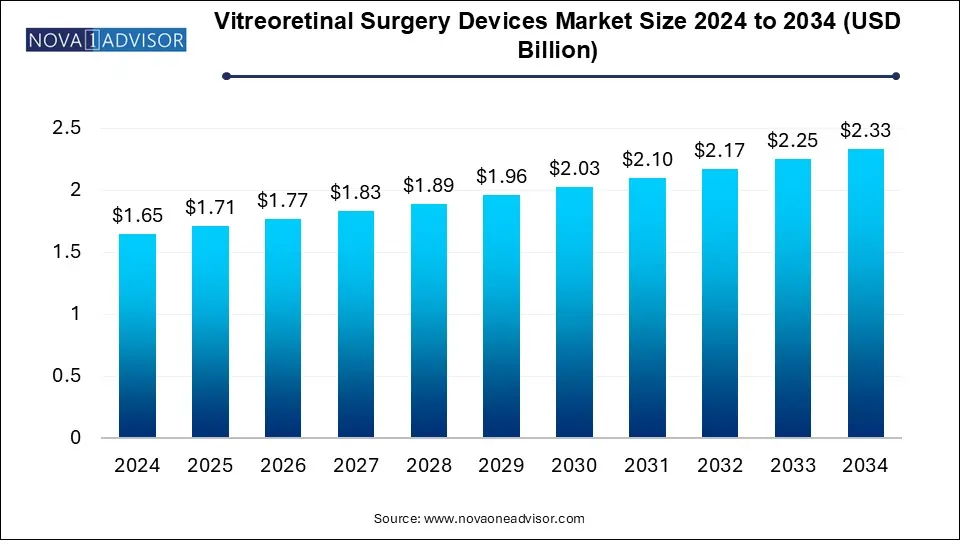

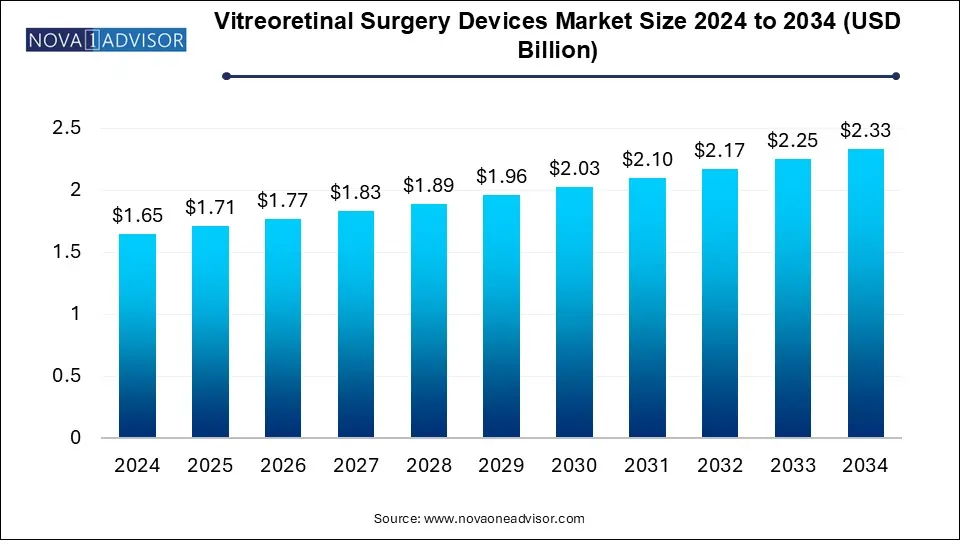

Vitreoretinal Surgery Devices Market Size and Growth

The vitreoretinal surgery devices market size was exhibited at USD 1.65 billion in 2024 and is projected to hit around USD 2.33 billion by 2034, growing at a CAGR of 3.5% during the forecast period 2025 to 2034.

Vitreoretinal Surgery Devices Market Key Insights

- The vitreoretinal packs segment held the largest revenue share, valued at USD 603.5 million in 2024.

- The posterior vitreoretinal surgery segment is anticipated to drive market expansion, growing at a CAGR of 3.6% and reaching approximately USD 1.9 billion by 2034.

- The diabetic retinopathy segment led the market, with a valuation of USD 638.9 million in 2024.

- Hospitals dominated the market, accounting for a 48.0% revenue share in 2024.

Report Scope of Vitreoretinal Surgery Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.71 Billion |

| Market Size by 2034 |

USD 2.33 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 3.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Surgery Type, Application, End Use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Alcon, Bausch + Lomb, BVI, Carl Zeiss Meditec, Cooper Vision, Designs for Vision, HOYA Surgical Optics, MedOne, OCULUS, Oertli, Peregrine Surgical, STAAR SURGICAL |

Market Growth Factors

Both government and private sector initiatives are playing a crucial role in raising awareness and improving accessibility to treatment, which is accelerating industry growth. Programs aimed at educating the public about retinal disorders and the benefits of early intervention are increasing demand for advanced surgical devices. Additionally, improved healthcare coverage and reimbursement policies in developed nations are reducing financial barriers, encouraging more patients to seek necessary surgical treatments.

The growing adoption of minimally invasive procedures is another driving force, as these techniques offer advantages such as shorter recovery periods, reduced complications, and enhanced patient comfort. This has led to the increased popularity of devices like microincision vitrectomy systems (MIVS), which minimize trauma and improve surgical precision. Innovations in illumination technologies are enhancing visibility, making complex procedures easier to perform. Additionally, advancements in surgical gases, silicone oils, and dyes are improving surgical outcomes and driving product development.

Overview of Vitreoretinal Surgery Devices:

Vitreoretinal surgery devices include specialized instruments, tools, and systems used for diagnosing and treating conditions affecting the vitreous humor and retina.

Trends in the Vitreoretinal Surgery Devices Market

- Technological advancements have significantly transformed vitreoretinal surgeries, making procedures more precise, efficient, and patient-friendly.

- Real-time imaging enables surgeons to visualize the retina with unparalleled clarity, enhancing surgical accuracy.

- Integration of imaging systems with digital platforms improves surgical planning and execution.

- Fiberoptic probes with adjustable lighting enhance visibility, particularly in peripheral retinal areas.

- LED and xenon-based illumination systems provide consistent, high-quality lighting while minimizing heat, reducing the risk of retinal damage.

- Innovative formulations of gases and silicone oils contribute to better surgical effectiveness and reduced complications.

Market Segmentation

Vitreoretinal Surgery Devices Market By Product

The market is categorized into vitreoretinal packs, photocoagulation lasers, vitrectomy machines, vitrectomy probes, illumination devices, and others. In 2024, vitreoretinal packs accounted for the largest revenue share at USD 603.5 million.

These pre-assembled, sterilized packs streamline procurement and preparation, enhancing operational efficiency. They also lower costs and mitigate infection risks by including single-use disposable instruments. Additionally, manufacturers offer customizable options to cater to specific surgical requirements, making these packs highly desirable for surgeons.

Vitreoretinal Surgery Devices Market By Surgery Type

Vitreoretinal surgeries are classified into posterior and anterior procedures. The posterior vitreoretinal surgery segment is poised for substantial growth, projected to reach approximately USD 1.9 billion by 2034 at a CAGR of 3.5%.

Advancements such as high-speed vitrectomy machines, intraoperative imaging, and small-gauge instruments are key growth drivers. The aging population, which is more prone to conditions like macular holes and epiretinal membranes, is also contributing to the increased demand for posterior segment surgeries.

Vitreoretinal Surgery Devices Market By Application

The market is divided into diabetic retinopathy, retinal detachment, macular degeneration, and other conditions. In 2024, the diabetic retinopathy segment dominated with a valuation of USD 638.7 million.

Rising diabetes prevalence, particularly in regions like Asia-Pacific, Latin America, and Africa, is increasing the demand for surgical interventions. The adoption of minimally invasive techniques, such as small-gauge vitrectomy systems, is making surgeries more efficient and accessible. Awareness campaigns and better healthcare accessibility are also facilitating earlier diagnoses and timely treatments.

Vitreoretinal Surgery Devices Market By End-Use

The market is segmented into hospitals, ophthalmic clinics, ambulatory surgery centers, and others. Hospitals led the market in 2024, accounting for 48.0% of total revenue.

Hospitals are equipped with state-of-the-art technology, including vitrectomy machines and real-time imaging systems, making them the preferred setting for vitreoretinal surgeries. Their comprehensive infrastructure, skilled specialists, and advanced tools contribute to superior surgical outcomes.

Vitreoretinal Surgery Devices Market By Regional

United States:

The U.S. vitreoretinal surgery devices market was valued at USD 659.5 million in 2024 and is projected to grow at a CAGR of 2.7% from 2025 to 2034.

Advancements in intraoperative imaging, including optical coherence tomography (OCT) and real-time retinal imaging, are enhancing precision, thereby driving demand. Increased awareness and improved diagnostic imaging have led to earlier detection and more surgical interventions. Additionally, insurance programs like Medicare are making these procedures more accessible to the elderly.

United Kingdom:

The UK market is expected to witness significant growth.

The rising prevalence of diabetes is increasing the incidence of diabetic retinopathy, necessitating vitreoretinal surgeries. Additionally, conditions such as retinal detachment, often due to trauma or age-related factors, are driving demand for surgical interventions. A growing trend toward robotic-assisted vitreoretinal surgeries is also enhancing surgical precision and efficiency.

China:

China is a dominant player in the Asia-Pacific vitreoretinal surgery devices market.

The country's aging population is contributing to a rising incidence of age-related macular degeneration (AMD), a leading cause of blindness among the elderly. The expansion of China’s private healthcare sector, driven by increased demand for faster and more advanced treatments, is further propelling market growth.

Market Competition and Key Players:

Leading companies are prioritizing innovation, expanding product offerings, and enhancing surgical precision. Investments in minimally invasive solutions, such as small-gauge vitrectomy systems, are aimed at improving patient recovery times and surgical outcomes. Additionally, integration of advanced imaging technologies like OCT is bolstering diagnostic capabilities and surgical accuracy.

Robotic-assisted surgery is another area of exploration, offering improved control and precision. Companies are also focusing on strategic partnerships with hospitals and ophthalmic clinics, as well as expanding into emerging markets to strengthen their market presence.

Some of The Prominent Players in The Vitreoretinal Surgery Devices Market Include:

- Alcon

- Bausch + Lomb

- BVI

- Carl Zeiss Meditec

- CooperVision

- Designs for Vision

- HOYA Surgical Optics

- MedOne

- OCULUS

- Oertli

- Peregrine Surgical

- STAAR SURGICAL

Vitreoretinal Surgery Devices Market Recent Developments

- In June 2024, Alcon announced that its UNITY Vitreoretinal Cataract System (VCS) and UNITY Cataract System (CS) have received FDA clearance and will now be available in the U.S. This development will expand its product range and improve industry presence in the country.

- In December 2023, Carl Zeiss Meditec AG announced that it has entered into an agreement to acquire 100% shares of the Dutch Ophthalmic Research Center (International) B.V. (D.O.R.C.) from France based investment firm, Eurazeo SE. This strategic development will allow Zeiss to expand its portfolio significantly and further consolidate its industry presence.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the vitreoretinal surgery devices market

By Product

- Vitreoretinal packs

- Photocoagulation lasers

- Vitrectomy machines

- Vitrectomy probes

- Illumination devices

- Other products

By Surgery Type

- Posterior vitreoretinal surgery

- Anterior vitreoretinal surgery

By Application

- Diabetic retinopathy

- Retinal detachment

- Macular degeneration

- Other applications

By End Use

- Hospitals

- Ophthalmic clinics

- Ambulatory surgery centers

- Other end users

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)