Smart Glass Market Size and Trends

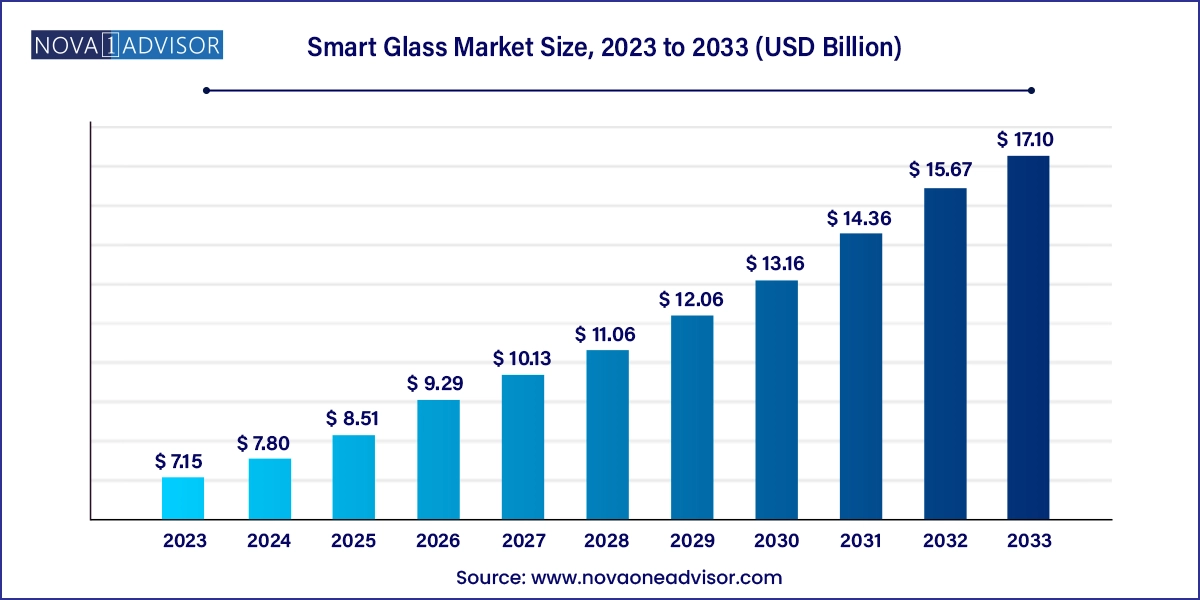

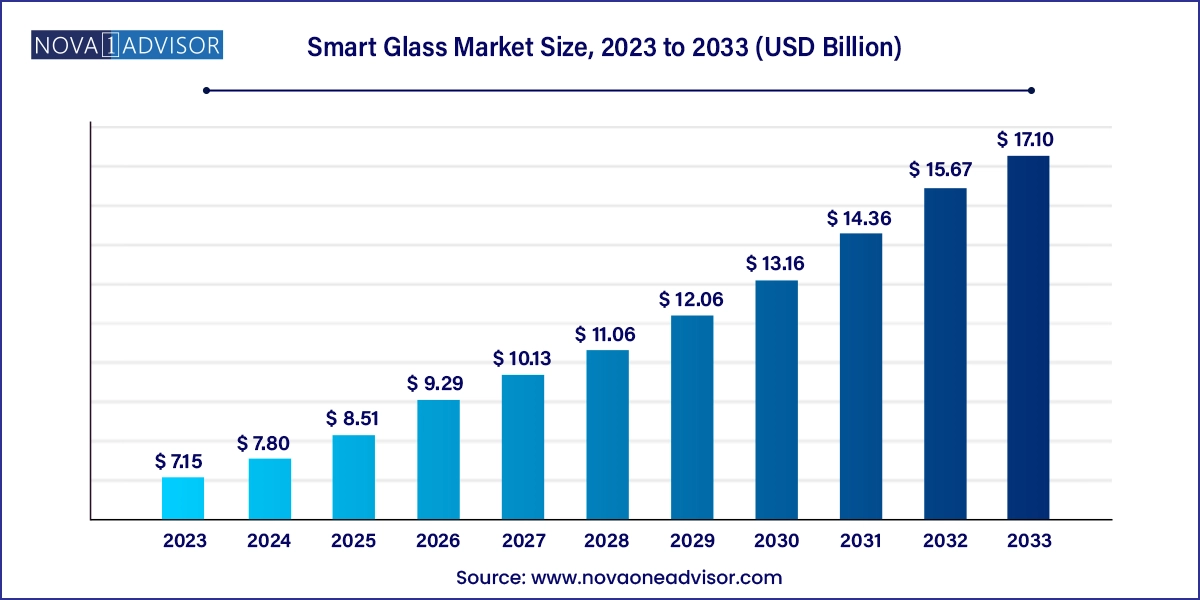

The smart glass market size was exhibited at USD 7.15 billion in 2023 and is projected to hit around USD 17.10 billion by 2033, growing at a CAGR of 9.11% during the forecast period 2024 to 2033.

Smart Glass Market Key Takeaways:

- Electrochromic segment captured a significant market share of around 62.0% in 2023.

- Transportation application segment accounted for a considerable market share of around 49.0% in 2023.

- North America dominated the market in 2023 accounting for largest revenue share of over 33.0%.

- Asia Pacific is projected to record a fastest CAGR of over 11.0% from 2024 to 2033.

Market Overview

The global Smart Glass Market is undergoing a transformative phase, propelled by the convergence of aesthetics, functionality, energy efficiency, and automation. Smart glass, also known as switchable glass or electronically tintable glass, refers to glazing or glass that changes its light transmission properties based on external stimuli—such as voltage, light, or heat. This dynamic ability to modulate transparency has unlocked its application across a variety of sectors, including architecture, automotive, aviation, consumer electronics, and energy.

Smart glass offers multiple benefits: it reduces glare, enhances privacy, optimizes indoor light, and significantly lowers energy costs by regulating solar heat gain. With the growing global emphasis on sustainable construction and energy conservation, smart glass has emerged as a critical component in building design. Additionally, its rising adoption in transportation—especially in premium cars and aircraft cabins underscores its relevance as both a luxury feature and a practical necessity.

From privacy screens in hospital rooms to immersive HUDs (heads-up displays) in vehicles, smart glass is becoming integral to how we interact with built environments and machines. With increasing smart city projects, government energy regulations, and advancements in electrochromic and PDLC technologies, the smart glass market is expected to experience accelerated growth over the next decade.

Major Trends in the Market

-

Integration with smart building systems: Smart glass is being integrated into building management systems (BMS) to automatically regulate light and temperature, reducing HVAC loads.

-

Rising demand in automotive sunroofs and windows: Luxury carmakers like Mercedes-Benz and BMW use SPD and PDLC smart glass in panoramic roofs and side windows for privacy and glare control.

-

Adoption in aircraft interiors: Boeing’s 787 Dreamliner utilizes electrochromic windows that passengers can dim or brighten without shades.

-

Growth of energy-efficient construction: Green building standards (e.g., LEED) are incentivizing developers to adopt smart glass for better insulation and energy ratings.

-

Expansion into consumer electronics: Smart glass is being used in devices like smartphones, tablets, smart mirrors, and display panels with adaptive lighting.

-

Mass customization: New manufacturing technologies are allowing vendors to offer customized smart glass for modular homes, yachts, and interior partitions.

-

Government policies promoting energy savings: Tax incentives and building codes in the EU, U.S., and China are pushing builders to incorporate smart materials like switchable glass.

Report Scope of Smart Glass Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 7.80 Billion |

| Market Size by 2033 |

USD 17.10 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.11% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Application, Control Mode, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; UAE; South Africa; Saudi Arabia |

| Key Companies Profiled |

AGC Inc.; ChromoGenics; Corning Inc.; Gauzy Ltd. & Entities; Gentex Corp.; Guardian Industries Holdings, LLC; Halio Inc.; Merck KGaA (Merck Group); Nippon Sheet Glass Co. Ltd.; PPG Industries Inc.; RavenWindow; Research Frontiers Inc.; Saint Goblin S.A.; Smartglass International Ltd.; VELUX Group; View Inc.; Polytronix Inc.; Smart Glass Technologies LLC |

Key Market Driver: Growing Demand for Energy Efficiency in Buildings

One of the major forces accelerating the smart glass market is the global demand for energy-efficient building solutions. Buildings account for a significant portion of energy consumption worldwide, particularly due to heating, cooling, and lighting needs. Smart glass addresses this challenge by dynamically adjusting its opacity or transparency to control solar heat gain and optimize daylight entry, reducing the need for artificial lighting and HVAC system usage.

In regions with extreme weather—such as North America, Europe, and the Middle East—smart glass can significantly cut down energy costs. For example, studies suggest that electrochromic windows can reduce peak cooling load by up to 20% in commercial buildings. The U.S. Department of Energy has recognized smart glass as a high-potential technology for zero-energy buildings. Moreover, with net-zero building codes becoming more stringent across Europe and parts of Asia, smart glass is increasingly viewed not just as a luxury material, but as an energy-saving imperative.

Key Market Restraint: High Installation and Material Costs

Despite its many advantages, the high cost of smart glass materials and installation continues to pose a significant barrier to widespread adoption. Smart glass technologies, particularly electrochromic and SPD variants, involve sophisticated manufacturing processes and require integration with power supply systems, sensors, and control mechanisms. This elevates both the production cost and the total cost of ownership for end users.

For instance, the price per square foot of electrochromic glass can be multiple times that of standard glass or even high-performance low-E glass. Additionally, retrofitting existing structures with smart glass may demand rewiring and custom installations, increasing the upfront investment. For many builders, especially in cost-sensitive markets or small-scale residential projects, the long-term savings may not sufficiently offset the initial cost burden—slowing down market penetration among mass adopters.

Key Opportunity: Rising Adoption in Consumer Electronics

A promising opportunity in the smart glass market lies in its increasing integration into consumer electronics. From smartphones to smart mirrors, the technology’s ability to dynamically alter appearance and function aligns perfectly with the current demand for sleek, functional, and interactive devices. OLED smartphones, for example, are beginning to explore the use of smart glass overlays that adjust tint to optimize viewing in different lighting conditions.

Furthermore, smart mirrors in luxury bathrooms and retail stores are now equipped with embedded displays that utilize PDLC or electrochromic layers. Augmented reality (AR) glasses and foldable tablets also present frontier applications for ultra-thin, flexible smart glass. The miniaturization of electronics and rapid growth in AR/VR spaces create a fertile ground for innovation. As material science improves and production becomes more cost-effective, consumer electronics could evolve into one of the fastest-growing application segments for smart glass technologies.

Smart Glass Market By Technology Insights

Electrochromic technology dominated the smart glass market by revenue in 2024. Electrochromic smart glass is widely adopted in architectural and transportation applications due to its high durability, wide range of transparency modulation, and low power consumption. It works by applying a small electrical voltage to alter the light transmission properties of the glass. Electrochromic glass is particularly favored for external windows, skylights, and automotive sunroofs because it can remain in its last state without continuous electricity, ensuring energy savings. The technology’s adoption is further supported by partnerships with architectural firms and premium car manufacturers aiming to integrate energy-saving components.

Suspended Particle Devices (SPD) technology is projected to be the fastest-growing segment. SPD glass contains particles that align or disperse based on electric current, allowing for near-instantaneous transitions from clear to darkened states. This makes it ideal for automotive and aircraft applications where users desire quick light modulation. SPD glass is being used in models such as the Mercedes-Benz S-Class and is gaining traction in business jets for window shading. Its quick response time, UV protection, and aesthetic appeal are positioning SPD technology as a viable option for future luxury and high-performance markets.

Smart Glass Market By Application Insights

Architectural application accounted for the largest market share. Within architecture, both residential and commercial buildings are incorporating smart glass for enhanced aesthetics, privacy, and energy efficiency. Commercial buildings—such as offices, hotels, and airports—are especially leading the charge. For instance, the Al Bahr Towers in Abu Dhabi utilize dynamic glass to reduce heat and glare while enhancing facade aesthetics. Smart glass helps achieve green certification targets and aligns with sustainability mandates in high-income regions.

Consumer electronics is expected to be the fastest-growing application segment. With rapid innovations in foldable displays, smart home devices, and wearable technology, manufacturers are exploring the use of smart glass for interactive user interfaces and dynamic design. Smart glass mirrors with built-in displays and sensors are already gaining traction in luxury homes and retail outlets. Startups and tech giants are investing in ultra-thin smart glass prototypes to enable new functionalities in next-gen smart devices.

Smart Glass Market By Regional Insights

North America remained the largest regional market for smart glass in 2024. The United States leads in smart glass implementation due to early adoption across both commercial and high-end residential sectors. Strong emphasis on energy-efficient construction, government incentives, and the prevalence of smart home technology contribute to the region’s leadership. Major players like View Inc. and SageGlass (a Saint-Gobain company) are headquartered or operate extensively within North America.

Notably, institutions such as the U.S. Department of Energy actively fund smart window research and pilot programs. Airports, such as Dallas Fort Worth International, have installed dynamic glazing to improve passenger comfort and energy performance. Automotive brands with a strong market in the U.S. also deploy SPD and PDLC glass in sunroofs and windows for luxury sedans and SUVs.

Asia Pacific is forecast to be the fastest-growing smart glass market. The region is undergoing rapid urbanization, with high-rise developments, smart city initiatives, and infrastructural modernization across countries like China, India, Japan, and South Korea. Increasing construction activity, coupled with growing awareness of green building benefits, is driving smart glass adoption in this region.

China’s push for sustainable architecture, India’s Smart Cities Mission, and Japan’s high-tech infrastructure projects are examples of policies accelerating the uptake of smart glass. Additionally, rising disposable income and consumer preference for high-tech features in vehicles and homes are encouraging automotive and electronics sectors to explore smart glass integration. Local manufacturers are also ramping up production, lowering costs and improving market access in developing economies.

Smart Glass Market Recent Developments

-

View Inc. (March 2025): Partnered with a major healthcare provider in California to install smart glass windows in hospital rooms for improved patient well-being through natural light modulation.

-

Gauzy Ltd. (February 2025): Announced a new smart glass facility in Germany, expanding its PDLC film production to meet rising demand from automotive OEMs in Europe.

-

Saint-Gobain (SageGlass) (January 2025): Launched SageGlass Harmony 2.0, offering enhanced tint transitions and AI-enabled automatic lighting control for commercial buildings.

-

Gentex Corporation (April 2024): Entered into a multi-year agreement with a U.S. electric vehicle startup to provide dimmable glass for panoramic sunroofs in upcoming EV models.

-

AGC Inc. (November 2024): Revealed its latest photochromic smart glass technology for automotive side windows, providing passive light control without electricity.

Some of the prominent players in the smart glass market include:

- AGC Inc.

- ChromoGenics

- Corning Incorporated

- Gauzy Ltd.

- Gentex Corporation

- Guardian Industries Holdings, LLC

- Halio Inc.

- Merck KGaA (Merck Group)

- Nippon Sheet Glass Co. Ltd.

- PPG Industries Inc

- RavenWindow

- Research Frontiers Inc.

- Saint Goblin S.A.

- Smartglass International

- VELUX Group

- RavenWindow

- View Inc.

- Polytronix Inc.

- Smart Glass Technologies LLC

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the smart glass market

Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromics

- Photochromic

Application

-

- Residential Buildings

- Commercial Buildings

-

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

Control Mode

- Rheostats

- Switches

- Remote

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)