Pet Cancer Therapeutics Market Size and Trends

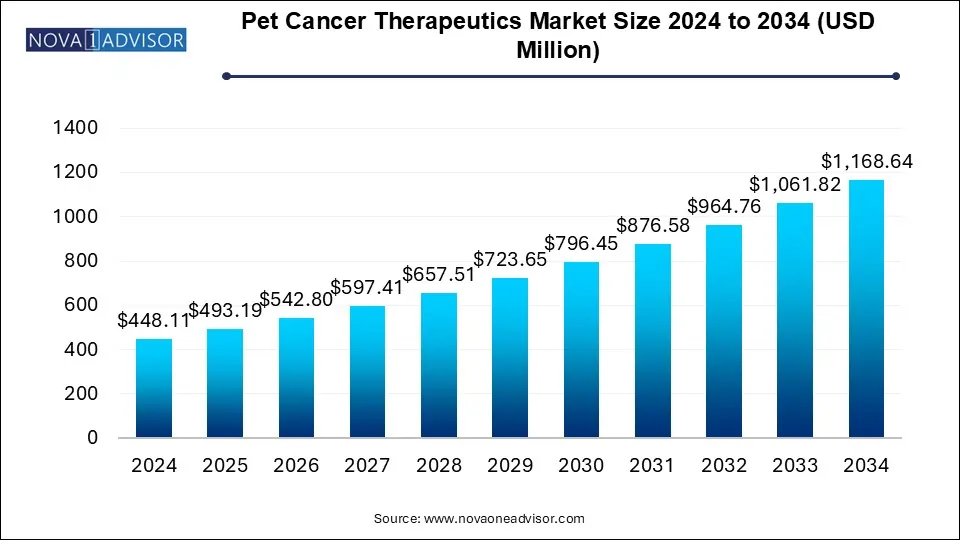

The pet cancer therapeutics market size was exhibited at USD 448.11 million in 2024 and is projected to hit around USD 1168.64 million by 2034, growing at a CAGR of 10.06% during the forecast period 2025 to 2034.

Pet Cancer Therapeutics Market Key Takeaways:

- The North America pet cancer therapeutics market size accounted for USD 289.08 million in 2024 and is expected to attain around USD 757.81 million by 2034, poised to grow at a CAGR of 10.11% between 2025 and 2034.

- North America dominated the market with the largest revenue share of 72.0% in 2024.

- Asia Pacific is observed to grow at a notable rate during the forecast period.

- By therapy, the chemotherapy segment dominated the market in 2024.

- By therapy, the immunotherapy segment is estimated to grow at the fastest rate during the forecast period.

- By application, the mast cell cancer segment is estimated to grow at the fastest rate during the forecast period.

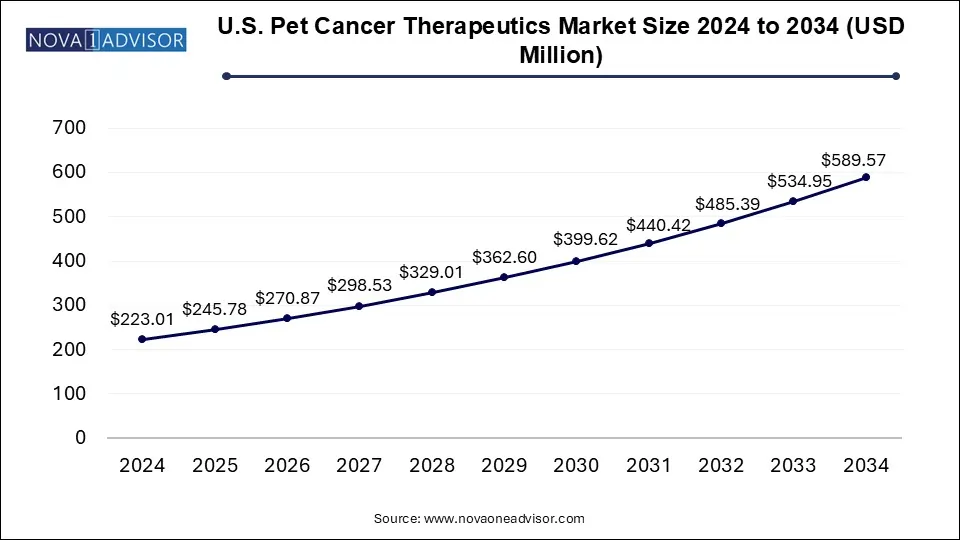

U.S. Pet Cancer Therapeutics Market Size and Growth 2025 to 2034

The U.S. pet cancer therapeutics market size was estimated at USD 223.01 million in 2024 and is predicted to be worth around USD 589.57 million by 2034 with a CAGR of 10.21% from 2025 to 2034.

In 2024, North America led the pet cancer therapeutics market. The region has one of the highest pet ownership rates globally, with a substantial number of households owning dogs and cats. North America is home to advanced veterinary hospitals and specialized clinics equipped with cutting-edge diagnostic and treatment facilities, including oncology departments. As a hub for pharmaceutical research and development, the region fosters innovation in pet cancer treatments. Regulatory bodies like the FDA enforce stringent veterinary drug approval standards, ensuring safety and efficacy. The U.S. holds a significant share of the global market due to its large pet population and well-established veterinary healthcare infrastructure. Meanwhile, Canada’s pet market continues to expand, driven by rising pet ownership and increasing demand for advanced veterinary care.

The Asia Pacific region is projected to experience significant growth in the pet cancer therapeutics market over the forecast period. Governments in the region are actively working to enhance animal healthcare services by supporting veterinary research and encouraging the development of healthcare facilities for pets. Additionally, the rising incidence of cancer in pets, influenced by longer lifespans due to improved healthcare, is increasing the demand for effective cancer treatments.

Europe has also witnessed a steady rise in pet ownership, especially in urban areas. Veterinary oncology services are expanding across the region, with specialized oncology centers and referral hospitals offering advanced cancer diagnosis and treatment options. The European Medicines Agency (EMA) oversees veterinary drug regulations across EU member states, ensuring standardized approval processes for pet cancer therapeutics. European countries are also focusing on personalized medicine, leading to the development of companion diagnostics and targeted cancer therapies for pets.

Pet Cancer Therapeutics Market Overview

The pet cancer therapeutics market includes pharmaceuticals, treatments, and healthcare services designed to diagnose, manage, and treat cancer in companion animals such as dogs and cats. This market has been steadily expanding due to increasing pet ownership, advancements in veterinary medicine, and growing awareness of pet health issues. Market size is influenced by factors such as geographical location, the prevalence of pet cancer, and accessibility to veterinary care. The sector includes pharmaceutical companies, veterinary oncology clinics, research institutions, and diagnostic firms.

Key industry players focus on developing and manufacturing cancer drugs, diagnostic tools, and treatment equipment. Market trends differ across regions based on pet ownership rates, economic conditions, and the availability of veterinary services. The demand for advanced cancer treatments is expected to rise, driven by technological advancements and continuous improvements in veterinary medicine. Collaboration among veterinary professionals, pharmaceutical companies, and regulatory agencies will be essential in fostering innovation and expanding access to effective pet cancer treatments.

Pet Cancer Therapeutics Market Growth Factors

- Pets are increasingly regarded as family members, leading to higher spending on their healthcare, including cancer treatments. Owners are more willing to invest in advanced therapies to enhance their pets’ quality of life and longevity.

- The global rise in pet ownership, particularly in developed nations, has expanded the demand for medical care, including cancer treatments.

- Veterinary oncology has made significant strides in recent years, with improved diagnostic tools, treatment options, and supportive care enhancing treatment success and extending pet lifespans.

- Growing awareness of cancer symptoms in pets has led to more proactive screening and early detection, allowing for timely intervention and improved treatment outcomes.

Report Scope of Pet Cancer Therapeutics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 493.19 Million |

| Market Size by 2034 |

USD 1168.64 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 10.06% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Therapy, Applications, and Regions |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

AB Science, Anivive Lifesciences, Elanco Animal Health, ELIAS Animal Health, Merial Inc., NovaVive, Qbiotics, Zoetis Inc., and Others. |

Pet Cancer Therapeutics Market Dynamics

Drivers

Increasing Prevalence of Cancer in Pets

The rising incidence of cancer in pets is attributed to aging populations, genetic predispositions, environmental exposures, and lifestyle factors. Advances in diagnostic technologies have enabled earlier and more precise detection, increasing reported cancer cases. Greater awareness among pet owners and veterinarians has led to more frequent screenings and diagnoses. These factors are expanding treatment options, improving outcomes, and enhancing the quality of life for pets with cancer. As research and development efforts continue to grow, the market is expected to expand further.

Significant Investment in Research & Development

Ongoing R&D efforts are driving the development of novel cancer therapies, including targeted treatments, immunotherapies, and gene therapies. Investments in research facilities and advanced diagnostic tools such as molecular diagnostics, imaging technologies, and biomarker assays are improving personalized treatment strategies. Clinical trials evaluating the safety and efficacy of new treatments are expanding available options. Collaboration between pharmaceutical companies, academic institutions, and veterinary professionals is accelerating innovation in pet cancer therapeutics.

Restraints

High Treatment Costs and Limited Awareness

- Cancer treatments such as surgery, chemotherapy, and radiation therapy can be costly, making comprehensive care inaccessible to some pet owners.

- Over time, pets may develop resistance to certain cancer treatments, reducing their effectiveness and posing challenges for veterinarians.

- Financial constraints and ethical considerations regarding prognosis and quality of life may impact treatment decisions.

- Despite increasing awareness, some pet owners remain unfamiliar with cancer symptoms and available treatments, leading to delayed diagnosis and intervention.

Opportunities

Technological Advancements and Personalized Medicine

- Innovations in molecular diagnostics, imaging technologies, and targeted therapies offer improved methods for early cancer detection, diagnosis, and treatment.

- Personalized medicine, including companion diagnostics and biomarker-based treatments, enhances therapeutic effectiveness while minimizing adverse effects.

Collaborative Research and Telemedicine Integration

- Industry collaborations among veterinarians, pharmaceutical firms, and research institutions are fostering new treatment breakthroughs.

- Telemedicine enables remote consultations with veterinary oncologists, improving access to specialized care, particularly in underserved regions.

Expansion of Supportive Care and Global Market Growth

- The development of supportive care services such as pain management, nutritional support, and palliative care enhances pets' quality of life during treatment.

- Emerging markets with rising disposable incomes and growing pet ownership present new growth opportunities for the pet cancer therapeutics industry.

Pet Cancer Therapeutics Market By Therapy Insights

In 2024, chemotherapy led the pet cancer therapeutics market. This treatment involves using drugs to destroy or slow cancer cell growth and is widely used for conditions such as lymphoma, mast cell tumors, and osteosarcoma. Chemotherapy protocols are customized based on cancer type, stage, and the pet’s overall health. It has been effective in extending survival rates while balancing the risk of side effects.

Pet Cancer Therapeutics Market By Rapid Growth of Immunotherapy

The immunotherapy segment is expected to grow at the fastest rate during the forecast period. Immunotherapy stimulates the pet’s immune system to recognize and fight cancer cells. Approaches such as therapeutic vaccines, monoclonal antibodies, and immune checkpoint inhibitors are being explored. Immunotherapy can be used alone or in combination with other treatments, offering a targeted approach with fewer side effects compared to traditional chemotherapy.

Pet Cancer Therapeutics Market By Targeted Therapy Advances

Targeted therapies focus on inhibiting specific molecular pathways or genetic mutations that drive cancer growth. These treatments are designed to be more selective and less toxic to healthy cells than conventional chemotherapy, making them a promising area of development in pet oncology.

Pet Cancer Therapeutics Market By Application Insights

The mast cell cancer segment is projected to grow at the fastest rate. Imaging studies, such as ultrasound and radiography, help assess tumor involvement and potential metastasis. Fine needle aspiration and biopsies are essential for diagnosing and staging mast cell tumors. Surgical excision with wide margins is the primary treatment for localized tumors, while advanced surgical techniques like Mohs micrographic surgery ensure complete tumor removal while preserving healthy tissue.

The use of imaging technologies such as CT scans, radiography, and ultrasound also plays a critical role in diagnosing melanoma and other aggressive cancers in pets. These imaging modalities help veterinarians evaluate tumor spread and determine the best course of treatment.

Some of The Prominent Players in The Pet cancer therapeutics market Include:

Pet Cancer Therapeutics Market Recent Developments

- In May 2024, a new drug for treating acute onset of canine pancreatitis was launched in the U.S. market.

- In June 2024, Union Minister Parshottam Rupala launched the Nandi portal, which promptly processes applications and grants non-objection certification (NOC) for veterinary drugs and vaccines.

- In August 2024, genetic modifications in animal models have permitted more efficient usage of animal models in basic research and therapeutic development.

- In February 2024, Elias Animal Health received federal regulatory approval for their canine cancer treatment.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pet cancer therapeutics market

By Therapy

- Chemotherapy

- Immunotherapy

- Targeted therapy

- Combination therapy

- Radiation therapy

- Surgery

By Applications

- Mast Cell Cancer

- Lymphoma

- Melanoma

- Mammary and Squamous Cell Cancer

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)