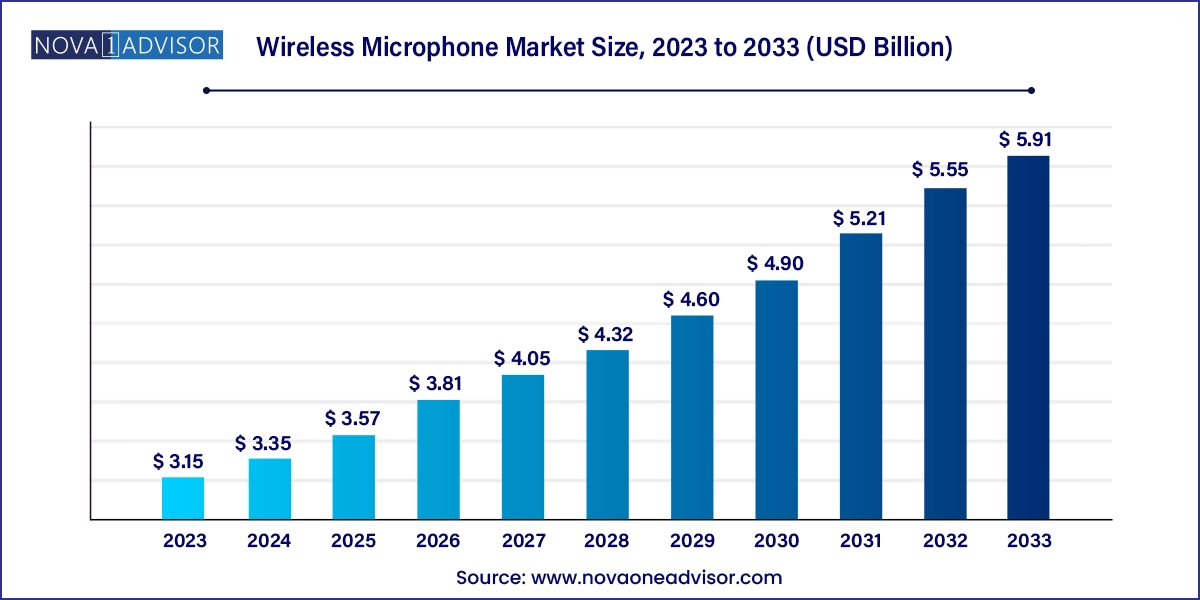

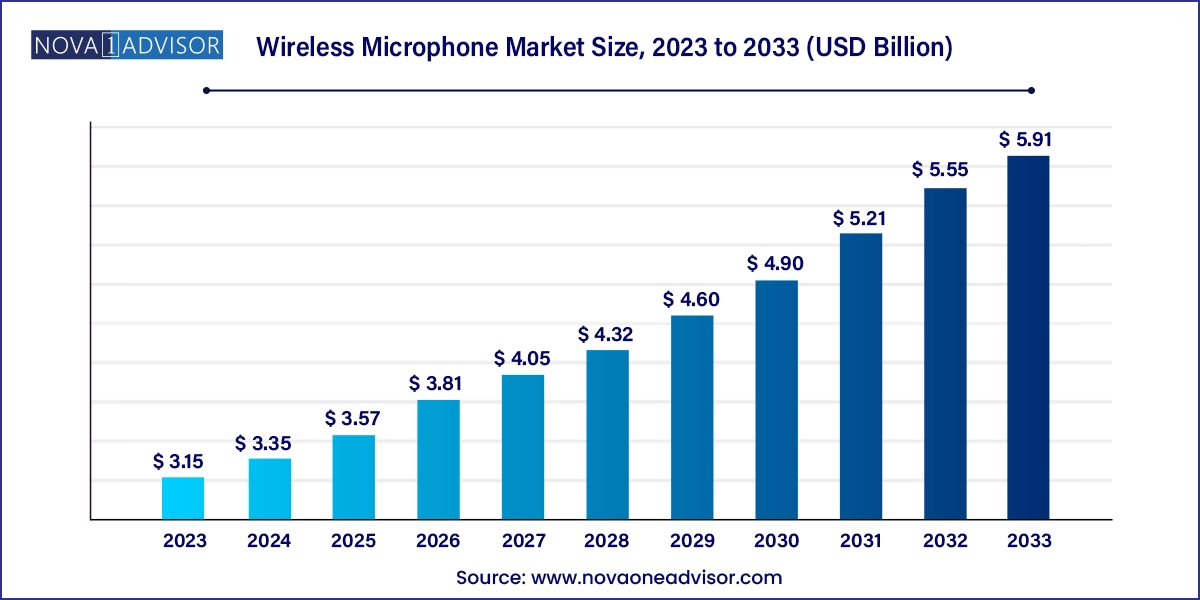

Wireless Microphone Market Size and Growth

The wireless microphone market size was exhibited at USD 3.15 billion in 2023 and is projected to hit around USD 5.91 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2024 to 2033.

Wireless Microphone Market Key Takeaways:

- The handheld segment dominated the wireless microphone market with a revenue of USD 1.52 billion in 2023.

- The clip-on segment is expected to witness the fastest growth at a CAGR of 7.3% during the forecast period.

- Corporate is the largest end-use segment, valued at USD 812.0 million in 2023.

- Sporting events is the fastest-growing segment, registering a CAGR of 8.2% over the forecast period.

- The radio frequency channel segment accounted for the largest revenue share of 63.2% in 2023.

- The radio frequency band segment is expected to experience rapid growth with a CAGR of 7.9% from 2024 to 2033.

- Asia Pacific is the fastest-growing regional market, registering a CAGR of 8.9% from 2024 to 2033.

- North America is the largest regional market, with a market value of USD 1.12 billion in 2023.

Market Overview

The wireless microphone market has witnessed remarkable transformation over the last two decades, becoming an essential tool across diverse industries such as entertainment, broadcasting, education, corporate events, and sports. Unlike traditional wired systems, wireless microphones eliminate physical constraints, offering freedom of movement and enhanced convenience for performers, speakers, and content creators. As a result, these devices are increasingly adopted in live concerts, conferences, classrooms, fitness centers, television studios, and even houses of worship.

A wireless microphone system typically comprises a transmitter (often embedded in the microphone or worn on the body), a receiver, and supporting audio equipment. The signal transmission can be facilitated through radio frequencies (VHF/UHF), digital RF, or even Wi-Fi-enabled protocols. Market dynamics have shifted significantly in recent years, fueled by the rapid expansion of streaming platforms, hybrid work models, and the proliferation of video content creation.

In addition, advancements in wireless protocols, digital signal processing (DSP), and spectrum optimization have improved the quality, latency, and range of wireless microphone systems. Regulatory shifts—particularly regarding spectrum allocation—have also driven innovation, as manufacturers adapt to new frequency band restrictions and reallocate operations to comply with global standards. As live communication and immersive media consumption continue to grow, the wireless microphone market is poised for sustained expansion.

Major Trends in the Market

-

Proliferation of content creators: The rise of podcasting, live streaming, and YouTube creators is fueling demand for affordable, portable wireless microphones.

-

Shift to hybrid corporate environments: Organizations are investing in AV conferencing tools, including wireless microphones, to support virtual meetings and remote collaboration.

-

Frequency reallocation driving innovation: Regulatory bodies like the FCC and Ofcom have reallocated several UHF bands, prompting manufacturers to develop devices operating on new, interference-free frequencies.

-

Miniaturization and wearable microphones: Compact clip-on and lavalier microphones are gaining popularity in education, fitness, and broadcasting sectors for unobtrusive audio capture.

-

Integration with smartphones and tablets: Wireless microphones with Bluetooth or Wi-Fi connectivity are increasingly compatible with mobile devices, supporting content creation on the go.

-

Emergence of AI-driven noise cancellation: Wireless microphones are incorporating smart noise filters and DSP algorithms to deliver studio-quality sound in noisy environments.

-

Adoption in smart classrooms and e-learning: Institutions are deploying wireless microphones to enhance student engagement and ensure clear instructor audio in hybrid learning environments.

Report Scope of Wireless Microphone Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.35 Billion |

| Market Size by 2033 |

USD 5.91 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Technology, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE |

| Key Companies Profiled |

Harman International Industries, Incorporated; Audio-Technica U.S, Inc.; Blue (Baltic Latvian Universal Electronics, LLC); LEWITT GmbH; RØDE; Samson Technologies Corp.; Sennheiser electronic GmbH & Co. KG; Shure Incorporated; Sony Corporation; Yamaha Corporation |

One of the primary drivers of the wireless microphone market is the growing demand for high-quality audio in live events and online media. The entertainment industry, which includes concerts, theater, and sports broadcasting, relies heavily on wireless audio systems to deliver seamless experiences. Wireless microphones allow performers to move freely without hindrance, significantly enhancing stage dynamics.

Simultaneously, the global rise of content platforms such as YouTube, TikTok, Twitch, and podcasting networks has democratized media production. Aspiring creators and influencers prioritize professional audio quality to engage audiences, which has led to increased sales of compact, easy-to-use wireless microphones. Additionally, online educational content, webinars, and corporate live streams have added to this surge in demand. With video content consumption expected to dominate internet traffic for years to come, wireless audio capture technologies will play a central role in shaping user engagement and content quality.

Key Market Restraint: Spectrum Availability and Interference

A significant challenge facing the wireless microphone industry is the limited availability of usable radio frequency spectrum. Governments and regulatory bodies continue to reallocate parts of the spectrum (especially UHF bands) for telecom, public safety, and broadband services, squeezing the space available for professional wireless audio transmission. For instance, in the United States, the FCC auctioned off the 600 MHz band for mobile data use, rendering several wireless microphones obsolete.

Moreover, with an increasing number of wireless devices in densely populated areas, signal interference and cross-talk can degrade audio quality. Managing frequency coordination becomes especially difficult in large-scale productions or live events where dozens of microphones and other RF devices operate simultaneously. Manufacturers must now design more spectrum-efficient systems, including digital transmission technologies, frequency agility, and real-time scanning, all of which can increase costs for end users.

Key Opportunity: Expansion into Education and Remote Learning

A key growth opportunity in the wireless microphone market lies in the expanding education technology (EdTech) sector and remote learning models. The COVID-19 pandemic accelerated digital transformation in education, leading to permanent investments in hybrid and distance learning platforms. Wireless microphones are increasingly being adopted in smart classrooms to enhance teacher mobility and ensure high-quality audio capture for students joining remotely.

Universities and K-12 institutions are investing in AV-over-IP technologies and integrating wireless audio systems to improve communication and accessibility. Wireless lapel microphones, headsets, and even handheld mics are used for lectures, panel discussions, and student presentations. As educational institutions worldwide aim to modernize their facilities and enhance student outcomes, wireless audio technologies are emerging as a critical enabler of inclusive and effective instruction.

Wireless Microphone Market By Product Insights

Handheld wireless microphones dominated the market by product in 2024. Favored for their versatility and ease of use, handheld mics are ubiquitous in live performances, interviews, conferences, and public speaking engagements. Their rugged design, integrated transmitters, and capability to support interchangeable capsules make them the top choice for on-stage and field applications. Additionally, broadcasters and media professionals prefer handheld wireless microphones for their directivity and quick deployment in dynamic environments.

Clip-on microphones (lavalier mics) are expected to grow at the fastest CAGR. These compact, wearable devices offer discreet audio capture, making them ideal for presentations, video production, and fitness instruction. As video content creation, vlogging, and online teaching surge, demand for lightweight clip-on microphones has expanded rapidly. Lavalier mics also facilitate hands-free operation and better mobility key features for speakers, actors, and trainers. Companies are now developing dual-channel clip-on systems with noise cancellation and mobile integration, further boosting their popularity.

Wireless Microphone Market By End-use Insights

Corporate environments were the dominant end-use sector. With the proliferation of hybrid work and AV conferencing solutions, wireless microphones have become standard equipment in boardrooms, co-working spaces, and training centers. Their utility in town halls, webinars, and remote team coordination has made them indispensable tools for business communication. Companies are increasingly deploying multiple wireless systems across locations to enable seamless virtual interaction.

Education is emerging as the fastest-growing end-use segment. Schools and universities are integrating wireless microphones to ensure effective delivery of lectures in hybrid or socially distanced settings. Smart classroom setups with audio-visual tools now include wireless audio solutions for teachers and students alike. The demand is particularly strong in developing nations where education infrastructure is undergoing digital transformation.

Wireless Microphone Market By Technology Insights

The 2.4 GHz Wi-Fi band led the market among wireless technologies. Devices operating in the 2.4 GHz range are generally license-free and widely adopted due to their global compatibility. Wireless microphones using this band offer plug-and-play functionality and are often used in classrooms, fitness studios, and small events. The increasing reliability of 2.4 GHz Wi-Fi and improved digital transmission protocols have expanded its application in the consumer and prosumer segments.

The 5 GHz band is projected to be the fastest-growing subsegment. As the 2.4 GHz spectrum becomes crowded with competing devices (e.g., routers, IoT gadgets), the 5 GHz band offers less interference and greater bandwidth for high-fidelity audio transmission. This makes it suitable for professional environments where clear and uninterrupted sound is critical. Manufacturers are developing dual-band systems capable of hopping between 2.4 and 5 GHz to ensure performance in diverse RF environments.

Wireless Microphone Market By Regional Insights

North America remained the largest market for wireless microphones in 2024. The region's mature entertainment industry, widespread corporate digitization, and robust adoption of AV technology in education and religious institutions drive this dominance. The United States leads with strong demand from the live music industry, film studios, sports broadcasting, and tech-enabled classrooms. The presence of global audio giants like Shure, Audio-Technica, and Lectrosonics adds to the innovation pipeline.

The region also benefits from a tech-savvy population and high disposable income, which supports the prosumer segment, including vloggers, podcasters, and gamers. Regulatory frameworks in the U.S., particularly from the FCC, continue to shape product development, pushing for digital, spectrum-efficient devices that meet modern compliance standards.

Asia Pacific is projected to be the fastest-growing market. Rapid urbanization, increasing media consumption, and the digitalization of education and corporate communication are key growth enablers. Countries like China, India, and South Korea are witnessing massive growth in content creation, event management, and hybrid educational setups. The popularity of e-sports, regional YouTube channels, and OTT platforms has elevated demand for accessible, high-quality audio capture tools.

Additionally, economic development and government investment in smart infrastructure across Southeast Asia and Oceania are opening up new deployment opportunities in hospitality, airports, and public sector projects. Local manufacturers are also producing cost-effective systems tailored to regional needs, boosting adoption among SMEs and educational institutions.

Wireless Microphone Market Recent Developments

-

Shure Incorporated (February 2025): Launched the MoveMic Wireless Microphone System, a lightweight dual-channel clip-on solution optimized for content creators and mobile journalists.

-

RØDE Microphones (January 2025): Released the Wireless PRO, an upgraded wireless lavalier system with onboard recording, timecode syncing, and 32-bit float support.

-

Sennheiser (March 2025): Introduced a new digital wireless system tailored for education and corporate environments, featuring auto-frequency scanning and encrypted audio transmission.

-

Sony Electronics (December 2024): Announced compatibility updates for its ECM-W3 wireless mic system, enabling seamless integration with the new Alpha series mirrorless cameras.

-

Boya (April 2024): Expanded its affordable wireless mic range with a focus on YouTubers and TikTok creators, targeting developing markets in Southeast Asia and Africa.

Some of the prominent players in the wireless microphone market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the wireless microphone market

Product

Technology

-

- Single Channel

- Dual Channel

- Multi-Channel

-

- 540 MHz - 680 MHz

- 721 MHz - 750 MHz

- 823 MHz - 865 MHz

End-use

- Corporate

- Education

- Hospitality

- Sporting Events

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa