Women Health Devices Market Size and Trends

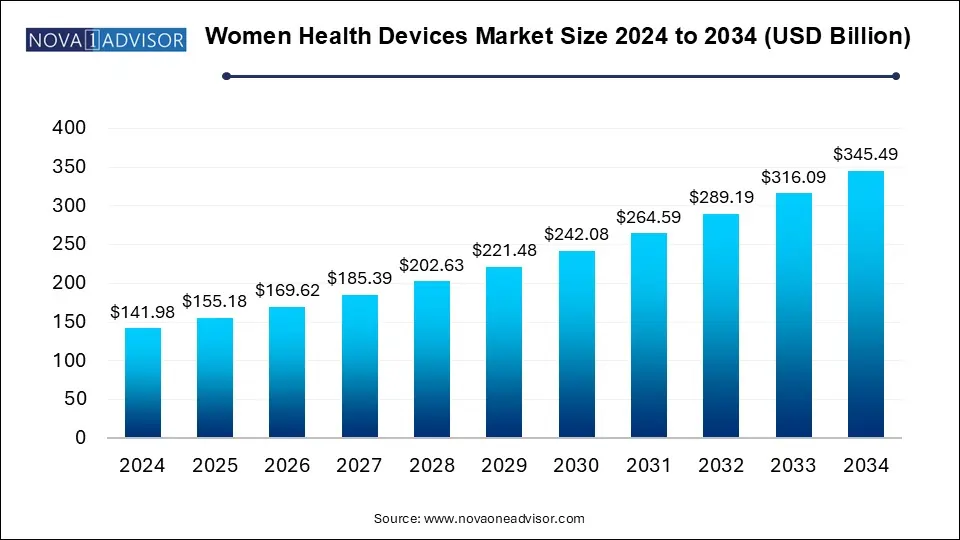

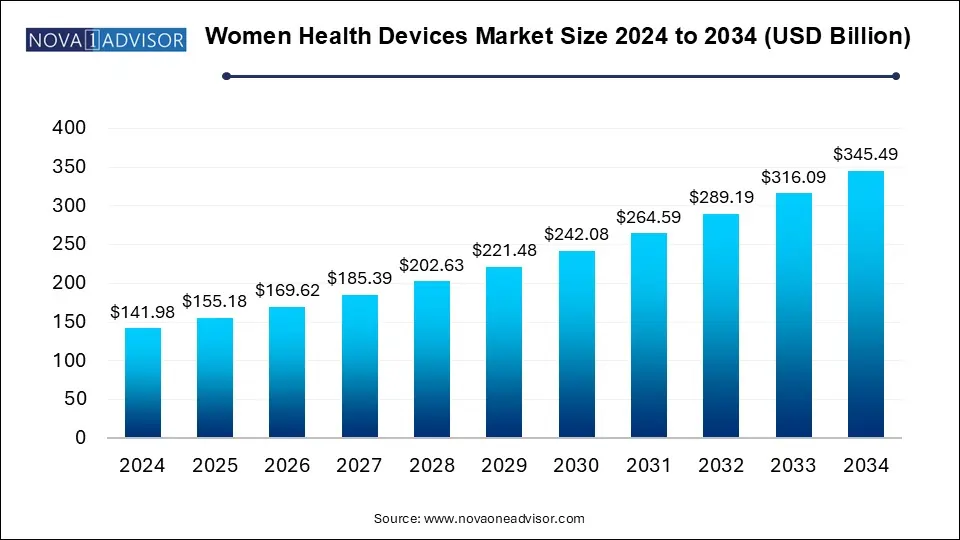

The women health devices market size was exhibited at USD 141.98 billion in 2024 and is projected to hit around USD 345.49 billion by 2034, growing at a CAGR of 9.3% during the forecast period 2025 to 2034. Women's health devices encompass medical instruments, equipment, and tools designed specifically for diagnosing, monitoring, and treating various health conditions and concerns unique to women.

Women’s health devices are designed to meet the unique anatomical and physiological needs of women throughout various life stages, from adolescence to menopause and beyond. These products cover a broad spectrum, including reproductive health, gynecological care, and the management of conditions such as breast cancer, cervical cancer, osteoporosis, and pelvic floor disorders.

With the global demographic shift towards an aging population—particularly among women, who generally have a longer life expectancy and lower birth rates in some regions—there is a rising prevalence of urinary incontinence. This condition, often linked to aging-related factors like weakened pelvic floor muscles, affects approximately 25 million adults in the U.S., with women making up 75-80% of those affected. Worldwide, nearly 200 million individuals experience urinary incontinence. Research indicates that one in four women aged 18 and older suffers from involuntary urine leakage, with a prevalence of around 24% among those aged 18-44 and 23% among women over 60. Consequently, the demand for women's health devices, such as urinary incontinence treatment solutions—including absorbent pads, vaginal pessaries, and pelvic floor electrical stimulators—is increasing. These products play a crucial role in improving the quality of life for aging women, promoting independence, and preserving their dignity.

Moreover, technological advancements in the healthcare sector have significantly propelled the women’s health devices market. Innovations tailored to women's specific health requirements have transformed diagnostics, treatment approaches, and overall care, contributing to better health outcomes.

Report Scope of Women Health Devices Market

Trends in the Women’s Health Devices Market

- The rising prevalence of health conditions among women in developed nations has driven the demand for specialized women’s health devices. These devices help with early disease detection, diagnosis, self-care management, and home-based treatment while integrating technology to enhance healthcare delivery and patient outcomes. This increasing demand has fueled innovation in the market, leading to the development of advanced medical technologies specifically designed for women’s health.

- Additionally, growing awareness of women’s health in developing countries has become a key factor in expanding the market for women's health devices.

- For example, there has been a heightened focus on educating women about their healthcare rights and needs in many developing nations. This includes providing access to information on reproductive health, maternal care, menstrual hygiene, and preventive measures against diseases like cervical and breast cancer.

The women’s health devices market is segmented based on product type into devices and consumables. The devices category is further classified into contraceptive devices, fertility monitoring devices, menstrual health products, breast health devices, pelvic health devices, maternal health products, general health monitoring devices, medical devices for gynecological conditions, and other related devices. This segment is projected to reach a market value of USD 211.8 billion by 2034.

This expansion is driven by multiple factors, including increasing awareness among women regarding their health needs and the growing availability of specialized medical devices.

Technological progress has led to the creation of more efficient and user-friendly products, addressing various aspects of women’s health. A shift towards preventive care, along with evolving lifestyles and demographics, has fueled demand for devices such as fertility monitors, menstrual health products, breast health devices, and general health monitoring solutions.

Additionally, the market is benefiting from a wider range of product offerings, supportive regulatory policies, increased investment in women's health research and development, and rising healthcare spending—all of which contribute to the strong growth of the women’s health devices sector.

Women Health Devices Market By Application

The women’s health devices market is categorized by application into cancer, osteoporosis, infectious diseases, uterine fibroids, pregnancy, female sterilization, menstrual disorders, and other medical conditions. Among these, the infectious diseases segment is expected to grow significantly during the forecast period, with a compound annual growth rate (CAGR) of 8.1%.

Infectious diseases that particularly impact women’s health, such as urinary tract infections (UTIs), sexually transmitted infections (STIs), and vaginal infections, remain a global concern. For example, in 2022, the World Health Organization (WHO) reported that 20 million women were living with HIV, with 540,000 new infections recorded and 23,000 deaths attributed to HIV-related complications.

Additionally, vaginal candidiasis is one of the most common vaginal infections in the U.S., second only to bacterial infections, as reported by the Centers for Disease Control and Prevention (CDC). An estimated 1.4 million outpatient visits annually are linked to vaginal candidiasis.

The increasing prevalence of these diseases highlights the urgent need for specialized diagnostic, monitoring, and treatment devices, which in turn is driving market growth.

Women Health Devices Market By End-User

The women’s health devices market is further segmented by end-user into hospitals, obstetrics and gynecology clinics, diagnostic laboratories, ambulatory surgical centers, and other healthcare facilities. Among these, the diagnostic laboratories segment was valued at USD 45.0 billion in 2024.

Diagnostic laboratories play a critical role in the timely and accurate detection of various women’s health conditions, including breast cancer, cervical cancer, osteoporosis, and reproductive health disorders.

Advancements in technology, such as improvements in imaging methods, molecular diagnostics, and automation, have greatly enhanced the accuracy, efficiency, and accessibility of diagnostic tests in these facilities.

Additionally, partnerships between diagnostic laboratories, healthcare providers, and medical device companies are fostering innovation, leading to the development and adoption of advanced diagnostic solutions tailored to women’s healthcare needs.

Women Health Devices Market By Regional

The U.S. women’s health devices market is projected to reach USD 78.15 billion by 2034.

Rising awareness of women’s health concerns and the increasing focus on preventive care are key drivers of market growth. Efforts to promote regular screenings and early diagnosis, particularly for conditions like breast cancer and osteoporosis, are fueling demand for specialized health devices.

Other contributing factors include increasing healthcare expenditures, government initiatives, advancements in medical technology, and the rising prevalence of lifestyle-related diseases. Together, these elements improve the accessibility and quality of women’s healthcare, further expanding the market.

The women’s health devices market in the United Kingdom is expected to witness substantial growth between 2025 and 2034.

Continuous technological advancements are leading to the introduction of more sophisticated women’s health devices. Innovations such as wearable health monitors, smart breast pumps, and cutting-edge diagnostic tools are making it easier for women to monitor and manage their health.

Moreover, the integration of digital platforms, including mobile applications and telemedicine services, is enhancing the functionality and accessibility of health devices, thereby driving market expansion in the region.

In Japan, the women’s health devices market is expected to experience significant growth from 2025 to 2034.

As Japan has one of the world's oldest populations, the increasing number of elderly women is driving demand for health devices that address age-related conditions such as osteoporosis, cardiovascular diseases, and menopause management.

The women’s health devices market in Saudi Arabia is projected to grow substantially between 2025 and 2034.

The Saudi government’s healthcare initiatives, including the Vision 2034 program, are dedicated to improving healthcare infrastructure and accessibility. These efforts, which focus on investing in healthcare facilities and medical technology, are fostering the adoption of advanced women’s health devices, including those for gynecological care, pregnancy monitoring, and menopause management. Such investments are contributing to the rapid expansion of the women’s health devices market in the region.

Competitive Landscape of the Women’s Health Devices Market

The women’s health devices industry is highly competitive, with both major global corporations and small to mid-sized enterprises striving for market leadership. Key players focus on innovation, investing heavily in research and development to introduce cutting-edge products.

Moreover, strategic partnerships, mergers, and acquisitions play a vital role in strengthening market positions and expanding global reach. The competitive environment is further intensified by rapid technological advancements and the increasing demand for personalized healthcare solutions. Companies are also prioritizing customer experience by tailoring products to meet specific needs, adding another dimension to the evolving market landscape.

Some of the prominent players in the Women Health Devices Market include:

- Abbott Laboratories

- Allengers Medical

- Alphabet Inc.

- Caldera Medical

- Carestream Health

- Garmin Ltd.

- GE Healthcare Technologies Inc.

- Hologic, Inc.

- Koninklijke Philips N.V.

- Mankind Pharma Limited

- OMRON Corporation

- Organon & Co.

- Samsung Electronics co., Ltd.

- The Cooper Companies, Inc.

Women Health Devices Industry News:

- In February 2024, Hologic, Inc. announced that its new Genius Digital Diagnostics System with the Genius Cervical AI algorithm has received clearance from the U.S. Food and Drug Administration (FDA), making it the first and only FDA-cleared digital cytology system that combines deep-learning-based artificial intelligence (AI) with advanced volumetric imaging technology to help identify pre-cancerous lesions and cervical cancer cells. This approval enabled the company to gain competitive edge over its peers.

- In March 2023, Garmin Ltd. launched a smartwatch - ‘Lily’ for women. Lily offers women’s health features, including menstrual cycle tracking and newly launched pregnancy tracking feature sharing mother-to-be a snapshot of their pregnancy alongside their other health, wellness and activity data. This product launch helped the company to acquire enhanced customer base.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Women Health Devices Market

By Product

-

- Contraceptive devices

- Fertility monitoring devices

- Menstrual health products

- Breast health devices

- Pelvic health devices

- Maternal health products

- General health monitoring devices

- Medical devices for gynecological conditions

- Other devices

By Application

- Cancer

- Osteoporosis

- Infectious diseases

- Uterine fibroids

- Pregnancy

- Female sterilization

- Menstrual disorders

- Other applications

By End-user

- Hospitals

- Obstetrics and gynecology clinics

- Diagnostic laboratories

- Ambulatory surgical centers

- Other end-users

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)