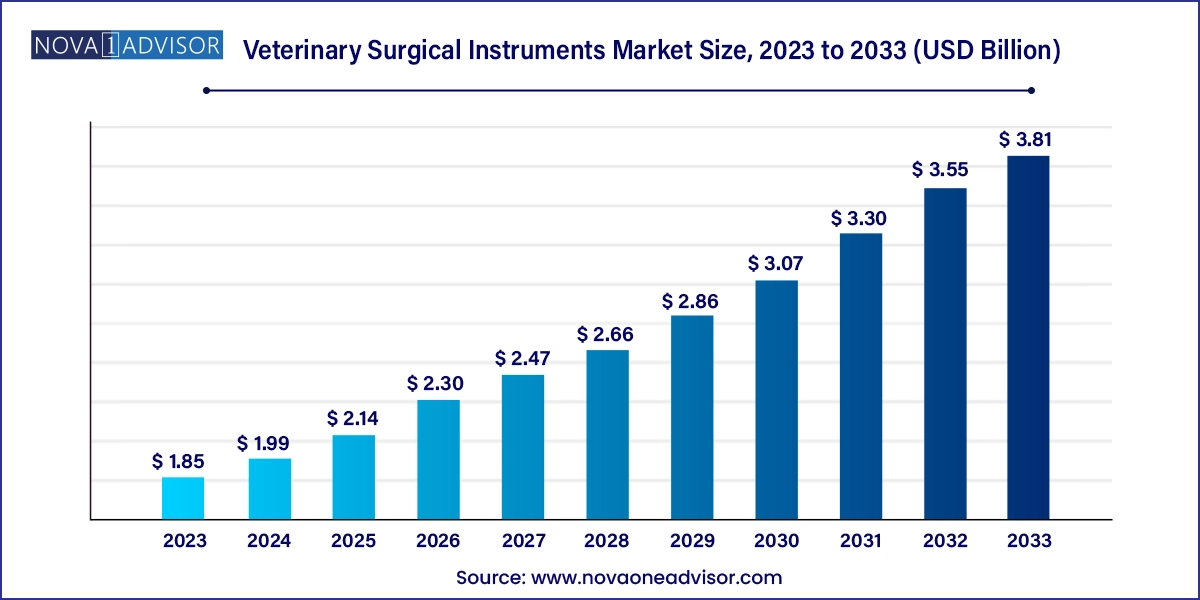

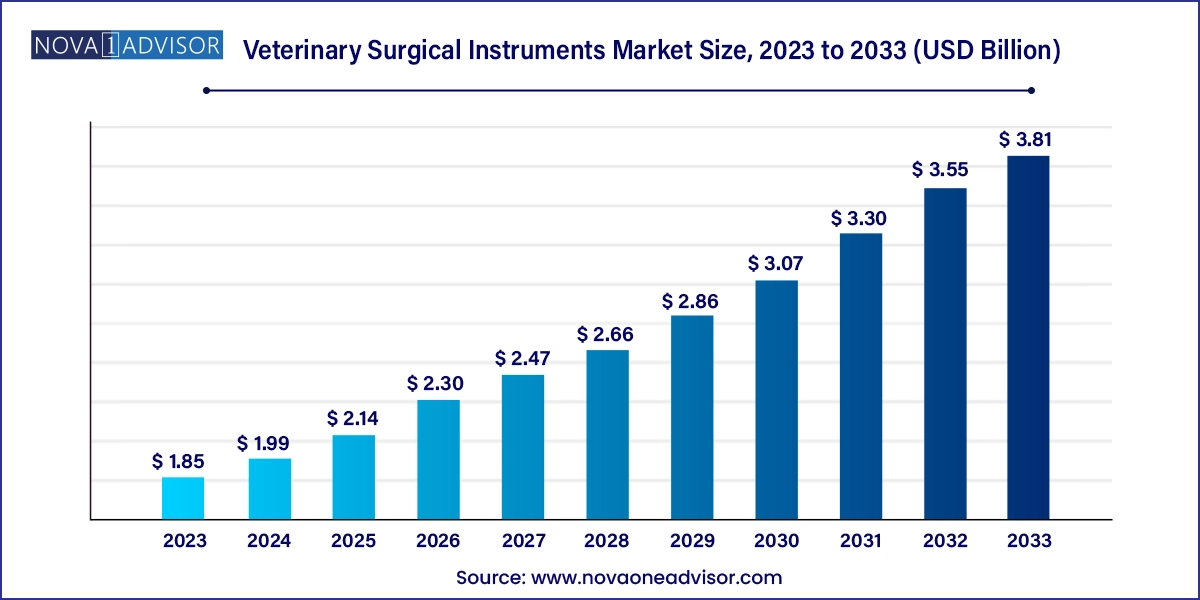

Veterinary Surgical Instruments Market Size and Growth

The global veterinary surgical instruments market size was exhibited at USD 1.85 billion in 2023 and is projected to hit around USD 3.81 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2024 to 2033.

Veterinary Surgical Instrument Market Key Takeaways:

- North America dominated the market with the largest revenue share of 37.9% in 2023.

- In addition, pet humanization and increased awareness of animal welfare are expected to fuel the Asia Pacific market over the forecast period.

- The handheld devices segment dominated the market and accounted for the largest revenue share in 2023.

- The large animal segment dominated the market and accounted for the largest revenue share of 67.3% in 2023.

- The small animal segment is expected to grow at the fastest CAGR of 7.6% during the forecast period.

- The dental surgery segment dominated the market and accounted for the largest revenue share in 2023.

- The orthopedic surgery segment is expected to witness lucrative growth over the forecast period.

Market Overview

The Global Veterinary Surgical Instrument Market is witnessing substantial growth, propelled by rising pet ownership, advancements in animal healthcare infrastructure, and increased spending on companion and livestock animals. As animals become more integrated into families and food production systems become increasingly regulated, the importance of sophisticated veterinary surgical tools has grown. These instruments are essential not only for routine procedures like sterilizations and wound management but also for complex surgeries involving orthopedics, cardiology, ophthalmology, and dental care.

Veterinary surgeries, once limited primarily to large animal applications in agricultural settings, now include high-precision procedures for small companion animals such as dogs, cats, rabbits, and exotic pets. This expansion has driven demand for instruments like handheld forceps, retractors, surgical scissors, electrosurgical devices, staplers, and advanced suturing systems. The evolution of veterinary care to match the standards of human medicine has made surgical accuracy and safety paramount, fostering innovations in instrument design, materials, and ergonomics.

Moreover, technological progress in surgical imaging, anesthesia, and minimally invasive procedures is complementing the growth of this market. Veterinary clinics, hospitals, and academic institutions are expanding their surgical offerings, supported by public and private investment. With regulatory attention also increasing, especially regarding animal welfare and surgical outcomes, there is a global push to standardize and upgrade the instruments used across practices. These developments signal a strong upward trajectory for the market.

Major Trends in the Market

-

Increased Pet Humanization: Rising emotional and financial investments in pets are fueling demand for high-quality veterinary surgical interventions.

-

Adoption of Minimally Invasive Surgical Techniques: Demand for precision and faster recovery has led to increased use of laparoscopic and electrosurgical instruments.

-

Technological Advancements in Surgical Tools: Development of ergonomic designs, antimicrobial coatings, and reusable tools to improve performance and hygiene.

-

Growth in Companion Animal Insurance: Pet insurance coverage is driving more frequent and complex surgical interventions in veterinary clinics.

-

Surge in Veterinary Specialty Clinics: Specialized centers for dental, ophthalmic, and orthopedic surgeries are increasing in urban areas.

-

Integration of Telemedicine and Remote Diagnosis: Diagnostics and surgical consultations via tele-vet platforms are improving access to care in rural regions.

-

Focus on Veterinary Education and Training: Academic partnerships and online certifications are boosting skilled usage of advanced surgical tools.

-

Rising Demand for Surgical Instruments in Emerging Economies: Expanding animal healthcare infrastructure in Asia and Latin America supports market expansion.

Report Scope of Veterinary Surgical Instrument Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.99 Billion |

| Market Size by 2033 |

USD 3.81 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Animal Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled |

B. Braun SE; Medtronic; Jorgen Kruuse A/S; Smiths Group plc; Neogen Corporation; STERIS; DRE Veterinary; Surgical Holdings; GerMedUSA; World Precision Instruments; Sklar Surgical Instruments; Integra LifeSciences; Im3 Inc.; Ethicon US LLC |

Key Market Driver: Rising Global Pet Ownership and Expenditure on Companion Animal Health

The primary driver for the veterinary surgical instrument market is the global surge in pet ownership and the rising willingness of owners to spend on advanced veterinary care. In developed countries, pets are increasingly considered family members, with significant emotional investment placed on their well-being. This has led to a willingness to opt for surgical treatments—even complex or expensive procedures—that improve quality of life or extend lifespan.

According to industry data, pet-related spending has risen consistently year over year in markets such as the U.S., Canada, Germany, and Australia. Veterinary care, including surgeries, accounts for a large share of this expenditure. Pet owners today are more educated about available procedures and actively seek second opinions, specialist surgeons, and advanced clinics, further pushing demand for sophisticated surgical instruments. As a result, clinics are upgrading their equipment portfolios with premium tools that mirror human surgery standards, from microsurgical scissors to electrocautery systems.

Key Market Restraint: High Cost and Lack of Access to Advanced Surgical Equipment in Rural Areas

A major challenge for the global veterinary surgical instrument market is the high cost associated with acquiring and maintaining advanced surgical tools, especially in rural and underdeveloped regions. Many modern surgical instruments—particularly electrosurgery systems and minimally invasive toolkits—require significant capital investment, along with trained personnel and supporting infrastructure like diagnostic imaging and sterile processing equipment.

In emerging markets or rural regions of developed countries, veterinary clinics often operate with constrained budgets and limited staff. This results in a reliance on basic instruments, with many complex procedures being referred to urban or academic veterinary hospitals. The lack of access hampers surgical outcomes and creates geographic disparities in care quality. Furthermore, supply chain inefficiencies, import taxes, and regulatory hurdles can limit the availability of specialized instruments in low-income countries.

Key Market Opportunity: Expansion of Specialized Veterinary Practices and Surgical Training

A significant growth opportunity lies in the expansion of specialized veterinary practices and continued education in surgical techniques. As the veterinary industry becomes more sophisticated, there is increasing segmentation into specialties such as orthopedic surgery, oncology, neurosurgery, ophthalmology, and dental care. Each of these specialties requires specific instruments designed for precision, tissue conservation, and efficiency.

To support this demand, many veterinary schools and continuing education programs are offering certifications and hands-on training modules in surgical skills. Manufacturers are partnering with veterinary colleges to provide instrument kits and educational resources, fostering early familiarity among practitioners. The rise of virtual surgical training tools, including augmented reality and 3D simulators, also enhances this opportunity. Clinics that offer niche services are in a strong position to demand and purchase premium tools, thereby boosting market potential in the specialty segment.

Veterinary Surgical Instrument Market By Product Insights

Handheld devices dominate the veterinary surgical instrument market, given their widespread use in nearly all types of surgeries. Instruments like forceps, scalpels, scissors, and retractors form the foundation of every surgical procedure—whether simple or complex. Their broad utility, affordability, and necessity make them indispensable across both small clinics and large animal hospitals. In addition, the continual demand for instrument replacements due to wear, damage, or sterilization limits ensures a recurring revenue stream in this category.

Electrosurgery instruments are the fastest-growing product segment, driven by a shift toward minimally invasive techniques and the desire to reduce bleeding and operating time. These instruments allow precise cutting, coagulation, and tissue ablation using electric current, thereby improving efficiency and surgical outcomes. Particularly useful in soft tissue surgeries and oncology applications, electrosurgical tools are gaining traction in both small and large animal practices. Clinics seeking faster recovery and lower complication rates are increasingly integrating these systems into their surgical suites.

Veterinary Surgical Instrument Market By Animal Type Insights

Small animals currently dominate the market by animal type, largely due to the growing number of household pets and their proximity to advanced veterinary facilities. Dogs and cats account for the majority of surgical procedures, ranging from spaying/neutering to orthopedic corrections and tumor removals. Pet parents are highly involved in medical decision-making and are more likely to approve surgical interventions that improve the quality or longevity of life, thereby increasing demand for specialized surgical equipment.

Large animals are an important and steadily growing segment, particularly in regions where livestock health is essential to the agricultural economy. Equine surgeries, for instance, require instruments designed for larger anatomical structures and higher tissue resistance. Veterinary centers that service cattle, horses, and sheep often invest in rugged, reusable surgical kits suited for field or on-farm use. Growth in this segment is supported by improved livestock insurance programs and government-led animal health campaigns.

Veterinary Surgical Instrument Market By Application Insights

Soft tissue surgery is the dominant application segment, as these procedures are the most common across both companion and livestock animals. Soft tissue surgeries include everything from tumor removal and wound repair to hernia corrections and gastrointestinal interventions. Instruments like scalpels, retractors, electrocautery devices, and suturing kits are in regular use. The segment benefits from a consistent flow of routine and emergency procedures, making it a steady revenue driver for surgical instrument manufacturers.

Orthopedic surgery is the fastest-growing application segment, fueled by rising incidences of musculoskeletal conditions in aging pets, trauma injuries, and breed-specific deformities. Procedures like hip replacements, cruciate ligament repairs, and bone fixation require specialized tools such as bone cutters, orthopedic plates, power drills, and screws. The growth of this segment is further supported by veterinary orthopedic centers and pet insurance coverage, which makes high-cost procedures more accessible to pet owners.

Veterinary Surgical Instrument Market By Regional Insights

North America currently dominates the global veterinary surgical instrument market, driven by high pet ownership rates, advanced veterinary healthcare infrastructure, and strong economic capacity to invest in premium surgical services. The U.S. alone is home to over 29,000 veterinary practices and boasts some of the most advanced veterinary medical facilities globally. Pet insurance penetration, especially in the U.S. and Canada, allows pet owners to opt for surgical procedures that might otherwise be prohibitively expensive. Furthermore, leading manufacturers such as Integra LifeSciences and B. Braun have a strong presence in this region, fostering product availability and innovation.

Asia Pacific is the fastest-growing regional market, propelled by rapid urbanization, rising disposable incomes, and growing awareness of animal welfare. Countries like China, India, Japan, and Australia are seeing significant increases in companion animal ownership. Moreover, the livestock industry in Asia is modernizing, creating demand for veterinary surgical procedures in cattle, poultry, and equine health. Government investments in animal healthcare infrastructure, especially in rural outreach and veterinary education, are enabling a wider adoption of surgical instruments. As Western-style veterinary care becomes more prevalent in Asia, the market is expected to grow substantially.

Some of the prominent players in the global veterinary surgical instruments market include:

Recent Developments

-

In February 2025, Integra LifeSciences launched a new ergonomic line of handheld surgical instruments specifically designed for veterinary use, with a focus on improving surgeon control and reducing fatigue.

-

B. Braun Vet Care GmbH, in December 2024, announced the opening of a dedicated veterinary instrument manufacturing unit in Germany to meet growing demand across Europe and North America.

-

In October 2024, Surgical Holdings introduced a portable electrosurgery unit targeting mobile veterinary clinics and field surgeons in emerging markets.

-

Jorgensen Laboratories, in August 2024, launched a redesigned orthopedic instrument kit for small animal fracture repairs, integrating lightweight alloys and sterilizable containers.

-

In March 2025, World Precision Instruments partnered with a U.S. veterinary college to provide customized surgical toolkits for student training and lab procedures.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global veterinary surgical instruments market

Product

-

- Forceps

- Scalpels

- Surgical Scissors

- Hooks & Retractors

- Others

- Electrosurgery Instruments

- Sutures, Staplers, And Accessories

- Others

Animal Type

- Large Animal

- Small Animal

Application

- Soft Tissue Surgery

- Cardiovascular Surgery

- Ophthalmic Surgery

- Dental Surgery

- Orthopedic Surgery

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa