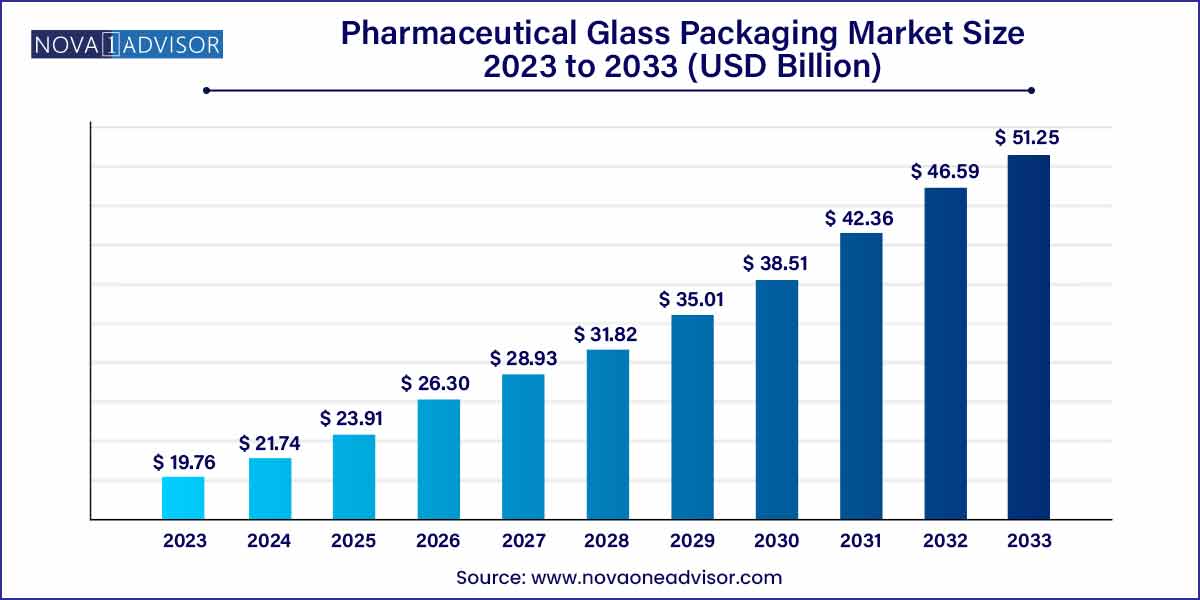

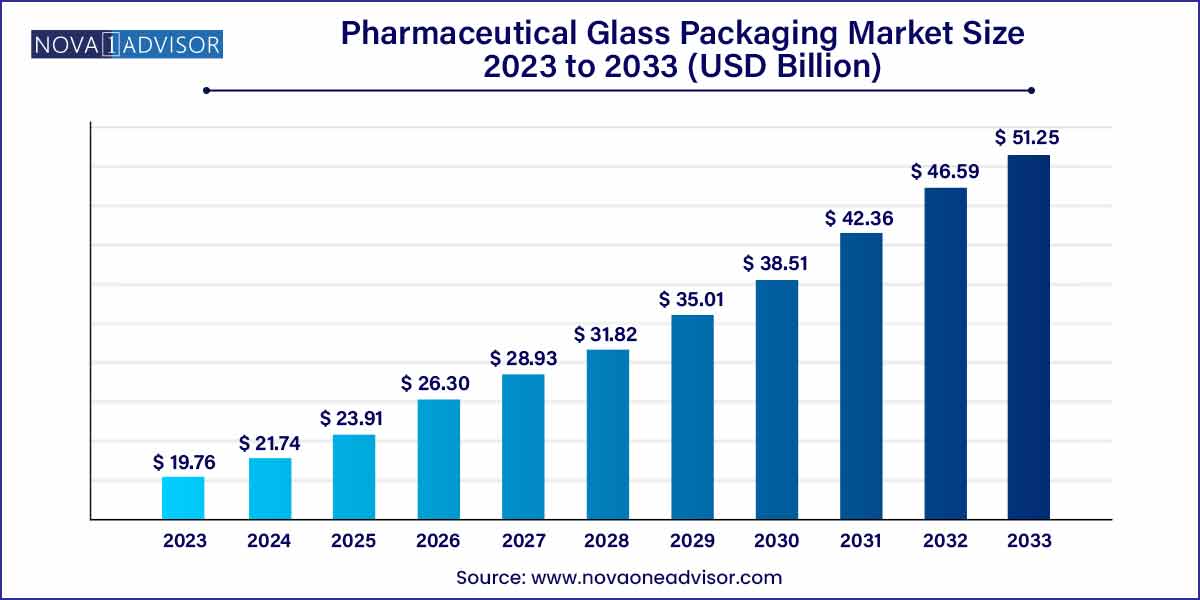

The global pharmaceutical glass packaging market size was exhibited at USD 19.76 billion in 2023 and is projected to hit around USD 51.25 billion by 2033, growing at a CAGR of 10.0% during the forecast period of 2024 to 2033.

Key Takeaways:

- North America dominated the market and accounted for more than 36.0% of global revenue in 2023.

- Pharmaceutical glass bottles were the largest market segment, accounting for more than 34.2% of global revenue in 2023.

- Generic drug types led the market and accounted for more than 73.0% of global revenue in 2023.

Market Overview

The global pharmaceutical glass packaging market has emerged as an essential component of the pharmaceutical supply chain, serving the critical role of preserving the integrity, safety, and efficacy of drugs. Glass remains a preferred packaging material in the pharmaceutical industry due to its exceptional barrier properties, chemical inertness, and ability to withstand sterilization. Whether used for storing small-volume injectables or oral liquid medications, glass provides unmatched protection against oxygen, moisture, and microbial contamination.

In recent years, the pharmaceutical industry has witnessed a surge in demand for advanced drug formulations, including biologics, vaccines, and specialty injectables—all of which require high-quality, chemically resistant packaging solutions. The COVID-19 pandemic further underscored the strategic importance of reliable pharmaceutical packaging, especially in vaccine distribution, where borosilicate glass vials played a crucial role in ensuring safe global delivery.

Driven by increasing global drug production, rising biologics consumption, expanding vaccination programs, and stringent regulatory standards, the pharmaceutical glass packaging market is experiencing steady growth. Leading manufacturers are also responding to the need for more sustainable and efficient packaging formats by investing in recyclable materials, lightweight designs, and modular packaging formats. With the rise in parenteral drugs and personalized medicine, the demand for precision-engineered, contamination-resistant glass packaging is expected to rise significantly.

Major Trends in the Market

-

Shift Toward Type I Borosilicate Glass: Rising demand for chemically resistant glass for storing sensitive biologics and vaccines is fueling Type I borosilicate glass adoption.

-

Adoption of Ready-to-Use (RTU) Packaging: Pre-washed, pre-sterilized glass containers are reducing contamination risks and operational time in aseptic filling lines.

-

Miniaturization and Precision Dosing: Small-dose packaging formats, including small vials and prefilled syringes, are gaining traction for vaccines, oncology drugs, and injectables.

-

Sustainability Initiatives: Manufacturers are focusing on developing recyclable, lightweight glass containers to reduce environmental impact and transportation costs.

-

Digital Labeling and Serialization: Integration of anti-counterfeit technologies like QR codes and RFID in glass containers is improving supply chain traceability.

-

Increased Demand from Biopharma and Contract Manufacturing Organizations (CMOs): Outsourcing trends are boosting bulk demand for standardized and customizable glass containers.

-

Geographic Expansion of Production Facilities: To meet global demand and mitigate supply chain disruptions, companies are expanding glass manufacturing in Asia and Eastern Europe.

Pharmaceutical Glass Packaging Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 19.76 Billion |

| Market Size by 2033 |

USD 51.25 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Material, Product, Drug Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Amcor plc; Becton, Dickinson, and Company; AptarGroup, Inc.; Drug Plastics Group; Gerresheimer AG; Schott AG; Owens Illinois, Inc.; West Pharmaceutical Services, Inc.; Berry Global, Inc.; WestRock Company; SGD Pharma; International Paper; Comar, LLC; CCL Industries, Inc.; Vetter Pharma International. |

Market Driver: Increasing Demand for Parenteral Drugs and Biologics

A key driver propelling the pharmaceutical glass packaging market is the rising production and consumption of parenteral drugs and biologics, which require highly inert and stable packaging formats. Biologics—complex molecules derived from living cells—are highly sensitive to temperature, pH, and chemical reactions. This necessitates packaging that offers high chemical resistance and does not interact with the drug formulation.

Type I borosilicate glass, known for its excellent thermal and chemical stability, is the material of choice for storing biologics, monoclonal antibodies, and vaccines. For example, COVID-19 mRNA vaccines from Pfizer-BioNTech and Moderna were stored in glass vials due to their stringent storage requirements. As biopharmaceutical innovation accelerates globally, the demand for precision-engineered glass containers is expanding rapidly. Pharmaceutical companies are also shifting toward injectable and intravenous therapies for chronic and lifestyle diseases, further increasing reliance on glass vials, syringes, and cartridges.

Market Restraint: Fragility and Handling Challenges

Despite its advantages, glass has inherent limitations related to its fragility and handling risks, which pose operational challenges in pharmaceutical manufacturing and distribution. Glass containers can break or crack under mechanical stress, mishandling, or during high-speed filling processes. Breakages not only cause product loss but can also lead to contamination and safety hazards.

Moreover, delamination where flakes or particles of glass shed from the container wall into the drug product—is a significant quality concern, particularly in long-term storage of high-potency injectables. This can trigger product recalls and compliance issues with regulatory bodies like the FDA or EMA. To mitigate these risks, pharmaceutical companies must invest in robust handling protocols, inspection systems, and specialized coatings or surface treatments, which add to operational complexity and cost.

Market Opportunity: Expansion of Personalized and Specialty Medicines

A significant opportunity lies in the growing market for personalized and specialty medicines, particularly in oncology, rare diseases, and immunology. These therapies often involve small batches, precision dosing, and highly sensitive biologics that require premium packaging solutions to maintain stability and efficacy. Glass packaging especially in the form of small vials, cartridges, and prefilled syringes—is ideally suited for these drugs due to its compatibility with parenteral administration.

Pharmaceutical companies are shifting their pipelines toward niche, high-value therapies, which demand high-quality packaging in small volumes. This shift is opening doors for innovation in pharmaceutical glass packaging ranging from smart packaging to dual-chamber vials. Manufacturers that offer customizable, small-volume, sterile glass packaging tailored to specific drugs and patient profiles stand to capture significant market share in the evolving biopharma landscape.

Segments Insights:

Material Insights

Type I (Borosilicate) glass held the dominant share of the pharmaceutical glass packaging market, largely due to its high chemical durability and resistance to thermal shock. This makes it ideal for storing sensitive drugs, such as vaccines, injectable biologics, and oncology drugs that require sterilization and stable storage environments. Type I glass does not react with aqueous or acidic solutions, minimizing the risk of contamination or degradation.

Its widespread use in high-value pharmaceutical applications has made Type I the gold standard for injectable drug containers. As the production of biologics and parenteral drugs continues to grow, demand for Type I glass is expected to remain robust across all major markets.

Type II glass, which is soda-lime glass treated with sulfur to enhance resistance, is gaining traction in storing buffered solutions, non-aqueous injectables, and certain oral formulations. While not as chemically resistant as Type I, it provides a cost-effective alternative for less reactive formulations. It is used in environments that require moderate durability but where drugs do not demand stringent inertness.

The growth of generic injectables and increased cost sensitivity in emerging markets are contributing to the rapid adoption of Type II glass. Manufacturers catering to both branded and off-patent drugs are increasingly integrating Type II packaging into their portfolios to meet diverse market demands.

Product Insights

Vials represented the most dominant product category within pharmaceutical glass packaging, owing to their extensive use in injectable drug delivery, including vaccines, antibiotics, and biological drugs. Small and large vials are widely used for both single- and multi-dose formulations in hospital and outpatient settings. Their compatibility with lyophilized (freeze-dried) drugs, ease of labeling, and ability to maintain sterility have made them indispensable in the industry.

The COVID-19 pandemic further emphasized the importance of vials, with billions of units produced for global vaccine distribution. Even as the pandemic subsides, ongoing vaccination programs and expansion of injectable therapies continue to fuel vial demand.

Cartridges and prefilled syringes are the fastest-growing product segment, driven by the increasing preference for self-administration and ease-of-use in chronic disease management. Prefilled syringes reduce dosing errors, improve patient compliance, and are preferred in therapies like insulin, rheumatoid arthritis biologics, and anticoagulants. They are also critical for emergency use drugs such as epinephrine.

Cartridges, often used in auto-injectors and pen devices, are expanding in tandem with digital drug delivery innovations. As pharmaceutical companies move toward patient-centric delivery formats, the demand for customized and sterility-assured glass cartridges and syringes continues to surge.

Drug Type Insights

Branded drugs held the largest market share due to their association with high-cost, high-efficacy formulations that demand superior packaging quality and protection. These include biologics, specialty therapies, and newly approved injectables that require Type I glass containers with the highest sterility and safety standards. Pharmaceutical companies developing new molecular entities (NMEs) heavily rely on borosilicate vials and prefilled syringes to support product efficacy and shelf life.

Additionally, branded drugs are often associated with small-volume production, making it cost-effective to invest in premium packaging formats that prevent degradation and extend usability. With growing R&D pipelines in oncology and immunotherapy, this segment will maintain its leadership.

Generic drugs are witnessing rapid growth, especially in Asia, Latin America, and Eastern Europe, where governments are promoting generic manufacturing to reduce healthcare costs. While generics often involve simpler formulations, they still require compliant and inert packaging to maintain drug integrity and meet global regulatory standards.

To meet price sensitivity in these regions, manufacturers are leveraging Type II and Type III glass bottles and vials, balancing cost and performance. The rising number of generic injectables and contract manufacturing deals are also driving demand for scalable glass packaging solutions tailored to the generics market.

Regional Insights

Europe led the pharmaceutical glass packaging market due to its strong base of pharmaceutical production, regulatory leadership, and well-established packaging infrastructure. Countries like Germany, Switzerland, and Italy host some of the world’s largest pharmaceutical and glass packaging companies, including Schott AG and Gerresheimer. The European Medicines Agency (EMA)’s stringent requirements for drug safety and packaging integrity have created a high benchmark for glass quality, especially for injectable drug packaging.

Moreover, Europe was a central hub for COVID-19 vaccine production, further increasing demand for pharmaceutical vials. The region's commitment to sustainability is also encouraging manufacturers to invest in energy-efficient glass melting and recycling technologies.

Asia-Pacific is experiencing the fastest growth, propelled by increased pharmaceutical manufacturing, expanding healthcare access, and rising exports. Countries such as India, China, and South Korea are not only major drug producers but also emerging as critical suppliers of glass packaging components. The region benefits from low-cost manufacturing, government incentives, and growing demand for generics and biologics.

Local manufacturers are investing in modernizing facilities to meet Western regulatory standards (e.g., US FDA and EU GMP), enabling exports of glass packaging components to global markets. With rising healthcare infrastructure and a growing middle class, Asia-Pacific is set to become the new center of gravity for pharmaceutical packaging demand.

Key Companies & Market Share Insights

Numerous pharmaceutical glass manufacturing companies are primarily concentrated in the developed regions such as Europe and North America resulting in well-established supply chain and production system in the regions. However, manufacturers are shifting their base to countries such as Brazil, India, and China due to low labor costs and growth of opportunities offered by these countries. The generic sector is expected to drive the demand for pharmaceutical glass packaging in these countries over the forecast period.

- In June 2023, Müller + Müller, the manufacturer of primary packaging materials made of tubular glass for the pharmaceutical industry, has invested 15 million EUR at its vial manufacturing site in Holzminden. The investment includes up to 14 new production lines as well as a corresponding clean room.

- In June 2023, Corning and SGD Pharma with joint venture open a new glass tubing facility and expand access to Corning Velocity Vial technology in in Telangana, India. Manufacturing of Velocity Vials at SGD Pharma’s facility in Vemula, India, is expected to begin in 2024. Pharmaceutical tubing production is expected to begin in 2025.

Recent Developments

-

Schott AG (March 2025): Announced a €70 million investment in expanding its pharmaceutical glass tubing production in India, aiming to strengthen its presence in Asia’s growing biopharmaceutical sector.

-

Gerresheimer (January 2025): Introduced a new line of eco-friendly lightweight borosilicate vials with reduced carbon emissions during production, supporting sustainability goals.

-

Corning Inc. (February 2025): Partnered with a major U.S. pharmaceutical firm to supply Valor Glass vials for injectable oncology drugs, citing reduced breakage and delamination.

-

Stevanato Group (April 2025): Launched a digital twin-based glass inspection system to enhance quality assurance for high-speed vial production lines.

-

DWK Life Sciences (February 2025): Expanded its syringe and cartridge product lines with tamper-proof features to meet increased demand for prefilled delivery systems.

Some of the prominent players in the pharmaceutical glass packaging market include:

- Corning Incorporated

- Nipro Corporation

- SGD S.A.

- Stoelzle Oberglas GmbH

- Bormioli Pharma S.p.A.

- West Pharmaceutical Services, Inc.

- Schott AG

- Gerresheimer AG

- Shandong Medicinal Glass Co., Ltd.

- Beatson Clark

- Ardagh Group S.A

- Arab Pharmaceutical Glass Co.

- Piramal Enterprises Ltd.

- ÅžiÅŸecam Group

- Owens-Illinois, Inc.

- DWK Life sciences

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global pharmaceutical glass packaging market.

Material Outlook

Product

-

- Small bottles

- Large bottles

- Cartridges & Syringes

- Ampoules

Drug Type

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)