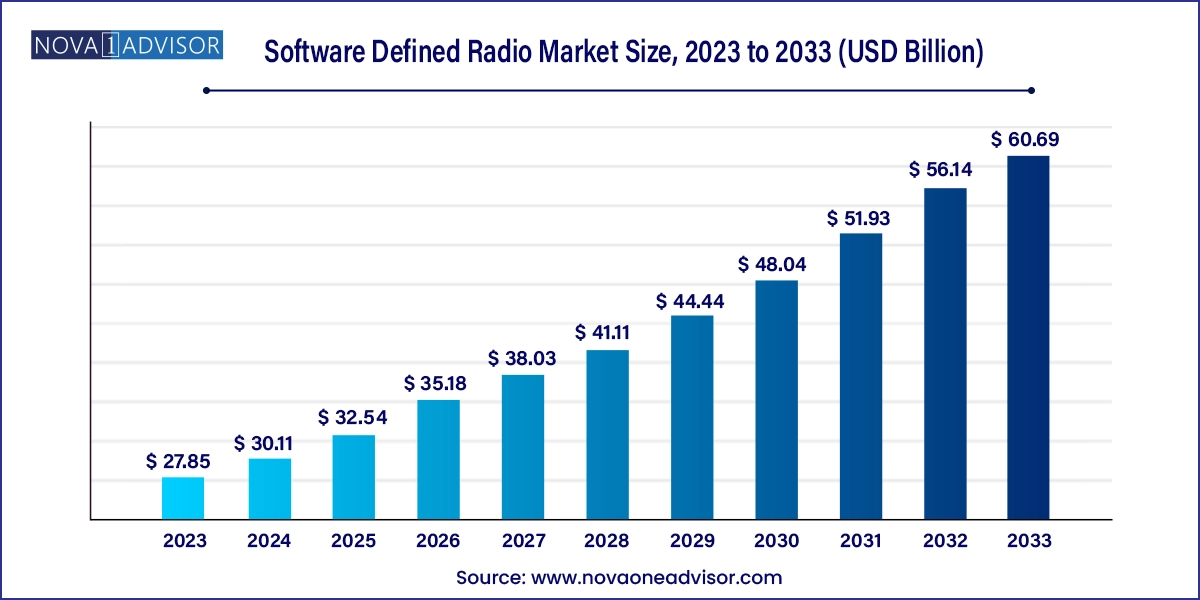

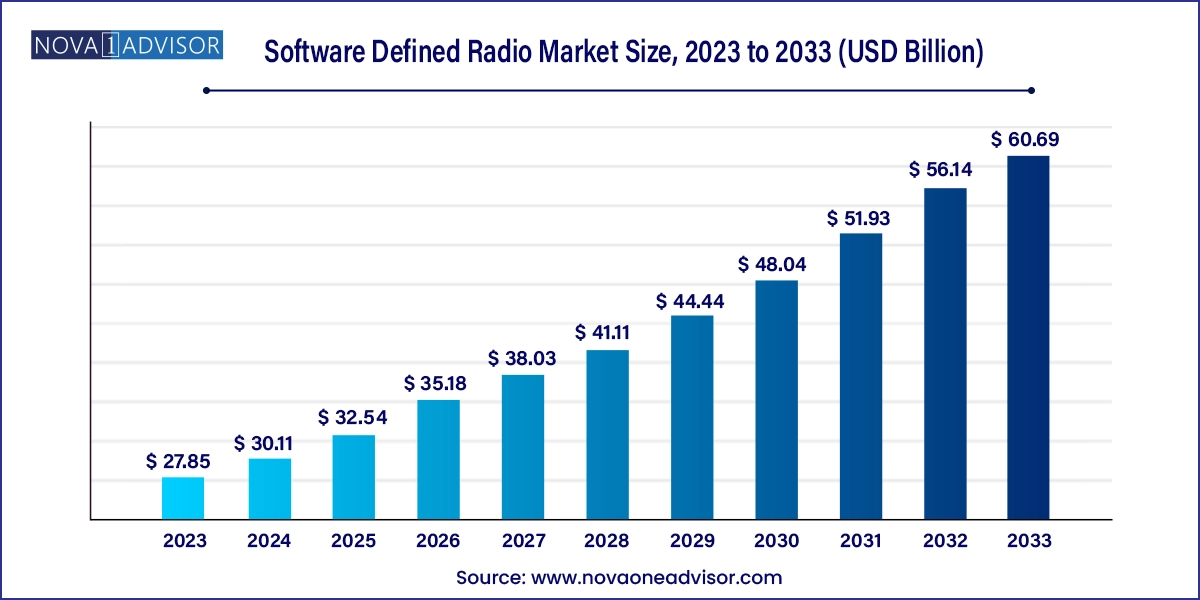

Software Defined Radio Market Size and Growth

The global software defined radio market size was exhibited at USD 27.85 billion in 2023 and is projected to hit around USD 60.69 billion by 2033, growing at a CAGR of 8.1% during the forecast period 2024 to 2033.

Software Defined Radio Market Key Takeaways:

- The aerospace & defense segment held the largest market revenue share in 2023.

- The commercial segment is projected to witness growth of 9.8% over the forecast period.

- The North America market held a revenue share of 34.2% in 2023.

- Asia Pacific is expected to witness significant growth in the market.

- Joint tactical radio system held the largest market revenue share in 2023.

- The cognitive radio segment is anticipated to register the fastest CAGR during the forecast period.

- Based on component, the hardware segment held the largest revenue share of 41.5% in 2023.

- The services segment is expected to register the fastest CAGR during the forecast period.

- The high frequency band segment held the largest market revenue share in 2023.

- The ultra-high frequency (UHF) segment is expected to register the fastest CAGR during the forecast period.

- The ground platform segment held the largest market revenue share in 2023.

- The airborne platform segment is anticipated to register the fastest CAGR over the forecast period.

Market Overview

The global software defined radio (SDR) market has emerged as a critical segment within the communications and defense ecosystems, witnessing increasing adoption across military, public safety, telecommunication, aerospace, and commercial domains. SDR technology enables communication devices to be dynamically reconfigured to support various frequency bands and protocols, enhancing interoperability, flexibility, and scalability. Unlike traditional hardware-based radios, SDR relies on software modules that execute functions such as modulation, demodulation, encoding, and frequency translation, allowing real-time adaptability and upgrades without replacing the physical hardware.

The continuous evolution of communication infrastructure, integration of next-generation wireless standards (like 5G and 6G), and heightened demand for secure, resilient, and flexible communication solutions in complex and contested environments have accelerated the global demand for SDRs. Additionally, the SDR market is benefiting from the proliferation of IoT, satellite communications, cognitive radio capabilities, and the increasing digitization of battlefield communication systems.

As of 2024, the market is projected to grow significantly over the coming decade, driven by substantial government and defense investments, especially in NATO countries, and the shift toward joint communication systems capable of multi-domain operations. The commercial telecommunication sector is also investing in SDR-enabled base stations and mobile networks to support frequency agility and dynamic spectrum access.

Major Trends in the Market

-

Integration of Artificial Intelligence (AI) and Machine Learning (ML) in SDRs to enable cognitive radio functionalities for autonomous decision-making and spectrum optimization.

-

Growing demand for multi-band and multi-mode radios in tactical military operations for seamless communication between various armed forces units.

-

Proliferation of 5G and upcoming 6G infrastructure, using SDRs for base stations and user equipment due to their reconfigurability and cost-effectiveness in long-term deployments.

-

Shift toward open architecture and modular platforms, enabling interoperability and faster upgrades across defense and commercial applications.

-

Expansion of SDR applications into satellite and space-based communication, especially in LEO (Low Earth Orbit) satellites for global broadband coverage.

-

Increasing adoption in public safety networks for emergency response systems, including disaster recovery and mission-critical communications.

-

Growing interest from commercial drone manufacturers for integrating SDR for secure, long-range communication and command and control systems.

Report Scope of Software Defined Radio Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 30.11 Billion |

| Market Size by 2033 |

USD 60.69 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.1% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Component, Frequency Band, Platform, End-use, Regional |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Analog Devices Inc.; Anaren Inc.; BAE Systems plc.; Collins Aerospace Systems; Data Device Corporation; DataSoft; Elbit Systems Ltd.; Huawei Technologies Co. Ltd.; Indra Sistemas S.A.; L3Harris Technologies Inc.; Microchip Technology Inc.; Northrop Grumman Corporation; RTX Corporation; Renesas Electronics Corporation; STMicroelectronics N.V.; Texas Instruments Incorporated |

Market Driver: Rising Military Modernization Programs

One of the pivotal drivers fueling the growth of the SDR market is the global surge in military modernization programs. Modern combat scenarios demand robust, interoperable communication systems capable of operating in highly dynamic and contested environments. SDRs enable armed forces to unify communication across land, sea, air, and space platforms by offering the flexibility to switch frequencies, protocols, and functionalities via software updates.

For instance, programs like the U.S. Joint Tactical Radio System (JTRS) and Europe's ESSOR (European Secure Software defined Radio) aim to establish a common platform for coalition forces, reducing dependency on proprietary hardware. Such initiatives demonstrate government commitments to invest in advanced, adaptable communication platforms, further boosting SDR adoption. This trend is echoed across regions like Asia Pacific, where countries like India, China, and South Korea are pursuing similar defense communications modernization efforts.

Market Restraint: High Initial Costs and Complex Integration

Despite its long-term cost-efficiency and versatility, SDR adoption is hindered by high initial investments and complex integration challenges. The software development, testing, and validation processes for SDR systems, especially in mission-critical military and aerospace environments, demand considerable technical expertise and compliance with stringent certification standards.

Moreover, integrating SDRs into existing infrastructure often requires retrofitting legacy systems, which can be time-consuming and expensive. In resource-constrained defense or public safety agencies, this acts as a deterrent to immediate large-scale deployments. Additionally, cybersecurity concerns related to software vulnerabilities in SDR platforms further complicate adoption, particularly where data confidentiality is paramount.

Market Opportunity: Emergence of Cognitive Radio Capabilities

A significant growth opportunity lies in the development and commercialization of cognitive radio (CR) enabled SDRs. Cognitive radios utilize AI and ML algorithms to analyze the radio spectrum environment and dynamically adjust operational parameters to avoid interference, optimize performance, and ensure continuity.

This is particularly promising in congested and contested spectrum environments, such as urban public safety networks or shared military-civilian frequencies. In the commercial sphere, CR-enabled SDRs can enhance spectrum utilization in telecom networks by intelligently allocating unused spectrum, an essential feature for 5G and future 6G networks. Start-ups and research organizations across North America and Europe are actively investing in cognitive SDR platforms, opening new frontiers for adaptive, intelligent communication systems.

Software Defined Radio Market By End-use Insights

Aerospace & Defense dominated the SDR market in 2023, accounting for the majority of SDR deployments globally. Military forces around the world use SDRs to ensure secure, interoperable communication across air, land, and sea. Within this, the military sub-segment leads due to the integration of SDR in battlefield management systems, unmanned vehicles, and air defense networks. Defense modernization programs, along with the need for tactical edge connectivity, have further solidified this dominance.

The Telecommunication sector is the fastest growing, driven by 5G deployment and the exploration of dynamic spectrum sharing and virtualization. SDRs enable telecom providers to reduce costs by consolidating hardware and enabling software updates for compatibility with emerging standards. Telecom giants in Asia Pacific and North America are leading the charge by leveraging SDR to optimize base stations and enhance user experience.

Software Defined Radio Market By Type Insights

The Joint Tactical Radio System (JTRS) segment dominated the SDR market in 2024, owing to extensive military adoption across North America and Europe. JTRS offers a standardized, scalable communication framework for various military units, allowing for seamless communication across domains and allies. The U.S. Department of Defense's long-term commitment to JTRS and similar programs in the UK and France has reinforced demand for this segment. Its role in enhancing situational awareness and reducing operational silos in joint missions remains critical, especially in multi-national coalitions and NATO exercises.

Cognitive radio is the fastest growing type segment, driven by AI-powered dynamic spectrum access capabilities. The increasing frequency congestion in both military and civilian communication systems has created demand for intelligent radios that can autonomously select the best frequency band. Emerging applications in disaster response, smart cities, and autonomous vehicles are also driving the interest in cognitive SDRs. With several pilot programs and R&D investments underway globally, cognitive radio systems are poised to revolutionize next-generation communication networks.

Software Defined Radio Market By Component Insights

Hardware remains the dominant component in the SDR market, particularly driven by military-grade transmitters, receivers, and antennas used in tactical communication systems. Hardware-based SDR components continue to be a necessary investment due to their ruggedness, precision, and compatibility with specialized applications such as radar, aerospace, and maritime platforms. Transmitter and antenna sub-segments, in particular, witness robust demand, owing to the need for long-range and interference-resistant communication, especially in naval and airborne systems.

Software is the fastest growing component, due to its central role in enabling reconfigurability and future-proofing radios. As platforms shift toward open architectures, software modules that handle modulation, encryption, waveform switching, and spectral analysis are increasingly outsourced or upgraded independently. With the emergence of software marketplaces and SDKs (Software Development Kits) for SDRs, third-party developers are also contributing to rapid innovation, reducing time to market for new communication features.

Software Defined Radio Market By Frequency Band Insights

The UHF Band dominated the frequency segment, as it supports long-distance transmission and is widely used in military and public safety applications. UHF is ideal for tactical field operations, enabling secure communication over varied terrains. It’s also less susceptible to environmental interferences, which is vital for reliable real-time communication. SDR platforms operating in UHF are increasingly embedded in vehicular and handheld military radios due to their robust signal propagation.

The HF Band is experiencing rapid growth, particularly in naval and aerospace applications. HF frequencies, with their ability to propagate over long distances and through ionospheric reflection, are well-suited for maritime and transcontinental operations. Innovations in SDR-enabled HF communication are allowing seamless integration with satellite and drone-based systems, opening new possibilities for beyond-line-of-sight (BLOS) communication.

The Ground segment holds the largest market share, driven by the need for tactical communication among land-based defense units, border patrols, and emergency responders. These systems are typically deployed in armored vehicles, portable field units, and fixed installations. Their role in modern battlefield networks such as C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems has made them indispensable.

The Space platform is the fastest growing, primarily due to the rapid rise in satellite-based internet and global communication initiatives like SpaceX’s Starlink, OneWeb, and military LEO satellite constellations. SDRs are ideal for satellites due to their reconfigurability and ability to adapt to changing frequencies without hardware modification. With the global race toward space-based communication intensifying, spaceborne SDR platforms are witnessing significant investments.

Software Defined Radio Market By Regional Insights

North America dominated the global SDR market in 2024, attributed to substantial defense budgets, advanced communication infrastructure, and early adoption of cutting-edge technologies. The U.S. Department of Defense is a major consumer of SDR technology, supporting a wide array of defense contractors and R&D efforts. Furthermore, public safety agencies and telecom firms in the U.S. and Canada have adopted SDR for secure communication, disaster management, and 5G deployment. The presence of industry leaders such as Northrop Grumman, L3Harris Technologies, and Raytheon Technologies further reinforces the region’s dominance.

Asia Pacific is the fastest growing regional market, due to a combination of rising defense expenditure, expanding telecom infrastructure, and government-backed digital transformation initiatives. Countries like China, India, Japan, and South Korea are not only modernizing their armed forces but are also actively investing in space and satellite communication systems. Moreover, Asia Pacific’s vast population base and mobile-first economies make it a fertile ground for SDR deployment in telecom and public safety networks.

Software Defined Radio Market Recent Developments

-

In March 2024, L3Harris Technologies announced a $250 million contract with the U.S. Navy to deliver advanced handheld SDRs for maritime operations.

-

In February 2024, Thales Group unveiled a new modular SDR platform designed for NATO interoperability under the ESSOR program.

-

In January 2024, Elbit Systems launched its new E-LynX family of tactical SDRs in India, aligning with local military modernization efforts under the “Make in India” initiative.

-

In December 2023, BAE Systems entered into a partnership with DARPA to develop AI-powered cognitive SDRs for future warfare applications.

-

In November 2023, Rohde & Schwarz deployed its latest software-defined base station radios in Germany’s 5G trial zones.

Some of the prominent players in the global software defined radio market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global software defined radio market

Type

- General Purpose Radio

- Joint Tactical Radio System

- Cognitive Radio

- TETRA

Component

-

- Antenna

- Transmitter

- Receiver

- Others

Frequency Band

- HF Band

- VHF Band

- UHF Band

- Others

Platform

- Ground

- Naval

- Airborne

- Space

End-use

- Telecommunication

- Public Safety

- Commercial

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)