U.S. Digital Signage Market Size and Research

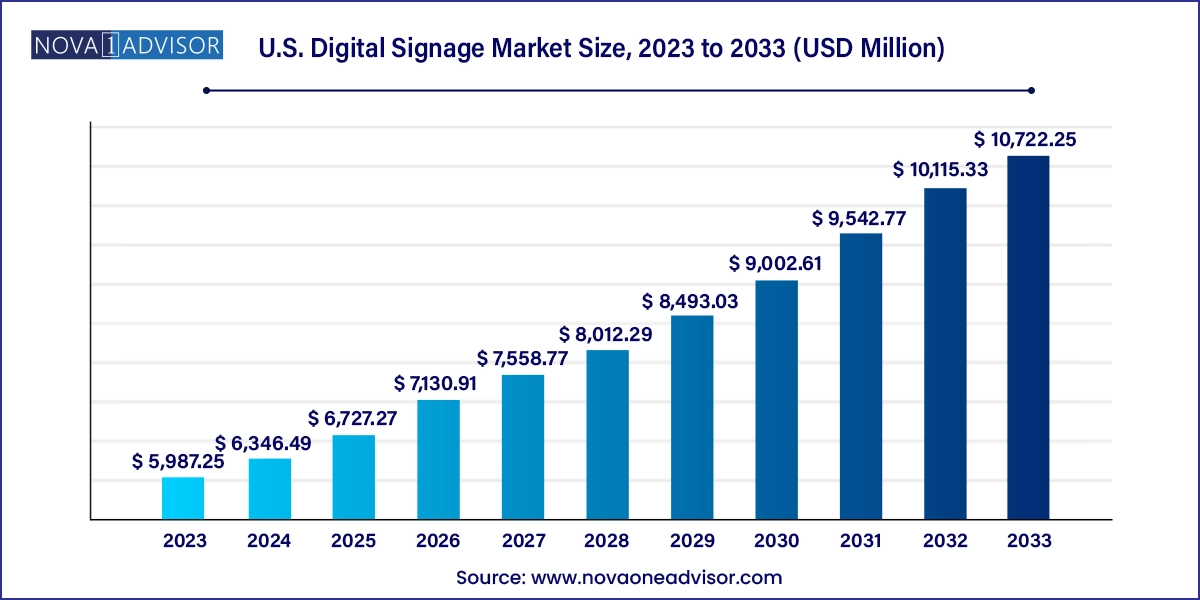

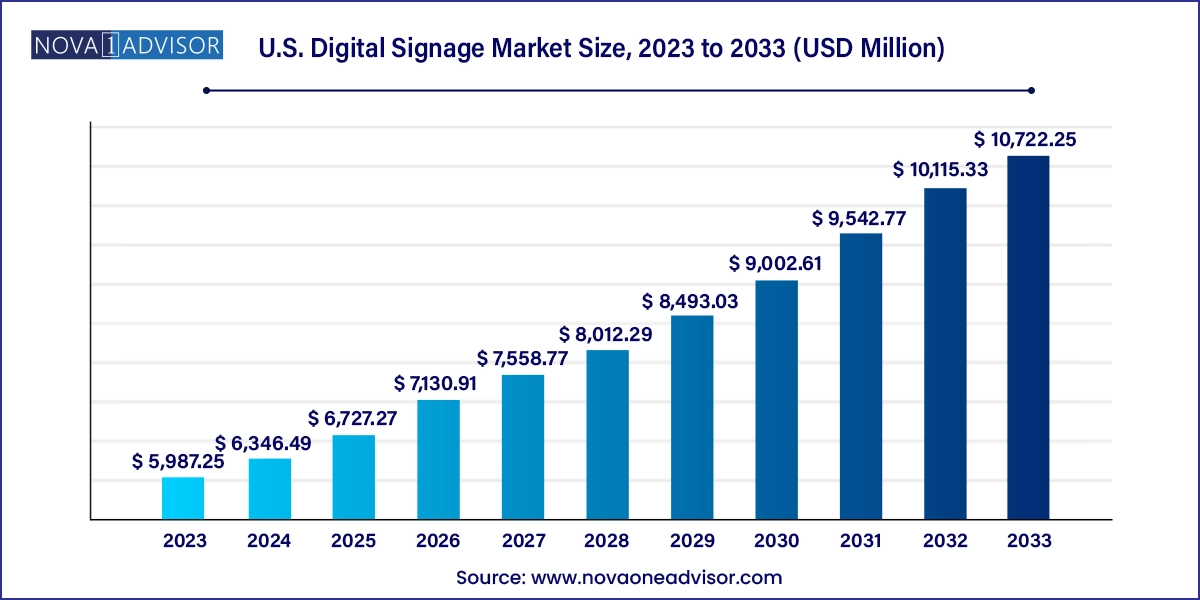

The U.S. digital signage market size was exhibited at USD 5,987.25 million in 2023 and is projected to hit around USD 10,722.25 million by 2033, growing at a CAGR of 6.0% during the forecast period 2024 to 2033.

U.S. Digital Signage Market Key Takeaways:

- In terms of revenue, the hardware segment accounted for largest market share of around 60.7% in 2023.

- On the basis of display type, video walls held a share of more than 21% of the displays market in 2023.

- The transparent LED screens segment is anticipated to exhibit the highest CAGR during the forecast period 2024 to 2033 .

- The retail sector spearheaded the market in 2023 and constituted a market share of 21.6%.

- The healthcare segment is estimated to witness substantial growth over the forecast period 2024 to 2033.

- In terms of revenue, the in-store segment dominated the market in 2023 contributing a market share of 60%.

- The out-store segment is projected to register a higher CAGR during the forecast period 2024 to 2033.

- Based on display technology, LED segment dominated the market in 2023 and accounted for the share of more than 40%.

- The LED segment is projected to exhibit the highest CAGR of 7.1% during the forecast period 2024 to 2033.

- The resolution segment is further segmented into 8K, 4K, full high definition (FHD), high definition (HD), and lower than HD.

- The signage size segment is further bifurcated into below 32 inches, 32 to 52 inches, and above 52 inches.

- Broadcast content category is expected to emerge as the fastest-growing segment expanding at a significant CAGR from 2024 to 2033.

- From a geographical front, in 2023, the western U.S. region held prominent share of 32.7%.

- The Midwest region is projected to witness the highest CAGR of 8.4% during the forecast period 2024 to 2033.

Market Overview

The U.S. digital signage market has emerged as a dynamic and fast-evolving industry driven by the growing demand for interactive visual communication across various end-use sectors. Digital signage, which involves the use of technologies such as LCD, LED, OLED, and projection to display digital content, is being increasingly deployed to enhance customer engagement, streamline communication, and promote products and services effectively. With advancements in display technologies and the integration of analytics and IoT features, digital signage has evolved from a static advertising medium to a real-time, data-driven communication platform.

In the United States, digital signage has found a robust application across sectors including retail, healthcare, transportation, banking, education, and hospitality. Businesses are leveraging digital signage to deliver personalized content, advertise in real-time, and enhance the customer experience. From interactive kiosks in airports to digital menu boards in fast-food restaurants, the versatility and effectiveness of digital signage are transforming customer-facing operations. With increasing investments in smart city projects, digital infrastructure, and in-store marketing technologies, the U.S. digital signage market is poised for substantial growth over the forecast period.

Major Trends in the Market

-

Adoption of 4K and 8K Displays: High-resolution displays are gaining popularity for their ability to deliver vivid and immersive content experiences.

-

Integration of AI and IoT: Smart digital signage powered by AI and IoT offers real-time content updates, facial recognition, and audience analytics.

-

Shift Toward Cloud-Based Solutions: Cloud-based digital signage platforms offer scalability, remote content management, and lower upfront costs.

-

Growth of Interactive Kiosks: Increased deployment in retail, healthcare, and transport sectors for self-service, wayfinding, and product exploration.

-

Expansion of Out-store Installations: Businesses are investing more in out-store signage such as billboards and transport hub displays to increase reach.

-

Content Personalization and Programmatic Advertising: Leveraging data for dynamic and targeted advertising content.

-

Sustainability and Energy-Efficient Displays: Development of eco-friendly signage solutions like energy-saving LED and OLED displays.

Report Scope of U.S. Digital Signage Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6,346.49 Million |

| Market Size by 2033 |

USD 10,722.25 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 6.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application, Technology, Resolution, Location, Component, Screen Size, Content Category, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

Northeast U.S.; Southeast U.S.; West U.S.; Midwest U.S.; Southwest U.S. |

| Key Companies Profiled |

BrightSign, LLC, Cisco Systems, Inc., Intel Corporation, KeyWest Technology, Inc., LG Electronics (LG Corporation), Microsoft, NEC Display Solutions, Omnivex Corporation, Panasonic Corporation, SAMSUNG, Scala Digital Signage, Winmate Inc.Christie Digital Systems USA, Inc, Meridian Kiosks |

Market Driver: Increasing Demand for Interactive and Real-Time Customer Engagement

One of the most compelling drivers of the U.S. digital signage market is the increasing demand for interactive and real-time customer engagement. Businesses across industries are realizing that static communication tools no longer suffice in a digital-first consumer landscape. Digital signage enables the dynamic presentation of content tailored to consumer behaviors, preferences, and locations. For instance, retail chains use interactive kiosks to suggest products based on customer queries, while QSRs (quick service restaurants) display real-time menu updates based on time-of-day or inventory.

Furthermore, the real-time capability of digital signage—enabled by cloud-based content management systems—means businesses can adapt quickly to market changes, promotions, or emergencies. This flexibility not only boosts customer engagement but also enhances operational efficiency and brand visibility. Hospitals and banks, for example, use digital signage to streamline visitor flows, offer directions, and communicate essential updates instantly. As consumer expectations continue to evolve, interactive and data-driven signage solutions will be pivotal to business success.

Market Restraint: High Initial Investment Costs

Despite the numerous advantages digital signage offers, the high initial costs associated with hardware acquisition, installation, and content development can act as a significant barrier, especially for small and medium-sized enterprises (SMEs). Advanced signage systems often require high-definition displays, media players, sensors, and software licenses, in addition to installation and maintenance services. For instance, a retail chain looking to implement digital signage across multiple stores must invest in both infrastructure and skilled personnel to manage and update content.

Moreover, ongoing operational expenses such as electricity consumption and maintenance can accumulate over time, making it challenging for budget-conscious organizations to justify the ROI. Although cloud-based solutions and subscription models are helping alleviate some of these cost burdens, the initial outlay remains a key consideration hindering widespread adoption across cost-sensitive industries and rural areas.

Market Opportunity: Growth in Smart City Projects and Public Infrastructure

The growing investment in smart city initiatives and public infrastructure across the U.S. presents a substantial opportunity for digital signage vendors. As urban areas aim to become more connected, efficient, and user-friendly, digital signage is increasingly being integrated into public transportation systems, smart buildings, and civic spaces. Interactive kiosks, real-time information boards, and emergency broadcast systems are becoming standard components of city infrastructure.

For example, New York City’s LinkNYC project has replaced public payphones with digital kiosks offering Wi-Fi, navigation, and emergency services, thereby opening avenues for advertising and public information dissemination. Similarly, transportation authorities are deploying digital displays in subways and buses to provide schedules, alerts, and advertising. These large-scale deployments not only create demand for hardware and software but also generate recurring revenue through advertising and content management. With federal and municipal governments increasingly allocating budgets toward digital infrastructure, the U.S. digital signage market is set to benefit significantly.

U.S. Digital Signage Market By Type Insights

Kiosks dominated the U.S. digital signage market by type, particularly due to the increased use of interactive and self-service kiosks in sectors like retail, transportation, and healthcare. Interactive kiosks are widely deployed in shopping malls, airports, and hospitals to provide services such as wayfinding, check-in/check-out, and digital assistance. These kiosks enhance the user experience by reducing wait times and enabling self-service capabilities, which have become increasingly important post-pandemic. Additionally, self-service kiosks in QSRs allow customers to place orders directly, streamlining operations and reducing staff dependency.

Meanwhile, transparent LED screens are expected to be the fastest-growing segment owing to their increasing use in luxury retail outlets and automobile showrooms. These screens offer futuristic aesthetics and blend seamlessly with architectural glass structures, making them ideal for premium advertising and promotional activities. Their growing popularity for both indoor and outdoor settings is supported by innovations in display transparency, brightness, and resolution.

U.S. Digital Signage Market By Application Insights

Retail continues to lead the digital signage application segment, as brick-and-mortar stores increasingly use digital displays for branding, in-store promotions, and interactive product showcases. In a competitive retail environment, visual merchandising through digital signage is crucial for attracting footfall and driving sales. Dynamic signage also allows retailers to quickly update prices, advertisements, and seasonal promotions.

In contrast, the healthcare segment is expected to witness the fastest growth. Hospitals and clinics are adopting digital signage to manage patient flows, display health tips, provide navigation, and communicate waiting times. This not only improves patient experience but also helps reduce administrative burdens on healthcare staff. Integration with hospital management systems further amplifies efficiency and service quality.

U.S. Digital Signage Market By Location Insights

In-store signage dominated the market by location due to its extensive use in retail outlets, corporate offices, and educational institutions. In-store signage facilitates a controlled environment for content delivery and enhances customer engagement by offering tailored experiences. Retailers rely on in-store digital signage for targeted promotions, upselling, and improving brand recall.

Nevertheless, out-store signage is growing rapidly, especially in the form of digital billboards, public transit displays, and smart city screens. These platforms offer greater visibility and reach, making them attractive for advertisers looking to capture mass attention. Technological improvements in weather-resistant and high-brightness displays have made out-store signage more durable and efficient.

U.S. Digital Signage Market By Technology Insights

LED technology currently dominates the U.S. market, primarily due to its superior brightness, energy efficiency, and longer lifespan compared to alternatives. LED displays are preferred for both indoor and outdoor environments, including retail billboards, stadiums, and corporate lobbies. Their ability to deliver vibrant visuals even under direct sunlight makes them ideal for out-store deployments.

On the other hand, OLED is emerging as the fastest-growing technology segment. OLED panels offer exceptional color accuracy, deep blacks, and flexible form factors, making them popular for high-end retail and creative displays. As the cost of OLED technology declines and production scales up, it is likely to witness accelerated adoption across niche and premium applications.

U.S. Digital Signage Market By Resolution Insights

Full HD (FHD) displays remain the dominant choice due to their cost-effectiveness and sufficient resolution for most applications. Retailers, schools, and healthcare providers frequently use FHD signage for general-purpose content dissemination. These displays strike a balance between performance and affordability, making them widely adopted across sectors.

However, 4K resolution displays are poised for the fastest growth. As content becomes richer and more visually detailed, especially in gaming, luxury retail, and entertainment venues, the demand for ultra-high-definition displays is on the rise. Falling prices of 4K panels and increasing consumer expectations for better visual experiences are pushing vendors to upgrade existing systems.

U.S. Digital Signage Market By Signage Size Insights

Displays sized between 32 to 52 inches hold the largest market share as they are ideal for most commercial applications, offering a balance of visibility and space efficiency. They are commonly seen in retail stores, hospitals, schools, and office lobbies.

Signage above 52 inches is experiencing the fastest growth, fueled by demand in auditoriums, malls, transportation terminals, and large event venues. These larger formats provide greater impact and are increasingly being used for video walls, outdoor advertising, and immersive brand experiences.

U.S. Digital Signage Market By Content Category Insights

Non-broadcast content dominates, particularly in sectors like retail, education, and corporate communication, where content is tailored and not tied to real-time programming. Custom advertisements, promotional videos, and internal communications form the bulk of non-broadcast signage content.

Conversely, broadcast content, especially news and weather updates, is gaining traction in transportation hubs, banks, and waiting areas. Real-time feeds enhance the value of signage in public spaces, making them more engaging and informative. Sports and live event updates also contribute to this growth, especially in venues such as stadiums and bars.

U.S. Digital Signage Market By Regional Insights

The U.S. stands as a technological hub for digital signage innovation, with widespread adoption across urban and semi-urban regions. Major cities like New York, Los Angeles, and Chicago lead in deployment across retail, transportation, and corporate sectors. The country’s strong digital infrastructure, high advertising spend, and consumer affinity for technological experiences contribute to its leadership in this market.

The government and private sector collaborations for smart cities are further enhancing deployment opportunities. For instance, public-private partnerships in digital transit boards and municipal communication systems have seen growing success. Additionally, increasing investment by U.S.-based tech giants in display technologies continues to strengthen the domestic digital signage landscape.

U.S. Digital Signage Market Recent Developments

-

March 2025: Samsung Electronics launched its new ultra-slim 8K digital signage series in the U.S., focusing on premium retail and luxury hospitality sectors.

-

February 2025: Intel partnered with Scala to develop AI-powered digital signage solutions for retail chains, integrating facial recognition and real-time analytics.

-

January 2025: LG Electronics introduced transparent OLED displays for use in high-end U.S. automotive showrooms and flagship stores.

-

December 2024: BrightSign announced a collaboration with Bluefin to release modular kiosk displays targeting healthcare and education.

-

November 2024: NEC Display Solutions completed a large-scale installation of interactive digital signage in the New York City subway system.

Some of the prominent players in the U.S. digital signage market include:

- BrightSign, LLC

- Cisco Systems, Inc.

- Intel Corporation

- KeyWest Technology, Inc.

- LG Electronics (LG Corporation)

- Microsoft

- NEC Display Solutions

- Omnivex Corporation

- Panasonic Corporation

- SAMSUNG

- Scala Digital Signage

- Winmate Inc.

- Christie Digital Systems USA, Inc

- Meridian Kiosks

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. digital signage market

Type

- Video Walls

- Video Screen

- Transparent LED Screen

- Digital Poster

- Kiosks

-

- Interactive Kiosks

- Self-service Kiosks

- Others

Component

-

- Displays

- Media Players

- Projectors

- Others

-

- Installation Services

- Maintenance & Support Services

- Consulting Services

- Others

Technology

Resolution

- 8K

- 4K

- Full High Definition (FHD)

- High Definition (HD)

- Lower than HD

Application

- Retail

- Hospitality

- Entertainment

- Stadiums & Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transport

Location

Content Category

-

- News

- Weather

- Sports

- Others

Signage Size

- Below 32 Inches

- 32 to 52 Inches

- More than 52 Inches

Regional

- Northeast

- Southeast

- West

- Midwest

- Southwest