Women’s Health Market Size and Trends

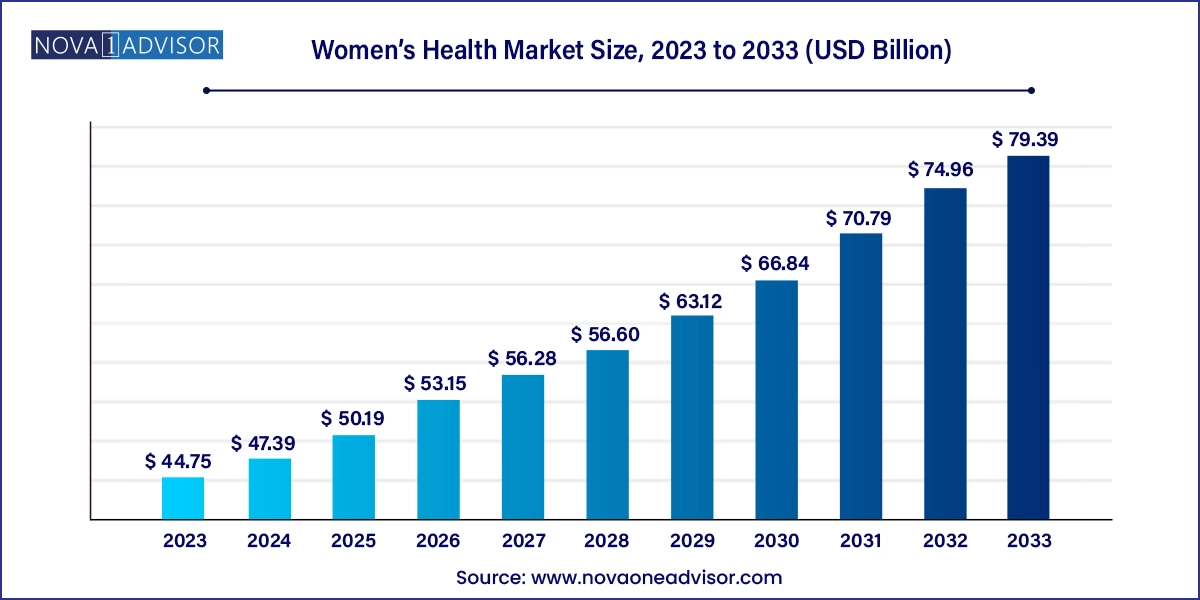

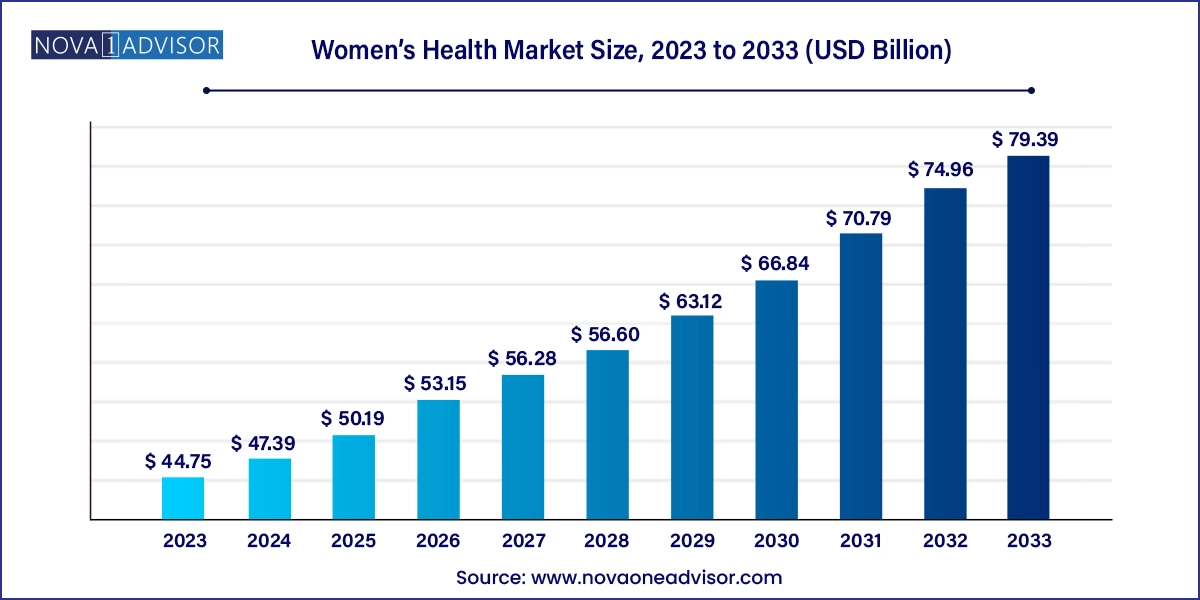

The global women’s health market size was exhibited at USD 44.75 billion in 2023 and is projected to hit around USD 79.39 billion by 2033, growing at a CAGR of 5.9% during the forecast period 2024 to 2033.

Women’s Health Market Key Takeaways:

- The contraceptives segment held the highest market share of more than 35.25% of the global revenue in 2023.

- The menopause segment is expected to grow at the highest CAGR of 9.6% for the forecast period.

- Prolia segment led the market in 2023 and is expected to grow at fastest growth rate over the forecast period.

- Minastrin 24 Fe segment is expected to grow at the lucrative CAGR over the forecast period.

- The others segment dominated the market in 2023 and is expected to sustain the position for the forecast period.

- The North American region dominated the market in 2023 with a market share of 41.44%.

- Furthermore, Asia Pacific is expected to witness the fastest CAGR from 2024 to 2033.

Market Overview

The Global Women’s Health Market is a multifaceted and rapidly evolving sector that addresses the unique medical, biological, and lifestyle-related health needs of women. Spanning across reproductive health, hormonal therapies, gynecological conditions, and aging-related disorders, the market plays a pivotal role in enhancing the quality of life for billions of women worldwide. Historically underrepresented in healthcare research and policy, women's health has witnessed a notable transformation in the 21st century, driven by rising awareness, regulatory reforms, technological advancements, and shifting demographic trends.

Women’s health is not limited to reproductive care; it encompasses chronic and acute conditions like osteoporosis, cardiovascular disease, hormonal imbalances, PCOS, endometriosis, and mental health concerns each of which disproportionately affects women. In parallel, the expansion of fertility treatments, contraceptive technologies, and menopause-related therapeutics has generated new subsegments within the broader market.

As life expectancy increases globally, a larger share of women are entering postmenopausal stages, increasing demand for hormone replacement therapies (HRT), bone health medications, and supportive care. Additionally, global efforts to improve maternal health, reduce gender health disparities, and increase access to healthcare have further stimulated investment and innovation.

From startups creating femtech wearables to pharmaceutical giants introducing hormone-regulating therapies, stakeholders across the spectrum are redefining how healthcare is delivered to and designed for women. The market continues to benefit from government initiatives, venture capital interest, and consumer-driven momentum, particularly in areas such as digital health, fertility tracking, telemedicine, and minimally invasive gynecological interventions.

Major Trends in the Market

-

Rise of Femtech: Mobile apps and wearable technologies are revolutionizing how women monitor fertility, menstruation, pregnancy, and menopause symptoms.

-

Increased Investment in Contraceptive Innovation: Long-acting reversible contraceptives (LARCs) and non-hormonal options are gaining popularity.

-

Growing Focus on Menopause Care: Biotech startups and pharmaceutical companies are introducing safer and more effective hormone therapies.

-

Personalized Healthcare for Women: Precision medicine is being applied to PCOS, endometriosis, and osteoporosis through genomics and hormone profiling.

-

Regulatory and Policy Support: Reforms and awareness campaigns are driving better access to reproductive and preventive healthcare.

-

Mental Health Integration: Depression, anxiety, and perinatal mental health services are becoming key areas within women's health portfolios.

-

Shift Toward Digital Therapeutics: Mobile interventions are addressing sexual health, pelvic floor disorders, and menopausal symptoms.

-

Rise of Global Health Equity Programs: NGOs and governments are focusing on reducing maternal mortality and improving access to contraception in low-income nations.

Report Scope of Women’s Health Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 47.39 Billion |

| Market Size by 2033 |

USD 79.39 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Age, Drug, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled |

AbbVie, Inc.; Bayer AG; Merck & Co., Inc.; Pfizer, Inc; Teva Pharmaceutical Industries Ltd.; Agile Therapeutics; Amgen, Inc; Apothecus Pharmaceutical Corp.; Blairex Laboratories, Inc.; and Ferring B.V. |

Key Market Driver: Rising Prevalence of Hormonal and Reproductive Disorders

A key driver fueling the women’s health market is the increasing incidence of hormonal and reproductive disorders among women across age groups. Conditions like polycystic ovary syndrome (PCOS), endometriosis, uterine fibroids, and postmenopausal osteoporosis affect millions globally and often go underdiagnosed due to limited awareness and insufficient access to gynecological care.

PCOS, in particular, affects around 1 in 10 women of childbearing age and is a leading cause of infertility and metabolic complications. Similarly, uterine fibroids are present in approximately 70% of women by the age of 50. As diagnostic technologies improve and awareness grows, more women are seeking treatment earlier, leading to increased prescriptions for hormonal therapies, fertility drugs, and surgical interventions.

In addition, hormonal changes associated with aging contribute to osteoporosis, with women over 50 being disproportionately affected due to estrogen loss. Drugs like Prolia, Reclast, and ACTONEL have become essential tools in postmenopausal care, further expanding this segment of the market. The interplay between rising disease burden and increasing diagnosis and treatment rates creates a robust foundation for long-term market growth.

Key Market Restraint: Stigma and Unequal Access to Care

Despite technological and therapeutic advances, the women’s health market faces a persistent barrier in the form of social stigma and unequal access to healthcare services, particularly in developing regions. Reproductive health, sexual wellness, and menopause management are still taboo topics in many societies, which prevents open conversations, early diagnosis, and proactive care-seeking behavior.

Additionally, healthcare access remains uneven across urban-rural divides, and socioeconomic disparities disproportionately impact women’s ability to afford specialized care. In many parts of Africa, Asia, and Latin America, limited infrastructure and cultural restrictions hinder access to contraception, prenatal care, and treatment for gynecological disorders.

Even in developed countries, insurance coverage and cost constraints can prevent access to newer therapies and personalized medicine options. As a result, a significant portion of the target population remains underserved. Overcoming these barriers will require systemic reforms, education campaigns, and the integration of mobile health solutions to extend care into hard-to-reach communities.

Key Market Opportunity: Expansion of Non-hormonal and Personalized Therapies

An exciting opportunity in the women’s health market lies in the growing demand for non-hormonal and personalized treatment options, especially for women who are contraindicated for hormone therapy or prefer natural alternatives. In recent years, biotech companies have begun developing innovative therapies that modulate hormonal responses or relieve symptoms without traditional estrogen or progesterone delivery.

For instance, neurokinin-3 receptor antagonists are showing promise as non-hormonal treatments for vasomotor symptoms associated with menopause. Simultaneously, personalized hormone testing and genetic screening are allowing clinicians to tailor contraceptive or HRT choices to each patient’s unique metabolic profile, reducing side effects and improving efficacy.

Startups focused on natural and plant-based supplements for menstrual pain, bone health, or sexual wellness are also entering the market, responding to consumer demand for holistic and integrative health approaches. This emerging wave of personalization aligns with broader trends in precision medicine and digital health, and holds immense potential for reshaping the future of women’s care.

Women’s Health Market By Application Insights

Contraceptives currently dominate the women’s health market, owing to their wide usage across reproductive age groups and continual demand in both developed and developing regions. Products like Mirena, YAZ, and NuvaRing remain widely prescribed for birth control, but also play a role in managing hormonal imbalances, heavy menstrual bleeding, and acne. Contraceptive usage is closely tied to public health policies and family planning programs, with sustained growth driven by increasing awareness, availability of long-acting reversible contraceptives (LARCs), and demand from younger generations for non-invasive, effective options.

Endometriosis and Uterine Fibroids are among the fastest-growing application segments, as more women are being diagnosed earlier due to advancements in imaging, laparoscopic surgery, and symptom awareness. Treatments include hormonal therapies, minimally invasive surgeries, and pain management medications. The growing body of research into the inflammatory and autoimmune dimensions of these conditions is spurring new drug development, including progesterone modulators and anti-inflammatory agents. As patient advocacy groups and public health agencies push for better education around these conditions, demand for targeted therapies is likely to rise sharply.

Women’s Health Market By Drug Insights

YAZ, Yasmin, and Yasminelle collectively dominate the drug segment, given their widespread use as oral contraceptives and in treating hormone-related conditions like PCOS and dysmenorrhea. These combined oral contraceptives (COCs) offer dual benefits of birth control and hormonal regulation, making them highly favored among physicians and patients alike. The brands have strong brand equity and global distribution, ensuring consistent market share.

However, Prolia is emerging as the fastest-growing drug, largely due to its efficacy in treating postmenopausal osteoporosis—a condition that affects nearly 1 in 3 women over 50 globally. As bone health becomes a central focus of aging women’s care, demand for potent, biannual injectable options like Prolia has surged. Clinical trials continue to support its long-term efficacy and low fracture rates, making it a popular choice among rheumatologists and endocrinologists.

Women’s Health Market By Age segment Insights

The segment of women aged 50 years and above dominates the age-based segmentation, primarily because this demographic is at greater risk for postmenopausal disorders like osteoporosis, uterine fibroids, and cardiovascular complications. As longevity improves globally, this cohort is also becoming more active in managing their health and wellness. Treatments for menopause-related symptoms—including hormone replacement therapy (HRT), bone health supplements, and cognitive wellness therapies—are in high demand.

Meanwhile, the “Others” age group, encompassing reproductive-age women, is the fastest-growing segment, driven by contraceptive use, fertility treatments, and increasing PCOS diagnoses among younger women. Awareness campaigns, telehealth platforms, and the rise of menstrual health trackers are engaging younger audiences in proactive care. Digital apps, fertility planning solutions, and teleconsultation services have made this segment digitally native and highly engaged, making it an ideal target for D2C (direct-to-consumer) health brands and personalized medicine initiatives.

Women’s Health Market By Regional Insights

North America currently dominates the global women’s health market, due to a combination of advanced healthcare infrastructure, high awareness, favorable reimbursement policies, and robust R&D in the pharmaceutical and biotech sectors. The U.S. leads in HRT, contraceptive innovation, and osteoporosis care, supported by a network of OB/GYN specialists and women's clinics. Large pharmaceutical companies like Pfizer, Amgen, and Bayer have a strong presence in North America, launching new therapies and engaging in clinical trials tailored to women’s health needs.

Moreover, policy shifts like the Affordable Care Act (ACA), which mandated insurance coverage for contraceptives and preventive services for women, have expanded access and increased demand. Femtech startups and women-focused digital health platforms have also flourished in this environment, making North America a hub for innovation.

Asia Pacific is the fastest-growing region, bolstered by rising awareness, urbanization, and a growing middle class prioritizing reproductive and preventive health. Countries like India, China, Japan, and South Korea are seeing increasing investment in gynecological care, fertility centers, and digital women’s health startups. Governments across Asia are introducing maternal health initiatives, expanding access to contraceptives, and subsidizing osteoporosis treatments in public hospitals. Cultural shifts and smartphone penetration have also enabled health apps focused on menstrual tracking, fertility prediction, and tele-gynecology, making Asia Pacific a promising landscape for expansion.

Women’s Health Market Recent Developments

-

In March 2025, Bayer AG announced a partnership with the Gates Foundation to develop and distribute a new long-acting contraceptive implant in low-income regions across Africa and Asia.

-

Amgen, in January 2025, expanded its osteoporosis drug Prolia to several new international markets, after receiving regulatory approval for postmenopausal indications in Brazil and South Korea.

-

In December 2024, Theramex, a women’s health-focused pharmaceutical company, launched a next-gen HRT patch in Europe with improved adhesion and skin tolerability.

-

Kindbody, a U.S.-based fertility care provider, secured $100 million in funding in October 2024 to expand its network of women’s health clinics and digital platforms.

-

Natural Cycles, in August 2024, received FDA clearance to integrate wearable temperature sensors into its fertility prediction algorithm, offering a hormone-free contraceptive alternative.

Some of the prominent players in the global women’s health market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global women’s health market

Application

- Hormonal Infertility

- Contraceptives

- Postmenopausal Osteoporosis

- Endometriosis & Uterine Fibroids

- Menopause

- Polycystic Ovary Syndrome (PCOS)

Drug

- ACTONEL

- YAZ,Yasmin,Yasminelle

- FORTEO

- Minastrin 24 Fe

- Mirena

- NuvaRing

- ORTHO TRI-CY LO

- Premarin

- Prolia

- Reclast/Aclasta

- XGEVA

- Zometa

- Others

Age

-

- Postmenopausal Osteoporosis

- Endometriosis & Uterine Fibroids

- Menopause

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa