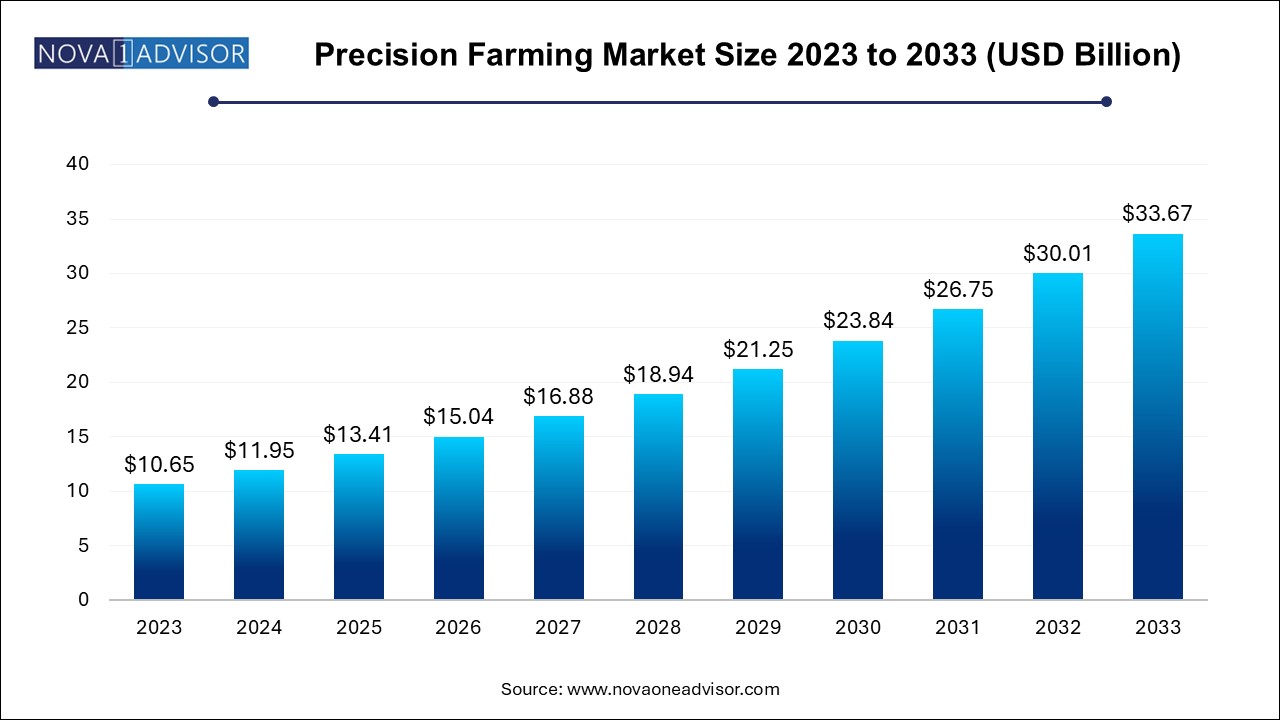

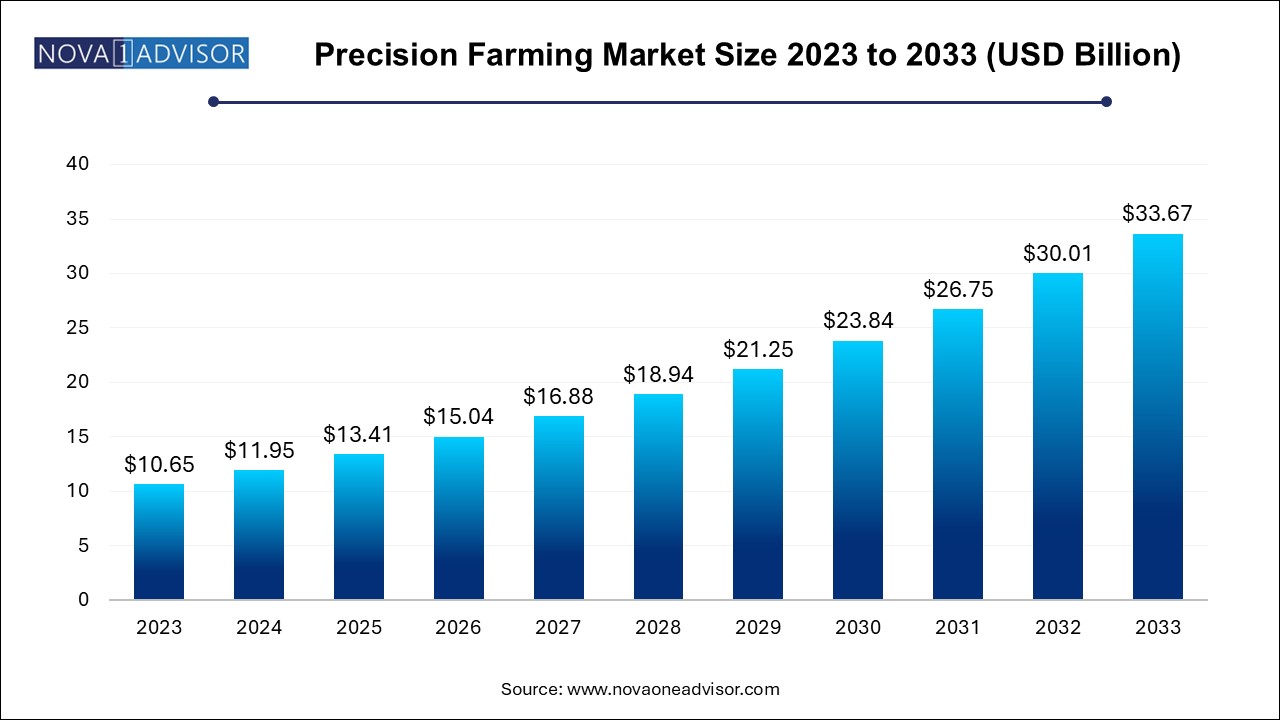

Precision Farming Market Size and Growth

The global precision farming market size was exhibited at USD 10.65 billion in 2023 and is projected to hit around USD 33.67 billion by 2033, growing at a CAGR of 12.2% during the forecast period 2024 to 2033.

Precision Farming Market Key Takeaways:

- The hardware segment accounted for the largest revenue share of 66.89% in 2023 and is expected to dominate the market during the forecast period.

- The yield monitoring segment accounted for the largest revenue share of 43.25% in 2023 and is expected to continue its dominance over the forecast period.

- North America accounted for the largest revenue share of 44.07% in 2023.

- Asia Pacific is expected to witness significant growth over the forecasted period. The region is expected to witness a CAGR of over 15.3% from 2024 to 2033.

Market Overview

The global precision farming market has emerged as a cornerstone of modern agriculture, enabling farmers to increase yield, reduce costs, and optimize resource utilization. Precision farming—also referred to as precision agriculture or smart farming—is a technology-driven approach that integrates GPS, GIS, drones, sensors, AI, and IoT to monitor and manage variability in agricultural fields. This approach facilitates data-driven decision-making, improving both the economic and environmental performance of farms.

In the face of global challenges such as climate change, rising food demand, and declining arable land, precision farming offers a sustainable path forward. It enables more efficient application of water, fertilizers, pesticides, and labor, thereby reducing waste and minimizing environmental footprint. Farmers are now adopting technology not just for mechanization but also for real-time insights, predictive analytics, and automation of farm operations.

Over the past decade, the sector has transformed from early-stage GPS-enabled tractors to fully connected, AI-driven systems capable of providing field-specific recommendations. The proliferation of mobile devices, cloud computing, and wireless communication has further democratized access to precision farming, allowing small and medium-sized farms in emerging economies to adopt smart agricultural solutions.

Furthermore, increasing government support, growing agri-tech investments, and a robust ecosystem of agri-startups and OEMs are accelerating the adoption of precision farming tools globally. As sustainability becomes a central goal across agricultural value chains, precision farming is becoming not just an option but a necessity for future-ready agriculture.

Major Trends in the Market

-

AI and Machine Learning in Crop Analytics: AI is enabling real-time data analysis for crop yield prediction, disease detection, and input optimization.

-

Rise of Drone-Based Agriculture: Drones are increasingly used for aerial imaging, spraying, and crop health assessment.

-

IoT Integration Across Farm Equipment: IoT sensors are used for soil monitoring, climate tracking, and asset management.

-

Shift Toward Cloud-Based Farm Management Platforms: Cloud infrastructure is facilitating real-time data sharing, storage, and collaborative decision-making.

-

Autonomous Farm Equipment: The development of driverless tractors and robotic weeders is changing the face of mechanized agriculture.

-

Sustainability and Carbon Tracking: Precision farming is being linked to carbon footprint tracking and sustainable certifications.

-

API-Driven Interoperability Between Devices: Standardized APIs are allowing integration of third-party devices and software into cohesive farm management platforms.

-

Government Incentives for Smart Farming Adoption: Subsidies and grants for technology adoption in agriculture are rising globally.

Report Scope of Precision Farming Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 11.95 Billion |

| Market Size by 2033 |

USD 33.67 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Offerings, Application and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, South America, MEA |

| Key Companies Profiled |

Ag Leader Technology; AgJunction, Inc.; CropMetrics LLC; Trimble, Inc.; AGCO Corporation; Raven Industries Inc.; Deere and Company; Topcon Corporation; AgEagle Aerial Systems Inc. (Agribotix LLC); DICKEY-john Corporation; Farmers Edge Inc.; Grownetics, Inc.; Proagrica (SST Development Group, Inc.); The Climate Corporation. |

Market Driver: Increasing Demand for High Crop Yield with Resource Efficiency

One of the most powerful drivers of the global precision farming market is the increasing demand for maximizing crop yields while minimizing resource use. As the global population is projected to reach 9.7 billion by 2050, agricultural production needs to increase significantly—without expanding farmland or depleting water and soil resources.

Precision farming enables site-specific crop management, allowing farmers to tailor inputs (like water, seeds, and fertilizers) to the specific needs of different field zones. For instance, variable rate technology (VRT) helps optimize fertilizer application based on real-time nutrient analysis, improving both yield and cost efficiency. Similarly, remote sensing and soil sensors allow for timely irrigation and disease prevention, reducing losses and environmental degradation.

Farmers using precision agriculture report increased productivity, lower costs, and better risk mitigation—driving adoption at scale. As environmental regulations tighten and ESG frameworks gain importance in agriculture, the role of precision farming in enabling sustainable intensification becomes indispensable.

Market Restraint: High Initial Investment and Technological Complexity

A major restraint hindering the growth of the precision farming market is the high capital investment and operational complexity associated with adopting these technologies. Precision farming systems require upfront investment in hardware like drones, sensors, GPS-guided machinery, and software platforms for analytics and control. While large-scale farms may find the ROI compelling, smallholder farmers—especially in developing countries—often face affordability challenges.

Moreover, the technology stack is data-intensive and requires specialized skills for interpretation and execution. Many farmers lack the training or access to agronomists and IT professionals needed to operate, maintain, and troubleshoot these systems effectively. Interoperability issues between devices from different vendors also present integration challenges, creating hesitation among users.

Although innovation and competition are bringing down costs, the transition to full-scale smart farming remains slow without widespread education, subsidies, and support infrastructure.

Market Opportunity: Integration of AI, Cloud, and Edge Computing for Real-Time Decision Making

A major opportunity within the precision farming market lies in the integration of artificial intelligence (AI), cloud computing, and edge computing to enable real-time, data-driven decision-making at scale. As farms become increasingly connected, vast amounts of sensor data on soil health, crop growth, and environmental conditions are being collected. Turning this raw data into actionable insights is where AI and analytics platforms are proving transformative.

Cloud-based platforms allow for remote access, seamless updates, and scalable storage, while edge computing ensures critical decisions like pest management or irrigation control can be made instantly, even without internet connectivity. Platforms powered by AI can identify disease patterns, predict yield, and provide personalized recommendations based on location, weather forecasts, and crop type.

This capability is particularly valuable for large farms and agribusinesses managing diverse crop portfolios across multiple geographies. It also presents opportunities for software vendors, analytics firms, and equipment manufacturers to co-create integrated solutions—accelerating digital transformation in agriculture.

Precision Farming Market By Offering Insights

Hardware dominates the precision farming market due to the essential role of physical devices ranging from GPS systems, drones, and sensors to automation systems like VRT and guidance systems. Within hardware, automation & control systems including driverless tractors and drones play a pivotal role in transforming traditional farm operations. Precision sowing, harvesting, and spraying are increasingly conducted using GPS-guided tractors integrated with application control devices.

However, software is the fastest growing segment, especially as farms scale up and seek to extract more value from collected data. Software solutions both cloud-based and web-based are central to converting sensor data into visual dashboards, predictions, and farm management strategies. Cloud-based platforms enable multi-user access, mobile compatibility, and integration with supply chains, financial records, and weather databases. Vendors are now offering AI-powered tools for crop health assessment, supply planning, and yield forecasting, making the software layer indispensable for intelligent farming.

Precision Farming Market By Application Insights

Yield monitoring is the leading application of precision farming technology, accounting for the largest share due to its critical role in assessing field variability and managing input use efficiently. Yield data is collected using sensors mounted on harvesting equipment, helping farmers analyze productivity zone-by-zone. On-farm yield monitoring enables immediate feedback for input decisions, while off-farm analysis helps in planning future crop cycles and benchmarking performance.

Irrigation management is the fastest-growing segment, fueled by increasing water scarcity and pressure to optimize water use. Precision irrigation systems combine soil moisture sensors, weather data, and automated valves to ensure water is delivered only when and where it’s needed. This not only conserves water but also reduces disease incidence due to overwatering and enhances nutrient uptake. Smart irrigation solutions are increasingly adopted in arid regions and areas facing water regulation, making them a key area of investment.

Precision Farming Market By Regional Insights

North America holds the largest share of the global precision farming market, owing to its advanced technological infrastructure, strong support from government programs (like USDA's precision ag initiatives), and early adoption by large-scale farms. The U.S. and Canada lead in the deployment of GPS-based systems, VRT, and AI-driven farm analytics platforms. Farmers in this region benefit from access to advanced agri-tech, financing options, and a mature ecosystem of OEMs and digital platforms.

Moreover, large agribusinesses and food companies in North America are integrating precision agriculture into their supply chains to enhance traceability, sustainability, and cost efficiency. The region also leads in agri-startup funding, R&D, and regulatory support for drone usage in agriculture.

Asia Pacific is witnessing the fastest growth, driven by government initiatives, population pressure, and increased adoption of smart farming practices. Countries like China, India, Japan, and Australia are investing in mechanization, remote sensing, and real-time monitoring tools to address challenges related to food security, water shortages, and smallholder productivity.

India’s Smart Farming Mission and China’s push for intelligent agricultural equipment are creating new growth avenues. Japanese farms, despite their smaller size, are adopting robotic automation and AI for labor efficiency. Meanwhile, Southeast Asia is exploring drone spraying and mobile-based advisory tools for rice and plantation crops. As internet penetration improves and mobile devices become widespread, Asia Pacific’s adoption of cloud and mobile-based farm management platforms is accelerating rapidly.

Precision Farming Market Recent Developments

-

April 2024 – Trimble Inc. announced the launch of a next-generation precision agriculture platform, featuring AI-powered crop insights and a modular hardware-software architecture that integrates with existing farm machinery. The platform enables farmers to optimize planting, irrigation, and harvesting decisions in real time. [Source: PR Newswire]

-

February 2024 – Deere & Company unveiled a partnership with SpaceX’s Starlink to provide satellite-powered connectivity to remote farms, enabling real-time data transfer from precision equipment and sensors, especially in low-bandwidth areas.

-

December 2023 – CNH Industrial completed its acquisition of Augmenta, an AI agritech firm specializing in camera-based crop health analysis and automated fertilizer application, strengthening its VRT portfolio.

-

November 2023 – AGCO Corporation launched FendtONE, a unified digital farming platform that connects tractors, terminals, and agronomic software into a single interface, enhancing precision farming across European and U.S. farms.

-

September 2023 – Climate FieldView (Bayer Crop Science) introduced weather-adjusted yield forecasting models for corn and soybeans in North and South America, improving planting and harvesting timing decisions.

Some of the prominent players in the global precision farming market include:

- Ag Leader Technology

- AgJunction, Inc.

- CropMetrics LLC

- Trimble, Inc.,

- AGCO Corporation

- Raven Industries Inc.

- Deere and Company

- Topcon Corporation

- AgEagle Aerial Systems Inc. (Agribotix LLC)

- DICKEY-john Corporation

- Farmers Edge Inc.

- Grownetics, Inc.

- Proagrica (SST Development Group, Inc.)

- The Climate Corporation

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global precision farming market

Offering

-

- Automation & Control Systems

-

-

- Drones

- Application Control Devices

- Guidance System

-

-

-

- Handheld

- Satellite Sensing

-

-

- Driverless Tractors

- Mobile Devices

- VRT

-

-

-

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

-

-

-

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

-

-

- Water Sensors

- Climate Sensors

- Others

-

- System Integration & Consulting

- Maintenance & Support

- Managed Types

-

-

- Data Types

- Analytics Types

- Farm Operation Types

-

- Assisted Professional Types

-

-

- Supply Chain Management Types

- Climate Information Types

Application

- Field Mapping

- Crop Scouting

- Weather Tracking & Forecasting

- Irrigation Management

- Inventory Management

- Farm Labor Management

Regional

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa (MEA)