HLA Typing Market Size and Research 2026 to 2035

The HLA typing market size was exhibited at USD 1,103.03 million in 2025 and is projected to hit around USD 2,115.59 million by 2034, growing at a CAGR of 6.73% during the forecast period 2026 to 2035.

HLA Typing Market Outlook

- Market Growth Overview: The HLA typing market is expected to grow significantly between 2025 and 2034, driven by the rising tranceplant procedures, technological advancement in molecular diagnostics, expansion of precision medicine and oncology, and increasing prevalence of chronic disease.

- Sustainability Trends: Sustainability trends involve the shift to high-resolution molecular methods, automation and workflow optimization, and digitalization and AI integration.

- Major Investors: Major investors in the market include Thermo Fisher Scientific, Inc., Illumina, Inc., Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., and CareDx, Inc.

HLA Typing Market Key Takeaways:

- The reagents and consumables in human leukocyte antigen typing is considered to be revenue generating segment with the largest market share of 54.2% in 2024 and fastest growth rate between 2026 to 2035.

- The diagnosis is anticipated to be the fastest-growing segment of HLA typing with a 6.8% CAGR during the forecast period.

- The molecular assay segment dominated the market and accounted for the largest revenue share of 53.0% in 2025.

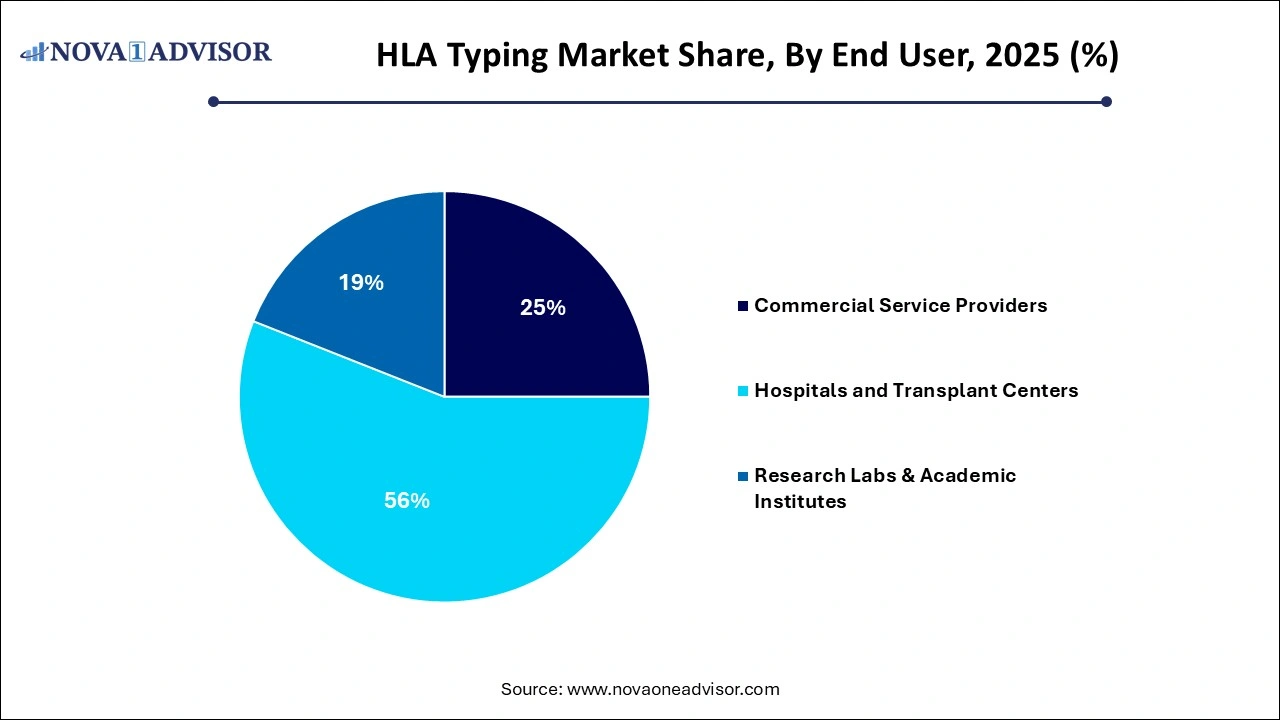

- The hospitals and transplant centers segment dominated the market and accounted for the largest revenue share of 56.0% in 2025.

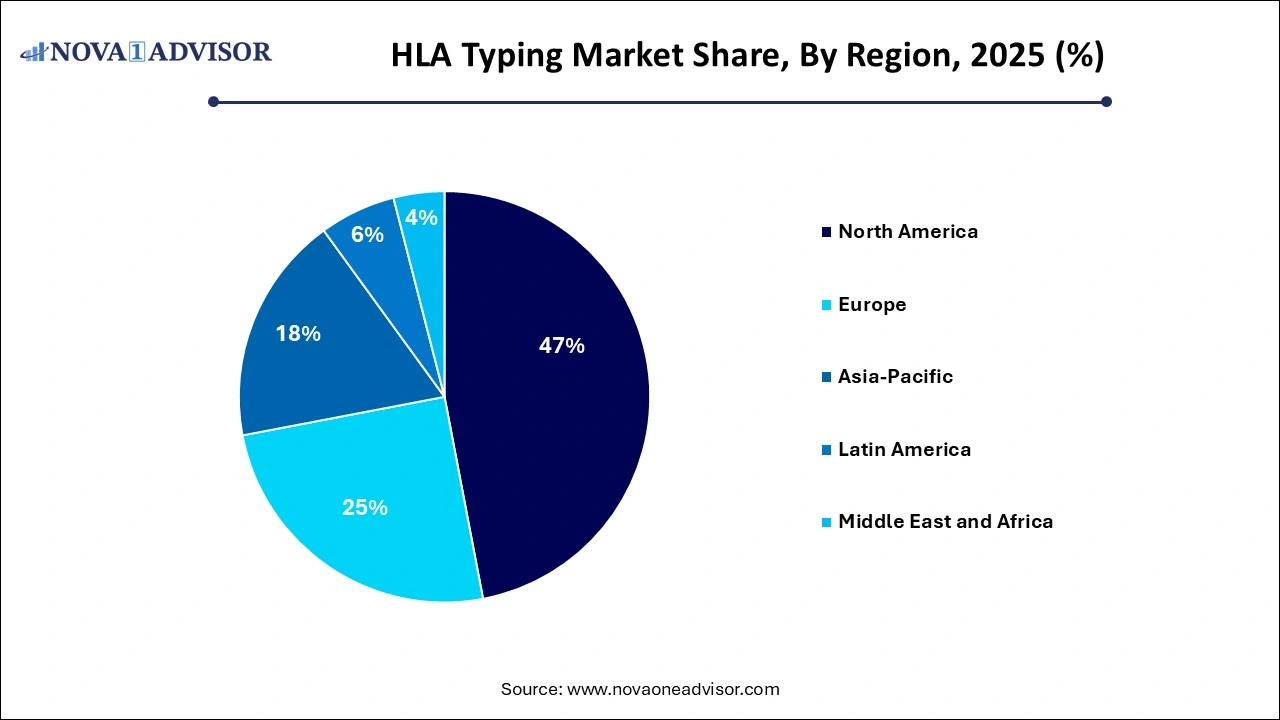

- North America is observed to have dominance in the HLA typing market with a share of 47% in 2025.

HLA Typing Market Overview

The HLA typing market occupies a critical space within transplant diagnostics, immunogenetics, and personalized medicine, offering essential technologies for determining human leukocyte antigen (HLA) compatibility between donors and recipients. HLA molecules are pivotal in immune system functioning, and matching HLA profiles significantly reduces transplant rejection risks and improves patient outcomes.

HLA typing is indispensable not only in solid organ and hematopoietic stem cell transplantation but also in autoimmune disease research, pharmacogenomics, and emerging fields such as immunotherapy. The demand for accurate, high-resolution HLA typing is surging, driven by the global rise in transplant procedures, expanding bone marrow registries, and advancements in molecular diagnostic technologies.

Modern HLA typing has evolved from traditional serological assays to sophisticated molecular techniques such as PCR, sequence-specific oligonucleotide (SSO) typing, sequence-based typing (SBT), and next-generation sequencing (NGS). These innovations enable high-throughput, ultra-precise typing essential for improving transplant success rates, especially with unrelated donors.

As the global focus intensifies on precision medicine, personalized treatment planning, and advanced immunotherapy development, the HLA typing market is poised for robust growth across both clinical and research applications.

How AI is Imacting on HlA Tying Market

AI is revolutionizing the HLA typing industry by significantly increasing the speed and accurancy of donor-recpient matching, particularly in complex transplantation cases. AI algorithms, including machine learning and deep learning, are being integrated with next-generation sequencing (NGS) to automate data analysis, reducing manual errors and decreasing turnaround times. These advanced models excel at identifying rare HLA alleles and reducing ambiguity, which enhances compatibility, lowers rejection rates, and improves long-term patient survival. AI supports the shift towards personalized medicine by enabling faster, high-resolution typing in immunotherapy and oncology applications.

Major Trends in the HLA Typing Market

-

Shift from Serological to Molecular HLA Typing: Molecular assays are now preferred for their superior resolution and accuracy.

-

Growing Adoption of Next-Generation Sequencing (NGS): High-throughput, multi-locus typing is gaining popularity in both clinical and research settings.

-

Integration of Artificial Intelligence (AI) in HLA Analysis: Automating complex HLA data interpretation for faster and more accurate results.

-

Expansion of Bone Marrow and Stem Cell Registries: Boosting the demand for high-resolution donor typing globally.

-

Increasing Focus on Personalized Immunotherapy: HLA typing becoming crucial in cancer vaccine development and adoptive T-cell therapies.

-

Development of Automated, Workflow-integrated HLA Typing Systems: Reducing manual error and enhancing laboratory throughput.

-

Emergence of HLA Typing for Disease Susceptibility Studies: Including autoimmune diseases, infectious diseases, and drug hypersensitivity research.

-

Geographical Expansion of Testing Facilities: Especially in Asia-Pacific and Latin America to support growing transplantation needs.

Value Chain Analysis of the HLA Typing Market

- Research & Development (R&D): This stage involves developing high-resolution HLA typing kits, refining NGS (Next-Generation Sequencing) algorithms, and identifying new polymorphisms.

Key Players: Illumina, Thermo Fisher Scientific, and GenDx.

- Raw Material Procurement & Manufacturing: Manufacturers secure specialized enzymes, DNA primers, and chemical reagents to produce kits and, in parallel, develop sophisticated molecular, PCR-based, or sequencing-based analyzers. Key Players: Bio-Rad Laboratories, Qiagen, Thermo Fisher Scientific, and Immucor.

- Distribution & Inbound Logistics: Reagents and high-end hardware are transported to clinical labs, hospitals, and blood centers globally, adhering to strict cold-chain management for test kit stability.

Report Scope of HLA Typing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 1,178.04 Million |

| Market Size by 2035 |

USD 2,115.59 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 6.73% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product, By Application, By Technique, By End-user |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; Bio-Rad Laboratories Inc.; Qiagen N.V.; Omixon Inc.; GenDx; Illumina Inc.; TBG Diagnostics Limited; Dickinson and Company; Takara Bio Inc.; F. Hoffman-La Roche Limited; Pacific Biosciences |

HLA Typing Market Dynamics

Driver

Rising Volume of Organ and Stem Cell Transplantations

The most significant driver accelerating the HLA typing market is the rising volume of organ and hematopoietic stem cell transplantations worldwide.

With the global burden of end-stage organ failure, leukemia, lymphoma, and other hematologic conditions increasing, there is a corresponding surge in transplant procedures. Successful transplantation heavily depends on HLA compatibility to minimize rejection risks and complications such as graft-versus-host disease (GVHD).

Programs such as the World Marrow Donor Association (WMDA) and regional bone marrow registries are expanding their donor databases, emphasizing the need for rapid, high-resolution HLA typing. The success of unrelated donor transplantations critically hinges on precise HLA matching, reinforcing the pivotal role of molecular HLA testing.

As transplantation becomes a more accessible treatment option globally, the demand for accurate and reliable HLA typing solutions is set to rise sharply.

Restraint

High Costs and Complexities of Advanced HLA Typing Technologies

A key restraint to market growth is the high cost and operational complexity associated with advanced HLA typing technologies, particularly sequencing-based assays.

Next-generation sequencing and high-resolution molecular assays require significant investment in instrumentation, reagents, bioinformatics infrastructure, and skilled personnel. Smaller healthcare facilities and transplant centers, particularly in low- and middle-income regions, may find it challenging to implement or sustain such capabilities.

Moreover, reimbursement structures for advanced HLA testing remain inconsistent across different healthcare systems, adding to financial barriers. Technical complexity can also extend turnaround times without sufficient automation, limiting accessibility.

To broaden market reach, efforts to lower costs, simplify workflows, and standardize procedures are necessary.

Opportunity

Integration of HLA Typing in Personalized Immunotherapy and Drug Development

A burgeoning opportunity in the market lies in the integration of HLA typing into personalized immunotherapy, cancer vaccine development, and pharmacogenomics.

Advances in immuno-oncology particularly the development of neoantigen-based cancer vaccines, adoptive T-cell therapies, and checkpoint inhibitors increasingly require precise HLA typing to predict immune responses and customize therapies.

Similarly, HLA genotyping is critical in identifying genetic predispositions to drug hypersensitivity reactions (e.g., HLA-B*57:01 for abacavir hypersensitivity in HIV treatment). Pharmaceutical companies are incorporating HLA profiling into clinical trials and drug labeling.

As precision medicine continues to expand, HLA typing will become a standard component of personalized treatment planning, opening new revenue streams beyond traditional transplant applications.

HLA Typing Market Segmental Insights

By Product Insights

Reagents and consumables dominate the product segment, accounting for the majority of market revenue. Frequent usage of PCR kits, sequencing reagents, oligonucleotide probes, and molecular assay consumables for each patient typing test ensures recurring demand.

Software and services are growing fastest, driven by the rising complexity of sequencing data analysis. Bioinformatics software solutions for automated allele assignment, mismatch identification, and report generation are becoming essential, while outsourced HLA typing services gain traction, particularly among small- and medium-sized transplant centers.

By Application Insights

Diagnosis dominates the application segment, reflecting the critical role of HLA typing in matching organ and stem cell donors with recipients, ensuring immunological compatibility, and preventing transplant rejection.

Research applications are growing fastest, propelled by expanding use of HLA genotyping in immunology, vaccine development, autoimmune disease research, and cancer immunotherapy studies. Academic institutions and pharmaceutical companies increasingly integrate HLA research into R&D pipelines.

By Technique Insights

Molecular assays dominate the technique segment, offering higher sensitivity, specificity, and reproducibility compared to non-molecular assays like serology and mixed lymphocyte culture (MLC).

Sequenced-based molecular assays are growing fastest, particularly next-generation sequencing (NGS) approaches that enable comprehensive, high-throughput typing across multiple loci. Sanger sequencing and other sequencing methods are also being refined for cost-effective and high-resolution typing, pushing adoption further.

By End-user Insights

Hospitals and transplant centers dominate the end-user segment, as they perform in-house HLA typing to support transplantation programs, manage patient lists, and reduce transplant wait times.

Commercial service providers are growing fastest, driven by increasing outsourcing of HLA typing to specialized reference laboratories offering high-throughput, fast-turnaround services at competitive pricing, particularly for institutions lacking in-house expertise.

HLA Typing Market By Regional Insights

North America holds the largest share of the HLA typing market, with the United States leading in transplant volumes, advanced healthcare infrastructure, and the adoption of cutting-edge molecular diagnostics.

The presence of major HLA typing companies, extensive bone marrow and organ donor registries, and strong government initiatives such as the National Marrow Donor Program (NMDP) contribute significantly to market dominance. Furthermore, robust research activity into immunogenetics and personalized medicine sustains high demand for advanced HLA typing technologies.

Asia-Pacific is the fastest-growing region, driven by rising chronic disease prevalence, growing healthcare investments, increasing transplant volumes, and expanding donor registries in countries like China, India, Japan, and South Korea.

Government programs promoting organ donation, partnerships with international transplant organizations, and rapid adoption of advanced molecular testing platforms are accelerating growth. As healthcare infrastructure matures and public awareness increases, Asia-Pacific is poised to become a major HLA typing market hub in the next decade.

U.S. HLA Typing Market Trends

U.S.’s critical need for high-resolution NGS and PCR-based matching in complex transplantations. The innovations, such as Thermo Fisher’s HybriType Flex Kit, which has slashed turnaround times to under 5.5 hours, and CareDx’s AlloSeq Tx17, enhancing the precision of genomic typing. North America continues to anchor the global landscape, supported by a robust infrastructure and favorable reimbursement for chronic disease management.

China HLA Typing Market Trends

Chiana’s HLA typing market growth is driven by significantly expanded the domestic donor base and necessitated high-resolution allele identification. The transition from traditional serological methods to next—generation sequencing, ensuring superior matching accurancy for an increasing volume of chronic kideney and liver tranceplant cases. The statergic focus on commercial diagnostic expansion and molecular innovation is positioning in the region.

Some of the prominent players in the HLA typing market include:

- Thermo Fisher Scientific Inc.: Thermo Fisher Scientific dominates the HLA typing market through its "One Lambda" brand, offering a comprehensive portfolio of molecular (NGS/PCR) and antibody detection assays.

- Bio-Rad Laboratories Inc.: Bio-Rad contributes to the HLA market by supplying specialized molecular diagnostics, particularly through its HLA-SSP (Sequence-Specific Primer) typing kits and real-time PCR systems.

- Qiagen N.V.: Qiagen provides key enabling technologies for HLA typing, focusing on high-resolution, Next-Generation Sequencing (NGS) solutions, such as the QIAseq xHYB Long Read Panels.

- Omixon Inc.: Omixon specializes in transitioning HLA laboratories to Next-Generation Sequencing (NGS) with their Holotype HLA kits, designed for fast, high-resolution genotyping on Illumina platforms.

- GenDx (Genome Diagnostics B.V.): GenDx, now part of Eurobio Scientific, is a major player offering comprehensive NGS-based HLA typing solutions, including NGSengine software for fast, automated analysis of HLA data.

- Illumina Inc.: Illumina provides the fundamental, high-throughput DNA sequencing hardware, such as MiSeq and NovaSeq systems, that serves as the foundation for modern NGS-based HLA typing in many laboratories.

Recent Developments

-

March 2025: Thermo Fisher Scientific launched the Ion Torrent Genexus Integrated Sequencer optimized for HLA typing, offering same-day high-resolution results.

-

February 2025: CareDx announced an expanded strategic partnership with Be The Match BioTherapies to enhance NGS-based HLA typing capabilities across global donor registries.

-

January 2025: QIAGEN unveiled its new QIAseq Targeted DNA Panels for high-resolution HLA typing, focusing on streamlined workflows and high-throughput compatibility.

-

December 2024: GenDx introduced its NGSengine 4.0 software, featuring enhanced automation and expanded HLA loci coverage for clinical laboratories.

-

November 2024: Omixon released Holotype HLA v5.0, an upgraded NGS-based HLA typing solution offering full gene coverage and faster turnaround for transplant laboratories.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the HLA typing market

By Product

- Instruments

- Reagents & Consumables

- Software & Services

By Application

By Technique

- Molecular Assay

- Sequenced-based Molecular Assay

- Non-Molecular Assay

By End-user

- Commercial Service Providers

- Hospitals and Transplant Centers

- Research Labs & Academic Institutes

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)