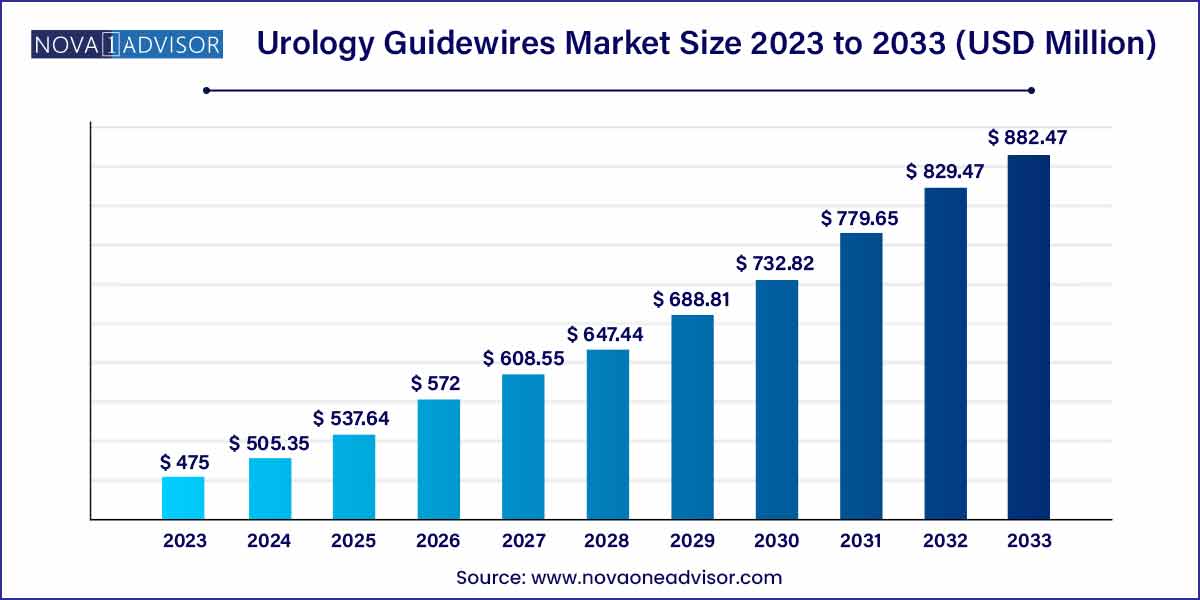

The global urology guidewires market size was exhibited at USD 475.00 million in 2023 and is projected to hit around USD 882.47 million by 2033, growing at a CAGR of 6.39% during the forecast period of 2024 to 2033.

Key Takeaways:

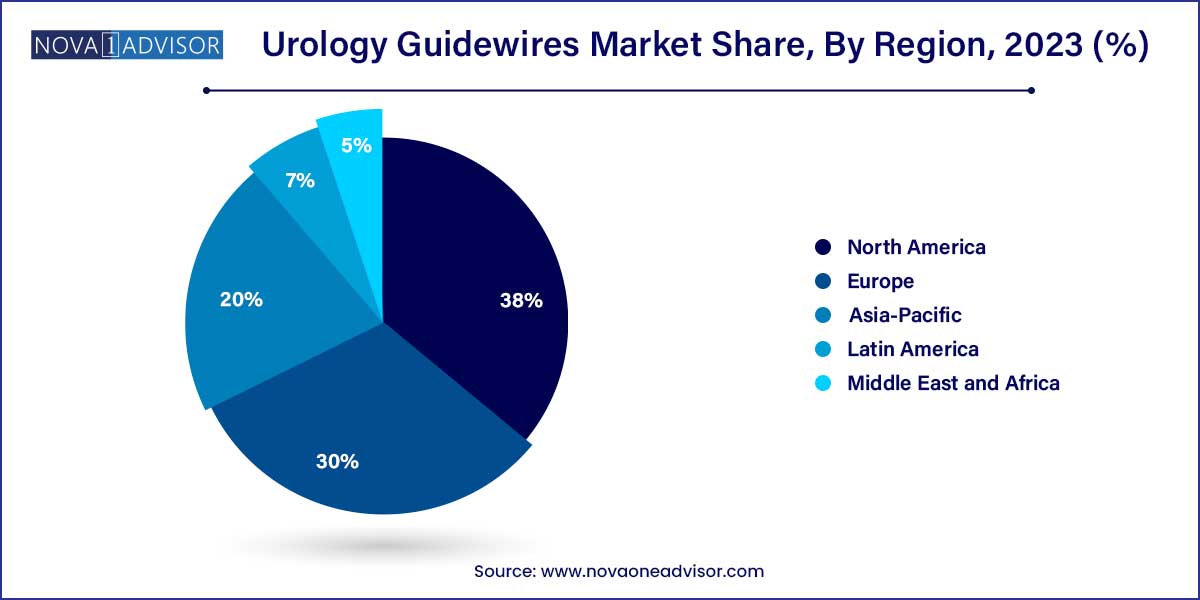

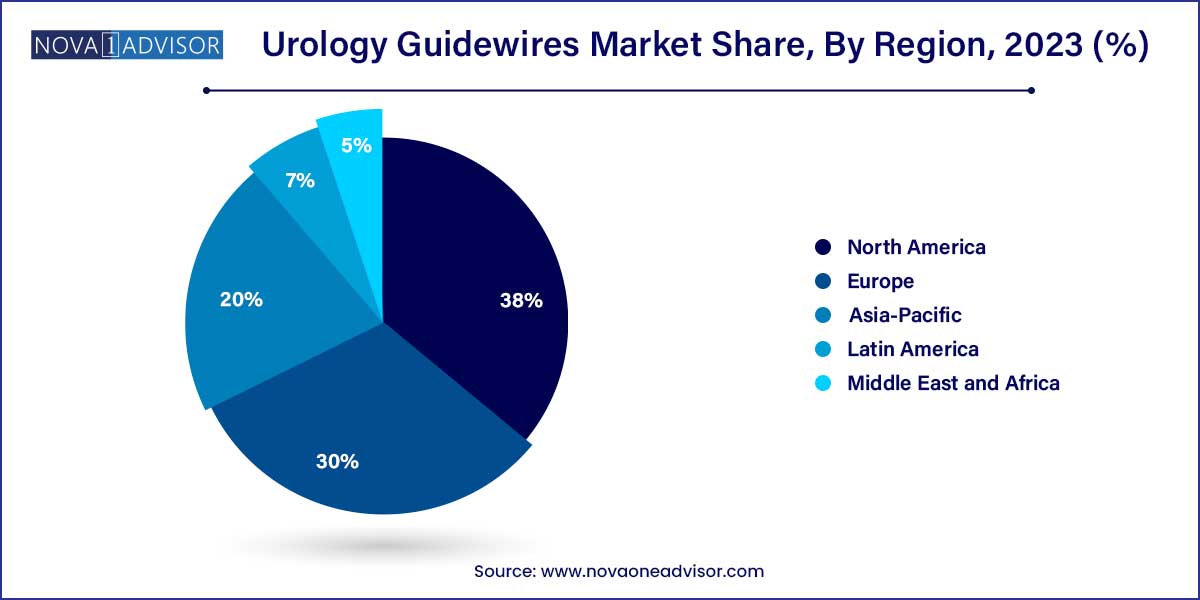

- North America dominated the market, with the highest share of more than 38.0% in 2023.

- Based on material, the stainless steel guidewires segment captured the largest market share with around 42.2% in 2023

- The straight tip segment dominated the market with around 49.9% of the revenue share.

