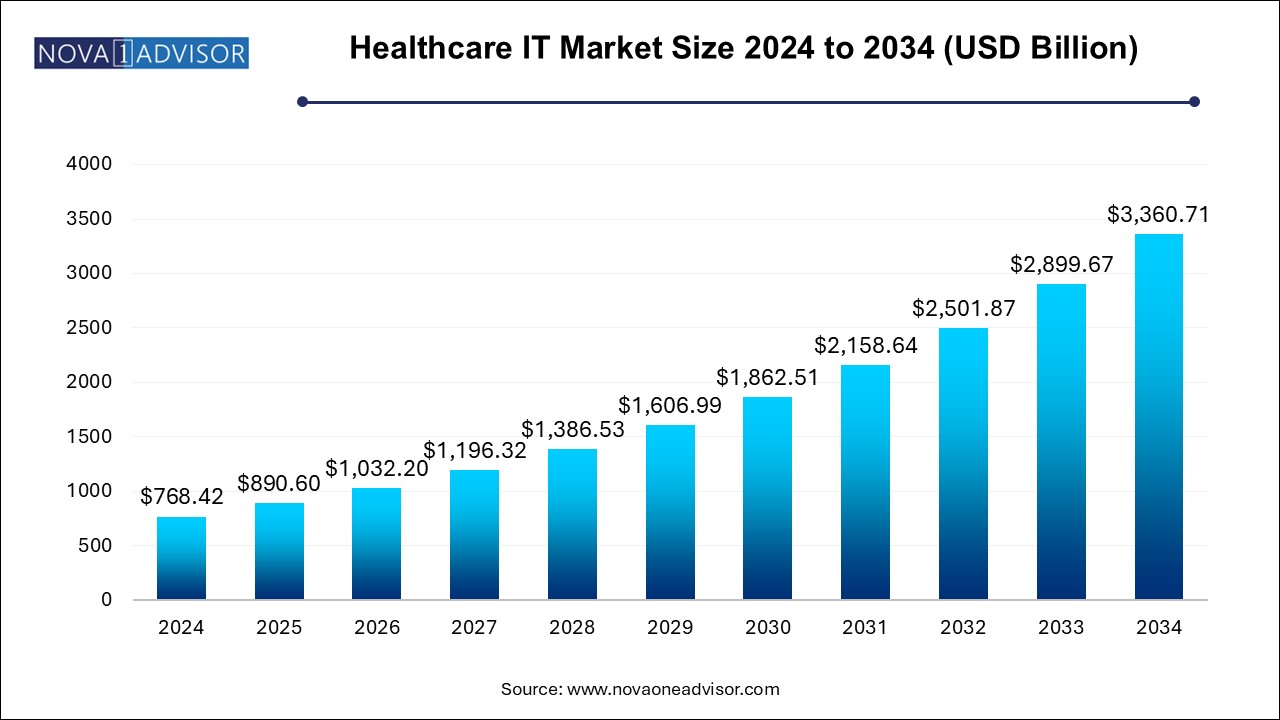

Healthcare IT Market Size and Trends

The healthcare IT market size was exhibited at USD 768.42 billion in 2024 and is projected to hit around USD 3360.71 billion by 2034, growing at a CAGR of 15.9% during the forecast period 2025 to 2034.

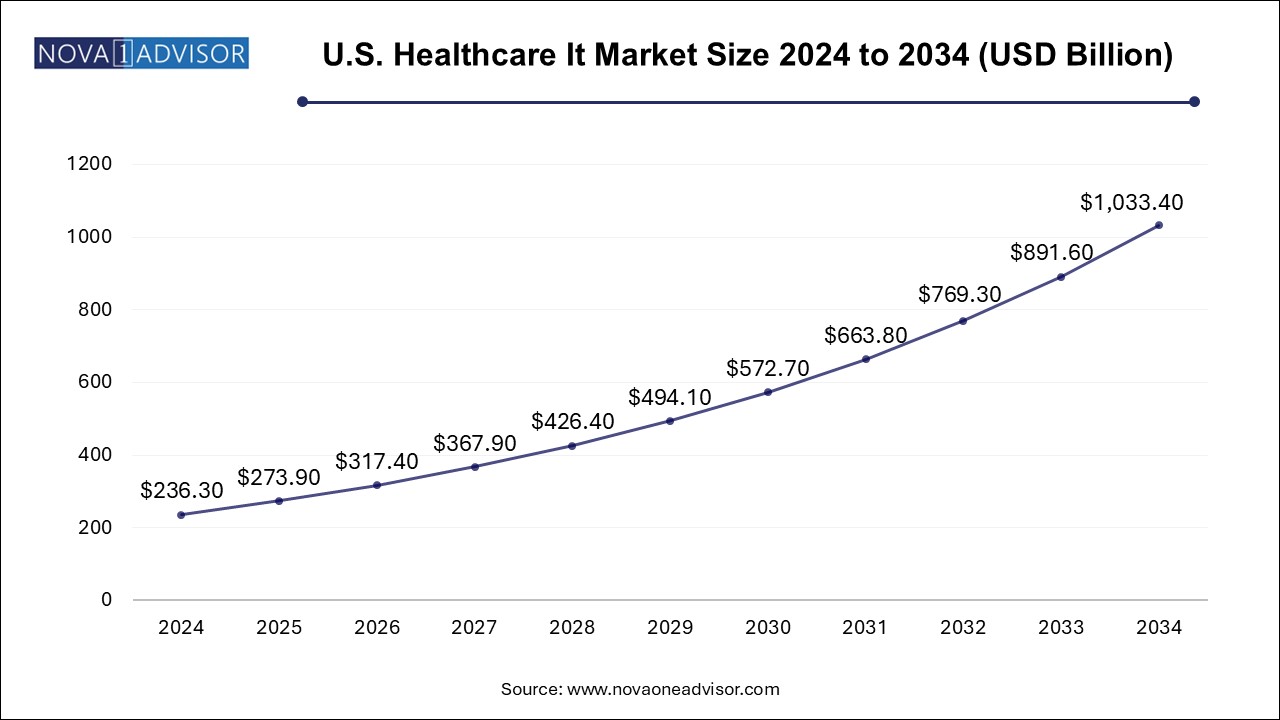

U.S. Healthcare IT Market Size and Growth 2025 to 2034

The U.S. healthcare IT market size is evaluated at USD 236.3 billion in 2024 and is projected to be worth around USD 1033.40 billion by 2034, growing at a CAGR of 14.35% from 2025 to 2034.

North America dominated the market with a revenue share of over 41.0% in 2024, attributed to its advanced healthcare infrastructure, strong regulatory frameworks, and high IT penetration in hospitals and insurance systems. Federal mandates such as the Affordable Care Act (ACA) and HITECH Act have significantly driven EHR adoption and interoperability initiatives. Moreover, leading healthcare IT vendors like Cerner, Epic, and Allscripts are based in the U.S., driving domestic innovation.

The region also leads in telemedicine regulations, reimbursement for digital health services, and AI-based clinical tools. For example, Mayo Clinic’s AI-enabled diagnostic platform for cardiology, and Mount Sinai’s predictive analytics for COVID-19 ICU planning, underscore the advanced use of digital technologies in patient care.

Asia Pacific is witnessing the fastest growth in healthcare IT, driven by a mix of government-led digital health initiatives, expanding middle-class healthcare demands, and booming private investments. Countries like India, China, and Singapore are aggressively digitizing public health systems through schemes such as Ayushman Bharat Digital Mission and China’s Healthy China 2030 strategy.

Startups and health-tech innovators in the region are leveraging mobile platforms, AI, and blockchain to address gaps in healthcare access, affordability, and outcomes. For instance, Indian startups like Practo and PharmEasy offer end-to-end digital healthcare services, while Chinese AI players like Ping An Good Doctor are scaling teleconsultations to millions. The combination of need, innovation, and policy support makes Asia Pacific a vibrant growth frontier.

Market Overview

The Healthcare Information Technology (Healthcare IT) Market represents one of the most transformative forces in modern healthcare, integrating digital technology to improve the quality, efficiency, and accessibility of care delivery across the globe. This ecosystem encompasses a wide array of technological solutions including Electronic Health Records (EHRs), Tele-healthcare, Revenue Cycle Management (RCM), eClinical platforms, healthcare analytics, supply chain systems, and customer relationship management tools tailored specifically for healthcare providers and payers.

Digital health transformation is no longer a luxury but a necessity, catalyzed by mounting pressures to control healthcare expenditures, reduce medical errors, and meet regulatory compliance standards. The COVID-19 pandemic acted as a significant catalyst in accelerating the adoption of digital solutions such as telehealth, remote monitoring, and electronic prescribing, highlighting the critical role of IT in maintaining care continuity even during crises.

Globally, governments and private stakeholders are heavily investing in digital health infrastructure. For instance, initiatives like the U.S. HITECH Act, Europe’s Digital Health Strategy, and India’s Ayushman Bharat Digital Mission are pivotal in propelling widespread adoption. As care delivery evolves into more personalized, preventive, and data-driven paradigms, healthcare IT platforms are becoming the backbone of this transformation.

Major Trends in the Market

-

Rapid Integration of Artificial Intelligence and Machine Learning in Clinical Workflows

-

Adoption of Cloud-based Infrastructure to Enhance Scalability and Interoperability

-

Rise of Telehealth Platforms and Virtual Care Ecosystems Post-Pandemic

-

Expansion of Healthcare Analytics from Descriptive to Predictive and Prescriptive Insights

-

Growing Emphasis on Cybersecurity in Healthcare Data Management

-

Widespread Use of IoT Devices for Remote Patient Monitoring and Chronic Disease Management

-

Blockchain Adoption for Secure and Transparent Health Data Exchange

-

Personalized Healthcare and Precision Medicine Enabled Through Integrated IT Systems

-

Increased Use of CRM Tools to Improve Patient Engagement and Experience

-

Automation in Supply Chain and Clinical Trial Management to Reduce Operational Overheads

Report Scope of Healthcare IT Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 890.6 Billion |

| Market Size by 2034 |

USD 3360.71 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 15.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Application, Delivery Mode, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

(Philips Healthcare, McKesson Corporation, eMDs, Inc., Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.), Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital), Carestream Health, GE Healthcare, Agfa- Gevaert Group, Hewlett Packard Enterprise Development LP, Novarad, Optum, Inc., IBM, Oracle, SAS Institute, Inc., IQVIA, Verisk Analytics, Inc., SAP, Accenture) |

Market Driver: Surge in Demand for Value-Based Care Models

The shift from volume-based to value-based care models has emerged as a pivotal driver for the healthcare IT market. Unlike traditional fee-for-service frameworks that reward providers based on quantity, value-based models emphasize outcomes, efficiency, and patient satisfaction. To achieve these goals, healthcare organizations are leveraging IT platforms to monitor performance metrics, analyze patient outcomes, and coordinate care more effectively across multidisciplinary teams.

For example, Electronic Health Records and Population Health Management (PHM) systems allow for real-time monitoring of chronic disease populations, helping identify care gaps and intervene early. Revenue Cycle Management tools ensure that reimbursements align with performance, while analytics engines track quality measures like readmission rates or preventive screening compliance. As reimbursement landscapes continue to evolve, IT solutions offer the critical infrastructure needed to support accountable, data-driven care.

Market Restraint: Interoperability and Data Silos

One of the major challenges limiting the full potential of healthcare IT is interoperability, or the ability of systems to exchange and interpret data seamlessly. Despite advancements in EHR adoption, many platforms remain siloed due to differences in vendors, standards, and legacy systems. This fragmentation not only obstructs care coordination but also undermines analytics capabilities.

For example, a patient’s lab results recorded at a diagnostic center may not be easily accessible to a physician using a different EHR system, causing delays and redundancy. Even within a hospital network, disparate systems for radiology, pharmacy, and billing may not communicate efficiently, creating inefficiencies. While regulatory efforts like the 21st Century Cures Act in the U.S. push for open APIs and data sharing standards, the practical implementation of true interoperability remains complex and costly.

Market Opportunity: Rising Adoption of AI-Driven Healthcare Analytics

The rise of AI-powered healthcare analytics presents a tremendous growth opportunity. As healthcare systems generate massive volumes of structured and unstructured data—ranging from patient records and lab tests to imaging scans and genomic data—there is a growing need to convert this data into actionable insights. Healthcare analytics platforms, particularly those infused with machine learning algorithms, are emerging as indispensable tools for clinicians, researchers, and administrators alike.

For instance, predictive analytics can forecast disease outbreaks, hospital readmission risks, or ICU admissions, enabling preemptive interventions. Prescriptive analytics can recommend optimal treatment paths based on historical outcomes, while clinical decision support tools assist physicians during diagnosis and drug selection. As organizations strive to personalize care, improve outcomes, and reduce costs, data-driven intelligence will be at the core of their strategies.

Healthcare IT Market By Application Insights

Electronic Health Records (EHRs) remain the cornerstone of healthcare IT, dominating the application segment. EHRs serve as centralized repositories for patient information—medical history, medications, lab results, radiological images, and more—allowing care providers to make informed decisions. Their integration with e-prescribing, clinical decision support, and scheduling tools enhances care quality while reducing administrative burden. The licensed software segment leads due to enterprise-scale deployments in hospitals, while subscriptions and professional services are gaining ground among outpatient and specialty clinics.

On the other hand, tele-healthcare, particularly telehealth services, is witnessing the fastest growth due to increasing consumer demand for virtual consultations and chronic care management. Platforms offering video consultations, digital prescriptions, and integrated monitoring tools are revolutionizing access to healthcare, especially in rural and underserved areas. The telecare segment, encompassing wearable sensors and home-based devices, is also gaining traction as part of remote monitoring programs for elderly or post-operative patients.

Healthcare IT Market By Delivery Mode

The solutions segment—primarily driven by software products—holds the largest market share. These include on-premise EHRs, laboratory information systems, RCM tools, and analytics dashboards tailored for institutional users. Many large hospitals and health systems prefer custom-built or hybrid models to maintain control over data and workflow customization.

However, cloud-based/web-based platforms are emerging as the fastest-growing delivery mode, enabling scalability, lower upfront investment, and remote access. Cloud deployment allows small clinics and developing region healthcare providers to adopt sophisticated IT tools without building full-scale infrastructure. Moreover, cloud environments support real-time updates, cybersecurity protocols, and integration with wearable devices and mobile apps, driving adoption across diverse settings.

Healthcare IT Market By End-use

Healthcare providers—especially hospitals and clinics—are the primary end users of healthcare IT. Their need for comprehensive digital infrastructure spans clinical documentation, imaging, diagnostics, patient engagement, and back-end operations. Hospitals increasingly rely on integrated platforms for seamless care transitions, compliance, and reimbursement management. Ambulatory surgery centers and physician clinics are adopting modular solutions suited to their size and scope.

Meanwhile, the life sciences industry, particularly pharmaceutical companies and Contract Research Organizations (CROs), is rapidly accelerating its healthcare IT adoption. Tools such as Clinical Trial Management Systems (CTMS), Electronic Data Capture (EDC), and eConsent platforms are revolutionizing drug development timelines, while predictive analytics is enhancing trial design and recruitment. Medical device manufacturers are also leveraging digital tools for regulatory submissions and post-market surveillance, driving robust growth in this segment.

Some of the prominent players in the healthcare IT market include:

- Philips Healthcare

- McKesson Corporation

- eMDs, Inc.

- Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.)

- Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital)

- Carestream Health

- GE Healthcare

- Agfa- Gevaert Group

- Hewlett Packard Enterprise Development LP

- Novarad

- Optum, Inc.

- IBM

- Oracle

- SAS Institute, Inc.

- IQVIA

- Verisk Analytics, Inc.

- SAP

- Accenture

Healthcare IT Market Recent Developments

-

March 2025: Oracle Health unveiled its cloud-native EHR platform aimed at integrating care coordination with AI-powered analytics for large health systems.

-

February 2025: Cerner Corporation, a part of Oracle, expanded its partnership with the Department of Veterans Affairs (VA) to enhance its EHR modernization program across federal healthcare centers.

-

January 2025: Epic Systems launched a new telehealth module that integrates behavioral health, oncology, and primary care in a unified virtual care interface.

-

December 2024: GE HealthCare collaborated with AWS to accelerate cloud-based imaging analytics, especially in low-resource hospitals through AI-assisted radiology.

-

November 2024: Philips Healthcare introduced a population health management dashboard equipped with predictive analytics and patient stratification tools, targeting value-based care programs in Europe.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the healthcare IT market

Healthcare IT By Application

- Computerized Provider Order Entry Systems

- Electronic Prescribing Systems (E-Prescribing Solutions)

- Laboratory Information

- Clinical Information Systems

- Regulatory Information Management (RIM) Systems

- Medical Imaging Information Systems

-

- Radiology Information Systems

- Monitoring Analysis Software

- Picture Archiving and Communication Systems

- Electronic Health Records

-

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

-

- Electronic Clinical Outcome Assessment (eCOA)

- Electronic Data Capture (EDC) & CDMS

- Clinical Analytics Platforms

- Clinical Data Integration Platforms

- Safety Solutions

- Clinical Trial Management System (CTMS)

- Randomization and Trial Supply Management (RTSM)

- Electronic Trial Master File (eTMF)

- eConsent

- Population Health Management (PHM)

- Digital Healthcare Supply Chain Management

- Clinical alarm management

-

- Nurse Call Systems

- Physiological Monitors

- Bed Alarms

- EMR Integration Systems

- Ventilators

- Others

- Healthcare Customer relationship management (CRM)

-

- Customer Service and Support

- Digital Commerce

- Marketing

- Sales

- Cross -CRM

- Technology Solutions in the Healthcare Payers

-

- Enrollment and Member Management

- Provider Management

- Claims Management

- Value based Payments

- Revenue Management and Billing

- Analytics

- Personalize/CRM

- Clinical Decision Support

- Data management and support

- Others

-

- Descriptive Analysis

- Predictive Analysis

- Prescriptive Analysis

Healthcare IT By Delivery Mode

-

-

- On-Demand/On-premise

- Cloud-based/ Web-based

Healthcare IT By End Use

-

- Hospitals & Clinics

- Home Care Settings

- Outpatient Facilities

-

-

- Ambulatory surgery centers (ASCs)

- Physician’s Clinic

- Others (Laboratories, Pharmacy, etc.)

-

- Long-term Care Facilities

- Specialty Centers

-

- Pharma & Biotech Organizations

- Medical Device Manufacturers

- Contract Research Organizations (CROs)

- Academic institutes

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)