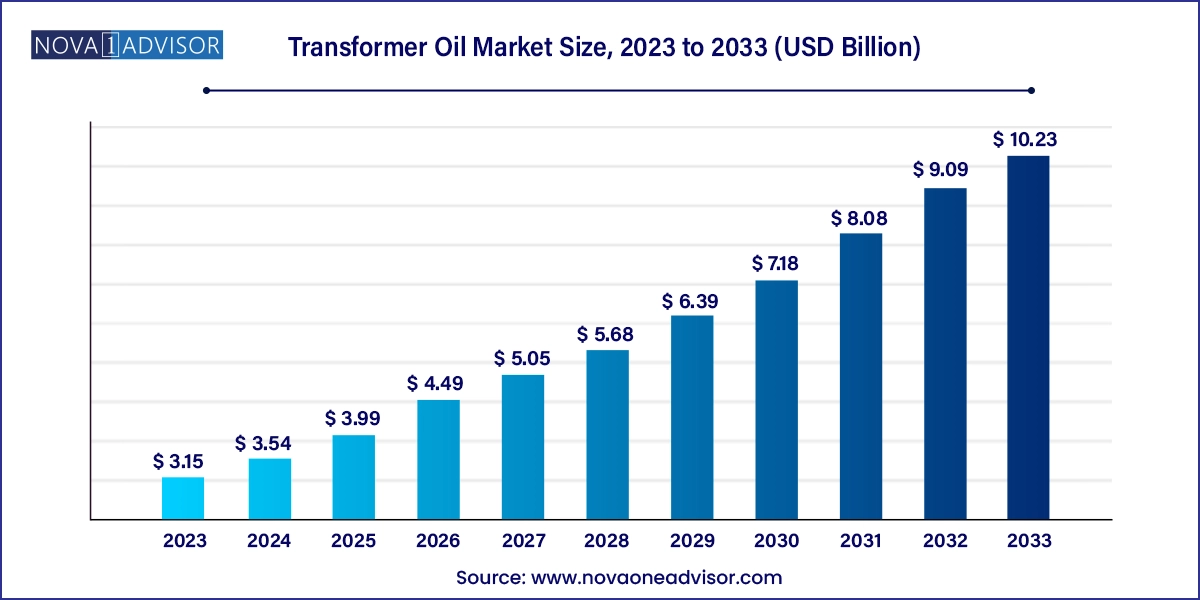

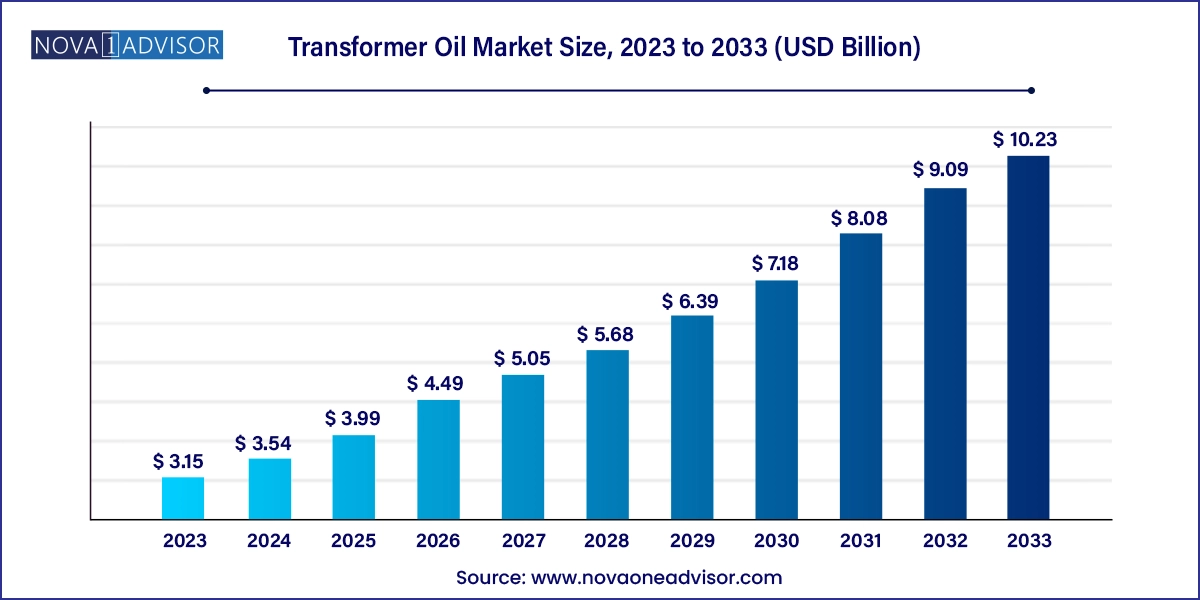

The transformer oil market size was exhibited at USD 3.15 billion in 2023 and is projected to hit around USD 10.23 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2024 to 2033.

- Mineral-based oils dominated with a revenue share of over 75.6% in 2023.

- The 100 MVA to 500 MVA segment dominated with a revenue share of over 53.8% in 2023.

- The <100 MVA segment held the second-largest position in 2023 and is projected to grow at a CAGR of 12.0% from 2024 to 2033.

- The industrial segment dominated with a revenue share of over 48.8% in 2023.

- The residential segment is expected to grow at the highest CAGR of 12.7% from 2024 to 2033.

- Asia Pacific dominated the transformer oil market with a revenue share of over 55.2% in 2023.

Market Overview

The transformer oil market is a crucial segment within the global power infrastructure and industrial fluids landscape. Transformer oil, also known as insulating oil, plays a vital role in the performance, efficiency, and longevity of power transformers. It serves as both a cooling medium and electrical insulator, helping dissipate heat generated during transformer operation while preventing electrical discharges. As the world increasingly depends on uninterrupted electricity supply, transformer oil forms a key component in supporting grid reliability and performance.

Transformer oils are extensively used in power transmission and distribution (T&D) networks, electrical equipment such as circuit breakers, switches, and capacitors. With the modernization of electrical grids and growing installation of renewable energy infrastructure, the demand for high-performance insulating oils is increasing rapidly. Furthermore, as aging electrical infrastructure in developed economies undergoes refurbishing and developing nations expand rural electrification, the transformer oil market continues to grow in parallel.

This market is shaped by diverse factors including industrialization, urbanization, grid upgrades, and environmental regulations. Oil composition, dielectric strength, oxidation stability, and biodegradability determine product suitability across use cases. As the industry moves toward sustainability, bio-based and silicone oils are emerging as promising alternatives to conventional mineral oils. Innovations in oil purification, reconditioning, and extended oil lifecycle management are also redefining performance standards in the sector.

Major Trends in the Market

-

Surging demand for smart and high-voltage transformers: Increasing deployment of smart grids and HVDC (High Voltage Direct Current) infrastructure boosts demand for premium-grade transformer oils.

-

Shift toward bio-based and biodegradable oils: Environmental regulations and eco-conscious procurement strategies are encouraging adoption of bio-transformer oils, especially in sensitive areas.

-

Focus on oil reconditioning and life-cycle extension: Utilities are investing in oil filtration and regeneration technologies to enhance transformer oil longevity and reduce replacement costs.

-

Expansion of power distribution in emerging markets: Rural electrification programs in Asia and Africa are contributing significantly to the demand for small to mid-size transformers and associated oils.

-

Aging power infrastructure in developed economies: Refurbishment of legacy grids in North America and Europe requires transformer oil upgrades or replacements.

-

Digital monitoring of oil health: Integration of IoT and remote sensing technologies for real-time oil condition monitoring is gaining traction for predictive maintenance.

-

Increased transformer installation in renewable projects: Solar and wind energy systems necessitate grid integration, often involving dry or oil-filled transformers for voltage regulation.

-

Preference for low-viscosity, high oxidation stability oils: Harsh environments demand transformer oils that can perform reliably under thermal stress and fluctuating load conditions.

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.54 Billion |

| Market Size by 2033 |

USD 10.23 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Rating, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; China; India; Japan; South Korea; Australia; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa; Turkey |

| Key Companies Profiled |

China Petroleum & Chemical Corporation; Cargill Inc.; Shell Plc.; Nynas AB; Ergon, Inc.; Engen Petroleum Ltd. |

Key Market Driver: Modernization of Electrical Grids and Expansion of T&D Infrastructure

The single most compelling driver for the transformer oil market is the global modernization of electrical grids and the rapid expansion of transmission and distribution (T&D) infrastructure. With rising energy consumption across sectors—industrial, commercial, and residential—governments and utilities are investing heavily in grid upgrades and network expansion.

This trend is especially prominent in fast-growing economies like China, India, and Southeast Asian nations, where rapid urbanization necessitates new substations, transmission lines, and transformers. Transformer oil demand aligns directly with this infrastructure build-out. Moreover, integration of renewable power sources like solar and wind into grids introduces voltage variability, requiring stable transformer performance supported by advanced insulating oils. The demand for reliable, thermally stable, and long-life transformer oils is thus expected to grow in tandem with global power infrastructure investments.

Key Market Restraint: Environmental Concerns and Regulatory Pressures on Mineral Oils

A significant restraint for the market is the environmental risk associated with traditional mineral-based transformer oils, particularly their toxicity, non-biodegradability, and fire hazards. Naphthenic and paraffinic base oils, while cost-effective and widely used, are petroleum-derived and pose environmental contamination risks in case of leaks or spills. In regions with fragile ecosystems or strict environmental controls, this can lead to regulatory complications and increased liability for utilities.

Governments and environmental agencies in Europe, North America, and parts of Asia have begun enforcing stricter guidelines around dielectric fluids. For example, transformer installations in water-sensitive areas may now require biodegradable or silicone-based oils. Disposal and recycling regulations are also becoming stringent, increasing the lifecycle costs of mineral oil usage. These factors are pressuring utilities and industrial operators to consider cleaner, albeit costlier, alternatives.

The growing demand for environmentally friendly and biodegradable transformer oils represents a promising opportunity for manufacturers. Bio-based oils, derived from renewable sources such as vegetable oils or esters, offer excellent insulation and cooling properties while being non-toxic, sustainable, and fire-resistant. These attributes make them highly desirable for use in eco-sensitive zones like forests, residential neighborhoods, and offshore wind installations.

With increasing global emphasis on green energy and sustainable practices, bio-transformer oils are gaining regulatory and consumer support. Pilot projects in Germany, the U.S., and Scandinavia have demonstrated successful large-scale use of natural ester-based transformer oils in high-voltage applications. As the technology matures and production scales up, the cost gap between bio-based and mineral oils is narrowing, setting the stage for mainstream adoption in both developed and emerging markets.

Mineral-based oils dominated the transformer oil market in 2024. This category includes naphthenic and paraffinic oils, which are widely preferred due to their affordability, accessibility, and satisfactory performance in most operating conditions. Naphthenic oils, in particular, exhibit superior solubility, low pour points, and excellent thermal conductivity, making them ideal for both small distribution and large power transformers. Paraffinic oils, though less favored due to higher pour points, offer superior oxidation stability and are used in specific applications. Their entrenched use, established supply chains, and lower initial costs ensure continued dominance.

Bio-based oils are the fastest-growing product segment. These oils are derived from natural esters and vegetable oil blends, and are biodegradable, environmentally benign, and have high fire points. Their adoption is rising rapidly, particularly in environmentally sensitive zones, residential areas, and indoor substations. Utilities in Germany and Nordic countries have reported successful implementation of bio-oils in grid infrastructure. As climate regulations become more stringent and green procurement gains policy traction, bio-based oils are set to expand their market share significantly.

The <100 MVA rating category dominated the transformer oil market in 2024. These transformers are used primarily in distribution networks, rural electrification, and local industrial setups. They account for the bulk of transformer installations in residential, commercial, and light industrial environments. Consequently, transformer oils designed for medium voltage and thermal performance dominate in this segment. Growth in urban housing, microgrids, and suburban commercial centers contributes significantly to this rating bracket.

The >800 MVA segment is the fastest growing. These high-capacity transformers are increasingly used in ultra-high voltage (UHV) transmission lines and cross-border power projects. Countries investing in grid stability and renewable energy integration, such as China, the U.S., and India, are adopting these large transformers for load balancing and long-distance transmission. Such applications demand high-performance, thermally stable transformer oils with enhanced dielectric strength and long service life. The growth of mega infrastructure projects and smart grids is expected to drive this high-rating segment forward.

Utilities held the dominant share in the end-use segment. Public and private utility companies are the primary consumers of transformer oils due to their ownership and operation of vast T&D networks. Utility transformers, both in transmission and distribution, operate continuously under varying load and environmental conditions, requiring reliable and stable insulating oils. Major utility expansion projects in Africa, the Middle East, and Asia ensure a consistent demand for transformer oil across all voltage classes.

The industrial segment is the fastest-growing. As industries modernize and expand operations across sectors such as manufacturing, oil and gas, mining, and data centers, the demand for transformers—and therefore transformer oil—is growing. These transformers often operate under harsh or demanding environments, requiring advanced oils with high oxidation stability and thermal endurance. Automation, electrification of operations, and private power distribution in large industrial zones further contribute to this growth.

Asia Pacific led the global transformer oil market in 2024. Countries like China, India, Indonesia, Japan, and South Korea have massive power infrastructure needs driven by rapid industrialization, population growth, and urbanization. China, with its expansive HVDC and UHV transmission networks, consumes a significant portion of global transformer oil supply. Meanwhile, India’s rural electrification initiatives and smart grid deployments continue to fuel demand for low- and mid-voltage transformer oils.

Government initiatives such as the "Ujwal DISCOM Assurance Yojana" (UDAY) and "Revamped Distribution Sector Scheme" in India, and the “Made in China 2025” plan that includes infrastructure and smart city development, reinforce regional growth. With domestic manufacturers expanding capacity and global players investing in APAC production bases, the region is poised to maintain its lead.

The Middle East and Africa (MEA) region is projected to witness the fastest growth. Rapid infrastructure development, energy diversification, and increasing electricity demand in countries such as Saudi Arabia, UAE, Egypt, Nigeria, and South Africa are fueling transformer installations. The electrification of off-grid and rural areas in Sub-Saharan Africa is further driving the demand for distribution transformers and associated oils.

Government-led renewable energy projects like Egypt’s Benban Solar Park and Saudi Arabia’s Vision 2030 renewable roadmap are expanding the need for advanced transformer oil solutions. Moreover, oil-exporting countries in the Gulf are investing heavily in industrial diversification and transmission upgrades, offering new opportunities for transformer oil manufacturers and suppliers.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the transformer oil market

Product

-

- Naphthenic Base Oils

- Paraffinic Base Oils

- Silicone-based Oils

- Bio-based Oils

Rating

- <100 MVA

- 100 MVA to 500 MVA

- 501 MVA to 800 MVA

- >800 MVA

End-use

- Utilities

- Industrial

- Residential

- Commercial

Regional

- North America

- Europe

- Asia Pacific

- Central & America

- Middle East & Africa