Heart Attack Diagnostics Market Size and Growth Report 2026 to 2035

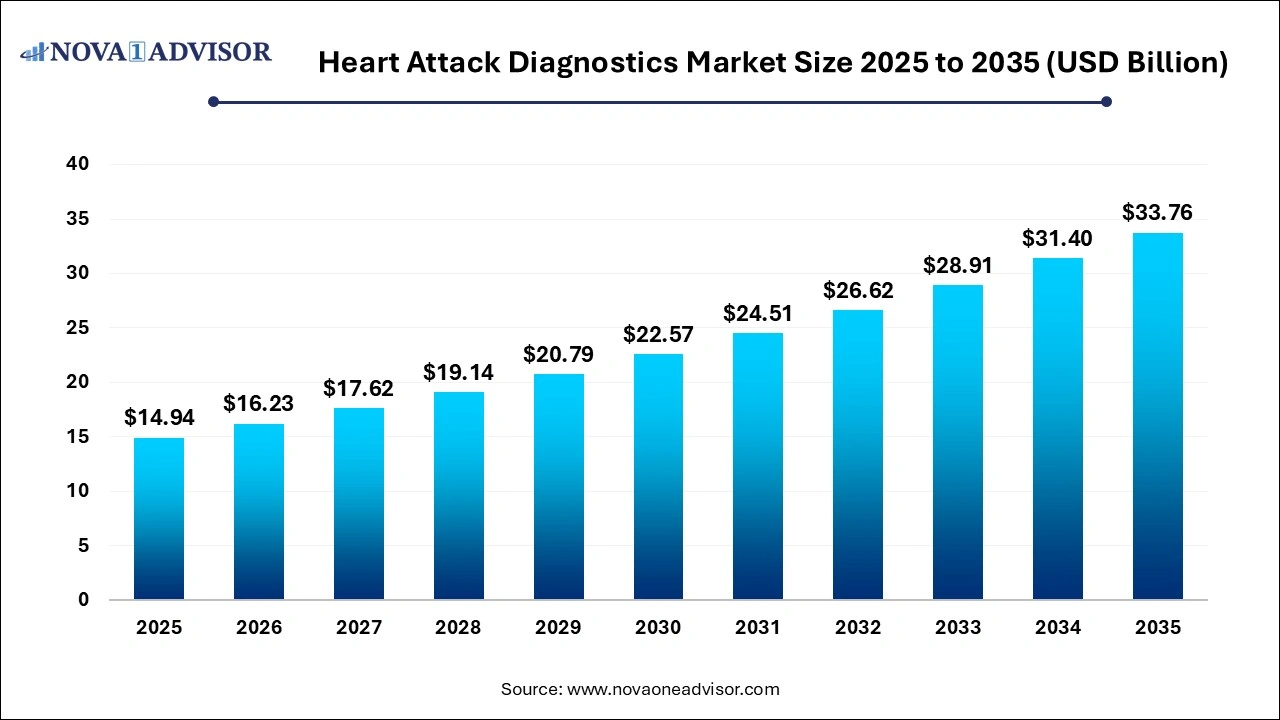

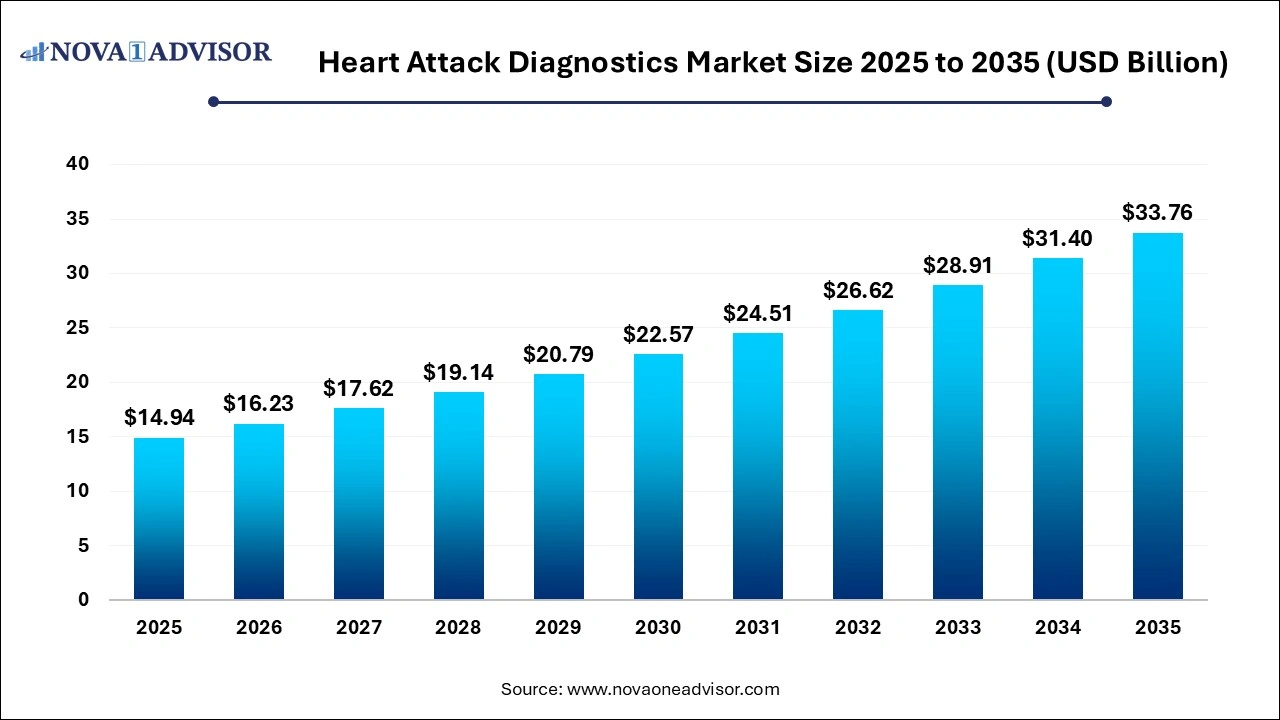

The global heart attack diagnostics market size was valued at USD 14.94 billion in 2025 and is anticipated to reach around USD 33.76 billion by 2035, growing at a CAGR of 8.49% from 2026 to 2035. The heart attack diagnostics market expansion is driven by the rising incidences of cardiovascular diseases, increasing mortality rates due to heart attacks, improvements in diagnostic modalities, growing emphasis on early diagnosis, and increasing disposable incomes.

Heart Attack Diagnostics Market Key Takeaways

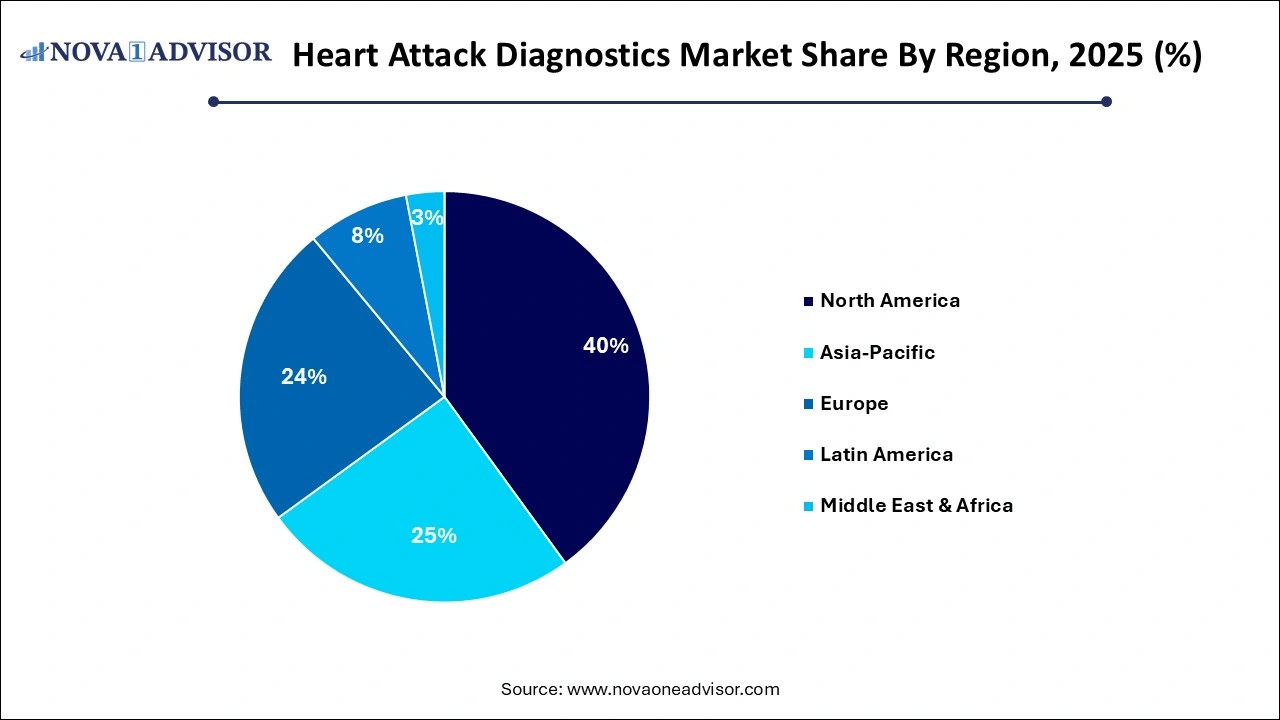

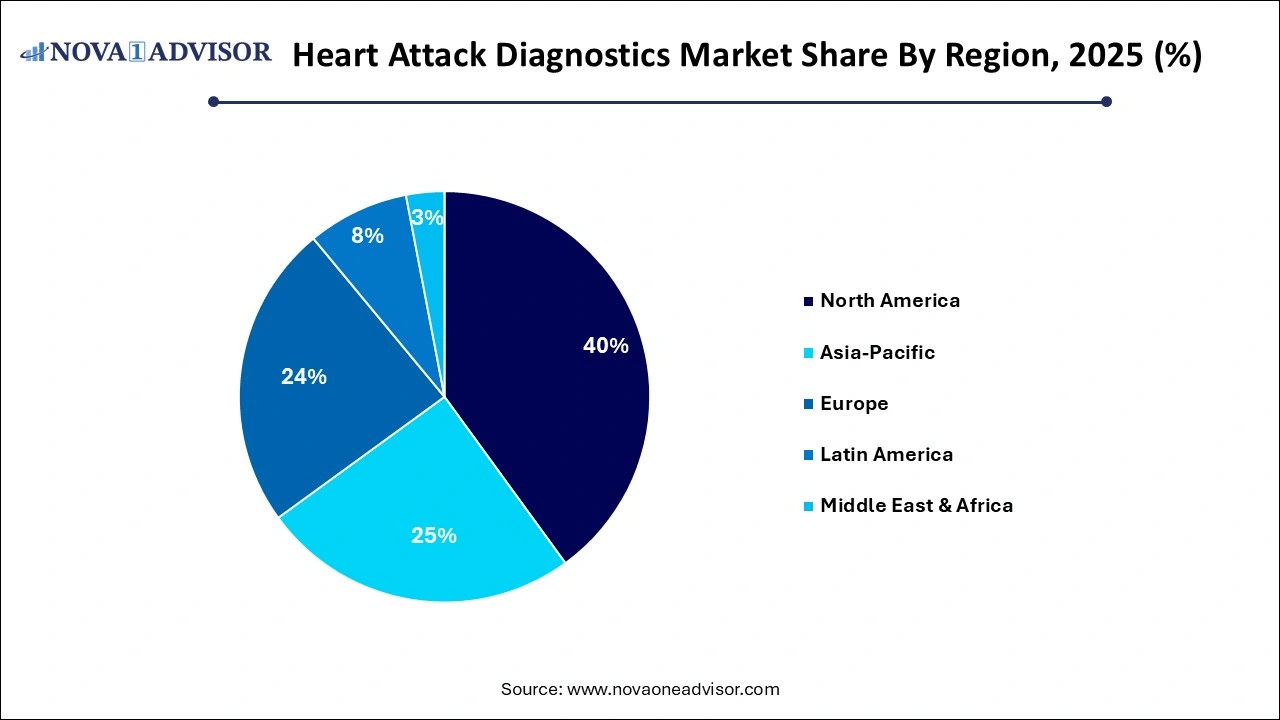

- North America emerged as the largest global heart attack diagnostics market, with a 40% share in 2025.

- The heart attack diagnostics market in Asia Pacific is projected to witness a steady CAGR of 10.0% during the forecast period.

- In 2025, the blood tests segment emerged as the market leader, capturing the largest revenue share of 54.19%.

- The electrocardiogram segment is anticipated to exhibit a CAGR of 7.2% from 2026 to 2035.

- The CK-MB (creatine kinase-myoglobin binding) segment in the blood tests category is expected to grow rapidly at a CAGR of 9.6% over the forecast period.

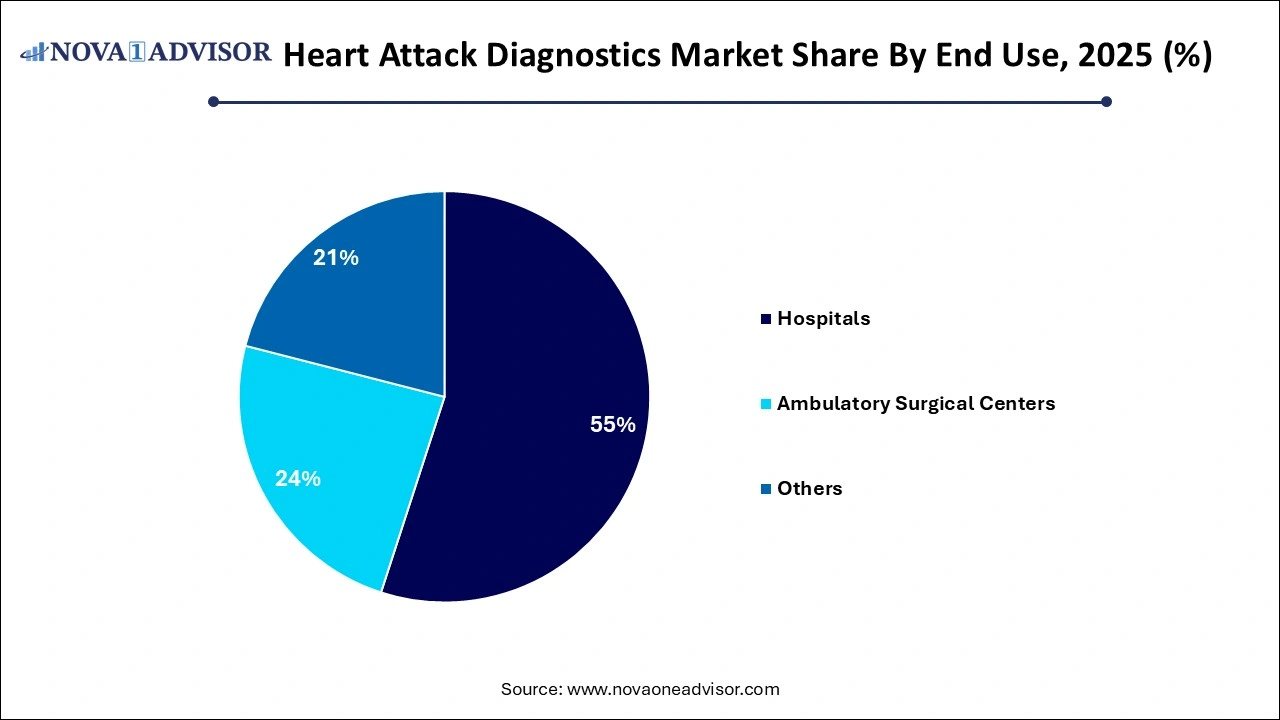

- The hospital segment accounted for a share of 55% in 2025.

- The ambulatory segment is expected to grow at a CAGR of 10.6% during forecast period.

Heart Attack Diagnostics Market Overview

The heart attack diagnostics market is a vital and rapidly evolving segment of the global cardiovascular healthcare industry. Heart attacks, medically referred to as myocardial infarctions (MI), remain one of the leading causes of mortality and morbidity worldwide. Prompt and accurate diagnosis is essential for reducing fatality rates, initiating early intervention, and improving long-term outcomes. This critical need for timely and reliable diagnostics is the primary force shaping the development of sophisticated diagnostic tools ranging from point-of-care testing to advanced imaging and laboratory-based assays.

In recent years, the heart attack diagnostics market has seen substantial investment and innovation. Technologies such as high-sensitivity cardiac biomarkers, machine learning-assisted electrocardiogram (ECG) interpretation, and rapid diagnostic kits have transformed emergency response protocols. Increasing global awareness about cardiovascular health, aging populations, sedentary lifestyles, and the rising prevalence of co-morbidities like diabetes and hypertension have all contributed to an escalating number of diagnostic procedures being performed worldwide.

The growing emphasis on preventive healthcare, coupled with government and private sector initiatives aimed at strengthening emergency medical services (EMS), is also fueling demand for portable and fast-acting diagnostic systems. Whether through mobile ECG units in ambulances or advanced biomarker analysis in labs, the market for heart attack diagnostics is now a cornerstone of modern cardiology, offering both clinical impact and commercial growth potential.

Major Trends in the Heart Attack Diagnostics Market

-

Adoption of High-Sensitivity Troponin Assays: These tests offer superior early detection of myocardial damage and are becoming the standard in emergency settings.

-

Growth in Point-of-Care (PoC) Testing Devices: Compact, easy-to-use diagnostic tools are gaining popularity in ambulances, clinics, and rural settings.

-

Integration of AI in ECG Interpretation: Machine learning tools are helping emergency responders and clinicians interpret ECG data more accurately in real time.

-

Multiplexed Biomarker Panels: Diagnostic labs are increasingly using panels that simultaneously test for troponin, CK-MB, and other cardiac markers to increase diagnostic precision.

-

Increased Investment in Telecardiology: Remote diagnosis tools and mobile ECG devices are facilitating heart attack detection in underserved areas.

-

Miniaturization and Automation in Diagnostics: Smaller, automated diagnostic platforms are enabling quicker results with less sample volume.

-

Wearable Cardiac Monitoring Devices: Although not diagnostic in isolation, wearables are helping detect early arrhythmias and irregularities that can signal imminent heart attacks.

-

Shift Toward Preventive Testing: At-risk individuals are undergoing cardiac diagnostics even without acute symptoms, contributing to market expansion.

How is AI Influencing the Heart Attack Diagnostics Market?

The integration of artificial intelligence (AI) in heart attack diagnostics market is driven by factors such as rising cases of cardiovascular diseases, shortage of skilled healthcare professionals, technological advancements, and growing demand for quick, accurate and reliable diagnostic tools. The rise in adoption of cloud computing platforms in healthcare systems as well as the increasing collaborations among AI companies, healthcare providers and diagnostic tool developers are driving the market growth.

AI algorithms can be applied for analyzing electrocardiogram (ECG) readings, CT scans, and echocardiograms, for detecting potential indicators of heart disease such as plaque buildup and inflammation, further leading to early and accurate diagnosis of heart attack risk. AI-powered tools can be deployed for analyzing large amounts of omics data, including genomics, proteomics, transcriptomics, metabolomics for identification of biomarkers suggestive of heart disease, allowing early diagnosis and development of more tailored treatments for patients.

- For instance, in January 2025, Peerbridge Health launched its COR-INSIGHT Trial, focused on validating the screening and diagnostic capacities of its Peerbridge Cor ambulatory ECG wearables. The trial will be conducted by leveraging two innovative and advanced AI SaMD platforms, namely CardioMIND and CardioQSync.

Heart Attack Diagnostics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 16.23 Billion |

| Market Size by 2035 |

USD 33.76 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 8.49% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Test, By End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

GE Healthcare; Hitachi Corporation; Koninklijke Philips NV; Midmark Corporation; F Hoffmann-La Roche Ltd; Schiller AG; Siemens Healthineers; Toshiba Corporation; Welch Allyn Inc; Astrazenca PLC |

U.S. Heart Attack Diagnostics Market Size, Industry Report 2026 to 2035

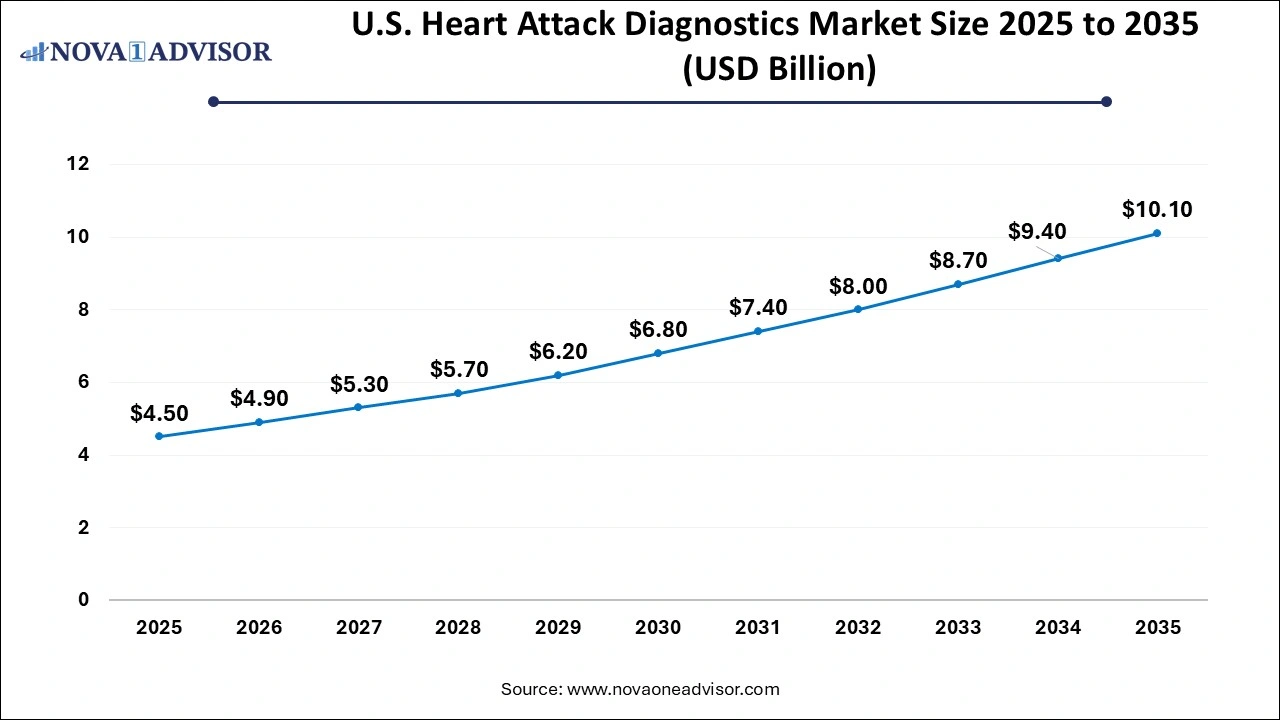

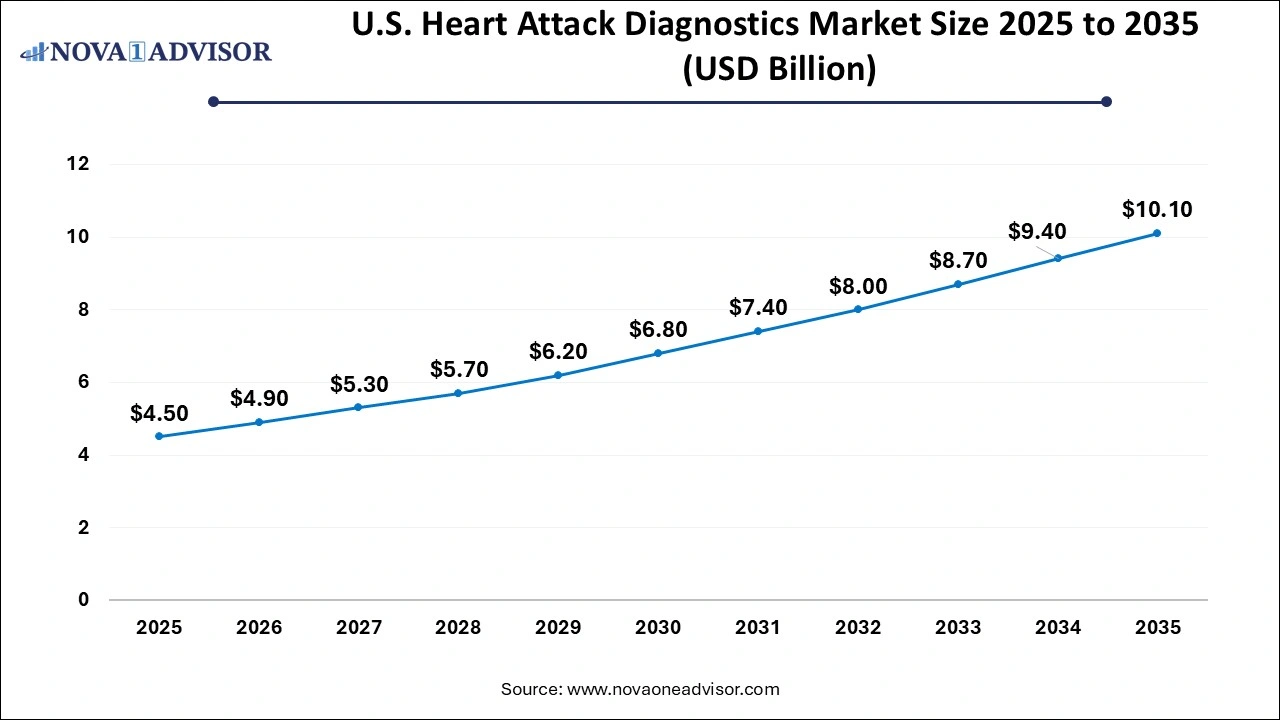

The U.S. heart attack diagnostics Market is valued at USD 4.50 Billion in 2025 and is projected to reach a value of USD 10.10 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 8.42% between 2026 to 2035.

North America accounted for the largest share of the global heart attack diagnostics market in 2025, thanks to advanced healthcare infrastructure, a high burden of cardiovascular diseases, and widespread adoption of cutting-edge diagnostic technologies. The U.S., in particular, has a well-established emergency care system supported by strong insurance coverage, government initiatives like the Million Hearts program, and extensive research into cardiac biomarkers. Major hospitals and cardiac centers regularly upgrade their diagnostic tools to incorporate high-sensitivity assays, AI-powered ECGs, and lab automation systems. The region also benefits from a strong presence of diagnostic giants like Abbott, Roche, and Siemens.

- For instance, in March 2025, Bracco Diagnostics Inc., a U.S.-based subsidiary of Bracco Imaging S.p.A, declared major transformations for its innovative HeartSee software, which is a key diagnostic tool used for myocardial blood flow (MBF) quantification with cardiac positron emission tomography (PET) imaging. The updates feature to the software will expand physicians access to cutting-edge technology in the diagnosis and treatment of coronary artery disease (CAD).

Asia-Pacific emerged as the fastest-growing region, driven by improving healthcare access, increasing incidence of heart disease, and rising investments in diagnostic infrastructure. Countries like India, China, and Indonesia are witnessing a significant rise in cardiac cases, spurring the need for scalable and affordable diagnostics. Governments across the region are investing in mobile health units, rural healthcare strengthening, and public-private partnerships to address the diagnostic gap. The growth of telehealth and home diagnostics is further encouraging the deployment of portable ECG and PoC blood testing kits, making Asia-Pacific a promising frontier for market expansion.

- For instance, in August 2025, Narayana Health launched India’s first-of-a-kind AI-powered tool capable of detecting heart failure from a standard ECG (electrocardiogram) image within 10 seconds. The AI-based model developed by the hospital’s Clinical Research Team and its AI division Medha AI helps in detecting early signs of heart failure in near real-time by analyzing ECG scans for predicting left ventricular ejection fraction (EF).

Heart Attack Diagnostics Market Segment Insights

Driver – Rising Global Burden of Cardiovascular Diseases

A major driver of the heart attack diagnostics market is the increasing global burden of cardiovascular diseases (CVDs), particularly myocardial infarction. According to the World Health Organization (WHO), CVDs account for nearly 17.9 million deaths annually, with heart attacks contributing a significant portion of these fatalities. Modern lifestyles—marked by sedentary behavior, poor dietary habits, stress, and obesity—have created an environment conducive to heart disease even among younger populations.

The growing prevalence of hypertension, diabetes, and high cholesterol is further elevating the risk of cardiac events. As more people fall into the high-risk category, the need for early and accurate heart attack diagnostics becomes increasingly critical. Hospitals, clinics, and ambulatory centers around the world are equipping themselves with high-sensitivity testing kits and real-time monitoring systems to manage this influx. The driver is reinforced by health policy shifts favoring early diagnosis and the establishment of cardiac care units (CCUs) in both urban and rural hospitals.

Restraint – Lack of Accessibility and Trained Personnel in Low-resource Settings

Despite the technological progress in diagnostics, limited accessibility in low- and middle-income regions continues to hamper market expansion. Rural hospitals and small healthcare facilities often lack the infrastructure and trained personnel to deploy or interpret advanced diagnostic tools like ECGs and biomarker assays. This results in delayed or inaccurate diagnoses, which can be fatal in cases of heart attack.

Additionally, even where testing kits are available, their utility is restricted by costs, electricity requirements, or maintenance complexities. The high capital investment needed to acquire diagnostic analyzers and maintain them, particularly in public health setups, poses a barrier. Training programs for emergency healthcare workers and nurses in ECG interpretation or biomarker assay handling are not uniformly available, further widening the care gap between urban and rural regions.

Opportunity – Expansion of Rapid Diagnostic Testing and Mobile Emergency Units

A key opportunity in the heart attack diagnostics market lies in the expansion of rapid diagnostic testing solutions integrated within mobile emergency response units. As healthcare systems globally work toward decentralizing emergency care, ambulances and mobile clinics are being equipped with point-of-care testing devices capable of measuring biomarkers like troponin or recording ECGs within minutes. These innovations dramatically reduce time-to-diagnosis and enable pre-hospital intervention, significantly improving survival rates.

Companies investing in battery-operated, wireless PoC devices with cloud-based data transfer are expected to capture a growing share of this market segment. Further, as governments fund initiatives aimed at strengthening rural and emergency medical services—particularly in Asia-Pacific and Latin America—the demand for portable and rapid diagnostic kits is poised to skyrocket. Partnerships between diagnostic companies and EMS providers could unlock untapped market segments and improve healthcare access in under-resourced geographies.

Heart Attack Diagnostics Market Segment Insights

By Test Insights

Electrocardiogram (ECG) tests dominated the heart attack diagnostics market in 2025, largely due to their widespread availability, non-invasive nature, and critical role in emergency diagnostics. An ECG provides immediate insights into the electrical activity of the heart and is the first line of diagnosis in suspected heart attack cases. Hospitals, ambulances, and even urgent care centers routinely use ECGs to identify ST-segment changes and other abnormalities that indicate myocardial infarction. Portable and wearable ECG devices have further enhanced accessibility, enabling broader use in home monitoring and pre-hospital care.

However, blood tests—particularly those measuring troponin levels—are the fastest-growing segment due to their increasing clinical preference for confirming myocardial damage. High-sensitivity troponin assays have set new standards in cardiology diagnostics by detecting even minute amounts of myocardial cell death, often within 1–2 hours of onset. CK-MB, while used less frequently today, still serves as a complementary marker in some hospitals. The growing adoption of PoC testing platforms that deliver troponin results in under 15 minutes is fueling this segment's rapid expansion, especially in emergency departments and paramedic settings.

By End-use Insights

Hospitals remained the largest end-use setting for heart attack diagnostics in 2025. These institutions handle the bulk of emergency cardiovascular cases and are equipped with advanced diagnostic infrastructure including high-throughput analyzers, ECG machines, and trained cardiologists. Hospitals are also centers for specialized cardiac units and tertiary care interventions, necessitating rapid and highly accurate diagnostic solutions. Their ability to integrate lab-based assays with imaging and clinical evaluation creates a comprehensive approach to diagnosis and intervention, reinforcing their dominance in the segment.

Conversely, ambulatory surgical centers (ASCs) are emerging as the fastest-growing end-use environment, driven by the increasing trend of outpatient diagnostic services and the proliferation of stand-alone cardiac care units. ASCs now offer initial evaluations, basic ECGs, and even rapid blood biomarker tests for patients with non-critical symptoms or for pre-operative cardiac screening. Their lower overheads and faster service have made them attractive to patients and insurers alike. As more ASCs are certified for diagnostic and minor interventional procedures, their demand for compact and accurate diagnostic tools is surging.

Heart Attack Diagnostics Market Top Key Companies:

- GE Healthcare

- Hitachi Corporation

- Koninklijke Philips NV

- Midmark Corporation

- F Hoffmann-La Roche Ltd

- Schiller AG

- Siemens Healthineers

- Toshiba Corporation

- Welch Allyn Inc

- Astrazenca PLC

Heart Attack Diagnostics Market Recent Developments

- In July 2025, Royal Philips, a globally leading health technology company, introduced the Philips ECG AI Marketplace, which is platform providing cardiac care teams access to various vendor offerings all in one central location for helping clinicians in the management and implementation of AI-powered diagnostic tools efficiently. Anumana, an AI-powered health technology company dedicated to revolutionize the continuum of cardiac care, became the first organization leveraging Philips ECG AI Marketplace platform, through which its FDA-approved ECG-AI LEF (Low Ejection Fraction) algorithm will be available.

- In April 2025, Caristo Diagnostics received approval from the American Medical Association's (AMA) CPT Editorial Panel for its new Category III CPT codes AI-assisted perivascular fat analysis, which are developed for Caristo’s proprietary CaRi-Heart technology.

- In March 2025, Caristo Diagnostics received the U.S. Food and Drug Administration’s (FDA’s) 510(k) clearance for its CaRi-Plaque technology, which is an AI-powered image analysis application developed for helping cardiologists and radiologists in the diagnosis of coronary artery disease (CAD).

Heart Attack Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Heart Attack Diagnostics market.

By Test

- Electrocardiogram

- Blood Test

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)