Waterjet Cutting Machine Market Size and Growth

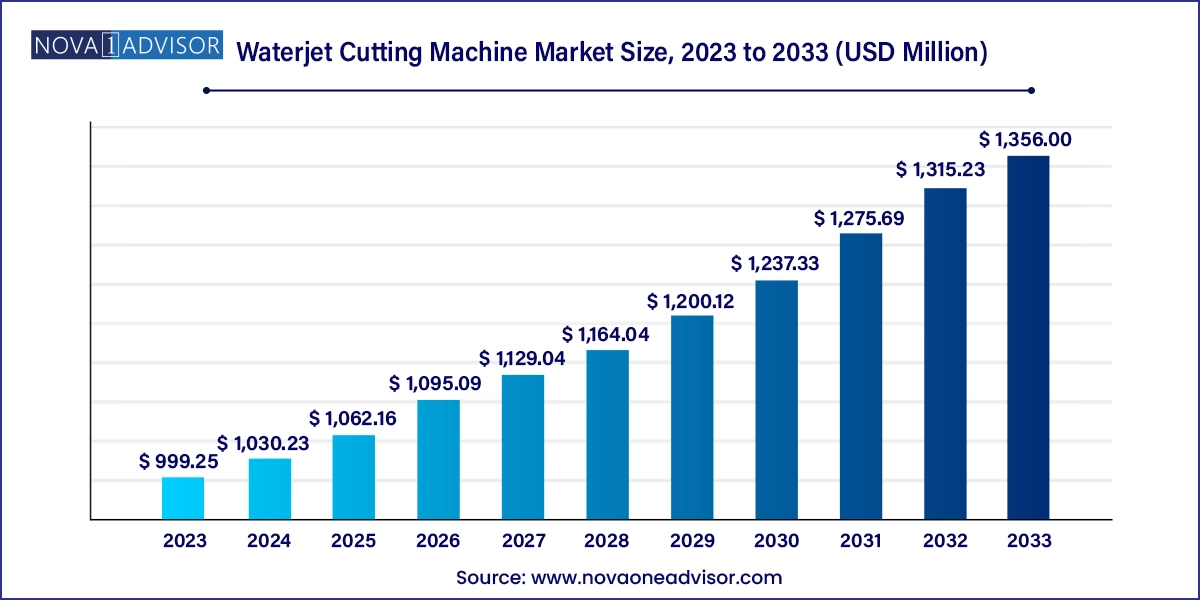

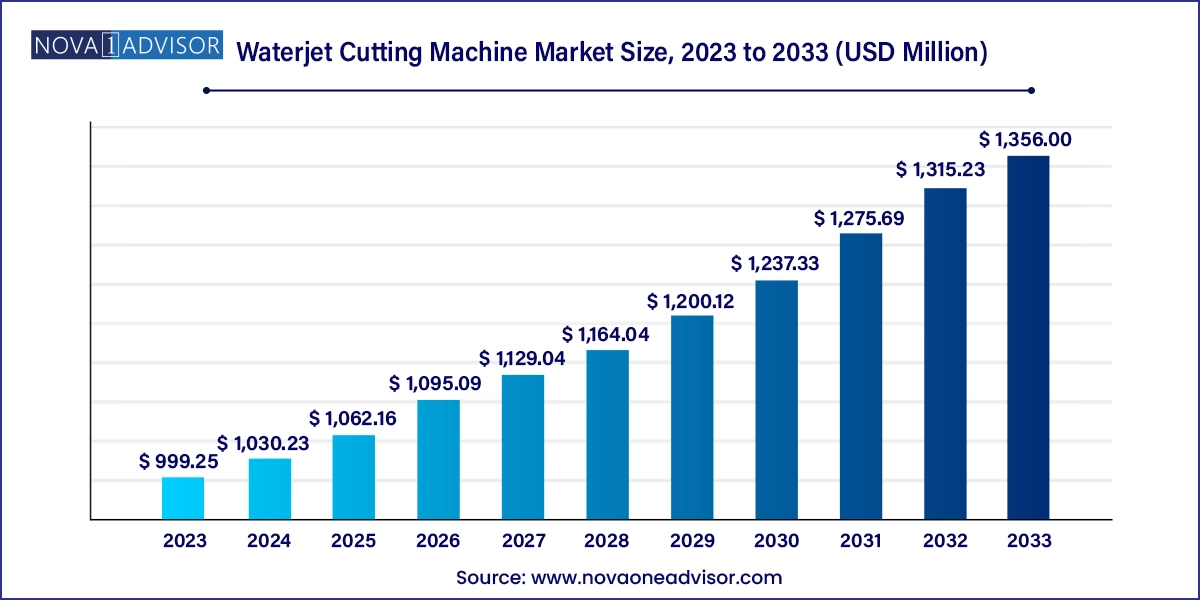

The global waterjet cutting machine market size was exhibited at USD 999.25 million in 2023 and is projected to hit around USD 1,356.00 million by 2033, growing at a CAGR of 3.1% during the forecast period 2024 to 2033.

Waterjet Cutting Machine Market Key Takeaways:

- Among these, the abrasive waterjet cutting machine accumulated the largest market share of 94.27 % in 2023.

- The pure water jet cutting machine segment has the fastest growth rate of 4.4 % from 2024-2033.

- Among these, the 3D waterjet cutting machines accumulated the largest market share of 52.52% in 2023.

- The robotic waterjet cutting machines segment is set to register the fastest growth rate of 4.6 % from 2024-2033.

- Among these, the glass/metal art segment accumulated the largest market share of 27.97 % in 2023

- Similarly, the foam-cutting product segment is expected to register the fastest growth rate of 5.3 % over the forecast period.

- Among these, the automotive segment accumulated the largest market share of 27.97 % in 2023.

- Aerospace and defense industries are expected to register the highest CAGR of 4.3 % from 2024-2033.

- The Asia Pacific region held the largest market share of 35.65 % in 2023. It is also expected to register the fastest growth rate of 4.3 % over the forecast period.

Market Overview

The waterjet cutting machine market has experienced robust growth over the past decade and continues to evolve as industrial sectors seek precision, flexibility, and environmentally conscious machining solutions. Waterjet cutting involves using a high-pressure stream of water, sometimes mixed with abrasive substances, to slice through materials such as metals, glass, stone, composites, and ceramics without generating heat. This cold-cutting technique prevents thermal distortion and material hardening, making it suitable for a wide range of applications across industries like aerospace, automotive, defense, electronics, and mining.

As manufacturers increasingly shift toward automation and high-precision fabrication, waterjet cutting systems offer an edge with their capability to cut intricate designs and thick materials with minimal post-processing. The rising demand for eco-friendly cutting techniques and the need for high-performance manufacturing in advanced sectors like aerospace and defense have further elevated the relevance of waterjet systems. Whether used in small workshops or large-scale production facilities, waterjet technology provides unmatched versatility and operational safety compared to laser or plasma cutting methods.

Major Trends in the Market

-

Rising Adoption of Robotic Waterjet Systems: Automation integration for high-precision, repeatable cuts.

-

Eco-conscious Manufacturing Trends: Preference for waterjet over thermal cutting due to zero emissions and no hazardous byproducts.

-

Miniaturization in Cutting: Growing use of micro waterjet machines for electronics and biomedical applications.

-

Multi-axis 3D Cutting Machines: Increasing deployment for aerospace and custom automotive components.

-

Integration with CAD/CAM Software: Streamlining design-to-cut workflows in fabrication environments.

-

Remote Monitoring & Predictive Maintenance: IoT-enabled systems that track wear and optimize performance.

-

Shift Toward Abrasive Waterjets: For materials requiring higher cutting strength and edge precision.

Report Scope of Waterjet Cutting Machine Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1,030.23 Million |

| Market Size by 2033 |

USD 1,356.00 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 3.1% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled |

Dardi International Corporation; ESAB; Flow International Corporation; Hypertherm, Inc.; Jet Edge, Inc.; Koike Aronson, Inc.; OMAX Corporation; Resato International; WARDJet, KMT |

Key Driver: Increasing Demand for High-Precision Cutting in Aerospace and Defense

The aerospace and defense industries are major contributors to the growth of the waterjet cutting machine market. These sectors require extremely tight tolerances and material integrity in components such as turbine blades, fuselage panels, and composite assemblies. Waterjet cutting’s cold cutting process ensures no heat-affected zones (HAZ), preserving the structural and metallurgical properties of high-value materials like titanium, carbon fiber, and Inconel.

For example, aircraft manufacturers increasingly rely on abrasive waterjet systems to cut complex profiles from composite materials without causing delamination. Defense contractors also use robotic waterjets to fabricate lightweight armor and parts for unmanned vehicles. This demand for precision, reduced waste, and material compatibility is driving investments in waterjet technologies.

Key Restraint: High Initial Investment and Operational Costs

Despite their advantages, waterjet cutting systems come with high acquisition and operational costs. The equipment involves specialized pumps, nozzles, and abrasive handling systems that require substantial capital. Maintenance of high-pressure components, continuous supply of abrasives like garnet, and high power consumption add to recurring expenses.

Small and medium-sized enterprises (SMEs), especially in cost-sensitive regions, often face difficulty justifying these expenses when alternatives like laser or plasma cutting offer lower upfront costs. Moreover, the learning curve for optimizing waterjet operations can deter inexperienced operators. As a result, adoption may be slower among smaller players unless financing options or modular systems become more accessible.

Opportunity: Expansion into Niche and Non-traditional Applications

An emerging opportunity lies in the expansion of waterjet cutting into niche applications such as biomedical device fabrication, luxury architectural design, and artistic installations. Micro waterjet machines, capable of producing intricate patterns in brittle materials, are being adopted by electronics and medical manufacturers for cutting wafers, implants, and delicate enclosures.

Additionally, interior designers and artisans are using waterjets to create customized marble inlays, glass sculptures, and metallic art installations. For example, the Burj Khalifa’s lobby features intricate waterjet-cut stonework sourced from bespoke European workshops. As awareness grows about the precision and aesthetic possibilities of waterjet systems, vendors can tap into new markets beyond traditional metal fabrication.

Waterjet Cutting Machine Market By Product Insights

3D waterjet cutting machines are the dominant product type, preferred in automotive and aerospace industries for producing complex geometries. These machines offer multi-axis movement, enabling them to cut intricate contours and three-dimensional components. Their precision and adaptability reduce the need for secondary machining.

Robotic waterjet systems are the fastest-growing category due to increasing automation across sectors. These systems are ideal for repetitive tasks in car manufacturing and shipbuilding. Their ability to operate in hazardous or confined environments also makes them valuable in the defense and demolition industries.

Waterjet Cutting Machine Market By Type Insights

Abrasive waterjet cutting machines dominated the market due to their ability to cut hard and thick materials such as stainless steel, glass, and ceramics. These systems use an abrasive material, typically garnet, mixed with the water stream to enhance cutting power. Industries requiring high precision in cutting reflective or heat-sensitive materials, such as aerospace, defense, and heavy manufacturing, predominantly use abrasive jets.

In contrast, pure waterjet machines are the fastest-growing segment, especially for soft material cutting. These machines are ideal for applications like foam, food, and rubber cutting where abrasives are unnecessary. Food processing facilities, for instance, increasingly use pure waterjet systems for hygienic, blade-free cutting of frozen meats and bakery products.

Waterjet Cutting Machine Market By Application Insights

Exotic metal and non-traditional material cutting holds the largest share, given the rise in advanced engineering materials like titanium alloys and carbon fiber composites. Waterjets are crucial in these applications due to their non-thermal and versatile cutting capability.

Glass and metal art cutting is growing rapidly, especially among commercial architects and luxury brands. Custom signage, decorative facades, and branded installations are frequently crafted using waterjet machines due to their fine edge quality and design freedom.

Waterjet Cutting Machine Market By End-Use Insights

Metal fabrication remains the dominant end-use industry. Waterjets are extensively used for steel sheet cutting, tool making, and machinery component manufacturing. Fabricators favor waterjets for their speed, precision, and ability to handle varying thicknesses without changing tools.

The aerospace and defense sector is the fastest-growing end-user, benefiting from rising defense budgets and commercial air traffic growth. Investment in composite material machining and component miniaturization is leading to greater reliance on advanced waterjet solutions.

Waterjet Cutting Machine Market By Regional Insights

North America leads the waterjet cutting machine market, driven by strong demand from aerospace, automotive, and metal fabrication sectors. The presence of industry giants such as Boeing, Lockheed Martin, and Tesla ensures a steady requirement for precision cutting technologies. Additionally, high labor costs and stringent safety standards have pushed manufacturers toward automation using robotic waterjet systems. The U.S. also hosts major waterjet machine manufacturers and technology innovators, consolidating its dominance.

Asia Pacific is the fastest-growing region, buoyed by rapid industrialization, infrastructure development, and an expanding manufacturing base. Countries like China, India, and South Korea are investing in smart factories, especially in automotive, electronics, and mining industries. The region’s price-sensitive SME segment is increasingly attracted to compact and cost-efficient waterjet systems. Furthermore, government policies supporting industrial modernization and export growth are propelling market expansion.

Some of the prominent players in the global waterjet cutting machine market include:

Recent Developments

-

March 2025 – Flow International launched "Flow NanoJet," a new line of micro waterjet machines targeting electronics and precision medical device markets.

-

February 2025 – OMAX Corporation introduced an AI-powered maintenance platform for predictive diagnostics across its abrasive waterjet systems.

-

January 2025 – KMT Waterjet announced a partnership with Siemens to integrate Industry 4.0 features into its pumps and motion systems.

-

November 2024 – WARDJet unveiled a customizable 5-axis robotic waterjet platform for the aerospace supply chain in Europe.

-

October 2024 – Jet Edge signed a strategic agreement with a Middle Eastern defense contractor to supply high-capacity cutting systems.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global waterjet cutting machine market

Type

Product

- 3D Waterjet Cutting Machines

- Robotic Waterjet Cutting Machines

- Micro Waterjet Cutting Machines

Application

- Foam Product Cutting

- Exotic Metal & Non-Traditional Material Cutting

- Ceramic/Stone Cutting

- Glass/Metal Art

- Gasket Cutting

- Fiberglass Cutting

End-Use

- Automotive

- Electronics

- Aerospace & Defense

- Mining

- Metal Fabrication

- Others

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)