Protein Purification and Isolation Market Size and Trends

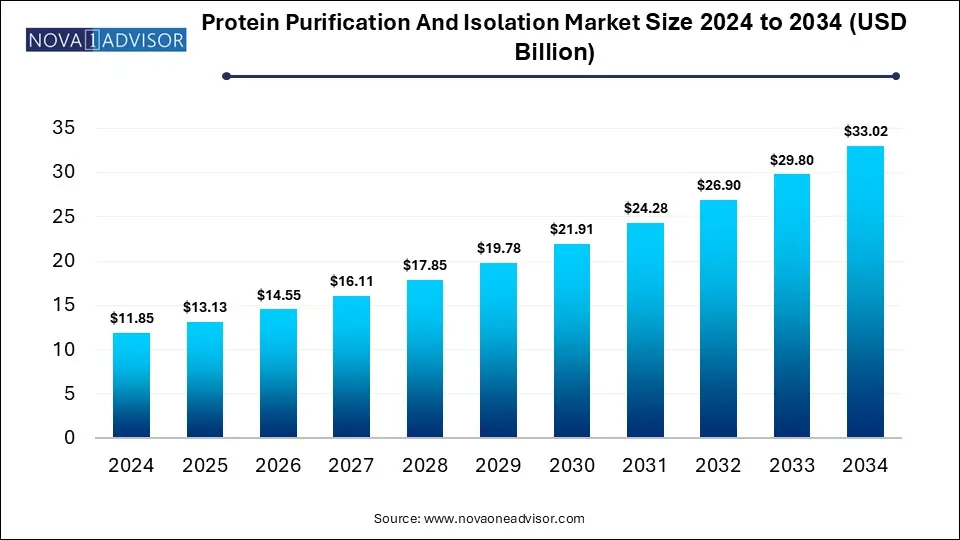

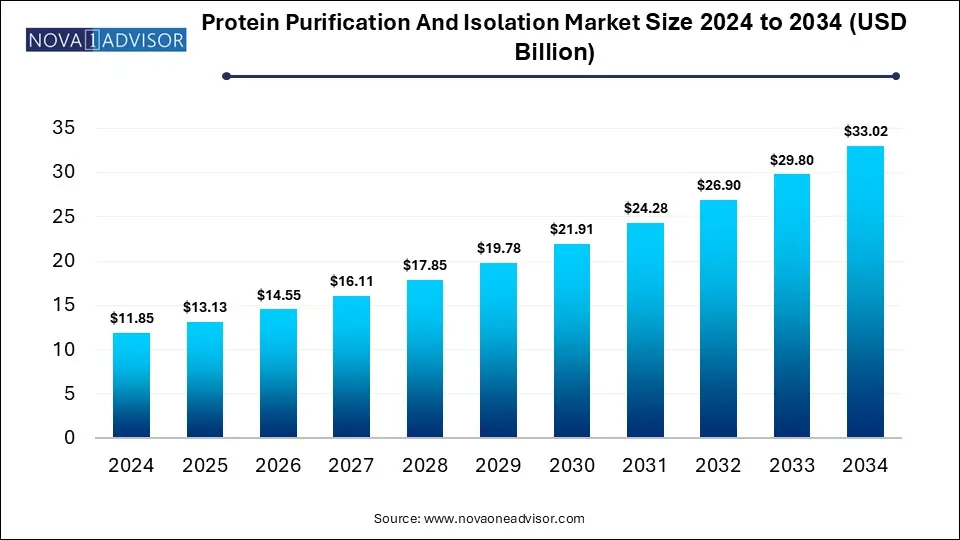

The global protein purification and isolation market size is calculated at USD 11.85 billion in 2024, grows to USD 13.13 billion in 2025, and is projected to reach around USD 33.02 billion by 2034, growing at a CAGR of 10.79% from 2025 to 2034. The protein purification and isolation market growth can be attributed to rising demand for protein-based therapies, advancements in proteomics research, and innovative product launches.

Protein Purification and Isolation Market Key Takeaways

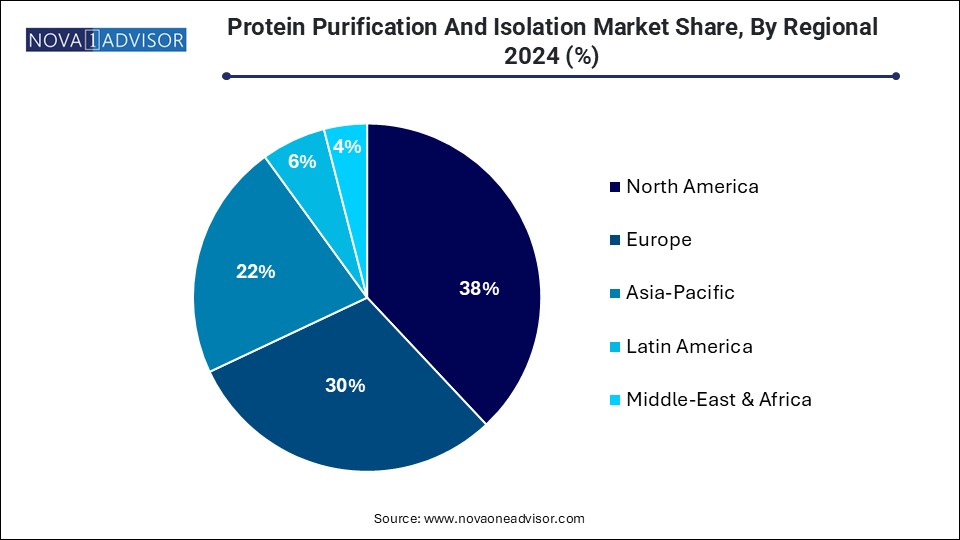

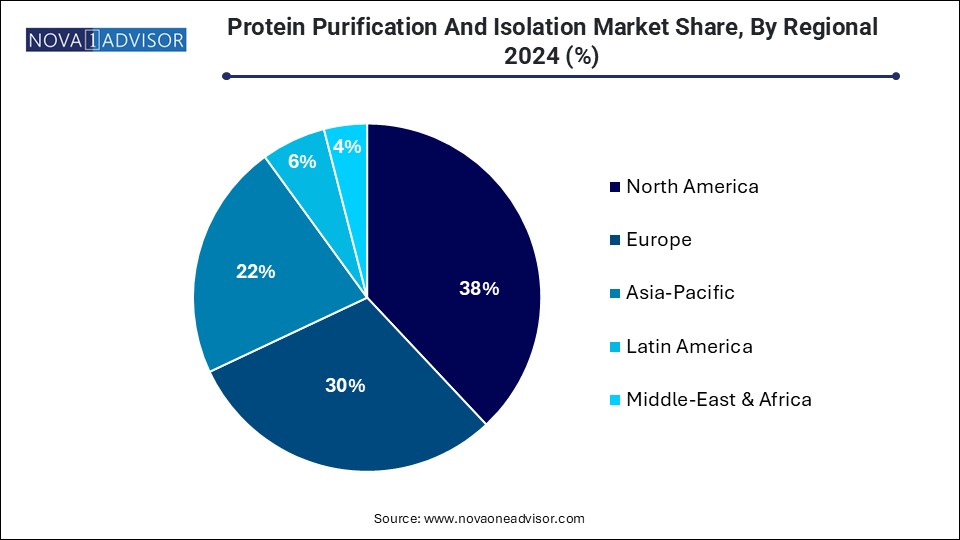

- North America dominated the global protein purification and isolation market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product, the consumables segment dominated the market with the largest share in 2024.

- By product, the instruments segment is expected to show a significant growth over the forecast period.

- By technology, the chromatography segment accounted for the highest market share in 2024.

- By technology, the electrophoresis segment is expected to register significant growth during the predicted timeframe.

- By application, the protein-protein interaction segment held the largest market share in 2024.

- By application, the drug screening segment is expected to register fastest growth during the forecast period.

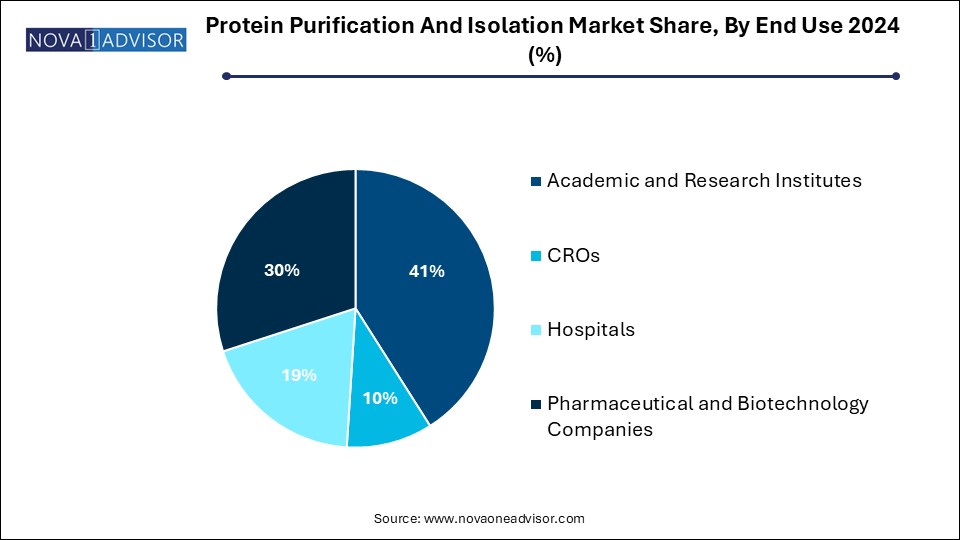

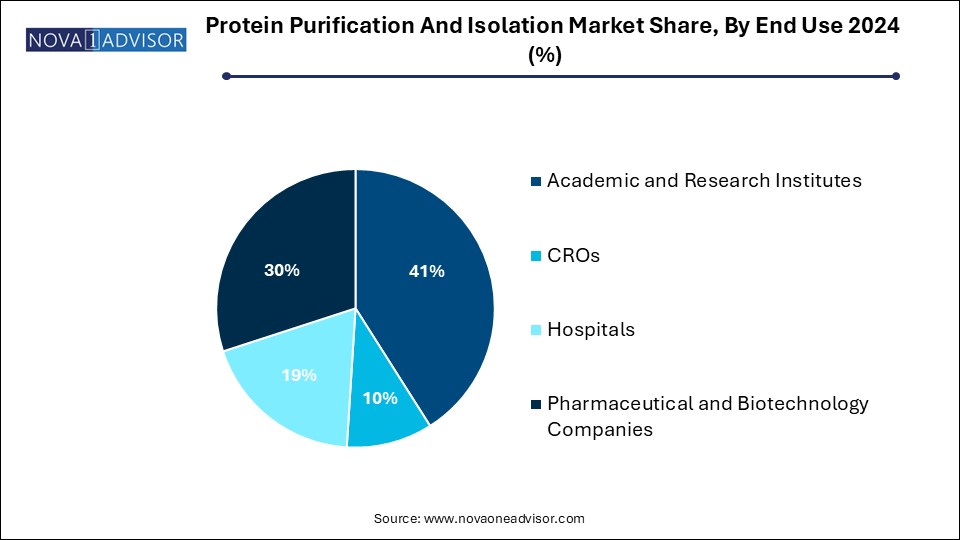

- By end use, the academic and research institutes segment captured the largest market share in 2024.

- By end use, the hospitals segment is expected to show the fastest growth during the forecast period.

What Drives the Growth of the Protein Purification and Isolation Market?

Protein purification and isolation are crucial steps in biochemistry and molecular biology which involves the segregation and filtration of a specific protein from a complex mixture to further isolate it for study or application. Increased emphasis on personalized medicine, rising investments made by public and private sectors in research and drug discovery and development, and focus of companies on expanding and strengthening protein-based drugs pipelines are driving the growth of the protein purification and isolation market. Rising outsourcing trend for conducting research and drug development activities from Contract Research Organizations (CROs) is contributing to the demand of protein purification services and products.

What Are the Key Trends in the Protein Purification and Isolation Market in 2025?

- In July 2025, Dotmatics, launched its next-generation protein-design & engineering solution, BioGlyph Luma which is the newest addition to the Luma Scientific, Intelligence Platform offering deep end-to-end support for protein designing, cloning, expression, purification and characterization.

- In May 2025, Waters Corporation introduced the BioResolve Protein A Affinity Columns with MaxPeak Premier Technology, offering precise titer measurements.

Where is AI Finding Applications in the Protein Purification and Isolation Market?

Artificial intelligence (AI) in protein purification and isolation market is transforming the designing and optimization of protein purification and stabilization strategies. AI algorithms can be applied for prediction of protein structures, in designing affinity tags using affinity chromatography as well as for designing novel protein sequences. Machine learning models can enable refinement of purification protocols, ensuring maximum yield and purity. Automation of designing purification strategies using AI-powered tools can potentially reduce time and resources needed for optimization. AI-powered models and platforms such as AlphaFold, RosettaFold, I-TASSER and AlphaProteo are enhancing the efficacy and accuracy of protein purification and isolation workflows by providing a data-driven and highly optimized approach.

Report Scope of Protein Purification And Isolation Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 13.13 Billion |

| Market Size by 2034 |

USD 33.02 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.79% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, Technology, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Cube Biotech GmbH, Danaher, Merck KGaA, Norgen Biotek Corp., Promega Corporation, QIAGEN, Takara Bio. Inc., Thermo Fisher Scientific, Inc. |

Market Dynamics

Drivers

Increasing Demand for Biopharmaceuticals

Rapid expansion of the biopharmaceutical industry with focus on development of biologics such as monoclonal antibodies, recombinant proteins and vaccines are driving the demand for highly purified forms of therapeutic proteins. To ensure the safety and efficacy of these proteins as well as to meet the stringent regulatory requirements, researchers and manufacturers rely on advanced protein purification techniques and systems. Furthermore, increasing complexities of molecules such as antibody-drug conjugates (ADCs), bispecific antibodies and gene therapies require highly specific and advanced purification techniques to maintain the structural integrity and biological activity of proteins.

Restraints

Lack of Skilled Personnel and High Upfront Investments

Specialized knowledge with hands-on experience is required for operating and optimizing sophisticated purification systems. Shortage of skilled scientists and technicians is leading to low yields, inefficiencies, increased errors and troubleshooting difficulties which can potentially impact the overall productivity and quality of purified proteins.

High costs associated with advanced purification systems such as high performance liquid chromatography (HPLC) systems, centrifuges and automated workstations can be a significant barrier for small companies, emerging start-ups and academic institutions. Additionally, operational costs for large-scale purification or high-throughput applications requiring consumables and purification systems as well as maintenance of complex equipment to ensure regulatory compliance can potentially restrain the market growth.

Opportunities

Advancements in Purification Technologies

Innovations in purification media and methods such as development of novel and more selective chromatography resins and affinity ligands, adoption of disposable (single-use) components like membrane filters and pre-packed columns as well as shift form batch to continuous purification processes are enhancing productivity and efficiency of workflows, leading to a significant opportunity for market growth. Emerging applications in non-healthcare sectors such as agriculture, cosmetics industry and food & beverage industry are fuelling the market expansion. Automated systems and high-throughput technologies are accelerating drug discovery and development processes by enabling researchers to purify and analyze multiple samples simultaneously.

Segmental Insights

What Made Consumables the Dominant Segment in 2024?

By product, the consumables segment accounted for the largest market share in 2024. Increased investments in R&D activities by various pharmaceutical and biotech companies, research organizations and academic institutions is driving the demand for consumables. Growing need for high-throughput purification and isolation workflows, increased emphasis on production of protein-based therapies such as biologics, innovations in consumables such as single-use and automated types and continuous advancements in proteomics research are contributing to the market growth.

By product, the instruments segment is expected to register a significant CAGR during the predicted timeframe. Continuous technological advancements in chromatography and electrophoresis techniques as well as development of automated and high-throughput protein purification and stabilization instruments are enhancing the accuracy and efficiency of processes. Increasing adoption of automated systems, rising investments by private and public organizations for protein research, and expansion of proteomics research are the factors fuelling the market growth. Protein purification instruments such as centrifuges, chromatography systems, centrifuges, electrophoresis units, filtration systems and spectrophotometers are essential tools for improving the throughput resolution and minimizing protein loss in both research and industrial settings.

How Chromatography Segment Dominated the Market in 2024?

By technology, the chromatography segment dominated the market with the highest share in 2024. Chromatography is the gold standard for attaining high levels of purity needed for therapeutic proteins and diagnostic reagents due to its high precision, efficiency and scalability for separating complex mixtures. Various types of chromatography techniques, such as affinity chromatography, ion-exchange chromatography, and size-exclusion chromatography, enable selective capture and segregation of target proteins on the basis of their distinctive chemical and physical properties. Preparative chromatography techniques are widely being implemented in the separation and purification of huge quantities of compound, especially for drug purification in the pharmaceutical industry. Increased use of chromatography techniques for downstream processing in biopharmaceutical manufacturing, the rise in R&D activities in drug discovery and proteomics, and ongoing technological innovations are boosting the market growth of this segment.

By technology, the electrophoresis segment is expected to show significant growth in the market over the forecast period. Electrophoresis technique is a widely used in protein characterization and analysis for assessment of purity, molecular weight determination and monitoring protein expression. Detection of post-translational modifications with techniques like 2D electrophoresis are resolving proteins based on their size and charge. Ongoing advancements in electrophoresis technologies such as development of automated electrophoresis systems, capillary electrophoresis and integration with mass spectrometry are creating opportunities for market growth. Electrophoresis is crucial in the biopharmaceutical industry for quality control to ensure the consistency, integrity and purity of therapeutic proteins.

Why Did the Protein-Protein Interaction Segment Dominate the Market in 2024?

By application, the protein-protein interaction segment captured the largest market share in 2024. Protein-protein interactions (PPIs) occur in nearly every cellular function such as metabolism, gene expression, immune response, signal transduction and cell division. Disruption of PPIs is widely associated with various diseases, including cancer, infectious diseases and neurodegenerative disorders. Increased focus of researchers on understanding PPIs for drug discovery, rise of network biology, use of sophisticated purification techniques for discovering protein biomarkers and growing emphasis on functional proteomics are driving the market dominance of this segment.

Additionally, advancements in PPI study technologies such as co-immunoprecipitation (Co-IP) and pull-down assays, yeast-two hybrid (Y2H) assays, cryo-electron microscopy (EM), x-ray crystallography as well as biophysical methods like Bio-Layer Interferometry (BLI), Isothermal Titration Calorimetry (ITC), MicroScale Thermophoresis (MST) and Surface Plasmon Resonance (SPR) are contributing to the market growth.

By application, the drug screening segment is expected to expand rapidly during the forecast period. Drug screening is a critical step, particularly for biologics or small molecules for identification and validation of target proteins. High-throughput screening methods are being deployed for modern drug discovery processes and require large quantities purified target proteins with consistent quality and reproducibility, further driving the market growth. Structure-based drug design (SBDD) approach in drug discovery processes is enhancing the efficiency and reducing off-target effects, leading to precise fitting of a drug into the active site of a protein.

How Did the Academic and Research Institutes Segment Generate Highest Revenue in 2024?

By end use, the academic and research institutes segment generated the highest revenue in the market in 2024. Increased research activities by academic and research institutes in biological and biomedical fields, including genomics, proteomics and molecular biology for gaining better comprehension of biological processes and development of innovative therapies are creating huge demand for protein purification and isolation techniques. Increased funding and research grants from government and private sectors is facilitating the adoption of advanced technologies such as automated and high-throughput purification systems for protein purification and isolation. Development of new methods and technologies for protein purification by these institutes is finding applications in the pharmaceutical industry and other sectors.

By end use, the hospitals segment is expected to register the fastest CAGR over the forecast period. The market growth of this segment is driven by increased adoption of protein-based diagnostics, integration of personalized medicine approaches, utilization of protein biomarkers in clinical settings for analyzing and monitoring disease progression, and focus on translational research through hospital-based research units. Rising investments by hospitals in their own laboratories and research facilities to expand their in-house capabilities in protein purification and isolation, further allowing them to perform advanced diagnostic and therapeutic procedures.

Regional Insights

What Drives North America’s Dominance in the Protein Purification and Isolation Market?

North America dominated the global protein purification and isolation market with the largest share in 2024. Increasing demand for biopharmaceuticals, ongoing research in proteomics, robust research infrastructure, well-established healthcare infrastructure and adoption of advanced purification systems are driving the region’s market dominance. Favorable regulatory environment, presence of major market players and research institutions and rising incidences of chronic diseases are contributing to the market growth.

How is the Asia Pacific Protein Purification and Isolation Market Expanding?

Asia Pacific is anticipated to register the fastest CAGR in the market over the forecast period. The region’s expanding biotechnology and pharmaceutical industries, increasing demand for personalized medicine and rising investments in R&D activities is driving the adoption of advanced protein purification technologies. Supportive government policies, increased biosimilar production, focus on proteomics and genomics research, surge in clinical trial activity and improving healthcare infrastructure are fuelling the market expansion. Regional players like China, Japan and India are actively contributing to the market growth.

Some of the Prominent Players in the Protein Purification and Isolation Market

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Cube Biotech GmbH

- Danaher

- Merck KGaA

- Norgen Biotek Corp.

- Promega Corporation

- QIAGEN

- Takara Bio. Inc.

- Thermo Fisher Scientific, Inc.

Protein Purification and Isolation Market Recent Developments

- In January 2025, Cube Biotech acquired IBA Lifesciences for developing a unified powerhouse devoted to advance research and production capabilities for the life science industry. The collective entity will focus on leveraging their complementary strengths for exceptional solutions in protein purification and stabilization.

- In January 2024, FUJIFILM Wako Pure Chemical Corporation launched the MassivEV EV Purification Column PS and MassivEV Purification Buffer Set. These products are designed for high-purity and high-efficiency mass purification of extracellular vesicles (EVs), further supporting exosome research.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the global protein purification and isolation market

Product

-

- Kits

- Reagents

- Columns

- Magnetic Beads

- Resins

- Others

Technology

- Ultrafiltration

- Precipitation

- Chromatography

-

- Ion Exchange Chromatography

- Affinity Chromatography

- Reversed-phase Chromatography

- Size Exclusion Chromatography

- Hydrophobic Interaction Chromatography

-

- Gel Electrophoresis

- Isoelectric Focusing

- Capillary Electrophoresis

Application

- Drug Screening

- Biomarker Discovery

- Protein-protein Interaction Studies

- Diagnostics

End-use

- Academic And Research Institutes

- Hospitals

- Pharmaceutical And Biotechnological Companies

- CROs

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)