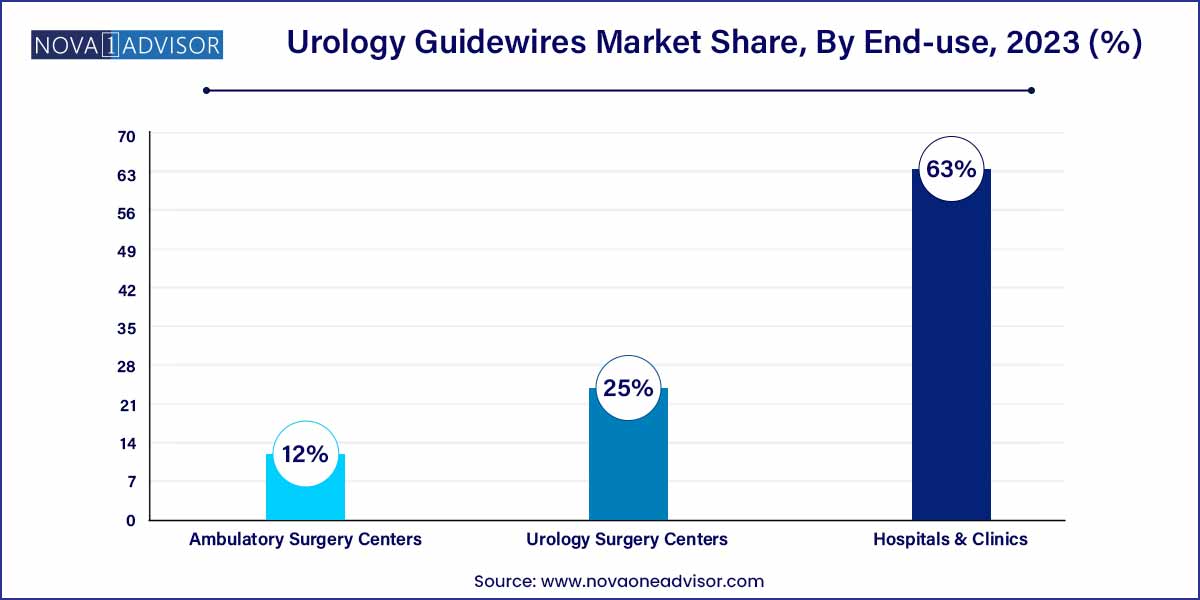

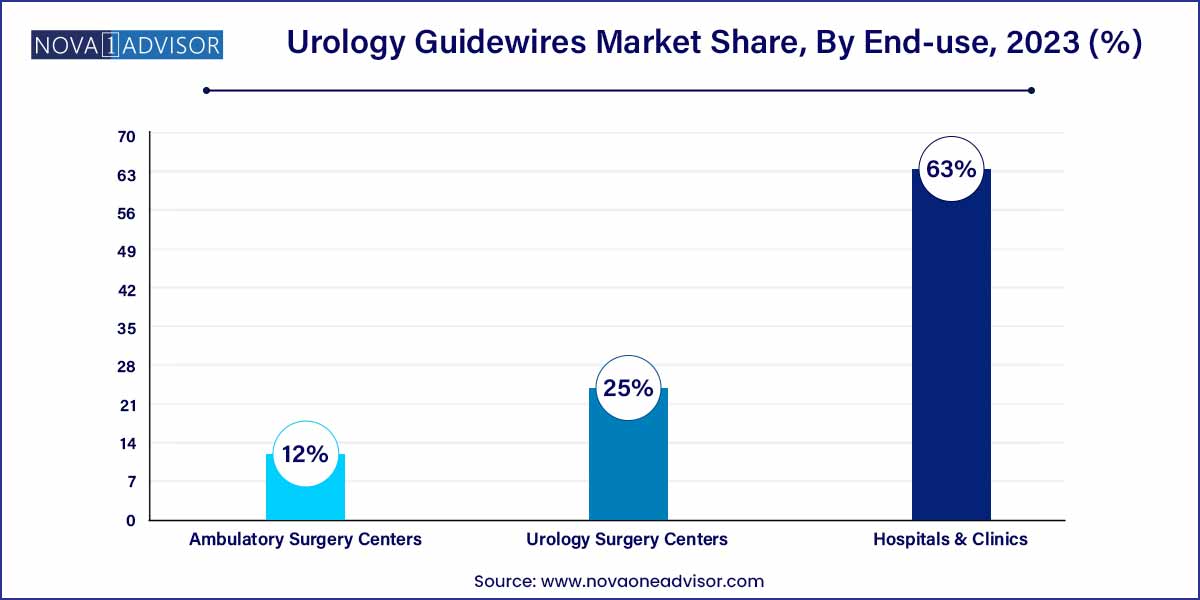

- The hospital & clinic segment dominated the market with a revenue share of over 63.0% in 2023.

Market Overview

The global urology guidewire market is witnessing steady and sustained growth driven by the increasing prevalence of urological conditions, the expansion of minimally invasive surgeries, and technological innovations in medical devices. Urology guidewires serve as critical accessories in a variety of urological procedures such as ureteroscopy, catheter placement, stent introduction, and percutaneous nephrolithotomy. These devices assist clinicians in navigating the urinary tract safely and accurately, ensuring procedural success and minimizing trauma to delicate tissues.

With an aging global population, the incidence of urological disorders—ranging from kidney stones and ureteral obstructions to urinary tract infections and prostate-related issues—is on the rise. For instance, studies show that kidney stones affect approximately 1 in 11 people in the U.S., with recurrence rates as high as 50% within 10 years. This growing patient pool is increasing the demand for reliable, high-performance guidewires.

The market is also being driven by a broader shift in urology toward endourology and minimally invasive procedures, which offer faster recovery times and fewer complications compared to traditional open surgeries. Technological advancements in guidewire design such as hydrophilic coatings, kink resistance, and steerability have significantly improved procedural efficacy and patient safety. Coupled with rising surgical volumes, improvements in hospital infrastructure, and expanding access to advanced care in emerging markets, these factors collectively underpin the market’s forward trajectory.

Major Trends in the Market

-

Increased Preference for Hydrophilic Coatings: Surgeons are favoring guidewires with hydrophilic coatings for smoother navigation through tortuous anatomical pathways.

-

Rising Demand for Nitinol Guidewires: Nitinol’s unique superelasticity and kink resistance make it the material of choice for complex urological interventions.

-

Miniaturization and Customization: There is a growing emphasis on miniaturized guidewires tailored for pediatric and geriatric patients to reduce tissue trauma.

-

Integration with Imaging Technologies: Advances are underway to develop guidewires with embedded sensors or contrast visibility to support real-time fluoroscopic or ultrasound-guided navigation.

-

Single-Use and Disposable Guidewires: To combat hospital-acquired infections, there is an increasing shift towards sterile, disposable guidewire models, especially in ambulatory settings.

-

Expansion of Outpatient Urology Procedures: The shift from inpatient to outpatient care is encouraging the use of more flexible, ergonomic, and time-saving guidewire solutions.

-

Increased M&A Activity and OEM Partnerships: Market players are actively pursuing strategic alliances and acquisitions to expand portfolios and tap into emerging markets.

Urology Guidewires Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 475.00 Million |

| Market Size by 2033 |

USD 882.47 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 6.39% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Material, Tip Shape, End-user, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Boston Scientific Corporation; Integer Holdings Corporation; Advin Health Care; Cook Medical; Olympus America; Teleflex Incorporated; MEDpro Medical B.V.; ACE Medical Devices. |

Market Driver: Growing Burden of Urological Disorders

A key driver for the urology guidewire market is the escalating global burden of urological disorders, particularly urinary stone disease, benign prostatic hyperplasia (BPH), and ureteral strictures. The increasing prevalence of lifestyle diseases, dietary shifts, sedentary behavior, and aging contribute to a sharp rise in these conditions. For example, kidney stones—highly prevalent in North America, South Asia, and the Middle East—often require endourological procedures where guidewires are indispensable.

In response to this clinical need, there has been an upsurge in ureteroscopy and retrograde intrarenal surgery (RIRS), both of which rely heavily on guidewire navigation for safe and precise access to the urinary tract. In complex stone cases, multiple guidewires may be used in tandem. The growing procedural load, especially in high-volume centers, underscores the indispensable role of guidewires and positions the market for continued growth.

Market Restraint: Device-Associated Risks and Complications

Despite advancements in design and material technology, urology guidewires are not without limitations. Improper placement, operator error, or poor guidewire quality can result in complications such as ureteral perforation, wire fragmentation, and kinking, which can delay procedures or necessitate additional interventions. These risks are particularly pronounced in cases involving narrow or distorted anatomy.

Additionally, the lack of standardized training in some developing healthcare systems contributes to inconsistent procedural outcomes. There are also concerns regarding the environmental and economic impact of single-use guidewires, especially in settings with constrained budgets. These factors may hamper adoption, particularly in resource-limited environments where device reuse is common.

Market Opportunity: Growth in Ambulatory and Day-Surgery Urology

An emerging opportunity lies in the rising number of urology procedures performed in ambulatory surgery centers (ASCs) and day-care urology units. With healthcare systems globally shifting towards cost-effective, decentralized care, more patients are undergoing stone removal, stent placement, and ureteral dilation on an outpatient basis. This creates demand for faster, more ergonomic guidewire solutions that reduce procedural time without compromising safety.

Manufacturers have an opportunity to create lightweight, easy-to-use guidewires designed for quick turnaround in high-throughput centers. Moreover, as these ASCs expand in emerging economies—driven by urbanization and improved insurance coverage—there’s potential to establish direct distribution networks and tailored offerings in fast-growing regional markets like Southeast Asia, Latin America, and parts of the Middle East.

Segments Insights:

Material Insights

Nitinol guidewires led the material segment due to their exceptional flexibility, shape memory, and kink resistance—properties that are particularly valuable in navigating tortuous urological anatomy. Nitinol’s elasticity allows for atraumatic passage through the ureter and renal pelvis while resisting deformation under repeated stress. These attributes make nitinol ideal for both routine and complex cases such as large kidney stones or ureteral strictures.

Furthermore, nitinol guidewires are often hydrophilic-coated, offering enhanced lubricity during insertion. Their rising adoption in hospital settings and high-end clinics is also linked to improved outcomes in minimally invasive procedures. Companies such as Boston Scientific and Cook Medical have developed nitinol-based guidewires tailored for endourology, setting benchmarks for performance and reliability.

While nitinol leads the high-end market, stainless steel guidewires are growing rapidly due to their cost-efficiency and mechanical robustness. These wires are widely used in developing regions and mid-tier hospitals where budget constraints necessitate more affordable yet reliable instruments. Stainless steel guidewires offer superior pushability and torque control in straight paths, making them suitable for basic catheterization and access procedures.

Recent innovations in coating technologies have improved the performance of stainless steel guidewires by enhancing their lubricity and reducing friction. As a result, their use is expanding even in semi-complex cases. Additionally, the ability to sterilize and reuse these guidewires in some healthcare systems further contributes to their growth trajectory.

Tip Shape Insights

Straight tip guidewires commanded the largest market share among tip configurations, primarily due to their widespread use in initial urinary tract access. These guidewires offer straightforward control and are often the first choice in simple catheter placements or diagnostic procedures. Their ease of use and availability in various stiffness levels make them a staple in most urological settings.

Their dominance is also supported by the increasing volume of basic urological interventions that do not necessitate specialized wire shapes. Manufacturers often package straight tip guidewires with other disposable urological kits, enhancing their reach in hospital procurement channels.

The J-shaped tip guidewire segment is witnessing the fastest growth, especially in procedures that require maneuvering around anatomical bends, strictures, or obstructions. The curled tip reduces the risk of tissue trauma and facilitates atraumatic navigation through the ureter and renal pelvis. These guidewires are particularly useful in managing complex calculi, post-operative ureteral scarring, or congenital anomalies.

As the complexity of urological procedures rises, the demand for more flexible and shape-retentive guidewires increases. New product designs with hybrid J-tip configurations and enhanced fluoroscopic visibility are also accelerating adoption across both developed and emerging surgical centers.

End-user Insights

Hospitals and clinics formed the dominant end-user segment, driven by their comprehensive infrastructure, procedural volume, and access to specialized urologists. Most complex surgeries, including those for nephrolithiasis or obstructive uropathy, are conducted in hospitals where advanced imaging and endoscopic systems are available. These settings require high-quality guidewires with proven clinical performance.

Furthermore, hospitals benefit from favorable reimbursement systems and bulk procurement processes, allowing them to invest in premium guidewire systems. Leading institutions often participate in product trials and clinical research, further cementing the use of specialized guidewires in routine protocols.

Ambulatory surgery centers (ASCs) are the fastest-growing segment as healthcare delivery increasingly shifts from inpatient to outpatient models. The rapid turnaround, lower costs, and convenience associated with ASCs make them ideal for elective urology procedures such as stent placements or minor stone extractions. These facilities require compact, ergonomic, and disposable guidewires that align with fast-paced workflows.

The rise of single-specialty urology centers and the increasing focus on same-day discharge procedures are enhancing demand in this segment. With more urologists opting to practice in ambulatory settings, tailored guidewire solutions are becoming a strategic priority for manufacturers aiming to serve this evolving landscape.

Regional Insights

North America retained its dominance in the global urology guidewire market due to its advanced healthcare infrastructure, high procedural volumes, and a strong presence of leading medical device manufacturers. The United States, in particular, has seen a rise in kidney stone incidence and related interventions, driving consistent demand for urology guidewires.

The region benefits from robust reimbursement systems, access to skilled urologists, and early adoption of innovative technologies. Moreover, strategic partnerships between hospitals and device companies for clinical trials and innovation pipelines provide North America with a competitive edge. The FDA's supportive regulatory environment for Class II medical devices further accelerates new product introductions.

Asia-Pacific is experiencing the highest growth rate, driven by a large aging population, rising incidence of urological conditions, and improving healthcare access. Countries like China, India, and Indonesia are witnessing increased adoption of endourological techniques, facilitated by expanding insurance coverage and infrastructure investment.

In addition to public health initiatives for early screening, the region is also seeing growth in private urology clinics and ambulatory surgical facilities. Regional manufacturers are developing affordable guidewire alternatives, enabling access in cost-sensitive markets. As training programs and minimally invasive surgical skills expand, the demand for high-performance guidewires in Asia-Pacific is expected to skyrocket.

Some of the prominent players in the urology guidewires market include:

- Boston Scientific Corporation

- Integer Holdings Corporation

- Advin Health Care

- Cook Medical

- Olympus America

- Teleflex Incorporated

- MEDpro Medical B.V.

- ACE Medical Devices& Others

Recent Developments

-

Boston Scientific (February 2025): Launched its FlexiSteer Plus guidewire with enhanced hydrophilic coating and torque response for improved control in complex ureteroscopic procedures.

-

Cook Medical (January 2025): Announced FDA clearance for its HiWire Nitinol Core guidewire featuring dual-tip technology for flexible maneuvering and increased procedural versatility.

-

Teleflex Inc. (March 2025): Entered a strategic partnership with a Southeast Asian distributor to expand its urology device footprint, particularly guidewires, in high-growth markets.

-

Olympus Corporation (April 2025): Unveiled a new line of steerable access guidewires designed to support precision navigation in anatomically difficult renal paths.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global urology guidewires market.

Material

- Nitinol Guidewires

- Stainless Steel Guidewires

- PTEE Guidewires

- Others

Tip Shape

- Straight Tip

- Angled Tip

- J-Shaped Tip

- Others

End-user

- Hospitals & Clinics

- Urology Surgery Centers

- Ambulatory Surgery Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)