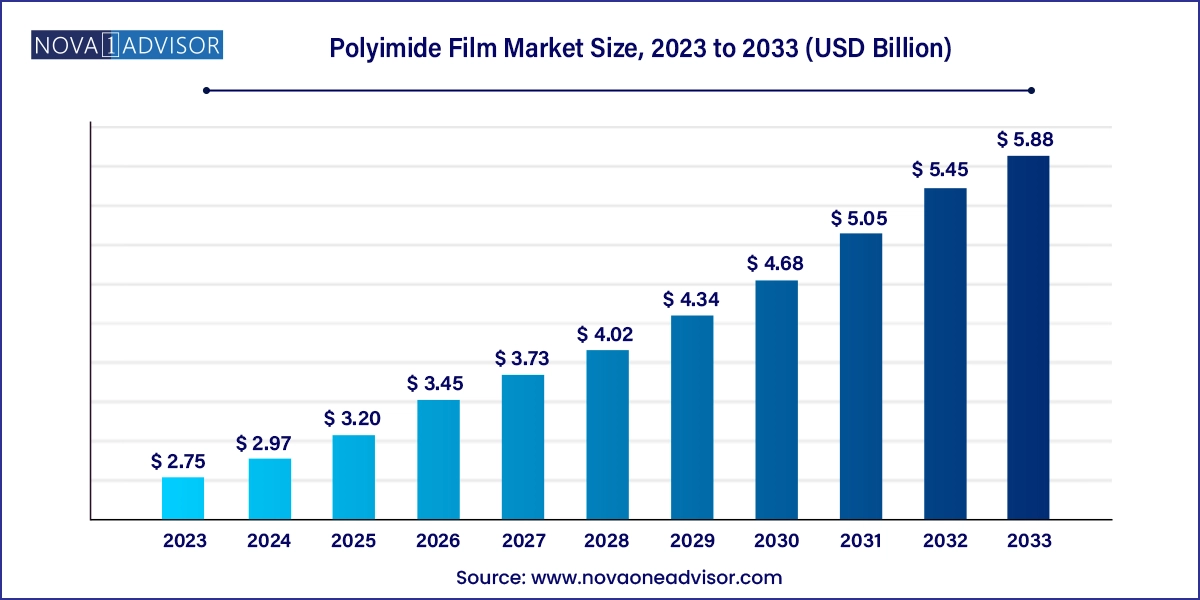

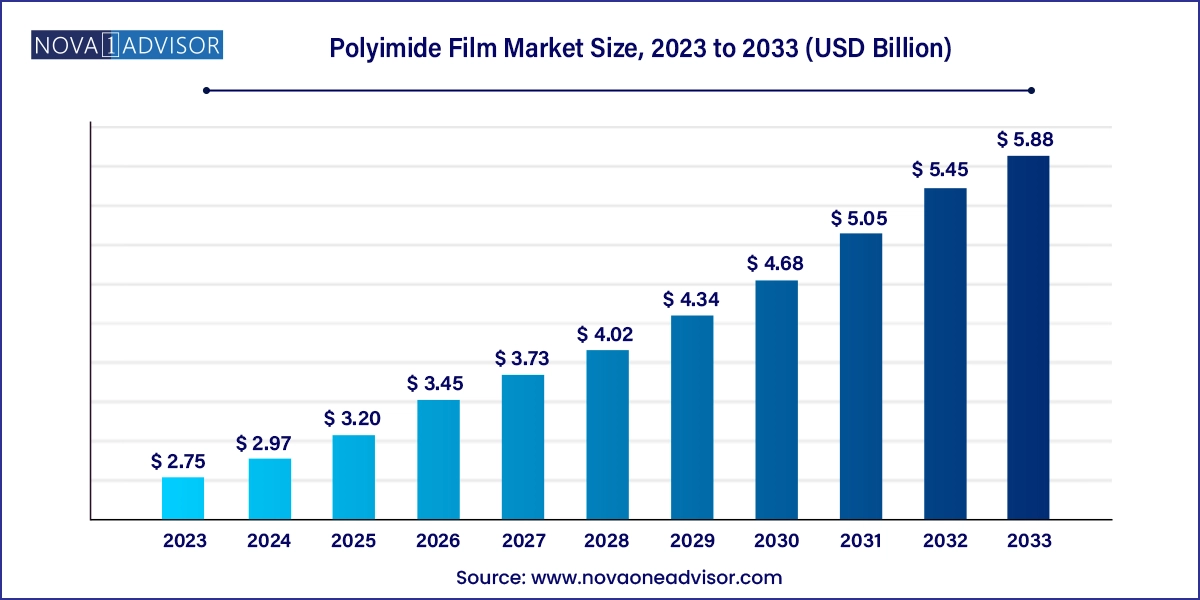

Polyimide Film Market Size and Growth

The polyimide film market size was exhibited at USD 2.75 billion in 2023 and is projected to hit around USD 5.88 billion by 2033, growing at a CAGR of 7.9% during the forecast period 2024 to 2033.

Polyimide Film Market Key Takeaways:

- Automotive dominated the global polyimide film industry and accounted for more than 33.0% of the total market share, in terms of revenue, in 2023.

- Flexible printed circuits (FPC) dominated the application segment in the global polyimide films market and accounted for more than 66% of the total market share, in terms of revenue, in 2023.

- North America dominated the polyimide film market in 2023 and accounted for more than 33.0% of the overall market revenue share.

- Europe accounted for a revenue share of more than 24.0% in 2023

Market Overview

Polyimide films are high-performance polymers characterized by exceptional thermal stability, chemical resistance, and mechanical strength. These films have carved a niche across various industries due to their ability to withstand extreme environments while maintaining dimensional integrity and flexibility. Traditionally used in aerospace and electronics, their applications have expanded into automotive, labeling, and flexible electronics due to the surging demand for miniaturized and durable electronic components.

The global polyimide film market has witnessed steady growth over the past decade, underpinned by a robust demand for high-performance materials in emerging technologies. Their excellent electrical insulation properties have made them indispensable in flexible printed circuits and wire insulation. Additionally, as industries push toward higher efficiency and miniaturization, polyimide films are gaining traction due to their high dielectric strength, lightweight nature, and low thermal expansion.

The market is highly fragmented, with the presence of both multinational corporations and regional players. Technological innovations, strategic collaborations, and increasing R&D investments have enabled players to tailor their products for industry-specific needs. As of 2025, the polyimide film market continues to grow rapidly, driven by evolving consumer electronics, electric vehicles, 5G infrastructure development, and the aerospace sector's inclination towards lightweight materials.

Major Trends in the Market

-

Miniaturization of electronics: Polyimide films are widely adopted in flexible printed circuits used in smartphones, tablets, and wearable electronics.

-

Electrification of vehicles: Increasing demand for heat-resistant materials in EV batteries and motors is fueling polyimide film usage.

-

Growth in aerospace demand: The need for lightweight and high-performance insulation materials in aircraft continues to boost demand.

-

Expansion of 5G infrastructure: With the roll-out of 5G, components requiring heat and frequency tolerance like antennas and circuit boards are driving consumption.

-

Sustainability and green chemistry: Manufacturers are investing in solvent-free production methods and bio-based polyimide films to meet environmental regulations.

-

Rise in flexible displays: The emergence of foldable screens and rollable display technologies is propelling the demand for ultra-thin and durable polyimide films.

-

Strategic collaborations: Companies are entering partnerships to integrate polyimide films with advanced composites and resins for next-gen applications.

Report Scope of Polyimide Film Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.97 Billion |

| Market Size by 2033 |

USD 5.88 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil; Argentina; GCC Countries; South Africa |

| Key Companies Profiled |

DuPont; Compagnie de Saint-Gobain; Kolon Industries, Inc.; KANEKA CORPORATION; Taimide Tech. Inc.; FLEXcon Company, Inc.; Arakawa Chemical Industries Ltd.; Anabond, Goodfellow; I.S.T Corporation |

Key Market Driver: Proliferation of Consumer Electronics

One of the primary growth drivers of the polyimide film market is the surging proliferation of consumer electronics, particularly in Asia Pacific. The rise of smartphones, tablets, wearable technology, and flexible displays has dramatically amplified the demand for lightweight, flexible, and thermally stable substrates. Polyimide films offer superior electrical insulation and can maintain their performance under extreme temperature variations, making them ideal for flexible printed circuits (FPCs) and display backplanes.

In regions like South Korea, Taiwan, and China home to major electronics manufacturing hubs—polyimide films are a backbone material in flexible OLED displays, printed circuit boards, and microelectronics. As foldable and rollable devices transition from prototypes to commercial products, the dependency on polyimide films is expected to intensify. For instance, Samsung's foldable phones employ colorless polyimide (CPI) films instead of glass to ensure flexibility and resilience. This trend is expected to remain pivotal in shaping the market over the coming years.

Key Market Restraint: High Cost of Production

Despite the broad range of benefits polyimide films offer, their high production cost remains a significant market restraint. The synthesis of polyimide involves complex chemical processes and expensive raw materials such as aromatic dianhydrides and diamines. Furthermore, the solvent-based imidization process requires stringent handling conditions, making manufacturing capital-intensive and environmentally challenging.

This cost factor limits the widespread adoption of polyimide films in cost-sensitive applications, especially in emerging markets. Manufacturers are investing in R&D to discover cost-effective processes such as solvent-free synthesis and roll-to-roll coating techniques. However, until scalable and cost-efficient manufacturing alternatives are established, the premium pricing of polyimide films is likely to hinder their penetration into lower-margin industries such as general packaging or consumer-grade labeling.

Key Opportunity: Rise of Electric Vehicles (EVs)

The global shift toward electric mobility presents a lucrative opportunity for the polyimide film market. Electric vehicles demand materials that are not only lightweight but also capable of withstanding high voltages and extreme temperatures. Polyimide films perfectly meet these criteria, making them suitable for insulation in batteries, motors, and power modules.

As countries enforce stringent emission regulations and offer incentives to promote EV adoption, automakers are scaling up EV production. This expansion creates a substantial demand for polyimide films used in battery packs, inverter insulation, wire harnessing, and motor slot liners. In addition, with the emergence of solid-state batteries, which operate at higher temperatures than traditional lithium-ion cells, the need for advanced insulation materials such as polyimide is expected to surge dramatically in the coming years.

Polyimide Film Market By End-use Insights

Electronics dominated the end-use segment due to the massive deployment of polyimide films in circuitry, semiconductors, and display technologies. As consumer electronics continue to shrink in size while increasing in performance, polyimide films are being increasingly used to meet these demands. Their role in flexible displays, wearables, and photovoltaic cells makes them irreplaceable in advanced electronics manufacturing. Major companies like LG, Sony, and Huawei rely heavily on polyimide films for their OLED-based products.

Automotive is anticipated to be the fastest-growing end-use industry. The transition toward electric and autonomous vehicles has increased the need for advanced materials that can perform reliably in under-the-hood environments. Polyimide films are used in temperature-sensitive applications such as lithium-ion battery insulation, sensors, and actuators. As vehicle electronics become more complex and critical to functionality, the adoption of polyimide films in this sector is set to accelerate, particularly with the integration of ADAS and infotainment systems.

Polyimide Film Market By Application Insights

Flexible Printed Circuit (FPC) dominated the application segment in 2024. With the increasing adoption of compact and lightweight electronic devices, FPCs are in high demand due to their ability to fit into tight spaces while offering reliable electrical performance. Polyimide films, known for their flexibility and thermal endurance, are a core material in FPCs, especially for smartphones, tablets, and IoT sensors. The electronics sector continues to evolve rapidly, and polyimide films help meet the needs for higher density circuitry and faster signal transmission in these devices.

The Specialty Fabricated Product segment is expected to grow at the fastest CAGR. These include custom-shaped insulation parts and flexible heaters used in aerospace and medical applications. Innovations in medical wearables and increasing space exploration missions are expanding the application base for specialty fabricated polyimide films. These products often require high customization, which polyimide materials can accommodate due to their moldability and thermal resistance. As industries focus more on reliability and precision in extreme environments, demand in this segment is projected to grow exponentially.

Polyimide Film Market By Regional Insights

Asia Pacific led the global polyimide film market in 2024 and is expected to maintain its dominance through 2030. This region is home to the world’s largest electronics and semiconductor manufacturing hubs, especially in countries like China, Japan, South Korea, and Taiwan. The presence of consumer electronics giants such as Samsung, Panasonic, and Foxconn ensures continuous demand for high-quality polyimide films. Additionally, China’s Belt and Road Initiative and infrastructural upgrades are creating robust demand for pressure-sensitive tapes and wire insulation materials.

In recent years, the region has also witnessed massive investments in EV production, especially from BYD and Nio in China, and Honda and Toyota in Japan. With such strong industrial backing, favorable government policies, and a vast consumer base, Asia Pacific is the epicenter of polyimide film consumption.

North America is projected to be the fastest-growing region during the forecast period. The region benefits from advanced aerospace and defense manufacturing capabilities, particularly in the United States. The increasing number of commercial and defense aircraft orders has led to heightened demand for high-performance insulation materials like polyimide films. Furthermore, the electric vehicle market in the U.S. is gaining momentum due to the Inflation Reduction Act and EV tax credits.

In addition, the region’s emphasis on R&D and the presence of technology innovators such as DuPont and Kaneka Corp. support new product development in polyimide-based materials. As sustainability and high-performance material adoption grow, North America will see strong demand across automotive, electronics, and aerospace domains.

Recent Developments

-

DuPont (March 2025): DuPont announced the expansion of its polyimide film manufacturing capacity in Circleville, Ohio. The facility will include advanced production lines designed for next-generation electronics and EV applications.

-

UBE Corporation (January 2025): UBE launched a new series of transparent polyimide films targeting the flexible OLED display market, emphasizing enhanced optical clarity and thermal resistance.

-

Kaneka Corporation (February 2025): Kaneka signed a partnership with a leading EV battery manufacturer in Europe to supply high-heat-resistant polyimide films for battery insulation in solid-state battery systems.

-

Taimide Tech Inc. (December 2024): The company developed a low-dielectric constant polyimide film for high-frequency communication devices, including components for 5G networks.

Some of the prominent players in the polyimide film market include:

- DuPont

- Compagnie de Saint-Gobain

- Kolon Industries, Inc.

- KANEKA CORPORATION

- Taimide Tech. Inc.

- FLEXcon Company, Inc.

- Arakawa Chemical Industries Ltd.

- Anabond

- Goodfellow

- I.S.T Corporation

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the polyimide film market

Application

- Flexible Printed Circuit

- Wire & Cable

- Pressure Sensitive Tape

- Specialty Fabricated Product

- Motor/Generator

End-use

- Electronics

- Aerospace

- Automotive

- Labelling

- Others

Regional

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa