Pharmaceutical Analytical Testing Outsourcing Market Size and Growth

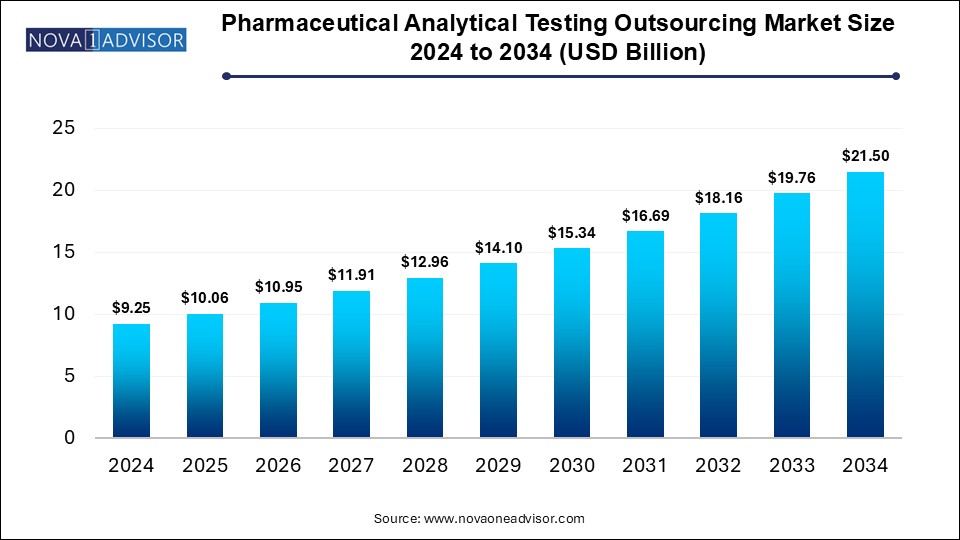

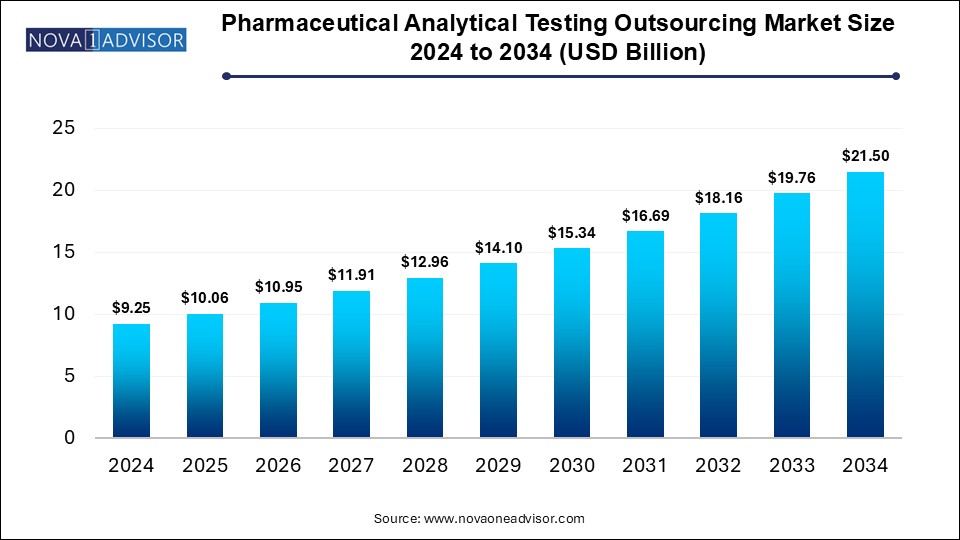

The global pharmaceutical analytical testing outsourcing market size was exhibited at USD 9.25 billion in 2024 and is projected to hit around USD 21.5 billion by 2034, growing at a CAGR of 8.6% during the forecast period 2025 to 2034.

Pharmaceutical Analytical Testing Outsourcing Market Key Takeaways:

-

In 2024, the "other services" category accounted for the highest market share, exceeding 41.0%.

-

The bioanalytical testing services segment is projected to register the most rapid expansion throughout the forecast period.

-

Pharmaceutical companies led the global pharmaceutical analytical testing outsourcing market in 2024, capturing more than 48% of the total revenue.

-

The biopharmaceutical companies segment is anticipated to experience strong and profitable growth in the coming years.

-

North America emerged as the leading regional market in 2024, contributing 54% of the global revenue.

-

The Asia Pacific region is forecasted to grow at a notable and promising rate during the projection period.

Market Overview

The global pharmaceutical analytical testing outsourcing market is undergoing a significant transformation, fueled by the growing complexity of drug development, the increasing pressure on time-to-market, and a surge in biopharmaceutical innovations. Outsourcing analytical testing services has become a critical strategy for pharmaceutical and biopharmaceutical companies to reduce operational costs, access specialized expertise, and maintain compliance with stringent regulatory standards. As of recent years, the market has gained remarkable momentum, propelled by the increasing need for comprehensive quality assurance during all stages of drug development—from preclinical to commercial production.

Pharmaceutical analytical testing encompasses a wide range of services, including bioanalytical testing, method development and validation, stability testing, and extractable and leachable analysis. These services ensure that drugs meet stringent quality, safety, and efficacy standards as required by global regulatory authorities like the FDA, EMA, and WHO. Due to the high cost and technical complexity of maintaining in-house analytical facilities, many pharmaceutical companies—especially small and mid-sized firms—prefer outsourcing these services to contract research organizations (CROs) or specialized analytical laboratories.

With increasing global R&D expenditure, the demand for robust and accurate analytical methods is rising. Moreover, advancements in analytical techniques such as mass spectrometry, high-performance liquid chromatography (HPLC), and nuclear magnetic resonance (NMR) have expanded the scope of testing capabilities, further supporting the market's expansion. The growth of the biopharmaceutical sector, personalized medicine, and novel drug modalities is also intensifying the need for outsourcing services that can keep up with evolving testing requirements.

Major Trends in the Market

-

Increasing Biopharmaceutical Pipeline: As more monoclonal antibodies, cell and gene therapies, and biosimilars enter development, demand for advanced analytical testing services has surged.

-

Regulatory Complexity Driving Outsourcing: Stringent guidelines by agencies like the FDA and EMA compel companies to seek expert third-party labs with proven compliance records.

-

Rising Demand for Method Development & Validation: Customized and validated methods are critical for novel drug entities, driving growth in this segment.

-

Technological Advancements in Analytical Testing: Innovations in LC-MS, NMR, and chromatography are enhancing test sensitivity, accuracy, and throughput.

-

Emergence of Specialized CROs: Companies are increasingly partnering with CROs that specialize in niche testing such as extractables & leachables and photostability studies.

-

Growth of Virtual Pharma Companies: These lean organizations heavily depend on outsourcing to manage analytical, preclinical, and clinical operations.

-

Shift Toward Risk-Based Stability Testing: Companies are adopting ICH Q12 frameworks, focusing on science- and risk-based approaches to stability studies.

Report Scope of Pharmaceutical Analytical Testing Outsourcing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 10.06 Billion |

| Market Size by 2034 |

USD 21.5 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.8% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Services, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled |

SGS SA, Labcorp, Eurofins Scientific, Pace Analytical Services LLC, Intertek Group plc, PPD Inc (Thermo fisher Scietific, Inc.), Wuxi AppTec, Boston Analytical, Charles River Laboratories, Pharmaceutical Services, Inc |

Key Market Driver: Increasing Complexity in Drug Development

A critical driver fueling the pharmaceutical analytical testing outsourcing market is the increasing complexity of drug development, particularly in the realm of biologics and advanced therapies. Traditional small-molecule drugs are gradually being supplemented—and in some cases, replaced—by highly complex molecules like monoclonal antibodies, fusion proteins, and gene therapies. These products necessitate highly sophisticated analytical procedures to verify their structural integrity, potency, purity, and biological activity.

Moreover, regulatory authorities have expanded the scope of testing for such complex therapeutics, demanding advanced characterization and impurity profiling. These intricate requirements place significant burdens on in-house teams, prompting both big pharma and biotech startups to outsource analytical tasks to specialized labs with access to cutting-edge technologies and domain expertise. As the molecular architecture of therapeutic candidates becomes more multifaceted, the reliance on outsourcing analytical testing continues to increase.

Market Restraint: Concerns Over Data Confidentiality and IP

Despite the apparent advantages of outsourcing analytical services, data confidentiality and intellectual property (IP) protection remain a significant restraint. Analytical testing often involves sharing sensitive information related to drug composition, process development, and proprietary methods with external partners. For pharmaceutical companies, particularly those involved in the development of innovative or first-in-class drugs, the risk of data leaks, breaches, or IP theft can be a major deterrent.

These concerns are amplified when outsourcing to service providers in regions with less stringent legal frameworks or weak enforcement mechanisms for IP protection. Although many CROs adopt stringent data security protocols and sign non-disclosure agreements (NDAs), apprehensions about information leakage persist, potentially hampering the willingness of some players to outsource critical testing functions.

Market Opportunity: Personalized Medicine and Companion Diagnostics

An emerging and lucrative opportunity for the market lies in the growth of personalized medicine and companion diagnostics. As pharmaceutical companies shift focus toward patient-specific therapies, including targeted oncology treatments and gene editing platforms, the need for precise analytical methods tailored to individualized formulations is increasing.

Personalized medicines often require biomarker-based assays, specialized stability testing for small patient-specific batches, and real-time release testing—all of which demand highly customized analytical support. Outsourcing partners with capabilities in genomics, proteomics, and multiplex assay development are in high demand. Analytical testing companies that can offer flexible, high-throughput, and bespoke solutions are well-positioned to capture this growing segment.

Pharmaceutical Analytical Testing Outsourcing Market By Services Insights

Bioanalytical testing dominated the service segment owing to the increasing number of biologics, biosimilars, and complex therapies in the development pipeline. Within bioanalytical testing, both clinical and non-clinical testing remain crucial for determining pharmacokinetic (PK) and pharmacodynamic (PD) parameters. Clinical bioanalysis is pivotal for understanding drug behavior in humans, while non-clinical testing supports safety profiling in preclinical models. The growing demand for bioequivalence and bioavailability studies further underscores the segment’s significance.

On the other hand, method development and validation is emerging as the fastest-growing segment due to the rising demand for customized analytical procedures for novel drug molecules. As companies explore complex formulations and delivery methods, they require unique analytical techniques validated to meet regulatory scrutiny. Sub-segments such as extractables and leachables testing are gaining traction, particularly in the biologics space where container-closure integrity is critical. Additionally, technical consulting services are in demand to help clients navigate the evolving ICH and USP regulatory frameworks.

Pharmaceutical Analytical Testing Outsourcing Market By End Use Insights

Pharmaceutical companies accounted for the largest market share in the end-use segment, driven by their extensive pipelines and continuous product development. These firms frequently outsource routine and advanced analytical tasks to third-party laboratories to optimize internal resources and accelerate go-to-market timelines. Outsourcing also helps them manage compliance with region-specific quality standards, making it an attractive long-term strategy.

Conversely, biopharmaceutical companies represent the fastest-growing end-use segment due to their focus on biologics and personalized therapies. Given the complexity of biologics, biopharmaceutical firms often seek outsourcing partners with advanced technical capabilities and GMP-certified facilities. The emergence of virtual biotech startups, which rely almost entirely on outsourcing for their R&D needs, is also contributing to the rapid growth of this segment. These firms benefit from the flexibility and cost-efficiency of outsourcing, making it central to their operational model.

Pharmaceutical Analytical Testing Outsourcing Market By Regional Insights

North America dominates the global pharmaceutical analytical testing outsourcing market, owing to the region’s robust pharmaceutical industry, sophisticated regulatory framework, and strong presence of established CROs. The U.S., in particular, leads in both drug innovation and testing infrastructure. Companies in this region are early adopters of new analytical technologies and maintain strict adherence to FDA and USP regulations. This ensures a continuous demand for outsourced services capable of delivering high-quality, validated, and regulatory-compliant results. Moreover, the presence of leading CROs and analytical labs, such as Charles River Laboratories and Eurofins Scientific, further consolidates North America’s dominance.

Asia Pacific is projected to be the fastest-growing region, driven by a confluence of cost advantages, expanding R&D infrastructure, and increasing participation in global drug development trials. Countries like India and China offer significant cost savings for analytical testing services, without compromising on quality or regulatory compliance. Global pharmaceutical firms are increasingly establishing partnerships with local CROs to access skilled labor and state-of-the-art labs. The region’s favorable government policies, growing domestic pharma industries, and strong academic research base further support this upward trajectory.

Pharmaceutical Analytical Testing Outsourcing Market Recent Developments

-

Eurofins Scientific (March 2025) announced the expansion of its bioanalytical laboratory facilities in the U.S., aiming to support increasing demand for immunogenicity and biomarker testing services, especially from biopharmaceutical clients.

-

Labcorp Drug Development (January 2025) partnered with a mid-size biotech company for comprehensive method development and validation services for its novel RNA-based therapy.

-

WuXi AppTec (November 2024) launched a new high-throughput stability testing platform in its Suzhou, China facility, targeting biologics and biosimilar developers.

-

SGS SA (October 2024) completed its acquisition of a leading North American analytical lab to enhance its capabilities in extractable and leachable testing and expand its regulatory consulting offerings.

Some of the prominent players in the global pharmaceutical analytical testing outsourcing market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global pharmaceutical analytical testing outsourcing market

Services

- Method Development & Validation

-

- Extractable & Leachable

- Impurity Method

- Technical Consulting

- Others

-

- Drug Substance

- Stability Indicating Method Validation

- Accelerated Stability Testing

- Photostability Testing

- Others

End Use

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Contract Research Organizations

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)