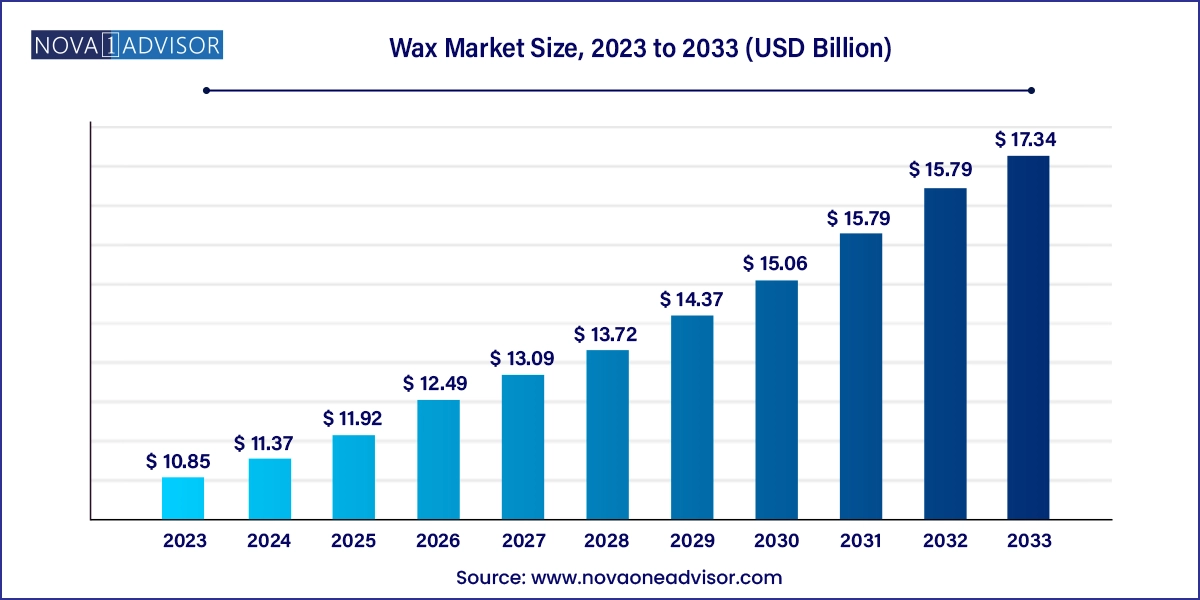

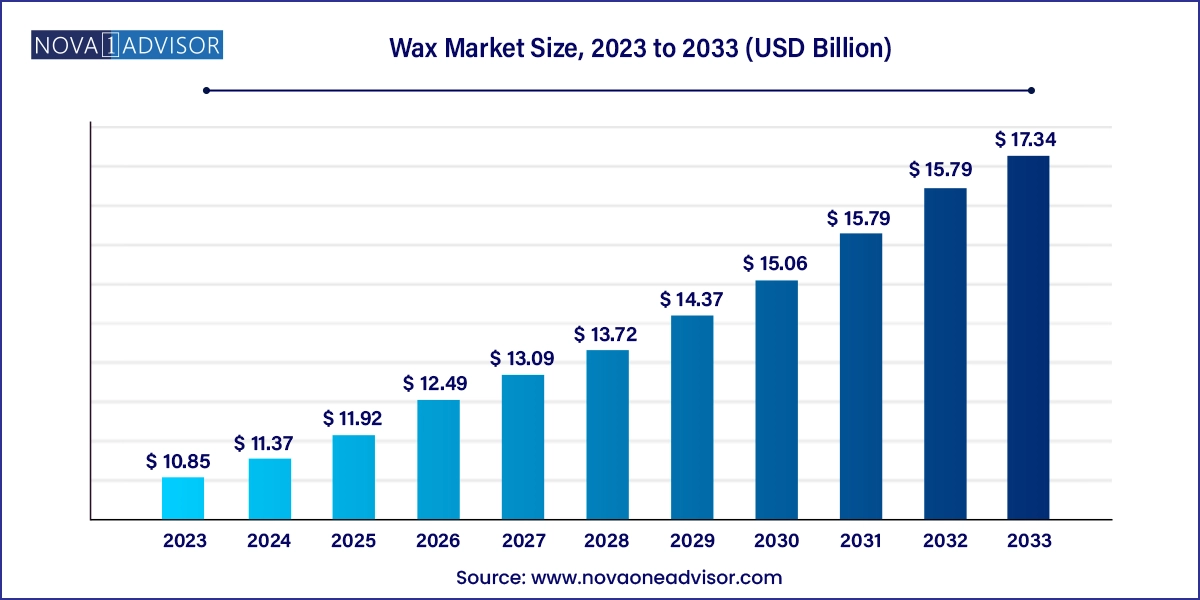

Wax Market Size and Growth

The wax market size was exhibited at USD 10.85 billion in 2023 and is projected to hit around USD 17.34 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2024 to 2033.

Wax Market Key Takeaways:

- The mineral wax product dominated the market, with a revenue share of 67.7% in 2023.

- Synthetic wax segment is expected to witness growth at 4.7% CAGR.

- Candle applications dominated the market with a revenue share of 31.6% in 2023.

- Cosmetics and Toiletries segment is expected to witness growth at 5.0% CAGR.

- Asia Pacific region is expected to witness growth at 4.9% CAGR.

- The North America wax market is anticipated to grow over the forecast period.

Market Overview

The global wax market plays a crucial role in a diverse array of industries, ranging from traditional candle making to advanced applications in pharmaceuticals, packaging, and cosmetics. Waxes are organic substances characterized by their malleability, water resistance, and ability to melt at relatively low temperatures. They are used as processing aids, carriers, coatings, and additives to enhance texture, gloss, stability, and functionality in end products.

The wax industry has evolved significantly from its reliance on petroleum-based sources to include synthetic and natural alternatives. This shift is driven by growing environmental consciousness, regulatory pressures, and technological advancements that enable the extraction and synthesis of high-performance waxes from sustainable sources such as plants, animals, and even biomass.

Major wax types include mineral waxes like paraffin and microcrystalline wax, synthetic waxes such as polyethylene and Fischer-Tropsch waxes, and natural waxes including beeswax, carnauba, and soy wax. These are widely applied in industries like personal care (lipsticks, lotions), packaging (coatings, food wraps), rubber and plastics (lubrication, dispersion), adhesives (hot-melt formulations), and specialty items like fire logs and surface polishes.

While candles remain the largest consumer of waxes globally due to cultural, aesthetic, and decorative uses, the rise of clean-label cosmetics, sustainable packaging, and bio-based manufacturing has significantly expanded the demand for natural and synthetic alternatives. As economies scale up environmental compliance and sustainability goals, the wax market is poised for dynamic change, offering opportunities for innovation and differentiation across segments.

Major Trends in the Market

-

Rising demand for bio-based and natural waxes driven by consumer preference for sustainable and vegan products in cosmetics and packaging.

-

Declining dependence on petroleum-derived paraffin wax as synthetic and plant-based alternatives gain traction.

-

Innovation in specialty synthetic waxes like Fischer-Tropsch and polyethylene waxes for high-performance industrial applications.

-

Growing use of waxes in hot-melt adhesives for packaging, automotive, and hygiene products.

-

Expansion of wax use in cosmetics and toiletries, particularly in formulations requiring emollients, film-formers, and stabilizers.

-

Increased adoption of waxes in pharmaceuticals as coatings and excipients due to their biocompatibility and controlled-release properties.

-

Development of wax recycling and recovery technologies to reduce industrial waste and support circular economy models.

-

Premiumization of candles with customized fragrances, colors, and clean-burning wax blends, particularly in home décor and luxury markets.

Report Scope of Wax Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 11.37 Billion |

| Market Size by 2033 |

USD 17.34 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia and South Africa |

| Key Companies Profiled |

Sinopec Corp; China National Petroleum Corporation; HollyFrontier Corporation; BP P.L.C; Nippon Seiro Co., Ltd; Baker Hughes Company; Exxon Mobil Corporation; Sasol Limited; The International Group, Inc.; Evonik Industries AG; BASF SE; Dow; Honeywell International Inc.; Royal Dutch Shell P.L.C; Mitsui Chemicals, Inc. |

Key Market Driver: Expanding Applications in Cosmetics and Personal Care

A primary driver in the wax market is the growing utilization of waxes in the cosmetics and personal care industry. Waxes are vital in the formulation of numerous beauty products—ranging from lip balms and mascaras to lotions, creams, deodorants, and exfoliators. They offer desirable properties such as emollience, water resistance, gloss, structure stabilization, and smooth skin feel, making them indispensable for formulators.

Natural waxes like beeswax, candelilla, and carnauba are increasingly favored for their plant- or animal-derived origins, meeting the demand for “clean beauty” and sustainable ingredients. Vegan and organic certifications further amplify the appeal of these waxes in global markets. In addition, synthetic waxes are used to enhance texture and improve thermal stability, while hybrid formulations combine different wax types for optimal performance.

The cosmetics industry’s continuous innovation driven by shifting consumer preferences, influencer culture, and product differentiation—has led to the constant evolution of formulations where waxes play a structural or functional role. Their importance has only increased as beauty brands look for safer alternatives to petroleum-based thickeners or film-formers, positioning waxes as both versatile and high-value ingredients.

Key Market Restraint: Supply Chain Dependence on Crude Oil for Paraffin Wax

One of the most significant restraints in the wax market is the dependency on crude oil refining processes for the production of paraffin wax, which still represents a major share of global wax consumption. Paraffin wax is a by-product of petroleum refining, and its supply is inherently linked to the operation of refineries producing Group I base oils—a segment steadily declining due to the industry's shift to higher-grade Group II and III lubricants.

As refiners modernize their processes or decommission less efficient plants, the availability of paraffin wax has tightened, leading to price volatility and supply constraints. Moreover, paraffin’s environmental profile—being petroleum-derived—has drawn scrutiny from regulators and consumers focused on sustainability, further limiting its long-term prospects.

These challenges force downstream industries to seek alternatives, which may involve higher costs or reformulation challenges. The uncertain future of paraffin supply also complicates planning for manufacturers reliant on consistent raw material sourcing. This restraint underscores the need for strategic diversification in feedstock sourcing and increased investment in synthetic and natural wax development.

Key Market Opportunity: Growth in Eco-Friendly Packaging and Sustainable Materials

A substantial opportunity in the wax market lies in the expansion of eco-friendly packaging solutions and the broader shift toward sustainable materials. Wax coatings are widely used to improve the barrier properties of paper, cardboard, and molded fiber packaging. They help prevent moisture ingress, enhance printability, and contribute to product protection—essential features in food service, e-commerce, and consumer goods packaging.

With rising concerns about plastic pollution, wax-coated paper has emerged as an attractive biodegradable or compostable alternative to plastic films and foils. Soy wax, carnauba wax, and other plant-derived options are particularly suited for this purpose, offering renewable content and a low carbon footprint.

Moreover, packaging innovation is central to brand storytelling in sustainability-conscious markets. Businesses are actively seeking materials that align with circular economy goals, including packaging that is recyclable, compostable, or repulpable. Waxes are being formulated to complement such goals without compromising performance.

This opportunity is further bolstered by regulatory movements such as bans on single-use plastics, extended producer responsibility (EPR) frameworks, and government incentives for eco-friendly packaging development—particularly in regions like the European Union, North America, and parts of Asia.

Wax Market By Product Insights

Mineral wax, particularly paraffin wax, has historically dominated the global wax market due to its widespread availability, cost-effectiveness, and versatility. It is commonly used in candles, packaging, rubber processing, and surface coatings. Paraffin wax, obtained from the de-oiling of slack wax in petroleum refineries, provides excellent barrier properties and moldability, making it a staple in traditional applications.

Microcrystalline wax, a denser form of mineral wax, is used in specialized applications like food packaging, pharmaceuticals, and cosmetics. It offers superior adhesion and moisture resistance, and is often blended with other waxes to improve consistency and temperature stability. Despite growing sustainability concerns, mineral wax continues to hold a significant share in emerging economies due to its low cost and familiarity across end-use sectors.

