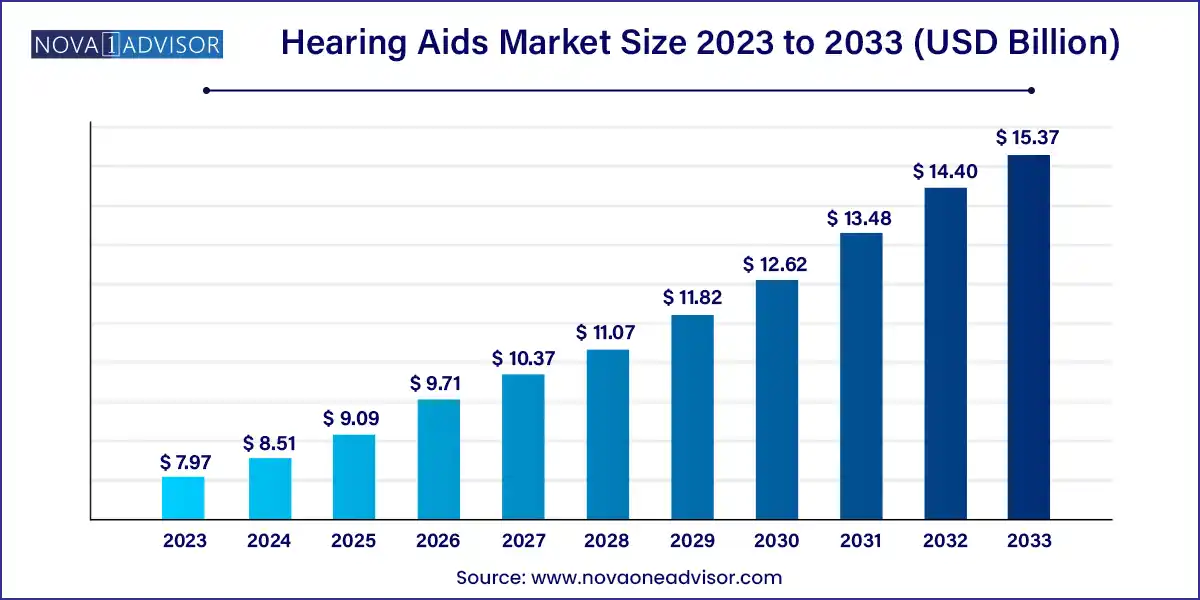

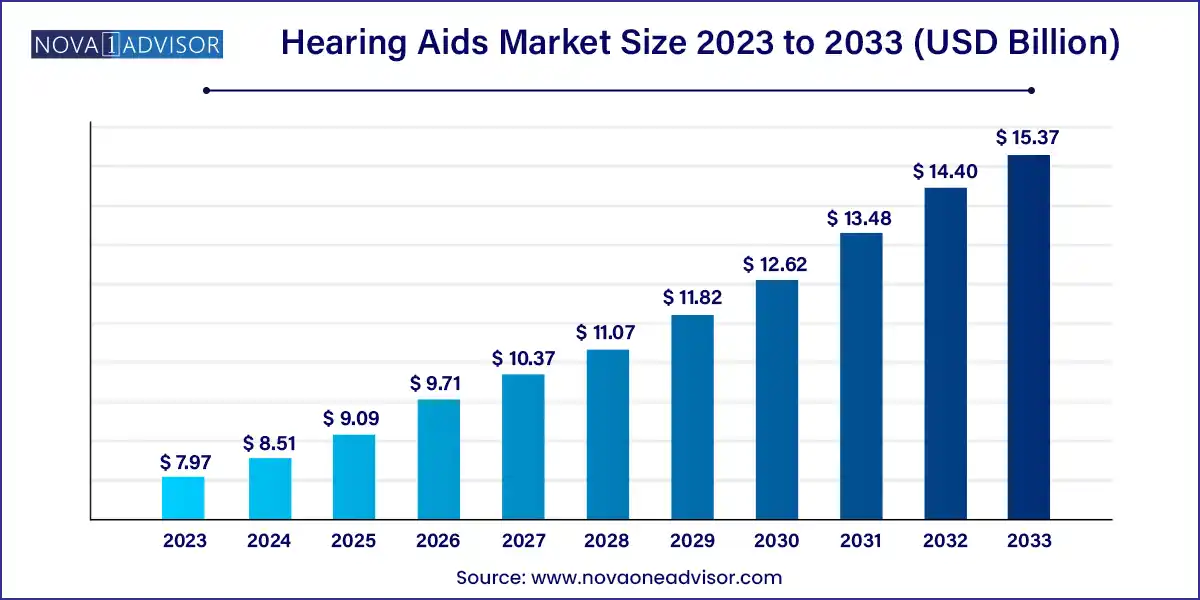

The global hearing aids market size was exhibited at USD 7.97 billion in 2023 and is projected to hit around USD 15.37 billion by 2033, growing at a CAGR of 6.79% during the forecast period 2024 to 2033.

Key Takeaways:

- Europe dominated the market with a revenue share of 38% in 2023.

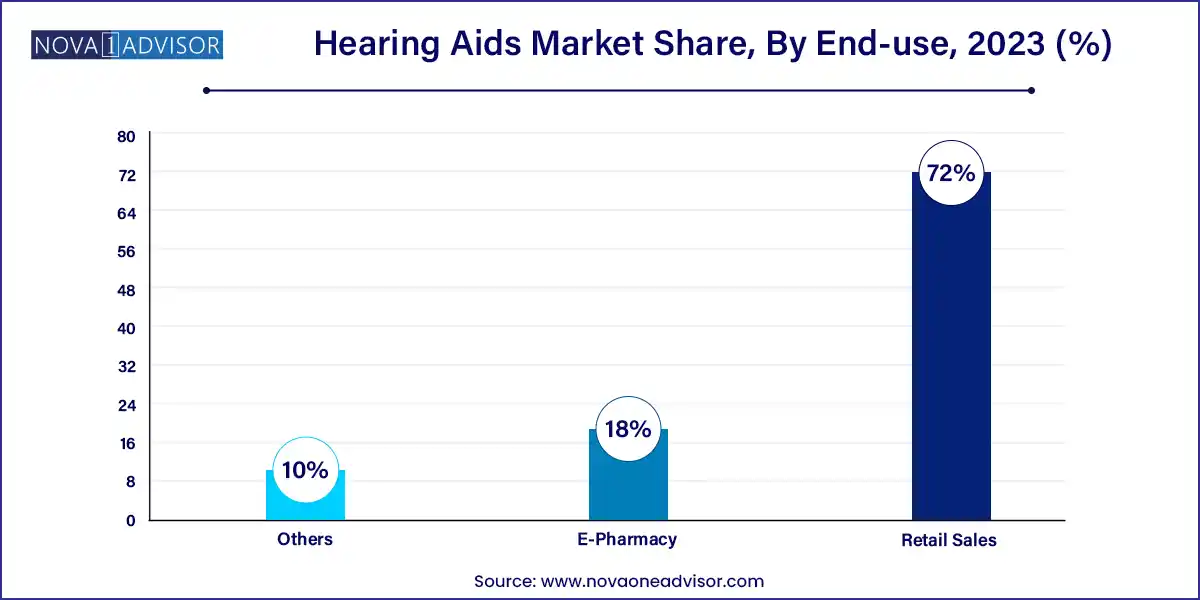

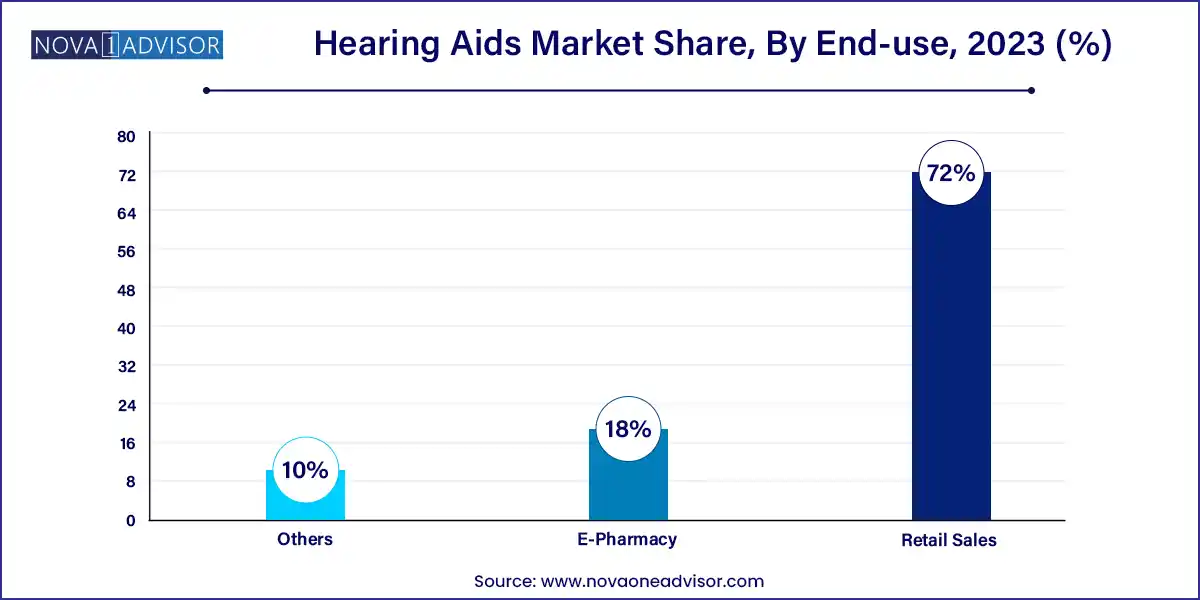

- Based on sales channel, the retail stores segment led the market with the largest revenue share of 72% in 2023.

Market Overview

The Hearing Aids Market plays a crucial role in improving the quality of life for millions of individuals suffering from hearing loss. Hearing aids are small electronic devices designed to amplify sound for individuals with partial hearing impairments, enabling better communication, social interaction, and overall well-being. These devices have become increasingly sophisticated, integrating digital processing, wireless connectivity, and AI-based sound optimization.

Globally, the prevalence of hearing loss is on the rise due to aging populations, increased exposure to environmental noise, and lifestyle-related conditions such as diabetes and cardiovascular disease, which are associated with sensorineural hearing impairments. According to the World Health Organization (WHO), over 1.5 billion people globally live with some degree of hearing loss, and this number is projected to grow.

The hearing aids market encompasses a range of product types from behind-the-ear (BTE) and receiver-in-the-ear (RITE) devices to canal and in-the-ear (ITE) models each catering to specific user needs and degrees of hearing loss. These devices are now increasingly available through various channels including company-owned retail stores, independent retailers, e-pharmacies, and audiology clinics.

Major Trends in the Market

-

Rise of Over-the-Counter (OTC) Hearing Aids: Regulatory approval in the U.S. has paved the way for consumer-friendly hearing aids without prescriptions.

-

AI and Machine Learning Integration: Devices are being equipped with adaptive algorithms that adjust to user environments automatically.

-

Smartphone Connectivity and Apps: Modern hearing aids are offering Bluetooth integration for music streaming, phone calls, and hearing customization.

-

Miniaturization and Invisible Devices: Canal and ITE aids are becoming smaller and more discreet, addressing aesthetic concerns of users.

-

Expansion of Online Sales and Teleaudiology: E-commerce and remote fitting services are transforming accessibility and affordability.

-

Increased Adoption of Rechargeable Devices: Lithium-ion battery-powered models are replacing disposable batteries due to convenience and sustainability.

-

Personalized Hearing Profiles: Devices that adapt to the user’s preferences over time based on AI feedback loops are gaining market share.

-

Growth in Pediatric Hearing Solutions: More attention is being placed on child-friendly designs and early detection tools for congenital hearing loss.

Hearing Aids Market Report Scope

Market Driver: Rising Prevalence of Hearing Loss and Geriatric Population

The most significant driver fueling growth in the hearing aids market is the increasing prevalence of hearing impairment, particularly among the elderly. Age-related hearing loss, also known as presbycusis, is one of the most common chronic conditions affecting older adults. In countries like Japan, Italy, and Germany, where the proportion of people aged 65 and over is growing rapidly, the demand for hearing enhancement solutions is surging.

Moreover, hearing impairment is increasingly recognized as a public health priority due to its associations with cognitive decline, depression, and social isolation. This recognition has led to wider public awareness, earlier diagnosis, and a growing willingness to seek hearing assistance. Coupled with advancements in audiological diagnostics and the availability of compact, high-performance devices, the market continues to expand robustly.

Market Restraint: High Cost and Limited Reimbursement in Developing Regions

Despite the growing demand, the hearing aids market is significantly hampered by affordability issues, especially in developing countries. High-end digital hearing aids can cost several thousand dollars, which is unaffordable for large portions of the global population. Unlike many medical devices, hearing aids are not always fully covered by public health insurance schemes, even in developed countries.

In nations with limited healthcare infrastructure, the situation is further exacerbated by a lack of trained audiologists and hearing care professionals, limited diagnostic capabilities, and minimal government awareness programs. These barriers hinder the adoption of hearing aids despite the availability of technology. As a result, many individuals remain untreated, creating a gap between demand and actual usage.

Market Opportunity: Expansion of OTC Hearing Aids and Digital Health Integration

A transformative opportunity in the hearing aids market is the regulatory clearance and expansion of over-the-counter (OTC) hearing aids, particularly in the U.S. Following the FDA’s decision in 2022 to allow hearing aids to be sold directly to consumers without a medical exam or fitting, numerous companies have entered the space with competitively priced and user-friendly products.

This trend is accelerating with the integration of digital health features, including hearing self-tests via mobile apps, personalized tuning based on AI, and remote consultations. These innovations not only reduce the cost barrier but also empower consumers to manage their hearing care independently.

Companies like Bose, Sony, and newer health-tech entrants are capitalizing on this shift, offering customizable, app-connected hearing aids directly through retail stores and online platforms. This development is likely to democratize hearing care and expand the total addressable market significantly.

Segments Insights:

By Sales Channel Insights

Retail sales through company-owned and independent outlets dominate the distribution landscape, as users often require professional fitting, consultation, and follow-up support. Large manufacturers operate vertically integrated chains to maintain quality control and offer value-added services such as hearing tests and warranty packages.

E-pharmacy and online retail channels are the fastest-growing segments, propelled by tech-savvy consumers, especially in North America and Europe. Platforms like Amazon, Best Buy, and brand-owned websites now offer FDA-cleared OTC hearing aids with app-based customization and virtual fitting services. Teleaudiology support further complements the online buying experience, enhancing consumer confidence and satisfaction.

By Product Type Insights

Behind-the-Ear (BTE) hearing aids dominate the market, largely due to their versatility, power, and suitability for a wide range of hearing loss severities. BTE models house more features, larger batteries, and stronger amplifiers compared to smaller counterparts, making them suitable for elderly and pediatric populations alike. Their external position also makes them easier to handle, clean, and maintain.

However, Receiver-in-the-Ear (RITE) hearing aids are the fastest-growing segment, appreciated for their discreet profile and superior sound clarity. They separate the receiver and amplifier, enabling less occlusion and more natural sound. These models appeal to younger users and active adults, driving their rapid uptake in both developed and emerging markets. Companies are investing heavily in RITE models equipped with streaming, telehealth, and AI-based sound customization capabilities.

By Technology Insights

Digital hearing aids have become the overwhelming market leader, having almost entirely replaced analog counterparts in most regions. Digital processing allows for real-time sound analysis, adaptive feedback cancellation, noise reduction, and wireless connectivity. These aids support sophisticated features such as geolocation-based sound profiles and personalized voice recognition, which enhance user experience.

Analog hearing aids, though nearly obsolete in high-income markets, still find niche demand in low-income settings or among users seeking ultra-basic amplification at low cost. They lack adaptive features but offer a functional and affordable solution for mild to moderate hearing loss.

By Regional Insights

North America leads the hearing aids market, with the United States accounting for the largest share due to high hearing loss prevalence, advanced healthcare infrastructure, and strong purchasing power. The 2022 FDA ruling on OTC hearing aids catalyzed rapid market expansion, with both startups and established players entering direct-to-consumer segments. Additionally, Medicare and VA programs support hearing aid adoption among the elderly and veterans, respectively.

Asia-Pacific is the fastest-growing region, driven by aging populations in China, Japan, South Korea, and India. Government-led hearing screening programs, increasing middle-class awareness, and mobile-enabled diagnostic tools are contributing to market growth. The region is also seeing growth in local manufacturing and affordable imports to meet rising demand. With supportive policies and public-private partnerships, Asia-Pacific is expected to contribute significantly to future hearing care innovation.

Recent Developments

-

GN Hearing (April 2025): Launched the ReSound Nexia series, integrating AI-powered real-time sound personalization and Bluetooth LE Audio streaming.

-

Sony Corporation (March 2025): Introduced a new line of OTC hearing aids in the U.S. market in partnership with WS Audiology, expanding access through electronics retail chains.

-

Starkey Hearing Technologies (February 2025): Announced new firmware update for Livio Edge AI devices, adding multilingual voice assistant functionality.

-

Sonova Holding AG (January 2025): Expanded its Hear the World Foundation into Latin America, focusing on pediatric hearing loss interventions.

-

Demant A/S (December 2024): Acquired a chain of 120 independent audiology clinics across Europe to strengthen its retail footprint and service network.

Some of the prominent players in the Hearing aids market include:

- Audicus

- Audina Hearing Instruments, Inc.

- Eargo, Inc.

- GN Store Nord A/S

- Horentek Hearing Diagnostics

- MDHearing

- SeboTek Hearing Systems, LLC

- Sonova

- Starkey Laboratories, Inc.

- WS Audiology

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global hearing aids market.

Product Type

- In-the-Ear Hearing Aids

- Receiver-in-the-Ear Hearing Aids

- Behind-the-Ear Hearing Aids

- Canal Hearing Aids

Technology

Sales Channel

-

- Company Owned

- Independent Retail

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)