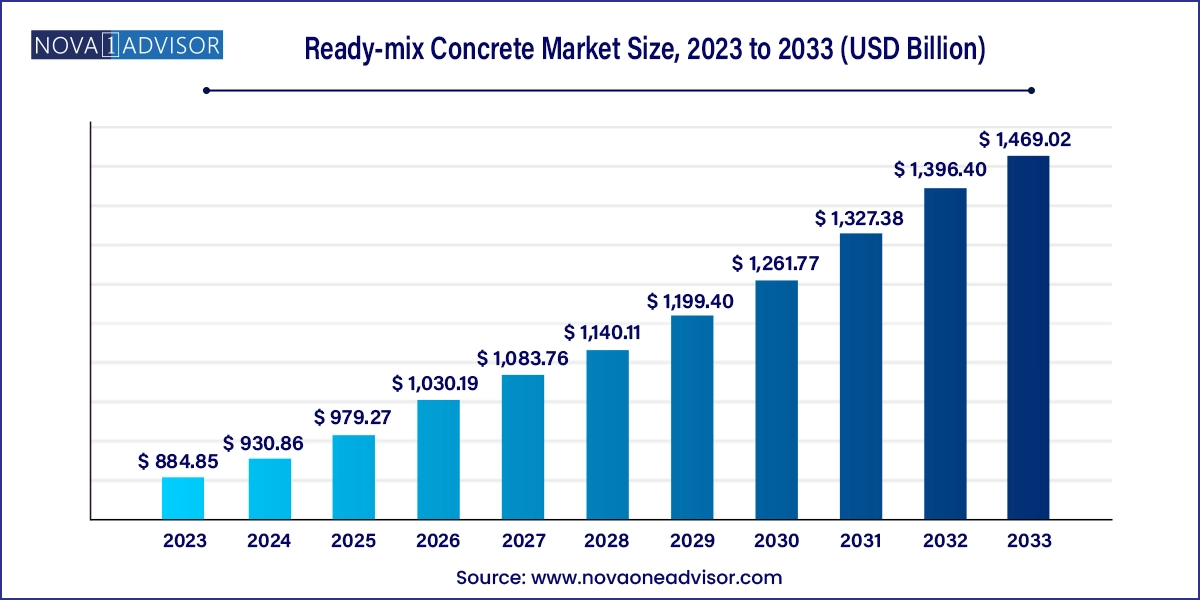

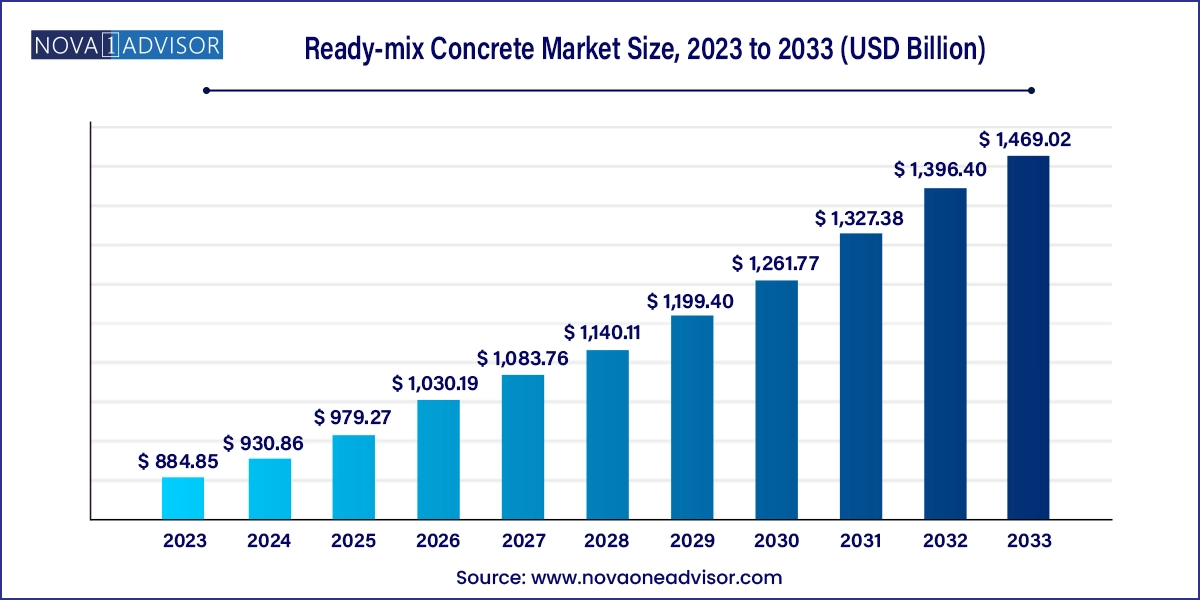

Ready-mix Concrete Market Size and Growth

The global ready-mix concrete market size was exhibited at USD 884.85 billion in 2023 and is projected to hit around USD 1,469.02 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2024 to 2033.

Ready-mix Concrete Market Key Takeaways:

- The residential segment held the largest revenue share of 34.0% in 2023.

- The infrastructure segment is expected to register the fastest growth at a CAGR of 6.2% over the forecast period.

- Asia Pacific dominated the market and accounted for the largest revenue share of 69.7% in 2023.

- The Middle East & Africa market is anticipated to grow at a CAGR of 5.9% over the forecast period.

Market Overview

The global ready-mix concrete (RMC) market has established itself as a critical component of the modern construction industry, offering a consistent, high-quality, and efficient solution for large-scale building projects across the globe. Ready-mix concrete is a type of concrete that is manufactured in a batching plant according to a set engineered mix design and then delivered to a worksite by truck-mounted transit mixers. This process ensures greater precision in the mixture and allows specialty concrete mixtures to be developed and implemented on construction sites. Unlike traditional on-site mixing methods, RMC minimizes labor dependency, reduces material wastage, and ensures faster project turnaround.

Valued at over USD 700 billion in recent years, the ready-mix concrete market has experienced substantial growth, propelled by urbanization, infrastructure development, and technological advancements in concrete manufacturing. The increasing preference for off-site prepared concrete due to strict construction timelines, labor constraints, and rising project complexities has cemented RMC’s position as the go-to solution in construction. Developed economies such as the U.S., Germany, and Japan have long adopted RMC as a standard in construction practices, while emerging economies like India, Brazil, and Indonesia are rapidly catching up, driven by government-led infrastructure initiatives.

As sustainability becomes a pivotal aspect of construction practices, RMC manufacturers are also focusing on incorporating supplementary cementitious materials such as fly ash, slag, and silica fumes to reduce environmental impact. With regulations favoring green construction and efficiency, RMC's value proposition continues to grow. Innovations such as self-healing concrete, ultra-high-performance concrete (UHPC), and the use of recycled aggregates are creating new avenues of growth, signaling a transformative phase in the global ready-mix concrete industry.

Major Trends in the Market

-

Growing Preference for Sustainable Construction: The shift toward green buildings and sustainable materials is boosting demand for eco-friendly RMC blends using recycled aggregates and industrial by-products.

-

Adoption of Digital Tools in Concrete Delivery: Integration of GPS tracking, IoT sensors, and fleet management software to optimize RMC delivery and minimize delays on-site.

-

Increased Use of High-Performance Concrete: Industries are exploring ultra-high-performance concrete (UHPC) and self-compacting concrete for high-rise structures, bridges, and critical infrastructure.

-

Boom in Urban Infrastructure Projects: Rapid urbanization and government investments in smart cities are driving demand, particularly in Asia-Pacific and Latin America.

-

Rise of Modular and Prefabricated Construction: The ready-to-use nature of RMC complements the growing trend of prefabricated construction systems in residential and commercial projects.

-

Expansion in Rural Construction Markets: Emerging economies are expanding housing and infrastructure projects into tier-2 and rural regions, creating a new demand hub.

-

Private-Public Partnerships (PPPs) Fueling Growth: Many countries are investing in public infrastructure via PPPs, driving large-scale consumption of RMC for roads, airports, and tunnels.

Report Scope of Ready-mix Concrete Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 930.86 Billion |

| Market Size by 2033 |

USD 1,469.02 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Key Companies Profiled |

ACC Limited; Vicat S.A.; HOLCIM; Buzzi SpA; R.W. Sidley, Inc.; Barney & Dickenson, Inc.; Dillon Bros Ready Mix Concrete; Livingston's Concrete Service, Inc.; CEMEX, S.A.B. de C.V.; Heidelberg Materials AG; China National Building Material Group Corporation; U.S. Concrete, Inc.; UltraTech Cement Ltd. |

Market Driver: Infrastructure Boom in Emerging Economies

One of the key drivers of the global ready-mix concrete market is the unprecedented infrastructure boom occurring across emerging economies. Countries like India, China, Brazil, and Indonesia are aggressively investing in infrastructure development to stimulate economic growth and improve quality of life. For instance, India’s National Infrastructure Pipeline (NIP), which outlines investments worth USD 1.4 trillion until 2025, is expected to exponentially boost the consumption of RMC in highways, railways, metro systems, and ports. Similarly, China’s Belt and Road Initiative (BRI) has triggered construction projects across Asia, Europe, and Africa, driving large-scale RMC requirements.

Ready-mix concrete is particularly suitable for such massive projects due to its consistency, ease of transportation, and speed of deployment. As time-bound execution becomes a norm for infrastructure ventures, RMC is seen as a vital solution to maintain quality, manage labor shortages, and meet environmental regulations. The ability of ready-mix suppliers to customize concrete grades for varied infrastructure demands—from pavements to bridges—further solidifies its relevance in this growth phase.

Market Restraint: Volatility in Raw Material Prices

A significant restraint impacting the ready-mix concrete market is the volatility in raw material prices, especially cement, aggregates, and admixtures. These fluctuations can result from supply chain disruptions, rising energy costs, and geopolitical uncertainties. For example, the ongoing energy crisis in Europe, compounded by conflicts in Eastern Europe and inflationary pressures, has led to increased costs in cement production. Likewise, shortages in fly ash or silica fume due to shifts in industrial outputs can disrupt the supply of blended concrete.

Since RMC producers operate in a highly competitive and low-margin environment, absorbing price hikes or passing them onto customers becomes a challenge. Unstable pricing not only impacts profitability but also affects project planning and bidding processes, particularly in public tenders. Additionally, dependency on natural resources such as sand raises sustainability and regulatory concerns, further complicating procurement strategies.

Market Opportunity: Innovation in Eco-Friendly Concrete

The demand for eco-friendly construction materials presents a lucrative opportunity for the RMC market. As construction accounts for a significant portion of global COâ‚‚ emissions, stakeholders are under pressure to decarbonize building practices. RMC producers can capitalize on this by innovating in sustainable concrete mixes using industrial by-products like fly ash, slag, and recycled concrete aggregates.

In 2023, Heidelberg Materials (formerly HeidelbergCement) launched “EcoCrete,” a range of low-carbon concrete options across Europe and North America. Similarly, CEMEX introduced “Vertua,” a climate-resilient concrete offering with a lower carbon footprint. These initiatives not only align with global climate goals but also enhance brand positioning and customer trust. Moreover, the emergence of carbon-capture technology in cement kilns and AI-powered mix design optimization opens new frontiers for RMC producers to differentiate and scale sustainability.

Ready-mix Concrete Market By Application Insights

Infrastructure segment dominated the market in terms of revenue share, driven by the growing need for roads, bridges, airports, and transit systems. With urban populations swelling, governments worldwide are allocating record budgets to infrastructure modernization and expansion. Infrastructure projects typically require large volumes of concrete delivered within tight deadlines, making RMC an ideal choice. In China and India, projects like the Delhi-Mumbai Industrial Corridor or the expansion of China's high-speed rail network are primary consumers of RMC. Furthermore, in the Middle East, megaprojects like Saudi Arabia’s NEOM city are expected to consume vast quantities of ready-mix concrete over the next decade.

The fastest-growing segment is the residential sector, attributed to the rapid urbanization in developing countries and the rising demand for affordable housing. Government-led housing schemes, such as India's "Housing for All" initiative and Brazil’s “Minha Casa, Minha Vida,” are actively promoting residential construction. RMC's ability to speed up the building process while ensuring structural integrity has made it a preferred material among real estate developers. In Western nations, luxury condominiums and green residential buildings are also increasingly turning to sustainable RMC variants, further driving growth in this segment.

Ready-mix Concrete Market By Regional Insights

Asia Pacific dominated the global ready-mix concrete market, accounting for the highest revenue share. The region's dominance is fueled by rapid urban growth, industrialization, and government spending on megaprojects. China, the world’s largest RMC consumer, continues to invest heavily in infrastructure, housing, and smart cities. India is following suit with its Smart Cities Mission and urban transit projects, all of which rely on RMC for speed and reliability. Additionally, the presence of large domestic players like UltraTech Cement and China National Building Material Company (CNBM) further boosts market consolidation and innovation within the region.

Middle East & Africa (MEA) is projected to be the fastest-growing region, driven by massive infrastructure investments, especially in the Gulf Cooperation Council (GCC) countries. Saudi Arabia’s Vision 2030, which includes building NEOM, the Red Sea Project, and multiple gigacities, demands substantial quantities of high-quality RMC. Similarly, the UAE continues to invest in construction, even post-Expo 2020, with new urban developments in Dubai and Abu Dhabi. In Africa, nations like Nigeria, Kenya, and Egypt are witnessing a surge in urban infrastructure funding, making MEA a hotbed of growth in the coming decade.

Ready-mix Concrete Market Recent Developments

-

March 2024 – CEMEX expanded its Vertua low-carbon concrete product line into new European markets, supporting regional carbon reduction targets. The company also partnered with Carbon Clean to explore COâ‚‚ capture from cement kilns.

-

January 2024 – Heidelberg Materials acquired a leading RMC producer in Texas, U.S., enhancing its footprint in North America and integrating low-emission product lines into regional operations.

-

October 2023 – LafargeHolcim (Holcim) introduced a range of bio-based admixtures for their RMC products in Latin America, aimed at enhancing performance and sustainability.

-

August 2023 – UltraTech Cement announced a new state-of-the-art RMC plant in Mumbai, India, capable of producing high-performance concrete with recycled aggregates.

-

June 2023 – Breedon Group acquired Express Minimix in the UK, expanding its regional footprint in small-load RMC deliveries and custom mix solutions.

Some of the prominent players in the global ready-mix concrete market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global ready-mix concrete market.

Application

- Commercial

- Residential

- Infrastructure

- Industrial

Regional

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)