However, natural wax is the fastest-growing product segment, propelled by consumer awareness and corporate sustainability mandates. Derived from renewable sources such as beeswax, carnauba (from the Brazilian palm), soy, and candelilla, natural waxes are gaining favor in personal care, packaging, and candle manufacturing. Soy wax, in particular, is expanding rapidly in the premium candle market due to its clean burn, scent throw, and eco-label appeal. Natural waxes also offer functional benefits in cosmetics, including film-forming and gloss-enhancing properties, making them popular among organic beauty brands.

Wax Market By Application Insights

Candles remain the dominant application segment for waxes, accounting for a significant share of global demand. Their usage spans religious, decorative, aromatic, therapeutic, and emergency lighting purposes. Paraffin wax has traditionally been the wax of choice in this sector due to its affordability and excellent fragrance dispersion. However, recent years have witnessed a shift toward natural and blended waxes such as soy, coconut, and beeswax in response to health and environmental concerns.

The premiumization of candles especially in home décor and aromatherapy has accelerated demand for cleaner-burning, aesthetically appealing wax formulations. Scented candles and artisanal offerings are increasingly preferred, often using high-end waxes that enhance visual and olfactory experiences. As consumers seek wellness and ambiance-enhancing products, candles are evolving from utility items to lifestyle symbols.

Meanwhile, cosmetics and toiletries is emerging as the fastest-growing application segment. Waxes are essential in providing body, texture, emollience, and structural integrity to formulations like lipsticks, balms, mascaras, and creams. Natural waxes, in particular, are gaining momentum as alternatives to synthetic polymers and petrochemical thickeners, supporting clean-label and vegan trends in beauty products. As demand for multifunctional, sensory-pleasing, and eco-friendly formulations grows, cosmetics brands are increasingly formulating with carnauba, candelilla, rice bran, and sunflower waxes.

Wax Market By Regional Insights

Asia Pacific emerged as the leading region in the global wax market, underpinned by its strong industrial base, expanding population, and increasing domestic consumption. China and India are the largest contributors due to their high demand for candles, packaging, rubber, and cosmetics. China, in particular, is both a major producer and consumer of paraffin wax and synthetic wax, benefiting from large refining capacities and cost-effective manufacturing.

India's growing middle class and urbanization trends are driving demand for wax-containing products such as candles, cosmetics, and processed foods. The regional packaging and personal care sectors are also experiencing robust growth, creating demand for specialty and natural waxes.

North America is the fastest-growing region, driven by rising interest in sustainable products, premium personal care, and decorative candles. The U.S. is a major hub for natural wax consumption, particularly soy wax, due to abundant soy production and consumer preference for domestic, clean-label goods.

The region's advanced cosmetics, packaging, and healthcare sectors are embracing plant-based and biodegradable waxes. Regulatory support for green chemistry, coupled with consumer-driven movements toward zero-waste and vegan beauty, are propelling innovation and growth in the natural and synthetic wax segments. In addition, leading companies in the region are investing in R&D and supply chain diversification to reduce reliance on imported paraffin wax and support circular economy goals.

Wax Market Recent Developments

-

April 2025 – Koster Keunen launched a new range of RSPO-certified palm waxes for use in cosmetics and candles, emphasizing traceability and sustainability.

-

February 2025 – Sasol Ltd. announced an expansion of its Fischer-Tropsch synthetic wax production facility in South Africa to meet growing industrial demand.

-

December 2024 – The International Group Inc. (IGI) introduced a soy-paraffin hybrid wax blend designed for clean-burning decorative candles with optimized fragrance retention.

-

October 2024 – Strahl & Pitsch Inc. partnered with a U.S. beauty brand to supply customized beeswax for a new organic skincare line.

-

August 2024 – BASF developed a biodegradable polyethylene wax additive for hot-melt adhesives used in packaging and hygiene products.

Some of the prominent players in the wax market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the wax market

Product

- Mineral wax

- Synthetic Wax

- Natural Wax

Application

- Candles

- Packaging

- Plastics & Rubber

- Pharmaceuticals

- Cosmetics & Toiletries

- Fire Logs

- Adhesives

- Others

Regional

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa