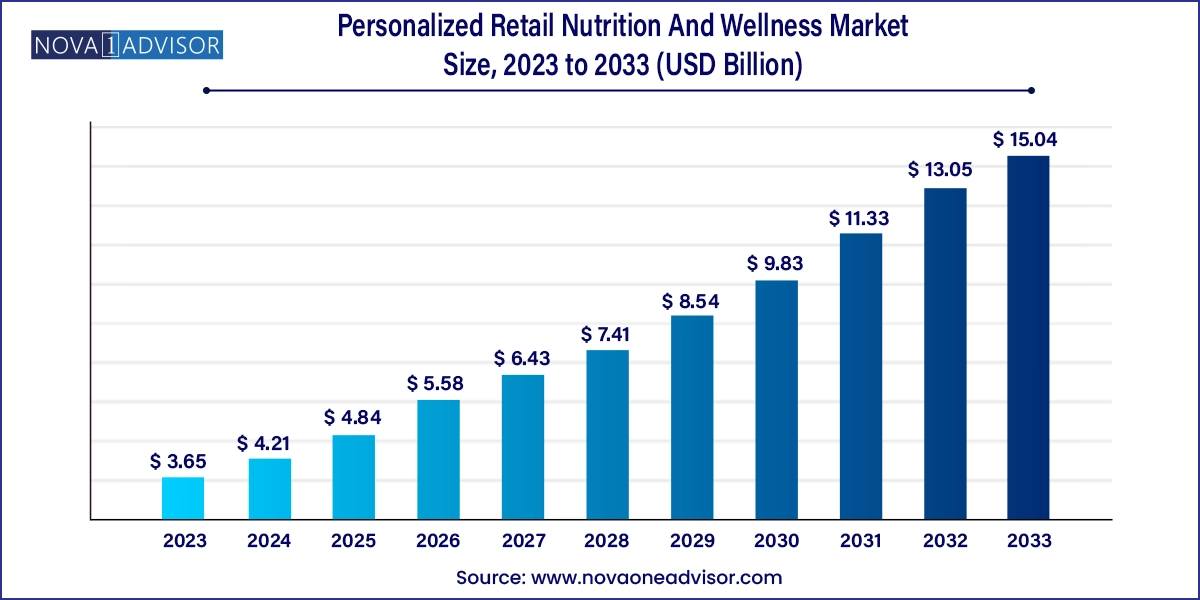

The global personalized retail nutrition and wellness market size was exhibited at USD 3.65 billion in 2023 and is projected to hit around USD 15.04 billion by 2033, growing at a CAGR of 15.21% during the forecast period 2024 to 2033.

Personalized Retail Nutrition And Wellness Market Key Takeaways:

- Based on type, the repeat recommendations segment led the market with the largest revenue share of 46.36% in 2023.

- The personalized testing segment is expected to grow at the fastest CAGR of 16.28% over the forecast period.

- North America dominated the personalized retail nutrition and wellness market with the largest revenue share of 41.43% in 2023.

Market Overview

The Global Personalized Retail Nutrition and Wellness Market is undergoing a transformative evolution, propelled by advances in health data analytics, consumer demand for customized wellness solutions, and innovations in nutrigenomics and diagnostic technologies. This market focuses on delivering health and nutrition products, services, and recommendations tailored to individual biological profiles, lifestyle patterns, and wellness goals. It transcends the conventional “one-size-fits-all” approach by integrating personal data such as genetic markers, microbiome health, metabolic rates, and behavioral tendencies into nutrition and wellness solutions.

Personalized nutrition, once a niche domain reserved for medical and elite sports applications, is now becoming mainstream thanks to direct-to-consumer testing kits, AI-powered apps, and smart wearables. Consumers are actively seeking dietary supplements, functional foods, and botanical ingredients tailored to their unique physiological needs. Retailers and brands are responding with precision-driven product lines and subscription-based services that offer evolving guidance through repeat and continuous recommendations.

COVID-19 amplified consumer awareness about immune health, disease prevention, and mental wellness catalyzing interest in individualized approaches to nutrition. The rise of preventative health, holistic wellness, and lifestyle medicine has redefined the boundaries of traditional food and pharmaceutical industries, ushering in a new era of hybridized consumer health products. Major players—from startups like Care/of and Baze to multinational giants like Nestlé Health Science and Herbalife are investing in algorithms, partnerships, and digital platforms to capture a share of this rapidly expanding market.

Major Trends in the Market

-

Rise of Direct-to-Consumer (D2C) Personalized Testing Kits: Saliva, blood, DNA, and microbiome testing kits empower consumers to access personalized wellness plans from home.

-

Integration of AI and Big Data in Nutrition Planning: AI algorithms are being used to deliver dynamic and real-time personalized recommendations based on evolving lifestyle data.

-

Subscription-Based Wellness Models: Consumers are adopting monthly subscription boxes with tailored supplements, foods, and tracking support.

-

Microbiome-Focused Nutrition: There is a growing trend toward customizing diets based on gut microbiota analysis to improve digestion, immunity, and mental health.

-

Expansion of Functional Ingredients: Increased use of adaptogens, nootropics, and phytonutrients in personalized nutrition formulations.

-

Retail Pharmacy Personalization: Pharmacies are integrating digital health and personalized recommendations into OTC product offerings.

-

Customization in Sports and Performance Nutrition: Athletes and fitness enthusiasts are leveraging real-time biomarker feedback to personalize supplement and hydration protocols.

-

Increased Emphasis on Preventative Healthcare: Chronic disease prevention through customized dietary plans is gaining traction in insurance and wellness programs.

Report Scope of Personalized Retail Nutrition And Wellness Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.21 Billion |

| Market Size by 2033 |

USD 15.04 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 15.21% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Nature's Lab; Cargill, Incorporated; Nature's Bounty; Bayer AG; PlateJoy LLC; Better Therapeutics, Inc.; Viome Life Sciences, Inc.; Noom, Inc.; Savor Health; Nutrigenomix; DNAfit (Prenetics Global) |

Key Market Driver: Consumer Shift Toward Preventative and Holistic Wellness

A primary driver of this market is the surging consumer demand for preventative and holistic wellness. Modern consumers are increasingly aware of how nutrition, lifestyle, and environmental exposures interact with individual biology to influence health. As chronic diseases such as diabetes, obesity, and cardiovascular issues continue to rise globally, there is a distinct shift from reactive treatment to proactive prevention.

Personalized nutrition and wellness products help individuals take control of their health by offering tailored dietary guidance and interventions that are grounded in personal health data. For instance, a person with lactose intolerance might receive plant-based alternatives, while another individual with inflammation markers may be directed toward omega-3 enriched supplements. This proactive approach not only enhances efficacy and compliance but also fosters long-term consumer engagement with wellness products. Retailers and healthcare providers alike are capitalizing on this trend by embedding personalized solutions into physical stores and virtual ecosystems.

Key Market Restraint: High Cost and Accessibility Barriers

Despite its promise, the high cost associated with personalized testing and premium product formulations remains a significant barrier to widespread adoption. Most personalized nutrition and wellness programs involve genetic or biochemical testing, which requires either lab analysis or at-home kits priced beyond the reach of average consumers. Furthermore, the supplements and functional foods recommended as part of these programs are often premium-priced due to their targeted nature and high-quality ingredients.

This cost structure limits accessibility, particularly in lower-income regions and populations, thereby widening health inequality gaps. Additionally, the complexity of interpreting personalized results and the lack of standardized regulatory frameworks can lead to misinformation or misuse. As a result, while personalized wellness holds great promise, its current positioning as a premium or luxury service could constrain market penetration until cost-effective, scalable models emerge.

Key Market Opportunity: Integration with Digital Health and Wearables

The integration of personalized nutrition with digital health platforms and wearable devices represents a major growth opportunity. Devices like smartwatches, fitness trackers, glucose monitors, and sleep analyzers collect real-time biometric data that can be used to generate dynamic nutrition recommendations. This allows for continuous, adaptive personalization, rather than static or one-time assessments.

For instance, companies like Fitbit and WHOOP are exploring partnerships with personalized nutrition platforms to align dietary inputs with physiological states such as energy expenditure, heart rate variability, and sleep quality. Meanwhile, mobile apps are providing users with meal suggestions, hydration alerts, and supplement reminders based on real-time vitals. This fusion of digital health and nutrition not only increases consumer engagement but also allows for longitudinal health tracking, which is of great interest to insurers, employers, and healthcare providers aiming to promote population wellness.

Personalized Retail Nutrition And Wellness Market By Type Insights

Fixed Recommendations currently dominate the personalized nutrition market, particularly in the form of dietary supplements and functional foods delivered through initial questionnaire-based assessments. Consumers typically fill out lifestyle, dietary, and health preference surveys to receive personalized product bundles that remain relatively stable over time. Fixed recommendation models are popular among first-time users or those exploring general wellness products without the need for frequent updates.

Within this type, vitamins and proteins are the most consumed subcategories. For example, subscription-based companies like Ritual and Persona deliver vitamin packs customized for age, gender, and lifestyle, based on initial assessments. Functional foods such as protein bars or vitamin-fortified beverages are also commonly offered under fixed recommendation models. This model offers scalability and ease of fulfillment but may lack the dynamic adaptability of more advanced models.

Continuous Recommendations are the fastest-growing segment, especially as wearable devices and personalized testing kits become more integrated. These models use continuous data streams to update nutrition and supplement plans in real-time or on a rolling basis. For example, a consumer using a CGM (continuous glucose monitor) may receive alerts and dietary suggestions aligned with their glycemic response. Companies like Levels and InsideTracker are pioneering this space, combining sensor data with AI-driven analytics to deliver evolving, precise nutritional guidance.

Under continuous recommendations, functional foods enriched with prebiotics, probiotics, and dietary fibers are gaining popularity due to their measurable impact on gut health and metabolic response. Botanical ingredients like adaptogens are also increasingly featured in dynamic wellness solutions aimed at stress management and cognitive performance.

Personalized Retail Nutrition And Wellness Market By Regional Insights

North America dominates the global personalized retail nutrition and wellness market, accounting for the largest market share. This dominance is attributed to high consumer awareness, well-developed digital infrastructure, and the presence of leading companies like Nestlé Health Science, GNC, and Thorne. The U.S. market, in particular, is characterized by a strong demand for subscription-based wellness services, digital health integration, and proactive healthcare management. Additionally, the prevalence of lifestyle-related disorders and the adoption of biohacking and personalized wellness among millennials and Gen Z consumers have propelled market maturity in this region.

Conversely, Asia Pacific is emerging as the fastest-growing region. The increasing urbanization, rise in chronic disease burden, and cultural inclination toward holistic wellness and traditional medicine are creating a fertile ground for personalized nutrition solutions. Countries like China, Japan, South Korea, and India are seeing rapid adoption of at-home diagnostic kits, health tracking devices, and functional foods. Additionally, the integration of Ayurvedic, Traditional Chinese Medicine (TCM), and other indigenous botanicals into personalized frameworks is drawing both local and global interest. The region is also benefiting from a rising middle class, increased healthcare spending, and government interest in preventative health strategies.

Personalized Retail Nutrition And Wellness Market Recent Developments

-

In February 2025, Nestlé Health Science announced the launch of a new DNA-based personalized nutrition platform in collaboration with Nutrigenomix, offering customized supplement kits based on genetic insights.

-

Viome Life Sciences received FDA breakthrough device designation in October 2024 for its AI-driven microbiome diagnostic test aimed at preventing chronic diseases through personalized food recommendations.

-

Care/of, a personalized vitamin brand under Bayer, introduced a new subscription line in August 2024 that integrates continuous glucose monitoring data to personalize supplement timing and dosage.

-

In December 2024, Unilever invested in a Singapore-based startup focused on personalized herbal supplement development using TCM principles and wearable health trackers.

-

Persona Nutrition, in March 2025, unveiled a mobile app that synchronizes wearable sleep and hydration data to dynamically adjust daily vitamin formulations.

Some of the prominent players in the global personalized retail nutrition and wellness market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global personalized retail nutrition and wellness market

Type

-

- Dietary Supplements & Nutraceuticals

-

-

- Vitamins

- Proteins

- Minerals

- Amino Acids

- Enzymes

- Others

-

-

- Proteins

- Vitamins

- Dietary Fibers

- Fatty Acids

- Minerals

- Prebiotics & Probiotics

- Carotenoids

-

- Dietary Supplements & Nutraceuticals

-

-

- Vitamins

- Proteins

- Minerals

- Amino Acids

- Enzymes

- Others

-

-

- Proteins

- Vitamins

- Dietary Fibers

- Fatty Acids

- Minerals

- Prebiotics & Probiotics

- Carotenoids

- Continuous Recommendation

-

- Dietary Supplements & Nutraceuticals

-

-

- Vitamins

- Proteins

- Minerals

- Amino Acids

- Enzymes

- Others

-

-

- Proteins

- Vitamins

- Dietary Fibers

- Fatty Acids

- Minerals

- Prebiotics & Probiotics

- Carotenoids

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)